March 16, 2023

www.angelone.in

Technical & Derivatives Report

Nifty Bank

Outlook (

39

051

)

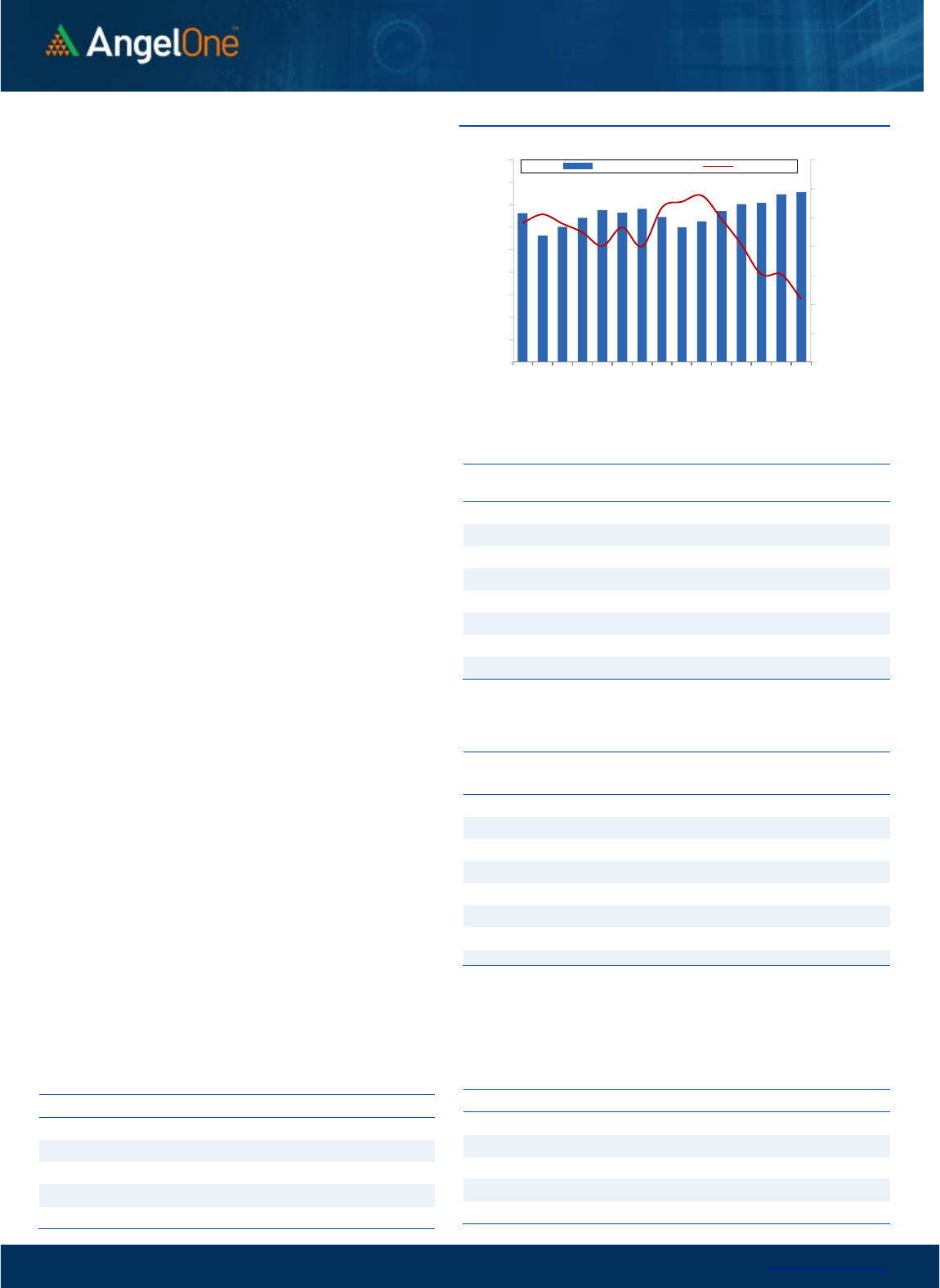

The banking index also had a gap-up start but failed to sustain at

higher levels and gradually plunged throughout the day to slip

below the 200 SMA. The Bank Nifty index corrected for the fifth

straight session and settled a tad above the 39000 mark with a cut

of nearly a percent.

