May 13, 2022

www.angelone.in

Technical & Derivatives Report

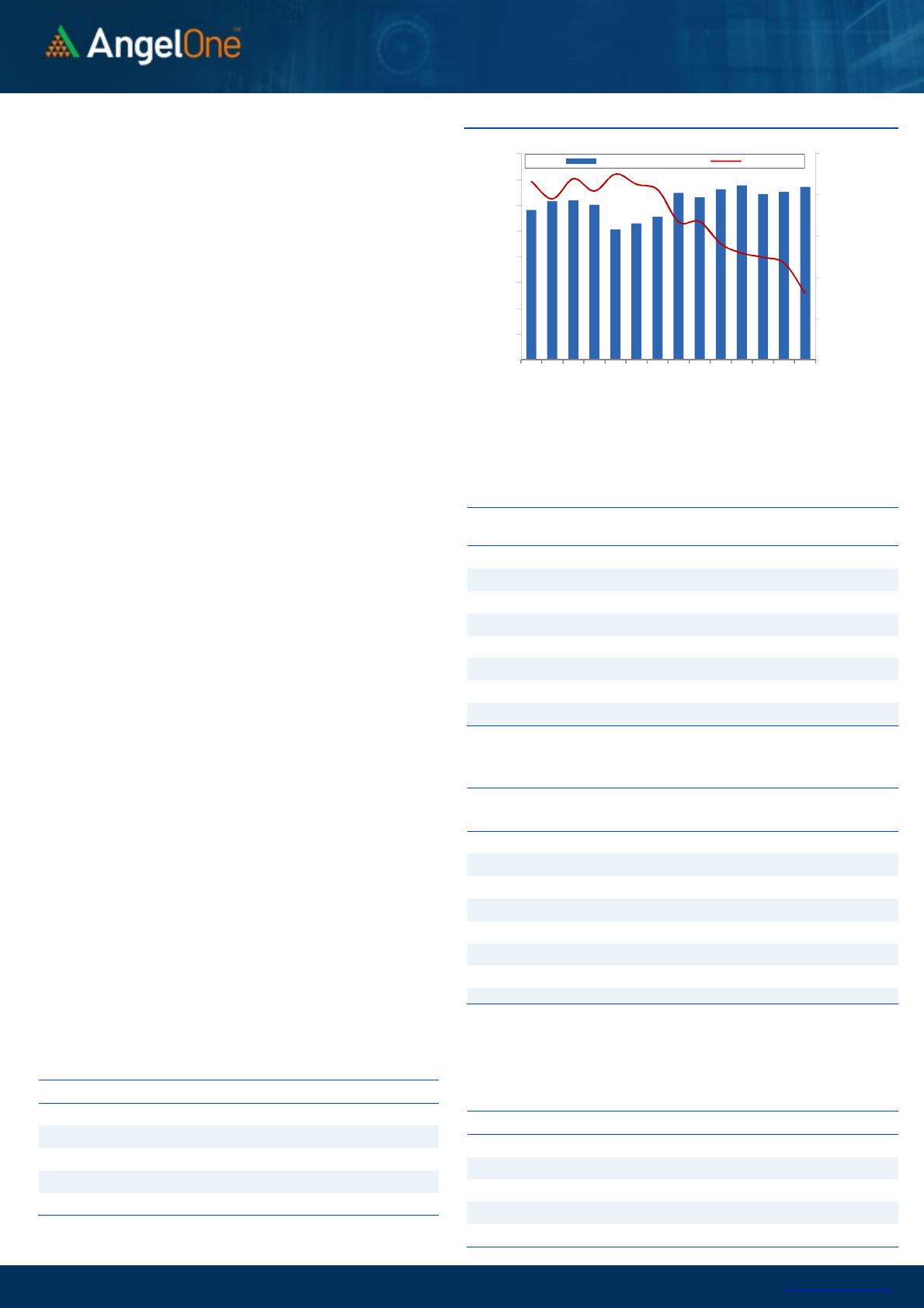

Nifty Bank Outlook

-

(33532)

Wednesday’s tail end recovery from key levels was an

encouraging sign but there is no respite in global markets. They

continue to sink and hence, yesterday morning, the SGX Nifty

indicated a gap down opening of more than 200 points on Nifty.

