Aug 10, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

Nifty Bank Outlook (38237)

On Monday, Bank Nifty started on a flat note that was followed by an

immediate dip; this dip however got bought into as there was strong

positive traction seen in heavyweight private banks. The positive

momentum continued throughout the session, to eventually end with

gains of 0.84% at 38237.

The last few sessions were very tiring for the bulls if we consider it

from the banking space point of view and on Monday as well,

initially, there was weakness following the sell-off in PSU heavyweight

SBIN however this was compensated by the rally in the private bank

space. Now, bulls seem to be back in action with the recent congestion

zone being broken on the higher side. However, one should avoid

being complacent as the indicators are in a deep overbought zone and

we have approached the supply zone from where we had seen a sharp

sell-off in April month. The resistance for this zone is between 38500

- 38760 and it would be crucial to see how markets react in this range.

On the flip side, 38000 - 37880 is the immediate support. We sense,

that traders should focus on a stock-specific approach that is likely to

give out performing opportunities on both sides of the trend.

Key Levels

Support 1 – 38000 Resistance 1 – 38500

Support 2 – 37880 Resistance 2 – 38760

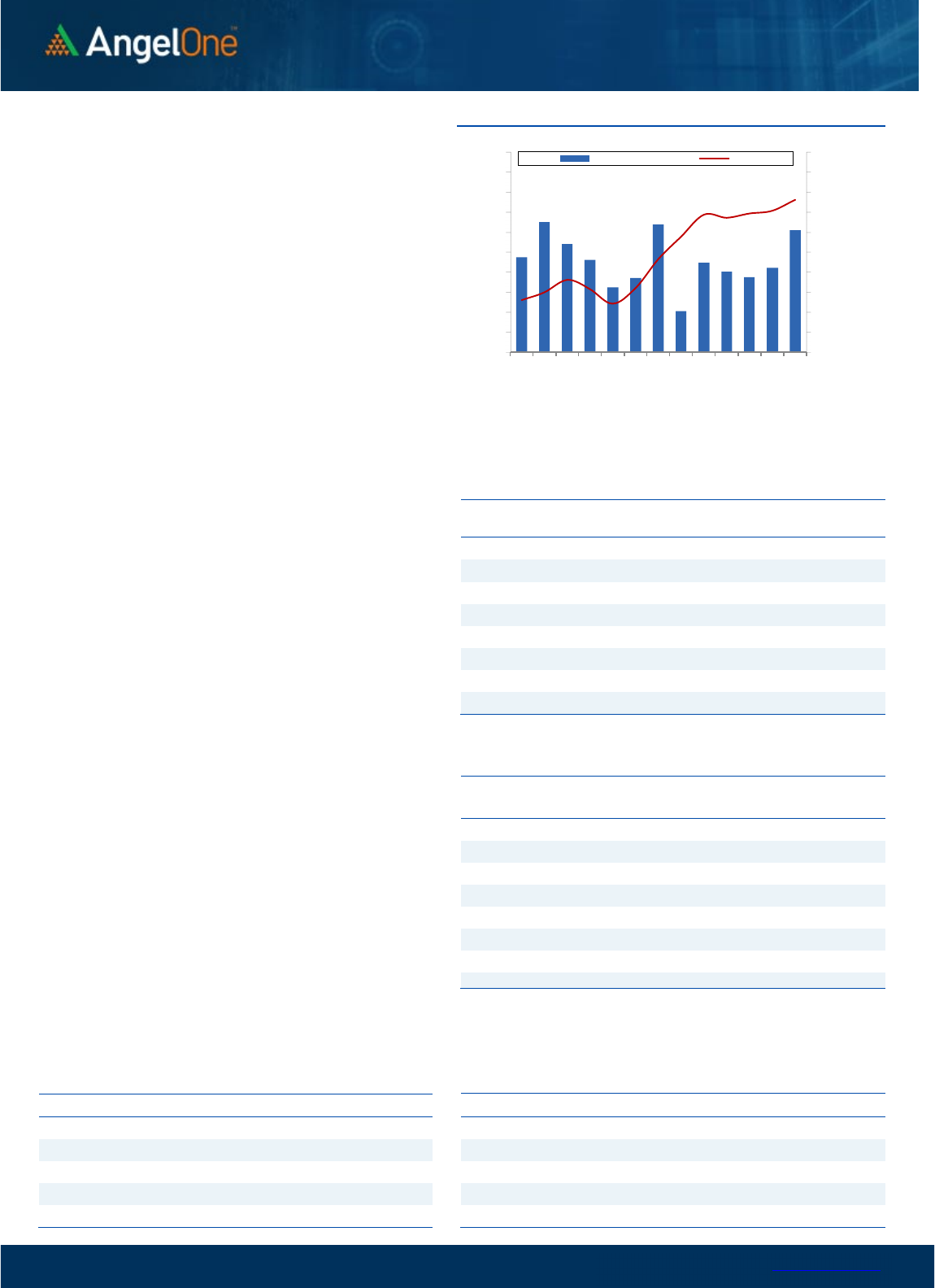

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (58853) / Nifty (17525)

The global cues were muted Monday morning and hence, our markets

too started the week on a flat note. After a small dip in the initial trades,

the buying resumed at lower levels. In fact, the momentum kept on

accelerating as the day progressed to close almost at the highest point

of the day. Eventually, the heavyweights led rally resulted in Nifty

reclaiming the 17500 mark on a closing basis, highest level since April

11.

Barring previous Monday, we witnessed some consolidation in the

following sessions. In fact, we had a reality test on Thursday to retest

sub-17200 levels. Fortunately, all declines were successfully bought

into and on Monday with the help of heavyweights chipping in, the

benchmark index Nifty managed to continue its northward trajectory.

The undertone is strongly bullish and now next level to watch out for is

17650. On the flipside, the immediate support is placed in the vicinity

