September 14, 2021

www.angelone.in

Technical & Derivatives Report

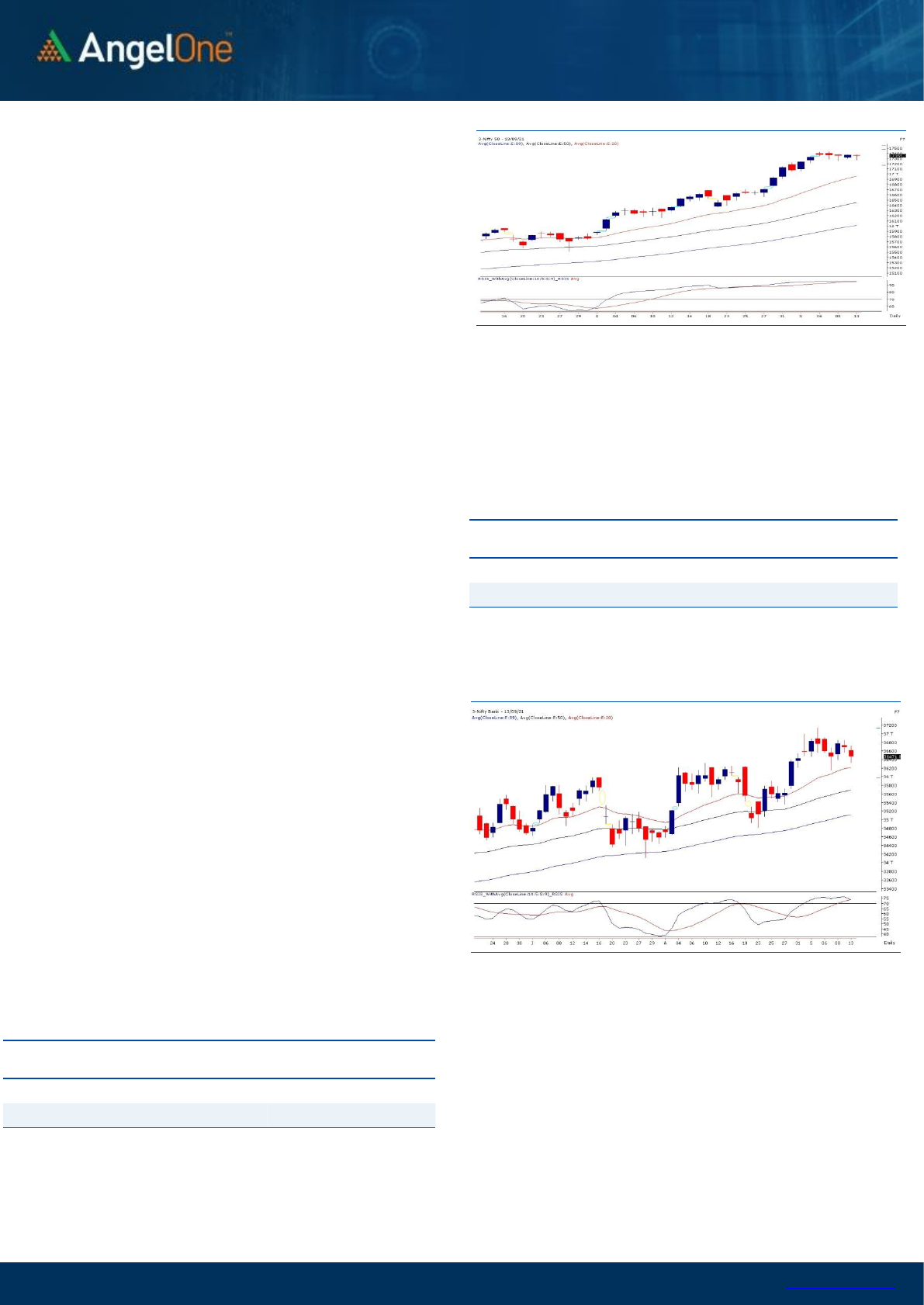

Exhibit 1: Nifty Daily Chart

Nifty Bank Outlook - (36472)

The banking index opened marginally in the red and then

immediately extended its losses to some extent. Fortunately

going by the recent trend, no major damage done as the banking

index stabilised around its intraday support.