On the technical aspect, the index has made a strong bearish

candle on the daily chart and has plunged below the 200 SMA,

indicating intense selling pressure in the overall space. The recent

development has shaken the chart structure in the intermediate

period. However, the index has slipped way below into the

oversold territory, and one should avoid fresh shorts for the time

being. As far as levels are concerned, 38800-38600 is likely to

cushion any further blip. While on the higher end, 39600 is likely to

act as resistance, followed by the 39800-40000 zone in the

comparable period. Hence, one needs to keep a close tab on the

mentioned levels and avoid aggressive trade in the index for the

time being.

Key Levels

Support 1 – 38800 Resistance 1 – 39800

Support 2 – 38600 Resistance 2 – 40000

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

5

7

556

) / Nifty (

16972

)

The positive development in the overseas market led to a promising

start to our Indian market, wherein the benchmark index had a

decent gap up opening. But soon after the opening bell, the index

gradually slipped to test the previous days’ closure, trimming down

all the initial gains and sentiments. Also, by the fag end, the sell-off

aggravated which plunged the index into the negative terrain to

slide below the psychological mark of 17000. With no respite from

the sell-off, Nifty continued its down run for the fifth consecutive

session and settled a tad below the 17000 mark, shedding 0.42

percent.

Technically, the bulls failed to capitalize on the heads-up move and

the lack of buying emergence led the market to slip to lower levels,

signifying a strong sense of tentativeness among participants. The

decisive breach of the 17000 mark undoubtedly dented the

sentiments, but as we allude to our previous commentary, the

16900-17000 odd zone is expected to cushion the fall. And we

remain hopeful till the market withholds the range. On the higher

end, 17200-17250 is expected to act as an immediate hurdle,

followed by the sturdy wall of 200 SMA, placed around 17400-

17450 in a comparable period.

Considering the price action, our market looks bleak but at the

same time a bit oversold too. We advocate not to comply with

the ongoing sell-off and wait for some positive triggers to levitate

the markets. Meanwhile, one should keep a close tab on the

mentioned levels and avoid aggressive bets for the time being.

Simultaneously, stay abreast with global developments.

Key Levels

Support 1 – 16900 Resistance 1 – 17200

Support 2 – 16800 Resistance 2 – 17250

www.angelone.in

Technical & Derivatives Report

March 16, 2023

View

We had a promising start after recent sell-off but we

failed to capitalized the early morning gains as index

gradually inched lower to not only erase all the gains

but conclude the day tad below psychological mark

of 17000

FIIs were net sellers in the cash market segment to

the tune of Rs. 1271 crores. Simultaneously, in Index

futures, they bought marginally with good amount of

fall in open interest, indicating unwinding of both

long and short positions.

