DEC 14, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

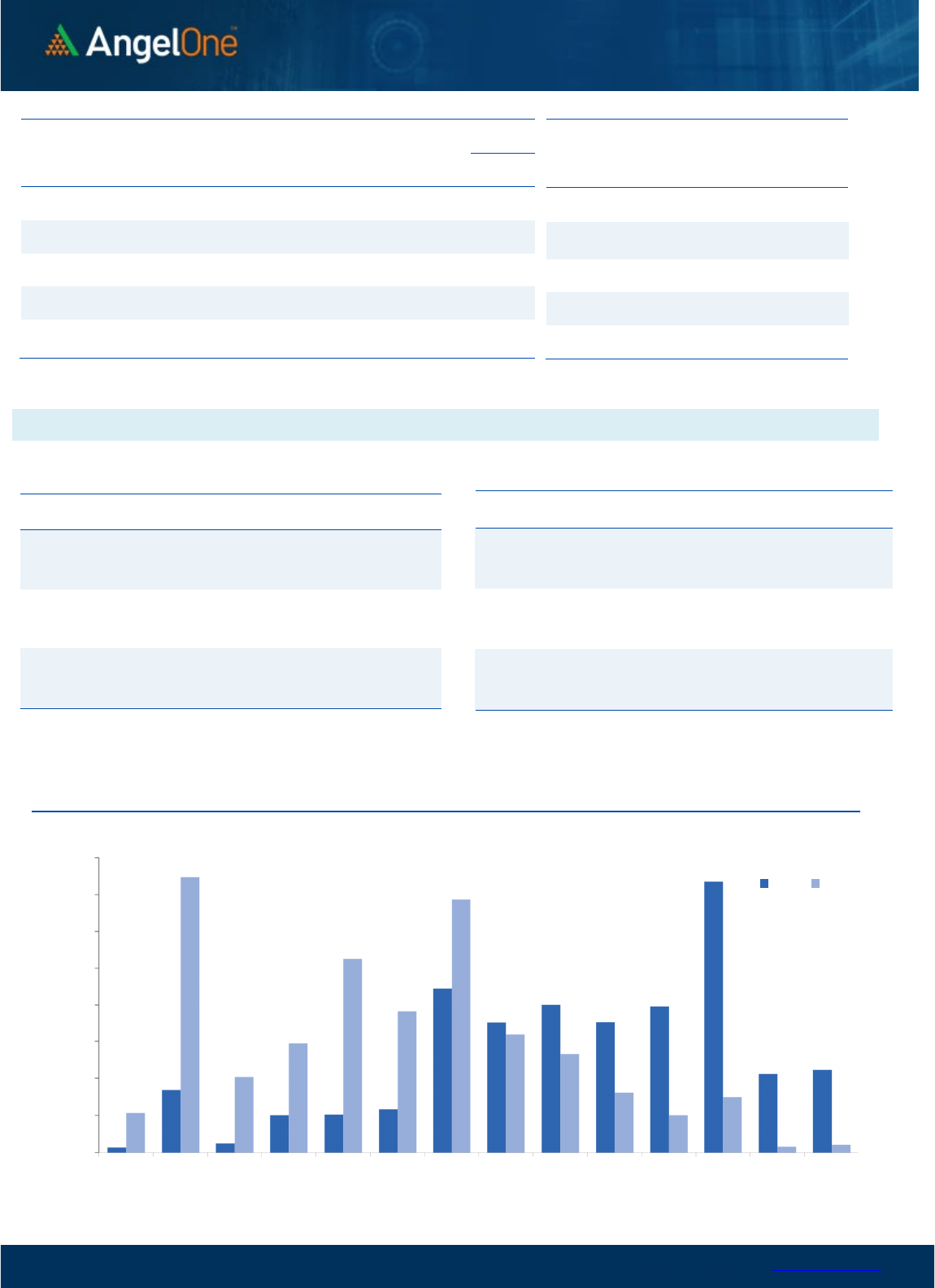

Nifty Bank Outlook (43947)

Bank Nifty as well started on a positive note, and as the day

progressed prices extended the up move. The second half was

however range-bound but prices ended up at the highest point

with gains of half a percent tad below 44000 levels.

