DEC 16, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

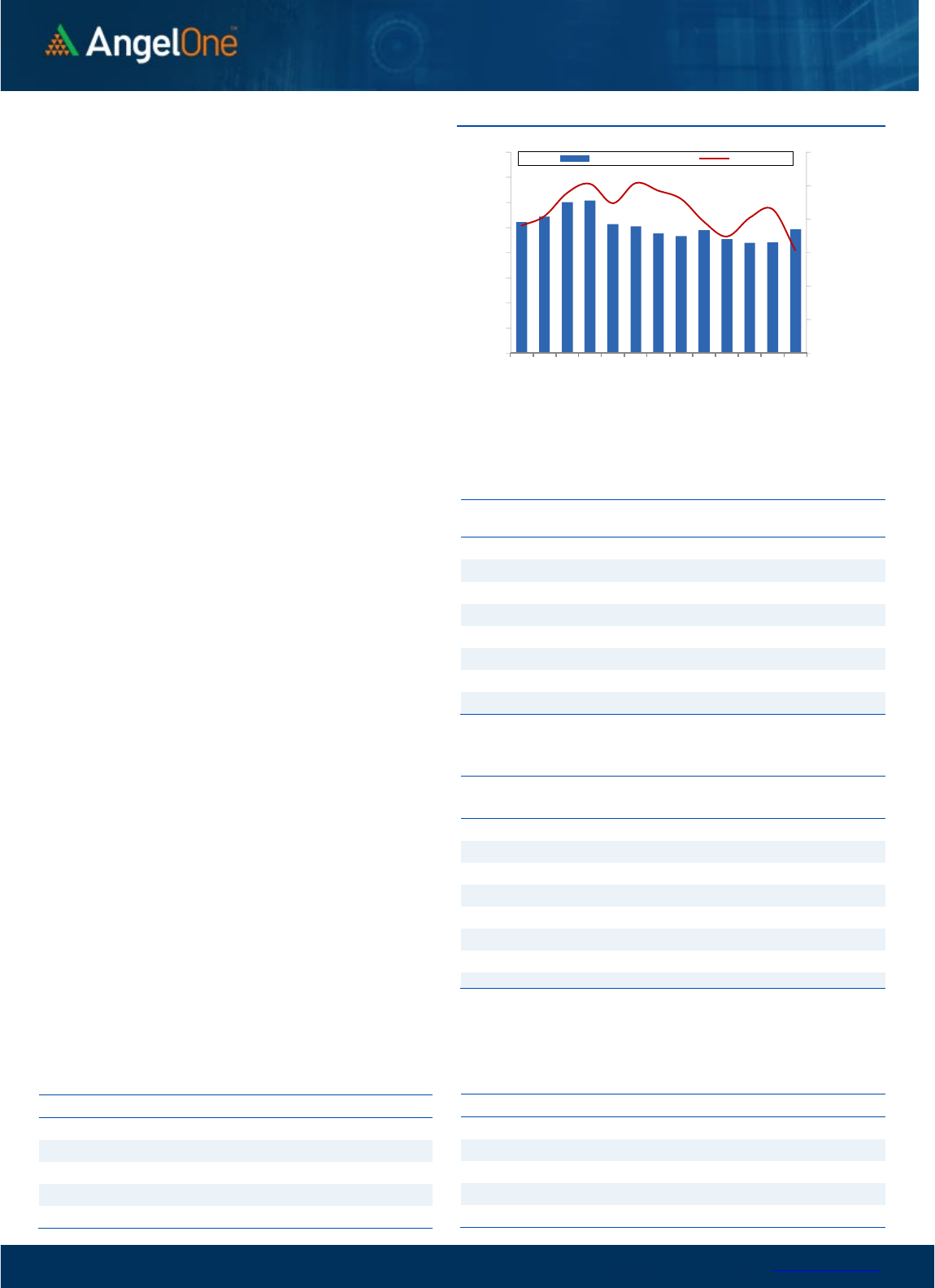

Nifty Bank Outlook (43498)

On the weekly expiry, Bank Nifty started on a weak note, and post

a modest recovery in the first hour there was sustained selling

pressure throughout the day. Bank Nifty eventually ended with a

loss of 1.25% tad below 43500.

Even though, the bank index was making fresh new highs; the

momentum was missing for the last few days as we were

witnessing small body candles indicating fatigue in the bulls' camp.

