March 17, 2023

www.angelone.in

Technical & Derivatives Report

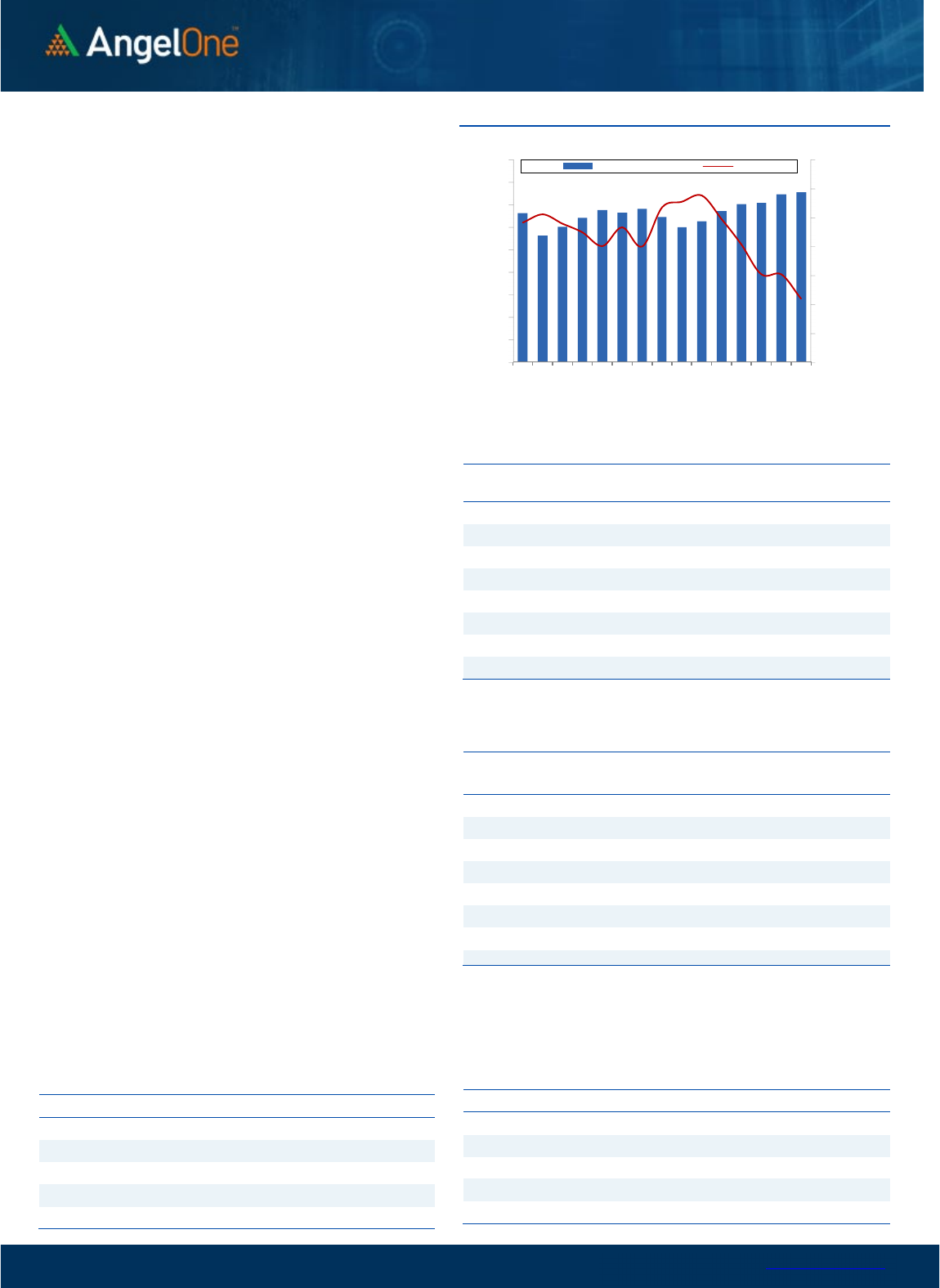

Nifty Bank

Outlook (

39

133

)

The Bank Nifty had a subdued beginning on the day of the weekly

expiry, and the recent unease in the market caused prices to dip to

38613 during the day. However, there was a sharp rebound that

helped to recoup the early losses, and prices remained in a range

for the rest of the day, ultimately closing with a 0.21% gain at

39133.

