November 17, 2021

www.angelone.in

Technical & Derivatives Report

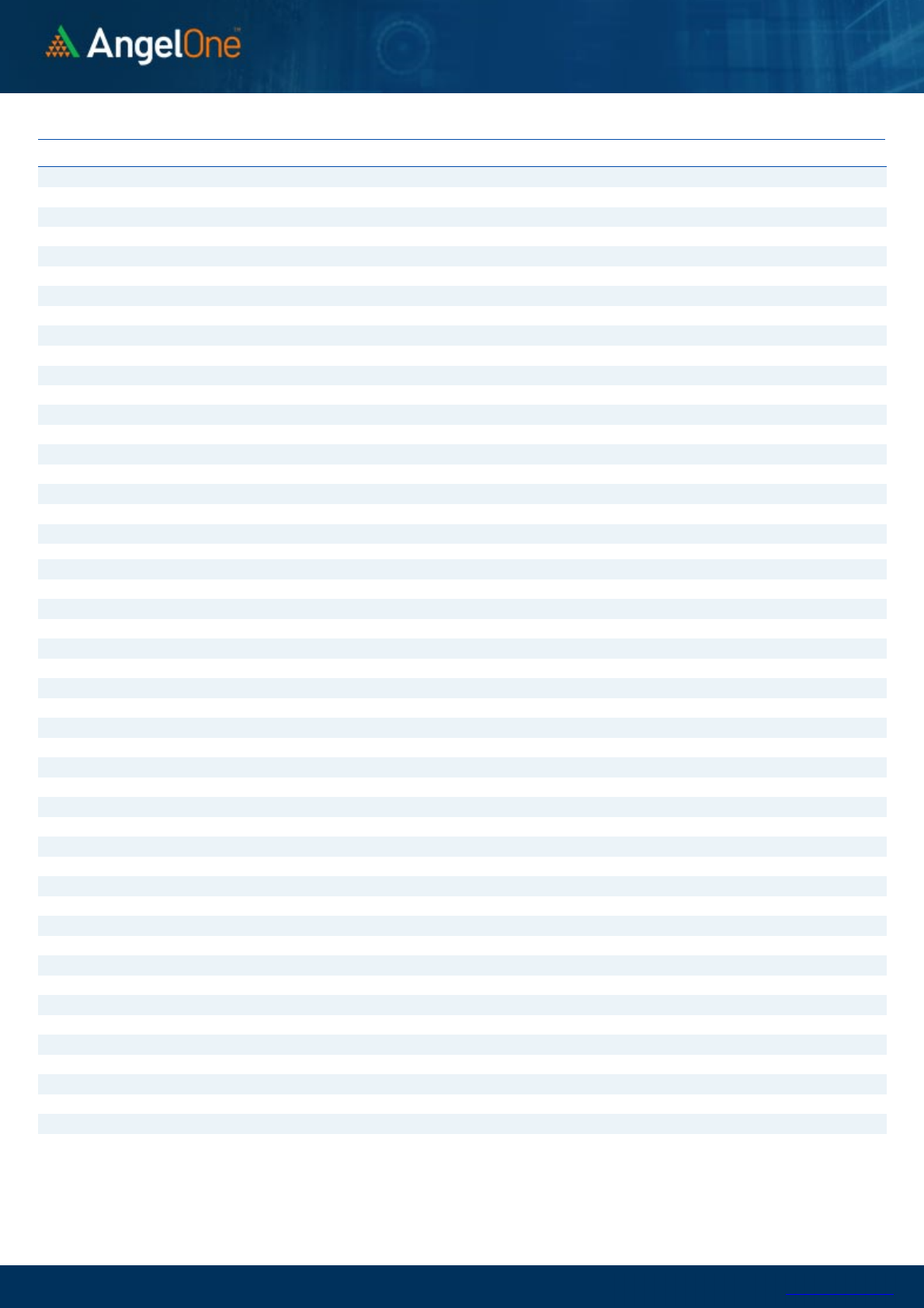

Nifty Bank Outlook - (38307)

We had a flat start yesterday and then index attracted fresh selling

right from the word go. During initial two hours, the banking index

corrected below 38300 and then made an attempt to recover but once

again this got sold into to almost touch 38200 in the final hour. Finally,

we conclude yet another session in red with a cut of a percent to

previous close.