Yesterday, eventually a price-wise correction was triggered that

should be considered a breather for the bulls after the recent

relentless run. Technically, if we see we are witnessing a small

trend line breakdown on the daily chart and if the selling persists

in the coming session, then we can expect this correction to get

extended in the near term. The next key support in such

a scenario would be the 20ema placed around the 43100 levels. On

the flip side, 44000 - 44200 may act as sturdy resistance in case of

an immediate bounce back. Traders should understand that the

undertone remains bullish and in case of any price-wise correction

it should be considered as a buying opportunity to buy quality

propositions in a staggered manner.

Key Levels

Support 1 – 43100 Resistance 1 – 44000

Support 2 – 43000 Resistance 2 – 44200

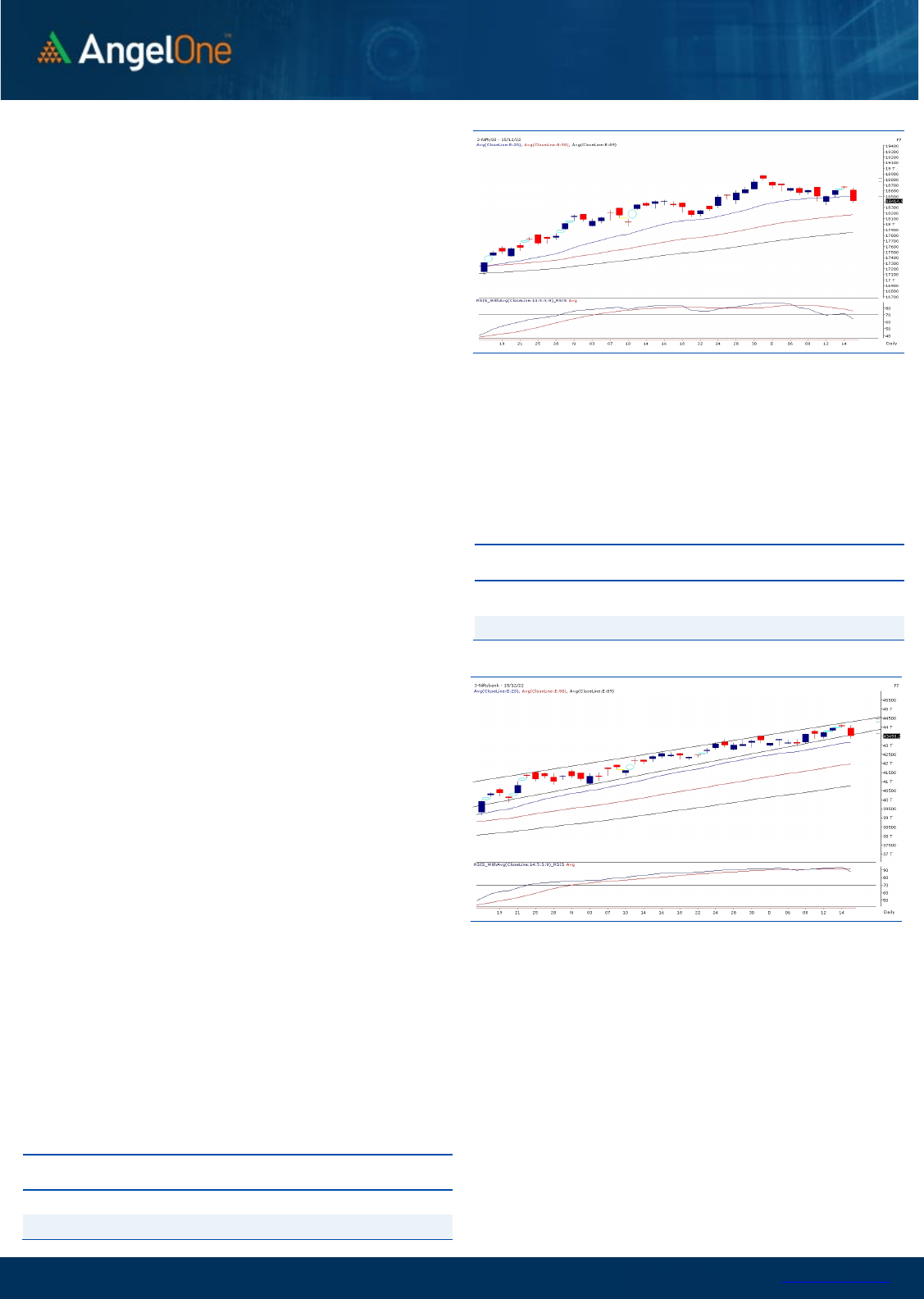

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (61799) / Nifty (18415)

