May 16, 2023

www.angelone.in

Technical & Derivatives Report

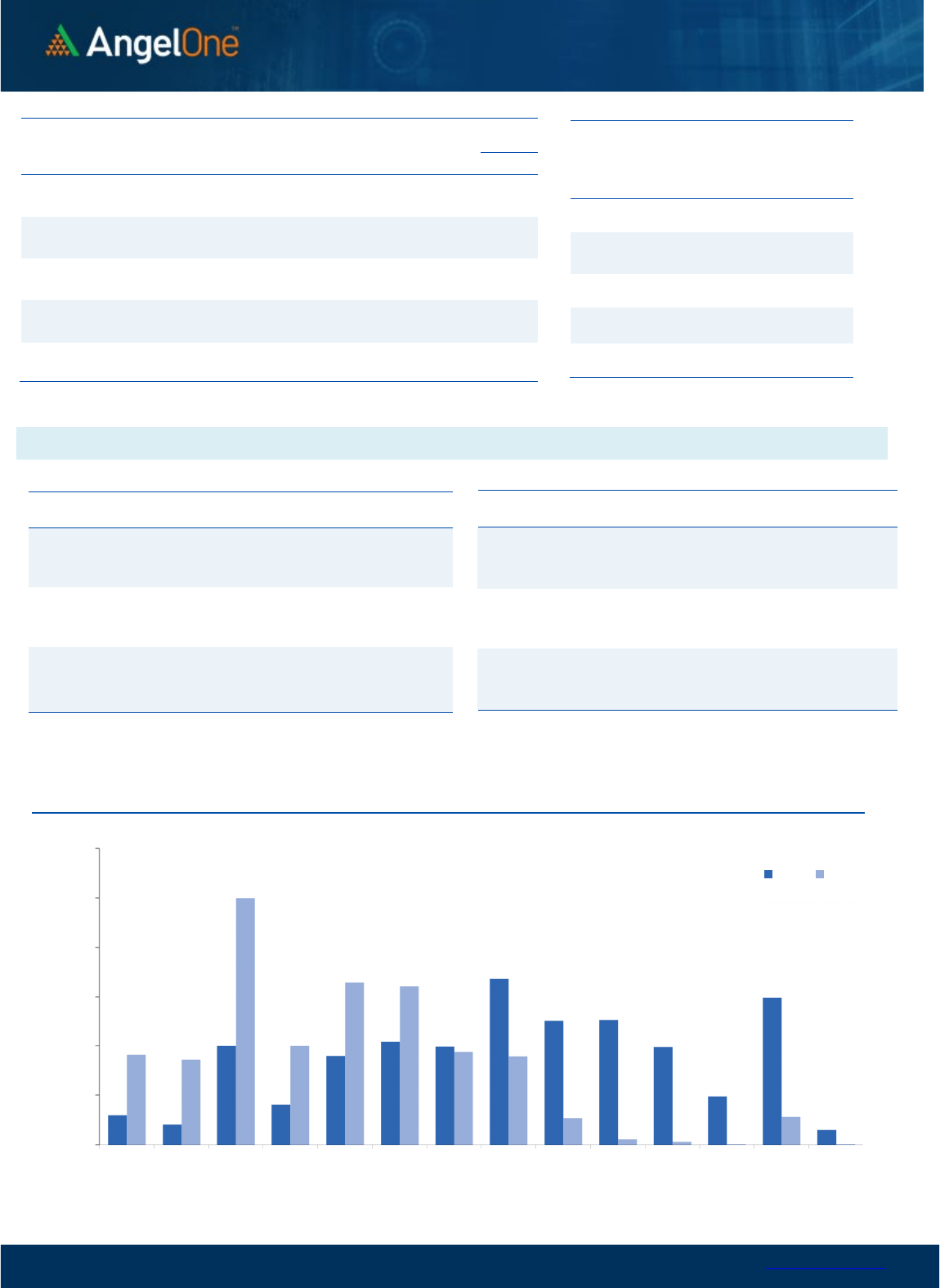

Nifty Bank

Outlook (

4

4072

)

The Bank Nifty index had a splendid run wherein it almost tested

the lifetime high levels amid the buoyancy in the heavyweight

counters. Also, the ease in the inflation data led to a sentimental

rush in the high beta index, which levitated the overall market

sentiments. Amidst the strong day of trade, the Banking index

witnessed the highest-ever close ending with gains of 0.64% tad

below 44100 levels.

