Aug 11, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

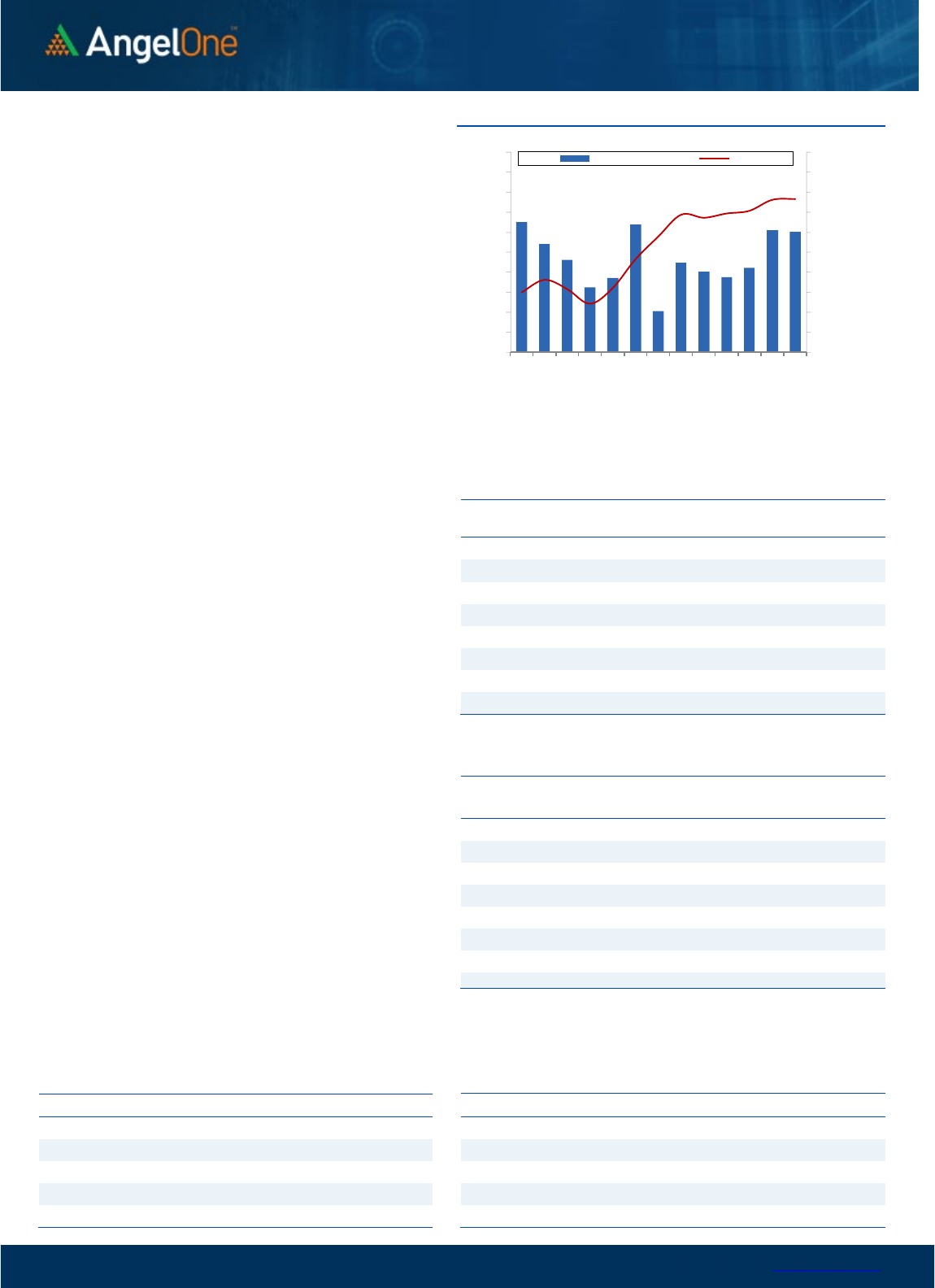

Nifty Bank Outlook (38288)

Post a mid-week holiday, Bank Nifty started on a flat note and

throughout the session, there was a lack of momentum as the Index

remained within a tight range and ended flat a tad below the opening

levels.

