May 12, 2022

www.angelone.in

Technical & Derivatives Report

Nifty Bank Outlook

-

(34693)

Unlike recent gap-down opening streak, our markets started

the day on a pleasant note in line with most of the Asian peers.

The banking index too commenced with decent gains; but once

again at higher levels, traders started liquidating their trades

which resulted in giving up all gains and therefore, trading well

inside the negative territory. Markets were on the cusp of a

break down from their key levels but fortunately, a smart buying

in most of the heavyweight counters lifted the BANKNIFTY

higher to conclude at opening levels.

Since last couple of days, the banking space is showing some

resilience as its continue to buck the trend. In a way, it turned

out to be a saviour for our benchmark index as it managed to

pulled the Nifty from the psychological mark of 16000.

Yesterday’s close has left us with some promise and if global

markets supports, we may see a good relief rally in our market

backed by the dominance of the banking counters. As far as

levels are concerned, 34800 is the level to watch out for above

which BANKNIFTY can test next levels of 35000 – 35200. On the

flipside, 34200 – 34000 remains a sacrosanct support zone.

Key Levels

Support 1 – 34200 Resistance 1 – 35000

Support 2 – 34000 Resistance 2 – 35200

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54088) / Nifty (16167)

Led by the overnight recovery in the global market, our market

started the session on a stable note. The benchmark index

Nifty50 witnessed a flat opening that soon went into a correction

as an across-board sell-off triggered and tested the 16000 odd

zone at the lower end. The bearishness intensified; however, the

market gets hold of the fall in the latter half and gradually

apprehends to pare down the losses. The recovery was quite

significant, wherein Nifty concluded the day with a mere cut of

0.45 percent, a tad above the 16150 level.

The technical structure looks very disruptive, with all indicators

signifying the trend southwards. Any breach below the 16000

mark could open the possibility of re-testing the previous swing

low of 15700 odd levels. Yesterday’s recovery from the

psychological level of 16000 in Nifty, led by the banking space,

bodes well for the bulls. Also, the midcap index saw some relief

in the latter half of the day, indicating a further recovery in the

coming session. However, the downward trend remains intact till

the time the unfilled gap of 16480-16650 on the higher end is not

taken over. Since the macro factors have weighed down heavily

on the global front, it would be important to have a regular tab

on these developments.

Going forward, the inflation data for the US

market is

expected to dictate the near-term trend among the global

bourses. Meanwhile, aggressive bets should be avoided till

the time global nervousness subsides completely.

Key Levels

Support 1 – 16000 Resistance 1 – 16300

Support 2 – 15950 Resistance 2 – 16400

www.angelone.in

Technical & Derivatives Report

May 12, 2022

View

Yesterday, our market opened with minor gains but

at it approached the territory around 16300, selling

got aggravated to not only test Monday’s low but

also the psychological mark of 16000. Fortunately,

there was no further damage done as market

witnessed a broad based recovery in the latter half

to recover fair bit of ground to close tad below

16200; courtesy to smart surge in the banking

conglomerates.

FIIs were net sellers in the cash market segment

to the tune of Rs. 3609 crores. Simultaneously, in

Index futures, they sold worth Rs. 966 crores with

rise in open interest, indicating short formation.

In F&O space, we saw some short covering in Nifty

and fresh long were visible in case of banking index.

FIIs continued their selling spree in cash segment

and also added decent shorts in index futures

segment. In options front, 16000 put option holds a

maximum outstanding contract and we saw addition

of fresh positions in 16100 put options as well;

suggesting a strong demand zone at 16000-16100.

On the other side, good amount of positions got piled

up in 16200-16500 call options, which is likely to

restrict the upside on the expiry day. Considering

the above data points, we expect some relief going

ahead and hence, would advocate buying ATM call

strikes in case of any dips towards 16050-16100.

Comments

The Nifty futures open interest has increased by 1.44%.

and BANK Nifty futures open interest has increased by

7.09% as the market closed at 16167.10.

The Nifty May future closed with a premium of 10.85

point against a premium of 7.05 point in the last trading

session. The June series closed at a premium of 21.40

point.

The INDIA VIX increased from 22.30 to 22.80. At the

same time, the PCR-OI of Nifty has decreased from 0.76

to 0.69.

