SEPT 15, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

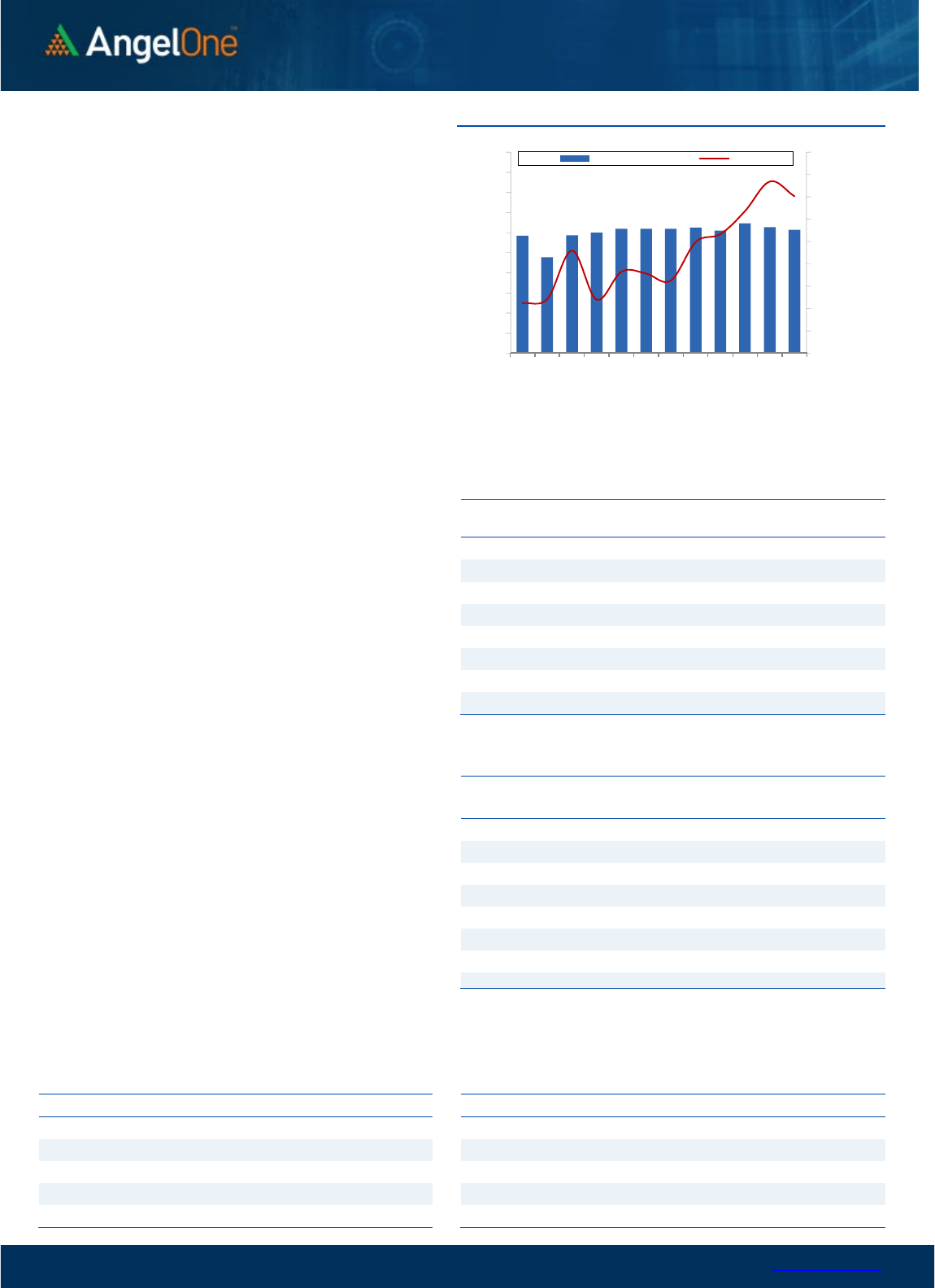

Nifty Bank Outlook (41405)

Bank Nifty as well started with a gap-down opening however

mighty bulls took this as an opportunity and right from the word

go the prices started moving higher. In this process, the bank

index not only recovered its lost ground of more than 500 points

but went on to add strong gains of 1.30% closing tad above

41400 levels. Things were looking extremely bleak at the

opening however the way we closed definitely indicates that

the bulls are in a dominating place and they are not willing to

give up so soon. The ongoing rally is mostly driven by the

banking space and yesterday as well it showed its mettle. We

have been advocating for the last few weeks that any dip should

be taken as a buying opportunity and we reiterate the same as

we see this space heading towards the all-time high levels and

beyond in the very near term. Yesterday many individual stocks

from this space gave a strong up move and one should ideally

focus on such counters for outperforming moves. As far as levels

for the bank index is concerned, immediate support is at 40900

- 40750 levels whereas resistance is at 41600 - 41830 levels.