Technically, the chart structure construes a robust development

and with the ongoing momentum, it is highly anticipated to surpass

the highs and enter uncharted territory in the near period. As far

as levels are concerned, 44000-43800 is likely to cushion any blip,

followed by the 43500 zone. On the flip side, 44500 could be seen

as the immediate pit-stop for the bulls. The undertone is strongly

bullish, wherein intraday correction could be seen as an

opportunity to add long positions in the index. Meanwhile, a pool

of BFSI counters showcased immense strength. Hence, one needs

to keep a close tab on the thematic movers for better trading

opportunities.

Key Levels

Support 1 – 43800 Resistance 1 – 44380

Support 2 – 43500 Resistance 2 – 44500

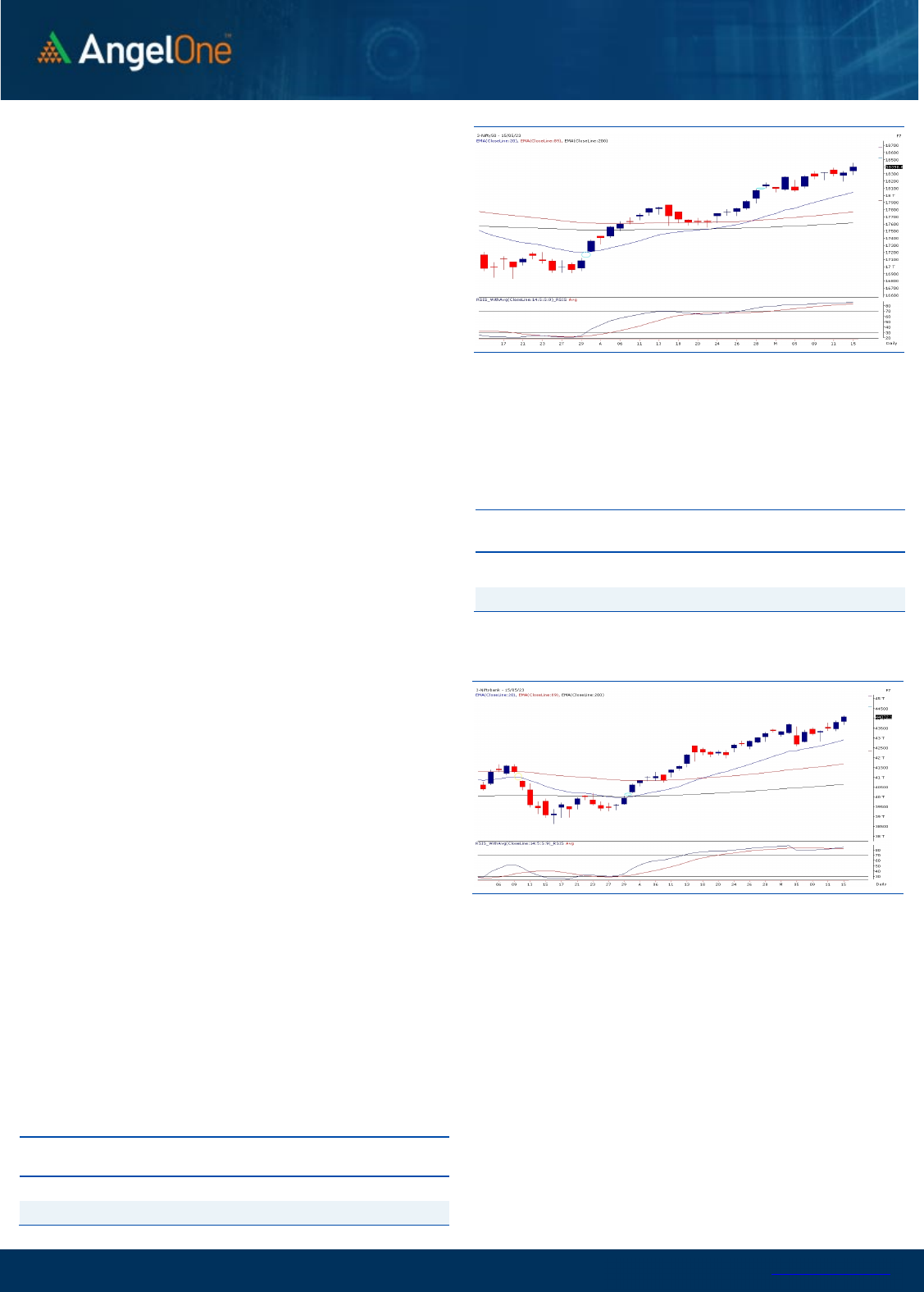

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

6

2

346

) / Nifty (

18

3

99

)

