SEPT 16, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

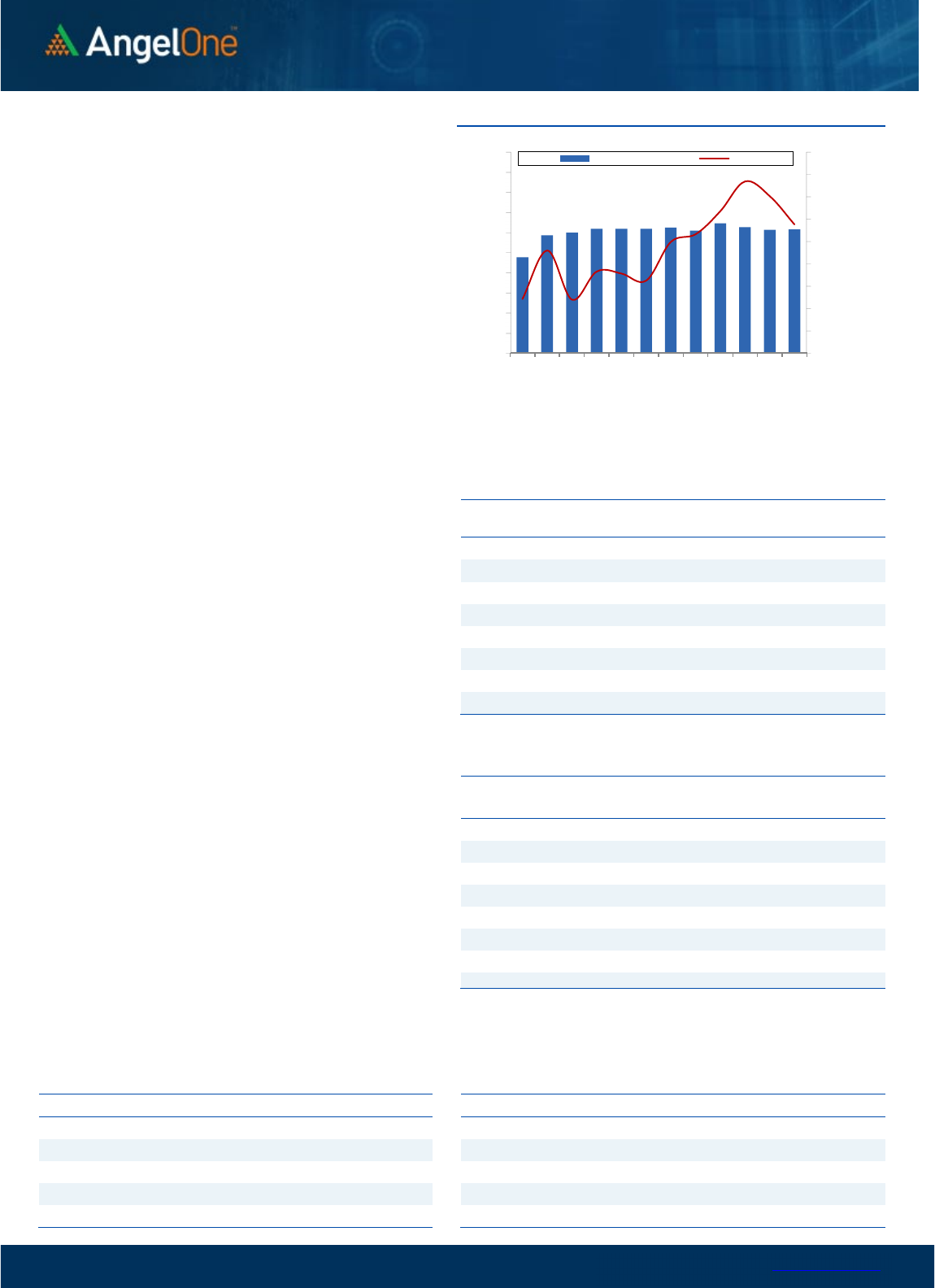

Nifty Bank Outlook (41209)

After a flat start, Bank Nifty immediately witnessed a follow-up

move to the previous session run, and within the first half an hour

itself, the Bank Index marked a fresh new high. The excitement for

this new achievement was however short-lived as we witnessed

profit booking during the remaining part of the session to

eventually end with a cut of 0.47% tad above 41200.

