October

1

6

, 2023

www.angelone.in

Technical & Derivatives Report

8

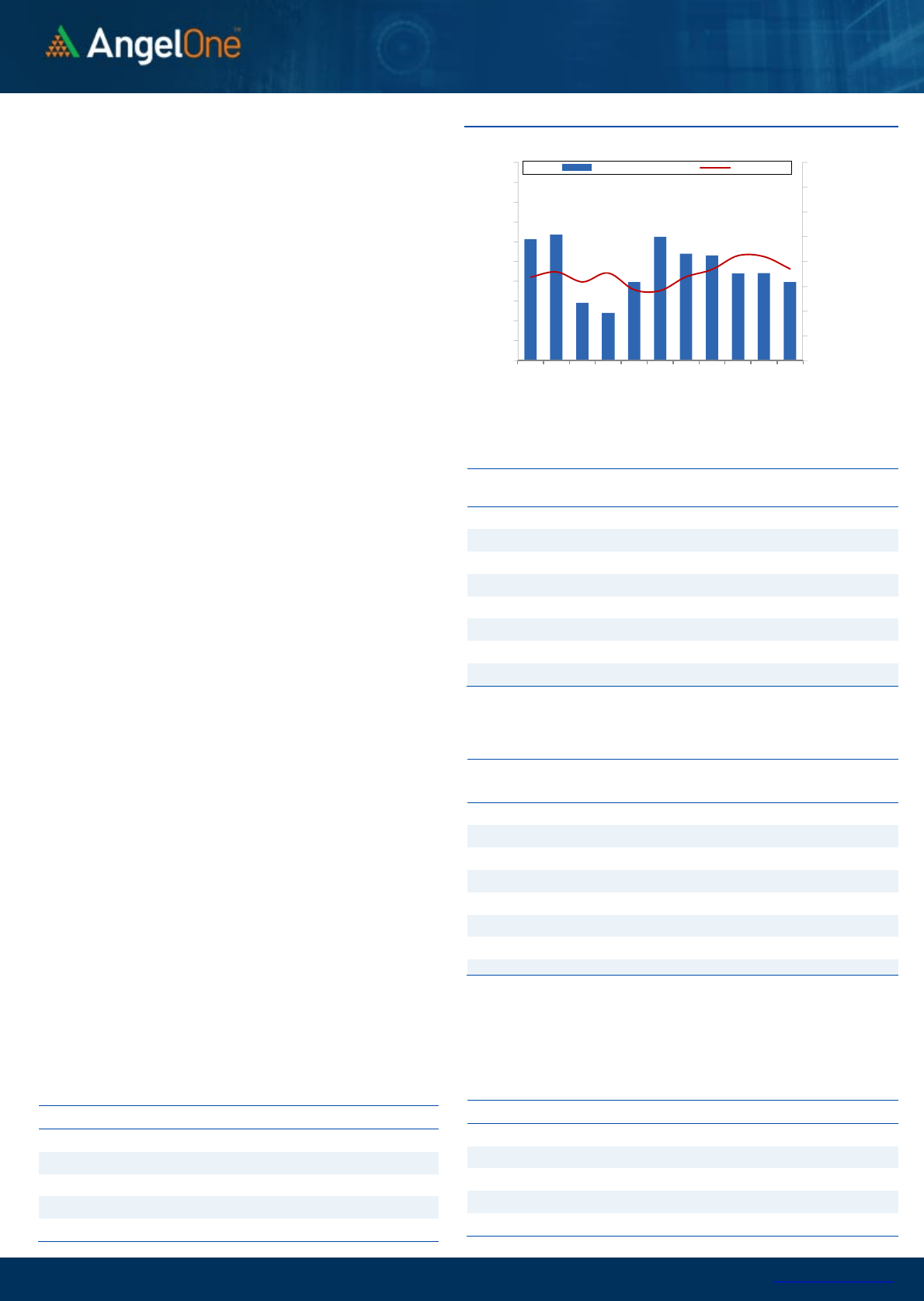

Nifty Bank Outlook (

4

4

288

)

The week began on a gloomy note for this heavyweight index as it

opened with a gap down, largely due to geopolitical uncertainties.

After the initial gap down, Bank Nifty re-tested its crucial level of

43800, sparking some smart buying interest which gradually pulled the

index higher. However, as the index inched higher, it encountered

strong resistance from the convergence of major EMA’s and closed the

week with little significant activity for the remainder of the week,

ultimately closing at 44288, losing 0.16 percent from previous week.