US markets wobbled a bit after the Fed policy on Wednesday. The

kind of reaction we witnessed overnight, it appeared as if global

markets have digested this development and no major damage was

done. However, yesterday morning, markets across the globe

started feeling some pressure, which augmented as the day

progressed. Hence, the initial gradual decline in our bourses

became the considerable correction at the close. Nifty shed more

than 1.30% to close convincingly below the 18450 mark.

With yesterday’s sharp decline, not only sentiments but recent

chart structure has also been dented now. Since last few months,

we did not have any discomfort in all in-between corrections; but

the kind of price action we witnessed yesterday, does not augur well

for the bulls. The coming session would be quite crucial for our

market in order to maintain the recent optimism intact. We are not

far away from the key swing low of 18350. If we extend the

correction and sustains below it, we may see at least 300 – 400

points in the following sessions. The next levels to watch out for

would be 18230 – 18100 levels. Hopefully, this doesn’t happen

because it will apply immediate brakes on recent positive trend.

On the flipside, it would be crucial to reclaim 18500 – 18600 in

coming couple of sessions. Once we surpass this crucial zone,

yesterday’s down move then can be construed as a running

correction and market then resumes its upwards trajectory. Let’s

see how things pan out. It would also be important to keep a

close eye on global developments, which are likely to dictate the

near term direction.

Key Levels

Support 1 – 18350 Resistance 1 – 18500

Support 2 – 18230 Resistance 2 – 18600

www.angelone.in

Technical & Derivatives Report

DEC 16, 2022

View

Our market tumbled over the weak global cues,

wherein the benchmark index Nifty50 witnessed a

one-sided sell-off and shed over 1.30 percent on the

weekly expiry session, settling a tad above 18400 level.

FIIs were net sellers in the cash market segment to

the tune of Rs. 711 crores. Simultaneously, in Index

futures, they sold worth Rs. 1935 crores with a minor

rise in open interest, indicating a short buildup.

Looking at the F&O data, we witnessed short

addition in Nifty and long unwinding in Bank Nifty.

On the options front, the piling up of OI is seen at

18400 put strike, followed by 18200 PE. On the flip

side, the maximum OI concentration is seen at the

18600-call strike, signifying a stiff resistance for the

Nifty. Meanwhile, the stronger hands have covered

their longs and added a few in the short side,

contracting the ‘Long Short Ratio’ to 54% from 59%.

Considering the recent price action, we would

advocate to avoid undue risk and also to stay

abreast with global developments in the near

period.

Comments

The Nifty futures open interest has increased by

4.20% and Bank Nifty futures open interest has

decreased by 6.64% as the market closed at 18414.90.

The Nifty December future closed with a premium of

52.10 point against a premium of 88.60 point in the

last trading session. The January series closed at a

premium of 167 point.

The INDIA VIX increased from 12.88 to 13.73. At the

same time, the PCR-OI of Nifty has decreased from

1.02 to 0.76.

Few of the liquid counters where we have seen high

cost of carry are IRCTC, TECHM, AMBUJACEM,

PAGEIND and BATAINDIA.