In line with our expectations, the bank index marked a fresh new

high yesterday however after achieving this target we saw some

profit booking and it was obvious after the sharp up move seen

from the Wednesday's swing low the intraday indicators were

highly overbought. The undertone remains bullish however since

the initial target has been achieved and considering yesterday's

sluggishness after marking a fresh new high; one needs to be

watchful for the next few sessions. Ideally going with the primary

uptrend, one should remain with the recent strategy of buying on

dips with strong support placed at Wednesday's low around 40300

whereas for the momentum to trigger again prices need to see a

sustained close above 41900 levels. Immediate supports to

consider for buying on dips would be in the range of 40750 - 41000.

Key Levels

Support 1 – 41000 Resistance 1 – 41600

Support 2 – 40750 Resistance 2 – 41850

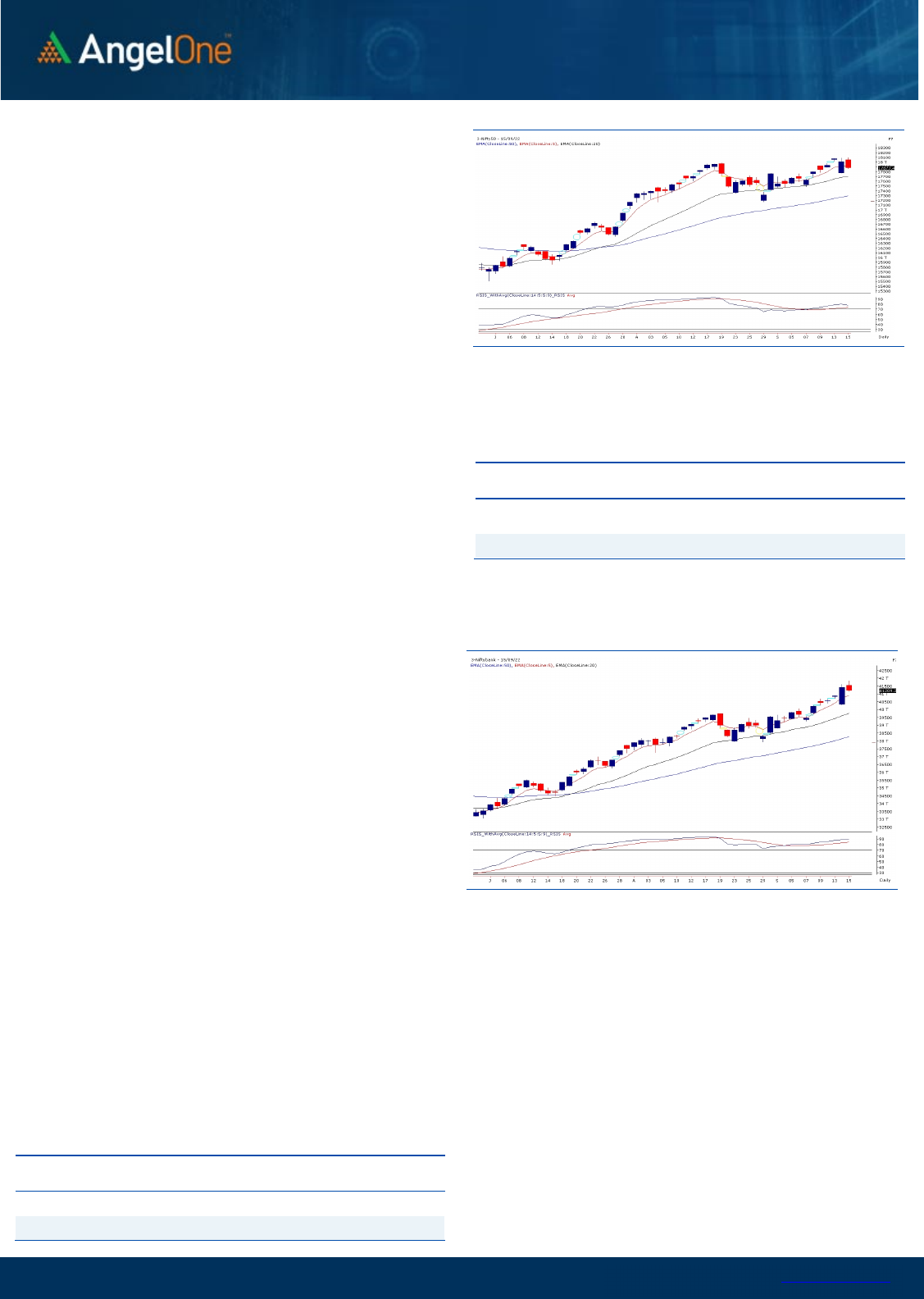

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59934) / Nifty (17877)

