November 10, 2021

www.angelone.in

Technical & Derivatives Report

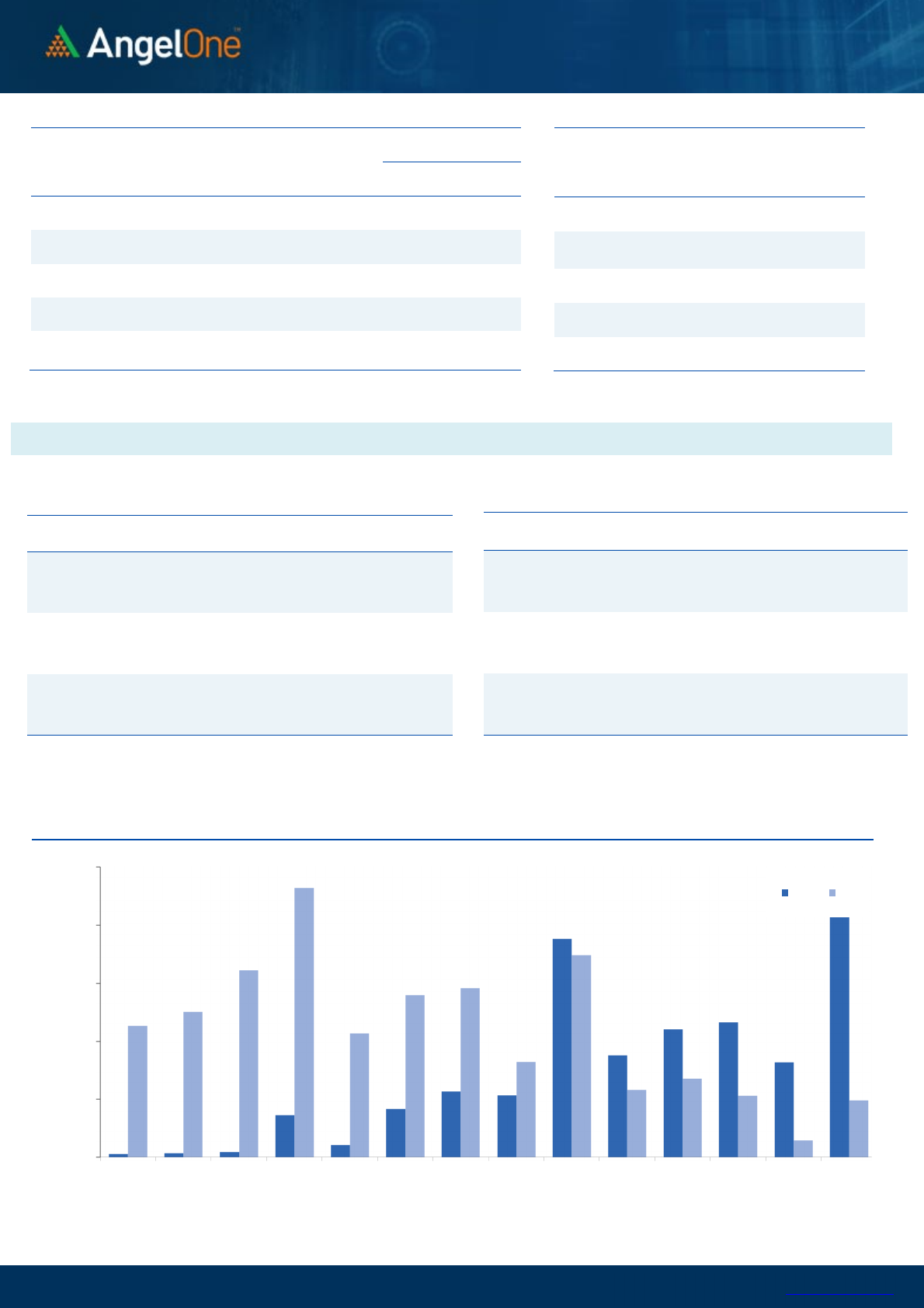

Nifty Bank Outlook - (39369)

We had a flat start yesterday and then prices remained in a range

throughout the session to eventually end with marginal a loss of

0.18% at 39369.

