November 11, 2021

www.angelone.in

Technical & Derivatives Report

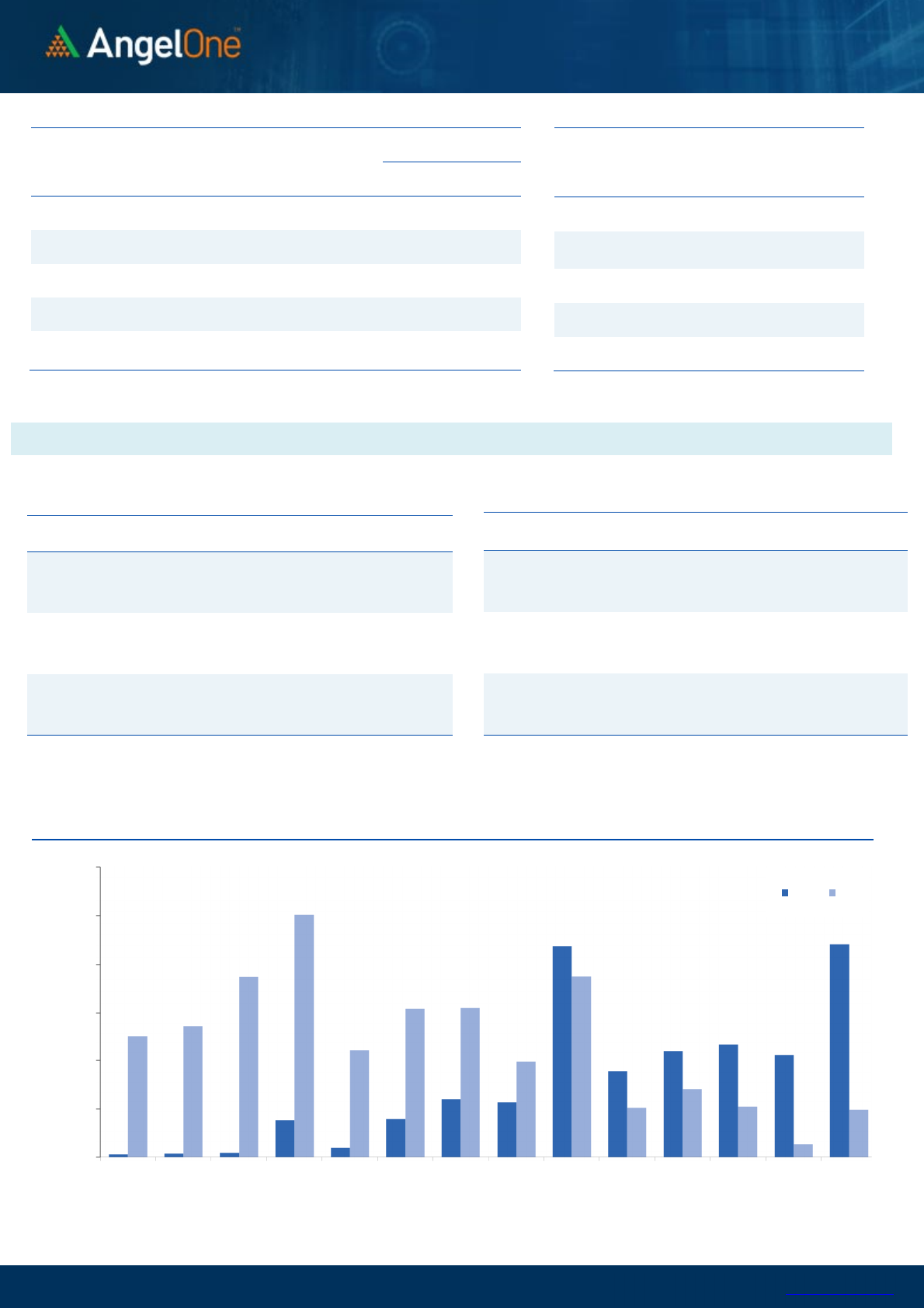

Nifty Bank Outlook - (39023)

BankNifty as well started with a gap down opening and slipped further

lower to mark an intraday low of 38874. Subsequently, we witnessed

a range bound session with intraday bounce got sold into. The bank

index eventually ended with cut of 0.88% tad above 39000.

