SEPT 14, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

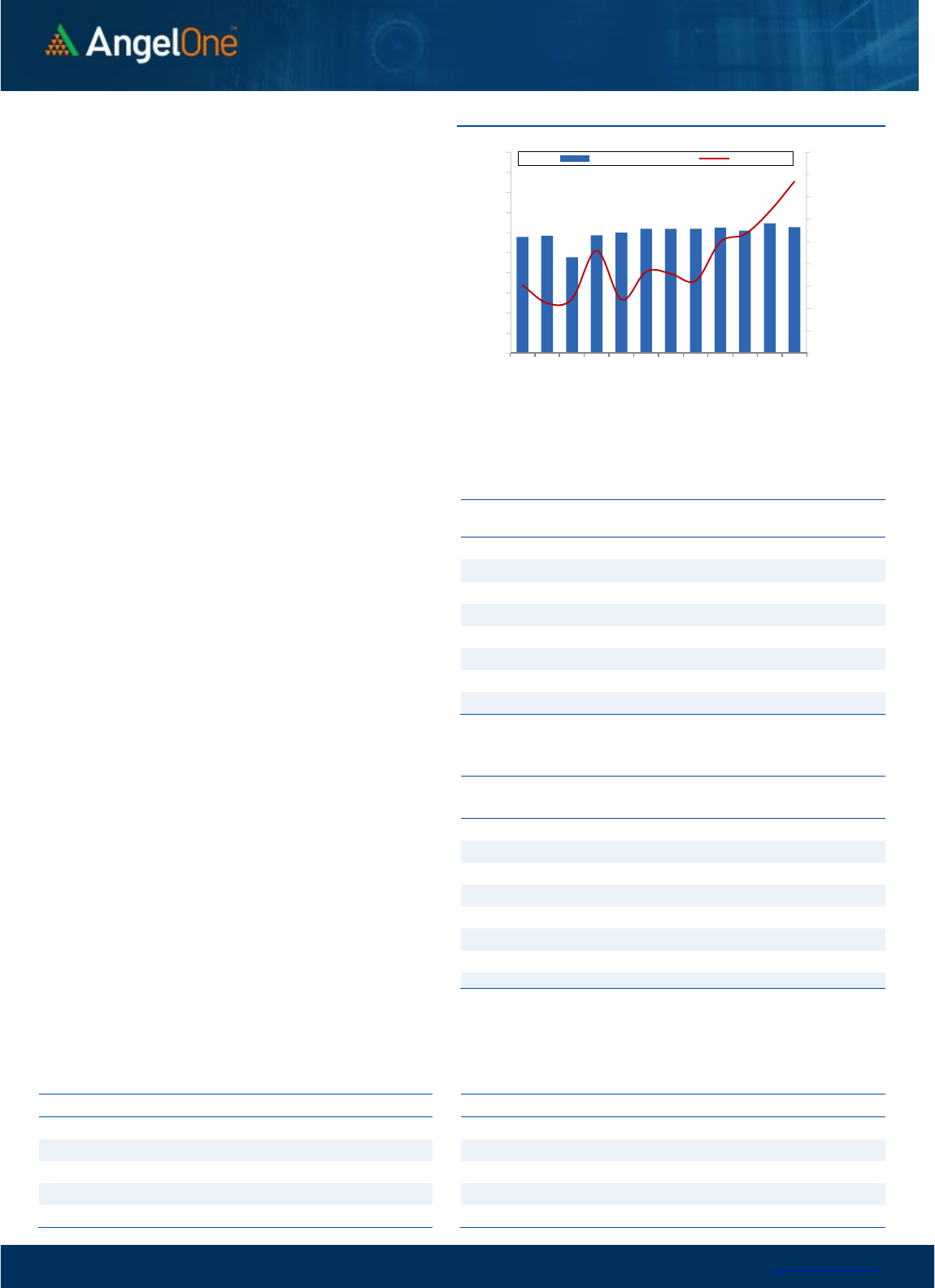

Nifty Bank Outlook (40873)

Once again, the Bank Index started on a positive note however

there was no major traction after opening gains. Eventually,

after trading in a slender range the bank index ended with gains

of 0.74% at 40873.