Historical Volatility

SCRIP HV

-

-

-

-

-

-

-

-

-

-

*D.V. File not updated on NSE Website during the time of report

publishing

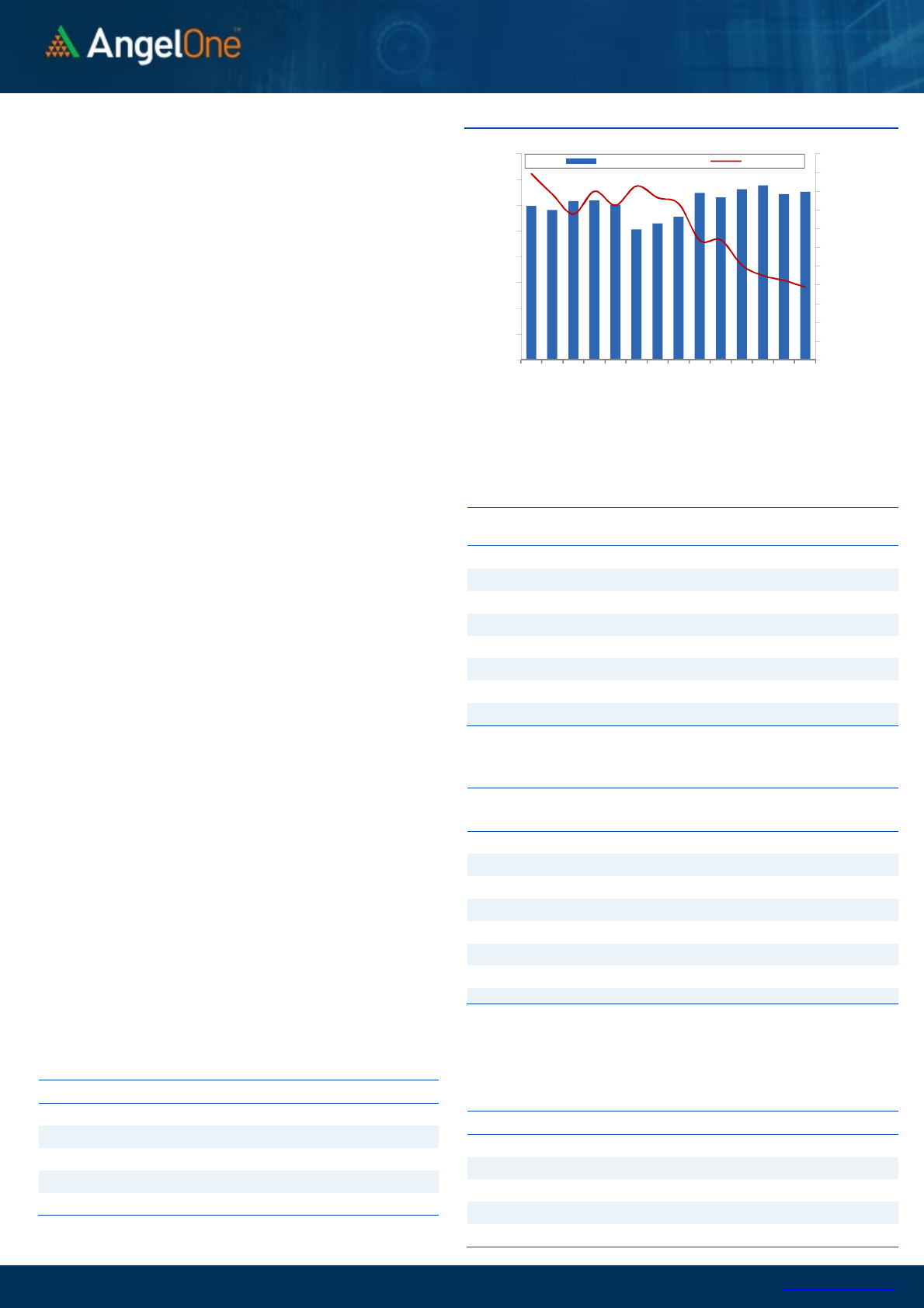

Nifty Vs OI

15400

15600

15800

16000

16200

16400

16600

16800

17000

17200

17400

17600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

4-21 4-25 4-27 4-29 5-4 5-6 5-10

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IBULHSGFIN 47966800 18.58 139.85 -20.74

CANFINHOME 4131075 11.68 504.05 -4.12

INDHOTEL 25897658 8.00 230.40 -2.19

AARTIIND 3307350 7.63 769.05 -2.76

SRF 4303875 6.78 2113.10 5.99

AUBANK 3153500 6.27 1262.70 0.99

HINDALCO 41754075 6.18 423.00 0.12

IGL 16148000 6.07 347.25 0.88

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GUJGASLTD 2886250 -14.29 507.05 6.37