This marks an end to the five consecutive days of losses. There is

now positive divergence, with prices hitting a new low, but RSI not

following suit. Additionally, the "Long Legged Doji" candlestick

pattern seen yesterday suggests that bulls are showing some

resilience at lower levels. However, the market is not yet

completely stable, and prices must continue to sustain above

yesterday's high of 39400 in the coming sessions, and close above

39950 to confirm a higher top on the hourly charts. Conversely, the

low seen yesterday around 38600 - 38500 is a critical level to

watch. Traders are advised to monitor these levels closely and take

things one step at a time.

Key Levels

Support 1 – 38600 Resistance 1 – 39400

Support 2 – 38500 Resistance 2 – 39900

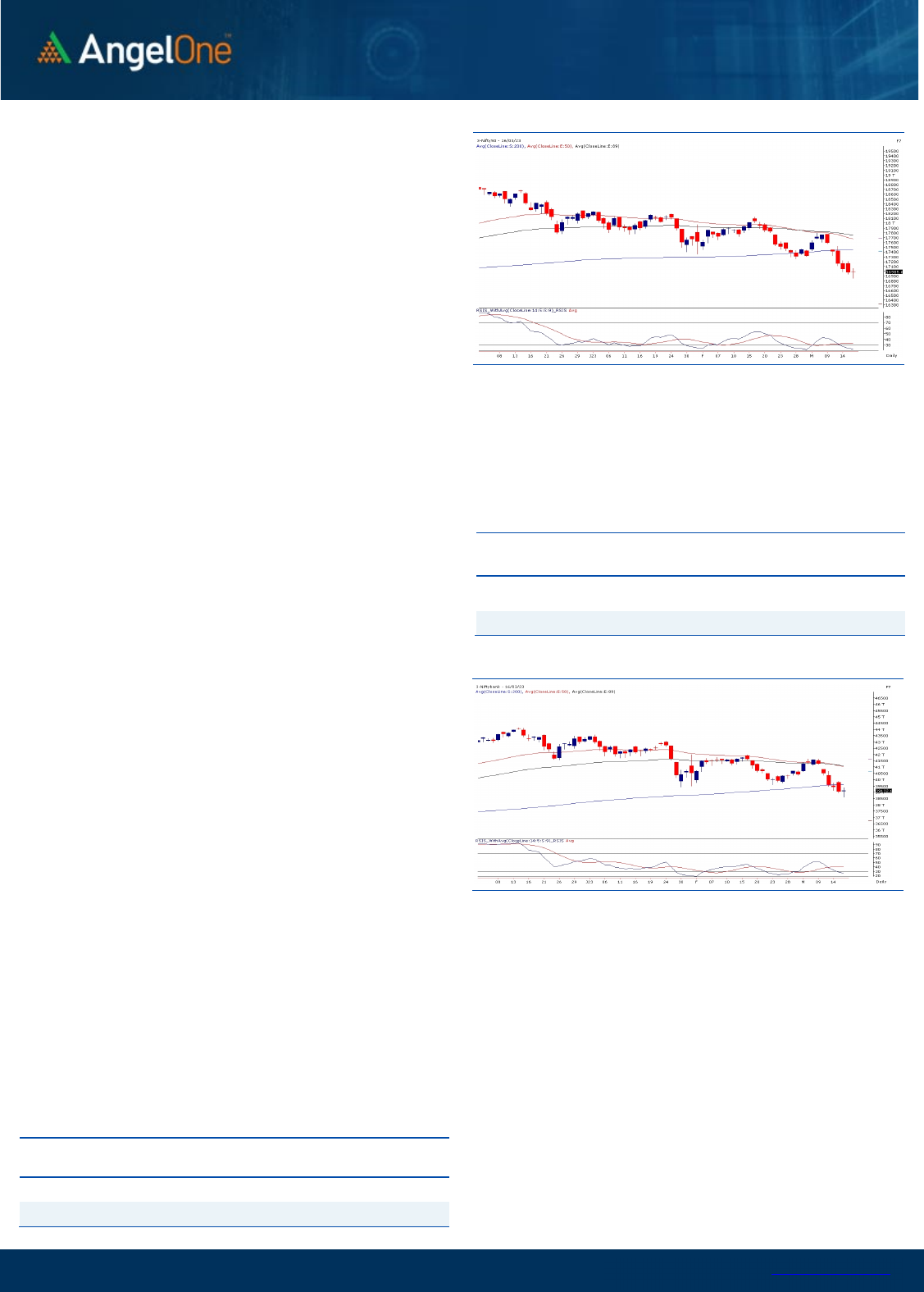

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

5

7

635

) / Nifty (

169

86

)