Despite rebounding from the key support level of 43800, BANKNIFTY

struggled to go past the sturdy wall of 44700 - 44800 in the latter

half of the week. Even after the buoyant effort from bulls following

Monday’s gap down, there hasn’t been much yield and the formation

of two consecutive small bodied candles which practically resembles a

'Doji'. This was followed by a weak session on Friday with formation of

yet another 'Doji'. This indicates nervousness among the market

participants. The hesitancy around pivotal levels and the false

breakout above falling trendline on daily charts; does not portray a

rosy picture and traders should heed caution. A violation of above-

mentioned level of 43800 could potentially open the flood gates,

signalling short term weakness that might push the index towards the

levels of 43300 and 43500.

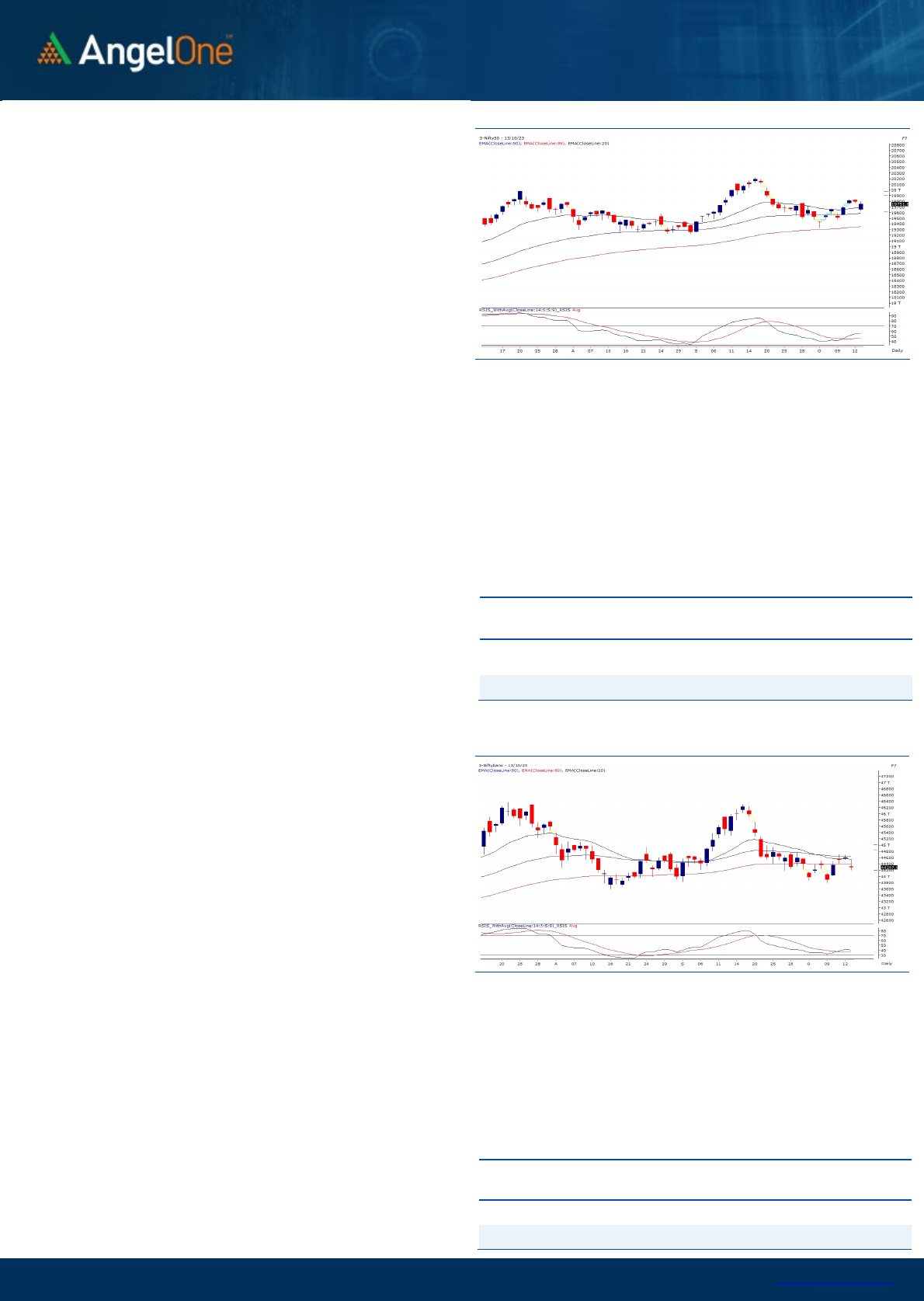

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

6

6

283

) / Nifty (

19

7

51

)