In our previous outlook, we had mentioned Bank Index approaching

the supply zone of April's month swing high. The undertone remains

positive however since the oscillators are highly overbought, we are

witnessing some signs of fatigue around this crucial hurdle. On the

daily chart, we witnessed a classical Doji pattern yesterday indicating

a lack of traction and going ahead we expect some further

consolidation in the near term with 38500 - 38760 as resistance

whereas 38000 - 37880 as immediate support. Yesterday

trading opportunities were seen on both sides of the trend and traders

should continue to focus on such outperforming opportunities.

Key Levels

Support 1 – 38000 Resistance 1 – 38500

Support 2 – 37880 Resistance 2 – 38760

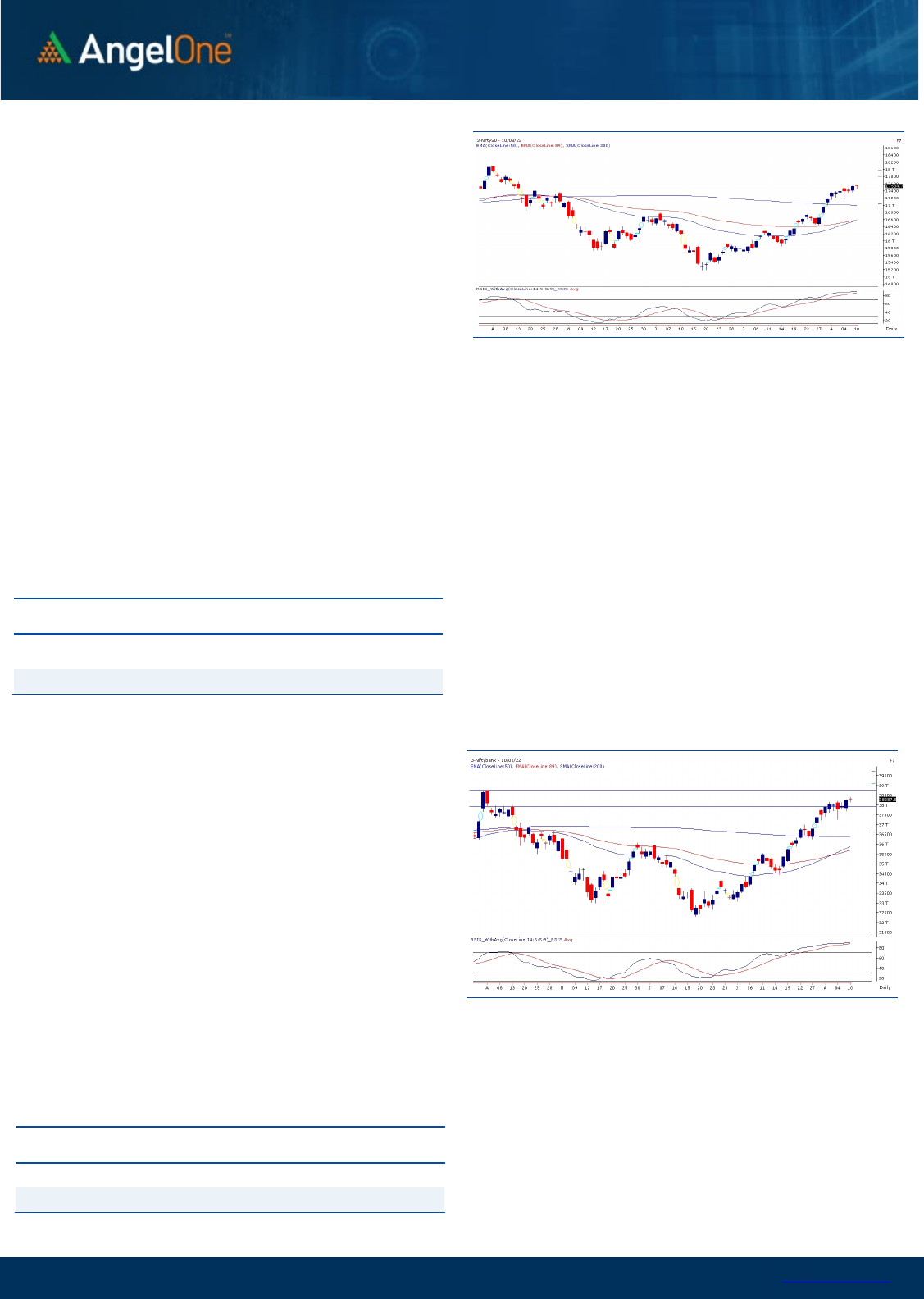

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (58817) / Nifty (17535)