Technically not much has changed as prices traded within a very

slender range of 300 points and ended within the previous candle

range. If we meticulously observe the daily chart, prices have traped

within a range of 40000 – 40200 on the higher side whereas 38400 on

the lower side. In the last few sessions, we have seen

underperformance by heavyweight private banks whereas the PSU

banks and some of the mid-size private banks have shown significanct

outperformance. Hence, as long the bank index is trapped in this

range, traders should continue with stock specific trades that are

giving opportunities on both sides of the trend.

Key Levels

Support 1 – 39000 Resistance 1 – 39750

Support 2 – 38400 Resistance 2 – 40200

Exhibit 2: Nifty Bank Daily Chart

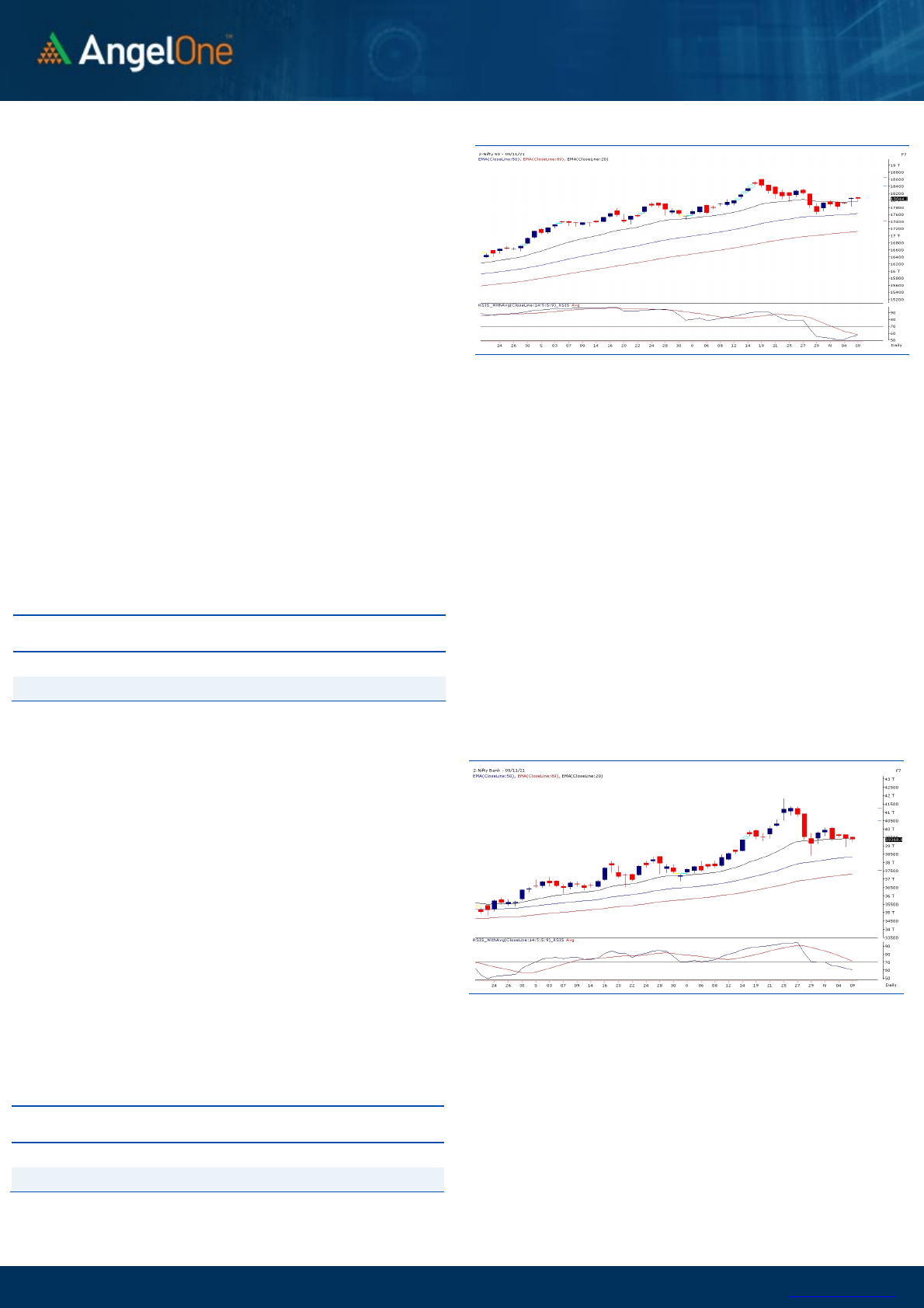

Sensex (60433) / Nifty (18044)

We had a flat opening yesterday on the back of muted cues from the

global peers. In first couple of hours, Nifty had a small bout of profit

booking after testing the 18100 mark. However there was no major

damage done as Nifty stabilised immediately after sneaking below

18000. During the remaining part of the session, it remained in a

slender range to eventually conclude the session with a negligible loss.