During the last week, key indices commenced with a gap-down opening

due to mounting geopolitical concerns with respect to the Israel -

Palestine war. The overall situation is very dismal there; but fortunately

in the market, we did not see further escalation. As the week

progressed, the benchmark index gradually ascended in the following

sessions. In anticipation of key quarterly results of a few heavyweight

IT counters, the tentativeness was clearly visible at higher levels. On

Friday, we started the session with a decent cut; courtesy to weak

guidance from Infosys. Nevertheless, traders swiftly bought this dip

and recovered major lost ground. Eventually, the eventful week

concluded with a gain of half a percent, ending a tad above the 19750.

Throughout the week, there was a tug-of-war between bulls and bears,

ultimately leaving prices in an uncertain position. Several positive

developments, such as prices closing above key moving averages and a

favorable RSI smoothened buy signal, were noted. However, these

indicators are sometimes laggard (late to interpret), and the true

situation is identified by the momentum that seemed to be missing by

the bulls. Additionally, prices seemed tentative as they approached a

critical level of 61.8% retracement, coinciding with a key bearish gap. It

is essential for the bulls to convincingly surpass this crucial level around

19880, or else there might be the formation of a lower top on the daily

chart, potentially leading to near-term weakness. On the flip side, while

there was a willingness to buy on dips during the week, caution is

advised due to ongoing geopolitical concerns, and aggressive long bets

should be avoided overnight.

The next market direction will depend on global developments and

the quarterly earnings announcements of key heavyweight

companies. Traders should keep an eye on specific levels to assess

the trend. Key support levels for the week are 19600 and 19480,

while formidable barriers are set at 19880 and 20000. Throughout

the week, there were opportunities for stock-specific trades, and in

the future, trading opportunities may emerge on both sides of the

trend across various sectors as the earnings season begins. Traders

can focus on these opportunities for potential outperformance, but

they should exercise caution and be highly selective.

Key Levels

Support 1 – 19600 Resistance 1 – 19880

Support 2 – 19480 Resistance 2 – 20000

On the contrary, hurdles for Bank Nifty are currently placed at every

short interval, and for this week the zone of 44500 - 44800 has now

become a tough nut to crack. As mentioned in our earlier reports,

markets appear to have entered a phase of uncertainty. Keeping that

in mind, it would be advisable for traders to monitor the above-

mentioned levels hawk-eyed and be patient for a while.

Key Levels

Support 1 – 44000 Resistance 1 – 44500

Support 2 – 43800 Resistance 2 – 44800

www.angelone.in

Technical & Derivatives Report

October

16

,

2023

View

The Indian equity market witnessed a volatile week.

The week was inaugurated on a rough note testing

19500 on the first day of the week; however, smart

recovery was seen from the next day onwards to

head towards 19850 mark. Friday we once again

witnessed a gap-down opening which got bought

into to end the week around 19750 mark.

FIIs were net buyers in the cash market segment to

the tune of Rs. 317 cr. Simultaneously, they sold

worth Rs. 785 cr in Index futures with a rise in open

interest, indicating the addition of fresh shorts.

On the derivatives front, open interest shed for the

key indices. FIIs continued to remain net sellers in

equities during the week and their activity in the

index futures segment remained muted. Their Long-

short ratio remained unchanged at 27% on a weekly

basis. For the coming festive weekly series, 19700

put and 19800 call strikes are attracting trader’s

attention. At this point in time, it’s advisable avoiding

any aggressive bets until the global uncertainty

subsides.

Comments

The Nifty futures open interest has decreased by 2.10%

and Bank Nifty futures open interest has increased by

9.56% as the market closed at 19751.05.

The Nifty October future closed with a discount of 9.00

points against 49.50 points in the last trading session.

The November series closed at a premium of 115.35

points.

The INDIA VIX has increased from 10.60 to 10.62. At the

same time, the PCR-OI of Nifty has increased from 1.05

to 1.14.

A few of the liquid counters where we have seen high

cost of carry are MOTHERSON, CROMPTON, CUB, BEL

and BIOCON.