Despite quiet global cues yesterday morning, our markets started the

session slightly on the positive side. However, within a blink of an eye,

this tiny lead just got disappeared. After a small pause, the buying

emerged at lower levels after entering the sub-17450 terrain. The

momentum wasn’t as strong as it was on Monday’s session. As a result,

the Nifty kept consolidating throughout the remaining part of the

session and eventually ended the session tad above previous close.

Except initial down tick, it was a day of some consolidation for key

indices. For most of the session, it kept on flirting around the

equilibrium point and eventually managed to close with negligible

gains. It seems that after one day rally, key indices have again slipped

into a consolidation mode. So as far as levels are concerned, 17400 –

17350 is likely to cushion any kind of intraday decline in the market;

whereas on the flipside, 17600 remains an immediate hurdle. Till the

time we do not surpass this range, the consolidation is likely to

continue. But there was complete abundance when it comes to the

stock specific action yesterday. Hence, traders can continue with their

stock centric approach for a while and try to follow strict stop losses for

existing positions.

Key Levels

Support 1 – 17400 Resistance 1 – 17600

Support 2 – 17350 Resistance 2 – 17650

www.angelone.in

Technical & Derivatives Report

Aug 11, 2022

View

Ahead of weekly expiry, we have seen a slender

range-bound movement in the index. The

benchmark index settled on a muted note with a

mere gain of 0.06 percent to maintain its positive

stature and concluded at 17535.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1062 crores. Simultaneously, in Index

futures, they sold worth Rs. 877 crores with a

decrease in open interest, indicating long unwinding.

Looking at the overall F&O data, we have witnessed

mixed trade in both indices ahead of the weekly expiry.

On the options front, the major concentration of OI is

seen at 17400-17500 put strikes, which is likely to

cushion any correction. On the contrary, 17600 call

strike has seen piling up of OI concentration followed

by 17800 CE, which is likely to act as immediate

resistance for the index. The Long Short ratio has also

reduced to 52% from 55%. Hence, considering the

recent developments, some tentativeness could be

sensed at the higher end, though the undertone

remains in favor of the bulls. Meanwhile, it is advisable

to keep a close tab on the mentioned levels and stay

abreast with global markets.

Comments

The Nifty futures open interest has decreased by

0.31%. and Bank Nifty futures open interest has

increased by 2.19% as the market closed at 17534.75.

The Nifty Aug future closed with a premium of 23.5

point against a premium of 32.65 point in the last

trading session. The Sep series closed at a premium

of 91.90 point.

The INDIA VIX increased from 19.30 to 19.58. At the

same time, the PCR-OI of Nifty has decreased from

1.30 to 1.23.

Few of the liquid counters where we have seen high

cost of carry are TATACHEM, CUB, MRF, IGL and

ABBOTINDIA.