Although banking index did not aggravate its morning losses, it

remained sulking for the remaining part of the day. As far as

levels are concerned, 36300-36000 are to be seen as key

supports; whereas on the flipside, 36600-36800 continues to be

strong intraday hurdles.

Key Levels

Support 1 – 36300

Resistance 1 – 36600

Support 2 – 36000

Resistance 2 – 36800

Exhibit 2: Nifty Bank Daily Chart

The banking sector underperformed along with the heavyweight

RIL which restricted the upmove in the index. On the flipside, the

Metals and the PSU names were buzzing which provided good

stock specific momentum for traders. It is advisable to focus on

such thematic moves and trade with proper risk management.

Key Levels

Support 1 – 17300

Resistance 1 – 17450

Support 2 – 17250

Resistance 2 – 17500

Sensex (58178) / Nifty (17355)

After an extended weekend, Nifty started the day on a flat note, but

it witnessed some selling pressure in the first hour of trade. As the

index entered sub-17300 level, some buying interest was seen and

the index recovered much of the losses and consolidated to end

with a marginal loss at 17350.

Yesterday’s price action in Nifty was similar to what we had seen

during the last week. We witnessed some selling pressure during the

day wherein the index breached 17300 mark. But again, buying

interest was seen there and the markets recovered the losses during

the day. Nifty traded within a range of 110 points but a lot of stock

specific action was seen. Clearly, it seems to be a time-wise

correction in the index and Nifty has formed a range of 17250-

17450. Now the next directional move is expected only when we

see a breakout on either side and until then, traders should trade

with a stock specific approach where better trading opportunities

are seen.