Historical Volatility

SCRIP HV

CUMMINSIND 31.00

IDEA 65.65

ICICIGI 28.36

INDIGO 34.78

COROMANDEL 29.52

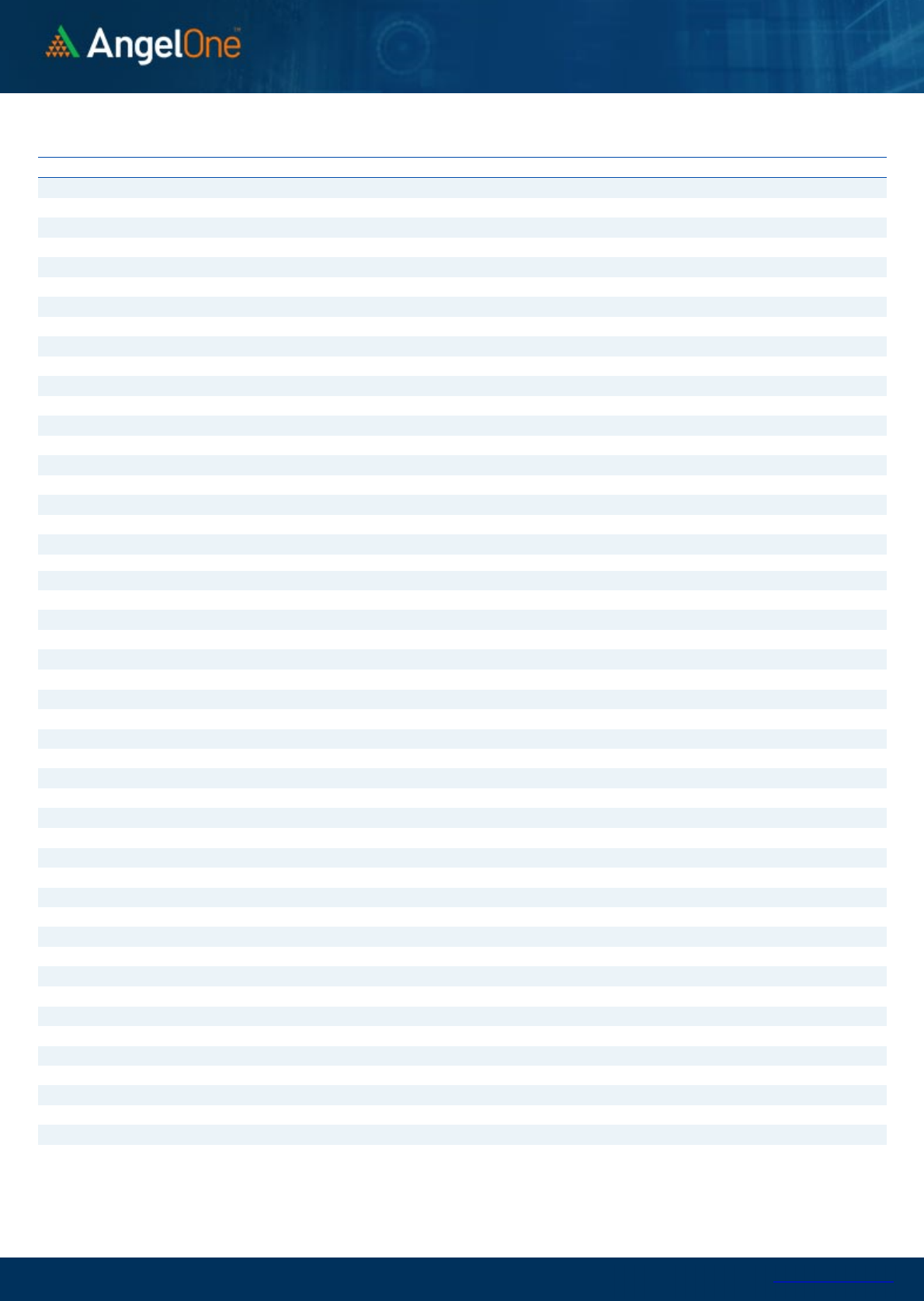

Nifty Vs OI

19000

19200

19400

19600

19800

20000

20200

20400

20600

9,000

9,500

10,000

10,500

11,000

11,500

12,000

12,500

13,000

13,500

14,000

9-26 9-28 10-3 10-6 10-10 10-13

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

INDIGO 5887200 14.61 2607.55 0.94

INFY 28519200 13.14 1431.20 -3.22

PETRONET 28509000 13.12 231.05 1.03

SYNGENE 4019000 12.01 779.65 -2.37

METROPOLIS 1779200 11.17 1558.40 2.84

TATAMOTORS 75385350 10.10 667.10 4.53

SBIN 103080000 9.10 576.15 -1.95

AXISBANK 52659375 7.45 994.05 -2.26

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

HDFCAMC 17600 -11.60 2855.45 3.61

HCLTECH 11307100 -9.50 1255.85 2.84

TCS 11838050 -6.52 3570.75 0.66

SUNTV 9562500 -5.63 633.50 -1.02

MGL 2431200 -5.56 1128.10 0.26

LTTS 659000 -5.15 4726.05 0.14

ALKEM 756200 -4.95 3612.40 0.33