If we closely watch the daily chart, the Bank Nifty has closed near the

Ascending Trend line support and if see this weakness persists then we

can see an extension of fall towards 38000 – 37500 levels in the near

term. Since it’s a very key support, we may see some bounce aswell

however the charts have been already distorted hence incase of any

bounce use it to lighten up long positions. Yesterday’s low at 38874

will be a key support whereas on the higher side resistance is seen

around 39200 – 39600 levels.

Key Levels

Support 1 – 38850 Resistance 1 – 39200

Support 2 – 38000 Resistance 2 – 39600

Exhibit 2: Nifty Bank Daily Chart

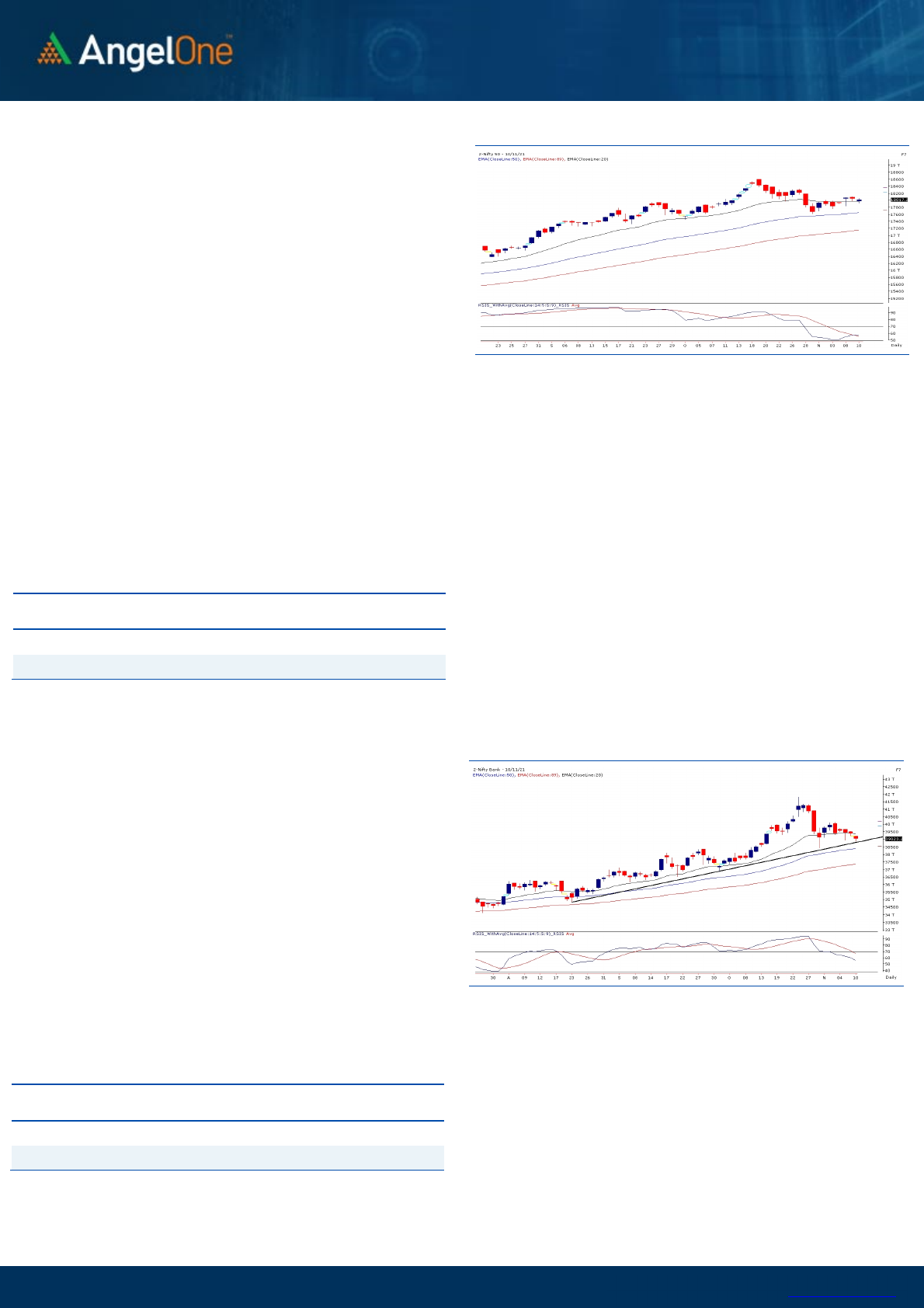

Sensex (60353) / Nifty (18017)

Market started yesterday’s session on a sluggish note, but still it was

certainly not as bad as the SGX Nifty was indicating . Nifty retested

17900 in the early morning trades which was then followed by some

consolidation. Post the mid-session, we witnessed a decent recovery in

some of the heavyweights which pulled the index beyond 18000 to

mark a flat close one day ahead of the weekly expiry.