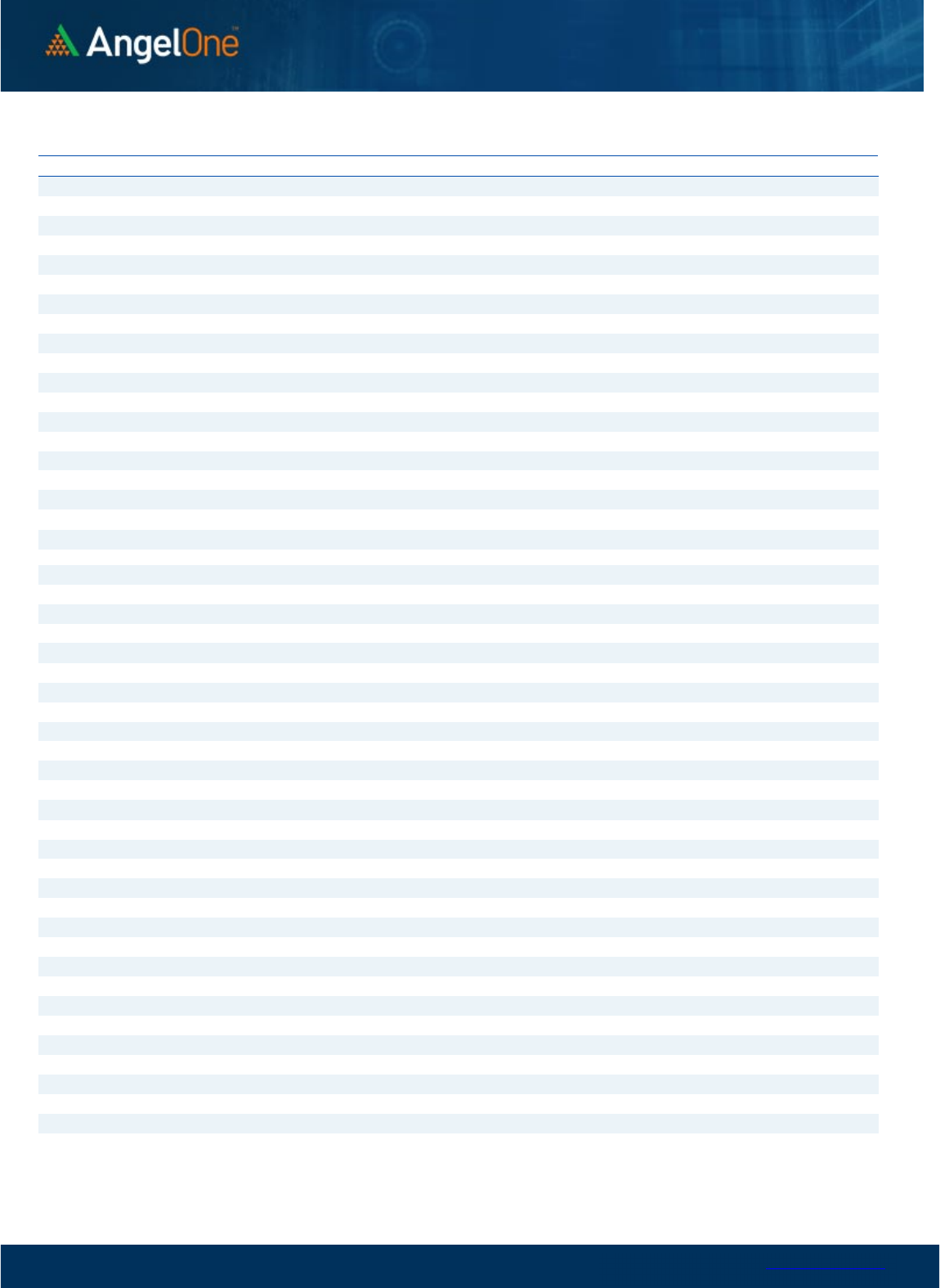

Looking at the F&O data, no relevant build-up

witnessed in key indices. On the options front, a

decent piling of OI is seen at the 17000-17300 call

strike, which is mostly short positions. On the flip

side, the highest open interest concentration is

visible in 16800 put strike; suggesting support has

shifted lower now. Meanwhile, the stronger hands

continue their selling streak not only in equities but

also in index futures recently. The ‘Long Short Ratio’

has declined further to 12% from 16% seen on Friday.

At this point in time, we believe market is extremely

oversold and 16800-16900 should act as a strong

support zone.

Comments

The Nifty futures open interest has increased by 0.97%

and Bank Nifty futures open interest has decreased by

0.83% as the market closed at 16972.15.

The Nifty March future closed with a premium of 65.20

point against a premium of 82.45 point in the last

trading session. The April series closed at a premium of

162.70 point.

The INDIA VIX has increased from 16.21 to 16.29. At the

same time, the PCR-OI of Nifty has decreased from 0.69

to 0.67.

Few of the liquid counters where we have seen high

cost of carry are IDEA, ASTRAL, TATACOMM, VEDL and

IOC.