BSOFT 8228000 -4.94 543.50 -0.06

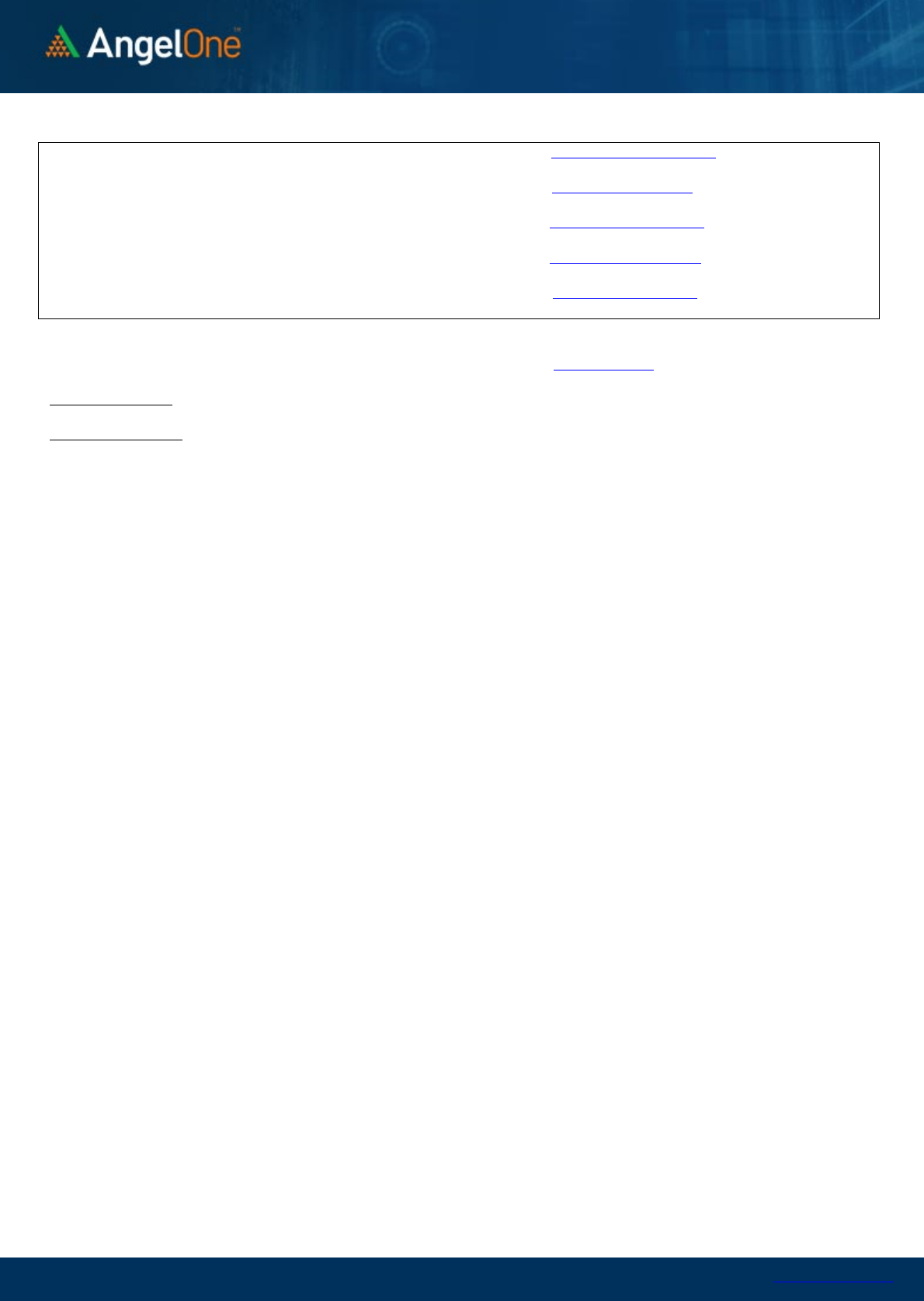

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.14 0.88

BANKNIFTY 0.81 0.86

RELIANCE 0.57 0.42

ICICIBANK 0.55 0.49

INFY 0.42 0.62

www.angelone.in

Technical & Derivatives Report

October

16

,

2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Oct Series) are given as an information and not as a recommendation.

Nifty Spot =

19

794

FII Statistics for

October

1

3

, 2023

Detail Buy

Contracts

OI Value

(in Cr.)

Sell Net CHANGE

INDEX

FUTURES

2820.49 3604.96 (784.47) 177885 14528.63 7.92

INDEX

OPTIONS

812410.15 823092.96 (10682.81) 3506018 285899.77 38.54

STOCK

FUTURES

15830.47 15835.39 (4.92) 2411056 190635.70 0.05

STOCK

OPTIONS

30282.04 30355.28 (73.24) 223964 18220.15 6.02

Total

861343.15

872888.59

(11545.44) 6318923

509284.25

18.85

Turnover on

October

1

3

, 2023

Instrument

No. of

Contracts

Turnover

(in Cr.)

Change

(%)

Index Futures

163188 13902.68

-32.08

Index Options

349198052

36977.83

-26.91

Stock Futures

799552 63622.39

13.09

Stock Options

4035391 4527.98 14.63

Total

40,35,391 4527.98 -9.32

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

19800

115.50 42.35

57.65

19842.35

Sell

19900

73.15

Buy

19800 115.50 70.85

129.15

19870.85

Sell

20000 44.65

Buy

19900

73.15 28.50 71.50 19928.50

Sell

20000 44.65

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

19800 169.70

45.05

54.95

19754.95

Sell 19700 124.65

Buy 19800 169.70

79.80

120.20

19720.20

Sell

19600 89.90

Buy

19700 124.65

34.75 65.25 19665.25

Sell 19600 89.90

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

19200 19300 19400 19500 19600 19700 19800 19900 20000 20100 20200 20300 20400 20500

Call Put

www.angelone.in

Technical & Derivatives Report

October

16

,

2023

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIENT 2,385 2,420 2,457 2,492 2,530