In line with this, the banking index too started off lower and then

complete capitulation was observed in so many banking

counters. The selling momentum aggravated as the day

progressed to conclude the day with massive cut over 1000

points in BANKNIFTY i.e. 3.35% from Wedenesday’s close.

Overall global weakness has poured in complete water on

Wednesday’s promise the banking stocks had left us with. But

not to surprise, this is the perfect characteristic of a downtrend.

Both Nifty and BANKNIFTY have now approached their critical

levels, so it would be interesting to see whether the oversold

market decides to rebound first or continue to be with the recent

trend. As far as levels are concerned, 34000 – 34500 has now

become a sturdy wall; whereas a sustainable move below 33200

– 33000 would lead to some panic kind of situation in this space.

One should avoid trading aggressively on both sides; because

we tend to see lot of whipsaws in such situations.

Key Levels

Support 1 – 33200 Resistance 1 – 34000

Support 2 – 33000 Resistance 2 – 34500

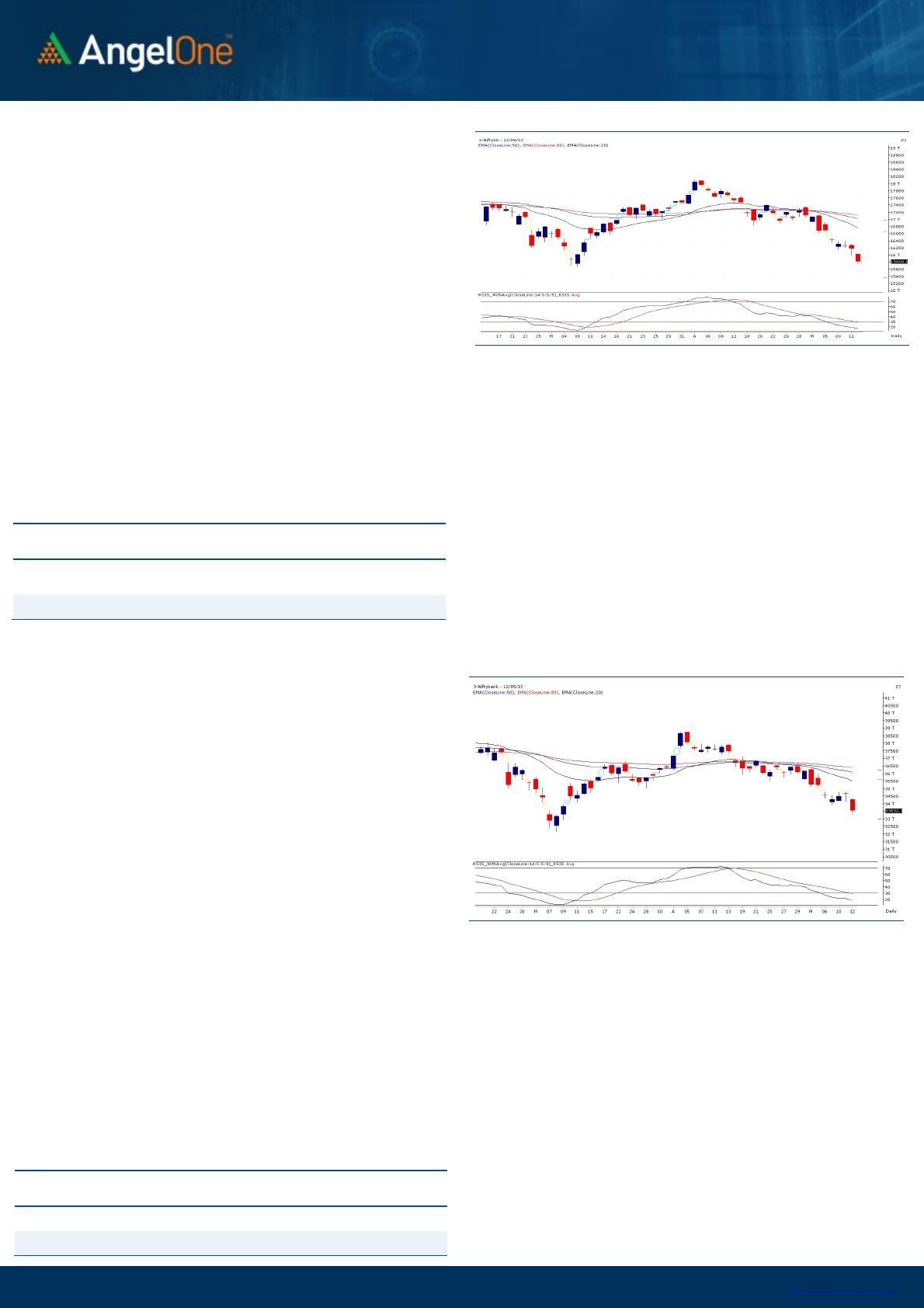

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (52930) / Nifty (15808)