Monday’s wild swings on both sides was followed by a quiet session

yesterday; because there were lot of mixed moves within the

heavyweight basket. However the real action was seen outside the

index in some of the individual stocks. Since there was no major price

movement in the benchmark, our view and levels more or less remains

the same. We have been mentioning the levels of 18100 – 18200

(immediate resistances) in order to regain strength but if we take a

close look at the broader picture, 18350 stands to be a crucial level

which if gets surpassed, Nifty could see new highs thereafter. But till

then one should continue with a ‘Sell on rise’ strategy. On the flipside,

17950 – 17850 are to be considered as key supports. Traders are still

advised to stay light and even if one wants to focus on individual stocks,

a proper money management is must to follow.

Key Levels

Support 1 – 18000 Resistance 1 – 18100

Support 2 – 17850 Resistance 2 – 18200

Exhibit 1: Nifty Daily Chart

www.angelone.in

Technical & Derivatives Report

November 10, 2021

View

We had a cheerful start backed by positive global cues;

In the initial hour, we saw index inching beyond 18100 but

this gains were short lived as we saw some

nervousness to drag index below 18000 mark in the

midst. In the latter half, index recovered and concluded

the day at 18044.25.

FIIs were net sellers in the cash market segment to the

tune of Rs. 2445 crores. In index futures, they sold worth

Rs. 2621 crores with decrease in open interest indicating

long unwinding.

Post Monday’s recovery, the momentum looked missing

in both the indices. In F&O space, we saw some open

interest reduction and banking index added some mixed

bets. Stronger hands continued their selling streak in

equities and preferred booking profits in index and stock

futures. In Nifty options front, we saw massive writing

in 18200 call options resulting highest build-up for call

shifting from 18500 to 18200 strike. On the other side,

good amount of unwinding was visible in 17900 puts

which holds highest outstanding contracts. Considering

the above data points, we believe upside is now capped

and hence would advocated ligherning longs in any and

buying ATM puts incase Nifty slides below 18000 mark.

Comments

The Nifty futures open interest has decreased by 3.12%.

Bank Nifty futures open interest has increased by 5.73%

as market closed at 18044.25 levels.

The Nifty November future closed with a premium of

26.15 point against a premium of 54.20 point in last

trading session. The December series closed at a

premium of 84.90 point.

The INDIA VIX decreased from 16.34 to 16.00. At the same

time, the PCR-OI of Nifty has decreased from 1.12 to 0.96.

Few of the liquid counters where we have seen high cost

of carry are BRITANNIA, M&M, TVSMOTOR, RBLBANK

and IBULHSGFIN.