The bulls continue with their bull run as for the fourth

consecutive session markets ended higher however if we

consider the index-specific action then there's no major action

for the intraday traders. The major action continues outside the

Index as individual stocks continue to give mesmerizing moves.

Traders are hence advised to focus on such outperforming

opportunities. We expect the bank index to move towards all-

time high levels and hence one should avoid contra bets and

rather any dip should be considered as a buying opportunity. As

mentioned above, we are likely to see a gap down opening in

such scenario, immediate support is seen at 40250 - 40000

whereas resistance is at 40600 - 40800 levels.

Key Levels

Support 1 – 40250 Resistance 1 – 40600

Support 2 – 40000 Resistance 2 – 40800

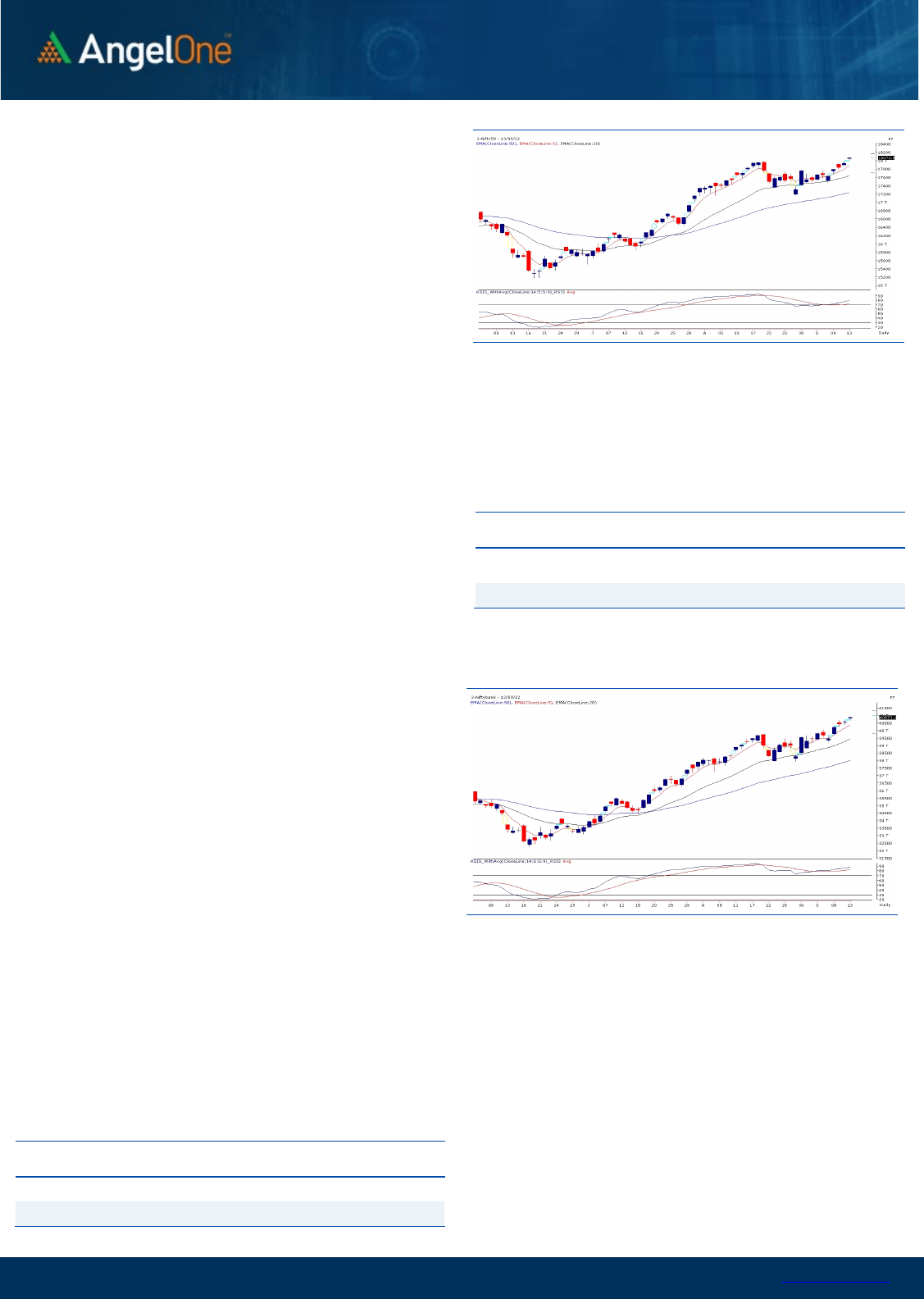

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (60571) / Nifty (18070)

