November 15, 2021

www.angelone.in

Technical & Derivatives Report

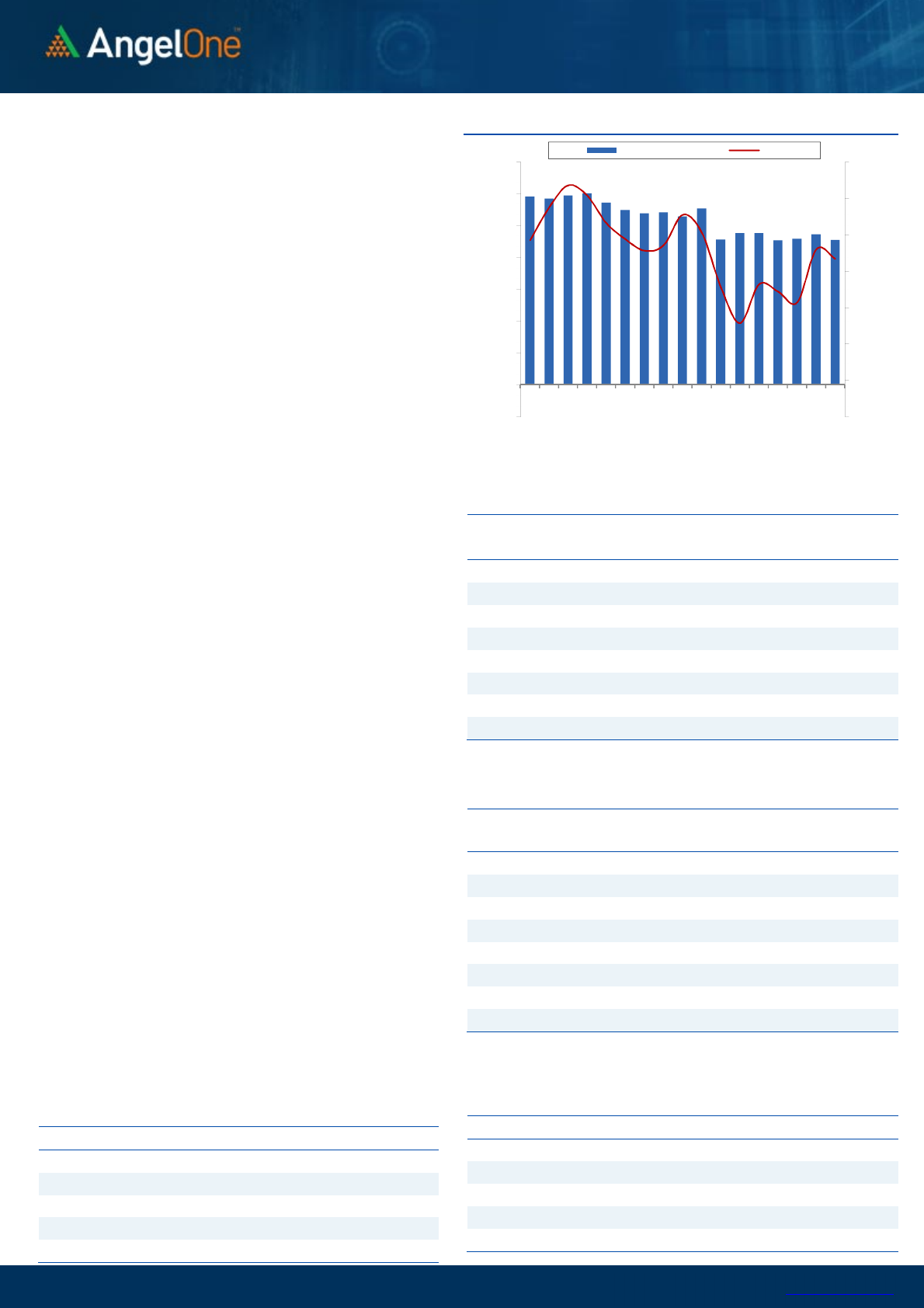

Nifty Bank Outlook - (38733)

On Friday, Bank Nifty started on a positive note however it slipped

lower in the first couple of hours. Subsequently, as the benchmark

index picked positive momentum the banking index as well bounced

back to re-test the opening levels and around the same with half a

percent gains at 38733.