Historical Volatility

SCRIP HV

IDEA 72.97

IBULHSGFIN 69.25

RBLBANK 67.73

GNFC 58.45

HINDCOPPER 58.18

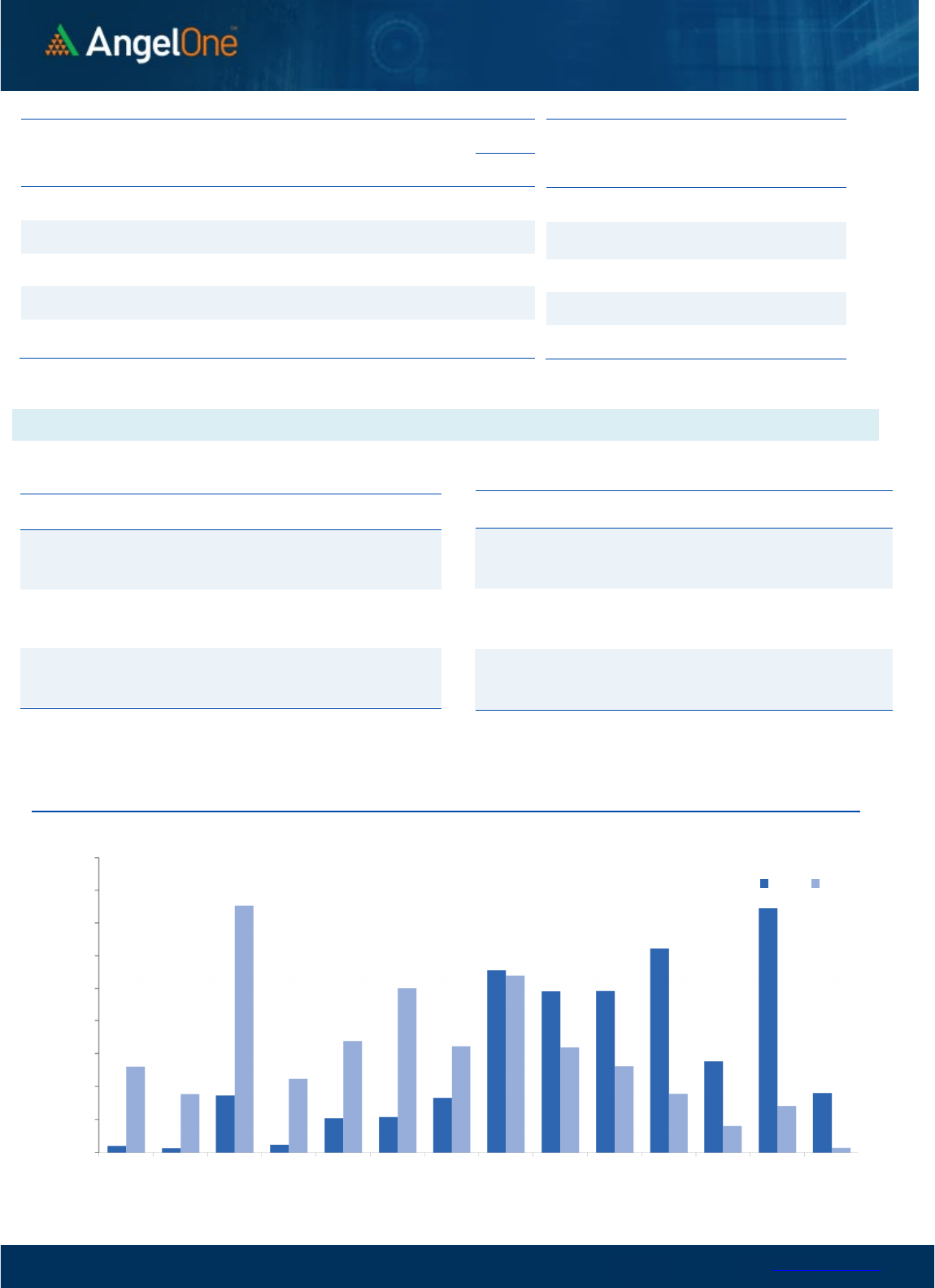

Nifty Vs OI

17800

18000

18200

18400

18600

18800

19000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

11/28 11/30 12/2 12/6 12/9 12/13 12/15

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IRCTC 21677250 25.09 689.05 -6.25

METROPOLIS 1723200 24.40 1322.05 -3.78

SRF 4648125 13.75 2400.65 -0.17

TECHM 13842000 13.48 1022.75 -3.88

AARTIIND 3806300 10.24 640.00 -3.23

INDIAMART 310350 8.38 4351.25 -1.79

CANBK 47744100 8.36 320.50 -2.46

TITAN 6816750 6.13 2522.70 -2.81

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CHAMBLFERT 8997000 -7.71 314.05 0.08

POLYCAB 1034700 -7.04 2981.45 -0.67

IBULHSGFIN 49204000 -6.71 149.80 2.88

ONGC 33895400 -6.69 147.45 -0.27

BHARATFORG 6388000 -6.49 899.25 -1.34

RAMCOCEM 3536850 -6.39 721.75 -0.65

VOLTAS 6234500 -5.71 850.40 -0.43

ABBOTINDIA 44160 -5.64 20571.60 -0.10

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.76 0.99

BANKNIFTY 0.75 1.01

RELIANCE 0.42 0.43

ICICIBANK 0.46 0.67

INFY 0.40 0.52

www.angelone.in

Technical & Derivatives Report

DEC 16, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

414

.

