SEPT 13, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank Outlook (40574)

The week started on a positive note but post the initial surge there

was no major traction in the bank index. For the major part, the index

consolidated in a range and ended with gains of 0.34% at 40574.

The bank nifty has been the major contributor to the recent up move

in the broader markets and is placed in a sweet spot above the multi-

month breakout levels of 40000. We sense it is headed towards the

all-time high levels of 41829; hence any dip should be taken as a

buying opportunity. In such a scenario, immediate support is seen at

40280 and 40100 levels whereas resistance is seen at 40750 - 41000

levels.

Key Levels

Support 1 – 40280 Resistance 1 – 40750

Support 2 – 40100 Resistance 2 – 41000

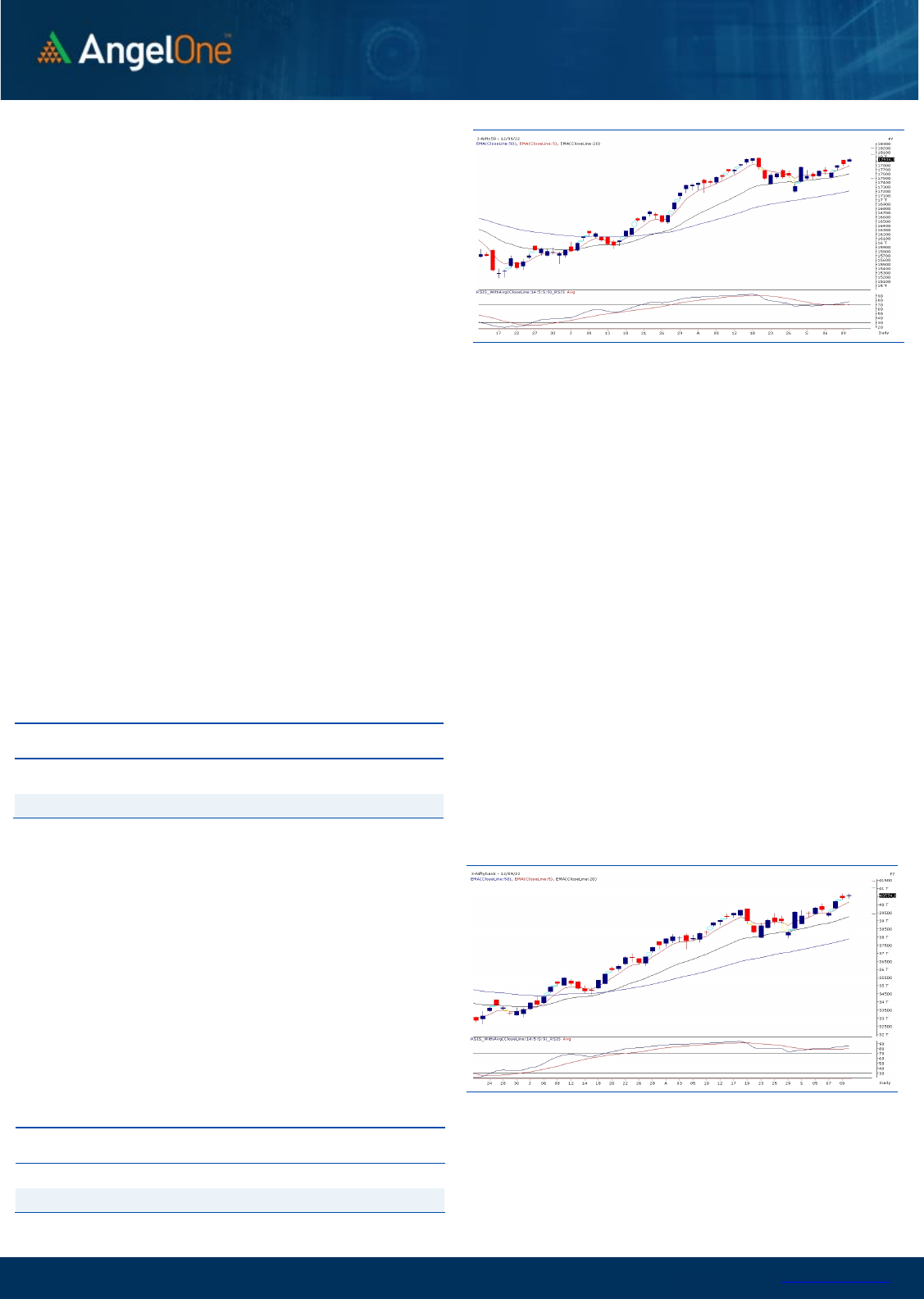

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (60115) / Nifty (17936)