In our previous outlook, we had mentioned Bank Nifty placed on the

50SMA and we may see a bounce back. Now the Bank Index has

formed a ‘Doji’ pattern which indicates uncertainty and is placed

between the trendline breakdown levels and 50SMA. In this week it

would be crucial to see the follow up move. However with the charts

already distorted we would suggest avoiding aggressive longs and

infact using any further bounce to lighten up longs. As far as levels are

concerned, immediate resistance is at 39000 – 39150 whereas support

is placed around 38400 – 38250.

Key Levels

Support 1 – 38250 Resistance 1 – 38900

Support 2 – 37900 Resistance 2 – 39150

Exhibit 2: Nifty Bank Daily Chart

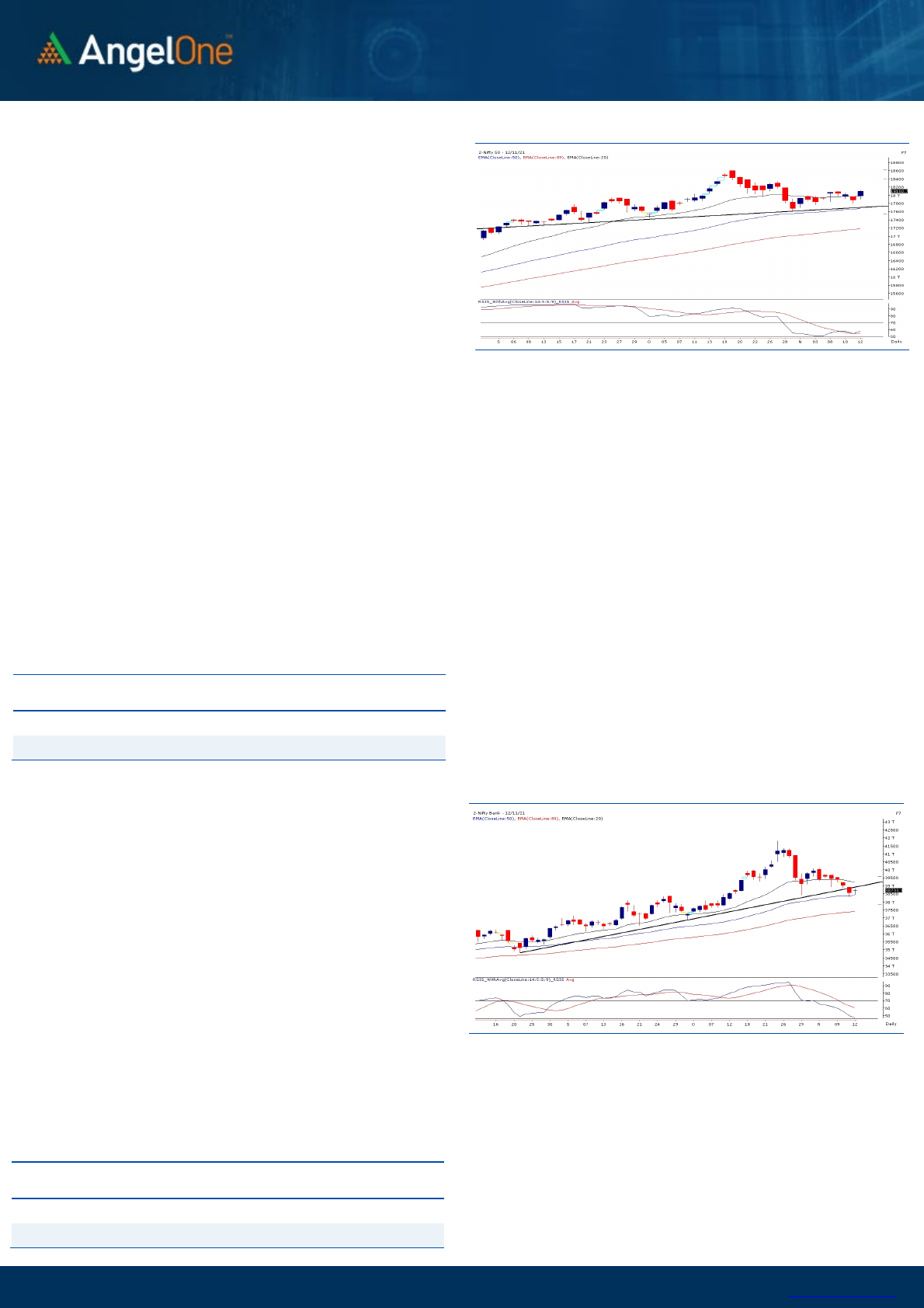

Sensex (60687) / Nifty (18103)