9

0

FII Statistics for

December

1

5

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2644.80 4579.43 (1934.63) 174403 17017.51 0.27

INDEX

OPTIONS

2242286.89 2235169.17 7117.72

1431237 137386.17 (32.28)

STOCK

FUTURES

8165.27 10135.53 (1970.26) 1960584 135526.04 0.28

STOCK

OPTIONS

10336.19 10355.78 (19.59) 166286 11769.97 5.24

Total 2263433.15

2260239.91

3193.24

3732510

301699.69

(15.18)

Turnover on

December

1

5

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

308677 3085072.74

37.29

Index

Options

314059646 4531168.56

49.64

Stock

Futures

677913 4886740.24

-0.80

Stock

Options

3102676 316664.93

-12.65

Total

31,02,676 316664.93

21.35

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18400 209.25

55.70

44.30

18455.70

Sell

18500 153.55

Buy

18400 209.25

103.25

96.75

18503.25

Sell

18600 106.00

Buy

18500 153.55

47.55 52.45 18547.55

Sell 18600 106.00

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18400 142.55

35.25

64.75

18364.75

Sell

18300 107.30

Buy 18400 142.55

60.30

139.70

18339.70

Sell 18200 82.25

Buy

18300 107.30

25.05 74.95 18274.95

Sell 18200 82.25

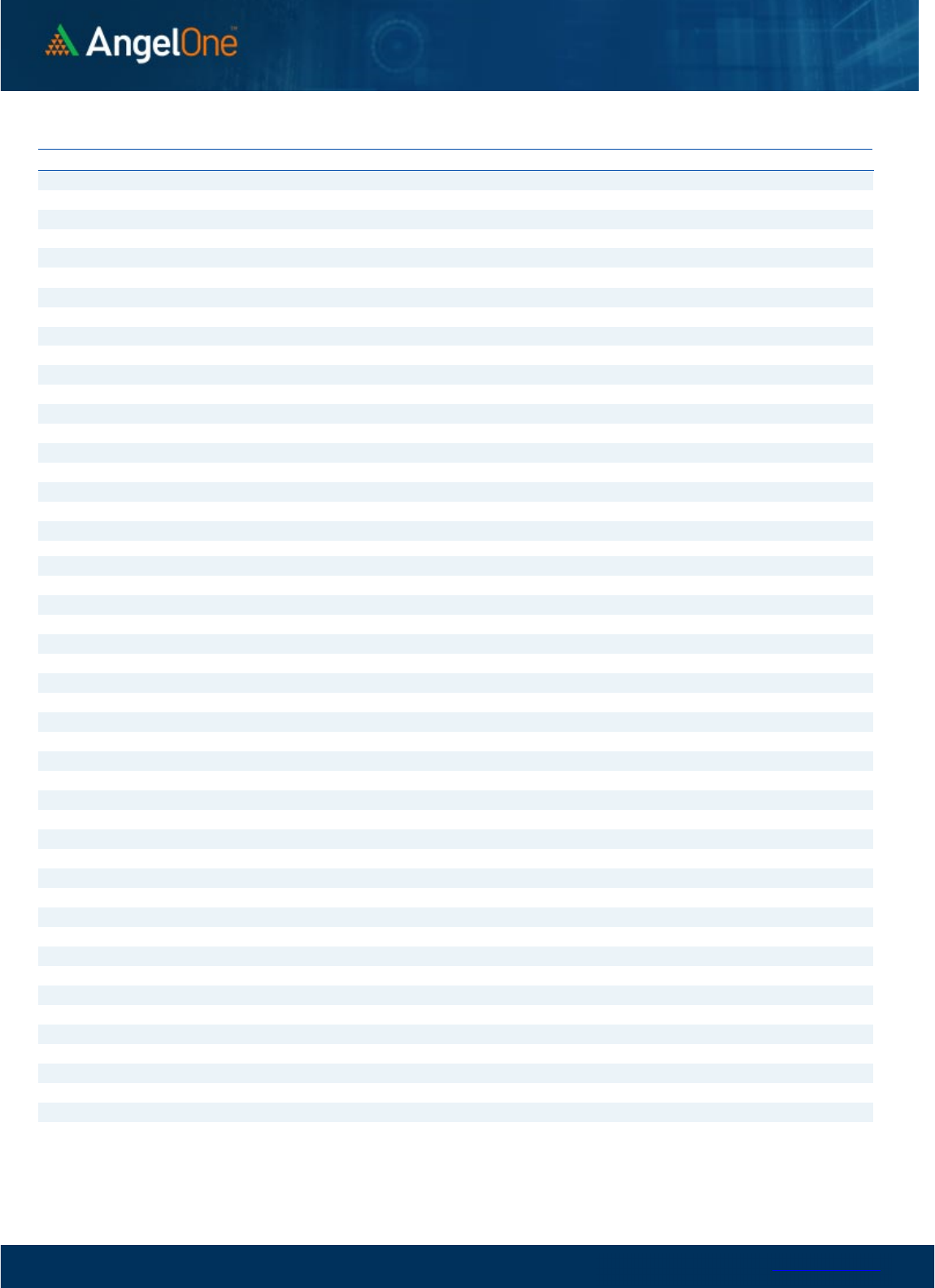

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

17800 17900 18000 18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100

Call Put

www.angelone.in

Technical & Derivatives Report

DEC 16, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT

3,999

4,021

4,047

4,070

4,095

ADANIPORTS

864

874

890

900

917

APOLLOHOSP 4,593 4,618

4,652

4,677

4,711

ASIANPAINT 3,092 3,111

3,136

3,156

3,181

AXISBANK 926 932

939

945

951

BAJAJ-AUTO 3,582 3,601

3,628 3,647 3,674

BAJFINANCE 6,538 6,582

6,648

6,692

6,758

BAJAJFINSV 1,581 1,593