of 17400 – 17350. Traders can continue with their buy on decline

strategy but one should avoid being complacent as a momentum

trader. Markets are continuing with their vertical move and in such

scenario, we do not get any swing lows which generally be referred as

strong base.

In such scenarios, ideally, previous day’s low should be considered a

key support on a closing basis. Till the time, it remains intact, one

should keep on riding the move. As we alluded to in the above

section, Monday’s rally was mainly propelled by the leaders and

midcaps were a bit quiet; but in our sense, midcaps would also

resume their buying momentum soon. Hence, one can keep focusing

on such potential movers going ahead.

Key Levels

Support 1 – 17400 Resistance 1 – 17600

Support 2 – 17350 Resistance 2 – 17650

www.angelone.in

Technical & Derivatives Report

Aug 10, 2022

View

We have witnessed a promising start of the

truncated week, wherein the benchmark index

Nifty50 reclaimed the 17500 with some authority.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1450 crores. Simultaneously, in Index

futures, they bought worth Rs. 138 crores with an

increase in open interest, indicating long formation.

Looking at the overall F&O data, we have witnessed

long addition in both indices at the start of the week.

On the options front, the major concentration of OI is

seen at 17400-17500 put strikes, which is likely to

cushion any correction in the near period. On the

contrary, 17600 call strike has seen piling up of OI

concentration followed by 17800 CE, which is likely to

act as immediate resistance for the index. Considering

the recent developments and price action, our market

is likely to remain upbeat, wherein any minor

correction could be utilized to add long positions. Also,

it is advisable to look for opportunities outside the

index and stay abreast with global developments.

Comments

The Nifty futures open interest has increased by

7.78%. and BANKNifty futures open interest has

increased by 12.36% as the market closed at 17525.10.

The Nifty Aug future closed with a premium of 32.65

point against a premium of 18.65 point in the last

trading session. The Sep series closed at a premium

of 95.30 point.

The INDIA VIX increased from 18.91 to 19.30. At the

same time, the PCR-OI of Nifty has increased from

1.05 to 1.30.

Few of the liquid counters where we have seen high

cost of carry are ALKEM, HAL, BALKRISIND, GAIL

and MANAPPURAM.