The merry run continues for the banking space as they continue to

create new milestones. If we consider the price change within the

index not much seems to have changed however there was strong

traction within many banking space counters. Going ahead as well

we continue to remain upbeat, but the focus would remain on

individual counters. As far as levels are concerned, 44350 - 44600

seems to be immediate resistance, and the higher range if

approached before weekly expiry then traders can look to book

some profits ahead of the key event. On the flip side, immediate

support is seen at 43700 - 43500 levels. We reiterate to use dips to

go longs whereas it would be advised to book longs at higher levels.

Key Levels

Support 1 – 43700 Resistance 1 – 44350

Support 2 – 43500 Resistance 2 – 44600

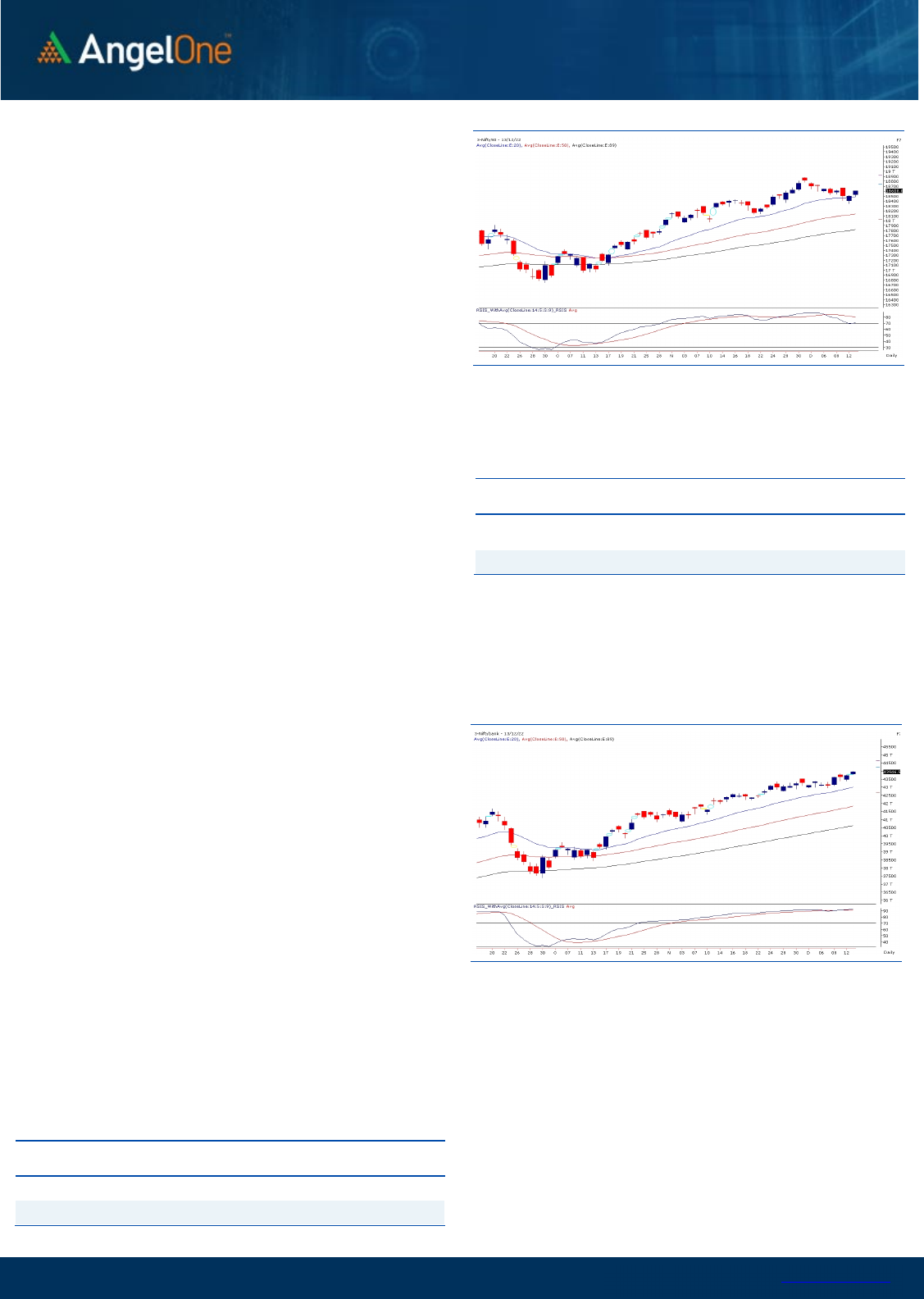

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (62533) / Nifty (18608)

Despite US markets rallying overnight, our domestic markets

started the session on a flat note yesterday morning. However, it

was merely a formality as we witnessed Nifty resuming its upward

momentum in the initial hours. The benchmark index successfully

maintained its positive posture throughout the session. With a

gradual surge, Nifty eventually reclaimed the 18600 mark on a

closing basis. The banking had a lion share in yesterday’s move as

BANKNIFTY clocked new high in the latter half and is now within the

touching distance of yet another magical figure of 44000.