www.angelone.in

Technical & Derivatives Report

September 14, 2021

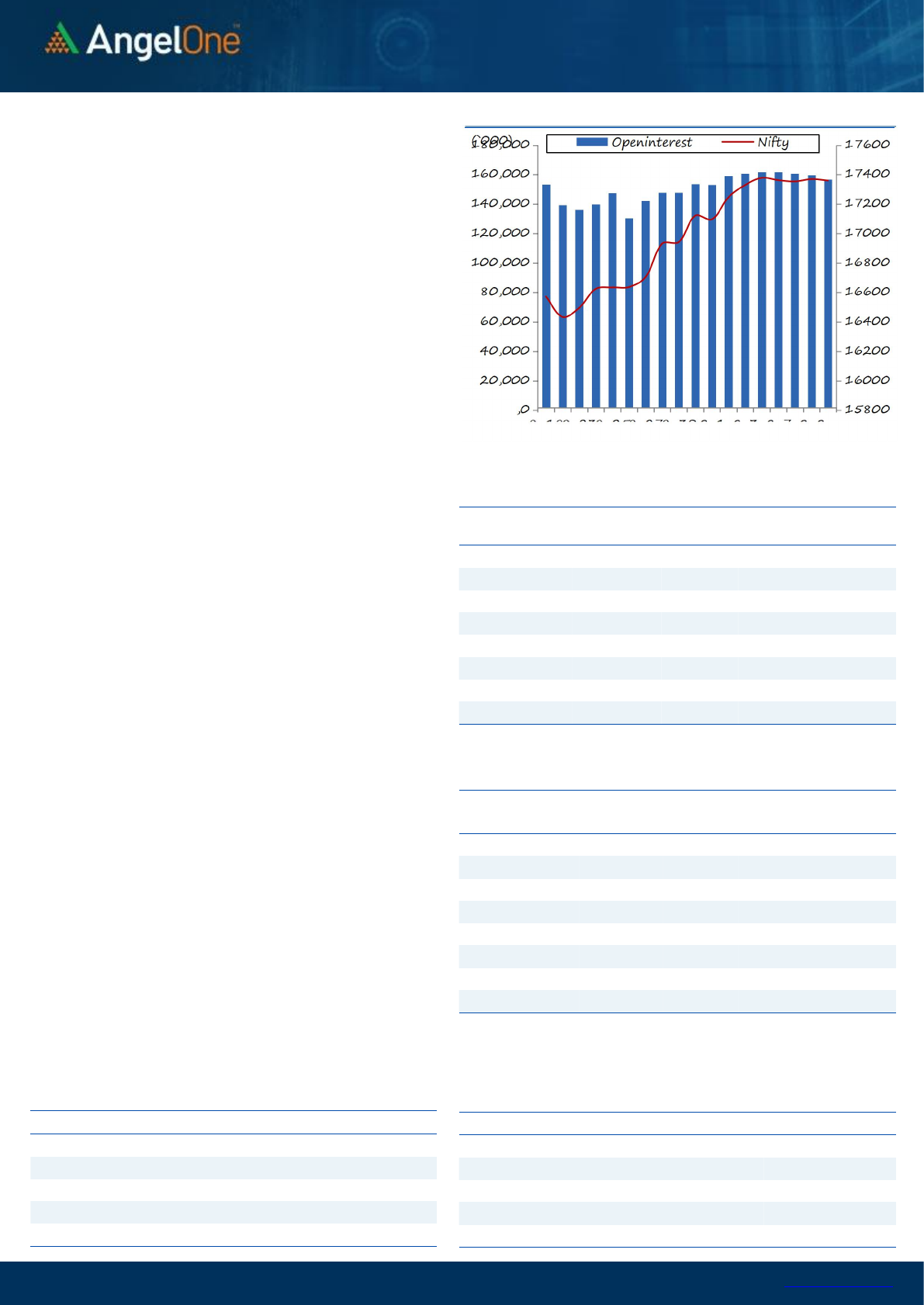

Nifty Vs OI

View

We began the week on a muted note and saw some

selling in the early morning trade to drag index below

17300. However, once again smart recovery was seen to

eventually conclude the day with marginal cuts.

FIIs were net buyers in cash market segment to the tune

of Rs. 1419 crores. In index futures, they sold worth

Rs. 647 crores with rise in open interest indicating short

formation on Monday.

In F&O space, we hardly saw any relevant open interest

activities in both the indices. Stronger hands continued

with their buying in equities but remained sellers in

index and stock futures segment. In Nifty options front,

the overall build-up was scattered between 17300-

17600 call and 17000-17350 put strikes. Highest open

interest concentration is placed at 17400 call and 17300

put options; hinting narrow range for Nifty. Considering

the above data points, its seems Nitfy may continue to

remain range bound and hence we would advise trader

continuing with stock specific approach for the time

being.

Comments

The Nifty futures open interest has decreased by 1.88%.

Bank Nifty futures open interest has increased by 2.73%

as market closed at 17355.30 levels.

The Nifty September future closed with a premium of

4.00 point against a premium of 10.80 point in last

trading session. The October series closed at a premium

of 32.10 point.

The INDIA VIX increased from 13.94 to 14.02. At the

same time, the PCR-OI of Nifty has increased from 1.27

to 1.33.

Few of the liquid counters where we have seen high cost

of carry are IDEA, OFSS, BHEL, INDHOTEL and

AMARAJABAT.

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SYNGENE

1800300

69.71

668.85

6.10

IPCALAB

217350

23.85

2596.10

2.96

POLYCAB

700500

22.32

2442.30

2.47

EXIDEIND

38606400

14.16

184.05

0.90

GUJGASLTD

4325000

12.16

676.15

-0.56

OFSS

521000

11.12

4856.20

1.73

HINDALCO

38702150

8.39

478.35

2.95

ASTRAL

506825

7.59

2135.60

4.28

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IRCTC

1691300

-10.55

3435.80

3.90

NAM-INDIA

4531200

-5.32

436.80

-0.78

MPHASIS

1876550

-4.15

3000.05

2.13

MUTHOOTFIN

2951250

-4.00

1544.55

0.19

SRTRANSFIN

4261200

-3.86

1341.70

-0.65

CUMMINSIND

2270400

-3.74

1044.15

-0.07

BHARTIARTL

70478676

-3.72

693.45

0.92

JUBLFOOD

1523750

-3.51

4135.20

0.88

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.33

0.95

BANKNIFTY

0.77

0.93

RELIANCE

0.47

0.41

ICICIBANK

0.44

0.54

INFY

0.51

0.31

Historical Volatility

SCRIP

HV

SYNGENE

38.77

IGL

39.17

COALINDIA

38.33

MINDTREE

47.95

ASTRAL

51.59

www.angelone.in

Technical & Derivatives Report

September 14, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17355.30

FII Statistics for September 13, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2733.00