The SGX Nifty was indicating a muted start yesterday morning. Despite

this, our benchmark index opened with a decent upside gap taking US

markets’ Friday’s rally into consideration. The opening lead got

extended in the initial hour itself beyond 17950. However, the

movement in most of the heavyweights became stagnant thereafter

and hence, the Nifty remained in a slender range throughout the

remaining part of the session. Eventually, it concluded with more than

half a percent gains convincingly above the 17900 mark.

Although, key indices are lacking a bit of momentum, the undertone

seems strongly bullish and as a result, the Nifty is now within a touching

distance of the psychological mark of 18000. It’s merely a formality

now, we would see it actually on the screen very soon. The real

question is, does market have enough legs to move beyond it to touch

the record highs. In our sense, it’s happening sooner or later. Before

this, a move towards 18200 – 18350 in near future is clearly on cards.

This view remains valid as long as Nifty defends 17700 – 17600 on a

closing basis.

Yesterday, the banking had a fantastic start but follow up was missing.

Never mind, we reckon, BANKNIFTY is headed towards its all time high

before the benchmark index. Also, the IT showed its willingness to

participate for the second straight session, which again is an

encouraging sign. In our sense, one should continue to remain positive

and even if key indices consolidates a bit, the stock specific action is

likely to continue.

Key Levels

Support 1 – 17800 Resistance 1 – 18000

Support 2 – 17750 Resistance 2 – 18140

www.angelone.in

Technical & Derivatives Report

SEPT 13, 2022

View

The Indian equity market has started the week on a

promising note amid the favorable global scenario. The

benchmark index Nifty gained over half a percent to

conclude the day a tad above the 17900 level.

FIIs were net buyers in the cash market segment to

the tune of Rs. 2050 crores. Simultaneously, in Index

futures, they bought worth Rs. 929 crores with a

decrease in open interest, indicating short covering.

Looking at the overall F&O data, we have witnessed a

long formation in both indices at the start of the week.

On the options front, piling up of positions is visible in

the 17800-17900 put strikes, indicating a shift in the

support base. While on the higher end, the maximum

OI concentration is seen at 18000 call strike, followed

by 18200 CE, indicating bullish biases. Meanwhile, the

stronger hands have seen adding up positions in cash

and future segments that also add a bullish quotient to

the market. Considering the data and recent price

action, the undertone is likely to remain bullish, and

any intraday dip could be seen as an opportunity to add

longs in the indices. Also, one should keep a close tab

on global developments.

Comments

The Nifty futures open interest has increased by

2.49%. and Bank Nifty futures open interest has

increased by 0.96% as the market closed at 17936.35.

The Nifty Sep future closed with a premium of 28

point against a premium of 33.10 point in the last

trading session. The Oct series closed at a premium

of 79.85 point.

The INDIA VIX increased from 17.71 to 17.93. At the

same time, the PCR-OI of Nifty has increased from

1.10 to 1.18.

Few of the liquid counters where we have seen high

cost of carry are ACC, HAL, NAVINFLUOR,

DEEPAKNTR and AMBUJACEM.

