Aug 12, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

Nifty Bank Outlook (38880)

Bank Nifty as well started with a big gap up opening, while there was

no follow-up buying in benchmark index Nifty; the banking index

extended beyond the morning gains and with positive momentum

throughout the session eventually ended with gains of 1.55% at

38880.

With yesterday's strong up move; Bank Nifty has surpassed the key

hurdle of the April Swing high of 38759 and this move is seen with a

strong bullish gap left on the daily chart. This indicates that the bulls

are in strong momentum however one should avoid getting

complacent as the oscillators are in deep overbought condition and as

the market is approaching the current calendar year high of 39424

marked in Feb month. Going ahead, 39000 - 39500 is seen as stiff

resistance whereas the bullish gap left yesterday at 38400 - 38650 is

seen as immediate support. Ahead of the long weekend traders are

advised to be very selective and avoid carrying aggressive overnight

bets.

Key Levels

Support 1 – 38650 Resistance 1 – 39000

Support 2 – 38400 Resistance 2 – 39500

Exhibit 1: Nifty Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (59333) / Nifty (17659)

The US markets climbed overnight after easing inflation report and

yesterday morning too, they extended the lead. This development

resulted in a bump up at the opening in our markets, mirroring the SGX

NIFTY. It appeared as if we are going to witness a bumper session on

weekly expiry, but the follow up was clearly missing as benchmark

index Nifty chose to consolidate in merely 60 points throughout the

remaining part of the session. Eventually the day ended with seven

tenths of percent gains; but convincingly below the opening level.

We had a muted session on Wednesday and if we exclude the opening

gap, yesterday’s session was lethargic than the previous one (for

NIFTY). However, the other high beta heavyweight index, BANKNIFTY

had its own plans. Unlike the Nifty, banking index extended its gains as

the day progressed and eventually ended the session almost at the

highest point with more than one and half a percent gains. It would be

interesting to see the activities in global bourses today; because one

more round of buying there would probably provide the much needed

force to surpass yesterday’s high. For the coming session, 17720

followed by 17780 are to be seen as immediate hurdles; whereas on

the flipside, 17630 – 17560 are to be treated as intraday supports.

Key Levels

Support 1 – 17630 Resistance 1 – 17720

Support 2 – 17560 Resistance 2 – 17780

In our sense, we are likely to have consolidation in coming trading

session too on the back of extended weekend. Hence, as a

momentum trader, we would advise traders to lighten up positions

at higher levels. One can continue to focus on individual stocks;

because the thematic moves are still playing out well in the market.

www.angelone.in

Technical & Derivatives Report

Aug 12, 2022

View

We have witnessed a slender range-bound

movement in the benchmark index post a strong

start. The Nifty50 index lacked follow up buying but

maintained its positive closure with gains of 0.71

percent and reclaimed 17650 level.

FIIs were net buyers in the cash market segment to

the tune of Rs. 2298 crores. Simultaneously, in Index

futures, they bought worth Rs. 922 crores with an

increase in open interest, indicating long addition.

Looking at the overall F&O data, we have witnessed

long addition in both indices. On the options front, the

major concentration of OI is seen at 17500 put strikes,

which is likely to cushion any correction, followed by

17400 PE. On the contrary, piling up of positions could

be seen at 17700 call strike followed by 17800 CE,

which is likely to act as an immediate hurdle. The

undertone is likely to remain in favor of bulls, though

some tentativeness could be sensed at higher levels.

Hence, it is advisable to keep a close tab on the

mentioned levels along with the global developments

and utilize any intraday dip to add long bets to the

index.

Comments

The Nifty futures open interest has increased by

1.22%. and Bank Nifty futures open interest has

increased by 11.09% as the market closed at 17659.00.

The Nifty Aug future closed with a premium of 25.95

point against a premium of 23.5 point in the last

trading session. The Sep series closed at a premium

of 94.15 point.

The INDIA VIX decreased from 19.58 to 18.35. At the

same time, the PCR-OI of Nifty has increased from

1.23 to 1.24.

Few of the liquid counters where we have seen high

cost of carry are MGL, IGL, CUMMINSIND, ZYDUSLIFE

and IPCALAB.