3379.57

(646.57)

174959

15378.66

3.24

INDEX

OPTIONS

198204.72

198761.48

(556.76)

1356700

119095.52

19.38

STOCK

FUTURES

9742.51

10902.33

(1159.82)

1473174

126036.39

0.84

STOCK

OPTIONS

13839.32

13867.04

(27.72)

271959

23230.46

1.77

Total

224519.55

226910.42

(2390.87)

3276792

283741.03

8.00

Turnover on September 13, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

220676

19624.81

11.66

Index Options

35033416

3135613.68

-67.28

Stock Futures

539747

46593.35

0.92

Stock Options

2272936

204818.87

13.81

Total

3,80,66,775

3406650.71

-65.34

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

155.20

43.70

56.30

17443.70

Sell

17500

111.50

Buy

17400

155.20

78.10

121.90

17478.10

Sell

17600

77.10

Buy

17500

111.50

34.40

65.60

17534.40

Sell

17600

77.10

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17300

196.85

47.60

52.40

17252.40

Sell

17200

149.25

Buy

17300

196.85

83.85

116.15

17216.15

Sell

17100

113.00

Buy

17200

149.25

36.25

63.75

17163.75

Sell

17100

113.00

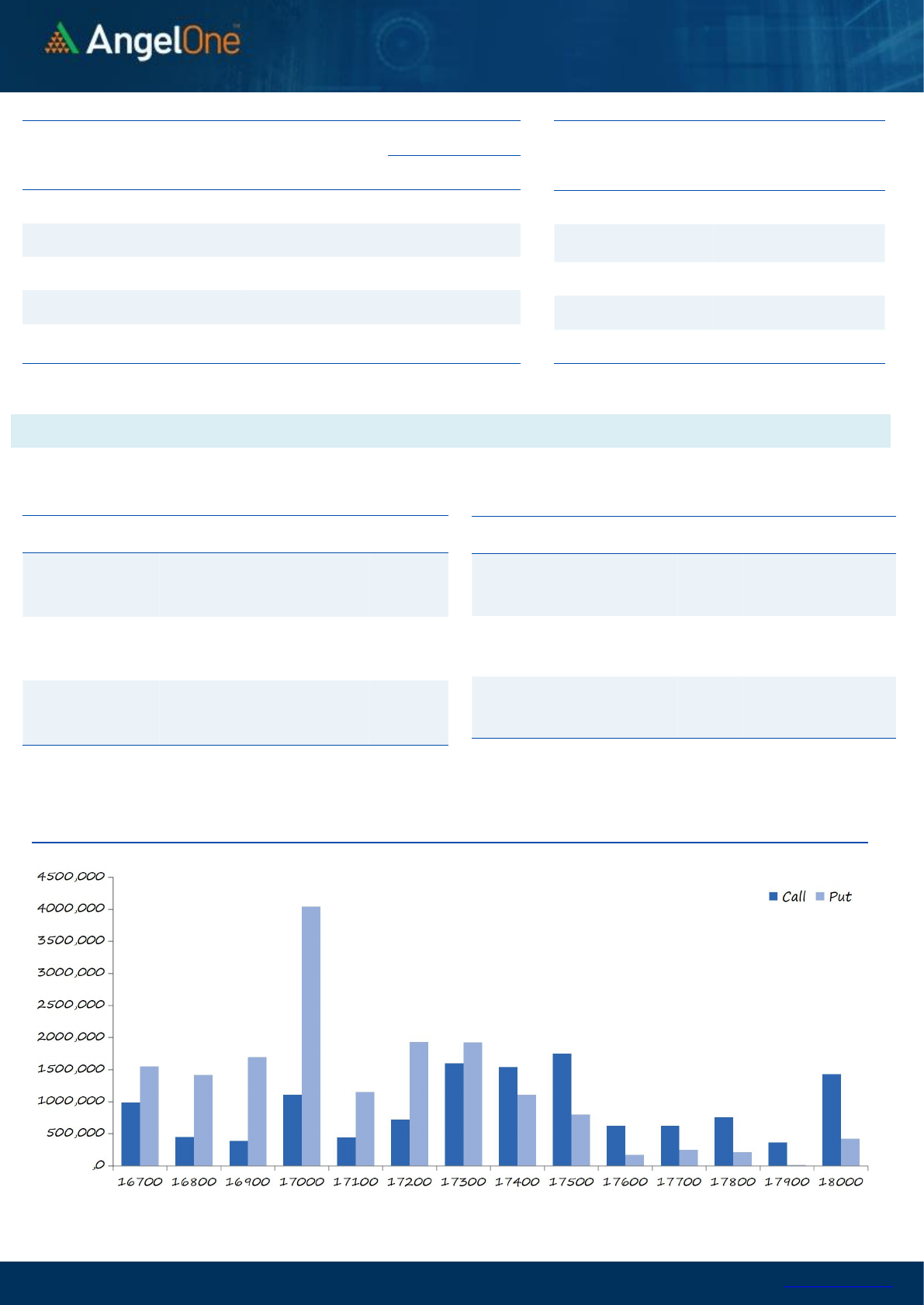