The Indian equity market tumbled, tracking the global bourses,

wherein the benchmark index Nifty50 plunged below the

psychological mark of 16000 from the start of the session. The

weakened macro factors have dampened the overall sentiments

as we witness the relentless selling pressure in the equities. The

index concluded the day in red with another cut of over 2.22

percent to settle at the 15808 level on the weekly expiry.

The previous swing low of 15670 is not far away, and it would be

a matter of time to retest the same. Though the market

subsidized in the oversold region for quite some time, a further

correction could be disruptive in the coming period. For the time

being, any breach below the 15670 odd zone would bring the

possibility for the index to shed another 200-300 odd points in

the near period. On the higher end, the 16000-16050 zone is

expected to act as immediate resistance, while the strength only

could be seen above the 16500-16650 zone.

Key Levels

Support 1 – 15670 Resistance 1 – 16000

Support 2 – 15500 Resistance 2 – 16050

The ongoing rampage is due to the global macro factors,

hence any improvement from the overseas market should act

as a catalyst for the bulls. Technically, the bearish formation

would only get discarded above the mentioned resistance

zone. Until that time, one should remain cautious and keep

close track of global and domestic developments. Also,

traders are advised to avoid aggressive bets and look for

stock-specific action, while investors could now seize this

opportunity by initiating accumulation in good blue-chip

companies but in a staggered manner.

www.angelone.in

Technical & Derivatives Report

May 13, 2022

View

Once again global factors led gap down opening in

our market. We began the day around 16000 mark

and observed follow-up selling right from the word

go to almost touch 15700 with no respite during the

entire day. Finally, we concluded the day with a cut

of over two percent to previous close.

FIIs were net sellers in the cash market segment

to the tune of Rs. 5256 crores. Simultaneously, in

Index futures, they sold worth Rs. 1361 crores

with rise in open interest, indicating continuation

of short formation.

In F&O space, we saw addition of few shorts in Nifty

and long unwinding in banking index. Stronger

hands continue curb liquidity in Indian equity market

and also added bearish bets in index and stock

futures segment. In index options front, we saw

build-up in 15800-16000 put strikes. On the other

side, 15800-16200 call strikes added fresh build-up

in coming weekly series. The Fear index surged 10%

seeing the selling pressure, this is not a healthy

sign for Bulls. Despite, decent fall in our market we

haven’t seen any relevant selling post Monday’s

session and we certainly feel market is a bit

oversold. Hence, we would advocate avoiding any

bearish bets and buying quality stock for short to

medium term.

Comments

The Nifty futures open interest has increased by 2.92%.

and BANK Nifty futures open interest has decreased by

2.35% as the market closed at 16810.25.

The Nifty May future closed with a premium of 0.50 point

against a premium of 10.85 point in the last trading

session. The June series closed at a premium of 6.20

point.

The INDIA VIX increased from 22.80 to 25.08. At the

same time, the PCR-OI of Nifty has decreased from 0.69

to 0.63.

Few of the liquid counters where we have seen high

cost of carry are IBULHSGFIN, IDEA, GSPL,

HINDCOPPER and ADANIPORTS.