Despite not so favourable global cues, our markets started the week

marginally in the green. After the initial seesaw, the bulls earned the

dominant position and then continued its northward move to even

surpass the 18450 mark on an intraday basis. However, with a

modest profit booking towards the fag end, Nifty concluded the

session around the 18400 mark by pocketing nearly half a percent

gains.

Yesterday’s up move is a sheer display of our inherent strength.

Over the weekend, the developments on the global as well as

domestic front indicated a bit shaky start; but our markets stabilised

in the initial trades to continue its northward journey. Towards the

end, although some profit booking was witnessed, the structure

remains strong, and we expect the benchmark index to challenge

the next resistance of 18500 quite soon. On the flipside, 18350 –

18290 are to be considered as immediate supports.

Any intraday decline towards this sacrosanct zone should ideally

be considered as a buying opportunity. In addition, the banking

index is on the verge of surpassing its previous record highs, we

expect the rally to gather some momentum going ahead. Traders

are advised to be with the trend and should focus on stock

centric approach.

Key Levels

Support 1 – 18350 Resistance 1 – 18500

Support 2 – 18290 Resistance 2 – 18600

www.angelone.in

Technical & Derivatives Report

May 16, 2023

View

The Indian equity markets had a splendid start to the

week, wherein a broad-based buying levitated the

market sentiments. The benchmark index Nifty50

surged nearly half a percent to settle near the 18400

level.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1685 crores. Simultaneously, in Index

futures, they bought worth Rs. 1290 crores with an

increase in open interest, indicating long addition.

In the F&O segment, fresh longs were added to key

indices at the start of the week. The put writers

added a good amount of positions in 18300-18200

strikes and on the other side, build-up remained

scattered 18500-18700 call options. Stronger hands

continued their buying streaks in equities and added

a few longs in the index futures segment. Their Long

Short Ratio’ advanced to 50% from 46%. Considering

the above data point, we expect a continuation of

the ongoing rally towards 18400-18500 and hence,

would advocate using intraday declines to add longs.

Comments

The Nifty futures open interest has increased by 2.27%

and Bank Nifty futures open interest has increased by

7.02% as the market closed at 18398.85.

The Nifty May future closed with a premium of 18.70

point against a premium of 18.60 point in the last

trading session. The June series closed at a premium of

75.10 point.

The INDIA VIX has increased from 12.85 to 13.17. At the

same time, the PCR-OI of Nifty has increased from 1.24

to 1.35.

Few of the liquid counters where we have seen high

cost of carry are DLF, COLPAL, HEROMOTOCO,

OBEROIRLTY and DABUR.

Historical Volatility

SCRIP HV

ADANIENT 88.64

IDEA 66.68

IBULHSGFIN 63.02

RBLBANK 60.60

ADANIPORTS 56.51

Nifty Vs OI

17200

17400

17600

17800

18000

18200

18400

18600

4,000

6,000

8,000

10,000

12,000

14,000

16,000

4/26 4/28 5/3 5/5 5/9 5/12

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

COROMANDEL 1470700 14.06 960.80 -1.17

COLPAL 2815050 13.91 1673.65 3.07

BALRAMCHIN 8150400 10.24 384.60 -0.67

BERGEPAINT 9825200 7.93 629.20 -0.71

ASHOKLEY 45525000 7.89 153.35 2.10

CANFINHOME 3993600 7.53 658.95 2.69

SBICARD 8307200 7.47 890.95 2.63

MGL 2432000 7.04 1052.95 0.48

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

HAL 17600 -13.53 3024.35 1.62

POLYCAB 1326900 -12.73 3381.15 -0.55

ABB 1534250 -11.94 3855.35 -2.18

ASTRAL 1615901 -10.92 1595.65 1.23

DABUR 13576250 -10.05 533.05 2.55

SIEMENS 2056175 -9.67 3833.40 -1.49

CIPLA 11711050 -8.03 922.80 -1.57

MCX 1366400 -6.67 1382.25 2.16

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.35 1.00

BANKNIFTY 1.42 0.81

RELIANCE 0.72 0.51

ICICIBANK 1.01 0.62

INFY 0.47 0.46

www.angelone.in

Technical & Derivatives Report

May 16, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot =

18

3

98

.8

5

FII Statistics for

May

1

5

, 202

3

Detail Buy

Contracts

OI Value

(in Cr.)