Monday’s sharp recovery from the midpoint of the sacrosanct

support range (18400 – 18300) was quite crucial for our markets.

With global peers supporting in the morning, we were all poised for

the continuation of the up move. For the coming session, 18650 is

the level to watch out for. Once we see Nifty surpassing this, the

bulls would become stronger and then we can expect the rally to

unfold towards the next milestone of 19000. As far as support level

is concerned, 18500 is to be considered as an intraday level. Traders

are advised to focus on stock specific actions; because even if we

are not witnessing bigger moves in key indices, a lot of thematic

moves have started to cut loose.

In fact, taking a glance at the NIFTY MIDCAP50 index, we reiterate

that stocks from the cash segment are providing excellent

opportunities. Hence, identifying such key movers is the key for

momentum traders.

Key Levels

Support 1 – 18500 Resistance 1 – 18650

Support 2 – 18430 Resistance 2 – 18780

www.angelone.in

Technical & Derivatives Report

DEC 14, 2022

View

Our market witnessed a stellar move, wherein the

benchmark index Nifty reclaimed the 18600 amid the

positive global cues. The banking space being the

charioteer to uplift the market sentiments.

FIIs were net buyers in the cash market segment to

the tune of Rs. 620 crores. Simultaneously, in Index

futures, they bought worth Rs. 557 crores with a minor

rise in open interest, indicating long addition.

Looking at the F&O data, we witnessed long addition

in Bank Nifty and short covering in Nifty. On the

options front, the piling up of positions is visible at

the 18500-18600 put strike, indicating a shift in

support for Nifty. On the flip side, the nearest piling

of OI concentration is seen at the 18700-call strike,

followed by 18800 CE, signifying intermediate

resistance. Meanwhile, the stronger hands have

added some longs in the system resulting in the

expansion of ‘Long Short Ratio’ to 61% from 60%.

Considering the recent price action, we would

advocate traders to utilise intraday declines to add

fresh longs in the system.

Comments

The Nifty futures open interest has decreased by

1.04% and Bank Nifty futures open interest has

increased by 6.17% as the market closed at 18608.

The Nifty December future closed with a premium of

95.85 point against a premium of 108.05 point in the

last trading session. The January series closed at a

premium of 205.75 point.

The INDIA VIX decreased from 13.31 to 12.88. At the

same time, the PCR-OI of Nifty has increased from

0.91 to 1.05.

Few of the liquid counters where we have seen high

cost of carry are TATACOMM, POLYCAB,

LALPATHLAB, MCX and LAURUSLABS.

Historical Volatility

SCRIP HV

IDEA 72.02

IBULHSGFIN 69.17

RBLBANK 67.60

GNFC 58.74

HINDCOPPER 58.17

Nifty

Vs OI

17800

18000

18200

18400

18600

18800

19000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

11/24 11/28 11/30 12/2 12/6 12/9 12/13

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

LALPATHLAB 1365500 35.74 2358.85 -4.43

POLYCAB 1092600 22.58 2942.05 4.50

LAURUSLABS 11015100 16.35 391.00 -3.24

CHAMBLFERT 9559500 15.24 313.95 0.86

ASTRAL 1799050 12.75 2099.50 2.56

ABBOTINDIA 45800 10.41 20837.65 1.31

CUB 9515000 10.13 195.80 0.56

METROPOLIS 1240000 9.80 1356.45 -0.99

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PNB 212128000 -7.79 59.90 3.00

HCLTECH 11340700 -6.33 1044.70 1.27

NAUKRI 1185625 -5.88 4159.90 2.51

SIEMENS 1902175 -5.83 2990.15 -1.72

WHIRLPOOL 802900 -4.77 1515.05 0.58

ALKEM 263000 -4.08 3104.00 0.33

TATASTEEL 187587750 -3.75 111.20 -0.58

DIVISLAB 2879400 -3.66 3355.55 0.38

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.05 0.93

BANKNIFTY 1.41 0.90

RELIANCE 0.45 0.34

ICICIBANK 0.50 0.40

INFY 0.42 0.43

www.angelone.in

Technical & Derivatives Report

DEC 14, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

608

.