Historical Volatility

SCRIP HV

IDEA 82.05

RBLBANK 73.12

IBULHSGFIN 73.08

ZEEL 64.35

HINDCOPPER 63.20

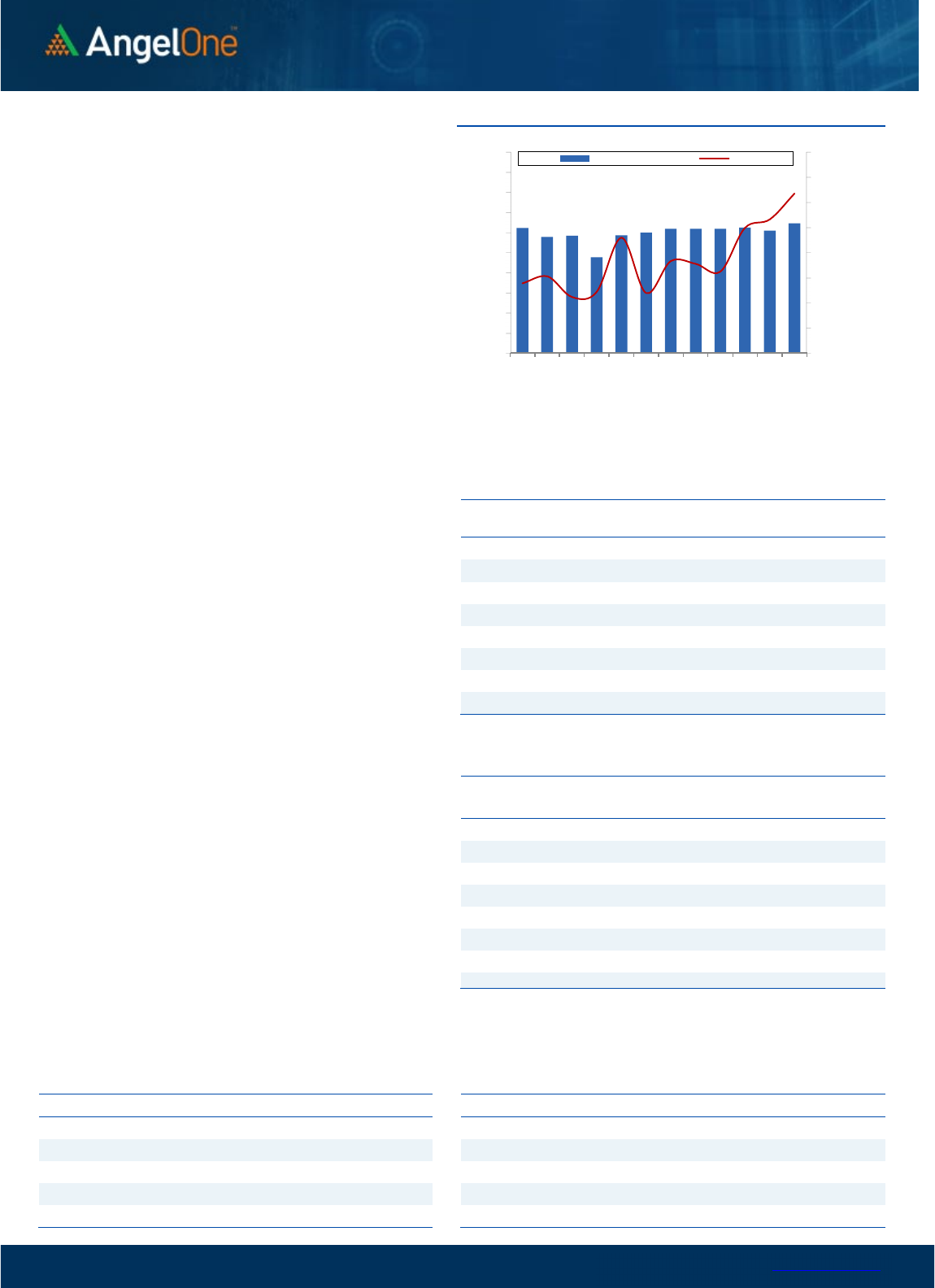

Nifty Vs OI

17300

17400

17500

17600

17700

17800

17900

18000

18100

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

17,000

18,000

8/23 8/25 9/1 9/5 9/7 9/9

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ATUL 208050 29.51 9614.50 4.19

JKCEMENT 388750 16.13 2850.35 0.51

IBULHSGFIN 50160000 14.90 134.65 -3.43

HAL 4192825 13.75 2613.95 7.35

AARTIIND 3220650 13.75 888.60 3.73

COALINDIA 37396800 13.64 231.50 -2.75

MFSL 2007200 13.40 786.95 -0.81

VOLTAS 5512000 13.12 966.90 0.22

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PVR 3309724 -10.08 1899.75 4.94

LTTS 934800 -8.21 3824.25 1.67

AMBUJACEM 76104000 -6.42 475.65 4.57

GNFC 6207500 -5.84 780.35 4.13

DIVISLAB 2990250 -5.62 3677.85 2.05

COFORGE 844800 -5.39 3618.05 1.45

JSWSTEEL 30199500 -4.90 686.55 -0.04

SYNGENE 4380000 -4.76 569.50 -0.31

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.18 0.89

BANKNIFTY 1.05 0.96

RELIANCE 0.55 0.41

ICICIBANK 0.77 0.60

INFY 0.42 0.28

www.angelone.in

Technical & Derivatives Report

SEPT 13, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

936

.

