March 14, 2023

www.angelone.in

Technical & Derivatives Report

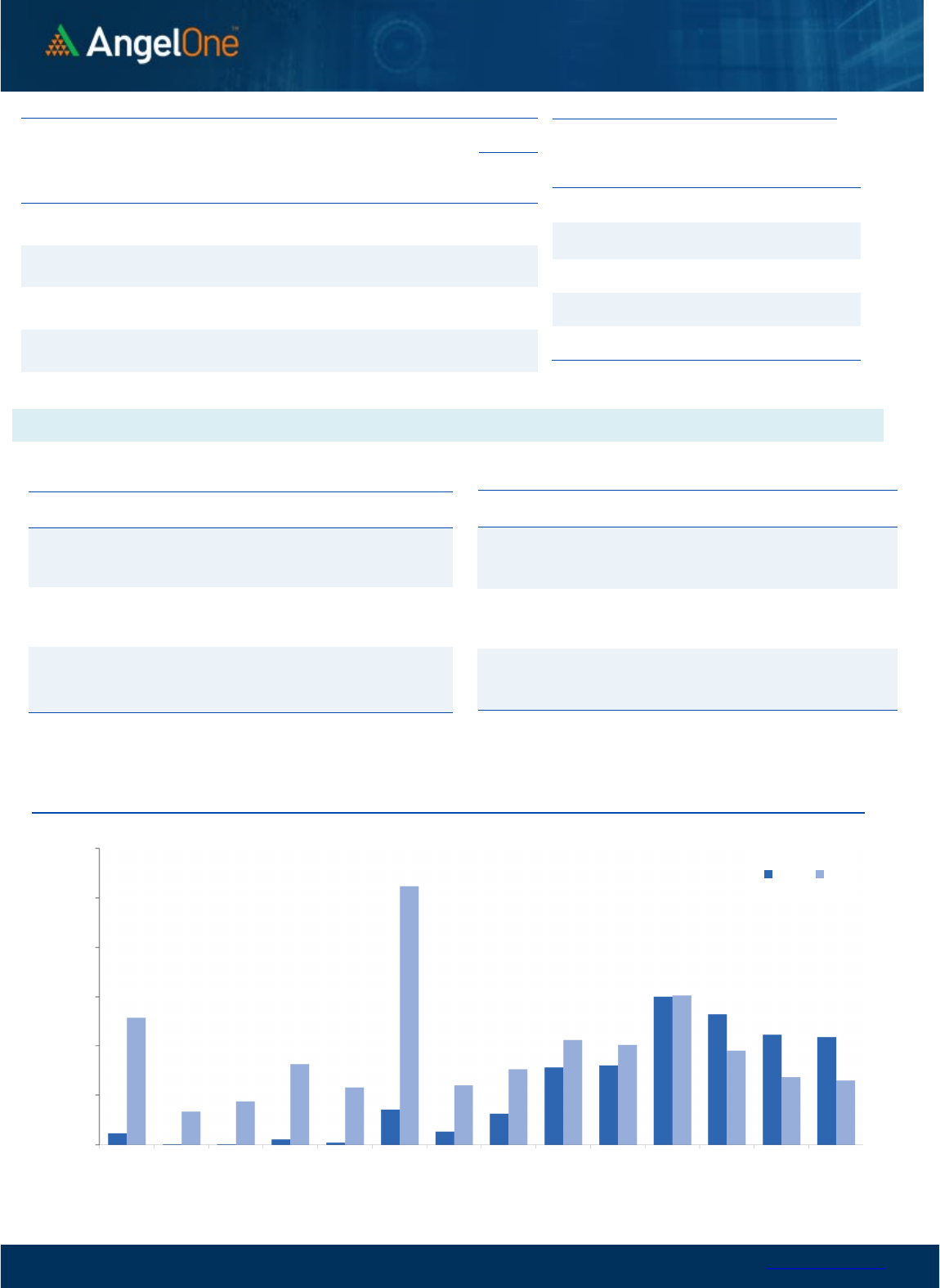

Nifty Bank

Outlook (

39565

)

Despite starting negatively, the Bank Index experienced strong

positive movement during the initial few minutes. However, this

was short-lived as a sharp selloff erased morning gains and further

weakness resulted in a sharp cut of 2.27% to end at 39565.