The Indian equity market had a volatile day of trade, wherein the

benchmark index Nifty50 started on a bleak note and slipped to the

low of 16850. But soon after, some resurgence was seen at the

lower grounds, which led to a modest recovery and the index

snapped its losing streak. Amidst the intense tug of war, the Nifty50

index concluded the weekly expiry session on a subdued note, with

mere gains of 0.08 percent and settled a tad below the 17000 mark.

Technically speaking, there is no significant change in the view as

the index is placed near the previous day’s close. However, with the

formation of a ‘long-legged Doji’ on the daily chart, one may

interpret a halt from the ongoing sell-off, which is an encouraging

sign for the market participants. As far as levels are concerned,

16900-16850 is expected to act as the sacrosanct support in the

near period. On the higher end, 17200-17250 is likely to act as an

immediate hurdle, followed by the sturdy wall of 200 SMA, placed

around 17400-17450 in a comparable period.

As we advance, one needs to keep close track of the strongly

beaten-up heavyweight counters, as they could witness some

recovery from hereon. Besides this, global development should

also be tracked closely, as any favorable cues could boost market

sentiments. Also, we would advocate traders to avoid aggressive

bets for the time being and focus on stock-specific actions.

Key Levels

Support 1 – 16900 Resistance 1 – 17150

Support 2 – 16850 Resistance 2 – 17200

www.angelone.in

Technical & Derivatives Report

March 17, 2023

View

Post slightly positive start, we saw some follow-up

selling to drag index towards 16850. However, in the

next hour itself it recouped all the losses and head

towards 17050. After some tug of war, we managed

to conclude the weekly expiry session with marginal

gains.

FIIs were net sellers in the cash market segment to

the tune of Rs. 282 crores. Simultaneously, in Index

futures, they sold worth Rs. 1814 crores with good

amount of rise in open interest, indicating addition

of short positions.

Though our market has been volatile in last couple of

sessions, no relevant build-up was witnessed in key

indices. On the options front, we are witnessing pile

up of positions in 17000 strike of both call and put

options which is quite rare. Meanwhile, the stronger

hands continue their selling streak not only in

equities but also in index futures recently. The ‘Long

Short Ratio’ has declined further to 11% from 16%

seen on Friday. At this point in time, we believe

market is extremely oversold and yesterday’s low

should be acting as a strong support zone, whereas

any sustainable move beyond 17200 shall be an

encouraging sign.

Comments

The Nifty futures open interest has increased by 1.82%

and Bank Nifty futures open interest has increased by

0.60% as the market closed at 16985.60.

The Nifty March future closed with a premium of 61.70

point against a premium of 65.20 point in the last

trading session. The April series closed at a premium of

157.95 point.

The INDIA VIX has decreased from 16.29 to 16.21. At

the same time, the PCR-OI of Nifty has increased from

0.67 to 0.75.

Few of the liquid counters where we have seen high

cost of carry are AMBUJACEM, HONAUT,

AUROPHARMA, INDIACEM and ACC.