Key Levels

Support 1 – 40900 Resistance 1 – 41600

Support 2 – 40750 Resistance 2 – 41830

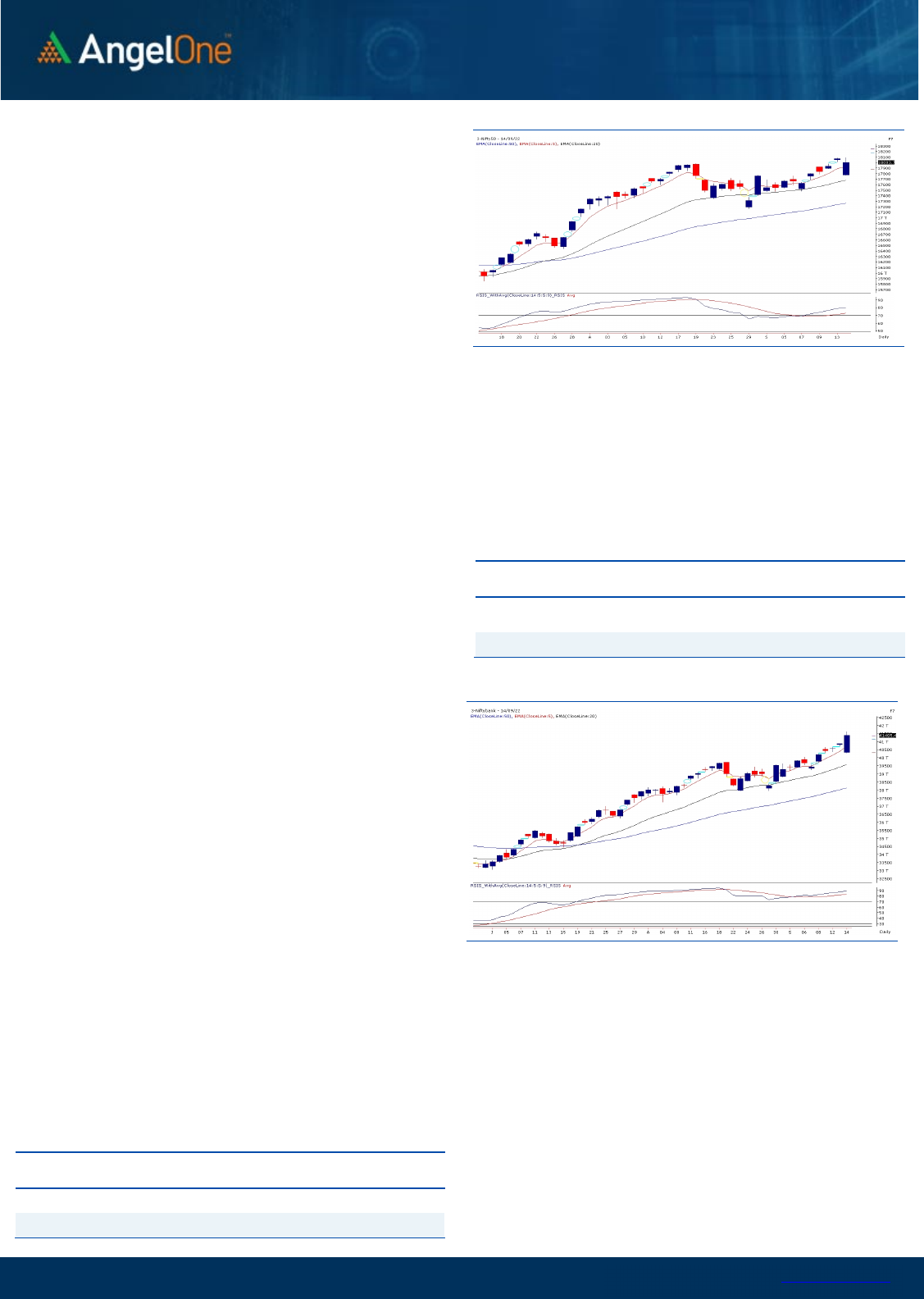

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (60345) / Nifty (18004)