1,612 1,624

1,644

BPCL

343

346

349

352

354

BHARTIARTL 821 823

827

830

834

BRITANNIA

4,381

4,423

4,454

4,496 4,527

CIPLA

1,088

1,095

1,106

1,113

1,125

COALINDIA

225

226

230

231

234

DIVISLAB

3,314

3,340

3,377

3,402 3,439

DRREDDY

4,419

4,444

4,486

4,511

4,552

EICHERMOT 3,242 3,273

3,327

3,358

3,413

GRASIM

1,749

1,768

1,797

1,815

1,844

HCLTECH

1,029

1,036

1,044

1,050

1,058

HDFCBANK

1,600

1,616

1,643

1,658

1,685

HDFCLIFE

570

575

581 586

592

HDFC

2,625

2,649

2,691

2,714

2,756

HEROMOTOCO

2,714

2,742

2,763

2,792

2,812

HINDALCO

452

456

464

468

475

HINDUNILVR 2,630 2,647

2,665

2,682 2,700

ICICIBANK

896

903

911

917

926

INDUSINDBK

1,211

1,225

1,249

1,264

1,288

INFY 1,514 1,527

1,549

1,562

1,583

ITC

333

336

341 344

349

JSW STEEL 727 735

749

757

771

KOTAKBANK

1,840

1,851

1,867

1,878

1,894

LT 2,151 2,164

2,187

2,200

2,222

M&M

1,276

1,281

1,287

1,293

1,299

MARUTI

8,512

8,548

8,611

8,647

8,710

NESTLEIND

19,325

19,532

19,841

20,047

20,356

NTPC

170

171

173

174

175

ONGC 145 146

148 149 150

POWERGRID

213

215

218

219

222

RELIANCE 2,544 2,561

2,588 2,605

2,632

SBILIFE

1,253

1,263

1,279

1,289

1,305

SBIN

605

610

620

626

635

SUNPHARMA

994

998

1,002

1,007

1,011

TCS

3,257

3,281

3,323

3,347 3,389

TATACONSUM

794

799

807

813 821

TATAMOTORS

411

414

418 421

426

TATASTEEL

109

110

112

113

114

TECHM

995

1,009

1,034

1,048

1,074

TITAN 2,468 2,495

2,542

2,569

2,616

ULTRACEMCO

7,010

7,062

7,140

7,192

7,269

UPL 752 761

775

784

798

WIPRO

391

393

396

399

402

www.angelone.in

Technical & Derivatives Report

DEC 16, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.