Wednesday’s dramatic session was followed by a pleasant start

yesterday morning. Within few minutes of trade, Nifty moved

towards 18100 and meanwhile the banking index just hastened to

register a new high of 41840.15. It looked like as if we are going to

have a great weekly expiry yesterday. But as mostly market

surprises every now and then, we witnessed a sharp profit booking

thereafter to not only pare down gains but also slipped well inside

the negative territory. With some volatile swings in the latter half,

the Nifty eventually concluded the weekly expiry with a cut of seven

tenths of a percent, tad below the 17900 mark.

Yesterday’s profit booking in BANKNIFTY was no surprise to us; but

the way it closed at the lowest point of the day, was a bit

unexpected. This price development should be construed as merely

a profit booking in key indices. But next couple of sessions would be

quite important in order to maintain the recent positivity. As far as

Nifty is concerned, Wednesday’s low of 17770 would be seen as a

pivotal point and till the time, we are able to defend it, there is no

reason to worry for. On the flipside, 17950 followed by 18100 are

to be considered as immediate hurdles.

As of now, we continue to remain upbeat and expect the market

to resume its upward trend, if there is no aberration on the global

front. Meanwhile, Midcaps continue to buck the trend and hence

its advisable to keep focusing on such ideas.

Key Levels

Support 1 – 17800 Resistance 1 – 17950

Support 2 – 17770 Resistance 2 – 18100

www.angelone.in

Technical & Derivatives Report

SEPT 16, 2022

View

Our market has witnessed some tentativeness at

higher levels, wherein the benchmark index has seen

a round of profit booking. With some volatile swings in

the latter half, Nifty concluded the day in red with a cut

of 0.70 percent and settled a tad below 17900 level.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1270 crores. Simultaneously, in Index

futures, they sold worth Rs. 944 crores with a mere

increase in open interest, indicating short formation.

Looking at the overall F&O data, we have witnessed

long unwinding in Bank Nifty and some short addition

in the Nifty. On the options front, the piling up of

positions is visible in the 17800 put strike, followed by

17600 PE. While on the higher end, the 18000-18100 call

strikes have a decent piling in the OI concentration,

indicating an immediate resistance. Meanwhile, the

stronger hands have contracted their ‘Long Short

Ratio’, which plunged to 24% from 28%. Considering the

recent price action, some tentativeness could be seen

at the higher levels. However, the undertone remains

in favor of the bulls, but aggressive bets should be

avoided for the time being.

Comments

The Nifty futures open interest has increased by

0.15%. and Bank Nifty futures open interest has

decreased by 6.17% as the market closed at 17877.40.

The Nifty Sep future closed with a premium of 14.40

point against a premium of 16.65 point in the last

trading session. The Oct series closed at a premium

of 71.30 point.

The INDIA VIX increased from 18.27 to 18.39. At the

same time, the PCR-OI of Nifty has decreased from

1.20 to 0.95.

Few of the liquid counters where we have seen high

cost of carry are MRF, APOLLOTYRE, ADANIENT, PVR

and DELTACORP.