As compared to Thursday’s move, we witnessed a complete opposite

action on Friday as we witnessed a gap up opening first and then due

to sustained buying in some of the heavyweights, Nifty went on to

reclaim the 18100 mark at the close. Market seems to have trapped in

a range and during the last week although point wise we gyrated within

300 points, it’s hardly one and half a percent range for the Nifty. So we

would rather call it a consolidation in the range of 17800 – 18100. For

this week, 18200 – 18350 is to be seen as a crucial range and till the

time we do not surpass it convincingly, we are not completely out of

the woods yet. In fact, it would be too early to comment on it; but we

can clearly see a bearish formation of ‘Head and Shoulder’ being in

process on the daily chart of Nifty. The neckline support is around

17700 – 17600, which if gets broken, we could see difficult days for

market in the short run. With reference to our recent cautious stance

on the market, we will not be surprised to see it happening soon, if we

fail to go beyond the mentioned zone of 18200 – 18350 in the

forthcoming week.

The main reason for us to continue with the cautious stance is the

formation of ‘Shooting Star’ pattern on monthly chart. As long as we do

not break the high of the candle, it can prove its significance anytime.

Hence, we reiterate on avoiding aggressive longs and even if one wants

to follow stock specific moves, needs to be very selective.

Key Levels

Support 1 – 18000 Resistance 1 – 18200

Support 2 – 17900 Resistance 2 – 18350

Exhibit 1: Nifty Daily Chart

www.angelone.in

Technical &

Derivatives Report

November 15, 2021

View

Last week was full of action, as we began the week on a

cheerful note and saw sharp selling in the initial hour of

trade to plunge below 17850. Luckily, index recovered to

recoup all the losses on the same day and reclaimed

18100 on Tuesday early morning. However, index

witnessed some nervousness at the higher levels and

hence corrected below 17800 on Thursday. On Friday, we

had a strong opening and follow-up buying led weekly

closing tad above 18100 mark.