Over the last three sessions, the index has declined by more than

2000 points, and it is now approaching a key support zone

between 39400-39200 levels. These levels coincide with the

200SMA and recent swing lows. Even if this support zone is

breached, it may not be advisable to take fresh short positions

because the hourly indicators are oversold, and there is positive

divergence in the RSI. Due to the high volatility in the banking

counters, it is best to avoid undue risk. Instead, investors should

wait for bullish reversal signs and accumulate high-quality

propositions in a staggered manner. In terms of resistance

levels, 40000-40350 is likely to act as immediate resistance.

Key Levels

Support 1 – 39400 Resistance 1 – 40000

Support 2 – 39200 Resistance 2 – 40350

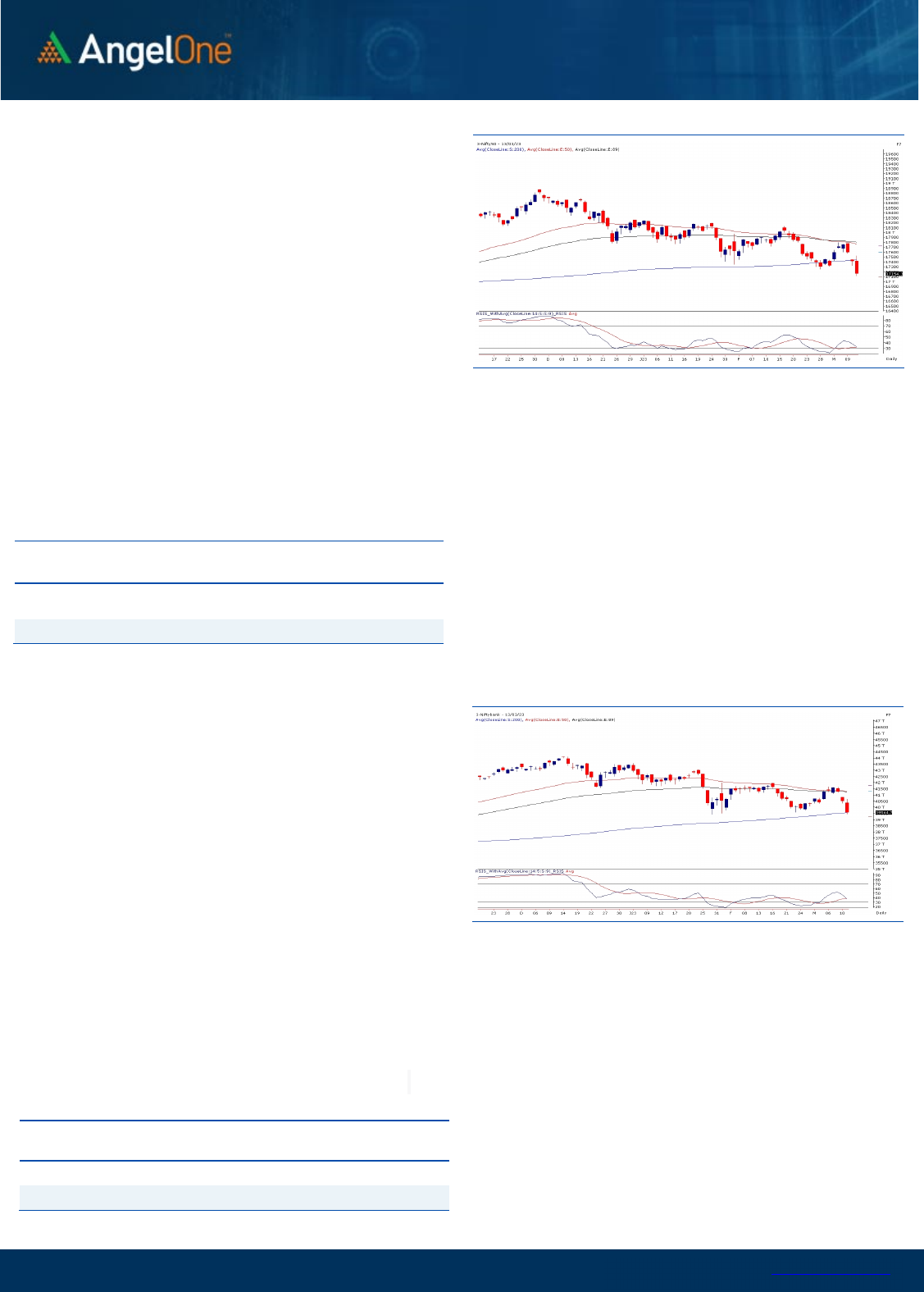

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

58238

) / Nifty (

1

7

154

)