Historical Volatility

SCRIP HV

-

-

-

-

-

-

-

-

-

-

*D.V. File dated 11-05-2022 not updated on NSE Website during the

time of report publishing

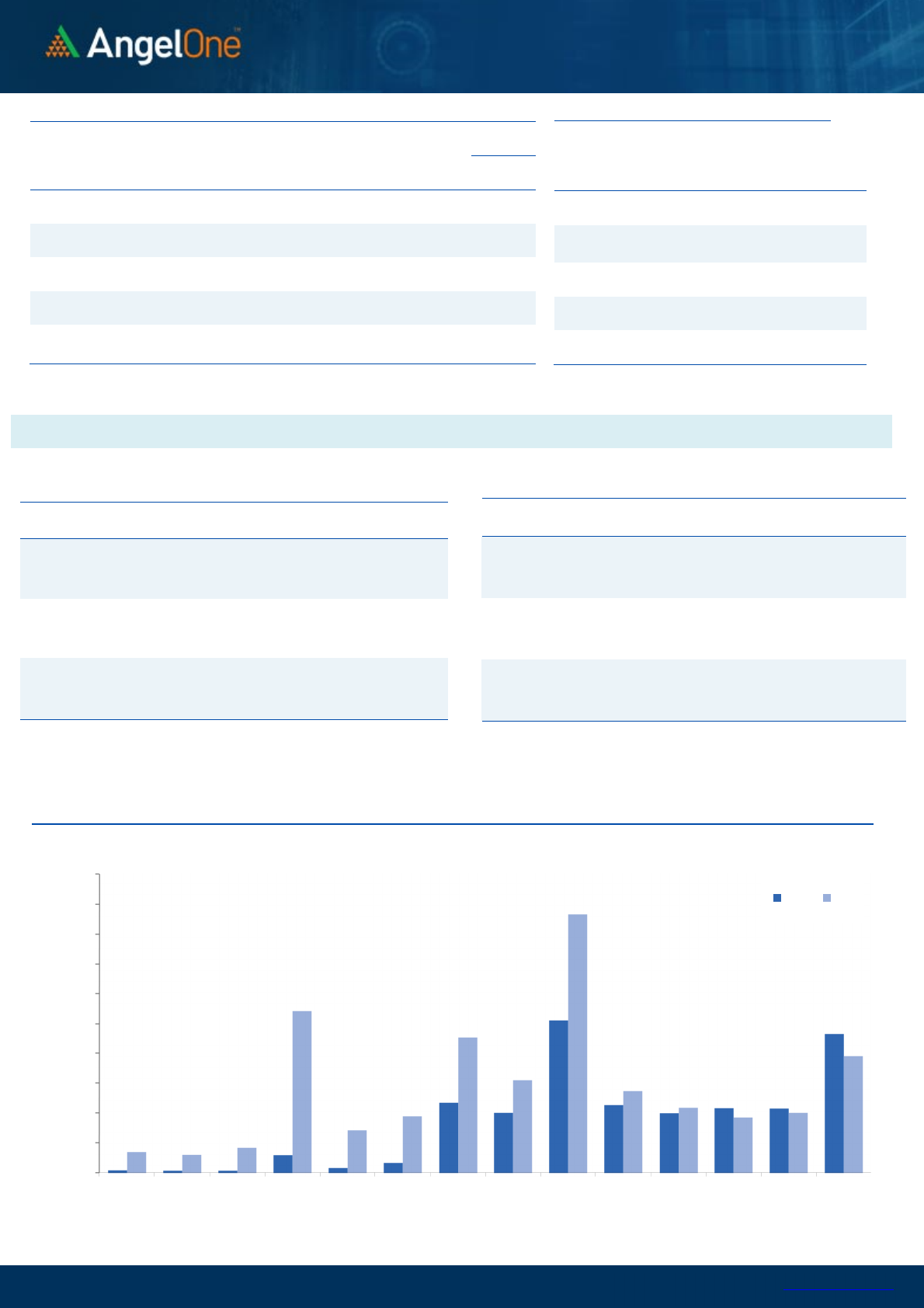

Nifty Vs OI

15000

15500

16000

16500

17000

17500

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

4-22 4-26 4-28 5-2 5-5 5-9 5-11

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PNB 332832000 15.33 28.60 -13.83

LTTS 1010200 12.57 3588.05 -3.65

BAJAJ-AUTO 3178750 9.34 3585.00 -0.76

AMBUJACEM 46180200 8.94 373.55 3.27

OFSS 314450 8.59 3500.15 -1.08

SIEMENS 1598300 7.37 2275.90 -1.59

NAVINFLUOR 418950 7.20 3887.95 -1.90

ABFRL 10075000 5.47 252.20 -2.51

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IBULHSGFIN 42682100 -11.02 118.70 8.33

VOLTAS 3692000 -9.38 949.40 -2.57

ABB 349250 -6.74 2233.50 -1.51

POLYCAB 606000 -6.26 2431.55 -0.23

BSOFT 3459300 -6.07 363.50 -0.14

DIXON 889250 -5.99 3401.10 -3.36

ASHOKLEY 30649500 -5.86 117.45 0.77

GSPL 2342600 -5.81 259.55 -0.99

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.63 0.82

BANKNIFTY 0.61 0.89

RELIANCE 0.27 0.38

ICICIBANK 0.44 0.75

INFY 0.35 0.48

www.angelone.in

Technical & Derivatives Report

May 13, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot =

15810.

