November 12, 2021

www.angelone.in

Technical & Derivatives Report

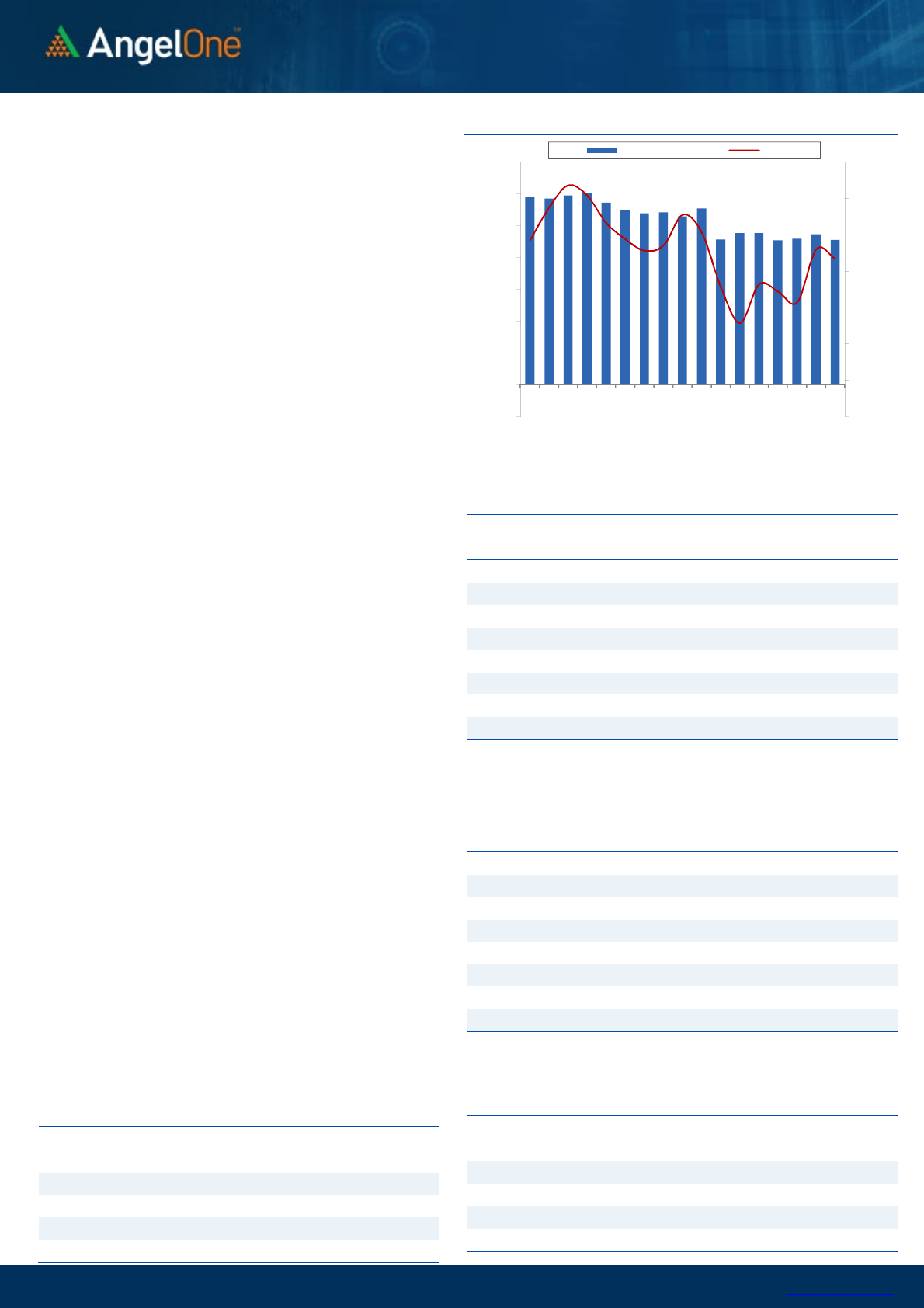

Nifty Bank Outlook - (38560)

Once again the Bank Nifty started on a weak note and on the weekly

expiry it marked an intraday low of 38346. Eventually, with some

minor bounce in the last hour it ended with a loss of 1.19% at 38560.