The Indian equity market started the day on a strong note, wherein

the benchmark index retested the 17500 zone within minutes after

the opening bell. However, it appeared to be a false momentum as

the index took a U-turn to pare down the early gains and gradually

nosedived into negative terrain. Amidst the hustle, the Nifty50

index slipped to a fresh low in the current calendar year with a cut

of 1.49 percent and settled around the 17150 level.

The rub-off effect of the global weakness was quite evident in our

market as we failed to sustain at the higher grounds. Technically,

our market is in the cycle of lower lows – lower bottoms formation

and with yesterday’s strong sell-off, Nifty plunged to new lows,

denting sentiments. As far as levels are concerned, the

psychological mark of 17000 is in the vicinity now, followed by

16900. While on the flip side, the 200 SMA placed around the

17400-17450 odd zone is expected to act as a sturdy hurdle in a

comparable period.

Key Levels

Support 1 – 17000 Resistance 1 – 17400

Support 2 – 16900 Resistance 2 – 17450

Going ahead, any positive developments in the US market could

bring some cheer back and hence one needs to keep a close tab

on global bourses. Meanwhile, we advocate to avoid aggressive

bets and keep accumulating quality propositions in a staggered

manner.

www.angelone.in

Technical & Derivatives Report

March 14, 2023

View

It was a third straight session of fall in our market.

Though, we started on a week note but smart buying

emerged to reclaim 17500, but this gains soon got

wiped-off to not only erase the morning gains but

also test February series low. The nifty inched lower

to almost touch 17100 in the final hour.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1547 crores. Simultaneously, in Index

futures, they sold worth Rs. 620 crores with an

increase in open interest, indicating short addition.

Looking at the F&O data, we witnessed short

formation in both key indices. On the options front,

a decent piling of OI is seen at the 17200-17500 call

strike, which is mostly short positions. On the flip

side, we observed decent unwinding in 17250-17400

put strikes and now the highest open interest

concentration is visible in 17000 put strike;

suggesting support has shifted lower now.

Meanwhile, the stronger hands have added mixed

bets in index futures with majority on the short side.

For now, we believe market is a bit oversold and

hence traders should avoid shorting.

Comments

The Nifty futures open interest has increased by 1.02%

and Bank Nifty futures open interest has increased by

7.27% as the market closed at 17154.30.

The Nifty March future closed with a premium of 51.5

point against a premium of 39.65 point in the last

trading session. The April series closed at a premium of

151.55 point.

The INDIA VIX increased from 13.41 to 16.21. At the

same time, the PCR-OI of Nifty has decreased from 0.89

to 0.71.

Few of the liquid counters where we have seen high

cost of carry are POLYCAB, HDFCBANK, RECLTD, CANBK,

AND INDIAMART.