Historical Volatility

SCRIP HV

IDEA 84.99

IBULHSGFIN 76.00

RBLBANK 72.35

HINDCOPPER 65.94

ZEEL 65.77

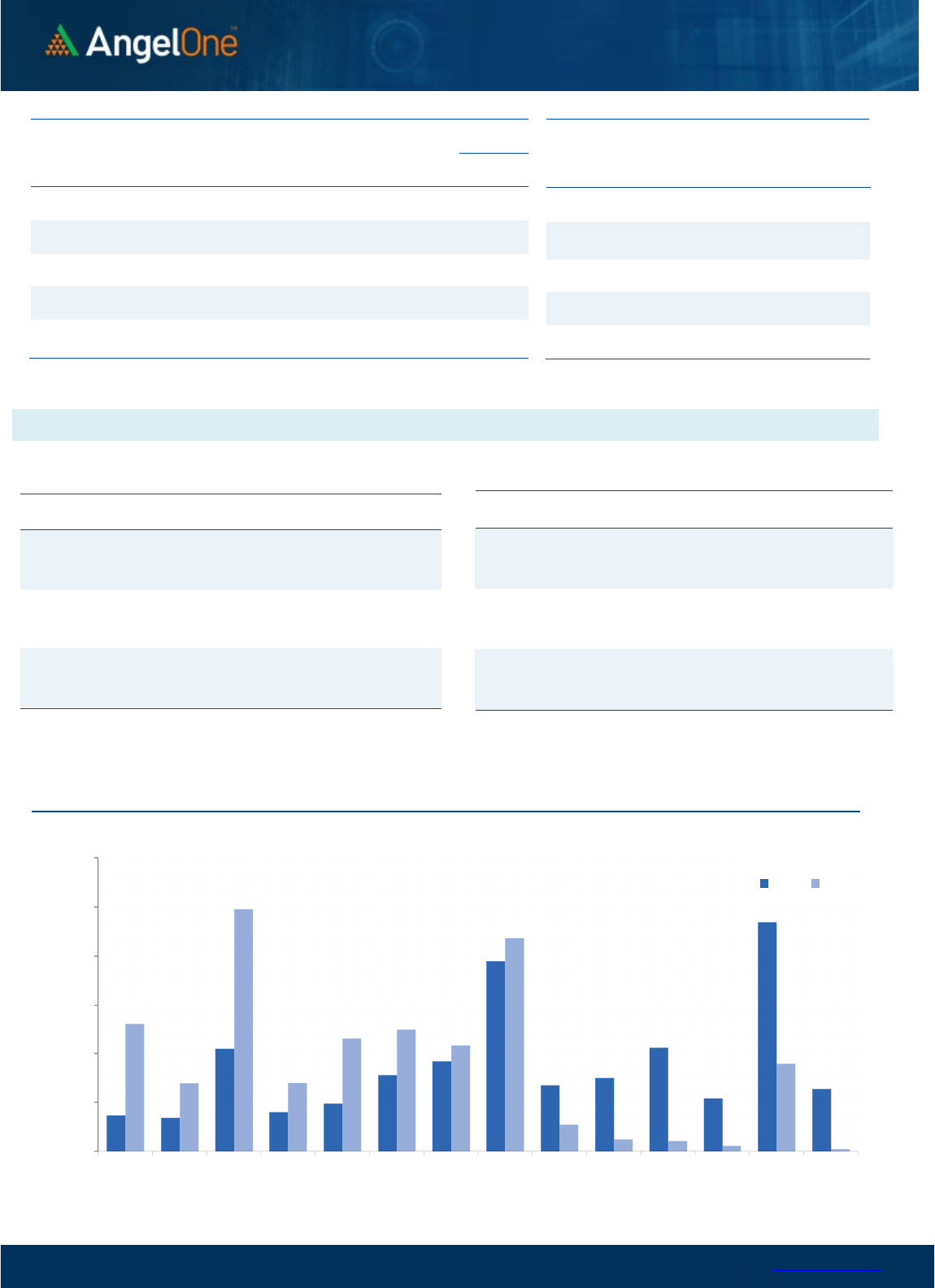

Nifty Vs OI

16000

16200

16400

16600

16800

17000

17200

17400

17600

17800

18000

10,000

10,500

11,000

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

7/21 7/25 7/27 8/29 8/2 8/5 8/10

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

TATACHEM 7590000 39.16 1074.15 12.17

CUB 6635000 23.56 176.70 8.80

MRF 85400 17.34 83466.80 -5.24

AARTIIND 3995850 16.13 819.75 2.16

HINDALCO 29552825 13.13 440.10 4.50

COROMANDEL 1387400 12.61 1076.25 2.44

ICICIPRULI 9375000 11.41 557.15 -2.57

ABB 936750 10.89 2770.55 1.76

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

WHIRLPOOL 437150 -11.92 1794.90 -0.02

BALRAMCHIN 9040000 -10.33 330.95 -6.19

ASTRAL 618475 -8.80 1943.15 -2.00

GUJGASLTD 4991250 -8.29 454.75 2.22

PERSISTENT 529050 -7.74 3643.40 -3.40

ESCORTS 2588300 -6.46 1689.90 2.52

IDFCFIRSTB 219690000 -6.04 44.80 0.22

BHARTIARTL 48383500 -5.78 715.25 1.46

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.23 0.96

BANKNIFTY 1.09 0.93

RELIANCE 0.52 0.52

ICICIBANK 1.08 0.57

INFY 0.70 0.75

www.angelone.in

Technical & Derivatives Report

Aug 11, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

5

34

.