ABB 374500 -9.87 2230.55 1.57

NAM-INDIA 3398400 -9.54 277.45 0.90

CHAMBLFERT 2124000 -9.00 427.45 -4.25

PERSISTENT 446100 -8.07 3951.15 -3.03

DALBHARAT 1308000 -7.64 1421.80 1.94

SYNGENE 1017200 -7.14 567.45 -3.86

TVSMOTOR 7394800 -6.99 616.20 0.77

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.69 0.74

BANKNIFTY 0.85 0.94

RELIANCE 0.28 0.38

ICICIBANK 0.44 0.50

INFY 0.37 0.47

www.angelone.in

Technical & Derivatives Report

May 12, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (May Series) are given as an information and not as a recommendation.

Nifty Spot = 16,

167.10

FII Statistics for

May

1

1

, 202

2

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4950.35 5915.99 (965.64) 185414 15356.15 6.97

INDEX

OPTIONS

955845.41 952309.26 3536.15

1832056 150309.15 11.93

STOCK

FUTURES

17286.98 16860.38 426.60

2236802 137940.65 0.83

STOCK

OPTIONS

7816.72 7757.74 58.98

131652 8438.49 5.65

Total

985899.46

982843.37

3056.09

4385924

312044.44

5.61

Turnover on

May

11

, 2

022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

553552 46005.20 14.90

Index

Options

137017332 11516390.13

49.21

Stock

Futures

1043365 63843.15 10.66

Stock

Options

3074673 204774.73 6.62

Total

30,74,673 204774.73 47.74

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

16200 259.45

48.25

51.75

16248.25

Sell

16300 211.20

Buy

16200 259.45

90.50

109.50

16290.50

Sell

16400 168.95

Buy

16300 211.20

42.25 57.75 16342.25

Sell 16400 168.95

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16200 286.50

47.65

52.35

16152.35

Sell

16100 238.85

Buy

16200 286.50

85.70

114.30

16114.30

Sell

16000 200.80

Buy

16100 238.85

38.05 61.95 16061.95

Sell

16000 200.80

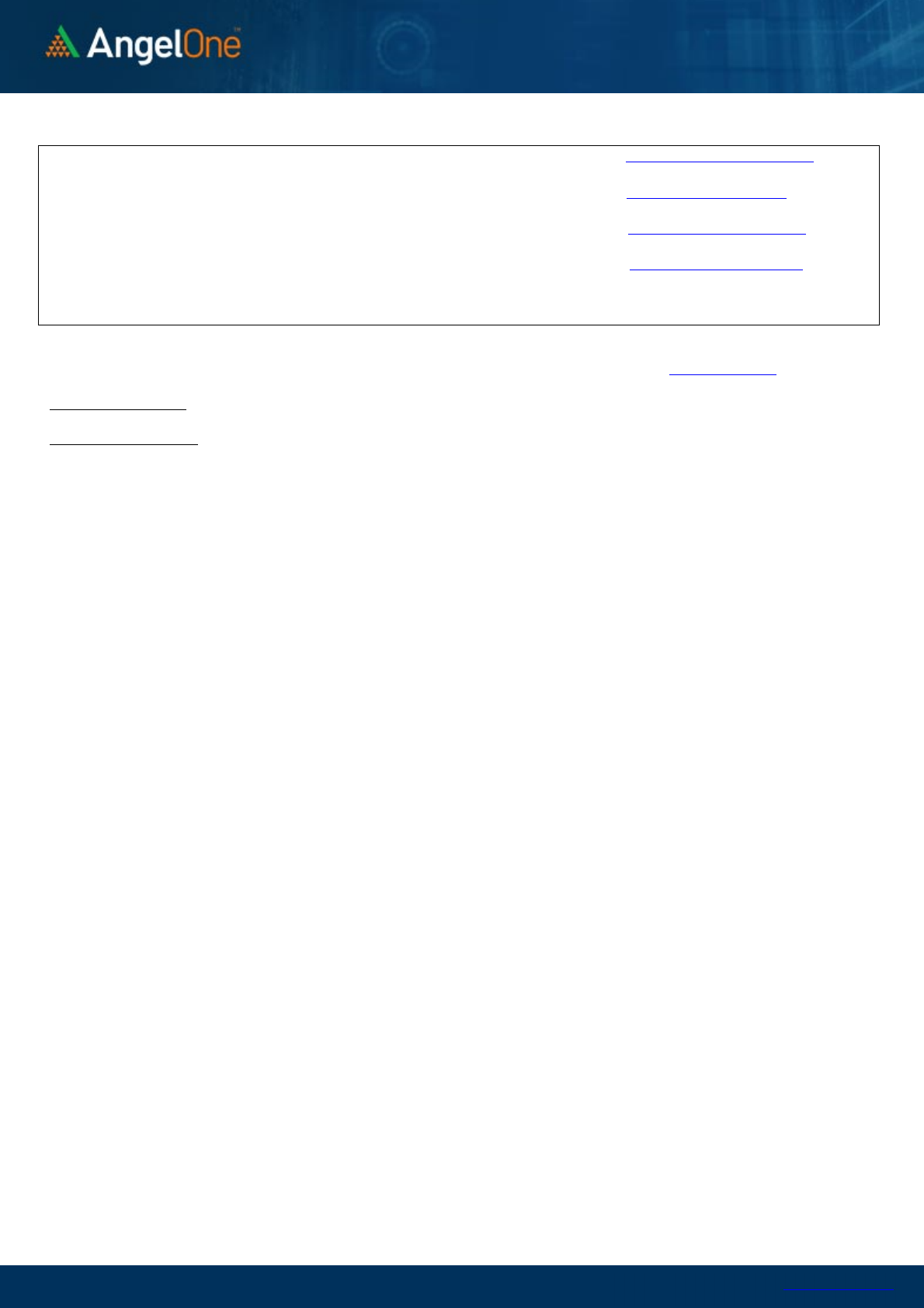

Nifty Put

-

Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700 16800

Call Put

www.angelone.in

Technical & Derivatives Report