00

FII Statistics for

December

1

3

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2963.74 2406.91 556.83

169967 16786.06 0.13

INDEX

OPTIONS

859924.78 864958.93 (5034.15) 2247653 221501.75 (1.44)

STOCK

FUTURES

6760.01 8433.71 (1673.70) 1953864 136762.94 0.32

STOCK

OPTIONS

8171.40 8107.50 63.90

155018 11091.27 1.64

Total 877819.93

883907.05

(6087.12) 4526502

386142.02

(0.53)

Turnover on

December

1

3

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

214881 2141558.98

-13.27

Index

Options

153102566 3228474.59

-13.40

Stock

Futures

609103 4361403.96

-3.37

Stock

Options

2811690 310241.84 6.19

Total

28,11,690 310241.84 -8.74

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18500 303.10

68.40

31.60

18568.40

Sell

18600 234.70

Buy

18500 303.10

129.80

70.20

18629.80

Sell

18700 173.30

Buy

18600 234.70

61.40 38.60 18661.40

Sell 18700 173.30

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18500 98.95

24.35

75.65

18475.65

Sell

18400 74.60

Buy 18500 98.95

42.60

157.40

18457.40

Sell 18300 56.35

Buy

18400 74.60

18.25 81.75 18381.75

Sell 18300 56.35

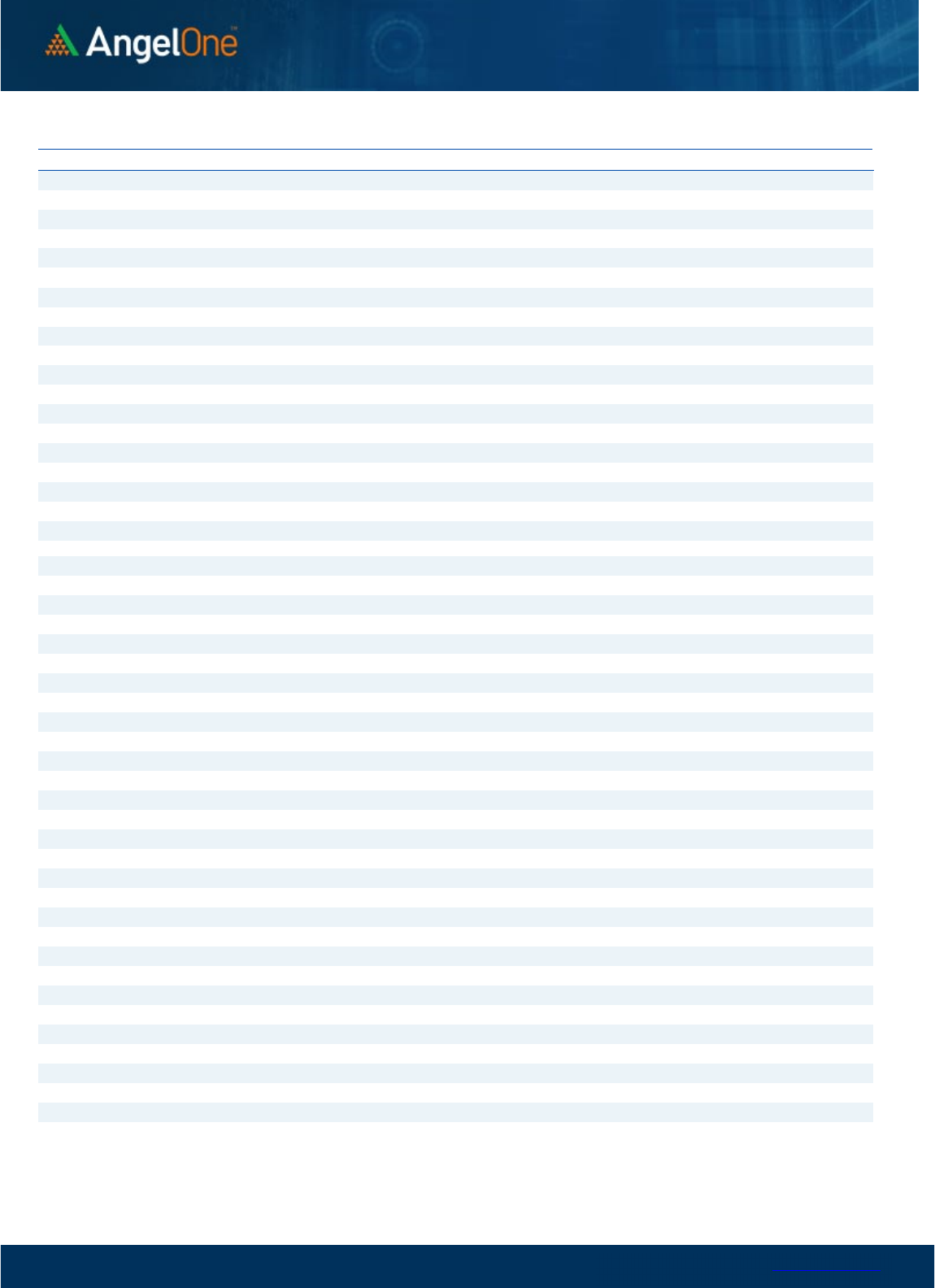

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

17900 18000 18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100 19200

Call Put

www.angelone.in

Technical & Derivatives Report

DEC 14, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,988 4,024

4,048

4,084

4,108

ADANIPORTS

875

885

891

901

908

APOLLOHOSP 4,600 4,640

4,701

4,740

4,801

ASIANPAINT

3,126

3,152

3,169

3,195

3,211

AXISBANK

931

938

944

950

956

BAJAJ-AUTO 3,573 3,605

3,623

3,655 3,674

BAJFINANCE

6,451

6,535

6,592

6,676

6,733

BAJAJFINSV 1,581 1,596

1,607