Historical Volatility

SCRIP HV

IDEA 84.78

IBULHSGFIN 75.83

RBLBANK 72.17

HINDCOPPER 65.78

ZEEL 65.61

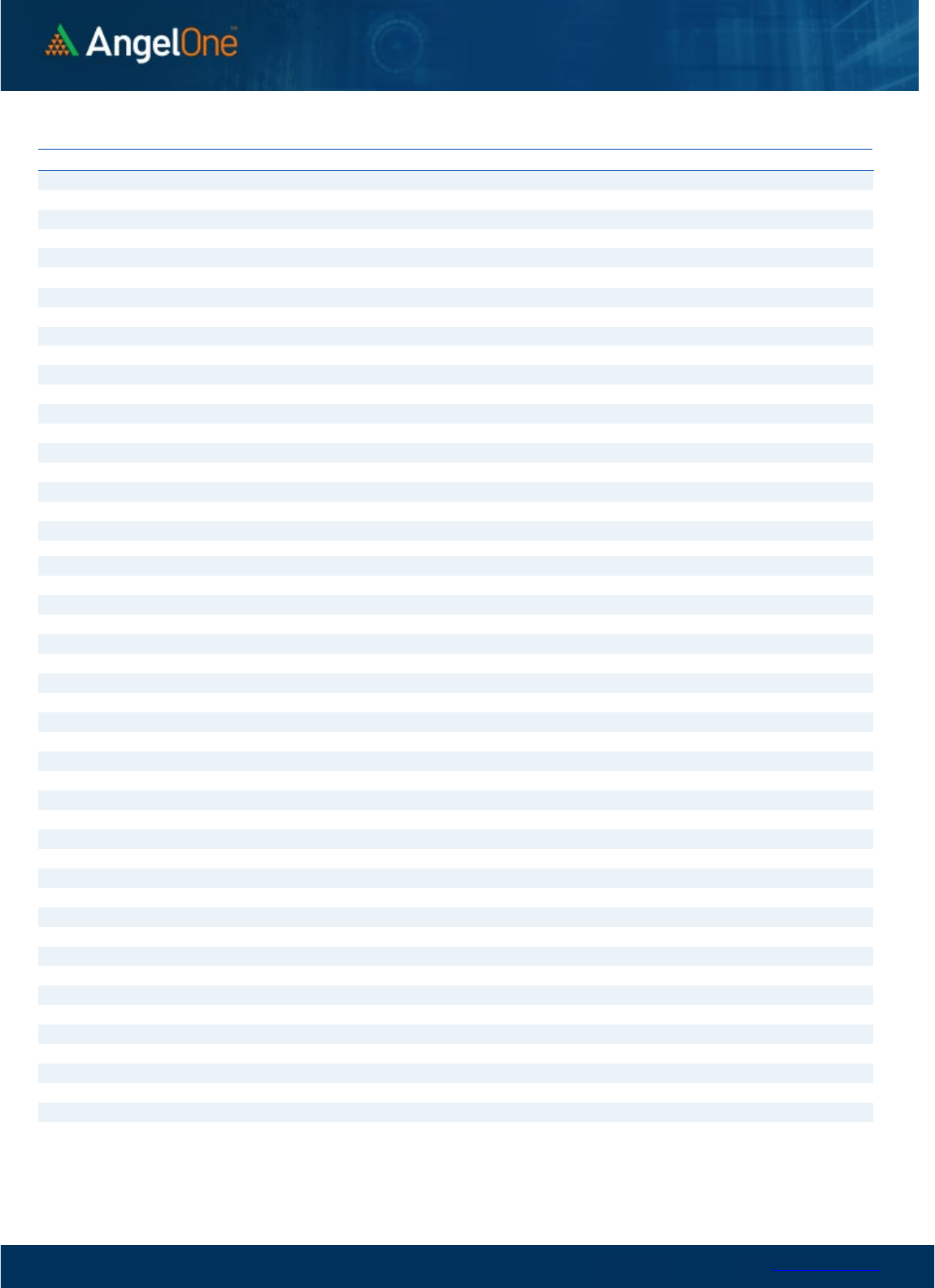

Nifty Vs OI

16000

16200

16400

16600

16800

17000

17200

17400

17600

17800

18000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

7/22 7/26 7/28 8/1 8/4 8/8 8/11

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

JUBLFOOD 12581250 18.78 588.15 3.65

GUJGASLTD 5911250 18.43 464.55 2.25

IRCTC 16265375 15.16 670.10 -1.29

BATAINDIA 2367750 10.93 1914.05 1.83

GAIL 55943100 10.36 128.65 -1.63

CHAMBLFERT 8938500 10.05 338.75 2.73

GLENMARK 8319100 9.82 389.00 3.51

BSOFT 5887700 9.74 343.10 2.07

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MGL 3291200 -10.39 860.40 7.87

AARTIIND 3637150 -8.98 815.35 -0.99

NTPC 63891300 -7.54 153.65 -1.60

EICHERMOT 3888500 -6.76 3176.40 0.50

COALINDIA 36078000 -6.38 218.60 0.64

IDFCFIRSTB 206580000 -5.97 45.25 1.00

CUMMINSIND 3325800 -5.84 1237.65 6.26

BALRAMCHIN 8563200 -5.27 338.95 2.40

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.24 1.09

BANKNIFTY 1.21 0.97

RELIANCE 0.53 0.54

ICICIBANK 1.21 0.68

INFY 0.73 0.55

www.angelone.in

Technical & Derivatives Report

Aug 12, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

659

.