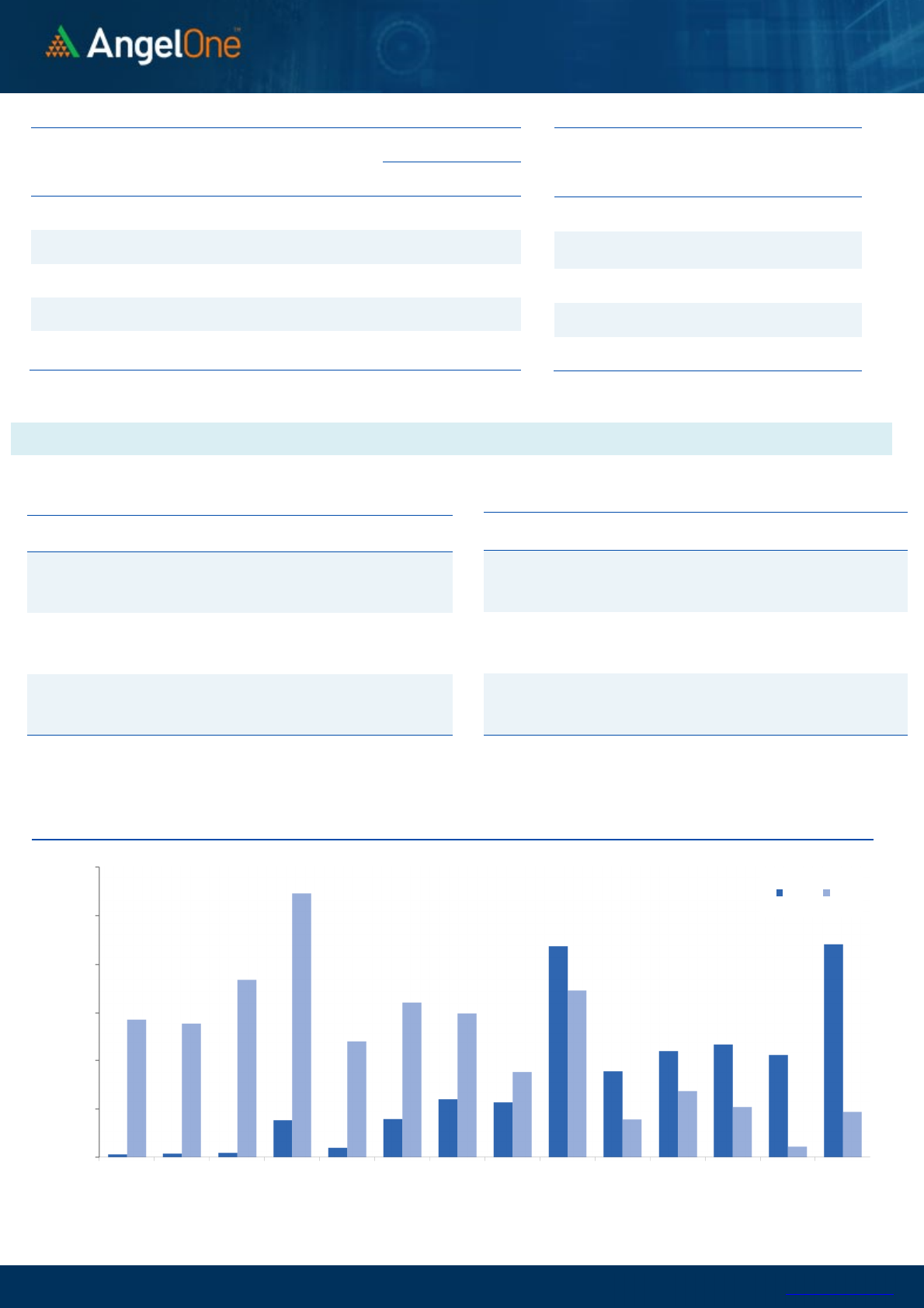

FIIs were net buyers in the cash market segment to the

tune of Rs. 511 crores. In index futures, they bought

worth Rs. 2103 crores with good amount of rise in open

interest indicating formation of long positions.

In F&O space, we hardly saw any relevant build-up in

Nifty; the recovery seen on Friday was mainly due to

short covering; whereas, banking index witnessed

decent open interest reduction. In options front, out the

money calls of 18300 and 18500 added meaningful

positions and in case of puts, 18000 puts added massive

positions. This has resulted highest open interest

addition shifting higher to 18000 put and 18500 call

options. Considering the options data, we would

advocate traders to trade with a positive bias until we

managed to sustain above 18000.

Comments

The Nifty futures open interest has decreased by 5.40%.

Bank Nifty futures open interest has decreased by 11.57%

as market closed at 18102.75 levels.

The Nifty November future closed with a premium of

30.70 point against a premium of 23.25 point in last

trading session. The December series closed at a

premium of 86.95 point.

The INDIA VIX decreased from 16.35 to 15.21. At the same

time, the PCR-OI of Nifty has increased from 0.83 to 1.16.

Few of the liquid counters where we have seen high cost

of carry are IDEA, BHEL, LICHSGFIN, ALKEM and PFIZER.

Nifty Vs OI

17200

17400

17600

17800

18000

18200

18400

18600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-13 10-18 10-20 10-22 10-26 10-28 11-1 11-3 11-5

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

TORNTPHARM

770500 16.17 2791.30 -1.56

IPCALAB

2245500 14.79 2219.05 0.01

BAJAJ-AUTO

3079000 13.87 3635.20 -3.24

ALKEM

695400 13.00 3550.20 0.61

RECLTD

35454000 12.72 145.65 -2.80

NATIONALUM

115736000 11.30 101.45 1.92

INDIGO

3754000 8.00 2306.20 7.40

TATASTEEL

48216250 7.55 1287.25 -0.97

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BERGEPAINT

4374700 -10.37 794.50 1.81

NAUKRI

898250 -9.61 6406.35 4.21

PFC

45663000 -8.53 138.10 -1.81

TITAN

5360625 -8.08 2539.50 0.47

PAGEIND

94920 -7.73 40439.95 0.29

JUBLFOOD

1584875 -7.05 4003.75 2.60

HINDALCO

25621550 -7.00 468.55 3.05

HDFCLIFE

16907000 -6.18 720.60 2.57

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

1.16 0.85

BANKNIFTY

0.70 0.86

RELIANCE

0.50 0.47

ICICIBANK

0.43 0.37

INFY

0.50 0.40

Historical Volatility

SCRIP HV

INDIGO

46.70

TECHM

38.78

ICICIPRULI

45.11

BAJAJ-AUTO

32.44

LTI

47.62

www.angelone.in

Technical &

Derivatives Report

November 15, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 1

8102.75

FII Statistics for November 12, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