Historical Volatility

SCRIP HV

TECHM 36.28

INDUSINDBK 45.80

COROMANDEL 33.32

PEL 48.78

AUBANK 42.43

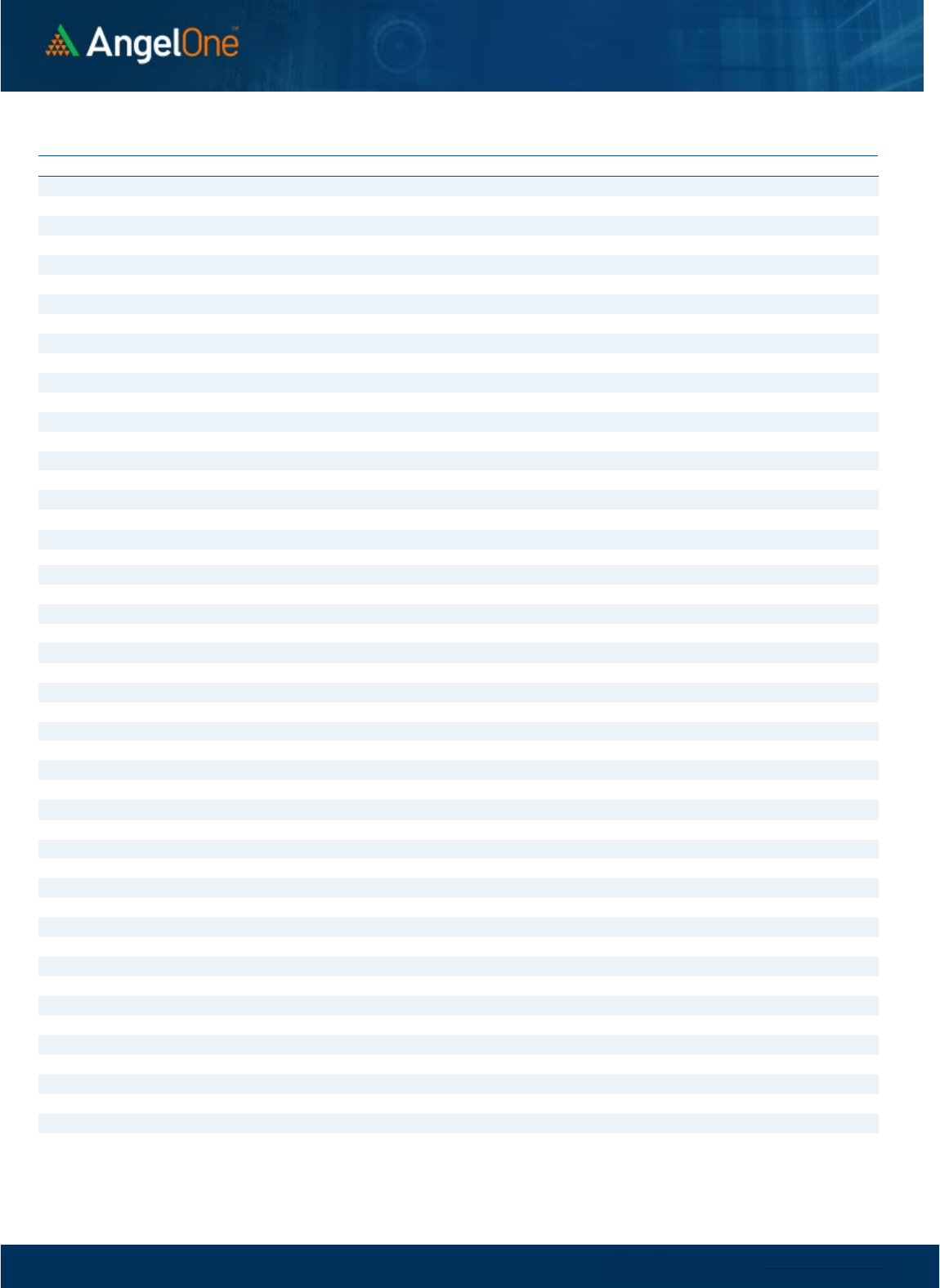

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/17 2/22 2/24 2/28 3/2 3/6 3/9 3/13

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IPCALAB 2314650 19.34 794.15 -0.67