The global set up was positive yesterday morning and as a result,

the Nifty started the session with a decent gap above the

psychological mark of 18000. However, the follow up buying was

clearly missing like the previous session in most of the

heavyweight index movers. In fact, the range shrunk to merely

30 points during the latter half. Eventually, the Nifty concluded

the session convincingly above 18000, first time in last seven

months.

Nifty surpassing 18000 this time wasn’t a surprise, because the

way our market behaved in last week or so, things were pretty

evident. Additionally, the global markets have been supportive

since last 4 – 5 days, which provided the much needed push.

Now, heavyweight constituents seem to have slipped into a

consolidation mode and hence, we are not seeing the follow the

momentum in key indices. However, market is not at all short of

any action if we take a glance at the broader market. We

reiterate that one can continue to remain bullish and focus more

on stock specific movements, which are likely to provide better

trading opportunities.

The SGX Nifty is indicating a big gap down opening and we are

likely to start around the strong support levels at 17800 -

17700 levels. In the recent past, it has been observed of such

openings getting bought into, and hence it would be crucial to

see how our markets react post the opening. On the flip side,

18000 - 18100 will be seen as immediate resistance.

Key Levels

Support 1 – 17800 Resistance 1 – 18000

Support 2 – 17700 Resistance 2 – 18100

www.angelone.in

Technical & Derivatives Report

SEPT 14, 2022

View

Our market has witnessed a gap up opening amid

favorable global bourses, wherein the benchmark

index Nifty50 saw a decisive closure above the

psychological mark of 18000 with gains of 0.75%.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1957 crores. Simultaneously, in Index

futures, they bought worth Rs. 2936 crores with a

decrease in open interest, indicating short covering.

Looking at the overall F&O data, we have witnessed a

long formation in the banking index while a short

covering rally in the benchmark index. On the options

front, piling up of positions is visible in the 18000-17900

put strikes, indicating a shift in the support base. While

on the higher end, the 18200 call strike has a decent

piling in the OI concentration. Considering the recent

price action, the undertone is likely to remain bullish,

and any intraday dip could be seen as an opportunity

to add longs in the indices. Meanwhile, we advocate

keeping a close tab on global developments and

looking for opportunities in the broader market.

Comments

The Nifty futures open interest has decreased by

1.31%. and Bank Nifty futures open interest has

increased by 4.00% as the market closed at 18070.05.

The Nifty Sep future closed with a premium of 35.45

point against a premium of 28.00 point in the last

trading session. The Oct series closed at a premium

of 85.25 point.

The INDIA VIX decreased from 17.93 to 17.47. At the

same time, the PCR-OI of Nifty has increased from

1.18 to 1.39.

Few of the liquid counters where we have seen high

cost of carry are TRENT, BAJAJFINSV, SIEMENS, ACC

and BRITANNIA.