The way Nifty closed beyond 18000 on Tuesday, market

participants were a bit complacent and took US macro data for

granted. But US markets took a complete nosedive in the evening

post the rising inflation data. Due to this brutal knock, last 3-4

day’s gains in US markets went for a toss. Needless to say, we

reacted yesterday morning with a massive gap down towards

17800. However, after an opening blip, the banking came for a

rescue and then (except IT) others too started participating in the

recovery. In the process, we not only managed to pare down

significant portion of losses but also reclaimed the 18000 mark

on a closing basis.

Yesterday’s session has clearly validated the level of strength our

domestic market has as compared to the global peers. Despite

such unfavourable environment, we remained firm and

managed to pull the market higher back into the safe terrain.

Now unless there is major aberration on the global front, we are

good to test 18200 - 18350 first and then record highs. On the

flipside, 17900 - 17800 now becomes a sacrosanct zone. This rally

is strongly back by the financial space and hence, it provides

credence to the move.

With reference to our commentary on Monday, the

BANKNIFTY is within a touching distance of previous highs and

is likely to make new one before Nifty does. Also, the stock

specific on the bullish side kept on accelerating as the day

progressed which again is an indication of overall breadth.

Traders are advised not to get carried away by such in

between hiccups and continue to focus on stock specific

moves.

Key Levels

Support 1 – 17900 Resistance 1 – 18100

Support 2 – 17800 Resistance 2 – 18240

www.angelone.in

Technical & Derivatives Report

SEPT 15, 2022

View

Our market has witnessed a gap down opening,

tracking weakness in global bourses. However, the

bulls got aggravated at the lower zone, resulting in a

modest recovery in the benchmark index that settled

above the 18000 mark with a mere cut of 0.37 percent.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1397 crores. Simultaneously, in Index

futures, they sold worth Rs. 2030 crores with an

increase in open interest, indicating short formation.

Looking at the overall F&O data, we have witnessed

mixed positions in both indices. On the options front,

piling up of positions is visible in the 17900-17800 put

strikes, indicating a nearby support zone. While on the

higher end, the 18200 call strike has a decent piling in

the OI concentration, indicating an immediate

resistance. The stronger hands have contracted their

‘Long Short Ratio’, which plunged to 28% from 35%.

Considering the recent price action, the undertone is

likely to remain bullish, and any intraday dip could be

seen as an opportunity to add longs in the indices.

Meanwhile, we advocate keeping a close tab on global

developments and looking for opportunities in the

broader market.

Comments

The Nifty futures open interest has decreased by

0.96%. and Bank Nifty futures open interest has

increased by 7.72% as the market closed at 18003.75.

The Nifty Sep future closed with a premium of 16.65

point against a premium of 35.45 point in the last

trading session. The Oct series closed at a premium

of 69.70 point.

The INDIA VIX increased from 17.47 to 18.27. At the

same time, the PCR-OI of Nifty has decreased from

1.39 to 1.20.

Few of the liquid counters where we have seen high

cost of carry are AMBUJACEM, ACC, VEDL,

INDIACEM and INFY.