Although we had a decent recovery post the nervous start, overall

there was no major action seen in the benchmark index. We once gain

had a neutral close around 18000 which keeps the chart structure

unchanged. Hence the view and the levels remained the same as

mentioned in the previous commentary. On an immediate basis 18100

– 18200 should be seen as crucial resistances; whereas with a broader

view, 18350 stands to be a crucial level which if gets surpassed, Nifty

could see new highs thereafter. But till then one should continue with

a ‘Sell on rise’ strategy. On the flipside, 17950 – 17850 are to be

considered as key supports. Traders are still advised to stay light and

even if one wants to focus on individual stocks, a proper money

management is must to follow.

Key Levels

Support 1 – 17950 Resistance 1 – 18100

Support 2 – 17850 Resistance 2 – 18200

Exhibit 1: Nifty Daily Chart

www.angelone.in

Technical & Derivatives Report

November 11, 2021

View

Market started Wednesday’s session on a sluggish note,

but still it was certainly not as bad as the SGX Nifty was

indicating .Nifty retested 17900 in the early morning

trades which was then followed by some consolidation.

Post the mid-session, we witnessed a decent recovery

in some of the heavyweights which pulled the index

beyond 18000 to mark a flat close one day ahead of the

weekly expiry.

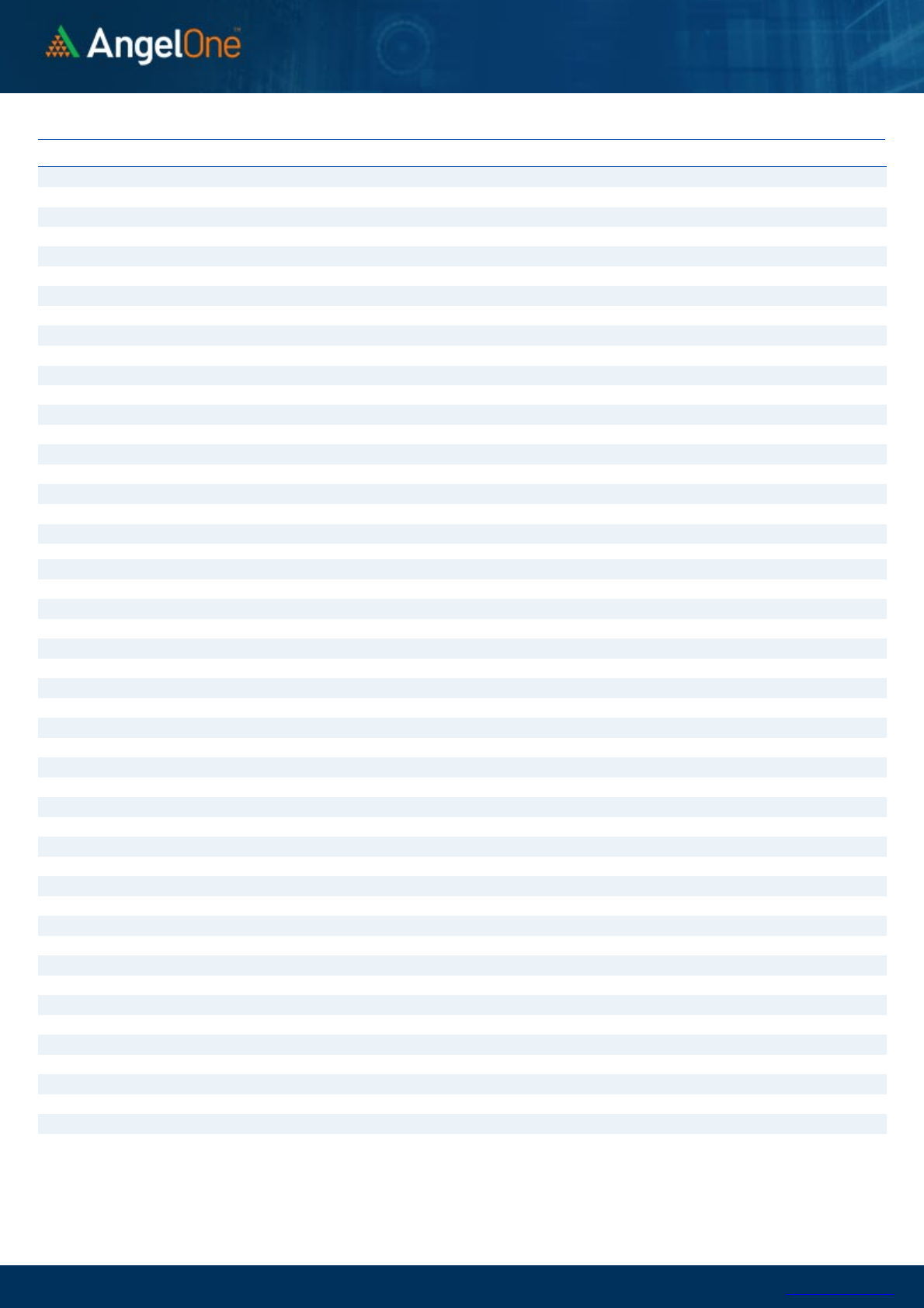

FIIs were net sellers in the cash market segment to the

tune of Rs. 469 crores. In index futures, they sold worth

Rs. 512 crores with rise in open interest indicating short

formation.

In F&O space, we saw some open interest reduction in

Nifty and banking index added good amount of fresh

shorts. Stronger hands continued their selling streak in

equities and also preferred adding shorts in index and

stock futures segment. In Nifty options front, there was

massive writing seen in 18100 and 18200 call options in

last two trading sessions. On the other side, some

unwinding was clearly visible in 18100 and 18150 put

options; followed by some build-up in 17750-17800

strikes. Considering the price action, it seems market