Historical Volatility

SCRIP HV

IDEA 81.92

RBLBANK 72.95

IBULHSGFIN 72.90

ZEEL 64.19

HINDCOPPER 63.10

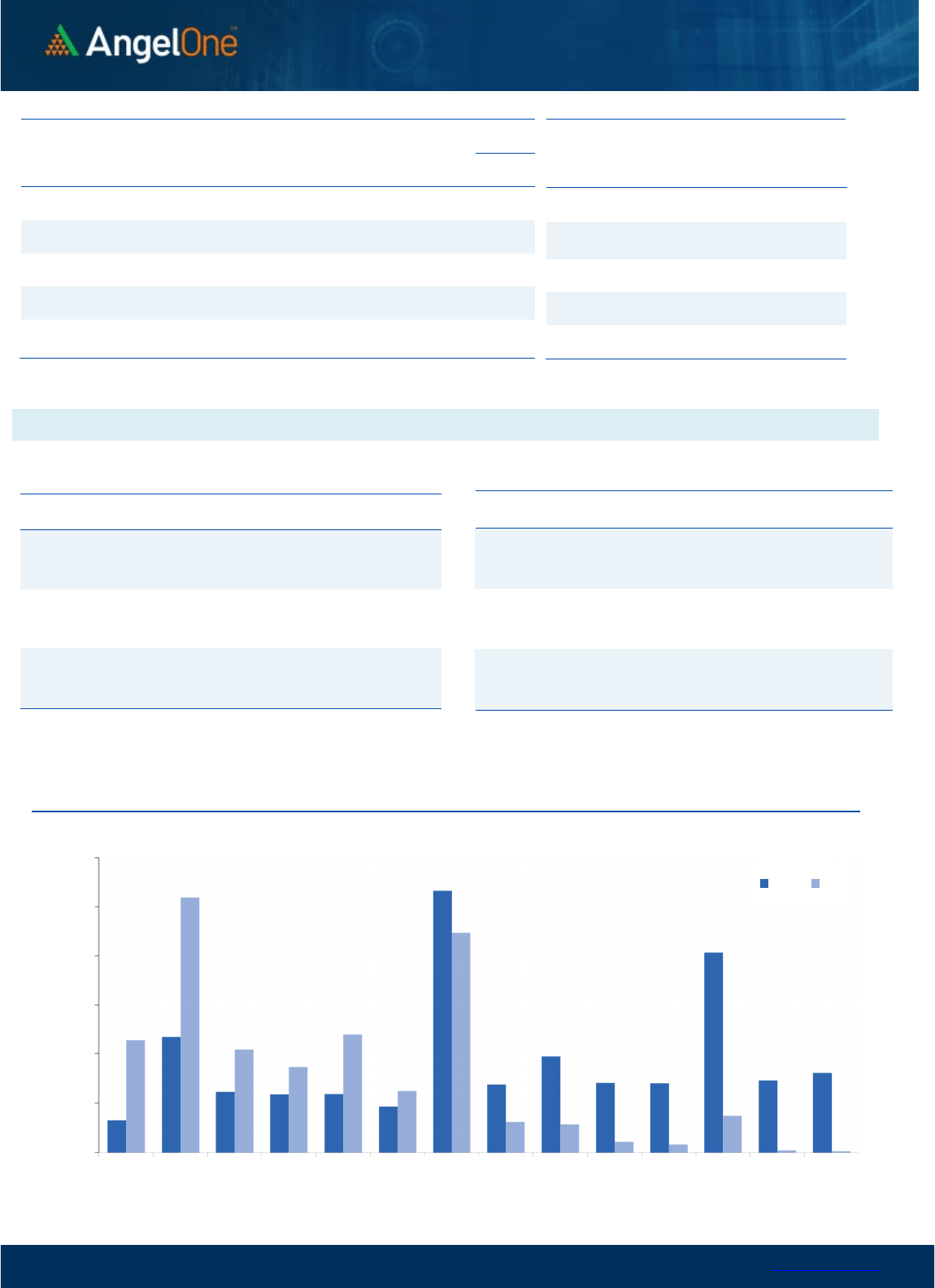

Nifty Vs OI

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

17,000

18,000

8/24 8/30 9/2 9/6 9/8 9/12

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABBOTINDIA 62360 14.80 17920.70 -1.41

POLYCAB 942600 11.97 2638.50 3.38

MFSL 2237950 11.50 795.75 1.05

VOLTAS 6091500 10.51 970.15 0.26

LALPATHLAB 1634000 9.02 2434.70 -2.52

JKCEMENT 423250 8.87 2858.05 0.15

SUNTV 11745000 8.15 531.65 2.16

CROMPTON 4282500 7.98 412.40 -2.17

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND 2955450 -8.23 894.55 0.41

LTTS 862400 -7.74 3840.60 0.54

NAVINFLUOR 581850 -7.64 4719.05 1.21

CUB 8405000 -6.25 181.65 -0.66

IBULHSGFIN 47392000 -5.52 135.75 0.67

AXISBANK 41065200 -5.22 805.55 0.55

AMBUJACEM 72135000 -5.22 486.50 2.29

AUBANK 6289000 -5.09 674.80 2.05

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.39 0.95

BANKNIFTY 1.20 0.96

RELIANCE 0.58 0.40

ICICIBANK 0.79 0.83

INFY 0.45 0.40

www.angelone.in

Technical & Derivatives Report

SEPT 14, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

,

070

.