Historical Volatility

SCRIP HV

IDEA 81.74

RBLBANK 72.87

IBULHSGFIN 72.78

ZEEL 64.13

HINDCOPPER 62.95

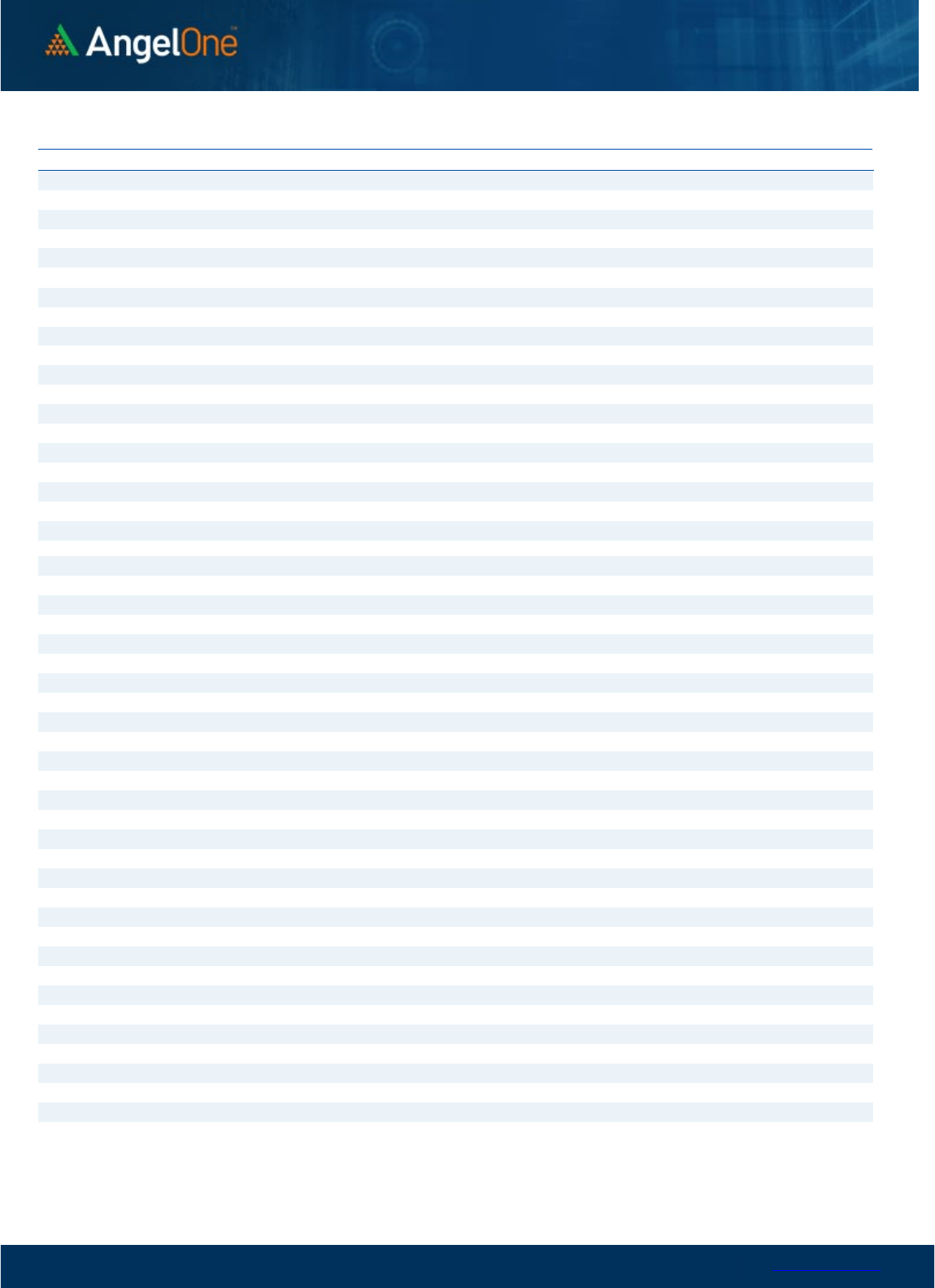

Nifty Vs OI

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

17,000

18,000

8/25 9/1 9/5 9/7 9/9 9/13

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ACC 5508000 23.23 2743.20 6.69

INFY 43181700 21.07 1475.40 -4.66

BEL 30707800 20.20 335.90 0.24

LTTS 999000 15.84 3676.95 -4.49

HONAUT 13545 15.03 42616.60 2.81

TATACONSUM 9202500 13.02 840.25 -1.15

RBLBANK 70550000 11.70 133.25 3.00

COFORGE 927000 10.34 3471.05 -4.09

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PVR 2957669 -9.76 1929.35 1.18

IBULHSGFIN 43708000 -7.77 138.10 2.28

CUB 7765000 -7.61 185.25 2.63

BAJAJFINSV 9331500 -6.69 1805.40 0.82

AMBUJACEM 67759200 -6.07 524.60 7.85

JUBLFOOD 10511250 -5.93 635.30 1.73

ESCORTS 1742950 -5.49 2002.30 0.74

TRENT 4368125 -5.28 1430.65 -1.97

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.20 0.83

BANKNIFTY 1.46 0.85

RELIANCE 0.54 0.42

ICICIBANK 0.90 0.54

INFY 0.35 0.43

www.angelone.in

Technical & Derivatives Report

SEPT 15, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

,

0

03

.