ADANIPORTS 796 805 815 824 834

APOLLOHOSP 4,898 4,958 4,993 5,053 5,089

ASIANPAINT 3,106 3,127 3,150 3,171 3,193

AXISBANK 980 987 999 1,006 1,018

BAJAJ-AUTO 4,989 5,020 5,072 5,104 5,155

BAJFINANCE 7,903 7,978 8,030 8,104 8,157

BAJAJFINSV 1,610 1,628 1,639 1,657 1,668

BPCL 345 346 348 350 352

BHARTIARTL 943 948 952 958 962

BRITANNIA 4,490 4,532 4,557 4,599 4,624

CIPLA 1,143 1,155 1,162 1,175 1,182

COALINDIA 301 305 308 311 314

DIVISLAB 3,710 3,723 3,743 3,755 3,775

DRREDDY 5,366 5,413 5,469 5,516 5,571

EICHERMOT 3,413 3,445 3,472 3,504 3,531

GRASIM 1,960 1,971 1,986 1,997 2,012

HCLTECH 1,186 1,221 1,244 1,279 1,302

HDFCBANK 1,519 1,528 1,538 1,546 1,557

HDFCLIFE 606 616 624 634 643

HEROMOTOCO 3,060 3,079 3,099 3,118 3,138

HINDALCO 472 476 482 486 492

HINDUNILVR 2,529 2,549 2,563 2,583 2,597

ICICIBANK 938 945 951 958 964

INDUSINDBK 1,404 1,434 1,450 1,480 1,496

INFY 1,385 1,408 1,423 1,446 1,461

ITC 444 446 449 451 454

JSW STEEL 770 774 777 781 784

KOTAKBANK 1,744 1,753 1,761 1,771 1,779

LT 3,049 3,069 3,084 3,105 3,120

LTIMINDTREE 4,995 5,045 5,125 5,175 5,255

M&M 1,538 1,550 1,562 1,574 1,586

MARUTI 10,452 10,590 10,667 10,805 10,883

NESTLEIND 22,725 23,140 23,370 23,784 24,014

NTPC 238 240 242 244 246

ONGC 183 184 185 186 187

POWERGRID 198 200 201 203 204

RELIANCE 2,317 2,333 2,345 2,361 2,374

SBILIFE 1,303 1,310 1,320 1,326 1,336

SBIN 571 574 577 580 584

SUNPHARMA 1,113 1,129 1,138 1,154 1,163

TCS 3,506 3,538 3,558 3,590 3,610

TATACONSUM

878 895 907 925 936

TATAMOTORS 620 644 656 680 692

TATASTEEL 123 124 125 126 127

TECHM 1,169 1,182 1,192 1,205 1,215

TITAN 3,245 3,265 3,286 3,305 3,326

ULTRACEMCO 8,254 8,312 8,364 8,422 8,474

UPL 613 618 622 627 630

WIPRO 406 409 412 414 417

www.angelone.in

Technical & Derivatives Report

October

16

,

2023

Technical and Derivatives Team:

Sameet Chavan Head Research – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Analyst - Technical rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Hitesh Rathi Analyst – Technical & Derivatives hitesh.rathi@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

We, Angel One Limited (hereinafter referred to as “Angel”) a company duly incorporated under the provisions of the Companies Act, 1956 with

its registered office at 601, 6th Floor, Ackruti Star, Central Road, MIDC, Andheri East, Mumbai – 400093, CIN: (L67120MH1996PLC101709) and

duly registered as a member of National Stock Exchange of India Limited, Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited,

Multi Commodity Exchange of India Ltd and National Commodity & Derivatives Exchange Ltd. Angel One limited is a company engaged in

diversified financial services business including securities broking, DP services, distribution of Mutual Fund products. It is also registered as a

Depository Participant with CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund

Distributor. Angel One Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164 and also registered with PFRDA as PoP ,Registration No.19092018. Angel Group does not have any joint

ventures or associates. Angel One Limited is the ultimate parent company of the Group. Angel or its associates has not been debarred/ suspended

by SEBI or any other regulatory authority for accessing /dealing in securities Market.

AOL was merged with Angel Global Capital Private Limited and subsequently name of Angel Global Capital Private Limited was changed to Angel

Broking Private Limited (AOL) pursuant to scheme of Amalgamation sanctioned by the Hon'ble High Court of Judicature at Bombay by Orders

passed in Company Petition No 710 of 2011 and the approval granted by the Registrar of Companies. Further, name of Angel Broking Private

Limited again got changed to Angel Broking Limited (AOL) pursuant to fresh certificate of incorporation issued by Registrar of Companies (ROC)

dated June 28, 2018. Further name of Angel Broking name changed to Angel One Ltd pursuant to fresh certificate of incorporation issued by

Registrar of Companies (ROC) dated 23-09-21.

In case of any grievances please write to: support@angelone.in, Compliance Officer Details: Name : Hiren Thakkar, Tel No. –08657864228, Email

id - compliance@angelone.in

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns

to investors.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither research entity nor research analyst has been engaged in market making activity for the subject company.

www.angelone.in

Technical & Derivatives Report

October

16

,

2023

*

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited does not warrant the accuracy, adequacy or

completeness of the service, information and materials and expressly disclaims liability for errors or omissions in the service, information and

materials. While Angel One Limited endeavours to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.

Investment in securities market are subject to market risks. Read all the related documents carefully before investing.

Any communication sent to clients on phone numbers or e-mail ids registered with the Trading Member is meant for client consumption and such

material should not be redistributed. Brokerage will not exceed SEBI prescribed limit. Any Information provided by us through any medium based

on our research or that of our affiliates or third parties or other external sources is subject to domestic and international market conditions and

we do not guarantee the availability or otherwise of any securities or other instruments and such Information is merely an estimation of certain

investments, and we have not and shall not be deemed to have assumed any responsibility for any such Information. You should seek independent

professional advice and/or tax advice regarding the suitability of any investment decision whether based on any Information provided by us

through the Site from inhouse research or third party reports or otherwise.

The report and information contained herein is strictly confidential and meant solely for the selected recipient and may not be altered in any way,

transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written

consent.