Historical Volatility

SCRIP HV

IDEA 85.20

IBULHSGFIN 76.16

RBLBANK 72.51

HINDCOPPER 66.07

ZEEL 65.93

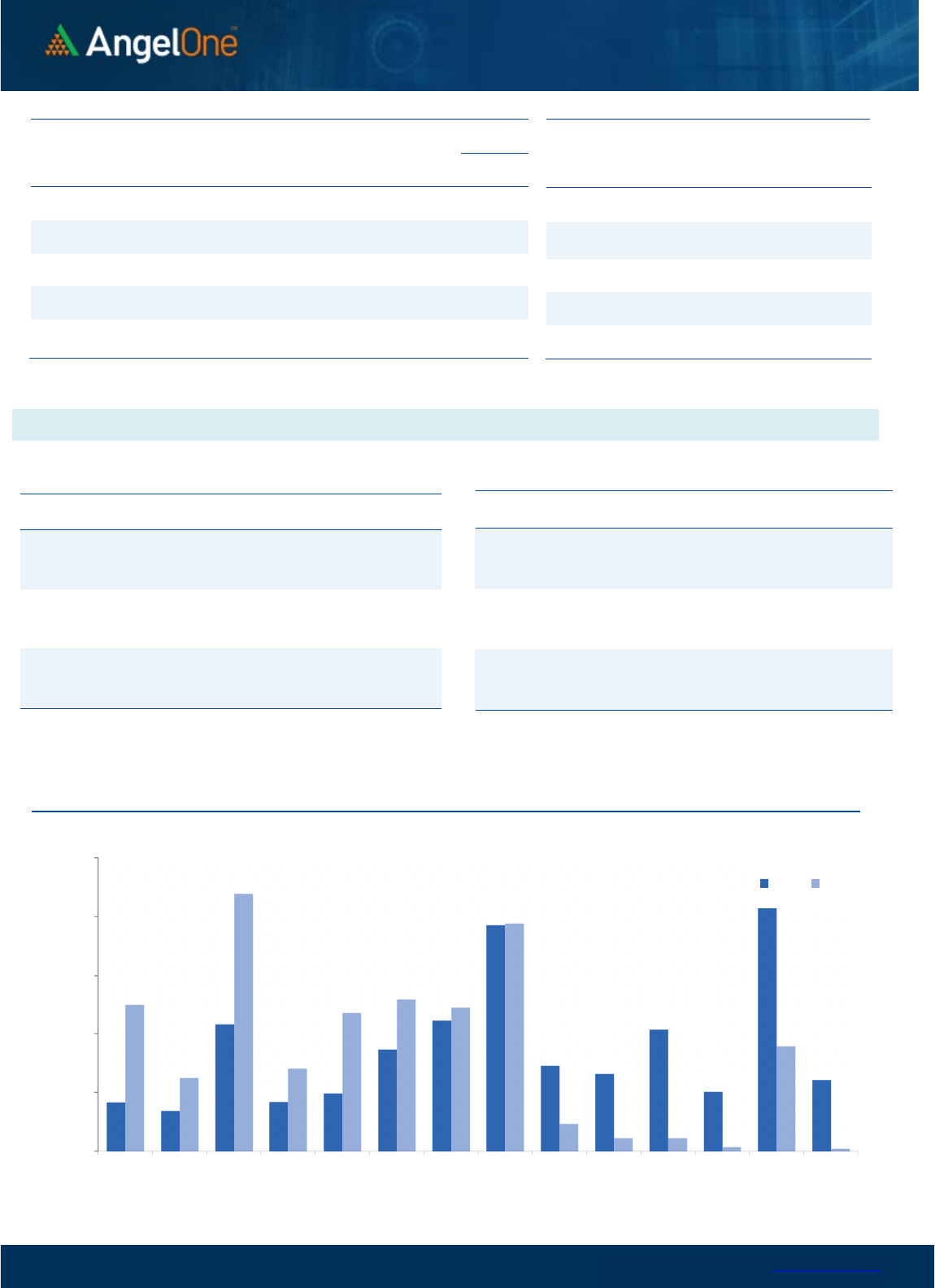

Nifty Vs OI

16000

16200

16400

16600

16800

17000

17200

17400

17600

17800

18000

10,000

10,500

11,000

11,500

12,000

12,500

13,000

13,500

14,000

14,500

15,000

7/20 7/22 7/26 7/28 8/1 8/4 8/8

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

HINDCOPPER 13695500 16.03 111.05 6.59

INDIACEM 11608700 14.83 195.80 2.46

ALKEM 486600 14.76 2984.45 -5.77

TATACHEM 5454000 10.09 957.00 0.91

COALINDIA 37304400 9.60 215.40 3.89

BALKRISIND 2007900 8.21 2149.95 -0.59

AMARAJABAT 6711000 6.20 510.45 1.11

INDHOTEL 26891092 5.72 270.85 0.61

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

HINDPETRO 20552400 -12.24 239.05 -4.62

INDIAMART 263850 -8.43 4489.55 -1.88

DRREDDY 2368125 -5.84 4223.30 1.36

NAM-INDIA 2360000 -5.81 305.25 1.35

BALRAMCHIN 10081600 -5.55 352.50 0.64

VOLTAS 4028000 -5.28 982.30 1.42

MANAPPURAM 28032000 -4.85 107.70 -0.74

BAJAJ-AUTO 1855750 -4.77 4022.60 0.69

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.30 0.84

BANKNIFTY 1.21 0.85

RELIANCE 0.53 0.40

ICICIBANK 0.90 0.51

INFY 0.78 0.84

www.angelone.in

Technical & Derivatives Report

Aug 10, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

525

.