Historical Volatility

SCRIP HV

IDEA 81.55

RBLBANK 72.75

IBULHSGFIN 72.61

ZEEL 63.97

HINDCOPPER 62.79

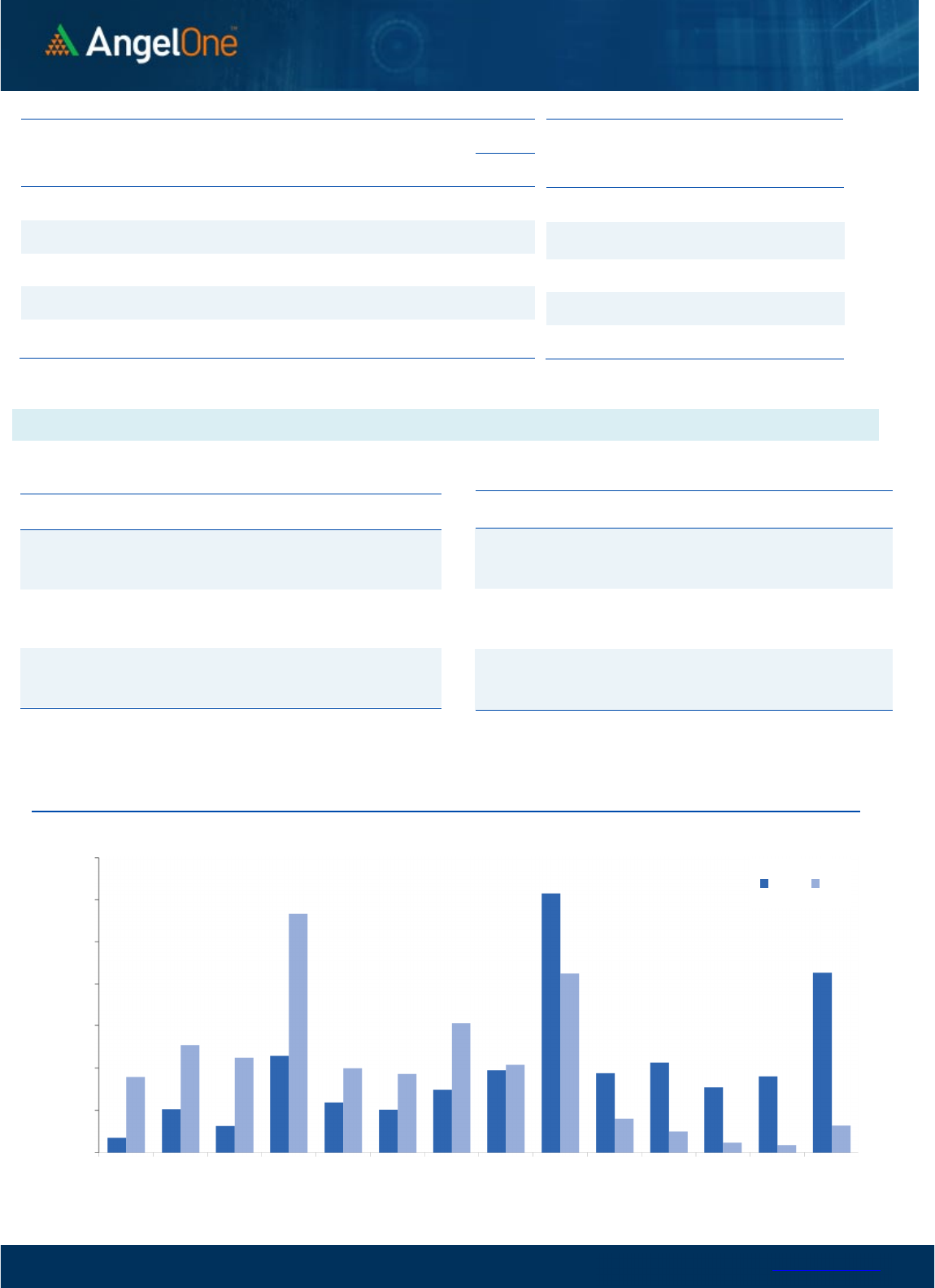

Nifty Vs OI

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

17,000

18,000

8/30 9/2 9/6 9/8 9/12 9/14

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BEL 85408800 178.13 111.10 -1.36

PVR 4684977 58.40 1845.35 -4.15

APOLLOTYRE 15179500 15.78 299.65 6.72

MGL 3040000 12.86 895.55 2.76

AMBUJACEM 75184200 10.96 538.75 2.84

MRF 69010 10.22 92861.80 8.08

GRANULES 10676000 9.32 318.20 3.85

INFY 47070300 9.01 1432.80 -2.68

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BANDHANBNK 27876600 -10.35 304.60 -0.63

DELTACORP 17611100 -9.78 221.50 5.49

RBLBANK 66960000 -5.09 130.65 -2.17

INDIACEM 15077100 -4.59 270.30 2.64

ACC 5286000 -4.03 2747.75 -0.12

JKCEMENT 431250 -3.69 2914.00 0.71

SIEMENS 1575200 -3.65 3061.25 -1.31

TATACONSUM 8868600 -3.63 837.40 -0.49

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.95 0.95

BANKNIFTY 0.97 1.01

RELIANCE 0.50 0.43

ICICIBANK 0.83 0.64

INFY 0.36 0.48

www.angelone.in

Technical & Derivatives Report

SEPT 16, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

,

877

.