On the daily chart, the bank index has broken below a key trend line

support and thus indicates further weakness going ahead. However,

the current weakness has pushed prices towards the key 50SMA that

has previously a couple of times have acted as strong support. Hence,

it would be crucial to see if prices witness an immediate fall or if it

bounces a bit before the second round of weakness. Whatever may be

the case traders are advised not to get complacent on the bounce and

use such bounce to lighten up long positions. As far as levels are

concerned, support is placed around 38250 and 37900 whereas

resistance is seen around 38900 and 39150 levels.

Key Levels

Support 1 – 38250 Resistance 1 – 38900

Support 2 – 37900 Resistance 2 – 39150

Exhibit 2: Nifty Bank Daily Chart

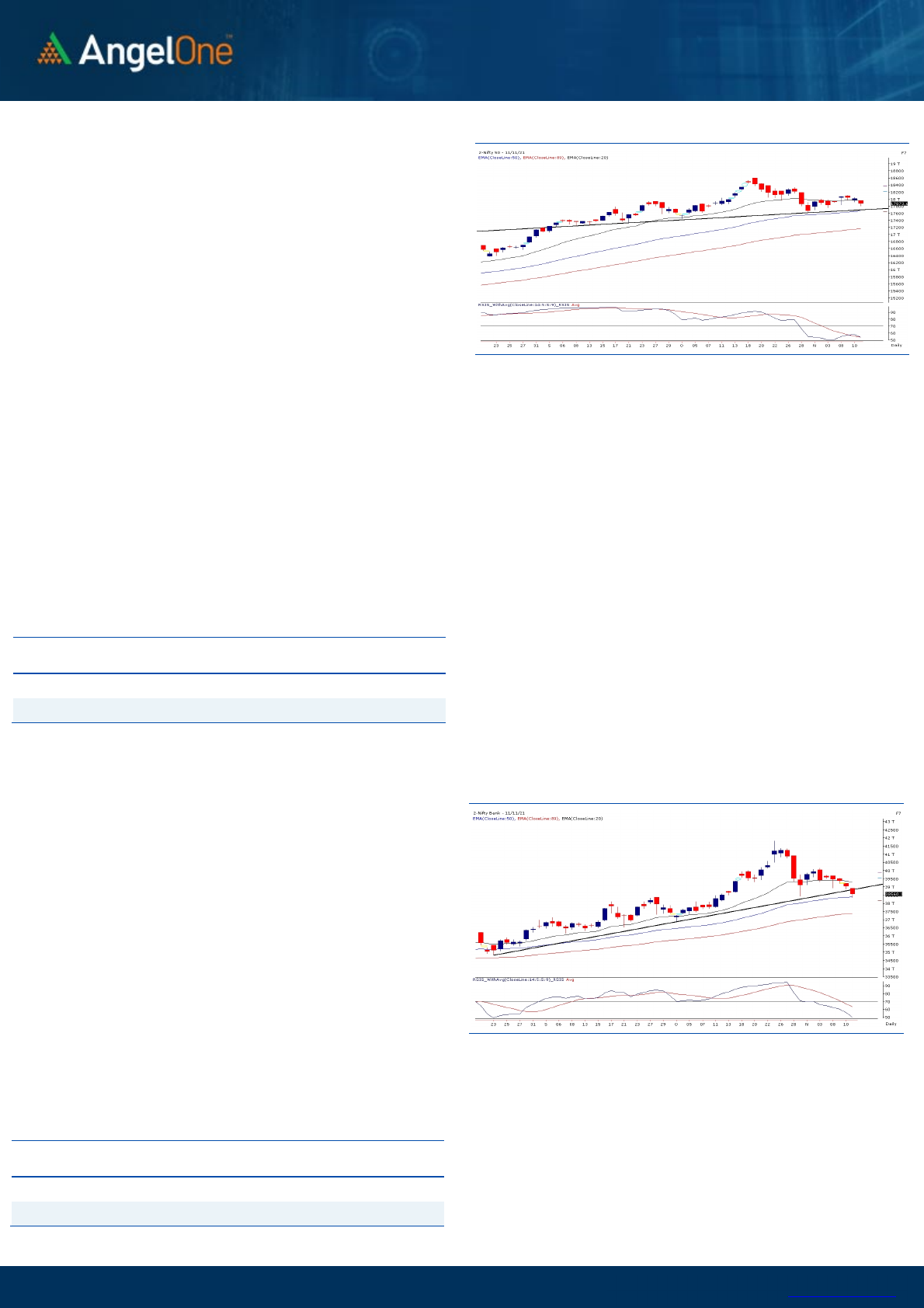

Sensex (59920) / Nifty (17874)