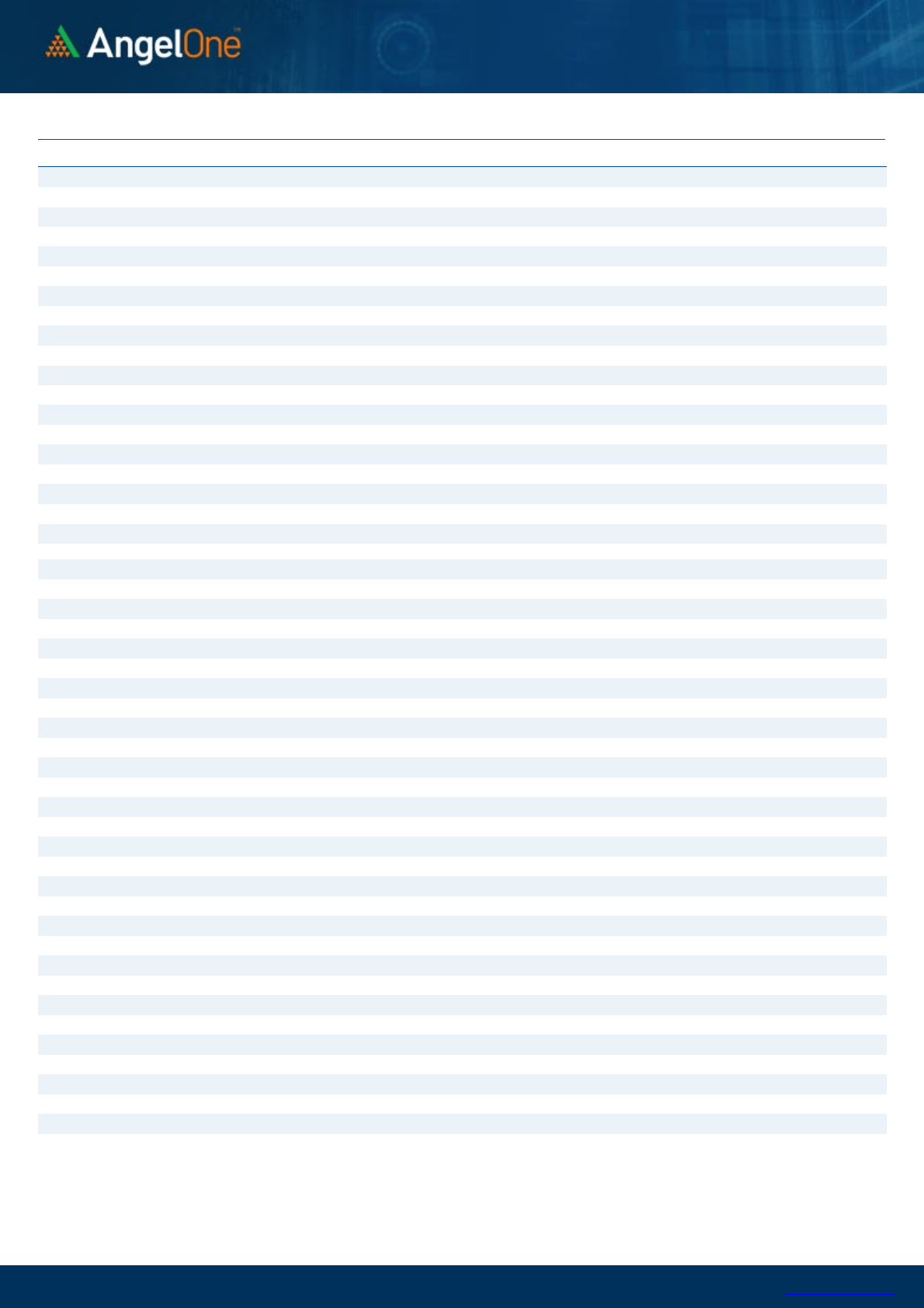

Nifty Vs OI

17200

17400

17600

17800

18000

18200

18400

18600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

10-13 10-18 10-20 10-22 10-26 10-28 11-1 11-3 11-5

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BRITANNIA

1409400 30.28 3621.60 -3.01

M&M

13827100 20.37 892.15 4.09

TVSMOTOR

8015000 18.87 731.45 2.31

RBLBANK

31943500 15.91 217.25 6.48

IBULHSGFIN

37361200 13.85 243.65 4.57

PFC

43691400 10.56 139.05 -1.39

INDIAMART

310575 10.52 7212.40 0.57

BOSCHLTD

162550 10.17 18762.10 3.05

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ULTRACEMCO

1699500 -6.64 8165.95 -0.65

VOLTAS

2201500 -5.72 1252.00 1.01

ADANIENT

24591500 -5.65 1635.45 4.52

SBILIFE

7216500 -5.36 1207.25 0.57

PFIZER

202875 -4.92 5240.55 -0.20

SUNTV

13939500 -4.91 581.10 0.56

ABFRL

11086400 -4.80 305.75 5.86

SRTRANSFIN

3120800 -4.68 1616.00 -2.59

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.96 0.90

BANKNIFTY

0.64 0.95

RELIANCE

0.42 0.33

ICICIBANK

0.43 0.38

INFY

0.46 0.31

Historical Volatility

SCRIP HV

ABFRL

50.55

RBLBANK

63.31

ESCORTS

45.69

POLYCAB

42.27

M&M

41.13

www.angelone.in

Technical & Derivatives Report

November 10, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (November Series) are given as an information and not as a recommendation.