7

5

FII Statistics for

September

1

4

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3842.37 5872.52 (2030.15) 128069 12148.68 10.88

INDEX

OPTIONS

1223196.67 1222215.36 981.31

1406466 132978.10 3.30

STOCK

FUTURES

13145.14 14885.68 (1740.54) 2138425 153043.53 2.24

STOCK

OPTIONS

11589.00 11768.19 (179.19) 190405 13923.47 5.77

Total 1251773.18

1254741.75

(2968.57) 3863365

312093.78

3.06

Turnover on

September

1

4

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

519052 49879.80 111.07

Index

Options

166785108

16317833.62

113.05

Stock

Futures

1103592 78832.94 27.35

Stock

Options

4531028 340657.22 29.52

Total

45,31,028

340657.22 109.64

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17900 317.55

57.45

42.55

17957.45

Sell

18000 260.10

Buy

17900 317.55

109.50

90.50

18009.50

Sell

18100 208.05

Buy

18000 260.10

52.05 47.95 18052.05

Sell 18100 208.05

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17900 199.25

34.10

65.90

17865.90

Sell

17800 165.15

Buy 17900 199.25

65.05

134.95

17834.95

Sell 17700 134.20

Buy

17800 165.15

30.95 69.05 17769.05

Sell 17700 134.20

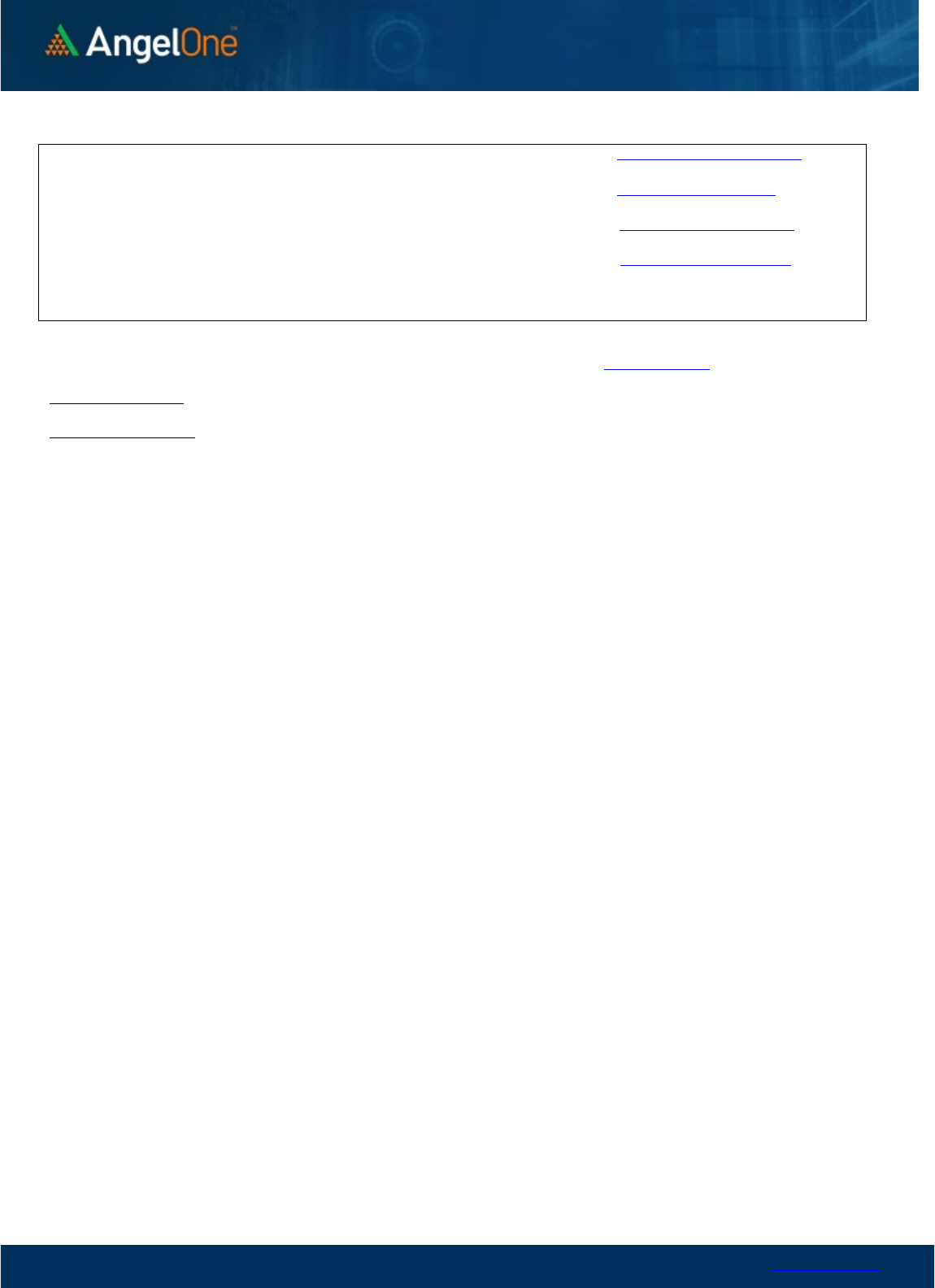

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500 18600

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 15, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS 929 938

949

958

968

APOLLOHOSP 4,363 4,395

4,438

4,470

4,512

ASIANPAINT 3,354 3,396

3,422 3,465

3,491

AXISBANK

786

795

803

811

820

BAJAJ-AUTO 3,753 3,802

3,860 3,909 3,968

BAJFINANCE 7,151 7,317

7,439 7,605

7,726

BAJAJFINSV

1,729

1,767

1,790

1,829

1,852

BPCL

332

334

337

340

343

BHARTIARTL 770 777

783

789