0

5

FII Statistics for

September

1

3

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4745.03 1808.78 2936.25

115503 10999.38 (13.88)

INDEX

OPTIONS

179808.29 182042.55 (2234.26) 1361515 127607.14 (0.16)

STOCK

FUTURES

10816.17 12060.88 (1244.71) 2091527 150517.76 (0.63)

STOCK

OPTIONS

6969.77 7168.59 (198.82) 180024 13243.22 5.26

Total 202339.26

203080.80

(741.54) 3748569

302367.50

(0.67)

Turnover on

September

1

3

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

248149 23631.96 -0.94

Index

Options

83437223

7659192.60 21.88

Stock

Futures

818662 61902.63 6.06

Stock

Options

3332189 263023.77 11.42

Total

33,32,189 263023.77 21.28

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18000 296.15

57.70

42.30

18057.70

Sell

18100 238.45

Buy

18000 296.15

110.10

89.90

18110.10

Sell

18200 186.05

Buy

18100 238.45

52.40 47.60 18152.40

Sell 18200 186.05

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18000 193.25

34.90

65.10

17965.10

Sell

17900 158.35

Buy 18000 193.25

63.55

136.45

17936.45

Sell 17800 129.70

Buy

17900 158.35

28.65 71.35 17871.35

Sell 17800 129.70

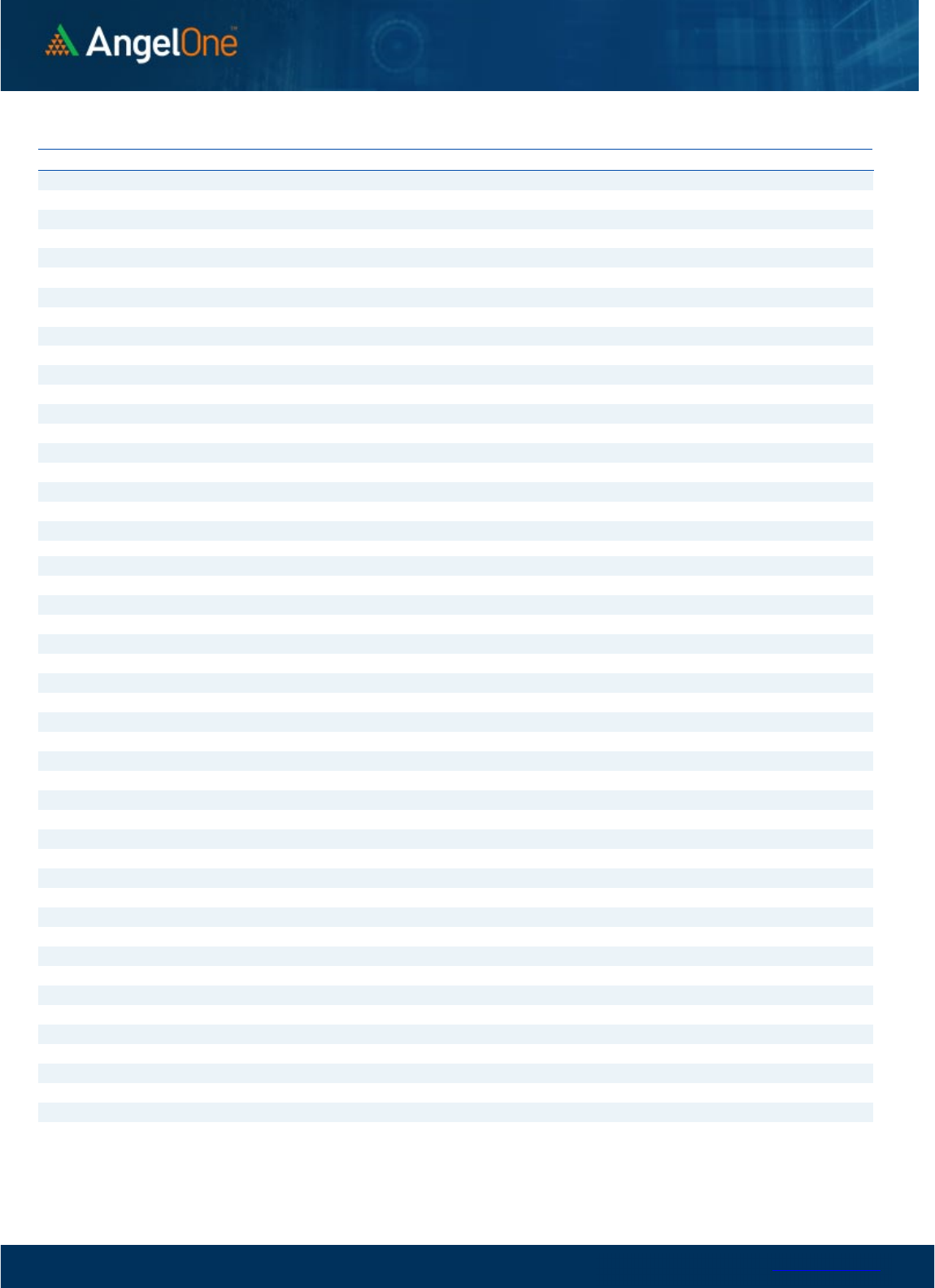

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500 18600 18700

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 14, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

924

937

945

957

966

APOLLOHOSP 4,438 4,464

4,492

4,518

4,546

ASIANPAINT 3,388 3,405

3,432 3,449 3,476

AXISBANK

800

803

806

809 812

BAJAJ-AUTO 3,836 3,851

3,871

3,886 3,906

BAJFINANCE 7,255 7,329

7,387

7,461

7,518

BAJAJFINSV

1,699

1,742

1,793

1,836

1,887

BPCL 337 339

342

344

348

BHARTIARTL 762 773

781 792