4825.22 2722.16 2103.06

166552 15367.54 10.98

INDEX

OPTIONS

312130.80 308828.70 3302.10

1470188 135530.78 (1.86)

297314.41

STOCK

FUTURES

14107.59 13226.72 880.87

1794874 135439.17 1.19

STOCK

OPTIONS

18348.10 18459.74 (111.64) 327157 25414.24 5.74

Total

349411.71

343237.32

6174.39

3758771

311751.73

0.74

43446.77

Turnover on November 12, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

282238 26220.20 -12.31

Index Options

38118332 3578483.92 -70.24

Stock Futures

852586 65136.46 11.05

Stock Options

3165109 245425.34 25.37

Total

4,24,18,265

3915265.92 -68.19

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18100 193.60

51.30 48.70 18151.30

Sell

18200 142.30

Buy

18100 193.60

92.95 107.05 18192.95

Sell

18300 100.65

Buy

18200 142.30

41.65 58.35 18241.65

Sell

18300 100.65

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

18100 158.40

38.30 61.70 18061.70

Sell

18000 120.10

Buy

18100 158.40

69.00 131.00 18031.00

Sell

17900 89.40

Buy

18000 120.10

30.70 69.30 17969.30

Sell

17900 89.40

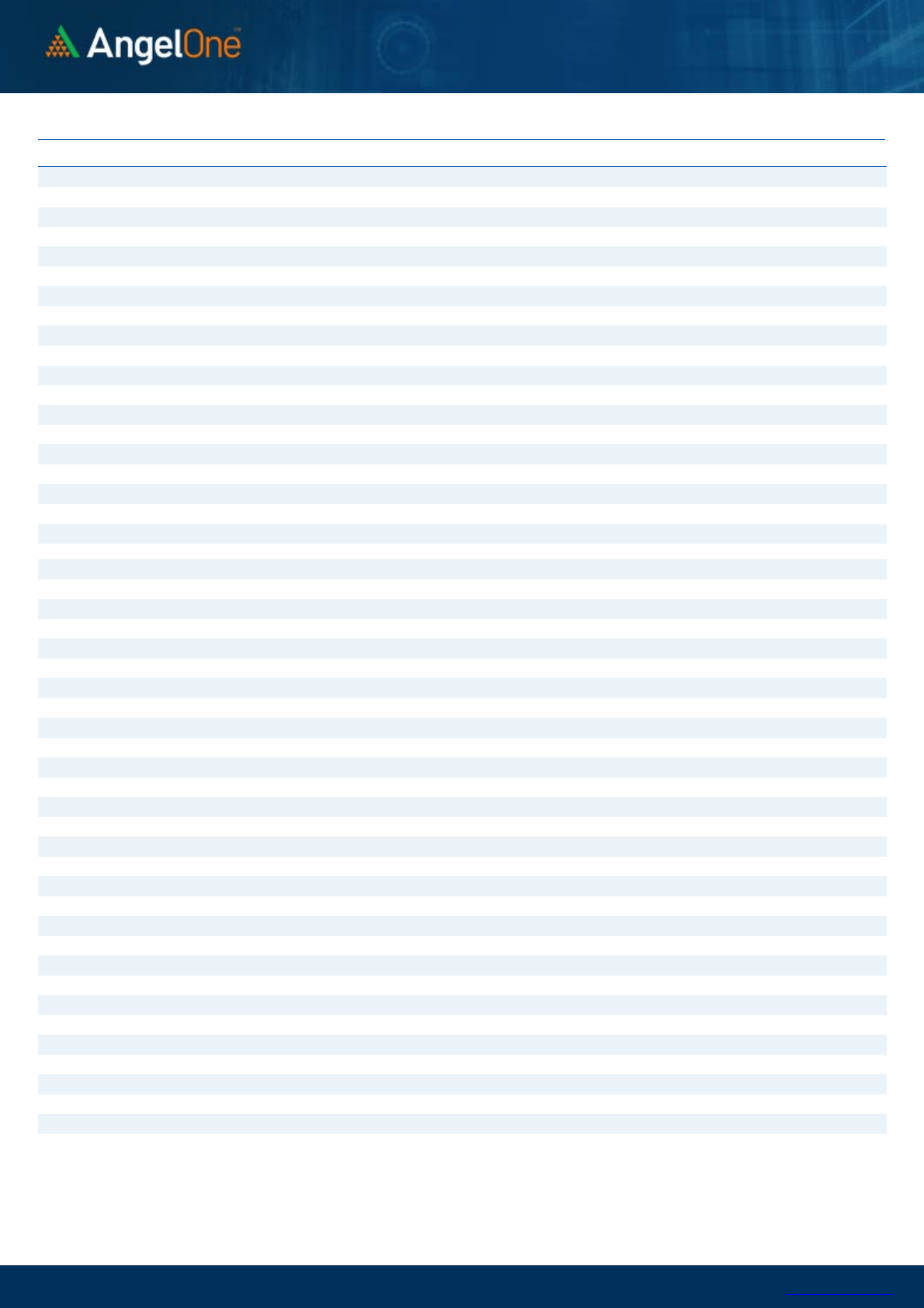

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical &

Derivatives Report

November 15, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 725 738

747 759 768

ASIANPAINT 3,057 3,090

3,109 3,142 3,161

AXISBANK 728 732

737 741 747

BAJAJ-AUTO 3,511 3,573

3,678 3,739 3,844

BAJFINANCE 7,397 7,488

7,544 7,635 7,691

BAJAJFINSV 17,759 18,016

18,183 18,440 18,607

BPCL 424 426

428 430 432

BHARTIARTL 718 731

738 751 758

BRITANNIA 3,616 3,652

3,677 3,713 3,738