75

FII Statistics for

August

10

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

1951.76 2828.49 (876.73) 148732 13507.61 (4.99)

INDEX

OPTIONS

825889.24 825098.32 790.92

1284792 115746.19 0.95

STOCK

FUTURES

10395.31 10856.08 (460.77) 2144035 147417.54 (0.06)

STOCK

OPTIONS

7566.93 7467.06 99.87

132118 9331.35 8.49

Total 845803.24

846249.95

(446.71) 3709677

286002.69

0.36

Turnover on

August

10

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

281991 25666.54 -13.78

Index Options

116111420

10668407.62 25.07

Stock Futures

802655 56403.90 7.18

Stock Options

3205401 237860.64 5.80

Total

32,05,401 237860.64 24.34

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 272.00

54.70

45.30

17554.70

Sell

17600 217.30

Buy

17500 272.00

103.45

96.55

17603.45

Sell

17700 168.55

Buy

17600 217.30

48.75 51.25 17648.75

Sell

17700 168.55

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17500 215.25

38.35

61.65

17461.65

Sell

17400 176.90

Buy 17500 215.25

70.80

129.20

17429.20

Sell 17300 144.45

Buy

17400 176.90

32.45 67.55 17367.55

Sell

17300 144.45

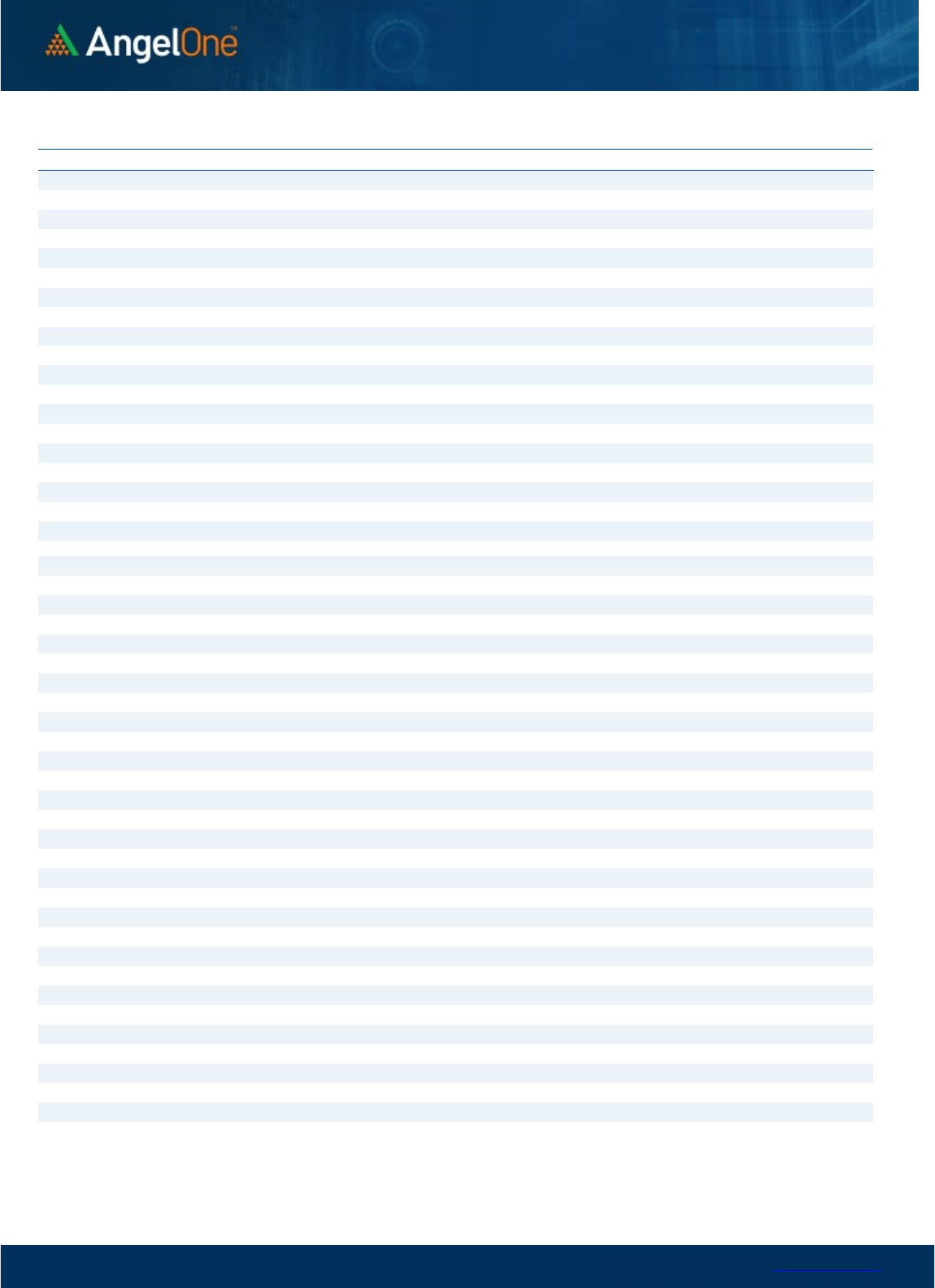

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 11, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS 763 777

792

806

822

APOLLOHOSP 4,285 4,401

4,513

4,630 4,742

ASIANPAINT 3,365 3,388

3,419

3,442 3,473

AXISBANK 729 734

741 746

753

BAJAJ-AUTO 3,986 4,011

4,038

4,063

4,090

BAJFINANCE 6,944 7,047

7,208 7,311

7,472

BAJAJFINSV

15,333

15,488

15,581

15,736

15,829

BPCL

324

326

328

330

332

BHARTIARTL

701

708

713

720

725

BRITANNIA 3,598 3,623

3,649 3,674 3,700