has stuck in a tight range of 17900-18100 now and hence,

until we don’t see a directional move beyond this range,

traders should strictly avoid any directional bet in index

and should ideally prefer trading in individual themes.

Comments

The Nifty futures open interest has decreased by 0.73%.

Bank Nifty futures open interest has increased by 9.58%

as market closed at 18017.20 levels.

The Nifty November future closed with a premium of 5.75

point against a premium of 26.15 point in last trading

session. The December series closed at a premium of

70.10 point.

The INDIA VIX increased from 16.00 to 16.30. At the same

time, the PCR-OI of Nifty has decreased from 1.12 to 0.94.

Few of the liquid counters where we have seen high cost

of carry are BRITANNIA, M&M, TVSMOTOR, RBLBANK

and IBULHSGFIN.

Nifty Vs OI

17200

17400

17600

17800

18000

18200

18400

18600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-13 10-18 10-20 10-22 10-26 10-28 11-1 11-3 11-5

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BRITANNIA

1410400 30.38 3698.45 2.16

IBULHSGFIN

42209600 28.62 245.35 0.49

HINDALCO

27484525 18.52 449.75 -3.26

STAR

3733425 17.35 503.75 -9.16

PFC

45979200 16.35 140.25 0.68

HDFCBANK

36860450 16.01 1555.25 -1.15

BHEL

146181000 14.19 66.25 -8.35

BERGEPAINT

5562700 13.74 774.95 -0.26

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AMBUJACEM

12160500 -12.68 428.35 -0.78

ABFRL

10202400 -12.39 301.90 -1.42

ADANIENT

23837000 -8.54 1655.80 1.23

EICHERMOT

3844750 -7.86 2746.75 0.39

VOLTAS

2155000 -7.71 1247.60 -0.54

GUJGASLTD

3525000 -7.48 659.45 1.72

MFSL

2113800 -7.43 993.05 -0.89

ULTRACEMCO

1687400 -7.30 8106.80 -0.44

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.94 0.78

BANKNIFTY

0.60 0.86

RELIANCE

0.46 0.38

ICICIBANK

0.44 0.35

INFY

0.47 0.40

Historical Volatility

SCRIP HV

STAR

55.80

BHEL

66.57

M&M

41.23

ABFRL

50.46

BRITANNIA

29.89

www.angelone.in

Technical & Derivatives Report

November 11, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty

Spot = 18017.20

FII Statistics for November 10, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2604.75 3116.85 (512.10) 150075 13855.55 2.07