800

BRITANNIA

3,629

3,693

3,729

3,793

3,829

CIPLA

1,048

1,053

1,058

1,064

1,069

COALINDIA

228

230

232

234

237

DIVISLAB

3,617

3,642

3,675

3,700

3,733

DRREDDY

4,196

4,224

4,266 4,294 4,336

EICHERMOT 3,467 3,494

3,538

3,566

3,610

GRASIM

1,752

1,771

1,790

1,809

1,827

HCLTECH

946

951

955

960

965

HDFCBANK

1,492

1,502

1,509

1,520

1,527

HDFCLIFE 572 579

593

600 614

HDFC

2,419

2,435

2,446 2,463 2,474

HEROMOTOCO

2,797

2,834

2,868 2,905

2,939

HINDALCO

429

433

436

440

443

HINDUNILVR

2,562

2,574

2,592

2,604

2,622

ICICIBANK

901

906

910

914 918

INDUSINDBK 1,127 1,145

1,155

1,174

1,184

INFY

1,535

1,540

1,546

1,552

1,558

ITC 329 332

333

336

338

JSW STEEL 681 686

692

697

703

KOTAKBANK

1,908

1,916

1,928

1,936

1,948

LT 1,951 1,971

1,983

2,003

2,015

M&M 1,281 1,291

1,300

1,310

1,319

MARUTI 8,864 8,895

8,942 8,973 9,020

NESTLEIND

18,804

18,934

19,100

19,230

19,397

NTPC 164 166

167

169

171

ONGC

133

133

134 135

136

POWERGRID 222 225

226

228

230

RELIANCE 2,588 2,604

2,617

2,633

2,646

SBILIFE

1,299

1,312

1,323

1,336

1,347

SHREECEM

23,145

23,539

24,243

24,637

25,341

SBIN 551 555

557

561

564

SUNPHARMA

879

885

889

894

899

TCS

3,201

3,215

3,239

3,254 3,278

TATACONSUM

821 835

844

857

866

TATAMOTORS 451 454

456

459

462

TATASTEEL

107

107

108 108

109

TECHM 1,130 1,139

1,152 1,160

1,173

TITAN 2,649 2,677

2,700

2,728

2,751

ULTRACEMCO

6,792

6,844

6,907

6,959

7,022

UPL

744

750

759

765

774

WIPRO 419 421

423

425

428

www.angelone.in

Technical & Derivatives Report

SEPT 14, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.