Historical Volatility

SCRIP HV

PETRONET 28.31

GMRINFRA 44.19

ASIANPAINT 29.74

IEX 42.43

PAGEIND 32.61

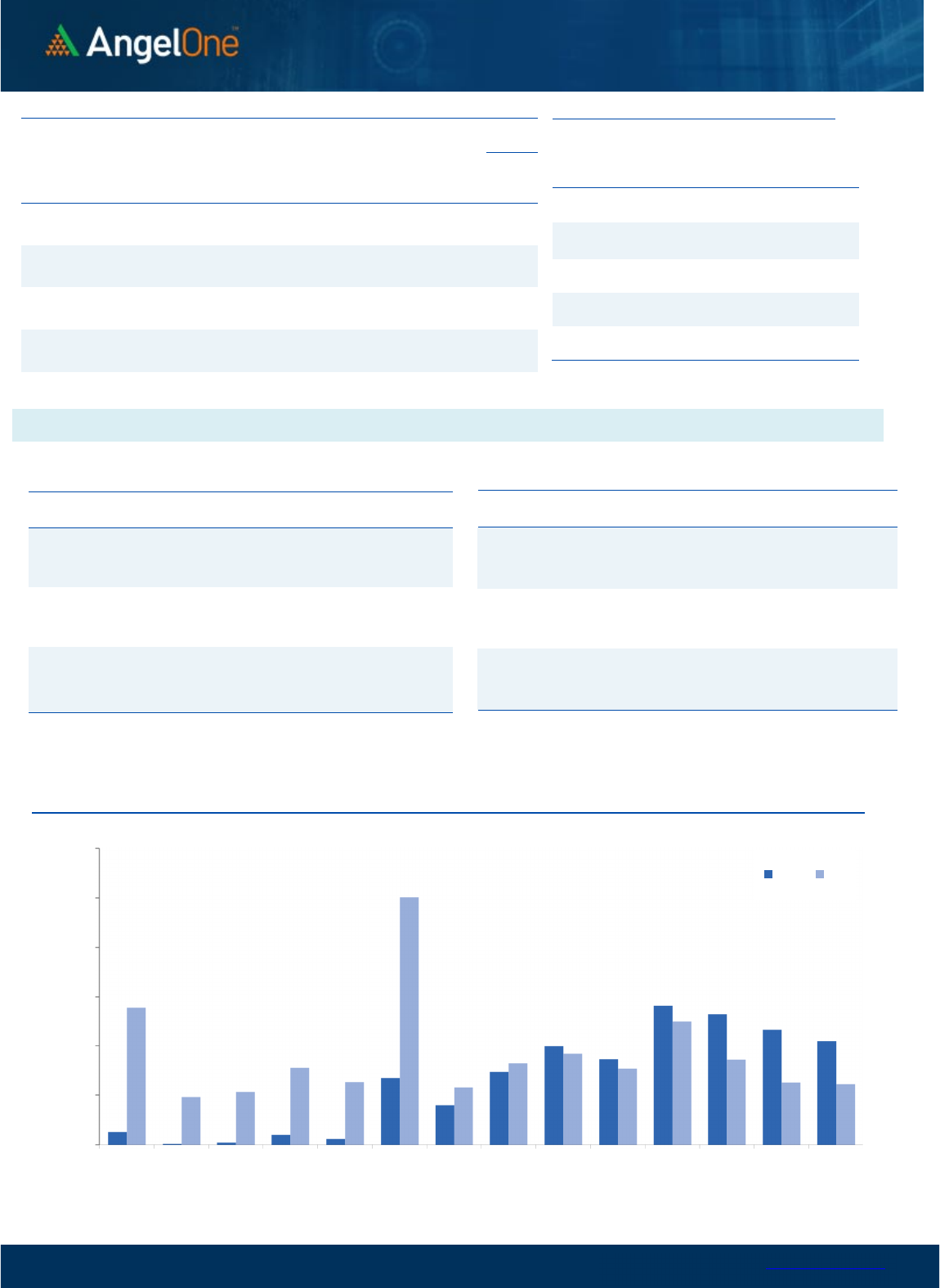

Nifty Vs OI

16600

16800

17000

17200

17400

17600

17800

18000

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

2/22 2/24 2/28 3/2 3/6 3/9 3/13 3/15

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CUMMINSIND 3792000 11.74 1697.60 -0.06

GMRINFRA 132435000 10.76 41.35 4.66

PETRONET 15261000 9.05 236.70 3.55

ATUL 170325 8.97 6820.80 -0.08

NAVINFLUOR 543600 8.11 4176.10 1.11

MPHASIS 2855050 6.61 1899.35 0.13

POLYCAB 1308900 6.23 2928.25 0.87

MARUTI 2217000 5.20 8474.85 -0.54

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

COFORGE 17600 -8.10 3950.00 0.72

JKCEMENT 453250 -8.06 2805.05 0.84

CROMPTON 6132000 -7.64 290.00 0.19

ASTRAL 2255582 -7.02 1349.80 -3.37

METROPOLIS 897200 -6.97 1264.85 2.79

GLENMARK 4821250 -6.81 428.15 2.75

GUJGASLTD 4645000 -6.77 491.65 -2.05

NATIONALUM 50407500 -6.65 83.70 1.64

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.67 0.94

BANKNIFTY 0.53 1.02

RELIANCE 0.49 0.50

ICICIBANK 0.58 0.54

INFY 0.42 0.55

www.angelone.in

Technical & Derivatives Report

March 16, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

6972.15

0900

Lot Size = 75

FII Statistics for

March

1

5

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

5284.11

5202.52

81.59

188550

16648.66

(4.19)