Historical Volatility

SCRIP HV

MOTHERSON 47.63

BPCL 32.37

ICICIPRULI 37.96

ZEEL 54.56

HINDPETRO 39.24

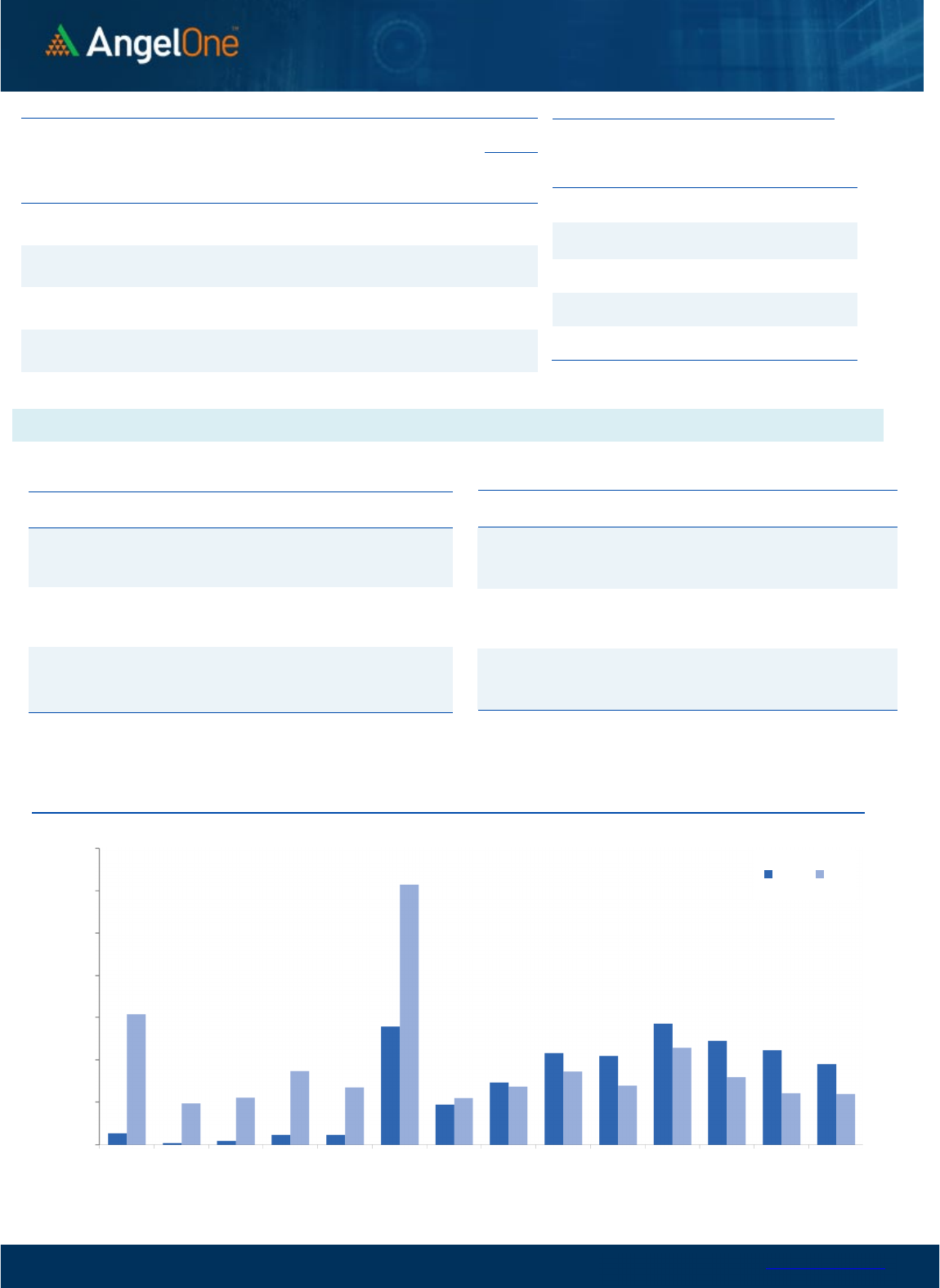

Nifty Vs OI

16600

16800

17000

17200

17400

17600

17800

18000

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

2/22 2/24 2/28 3/2 3/6 3/9 3/13 3/15

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SBILIFE 6979500 12.68 1062.65 -0.32

BAJAJ-AUTO 1148750 11.15 3800.20 1.76

CUB 14835000 9.69 130.10 -1.65

VEDL 42834000 9.42 275.05 -1.62

HINDALCO 29017800 8.83 384.95 -4.90

BPCL 15364800 8.11 350.90 5.97

MOTHERSON 67189500 7.95 68.50 -10.68

RBLBANK 36580000 7.87 141.45 -0.25

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SBILIFE 17600 12.68 1062.65 -0.32