INDEX

OPTIONS

480467.72 480709.53 (241.81) 1498085 138040.31 7.87

297314.41

STOCK

FUTURES

14257.38 15478.64 (1221.26) 1773706 133504.22 1.12

STOCK

OPTIONS

15308.19 15412.74 (104.55) 309398 24081.00 6.50

Total

512638.04

514717.76

(2079.72) 3731264

309481.08

4.22

43446.77

Turnover on November 10, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

257091 24072.82 5.63

Index Options

59350902 5625530.70 24.40

Stock Futures

850854 66216.11 -6.42

Stock Options

2656165 215231.12 -4.38

Total

6,31,15,012

5931050.75 22.52

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18000 226.65

49.85 50.15 18049.85

Sell

18100 176.80

Buy

18000 226.65

91.10 108.90 18091.10

Sell

18200 135.55

Buy

18100 176.80

41.25 58.75 18141.25

Sell

18200 135.55

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

18000 200.00

41.95 58.05 17958.05

Sell

17900 158.05

Buy

18000 200.00

77.40 122.60 17922.60

Sell

17800 122.60

Buy

17900 158.05

35.45 64.55 17864.55

Sell

17800 122.60

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

November 11, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 723 730

738 745 753

ASIANPAINT 3,052 3,080

3,108 3,136 3,165

AXISBANK 724 736

745 758 766

BAJAJ-AUTO 3,715 3,743

3,772 3,801 3,830

BAJFINANCE 7,460 7,521

7,565 7,626 7,670

BAJAJFINSV 17,862 18,094

18,235 18,467 18,607

BPCL 428 430

432 433 436

BHARTIARTL 696 716

727 747 758

BRITANNIA 3,553 3,626

3,673 3,746 3,793

CIPLA 901 907

916 921 930

COALINDIA 164 165

168 170 172

DIVISLAB 4,825 4,866

4,906 4,946 4,987

DRREDDY 4,742 4,786

4,818 4,862 4,894

EICHERMOT 2,685 2,716

2,741 2,772 2,796

GRASIM 1,828 1,851

1,865 1,889 1,903

HCLTECH 1,156 1,163

1,169 1,175 1,182

HDFCBANK 1,539 1,547

1,558 1,566 1,577

HDFCLIFE 698 702

705 709 712

HDFC 2,863 2,904

2,928 2,969 2,993

HEROMOTOCO 2,687 2,703

2,718 2,733 2,748

HINDALCO 439 444

454 460 470

HINDUNILVR 2,381 2,391

2,405 2,415 2,429

ICICIBANK 768 775

779 786 791

IOC 137 138

140 141 142

INDUSINDBK 1,003 1,018

1,042 1,057 1,081

INFY 1,709 1,724

1,738 1,753 1,767

ITC 225 228

230 233 236

JSW STEEL 640 651

664 675 687

KOTAKBANK 2,049 2,062

2,077 2,091 2,105

LT 1,923 1,937

1,945 1,959 1,967

M&M 883 901

913 931 943

MARUTI 7,397 7,454

7,517 7,574 7,637

NESTLEIND 18,689 18,821

18,932 19,064 19,174

NTPC 136 137

137 138 139

ONGC 155 157

158 159 160

POWERGRID 182 183

185 186 188

RELIANCE 2,483 2,516

2,537 2,571 2,592

SBILIFE 1,166 1,175

1,190 1,199 1,214

SHREECEM 28,786 29,071

29,250 29,535 29,714

SBIN 518 521

525 528 532

SUNPHARMA 790 800

808 818 826

TCS 3,455 3,470

3,495 3,509 3,534

TATACONSUM

824 833

840 849 855

TATAMOTORS 493 502

509 518 525

TATASTEEL 1,263 1,281

1,305 1,323 1,347

TECHM 1,535 1,551

1,562 1,578 1,589

TITAN 2,440 2,462

2,495 2,517 2,549

ULTRACEMCO 7,977 8,042

8,115 8,180 8,253

UPL 729 750

762 783 795

WIPRO 647 650

654 657 662

www.angelone.in

Technical & Derivatives Report

November 11, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in