As mentioned in our last couple of articles, we were uncomfortable in

initiating any bullish bets specifically in this space considering its

underperformance. Yesterday, the index even tested the previous

swing lows of 38346 and further selling may easily drag the BankNifty

below 37500. Thus, we maintain our cautious stance on market and

we advise exiting any longs in pull back. As far as levels are concerned,

38700-38800 shall be looked as strong resistance zone; whereas,

37700 and 37400 are the demand zone now.

Key Levels

Support 1 – 37700 Resistance 1 – 38800

Support 2 – 37400 Resistance 2 – 38700

Exhibit 2: Nifty Bank Daily Chart

Sensex (60322) / Nifty (17999)

Market had a quiet start yesterday marginally in the green owing to

mixed global cues. During the first couple of hours Nifty came off a bit

to test 18050 and then went through a brief period of consolidation.

Around the midsession, the buying emerged in some of the

heavyweights which pulled the index back above the 18100 mark.

However as we stepped into the final session of the day, index started

becoming a bit nervous. In fact due to aggravated selling towards the

end, Nifty went on to slide below 18000 with a cut over half a percent

to the previous close.

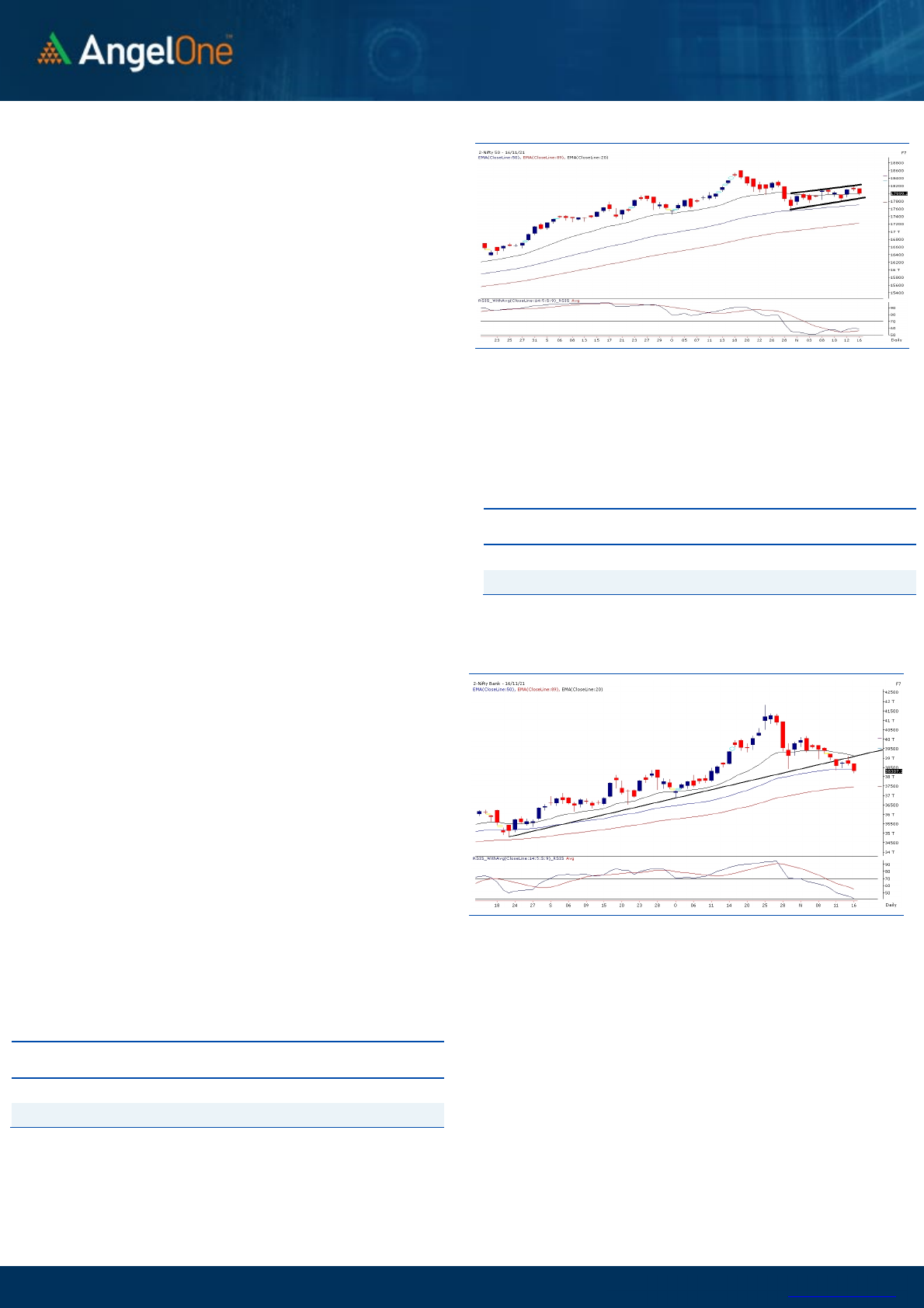

Since last 10 odd sessions, Nifty has done nothing. In fact if we take a

close look at the daily time frame chart, we can see prices oscillating

precisely within the boundaries of a small ‘Upward Sloping channel’.

Due to last two days’ of small correction, we are trading at the mid-

point of this trading range; but some of the heavyweights are now

indicating a possible weakness from hereon. For the coming session,

17900 – 17800 are the levels to watch out for. This being the lower

boundary of the ‘Channel’ pattern, a sustainable breach of this lower

range would lead to further correction in coming days.

Exhibit 1: Nifty Daily Chart

On the flipside,

18130

followed by

18200

are to be considered as

stiff hurdles. We continue to remain cautious on the market and

advise using intraday rebounds to lighten up longs. Yesterday’s

correction was mainly led by RELIANCE and banking space; hence all

eyes on these going ahead as they are going to dictate the near term

direction.

Key Levels

Support 1 – 17900 Resistance 1 – 18130

Support 2 – 17800 Resistance 2 – 18200

www.angelone.in

Technical & Derivatives Report

November 17, 2021

View

Yesterday, Nifty started on a positive note and remained

in a range for the major part. In the penultimate hour

however it started moving lower and eventually ended

with a loss of more than half a percent tad below 18000.

FIIs were net sellers in the cash market segment to the