INDEX

OPTIONS

1344005.66

1355994.72

(11989.06) 3088720

274695.39

(1.01)

STOCK

FUTURES

9739.22

9482.91

256.31

2214454

142467.37

(0.18)

STOCK

OPTIONS

12504.14

12608.17

(104.03) 174169

11277.38

2.14

Total 1371533.13

1383288.32

(11755.19) 5665893

445088.80

(0.70)

Turnover

on

March

1

5

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

429018 39766.83

-23.47

Index Options

229139189

64045.80

-22.24

Stock Futures

715996 45842.27

-11.68

Stock Options

3309320 3203.47 -3.98

Total

3,309,320 3203.47 -19.36

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17000 228.95

53.75

46.25

17053.75

Sell

17100 175.20

Buy

17000 228.95

99.75

100.25

17099.75

Sell

17200 129.20

Buy

17100 175.20

46.00 54.00 17146.00

Sell

17200 129.20

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17000 197.70

37.85

62.15

16962.15

Sell 16900 159.85

Buy 17000 197.70

70.55

129.45

16929.45

Sell

16800 127.15

Buy

16900 159.85

32.70 67.30 16867.30

Sell 16800 127.15

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

March 16, 2023

`

Daily

Pivot Levels for Nifty

Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,656

1,748

1,820

1,911

1,983

ADANIPORTS 644 662

675

692

705

APOLLOHOSP

4,277

4,303

4,335

4,361

4,394

ASIANPAINT

2,719

2,773

2,820

2,874

2,921

AXISBANK 805 814

829

839

853

BAJAJ-AUTO

3,679

3,705

3,746

3,771

3,813

BAJFINANCE

5,628

5,673

5,747

5,792

5,866

BAJAJFINSV

1,258

1,271

1,290

1,302

1,322

BPCL 324 327

330

333

336

BHARTIARTL 745 751

758

764

771

BRITANNIA

4,182

4,213

4,268

4,299

4,354

CIPLA 867 873

878

883

889

COALINDIA 217 219

221

222

225

DIVISLAB

2,731

2,754

2,779

2,801

2,827

DRREDDY

4,303

4,349

4,387

4,433

4,471

EICHERMOT

2,965

2,986

3,023

3,044

3,081

GRASIM

1,526

1,538

1,559

1,571

1,592

HCLTECH

1,062

1,071

1,084

1,093

1,107

HDFCBANK

1,508

1,525

1,554

1,571

1,600

HDFCLIFE

457

462

470

475

483

HDFC

2,479

2,504

2,545

2,570

2,612

HEROMOTOCO

2,348

2,364

2,386

2,402

2,424

HINDALCO 400 403

408

411

416

HINDUNILVR

2,353

2,380

2,420

2,446

2,486

ICICIBANK 809 817

831

839

852

INDUSINDBK

1,010

1,027

1,057

1,074

1,104

INFY

1,400

1,410

1,426

1,436

1,452

ITC 374 377

381

383

387

JSW STEEL 670 675

680

685

690

KOTAKBANK

1,645

1,656

1,672

1,682

1,698

LT

2,131

2,154

2,183

2,206

2,235

M&M

1,141

1,151

1,163

1,172

1,184

MARUTI

8,275

8,375

8,540

8,640

8,805

NESTLEIND

17,590

17,792

18,081

18,283

18,573

NTPC 177 177

179

179

180

ONGC 150 151

153

154

156

POWERGRID 224 226

228

230

232

RELIANCE

2,183

2,210

2,254

2,281

2,325

SBILIFE

1,048

1,056

1,068

1,076

1,087

SBIN 505 511

522

528

538

SUNPHARMA 940 946

955

961

971

TCS

3,149

3,174

3,217

3,242

3,285

TATACONSUM

678 683

691

696

705

TATAMOTORS 401 406

415

421

430

TATASTEEL 107 108

108

109

110

TECHM

1,097

1,106

1,119

1,128

1,141

TITAN

2,364

2,381

2,398

2,415

2,432

ULTRACEMCO

7,018

7,059

7,124

7,165

7,229

UPL 691 697

706

712

721

WIPRO 369 373

378

381

387

www.angelone.in

Technical & Derivatives Report

March 16, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.