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 14, 2021

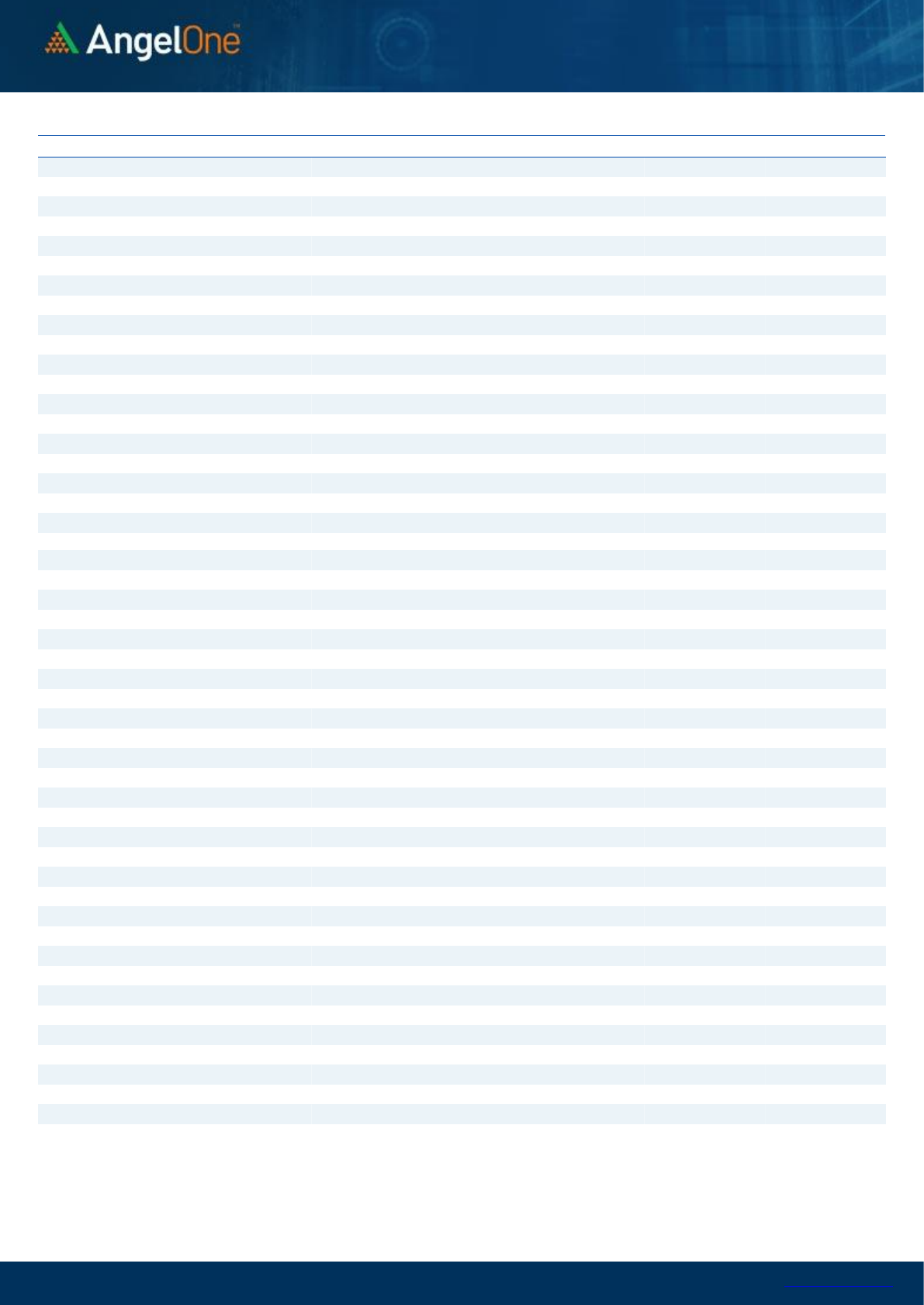

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

734

740

746

752

758

ASIANPAINT

3,313

3,340

3,357

3,384

3,401

AXISBANK

780

784

787

791

794

BAJAJ-AUTO

3,660

3,680

3,700

3,720

3,740

BAJFINANCE

7,288

7,367

7,431

7,510

7,574

BAJAJFINSV

16,423

16,681

16,837

17,095

17,251

BPCL

489

493

496

501

504

BHARTIARTL

681

687

692

698

703

BRITANNIA

4,041

4,067

4,085

4,112

4,129

CIPLA

938

944

949

955

960

COALINDIA

147

151

153

157

160

DIVISLAB

4,966

5,025

5,061

5,120

5,156

DRREDDY

4,843

4,887

4,917

4,961

4,991

EICHERMOT

2,761

2,783

2,799

2,821

2,837

GRASIM

1,566

1,586

1,600

1,620

1,634

HCLTECH

1,161

1,185

1,200

1,223

1,239

HDFCBANK

1,534

1,545

1,564

1,575

1,595

HDFCLIFE

714

725

734

744

753

HDFC

2,810

2,830

2,853

2,873

2,896

HEROMOTOCO

2,748

2,769

2,791

2,812

2,834

HINDALCO

464

471

476

483

488

HINDUNILVR

2,747

2,767

2,795

2,814

2,842

ICICIBANK

697

702

710

715

723

IOC

112

113

114

115

115