Sell Net

CHANGE

INDEX

FUTURES

3461.90 2171.41 1290.49

192850 18565.81 3.65

INDEX

OPTIONS

840029.44 838575.85 1453.59

3367751 324732.49 20.89

STOCK

FUTURES

11707.95 11062.37 645.58

2335017 161514.16 0.05

STOCK

OPTIONS

17169.27 17294.04 (124.77) 253896 17913.87 2.14

Total

872368.56

869103.67

3264.89

6149514

522726.33

10.72

Turnover on

May

1

5

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

218399 21723.70 -48.27

Index Options

147551374

42835.06 -30.65

Stock Futures

784640 55047.67 -26.21

Stock Options

4018640 3651.57 -16.97

Total

40,18,640

3651.57 -32.56

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18400 132.95

50.25

49.75

18450.25

Sell

18500 82.70

Buy

18400 132.95

87.75

112.25

18487.75

Sell

18600 45.20

Buy

18500 82.70

37.50 62.50 18537.50

Sell

18600 45.20

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

18400 112.00

34.50

65.50

18365.50

Sell 18300 77.50

Buy 18400 112.00

59.70

140.30

18340.30

Sell

18200 52.30

Buy

18300 77.50

25.20 74.80 18274.80

Sell 18200 52.30

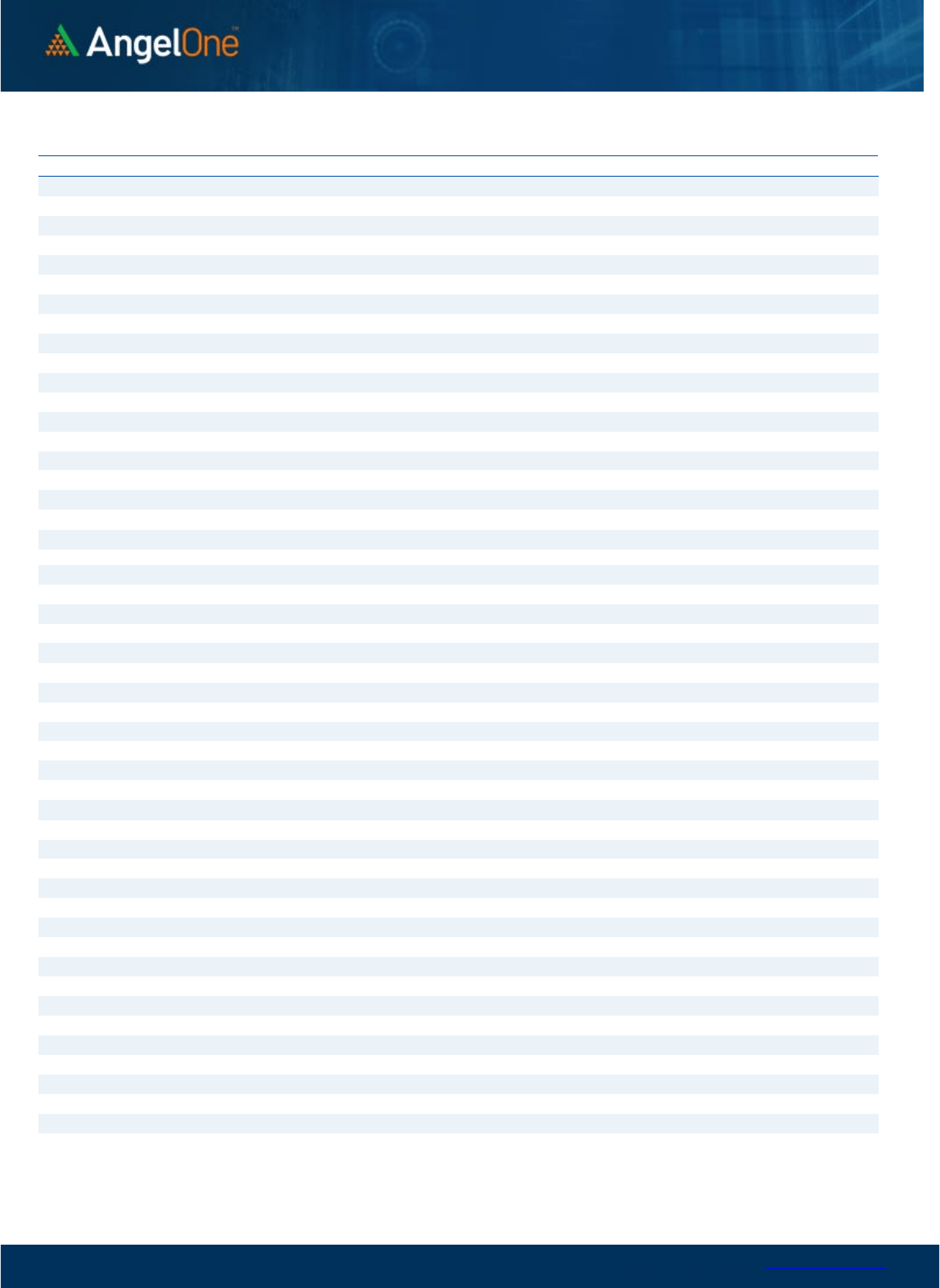

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

17800 17900 18000 18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100

Call Put

www.angelone.in

Technical & Derivatives Report

May 16, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,836

1,876

1,920

1,961

2,005

ADANIPORTS 680 687

694

701

709

APOLLOHOSP

4,537

4,582

4,635

4,680

4,733

ASIANPAINT

3,093

3,113

3,140

3,160

3,187

AXISBANK 904 910

915

920

925

BAJAJ-AUTO

4,505

4,535

4,572

4,601

4,638

BAJFINANCE

6,652

6,682

6,716

6,746

6,780

BAJAJFINSV

1,408

1,415

1,422

1,429

1,436

BPCL 352 354

359

362

367

BHARTIARTL 783 790

796