BAJAJ-AUTO 1148750 11.15 3800.20 1.76

CUB 14835000 9.69 130.10 -1.65

VEDL 42834000 9.42 275.05 -1.62

HINDALCO 29017800 8.83 384.95 -4.90

BPCL 15364800 8.11 350.90 5.97

MOTHERSON 67189500 7.95 68.50 -10.68

RBLBANK 36580000 7.87 141.45 -0.25

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.75 0.95

BANKNIFTY 0.78 0.89

RELIANCE 0.46 0.49

ICICIBANK 0.57 0.61

INFY 0.40 0.49

www.angelone.in

Technical & Derivatives Report

March 17, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

69

85.60

0900

Lot Size = 75

FII Statistics for

March

1

6

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4443.77

6258.45

(1814.68) 211120

18719.93

11.97

INDEX

OPTIONS

3606663.38

3586329.42

20333.96

2490384

219399.21

(19.37)

STOCK

FUTURES

12249.61

13668.35

(1418.74) 2236871

144338.10

1.01

STOCK

OPTIONS

13723.07

13480.21

242.86

179329

11589.27

2.96

Total 3637079.83

3619736.43

17343.40

5117704

394046.51

(9.68)

Turnover

on

March

1

6

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

547675 50417.65

26.78

Index Options

478361327

85573.13

33.61

Stock Futures

843395 54326.95

18.51

Stock Options

3239193 2967.19 -7.38

Total

3,239,193 2967.19 26.45

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17000 230.95

55.20

44.80

17055.20

Sell

17100 175.75

Buy

17000 230.95

103.90

96.10

17103.90

Sell

17200 127.05

Buy

17100 175.75

48.70 51.30 17148.70

Sell

17200 127.05

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17000 190.30

37.45

62.55

16962.55

Sell 16900 152.85

Buy 17000 190.30

68.45

131.55

16931.55

Sell

16800 121.85

Buy

16900 152.85

31.00 69.00 16869.00

Sell 16800 121.85

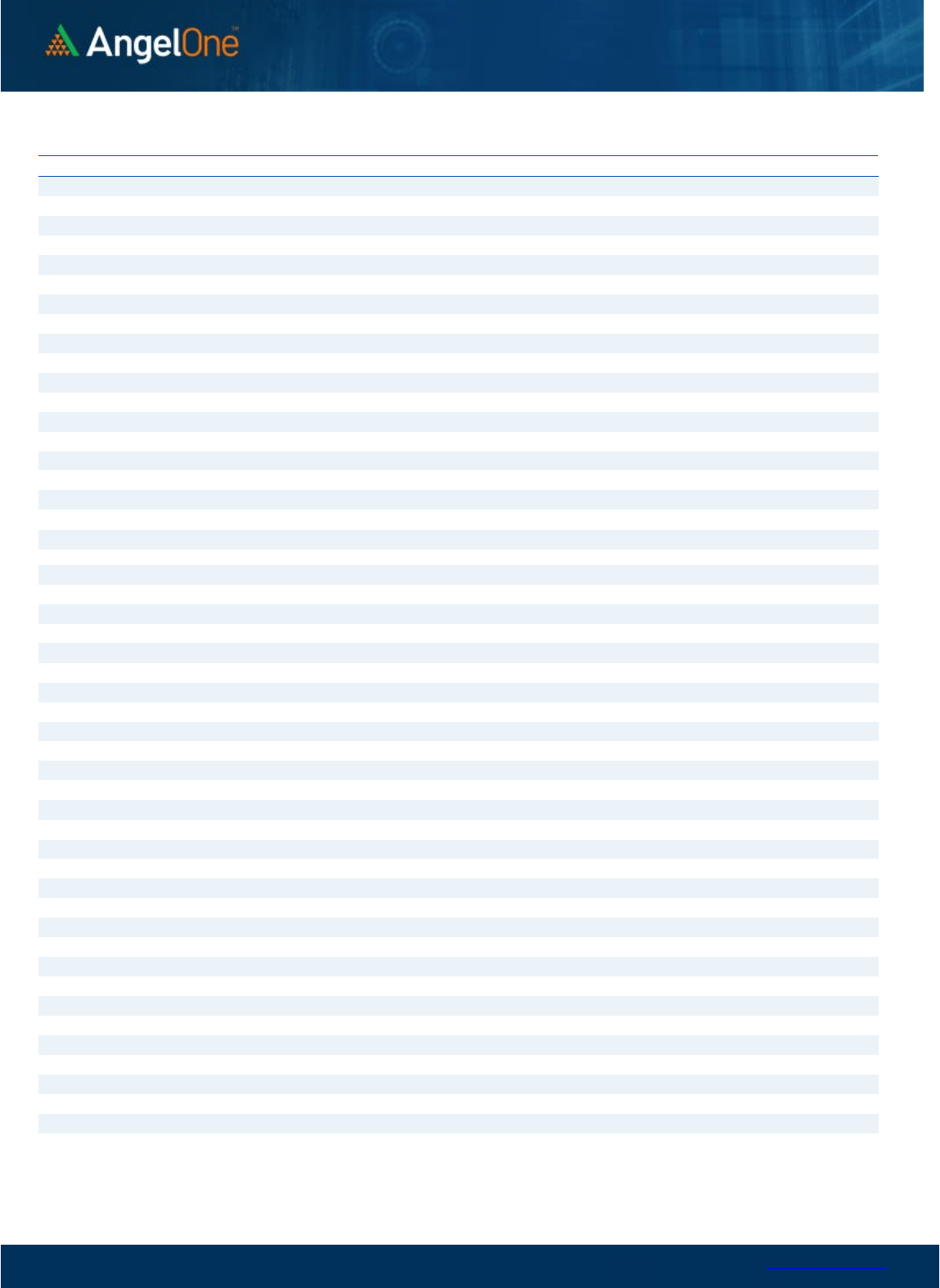

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

7000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

March 17, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,758

1,801

1,838

1,881

1,918

ADANIPORTS 665 672

682

690

700

APOLLOHOSP