1,622

1,632

BPCL

343

345

347

348 351

BHARTIARTL 815 827

833

845 851

BRITANNIA 4,388 4,407

4,430

4,449 4,472

CIPLA

1,079

1,095

1,104

1,119

1,128

COALINDIA 229 230

232

234

236

DIVISLAB

3,318

3,337

3,351

3,370

3,384

DRREDDY 4,424 4,441

4,458

4,475

4,492

EICHERMOT 3,278 3,295

3,319

3,336

3,360

GRASIM 1,791 1,801

1,813

1,823

1,835

HCLTECH

1,025

1,035

1,041

1,051

1,057

HDFCBANK

1,638

1,643

1,650

1,655

1,662

HDFCLIFE

575

579

581 585

588

HDFC 2,683 2,693

2,700 2,710

2,717

HEROMOTOCO

2,707

2,733

2,774

2,800

2,841

HINDALCO

452

455

460

464

469

HINDUNILVR

2,687

2,699

2,709

2,721

2,732

ICICIBANK

924

929

932

937

940

INDUSINDBK 1,197 1,216

1,228

1,247

1,260

INFY

1,527

1,550

1,564

1,586

1,600

ITC 341 343

345

347

348

JSW STEEL 732 738

742

748

752

KOTAKBANK

1,853

1,861

1,866

1,874

1,880

LT

2,144

2,158

2,167

2,182

2,190

M&M

1,260

1,272

1,279

1,291

1,298

MARUTI 8,555 8,588

8,643 8,675 8,730

NESTLEIND

20,145

20,267

20,451

20,573 20,757

NTPC

167

168

169

170

171

ONGC 142 143

144 145 146

POWERGRID

212

214

215

218

219

RELIANCE 2,595 2,610

2,622

2,636

2,648

SBILIFE 1,251 1,265

1,272

1,286

1,294

SBIN

611

614

616

619

620

SUNPHARMA

974

984

990

1,001

1,007

TCS 3,243 3,288

3,312

3,356

3,381

TATACONSUM

799 803

809

813 819

TATAMOTORS 415 417

419 421

423

TATASTEEL

110

110

112

112

114

TECHM

1,024

1,035

1,041

1,052

1,058

TITAN 2,545 2,561

2,580

2,596

2,615

ULTRACEMCO

7,120

7,173

7,208

7,260

7,296

UPL 756 762

769

775

782

WIPRO

394

396

398

399 401

www.angelone.in

Technical & Derivatives Report

DEC 14, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.