1

0

FII Statistics for

August

0

8

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2566.95 2429.15 137.80

156542 14185.58 7.42

INDEX

OPTIONS

698027.34 692697.28 5330.06

1272700 114241.91 20.68

STOCK

FUTURES

9758.31 9321.56 436.75

2145265 147413.09 (0.02)

STOCK

OPTIONS

7610.02 7768.78 (158.76) 121776 8558.80 6.13

Total 717962.62

712216.77

5745.85

3696283

284399.38

6.81

Turnover on

August

0

8

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

326393 29769.23 -11.36

Index Options

94868447 8530158.87 19.81

Stock Futures

734372 52622.99 -12.90

Stock Options

3003208 224816.70 -1.83

Total

30,03,208 224816.70 18.73

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 282.00

55.35

44.65

17555.35

Sell

17600 226.65

Buy

17500 282.00

104.95

95.05

17604.95

Sell

17700 177.05

Buy

17600 226.65

49.60 50.40 17649.60

Sell

17700 177.05

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17500 224.25

38.50

61.50

17461.50

Sell

17400 185.75

Buy 17500 224.25

70.90

129.10

17429.10

Sell 17300 153.35

Buy

17400 185.75

32.40 67.60 17367.60

Sell

17300 153.35

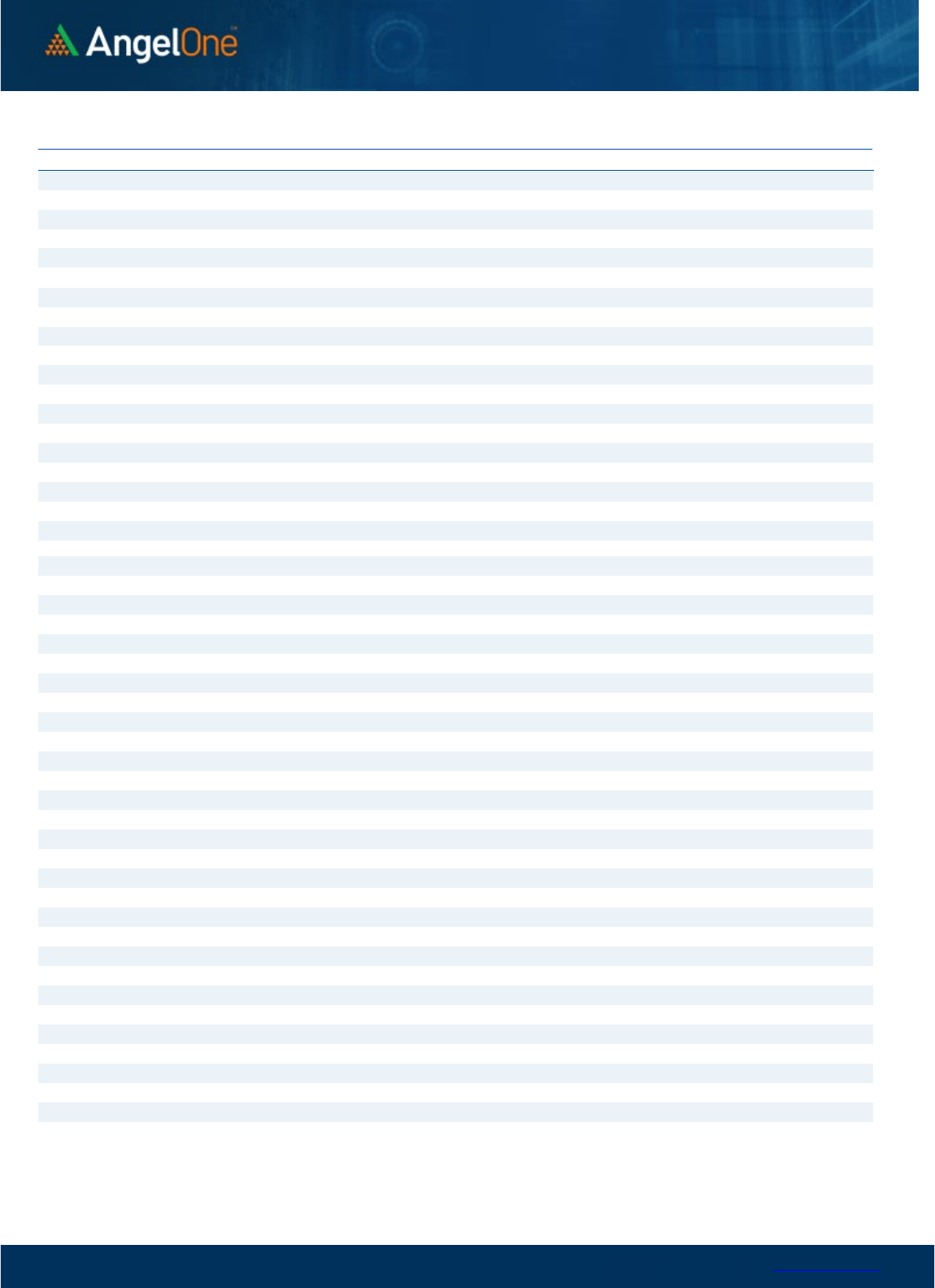

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 10, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS 779 790

807

818

834

APOLLOHOSP 4,333 4,380

4,427 4,475 4,522

ASIANPAINT

3,417

3,438

3,457 3,478

3,498

AXISBANK

721

733

740

753

760

BAJAJ-AUTO

3,981

4,002

4,021

4,042

4,061

BAJFINANCE

7,201

7,271

7,335 7,405

7,469

BAJAJFINSV

14,839

15,185

15,387

15,733

15,935

BPCL 315 321

325

330

335

BHARTIARTL

694

699

704

710

715

BRITANNIA 3,560 3,596

3,649 3,685 3,738