We had a soft opening yesterday on the back of some nervousness seen

in major global peers. In fact in the initial hour itself, the weakness

extended in some of the heavyweight pockets. This led to breach of

17900 first and then after a decent consolidation, Nifty went on to even

test the 17800 mark. At the stroke of the penultimate hour, the expiry

factor started playing out and this time it fortunately favoured the bulls

as we witnessed a smart recovery towards the end to trim some portion

of losses.

Market was quiet in last couple of sessions as it was trapped in a slender

range. Yesterday it finally had some action but unfortunately it was

dominated by the bears for the most part of the day. Percentage wise,

it was not even a percent cut yesterday on a closing basis; but the more

it fails to surpass 18100 – 18200, the harder it becomes for the bulls to

maintain their grip on the market. In fact, it would be too early to

comment on it; but we can clearly see a bearish formation of ‘Head and

Shoulder’ being in process on the daily chart of Nifty. The neckline

support is around 17700 – 17600, which if gets broken, we could see

difficult days for market in the short run. With reference to our recent

cautious stance on the market, we will not be surprised to see it

breaking in the forthcoming week itself.

Key Levels

Support 1 – 17800 Resistance 1 – 17950

Support 2 – 17700 Resistance 2 – 18000

Exhibit 1: Nifty Daily Chart

For the coming session, the immediate resistance is placed in the

zone of 17950 – 18000. Traders are repeatedly advised not to create

aggressive longs and even if one wants to follow stock specific

moves, needs to be very selective.

www.angelone.in

Technical & Derivatives Report

November 12, 2021

View

Market started with a downside gap tad below 18000

mark and we witnessed follow-up selling from the word

go. As we progressed,market made an attempt of

recovery but 17900 acted as a strong resistance. Post

decent volatility in the 100 points range, Nifty concluded

the weekly expiry day tad below 18900 with a cut of eight

tenth of a percent.