AUBANK 14548000 18.31 596.45 -5.24

INDUSINDBK 29377800 13.95 1060.10 -7.58

NAVINFLUOR 490500 12.45 4121.95 -2.07

INDIAMART 345150 11.05 4661.05 -2.05

ATUL 154425 10.17 6844.15 -2.40

TECHM 13187400 9.57 1133.80 6.92

PERSISTENT 1054725 8.40 4622.05 -2.20

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MGL 17600 -8.51 990.30 0.05

LALPATHLAB 881000 -6.53 1833.30 0.05

GAIL 66410700 -5.96 110.20 -1.03

POWERGRID 34597800 -5.49 226.10 -0.46

ABB 1607500 -5.18 3274.45 -3.07

GUJGASLTD 4905000 -4.85 507.60 -0.57

SIEMENS 1889800 -4.85 3269.90 -1.32

ABBOTINDIA 45800 -4.82 20259.65 -1.49

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.89 0.91

BANKNIFTY 0.66 0.99

RELIANCE 0.52 0.52

ICICIBANK 0.60 0.68

INFY 0.45 0.43

www.angelone.in

Technical & Derivatives Report

March 14, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

154.30

0900

Lot Size = 75

FII Statistics for

March

1

3

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

8408.90

9028.83

(619.93) 188388

16813.82

5.46

INDEX

OPTIONS

1224256.84

1216245.31

8011.53

2835715

252138.95

19.22

STOCK

FUTURES

10801.17

12387.06

(1585.89) 2199280

142621.49

0.77

STOCK

OPTIONS

12703.60

12793.93

(90.33) 163830

10659.07

4.26

Total 1256170.51

1250455.13

5715.38

5387213

422233.33

10.01

Turnover

on

March

1

3

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

627368 58848.80

114.88

Index Options

232041330

74082.00

42.82

Stock Futures

841224 55043.44

31.78

Stock Options

3261661 3212.62 0.39

Total

3,261,661 3212.62 53.90

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17200 225.60

54.80

45.20

17254.80

Sell

17300 170.80

Buy

17200 225.60

95.90

104.10

17295.90

Sell

17400 129.70

Buy

17300 170.80

41.10 58.90 17341.10

Sell

17400 129.70

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17100 222.20

34.85

65.15

17065.15

Sell 17000 187.35

Buy 17100 222.20

69.85

130.15

17030.15

Sell

16900 152.35

Buy

17000 187.35

35.00 65.00 16965.00

Sell 16900 152.35

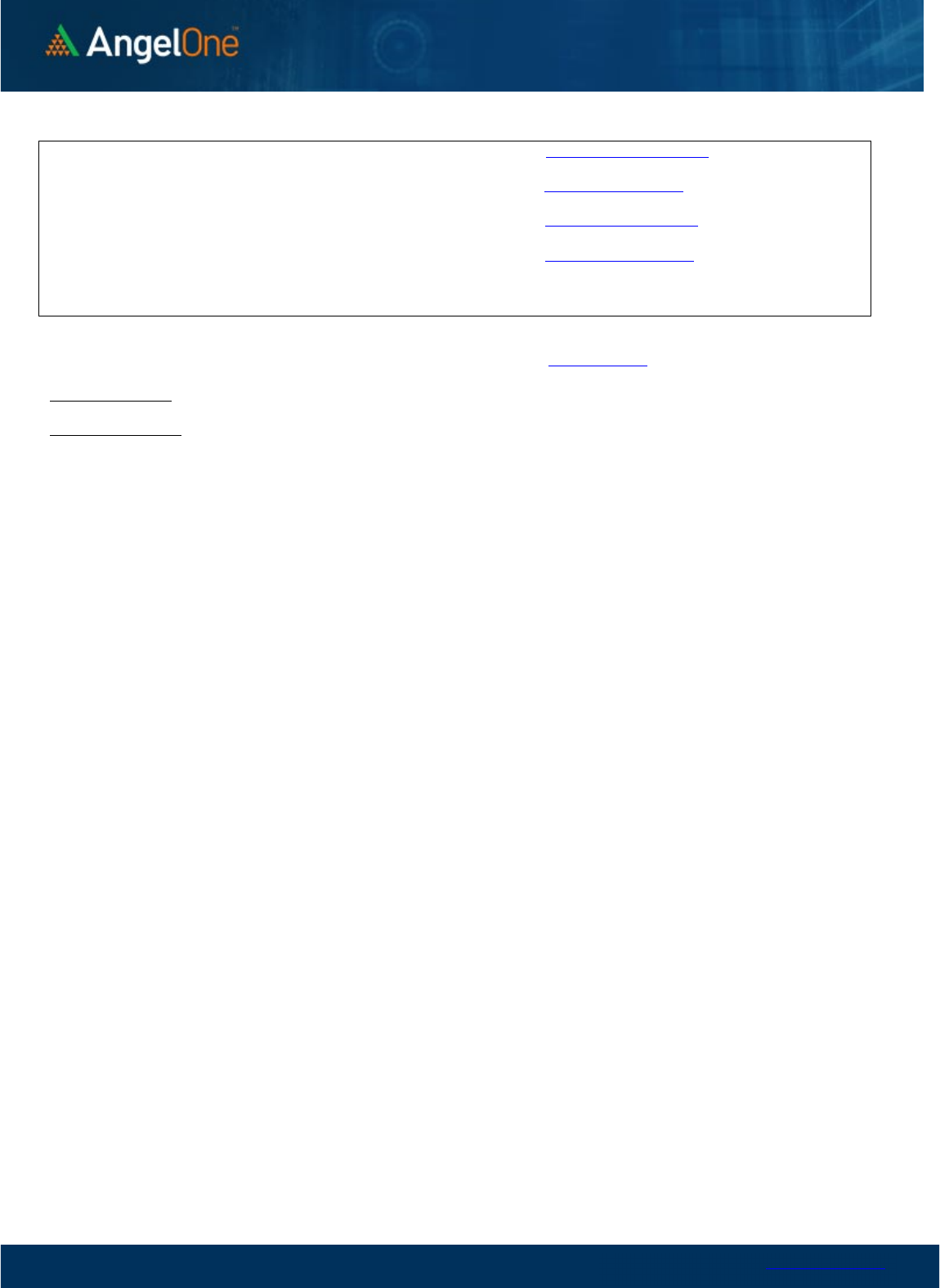

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

March 14, 2023

`

Daily