CIPLA 901 908

913 920 925

COALINDIA 164 165

167 169 170

DIVISLAB 4,764 4,804

4,850 4,890 4,935

DRREDDY 4,788 4,816

4,843 4,871 4,898

EICHERMOT 2,677 2,700

2,721 2,744 2,764

GRASIM 1,826 1,842

1,859 1,875 1,891

HCLTECH 1,156 1,164

1,171 1,179 1,186

HDFCBANK 1,538 1,546

1,552 1,560 1,566

HDFCLIFE 699 710

716 727 733

HDFC 2,873 2,933

2,965 3,025 3,058

HEROMOTOCO 2,654 2,669

2,694 2,709 2,734

HINDALCO 454 462

466 473 478

HINDUNILVR 2,361 2,383

2,398 2,420 2,436

ICICIBANK 767 772

776 781 785

IOC 131 132

133 134 136

INDUSINDBK 1,021 1,029

1,036 1,044 1,051

INFY 1,722 1,751

1,767 1,796 1,812

ITC 227 230

232 235 237

JSW STEEL 658 665

670 677 683

KOTAKBANK 2,042 2,059

2,069 2,085 2,096

LT 1,914 1,937

1,951 1,974 1,988

M&M 920 929

934 943 949

MARUTI 7,387 7,433

7,489 7,535 7,591

NESTLEIND 18,689 18,916

19,088 19,314 19,486

NTPC 133 135

136 138 140

ONGC 152 153

155 156 157

POWERGRID 179 180

182 184 185

RELIANCE 2,541 2,567

2,583 2,609 2,625

SBILIFE 1,137 1,156

1,167 1,185 1,196

SHREECEM 28,596 28,992

29,266 29,663 29,936

SBIN 499 505

509 515 519

SUNPHARMA 791 799

804 811 816

TCS 3,467 3,496

3,515 3,545 3,564

TATACONSUM

834 841

847 854 860

TATAMOTORS 492 500

505 512 517

TATASTEEL 1,231 1,259

1,299 1,328 1,368

TECHM 1,510 1,548

1,569 1,606 1,627

TITAN 2,503 2,521

2,541 2,560 2,580

ULTRACEMCO 7,958 8,019

8,067 8,128 8,175

UPL 760 765

770 774 779

WIPRO 639 650

656 666 673

www.angelone.in

Technical &

Derivatives Report

November 15, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in