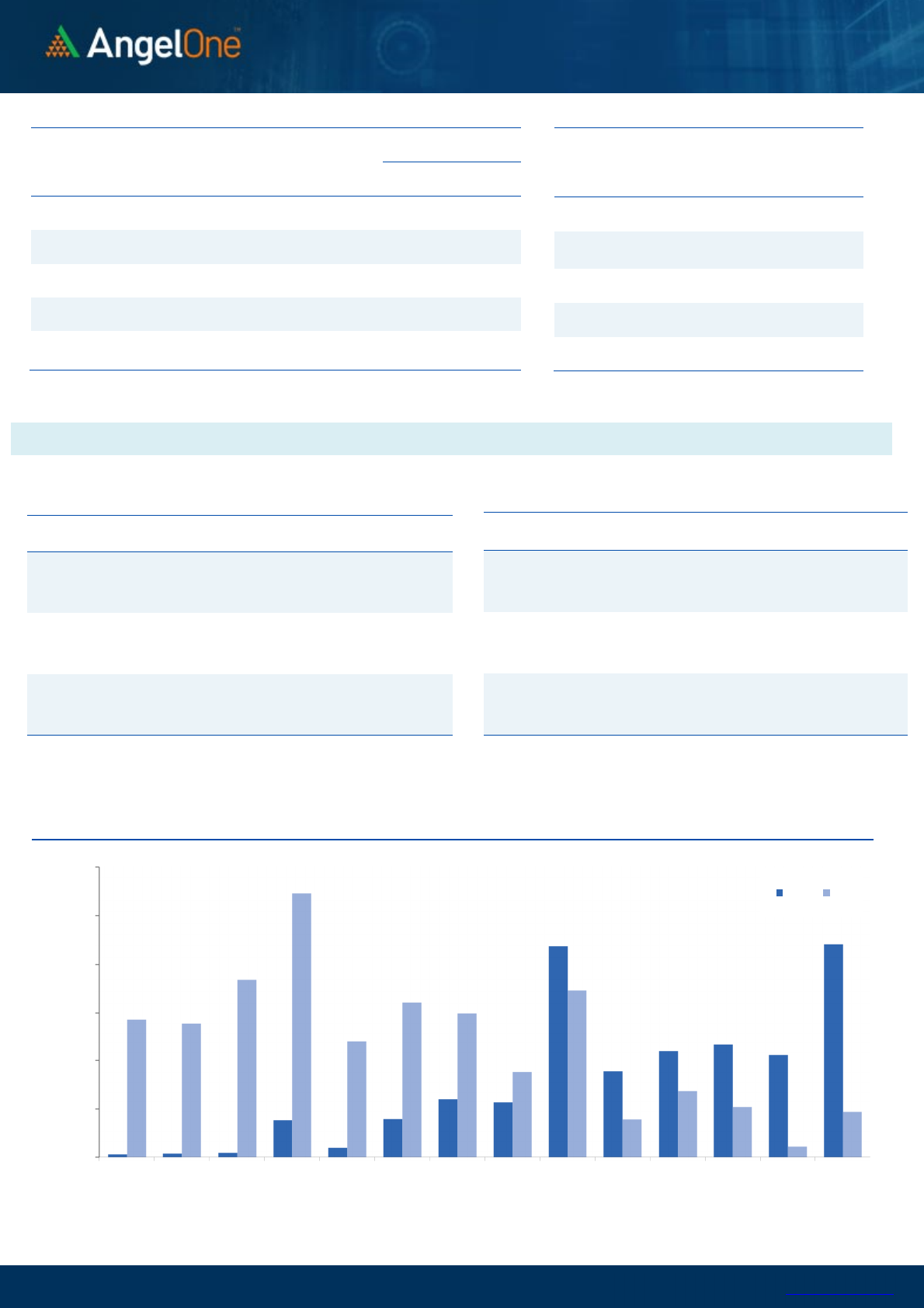

FIIs were net sellers in the cash market segment to the

tune of Rs. 1637 crores. In index futures, they bought

worth Rs. 193 crores with good amount of rise in open

interest indicating formation of mixed positions.

In F&O space, we saw addition of fresh shorts in both

the indices. Stronger hands continued their selling

streak in equities and preferred adding mixed bets in

index futures segment. In the coming weekly series,

build-up was seen in 17900-18200 call options. On the

other side, 17800 and 17900 put options added fresh

positions. Considering yesterday’s fall, it seems market

has strong hurdle around 17900-18000; whereas 17750

and 17600 are the support zone. We would stick to our

cautious stance on market and would advise traders

avoiding any bottom fishing for now.

Comments

The Nifty futures open interest has increased by 4.90%.

Bank Nifty futures open interest has increased by 4.69%

as market closed at 17873.60 levels.

The Nifty November future closed with a premium of

23.25 point against a premium of 5.75 point in last trading

session. The December series closed at a premium of

88.35 point.

The INDIA VIX increased from 16.30 to 16.35. At the same

time, the PCR-OI of Nifty has decreased from 0.94 to

0.83.

Few of the liquid counters where we have seen high cost

of carry are BRITANNIA, M&M, TVSMOTOR, RBLBANK

and IBULHSGFIN.

Nifty Vs OI

17200

17400

17600

17800

18000

18200

18400

18600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-13 10-18 10-20 10-22 10-26 10-28 11-1 11-3 11-5

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

NAVINFLUOR

852525 22.94 3596.35 2.80

BALKRISIND

1575200 21.69 2379.85 -5.72

MRF

73630 9.86 77210.30 -1.29

BOSCHLTD

168600 9.02 18250.10 -2.81

NTPC

53505900 8.99 136.65 -0.80

BHARATFORG

11019750 8.75 782.05 -5.46

TVSMOTOR

7158200 8.65 747.05 -0.49

PFC

49922400 8.58 139.50 -1.00

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BERGEPAINT

4880700 -12.26 779.15 0.60

BANKBARODA

173721600 -8.49 101.30 0.94

APOLLOHOSP

2142875 -8.27 4567.25 0.23

ONGC

42719600 -7.72 153.50 -2.45

DABUR

11840000 -7.55 598.45 -0.51

IGL

16777750 -6.02 499.70 1.75

BHEL

137466000 -5.96 64.80 -2.11

VOLTAS

2042000 -5.24 1248.90 0.07

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.83 0.82

BANKNIFTY

0.66 0.84

RELIANCE

0.45 0.37

ICICIBANK

0.41 0.47

INFY

0.44 0.39

Historical Volatility

SCRIP HV

PIDILITIND

31.28

BALKRISIND

41.83

BHARATFORG

49.10

APLLTD

42.49

DLF

56.12

www.angelone.in

Technical & Derivatives Report

November 12, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 17873.60

FII Statistics for November 11, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