40

FII Statistics for

September

1

5

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4179.41 5123.35 (943.94) 128181 12056.63 0.09

INDEX

OPTIONS

2853830.06 2850147.40 3682.66

1028197 95261.58 (26.89)

STOCK

FUTURES

12105.16 15557.46 (3452.30) 2160836 154325.47 1.05

STOCK

OPTIONS

11217.47 11018.48 198.99

200830 14737.03 5.48

Total 2881332.10

2881846.69

(514.59) 3518044

276380.71

(8.94)

Turnover on

September

1

5

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

461334 44532.65 -10.72

Index

Options

341701398

33785859.87

107.05

Stock

Futures

981314 73526.68 -6.73

Stock

Options

3969645 317757.93 -6.72

Total

39,69,645

317757.93 103.86

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 290.45

58.30

41.70

17858.30

Sell

17900 232.15

Buy

17800 290.45

107.90

92.10

17907.90

Sell

18000 182.55

Buy

17900 232.15

49.60 50.40 17949.60

Sell 18000 182.55

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17800 200.15

37.85

62.15

17762.15

Sell

17700 162.30

Buy 17800 200.15

69.05

130.95

17730.95

Sell 17600 131.10

Buy

17700 162.30

31.20 68.80 17668.80

Sell 17600 131.10

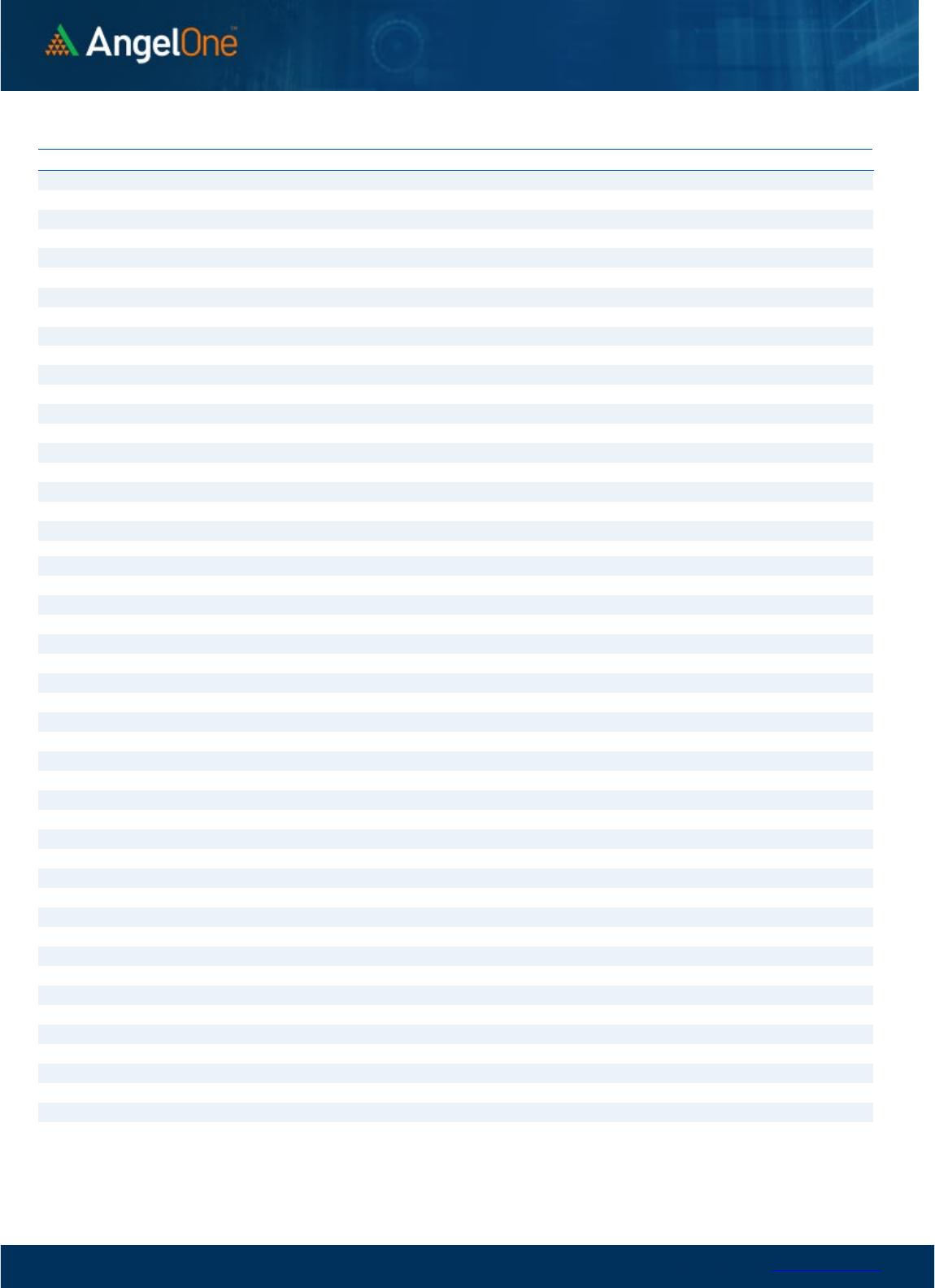

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 16, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

942

955

964

977

986

APOLLOHOSP 4,245 4,294

4,376 4,425

4,507

ASIANPAINT 3,345 3,370

3,414

3,440

3,484

AXISBANK 776 783

795

802

814

BAJAJ-AUTO 3,668 3,718

3,801

3,851

3,935

BAJFINANCE

7,266

7,326

7,430 7,490

7,593

BAJAJFINSV

1,735

1,753

1,789

1,807

1,843

BPCL

325

328

334

337

342

BHARTIARTL 777 781

786

790

795

BRITANNIA

3,665

3,693

3,741