tune of Rs. 561 crores. In index futures, they sold worth Rs.

578 crores with decrease in open interest indicating long

unwinding in yesterday’s session.

Nifty futures witnessed a marginal increase in open

interest in yesterday’s fall whereas Bank Nifty witnessed a

good build up indicating fresh short formations. FIIs were

sellers in cash segment and they unwounded their longs in

index futures. With yesterday’s fall, the put writers ran for

cover and hence we witnessed unwinding in strikes of

17900-18000 put options. On the flip side, fresh build up is

seen at 18100 call strikes. With above data, we sense

bounce are likely to get sold into and 18100 shall now act

as stiff resistance. On the lower side, 17900 followed by

17800 are the support that can be tested.

Comments

The Nifty futures open interest has increased by 0.86%. Bank

Nifty futures open interest has increased by 10.36% as

market closed at 17999.20 levels.

The Nifty November future closed with a premium of 4.8

point against a premium of 31.55 point in last trading session.

The December series closed at a premium of 64.05 point.

The INDIA VIX decreased from 15.46 to 15.20. At the same

time, the PCR-OI of Nifty has decreased from 0.99 to 0.86.

Few of the liquid counters where we have seen high cost of

carry are CROMPTON, INDUSTOWER, GSPL, TVSMOTOR, AND

INDHOTEL

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

18300

18400

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-20 10-22 10-26 10-28 11-1 11-3 11-5 11-11 11-15

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BSOFT

3205800 35.20 438.55 4.42

CHAMBLFERT

1231500 28.28 376.15 5.67

COFORGE

738600 22.65 5721.75 4.21

ASHOKLEY

50386500 17.52 147.10 -3.64

MARUTI

2860700 15.43 8050.35 7.15

INDHOTEL

18794806 10.92 216.90 0.30

M&M

12226200 10.87 960.30 3.35

FSL

7129200 9.81 174.50 3.83

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IRCTC

13673375 -11.97 921.05 1.71

BIOCON

14848800 -9.50 369.35 2.15

POWERGRID

22137283 -9.45 187.60 -0.42

HEROMOTOCO

4500000 -7.59 2750.90 2.01

SYNGENE

1430550 -7.32 602.75 1.59

BOSCHLTD

157850 -6.40 18617.25 1.78

AARTIIND

3529200 -6.40 960.30 -0.30

TECHM

9876000 -6.15 1599.95 1.26

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.86 0.85

BANKNIFTY

0.55 0.96

RELIANCE

0.46 0.44

ICICIBANK

0.40 0.37

INFY

0.51 0.37

Historical Volatility

SCRIP HV

MARUTI

37.29

METROPOLIS

50.74

MOTHERSUMI

56.33

CHAMBLFERT

53.12

SHREECEM

36.02

www.angelone.in

Technical & Derivatives Report

November 17, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 17999.20

FII Statistics for November 16, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3828.19 4406.14 (577.95) 166179 15245.60 (1.25)