00

FII Statistics for

August

1

1

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3666.09 2744.29 921.80

154029 14131.56 3.56

INDEX

OPTIONS

1390196.27 1389073.65 1122.62

884503 79673.48 (31.16)

STOCK

FUTURES

11273.00 10289.96 983.04

2152115 149400.60 0.38

STOCK

OPTIONS

7735.37 7909.08 (173.71) 141762 10079.77 7.30

Total 1412870.73

1410016.98

2853.75

3332409

253285.41

(10.17)

Turnover on

August

1

1

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

312277 28859.89 12.44

Index Options

223147625

20790975.73 94.88

Stock Futures

823796 58289.43 3.34

Stock Options

3224151 238249.49 0.16

Total

32,24,151 238249.49 92.17

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17600 258.45

59.25

40.75

17659.25

Sell

17700 199.20

Buy

17600 258.45

110.05

89.95

17710.05

Sell

17800 148.40

Buy

17700 199.20

50.80 49.20 17750.80

Sell

17800 148.40

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17600 172.50

34.35

65.65

17565.65

Sell

17500 138.15

Buy 17600 172.50

63.65

136.35

17536.35

Sell 17400 108.85

Buy

17500 138.15

29.30 70.70 17470.70

Sell

17400 108.85

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 12, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

782

787

794

799

805

APOLLOHOSP 4,332 4,381

4,467

4,515

4,601

ASIANPAINT

3,336

3,371

3,424 3,459

3,512

AXISBANK 737 748

754

765

772

BAJAJ-AUTO 4,002 4,018

4,038

4,054

4,074

BAJFINANCE

7,179

7,249

7,287

7,357

7,395

BAJAJFINSV 15,561 15,649

15,789

15,878

16,018

BPCL

325

327

329

331

333

BHARTIARTL

698

704

712

718

725

BRITANNIA

3,601

3,621

3,652

3,671

3,702

CIPLA

1,027

1,033

1,041

1,047

1,055

COALINDIA

212

215

221

224

230

DIVISLAB 3,886 3,917

3,936

3,967

3,986

DRREDDY

4,215

4,237

4,257

4,279

4,300

EICHERMOT

3,067

3,122

3,194

3,249

3,321

GRASIM

1,577

1,589

1,604

1,616

1,631

HCLTECH

953

958

963

968

973

HDFCBANK

1,467

1,477

1,484

1,493

1,500

HDFCLIFE

536

539

542

545

548

HDFC

2,397

2,426

2,445

2,474 2,492

HEROMOTOCO 2,740 2,762

2,790

2,813

2,841

HINDALCO

423

428

437

443

452

HINDUNILVR 2,568 2,591

2,629

2,652

2,691

ICICIBANK

853

856

861 865

870

INDUSINDBK 1,061 1,070

1,078

1,087

1,095

INFY

1,607

1,614

1,622

1,629

1,638

ITC

300

303

308

311

316

JSW STEEL

665

669

674

678

683

KOTAKBANK

1,824

1,839

1,848

1,862

1,871

LT

1,843

1,855

1,867

1,879

1,891

M&M 1,241 1,254

1,266

1,279

1,291

MARUTI

8,571

8,693

8,845

8,967

9,119

NESTLEIND

19,355

19,517

19,750

19,912

20,145

NTPC 150 152

154

156

158

ONGC 130 131

134 135 138

POWERGRID

219

221

224

226

229

RELIANCE 2,564 2,578

2,594

2,607

2,623

SBILIFE

1,243

1,252

1,268

1,277

1,293

SHREECEM 20,965 21,079

21,264

21,379

21,564

SBIN 514 519

523

528 531

SUNPHARMA

912

917

922

926

931

TCS 3,355 3,389

3,409 3,442 3,462

TATACONSUM

754

764

781

791

808

TATAMOTORS

470

473

479

483

488

TATASTEEL

107

108

109

110

112

TECHM

1,057

1,067

1,080

1,091

1,104

TITAN 2,428 2,450

2,468 2,490

2,508

ULTRACEMCO

6,527

6,562

6,609

6,644

6,690

UPL

754

761

767

774 781

WIPRO

433

436

439

442

445

www.angelone.in

Technical & Derivatives Report

Aug 12, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.