Pivot Levels for Nifty

Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,778

1,826

1,906

1,954

2,033

ADANIPORTS 656 669

690

702

723

APOLLOHOSP

4,254

4,299

4,368

4,413

4,482

ASIANPAINT

2,725

2,754

2,802

2,832

2,879

AXISBANK 811 822

839

850

868

BAJAJ-AUTO

3,725

3,752

3,795

3,822

3,865

BAJFINANCE

5,728

5,781

5,864

5,917

6,001

BAJAJFINSV

1,260

1,278

1,310

1,327

1,359

BPCL 318 320

323

326

329

BHARTIARTL 754 760

769

774

783

BRITANNIA

4,259

4,283

4,315

4,339

4,371

CIPLA 862 868

879

885

896

COALINDIA 216 218

222

225

228

DIVISLAB

2,728

2,748

2,777

2,797

2,826

DRREDDY

4,307

4,339

4,377

4,409

4,448

EICHERMOT

2,963

2,998

3,060

3,096

3,158

GRASIM

1,507

1,535

1,576

1,604

1,645

HCLTECH

1,070

1,085

1,109

1,123

1,148

HDFCBANK

1,540

1,554

1,579

1,593

1,618

HDFCLIFE

466

472

484

491

502

HDFC

2,529

2,552

2,589

2,613

2,650

HEROMOTOCO

2,341

2,364

2,403

2,426

2,465

HINDALCO 389 396

405

412

422

HINDUNILVR

2,419

2,437

2,463

2,481

2,506

ICICIBANK 805 816

836

848

867

INDUSINDBK

1,014

1,037

1,078

1,101

1,143

INFY

1,397

1,416

1,447

1,466

1,497

ITC 377 380

386

389

394

JSW STEEL 662 669

680

687

698

KOTAKBANK

1,631

1,652

1,688

1,709

1,745

LT

2,068

2,101

2,140

2,173

2,212

M&M

1,154

1,174

1,202

1,222

1,251

MARUTI

8,389

8,454

8,546

8,610

8,702

NESTLEIND

18,119

18,218

18,359

18,458

18,599

NTPC 178 179

180

181

182

ONGC 154 155

156

157

159

POWERGRID 223 224

227

229

232

RELIANCE

2,232

2,258

2,301

2,327

2,370

SBILIFE

1,045

1,059

1,080

1,094

1,115

SBIN 513 521

537

546

562

SUNPHARMA 942 948

954

960

966

TCS

3,210

3,246

3,308

3,344

3,406

TATACONSUM

682 688

698

704

713

TATAMOTORS 408 415

426

433

444

TATASTEEL 105 106

107

108

110

TECHM

1,101

1,118

1,141

1,157

1,181

TITAN

2,287

2,310

2,343

2,366

2,399

ULTRACEMCO

6,926

7,001

7,129

7,204

7,333

UPL 692 698

709

715

725

WIPRO 378 382

387

391

396

www.angelone.in

Technical & Derivatives Report

March 14, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.