May 12, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 729 744

765 780 801

APOLLOHOSP 3,563 3,621

3,678 3,736 3,793

ASIANPAINT 2,917 2,985

3,047 3,116 3,178

AXISBANK 647 660

668 680 688

BAJAJ-AUTO 3,502 3,557

3,593 3,648 3,683

BAJFINANCE 5,587 5,697

5,847 5,957 6,106

BAJAJFINSV 12,759 13,044

13,438 13,723 14,116

BPCL 336 341

350 356 365

BHARTIARTL 707 715

725 733 743

BRITANNIA 3,157 3,209

3,246 3,297 3,335

CIPLA 890 914

928 952 967

COALINDIA 161 166

170 174 178

DIVISLAB 4,199 4,246

4,288 4,335 4,376

DRREDDY 3,801 3,842

3,893 3,934 3,985

EICHERMOT 2,311 2,350

2,392 2,431 2,473

GRASIM 1,480 1,508

1,536 1,563 1,591

HCLTECH 1,040 1,050

1,065 1,075 1,090

HDFCBANK 1,318 1,333

1,344 1,360 1,370

HDFCLIFE 550 557

566 573 582

HDFC 2,163 2,191

2,214 2,243 2,266

HEROMOTOCO 2,354 2,412

2,466 2,524 2,577

HINDALCO 406 414

422 430 438

HINDUNILVR 2,083 2,123

2,156 2,197 2,230

ICICIBANK 701 708

714 720 726

INDUSINDBK 878 900

914 937 951

INFY 1,491 1,509

1,529 1,547 1,568

ITC 246 251

257 261 267

JSW STEEL 625 637

647 660 670

KOTAKBANK 1,786 1,798

1,808 1,820 1,830

LT 1,527 1,549

1,579 1,601 1,631

M&M 865 876

887 898 909

MARUTI 7,221 7,309

7,434 7,522 7,647

NESTLEIND 16,058 16,285

16,462 16,689 16,866

NTPC 146 149

153 156 160

ONGC 151 155

157 161 164

POWERGRID 233 236

242 245 251

RELIANCE 2,389 2,419

2,452 2,482 2,515

SBILIFE 1,065 1,076

1,090 1,101 1,116

SHREECEM 22,302 22,842

23,791 24,331 25,280

SBIN 458 467

473 482 488

SUNPHARMA 842 848

858 864 874

TCS 3,348 3,380

3,414 3,446 3,481

TATACONSUM

726 735

747 756 768

TATAMOTORS 368 378

388 398 407

TATASTEEL 1,093 1,129

1,160 1,197 1,228

TECHM 1,174 1,199

1,232 1,258 1,291

TITAN 2,074 2,094

2,116 2,137 2,158

ULTRACEMCO 6,102 6,221

6,329 6,448 6,555

UPL 766 779

796 809 826

WIPRO 453 462

472 482 492

www.angelone.in

Technical & Derivatives Report

May 12, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.