4243.65 4050.57 193.08

161283 14748.05 7.47

INDEX

OPTIONS

1016833.03 1014741.66 2091.37

1152798 104833.44 (23.05)

297314.41

STOCK

FUTURES

13045.27 13787.01 (741.74) 1784680 133346.71 0.62

STOCK

OPTIONS

15186.93 15487.87 (300.94) 321685 24835.59 3.97

Total

1049308.88

1048067.11

1241.77

3420446

277763.79

(8.33)

43446.77

Turnover on November 11, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

322678 29901.80 24.21

Index Options

127463514 12023876.52 113.74

Stock Futures

757088 58656.86 -11.42

Stock Options

2446881 195760.66 -9.05

Total

13,09,90,161

12308195.84 107.52

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17900 202.90

46.00 54.00 17946.00

Sell

18000 156.90

Buy

17900 202.90

86.35 113.65 17986.35

Sell

18100 116.55

Buy

18000 156.90

40.35 59.65 18040.35

Sell

18100 116.55

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17900 207.00

45.20 54.80 17854.80

Sell

17800 161.80

Buy

17900 207.00

81.45 118.55 17818.55

Sell

17700 125.55

Buy

17800 161.80

36.25 63.75 17763.75

Sell

17700 125.55

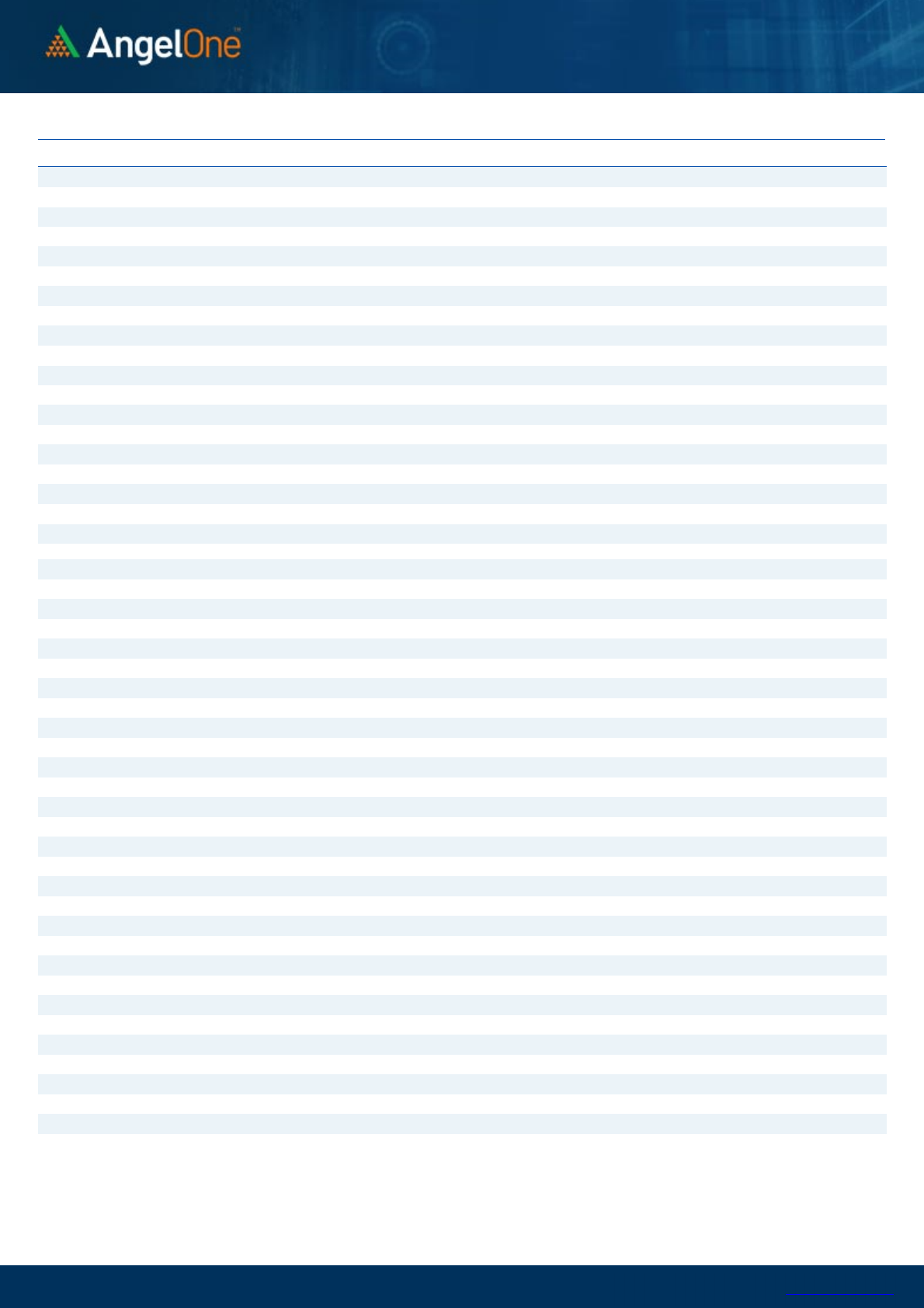

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

November 12, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 722 729

735 742 748

ASIANPAINT 3,019 3,041

3,074 3,096 3,129

AXISBANK 727 733

740 746 753

BAJAJ-AUTO 3,697 3,723

3,753 3,779 3,808

BAJFINANCE 7,297 7,375

7,488 7,566 7,679

BAJAJFINSV 17,470 17,671

18,010 18,211 18,550

BPCL 420 422

425 428 430

BHARTIARTL 716 722

730 737 745

BRITANNIA 3,580 3,612

3,665 3,697 3,750