803

809

BRITANNIA

4,586

4,609

4,644

4,666

4,701

CIPLA 877 900

920

943

963

COALINDIA 231 235

237

240

243

DIVISLAB

3,221

3,249

3,293

3,320

3,364

DRREDDY

4,413

4,466

4,499

4,552

4,585

EICHERMOT

3,590

3,624

3,665

3,699

3,740

GRASIM

1,710

1,722

1,742

1,753

1,773

HCLTECH

1,086

1,093

1,100

1,106

1,113

HDFCBANK

1,658

1,667

1,674

1,683

1,690

HDFCLIFE

553

556

560

563

566

HDFC

2,759

2,772

2,784

2,797

2,809

HEROMOTOCO

2,559

2,625

2,673

2,739

2,787

HINDALCO 401 406

409

414

418

HINDUNILVR

2,604

2,633

2,652

2,681

2,700

ICICIBANK 934 940

944

950

955

INDUSINDBK

1,186

1,203

1,213

1,229

1,239

INFY

1,234

1,246

1,258

1,270

1,281

ITC 416 422

425

431

435

JSW STEEL 691 698

704

712

718

KOTAKBANK

1,943

1,958

1,967

1,983

1,992

LT

2,196

2,221

2,241

2,266

2,286

M&M

1,267

1,276

1,282

1,291

1,297

MARUTI

9,111

9,159

9,233

9,281

9,356

NESTLEIND

21,584

21,685

21,853

21,954

22,121

NTPC 173 174

176

177

178

ONGC 163 164

166

167

168

POWERGRID 240 242

244

245

247

RELIANCE

2,458

2,473

2,489

2,505

2,520

SBILIFE

1,175

1,182

1,188

1,196

1,202

SBIN 571 576

580

586

590

SUNPHARMA 945 949

952

956

960

TCS

3,221

3,238

3,265

3,282

3,309

TATACONSUM

780 784

788

791

795

TATAMOTORS 514 523

530

538

545

TATASTEEL 105 106

107

109

110

TECHM

1,031

1,048

1,059

1,076

1,087

TITAN

2,744

2,762

2,782

2,800

2,820

ULTRACEMCO

7,692

7,727

7,751

7,785

7,809

UPL 671 674

677

680

683

WIPRO 381 383

385

388

390

www.angelone.in

Technical & Derivatives Report

May 16, 2023

*

Technical and Derivatives Team:

Sameet Chavan Head Research – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.