CIPLA 1,021 1,030

1,038

1,047

1,055

COALINDIA 214 217

219

222

224

DIVISLAB 3,882 3,915

3,945 3,978

4,007

DRREDDY 4,191 4,217

4,241

4,267

4,290

EICHERMOT 3,095 3,125

3,147

3,177

3,199

GRASIM

1,575

1,593

1,605

1,623

1,634

HCLTECH 937 944

956

963

975

HDFCBANK

1,440

1,453

1,462

1,476

1,485

HDFCLIFE

534

537

541 544

548

HDFC

2,356

2,377

2,392

2,413

2,428

HEROMOTOCO

2,712

2,744

2,764

2,796

2,817

HINDALCO

406

423

434

451

462

HINDUNILVR 2,605 2,624

2,650

2,669

2,696

ICICIBANK

837

843

848

854

859

INDUSINDBK

1,033

1,048

1,058

1,073

1,082

INFY 1,571 1,587

1,604

1,620

1,637

ITC

309

310

312

313

315

JSW STEEL

654

662

668

677

683

KOTAKBANK

1,805

1,817

1,833

1,845

1,861

LT

1,803

1,829

1,848

1,874

1,893

M&M

1,250

1,259

1,269

1,278

1,289

MARUTI 8,728 8,804

8,902

8,977

9,075

NESTLEIND 19,163 19,466

19,808

20,111

20,453

NTPC 154 155

156

157

158

ONGC

131

133

135

136

138

POWERGRID

219

221

223

225

227

RELIANCE 2,544 2,563

2,576

2,596

2,609

SBILIFE

1,254

1,263

1,279

1,289

1,304

SHREECEM 20,542 20,823

21,137

21,418

21,732

SBIN

507

511

517

521

527

SUNPHARMA

906

913

920

927

934

TCS 3,308 3,331

3,358 3,381

3,408

TATACONSUM

783

787

790

794

798

TATAMOTORS

458

467

472

481

486

TATASTEEL 105 107

109

111

112

TECHM

1,036

1,046

1,052

1,062

1,069

TITAN 2,387 2,411

2,440

2,463 2,493

ULTRACEMCO 6,478 6,537

6,639

6,698

6,801

UPL

746

756

762

771

777

WIPRO 421 426

431 435

441

www.angelone.in

Technical & Derivatives Report

Aug 11, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.