3

5

FII Statistics for

September

12

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2500.51 1571.60 928.91

134118 12621.44 (1.26)

INDEX

OPTIONS

166563.70 164768.02 1795.68

1363688 126891.03 5.57

STOCK

FUTURES

10793.19 11226.78 (433.59) 2104833 150924.90 (0.32)

STOCK

OPTIONS

6230.23 6235.92 (5.69) 171030 12478.08 4.79

Total 186087.63

183802.32

2285.31

3773669

302915.45

1.92

Turnover on

September

12

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

250943 23855.59 -15.94

Index

Options

65847866

6284219.50 -4.81

Stock

Futures

798222 58364.55 -12.15

Stock

Options

3120694 236070.48 -13.64

Total

31,20,694 236070.48 -5.27

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17900 286.60

54.30

45.70

17954.30

Sell

18000 232.30

Buy

17900 286.60

102.70

97.30

18002.70

Sell

18100 183.90

Buy

18000 232.30

48.40 51.60 18048.40

Sell 18100 183.90

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17900 225.60

39.10

60.90

17860.90

Sell

17800 186.50

Buy 17900 225.60

73.15

126.85

17826.85

Sell 17700 152.45

Buy

17800 186.50

34.05 65.95 17765.95

Sell 17700 152.45

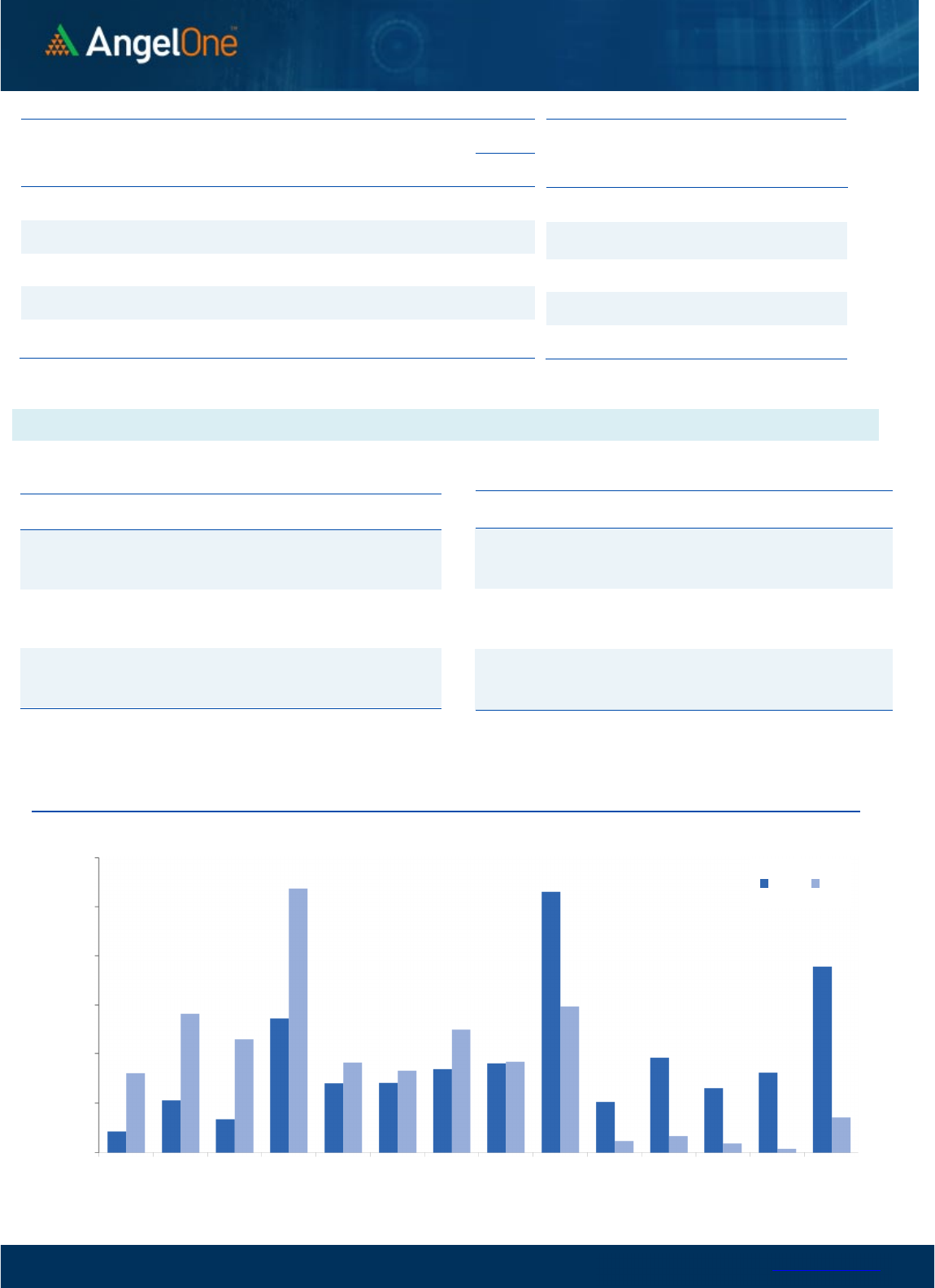

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

SEPT 13, 2022

`

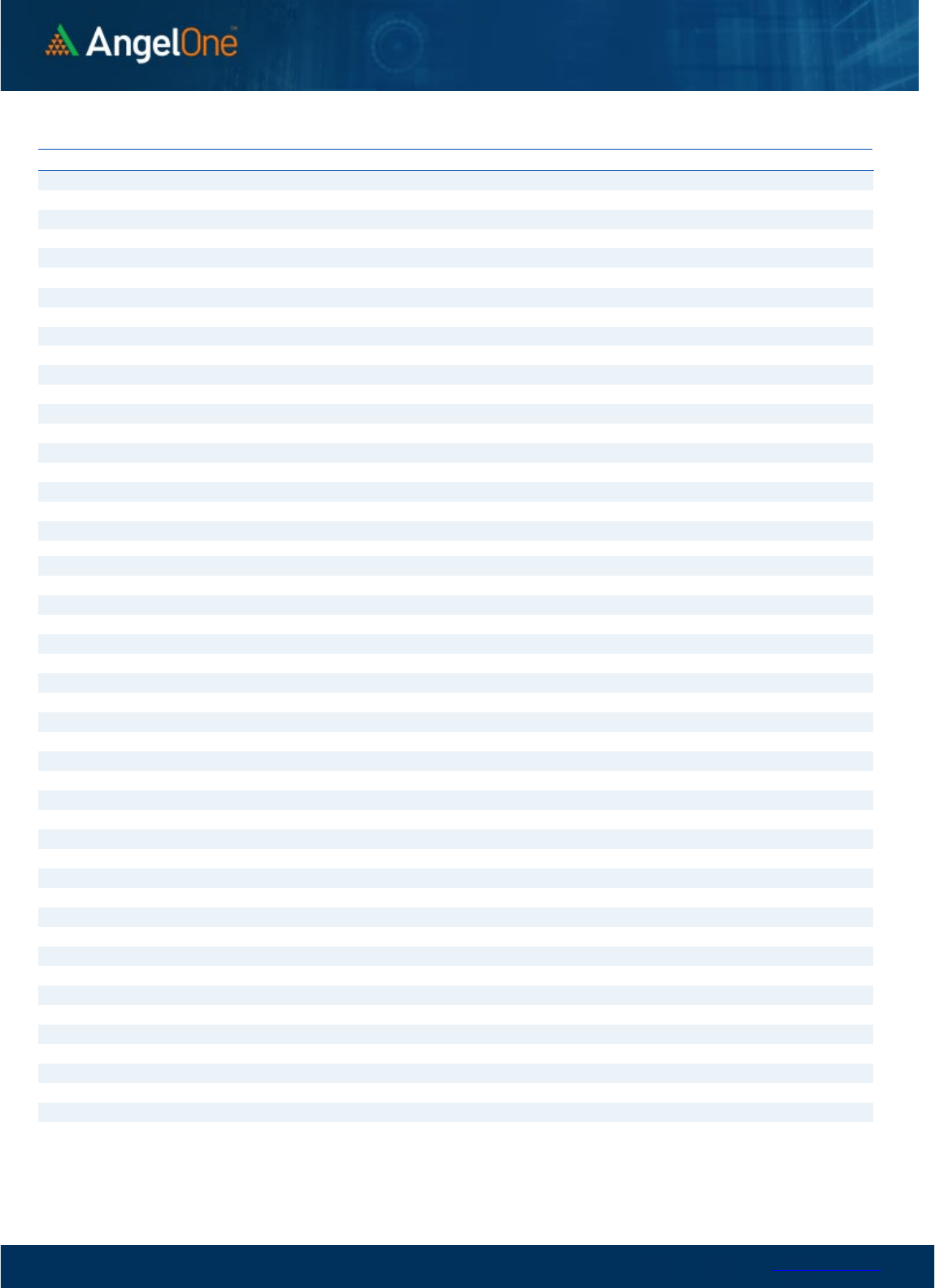

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

900

919

931

950

962

APOLLOHOSP 4,422 4,452

4,477 4,507 4,532

ASIANPAINT 3,406 3,419

3,436 3,450 3,467

AXISBANK 779 790

798

808 816

BAJAJ-AUTO

3,797

3,834

3,862 3,898

3,927

BAJFINANCE

7,133

7,210

7,265

7,342

7,397

BAJAJFINSV

16,836

16,987

17,203

17,355

17,571

BPCL

335

339

342

346

349

BHARTIARTL

761

765

768

772

775

BRITANNIA

3,612

3,642

3,670

3,700 3,728

CIPLA

1,052

1,058

1,063

1,070

1,075

COALINDIA 222 227

233

238

244

DIVISLAB

3,571

3,625

3,656

3,710

3,741

DRREDDY

4,213

4,237

4,269 4,293

4,324

EICHERMOT

3,431

3,485

3,519

3,573

3,607

GRASIM

1,737

1,753

1,762

1,778

1,787

HCLTECH

948

952

958

962

968

HDFCBANK

1,482

1,488

1,496

1,502

1,510

HDFCLIFE 567 573

578

584

590

HDFC

2,401

2,410

2,423 2,433

2,446

HEROMOTOCO 2,828 2,843

2,856 2,871

2,885

HINDALCO

427

429

431 433

435

HINDUNILVR 2,555 2,568

2,586

2,599

2,617