4,214

4,267

4,318

4,371

4,422

ASIANPAINT

2,803

2,848

2,874

2,919

2,945

AXISBANK 804 817

828

841

851

BAJAJ-AUTO

3,714

3,757

3,784

3,827

3,854

BAJFINANCE

5,622

5,668

5,712

5,758

5,802

BAJAJFINSV

1,256

1,275

1,289

1,308

1,323

BPCL 327 339

346

358

365

BHARTIARTL 734 740

749

755

765

BRITANNIA

4,224

4,267

4,294

4,337

4,364

CIPLA 870 877

883

890

897

COALINDIA 214 217

220

223

226

DIVISLAB

2,725

2,763

2,806

2,844

2,887

DRREDDY

4,335

4,359

4,395

4,419

4,454

EICHERMOT

2,952

2,994

3,037

3,079

3,122

GRASIM

1,512

1,536

1,551

1,576

1,591

HCLTECH

1,059

1,066

1,077

1,083

1,094

HDFCBANK

1,521

1,536

1,548

1,563

1,575

HDFCLIFE

452

456

463

468

474

HDFC

2,481

2,506

2,527

2,552

2,573

HEROMOTOCO

2,348

2,359

2,377

2,388

2,406

HINDALCO 372 378

390

396

407

HINDUNILVR

2,384

2,422

2,445

2,483

2,507

ICICIBANK 801 812

822

833

843

INDUSINDBK 981 999

1,021

1,039

1,061

INFY

1,388

1,396

1,407

1,415

1,426

ITC 375 378

380

384

386

JSW STEEL 636 649

662

676

689

KOTAKBANK

1,633

1,648

1,664

1,679

1,694

LT

2,109

2,141

2,164

2,196

2,219

M&M

1,126

1,146

1,161

1,181

1,196

MARUTI

8,338

8,388

8,461

8,510

8,583

NESTLEIND

17,774

18,112

18,306

18,645

18,838

NTPC 176 178

179

181

182

ONGC 146 149

151

154

157

POWERGRID 227 229

231

234

236

RELIANCE

2,176

2,201

2,227

2,253

2,279

SBILIFE

1,035

1,049

1,069

1,083

1,103

SBIN 508 516

523

531

538

SUNPHARMA 945 956

963

974

981

TCS

3,144

3,165

3,192

3,213

3,240

TATACONSUM

686 690

693

697

701

TATAMOTORS 400 408

413

421

427

TATASTEEL 102 103

105

107

109

TECHM

1,092

1,105

1,114

1,127

1,135

TITAN

2,379

2,415

2,448

2,484

2,517

ULTRACEMCO

7,036

7,071

7,110

7,144

7,184

UPL 684 690

698

704

712

WIPRO 366 370

373

376

380

www.angelone.in

Technical & Derivatives Report

March 17, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.