INDEX

OPTIONS

405282.86 407388.58 (2105.72) 1600669 146912.94 4.00

297314.41

STOCK

FUTURES

14590.85 14559.58 31.27

1827727 136739.94 1.21

STOCK

OPTIONS

23362.77 23392.88 (30.11) 345347 26321.50 1.83

Total

447064.67

449747.18

(2682.51) 3939922

325219.98

2.27

Turnover on November 16, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

276983 25804.90 22.84

Index Options

53109499 5009316.75 26.84

Stock Futures

901940 70415.79 16.02

Stock Options

3632476 293429.49 28.61

Total

5,79,20,898

5398966.93 26.76

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18000 165.15

46.75 53.25 18046.75

Sell

18100 118.40

Buy

18000 165.15

84.85 115.15 18084.85

Sell

18200 80.30

Buy

18100 118.40

38.10 61.90 18138.10

Sell

18200 80.30

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

18000 153.10

40.05 59.95 17959.95

Sell

17900 113.05

Buy

18000 153.10

73.90 126.10 17926.10

Sell

17800 79.20

Buy

17900 113.05

33.85 66.15 17866.15

Sell

17800 79.20

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500 18600 18700 18800

Call Put

www.angelone.in

Technical & Derivatives Report

November 17, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 732 739

751 758 769

ASIANPAINT 3,071 3,112

3,160 3,200 3,249

AXISBANK 715 721

727 733 739

BAJAJ-AUTO 3,546 3,577

3,615 3,646 3,683

BAJFINANCE 7,420 7,488

7,569 7,637 7,718

BAJAJFINSV 17,888 18,049

18,280 18,441 18,672

BPCL 413 417

422 425 430

BHARTIARTL 718 724

733 739 748

BRITANNIA 3,632 3,661

3,711 3,740 3,790

CIPLA 903 913

928 937 953

COALINDIA 157 158

160 161 163

DIVISLAB 4,797 4,825

4,870 4,898 4,943

DRREDDY 4,735 4,776

4,839 4,880 4,942

EICHERMOT 2,611 2,661

2,700 2,750 2,789

GRASIM 1,780 1,802

1,838 1,860 1,896

HCLTECH 1,151 1,157

1,166 1,172 1,182

HDFCBANK 1,533 1,541

1,549 1,556 1,565

HDFCLIFE 707 710

715 718 723

HDFC 2,936 2,956

2,977 2,997 3,019

HEROMOTOCO 2,672 2,712

2,740 2,780 2,808

HINDALCO 433 439

450 456 466

HINDUNILVR 2,379 2,393

2,414 2,428 2,448

ICICIBANK 754 759

767 773 781

IOC 129 130

132 133 135

INDUSINDBK 1,001 1,011

1,028 1,039 1,056

INFY 1,761 1,777

1,793 1,809 1,825

ITC 232 234

237 238 241

JSW STEEL 647 656

665 674 683

KOTAKBANK 2,052 2,067

2,086 2,101 2,119

LT 1,924 1,940

1,960 1,976 1,996

M&M 910 935

951 976 991

MARUTI 7,311 7,681

7,905 8,274 8,498

NESTLEIND 19,183 19,322

19,461 19,600 19,739

NTPC 132 133

135 137 139

ONGC 155 156

158 159 161

POWERGRID 184 186

188 190 193

RELIANCE 2,449 2,484

2,529 2,564 2,609

SBILIFE 1,136 1,144

1,159 1,168 1,183

SHREECEM 27,199 27,669

28,472 28,942 29,745

SBIN 485 490

499 504 513

SUNPHARMA 782 790

804 812 826

TCS 3,524 3,540

3,558 3,574 3,592

TATACONSUM

813 823

840 851 868

TATAMOTORS 497 508

517 529 538

TATASTEEL 1,201 1,215

1,238 1,252 1,275

TECHM 1,565 1,582

1,594 1,611 1,623

TITAN 2,503 2,517

2,534 2,549 2,566

ULTRACEMCO 7,677 7,779

7,959 8,062 8,242

UPL 767 773

784 790 801

WIPRO 648 654

662 669 676

www.angelone.in

Technical & Derivatives Report

November 17, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in