Nifty Spot = 180

44.25

FII Statistics for November 09, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2411.50 5033.05 (2621.55) 147027 13648.94 (8.79)

INDEX

OPTIONS

356755.31 354363.95 2391.36

1388780 128195.40 0.78

297314.41

STOCK

FUTURES

14828.24 15676.98 (848.74) 1754006 132414.45 (0.17)

STOCK

OPTIONS

16524.55 16674.36 (149.81) 290519 22816.35 7.18

Total

390519.60

391748.34

(1228.74) 3580332

297075.14

0.37

43446.77

Turnover on November 09, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

242849 22790.04 -38.29

Index Options

47454028 4522043.18 -14.33

Stock Futures

871704 70761.21 -5.55

Stock Options

2695066 225099.61 1.26

Total

5,12,63,647

4840694.04 -13.75

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18100 204.55

45.15 54.85 18145.15

Sell

18200 159.40

Buy

18100 204.55

82.10 117.90 18182.10

Sell

18300 122.45

Buy

18200 159.40

36.95 63.05 18236.95

Sell

18300 122.45

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

18100 229.35

46.00 54.00 18054.00

Sell

18000 183.35

Buy

18100 229.35

84.40 115.60 18015.60

Sell

17900 144.95

Buy

18000 183.35

38.40 61.60 17961.60

Sell

17900 144.95

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

November 10, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 720 729

737 745 753

ASIANPAINT 3,105 3,125

3,140 3,160 3,175

AXISBANK 737 741

747 752 758

BAJAJ-AUTO 3,731 3,763

3,804 3,836 3,877

BAJFINANCE 7,423 7,500

7,627 7,705 7,832

BAJAJFINSV 17,848 18,010

18,243 18,405 18,638

BPCL 424 427

430 433 436

BHARTIARTL 700 707

712 718 723

BRITANNIA 3,495 3,558

3,599 3,662 3,702

CIPLA 901 908

916 923 932

COALINDIA 168 169

171 172 174

DIVISLAB 4,809 4,880

4,987 5,058 5,164

DRREDDY 4,741 4,767

4,801 4,826 4,861

EICHERMOT 2,680 2,702

2,723 2,745 2,766

GRASIM 1,833 1,848

1,864 1,880 1,895

HCLTECH 1,158 1,165

1,178 1,186 1,199

HDFCBANK 1,553 1,563

1,579 1,588 1,604

HDFCLIFE 694 700

705 711 716

HDFC 2,891 2,916

2,942 2,967 2,992

HEROMOTOCO 2,650 2,682

2,716 2,748 2,782

HINDALCO 454 459

468 473 482

HINDUNILVR 2,402 2,416

2,431 2,446 2,461

ICICIBANK 775 781

785 790 794

IOC 138 139

140 141 143

INDUSINDBK 1,049 1,059

1,072 1,081 1,094

INFY 1,716 1,729

1,740 1,753 1,764

ITC 226 227

229 230 232

JSW STEEL 665 671

681 687 697

KOTAKBANK 2,059 2,078

2,102 2,122 2,146

LT 1,912 1,928

1,946 1,962 1,980

M&M 844 868

887 911 930

MARUTI 7,401 7,489

7,627 7,715 7,853

NESTLEIND 18,685 18,813

18,929 19,057 19,173

NTPC 136 137

139 141 143

ONGC 153 155

157 158 160

POWERGRID 182 184

187 190 192

RELIANCE 2,471 2,496

2,513 2,538 2,554

SBILIFE 1,184 1,196

1,204 1,215 1,223

SHREECEM 28,772 29,001

29,380 29,609 29,989

SBIN 518 524

528 533 538

SUNPHARMA 788 795

803 810 818

TCS 3,473 3,489

3,512 3,528 3,551

TATACONSUM

819 827

834 843 850

TATAMOTORS 494 502

511 519 528

TATASTEEL 1,310 1,323

1,342 1,355 1,373

TECHM 1,542 1,551

1,561 1,570 1,580

TITAN 2,463 2,488

2,516 2,540 2,568

ULTRACEMCO 8,076 8,121

8,188 8,233 8,300

UPL 737 742

747 752 758

WIPRO 651 655

660 664 670

www.angelone.in

Technical & Derivatives Report

November 10, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in