25

FII Statistics for

May

1

2

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

5037.41 6398.38 (1360.97) 188251 15160.28 1.53

INDEX

OPTIONS

1534649.10 1524741.17 9907.93

1699953 135387.83 (7.21)

STOCK

FUTURES

15419.24 16693.62 (1274.38) 2276265 136869.67 1.76

STOCK

OPTIONS

7737.21 7458.86 278.35

138513 8629.80 5.21

Total

1562842.96

1555292.03

7550.93

4302982

296047.58

(1.89)

Turnover on

May

12

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

598834 48837.74 6.16

Index

Options

247307328 20477747.31

77.81

Stock

Futures

987869 59821.31 -6.30

Stock

Options

2791143 185331.51 -9.49

Total

27,91,143 185331.51 75.57

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

15800 291.65

56.35

43.65

15856.35

Sell

15900 235.30

Buy

15800 291.65

100.95

99.05

15900.95

Sell

16000 190.70

Buy

15900 235.30

44.60 55.40 15944.60

Sell 16000 190.70

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

15800 283.25

40.15

59.85

15759.85

Sell

15700 243.10

Buy

15800 283.25

77.80

122.20

15722.20

Sell

15600 205.45

Buy

15700 243.10

37.65 62.35 15662.35

Sell

15600 205.45

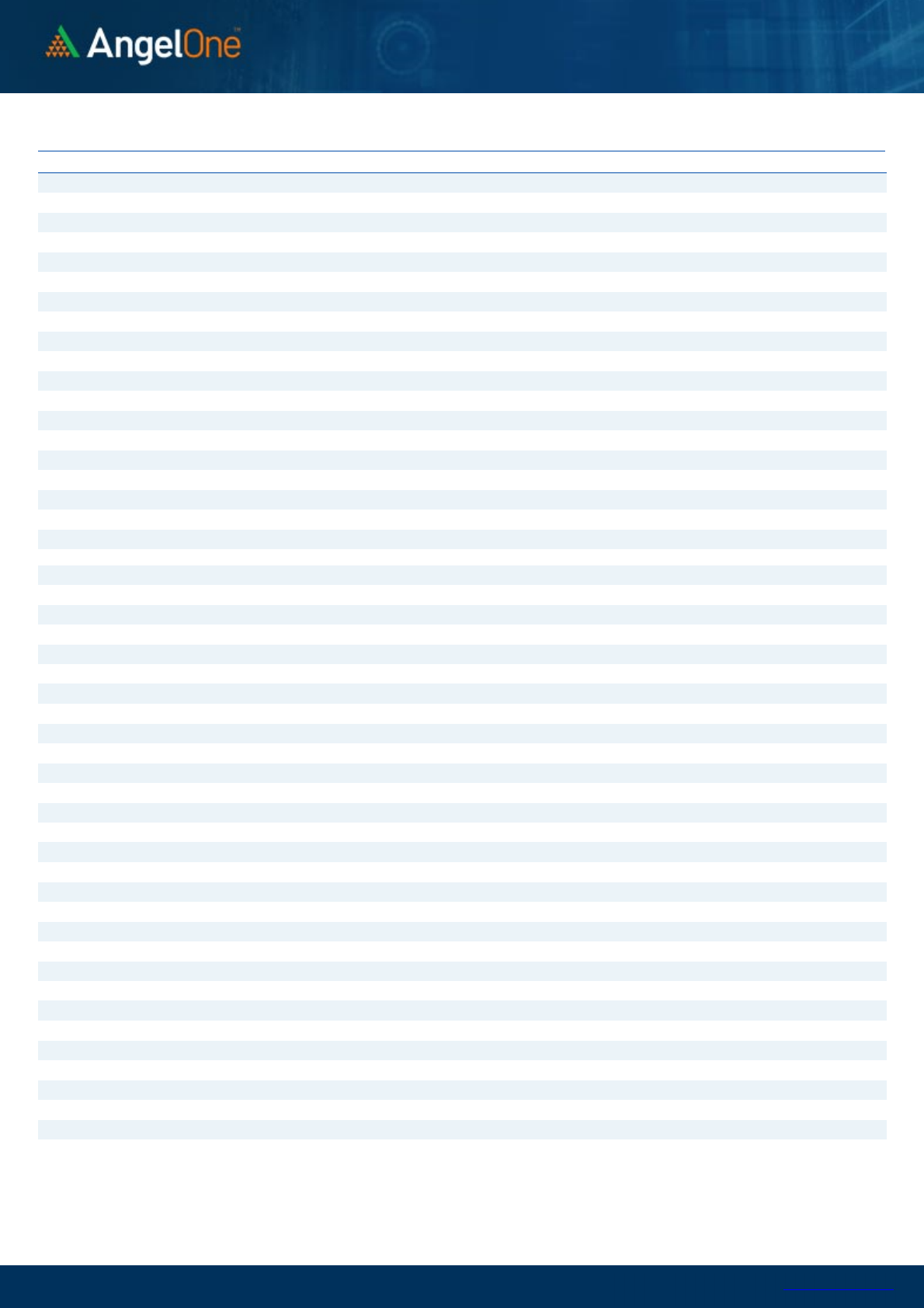

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

15200 15300 15400 15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500

Call Put

www.angelone.in

Technical & Derivatives Report

May 13, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 672 693

726 746 780

APOLLOHOSP 3,482 3,532

3,591 3,640 3,699

ASIANPAINT 2,945 2,993

3,035 3,083 3,125

AXISBANK 631 640

654 663 677

BAJAJ-AUTO 3,478 3,531

3,593 3,646 3,708

BAJFINANCE 5,363 5,478

5,621 5,737 5,880