CIPLA 888 896

904 913 921

COALINDIA 164 166

167 168 169

DIVISLAB 4,764 4,799

4,849 4,884 4,934

DRREDDY 4,751 4,783

4,816 4,848 4,881

EICHERMOT 2,655 2,680

2,711 2,736 2,768

GRASIM 1,795 1,820

1,856 1,881 1,918

HCLTECH 1,145 1,153

1,160 1,168 1,176

HDFCBANK 1,527 1,538

1,546 1,557 1,566

HDFCLIFE 696 700

703 706 710

HDFC 2,862 2,885

2,909 2,932 2,956

HEROMOTOCO 2,664 2,683

2,704 2,722 2,743

HINDALCO 443 448

452 458 462

HINDUNILVR 2,342 2,359

2,383 2,400 2,424

ICICIBANK 761 766

772 777 782

IOC 131 132

134 135 137

INDUSINDBK 1,013 1,023

1,031 1,041 1,048

INFY 1,697 1,715

1,727 1,746 1,758

ITC 227 229

230 231 233

JSW STEEL 656 662

666 671 675

KOTAKBANK 2,030 2,042

2,060 2,072 2,090

LT 1,890 1,911

1,946 1,967 2,002

M&M 904 914

922 932 939

MARUTI 7,362 7,408

7,488 7,533 7,613

NESTLEIND 18,545 18,699

18,825 18,979 19,105

NTPC 133 135

136 138 140

ONGC 151 152

154 156 158

POWERGRID 178 180

183 185 187

RELIANCE 2,519 2,537

2,554 2,572 2,588

SBILIFE 1,123 1,138

1,165 1,180 1,207

SHREECEM 28,605 28,808

29,053 29,256 29,501

SBIN 497 504

513 519 529

SUNPHARMA 781 788

799 806 817

TCS 3,404 3,446

3,478 3,520 3,552

TATACONSUM

816 827

834 845 853

TATAMOTORS 490 497

508 515 526

TATASTEEL 1,268 1,284

1,304 1,320 1,340

TECHM 1,487 1,505

1,532 1,550 1,577

TITAN 2,449 2,489

2,516 2,555 2,582

ULTRACEMCO 7,929 7,990

8,066 8,127 8,203

UPL 750 757

768 775 785

WIPRO 630 636

643 649 656

www.angelone.in

Technical & Derivatives Report

November 12, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in