3,769

3,817

CIPLA

1,007

1,020

1,042

1,055

1,076

COALINDIA

231

233

234

235

237

DIVISLAB 3,535 3,570

3,625

3,661

3,716

DRREDDY 4,088 4,128

4,182

4,222

4,276

EICHERMOT 3,497 3,560

3,616

3,678 3,735

GRASIM 1,761 1,785

1,800

1,824

1,840

HCLTECH

904

912

924

932

945

HDFCBANK

1,496

1,508

1,525

1,537

1,554

HDFCLIFE

555

561

572

578

589

HDFC

2,416

2,438

2,459

2,481

2,502

HEROMOTOCO

2,716

2,753

2,804

2,841

2,892

HINDALCO 413 419

429

435

445

HINDUNILVR

2,522

2,541

2,570 2,589

2,618

ICICIBANK

902

910

923

931

944

INDUSINDBK 1,165 1,181

1,200

1,216

1,235

INFY

1,400

1,416

1,446

1,462

1,492

ITC

331

332

335

336

339

JSW STEEL 677 683

691

697

704

KOTAKBANK

1,884

1,909

1,948

1,973

2,012

LT

1,936

1,947

1,966

1,977

1,996

M&M

1,275

1,286

1,300

1,311

1,325

MARUTI 8,893 9,052

9,188

9,347

9,483

NESTLEIND

18,802

18,905

19,081

19,185

19,361

NTPC

171

173

175

177

178

ONGC

131

132

133

134 135

POWERGRID

230

234

236

240

242

RELIANCE 2,528 2,545

2,574

2,592

2,621

SBILIFE

1,256

1,275

1,296

1,316

1,337

SHREECEM

23,227

23,570

24,053

24,396

24,879

SBIN

562

567

573

578

583

SUNPHARMA 861 868

878

885

895

TCS

3,076

3,090

3,114

3,128

3,152

TATACONSUM

821 829

839

847

856

TATAMOTORS

440

444

450

453

460

TATASTEEL 105 106

108

109

110

TECHM

1,049

1,066

1,095

1,112

1,141

TITAN 2,605 2,630

2,674

2,699

2,743

ULTRACEMCO 6,658 6,724

6,824 6,891

6,991

UPL

731

737

747

752

762

WIPRO

409

412

416 420

424

www.angelone.in

Technical & Derivatives Report

SEPT 16, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.