CIPLA 1,016 1,023

1,031

1,038

1,046

COALINDIA

204

210

213

219

222

DIVISLAB 3,847 3,892

3,921

3,966

3,995

DRREDDY

4,128

4,175

4,205 4,253

4,282

EICHERMOT 3,038 3,078

3,111

3,151

3,184

GRASIM

1,575

1,587

1,597

1,609

1,619

HCLTECH

943

955

961

973

979

HDFCBANK 1,414 1,438

1,451

1,475

1,489

HDFCLIFE 531 534

539

542

546

HDFC

2,319

2,357

2,379

2,416 2,439

HEROMOTOCO

2,690

2,714

2,754

2,778

2,817

HINDALCO

411

416

419 425

428

HINDUNILVR

2,613

2,632

2,645 2,664

2,677

ICICIBANK

826

831

837

842

848

INDUSINDBK

1,023

1,037

1,047

1,061

1,071

INFY

1,586

1,603

1,612 1,629

1,638

ITC

308

311

312

315

316

JSW STEEL

656

662

669

676

683

KOTAKBANK

1,804

1,824

1,837

1,857

1,870

LT

1,776

1,803

1,817

1,844

1,859

M&M

1,229

1,253

1,266

1,290

1,304

MARUTI 8,763 8,843

8,920 9,000

9,077

NESTLEIND

19,293

19,473

19,730

19,910

20,167

NTPC 153 156

158 161

163

ONGC 134 135

136

138

139

POWERGRID 218 220

223

225

228

RELIANCE 2,508 2,538

2,561

2,590

2,613

SBILIFE

1,243

1,257

1,265

1,278

1,286

SHREECEM

20,888

21,042

21,157

21,311

21,426

SBIN

509

515

519

525

530

SUNPHARMA

901

906

913

917

924

TCS 3,320 3,347

3,363

3,390

3,406

TATACONSUM

775 782

788

795 801

TATAMOTORS 461 465

468

472

476

TATASTEEL

106

107

107

108

109

TECHM 1,041 1,049

1,057

1,065

1,073

TITAN

2,410

2,429

2,452 2,470 2,493

ULTRACEMCO

6,572

6,625

6,700

6,753

6,828

UPL

731

740

746

755

761

WIPRO

430

433

438

441

446

www.angelone.in

Technical & Derivatives Report

Aug 10, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.