BAJAJFINSV 12,438 12,644

12,957 13,163 13,476

BPCL 331 335

341 346 351

BHARTIARTL 688 697

710 718 731

BRITANNIA 3,122 3,169

3,205 3,252 3,288

CIPLA 903 912

924 933 946

COALINDIA 162 164

167 170 173

DIVISLAB 4,068 4,150

4,223 4,306 4,379

DRREDDY 3,749 3,815

3,855 3,921 3,962

EICHERMOT 2,304 2,344

2,373 2,413 2,441

GRASIM 1,426 1,456

1,493 1,523 1,560

HCLTECH 1,031 1,045

1,058 1,072 1,085

HDFCBANK 1,274 1,288

1,308 1,322 1,341

HDFCLIFE 532 539

552 560 572

HDFC 2,105 2,128

2,166 2,189 2,227

HEROMOTOCO 2,322 2,362

2,410 2,450 2,498

HINDALCO 380 393

407 420 435

HINDUNILVR 2,082 2,110

2,138 2,166 2,193

ICICIBANK 683 689

700 707 717

INDUSINDBK 820 845

881 906 941

INFY 1,490 1,500

1,514 1,523 1,537

ITC 246 249

253 256 260

JSW STEEL 601 613

632 644 664

KOTAKBANK 1,725 1,743

1,775 1,793 1,824

LT 1,490 1,508

1,531 1,550 1,573

M&M 834 850

869 885 905

MARUTI 7,150 7,202

7,263 7,315 7,376

NESTLEIND 15,919 16,070

16,277 16,427 16,635

NTPC 145 147

150 152 155

ONGC 150 153

157 160 164

POWERGRID 227 231

237 241 246

RELIANCE 2,337 2,368

2,401 2,433 2,466

SBILIFE 1,030 1,045

1,064 1,079 1,097

SHREECEM 21,966 22,297

22,840 23,170 23,713

SBIN 447 455

464 472 481

SUNPHARMA 826 838

847 859 868

TCS 3,303 3,356

3,403 3,456 3,502

TATACONSUM

718 728

738 748 758

TATAMOTORS 356 364

374 383 393

TATASTEEL 1,068 1,093

1,128 1,152 1,187

TECHM 1,178 1,196

1,214 1,231 1,250

TITAN 1,994 2,021

2,063 2,090 2,131

ULTRACEMCO 5,965 6,075

6,188 6,298 6,410

UPL 733 749

769 785 805

WIPRO 457 465

471 479 485

www.angelone.in

Technical & Derivatives Report

May 13, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.