ICICIBANK

900

904

906

910

912

INDUSINDBK 1,120 1,128

1,137 1,145

1,154

INFY 1,510 1,523

1,534

1,548

1,559

ITC 329 330

331

332

334

JSW STEEL 675 681

687

693

700

KOTAKBANK

1,902

1,913

1,929

1,939

1,955

LT

1,940

1,951

1,959

1,970

1,978

M&M

1,282

1,290

1,303

1,310

1,323

MARUTI 8,840 8,884

8,948

8,992 9,056

NESTLEIND

18,736

18,852

19,006

19,122

19,276

NTPC 164 165

167

168

169

ONGC

133

133

134 135

136

POWERGRID

221

223

224

225

226

RELIANCE 2,552 2,575

2,594 2,617

2,635

SBILIFE

1,288

1,297

1,304

1,313

1,320

SHREECEM 23,249 23,692

24,346

24,789

25,443

SBIN

548

551

555

559

562

SUNPHARMA

879

883

889

894

899

TCS

3,201

3,222

3,246

3,267

3,291

TATACONSUM

815 820

826

831

836

TATAMOTORS

444

448

450

454

456

TATASTEEL

106

107

107

108

109

TECHM 1,127 1,138

1,152 1,163 1,177

TITAN 2,587 2,624

2,647

2,684

2,707

ULTRACEMCO

6,677

6,773

6,837

6,933

6,997

UPL

738

747

753

762

768

WIPRO 415 419

421 425

428

www.angelone.in

Technical & Derivatives Report

SEPT 13, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.