INDUSINDBK

986

991

998

1,003

1,009

INFY

1,663

1,678

1,690

1,704

1,716

ITC

210

212

214

216

217

JSW STEEL

681

688

694

700

706

KOTAKBANK

1,773

1,807

1,828

1,862

1,883

LT

1,654

1,663

1,669

1,678

1,684

M&M

733

739

746

753

760

MARUTI

6,779

6,826

6,861

6,908

6,943

NESTLEIND

20,124

20,288

20,394

20,558

20,664

NTPC

114

114

115

116

116

ONGC

120

122

123

124

125

POWERGRID

172

173

174

175

175

RELIANCE

2,326

2,349

2,391

2,414

2,456

SBILIFE

1,140

1,153

1,166

1,178

1,192

SHREECEM

30,103

30,383

30,608

30,888

31,113

SBIN

427

430

432

435

437

SUNPHARMA

767

774

778

785

790

TCS

3,736

3,791

3,822

3,876

3,907

TATACONSUM

866

874

879

887

892

TATAMOTORS

293

297

300

304

306

TATASTEEL

1,422

1,443

1,457

1,478

1,493

TECHM

1,410

1,420

1,430

1,439

1,449

TITAN

2,009

2,020

2,032

2,042

2,054

ULTRACEMCO

7,878

7,911

7,938

7,971

7,998

UPL

742

749

758

765

775

WIPRO

653

662

667

676

681

www.angelone.in

Technical & Derivatives Report

September 14, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.