795

BRITANNIA 3,685 3,716

3,739

3,770

3,793

CIPLA

1,028

1,044

1,056

1,072

1,084

COALINDIA

228

230

232

234

236

DIVISLAB

3,571

3,620

3,654 3,703 3,738

DRREDDY 4,117 4,166

4,214

4,263

4,311

EICHERMOT 3,407 3,475

3,519

3,587

3,631

GRASIM

1,747

1,765

1,782

1,800

1,817

HCLTECH

920

926

932

938

944

HDFCBANK

1,473

1,501

1,520

1,548

1,567

HDFCLIFE

568

572

579

583

590

HDFC

2,363

2,408

2,443 2,489 2,524

HEROMOTOCO 2,811 2,831

2,850 2,871 2,890

HINDALCO 414 428

438

452

462

HINDUNILVR

2,515

2,543

2,575 2,603 2,634

ICICIBANK

889

903

913

928

937

INDUSINDBK

1,112

1,164

1,194

1,246

1,277

INFY

1,455

1,465

1,482

1,492

1,509

ITC 327 331

335

339

343

JSW STEEL 672 683

692

702

712

KOTAKBANK

1,856

1,905

1,942

1,991

2,027

LT

1,935

1,945

1,959

1,968

1,982

M&M

1,263

1,281

1,297

1,315

1,331

MARUTI 8,757 8,862

8,931

9,036

9,105

NESTLEIND

18,708

18,908

19,071

19,272

19,435

NTPC

162

167

170

175

178

ONGC

131

132

133

134 135

POWERGRID 222 227

230

236

239

RELIANCE 2,553 2,571

2,590 2,608 2,628

SBILIFE

1,288

1,296

1,308

1,316

1,328

SHREECEM

23,185

23,658

23,978 24,452 24,772

SBIN

540

556

565

581

591

SUNPHARMA

870

877

887

894

905

TCS 3,098 3,109

3,125

3,137

3,153

TATACONSUM

824

832

847

855

869

TATAMOTORS

443

447

451 454

458

TATASTEEL 104 107

108 111

113

TECHM

1,084

1,099

1,111

1,126

1,137

TITAN

2,619

2,660

2,686

2,727

2,753

ULTRACEMCO

6,662

6,769

6,867

6,973

7,071

UPL

734

741

751

758

767

WIPRO

402

409

416 423

430

www.angelone.in

Technical & Derivatives Report

SEPT 15, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.