September 09, 2021

www.angelone.in

Technical & Derivatives Report

Exhibit 1: Nifty Daily Chart

Nifty Bank Outlook - (36768)

Bank Nifty yesterday started on a flat note and then an intraday dip

was seen along with the benchmark index. However in the

penultimate hour the bank index sharply bounced back to eventually

end with gains of 0.82% at 36768.

Yesterday, Bank Nifty outperformed and came as a saviour when

things started looking bleak for the markets. It helped benchmark

Index to bounce from intraday dips and it would be crucial to see if it

continues with its outperformance. For the weekly expiry, Bank Nifty

seems to have resistance around the 37000 levels and if it sustains

above the same we may see further leg of upmove whereas on the

flip side, 36400 - 36300 remain a key support to watch. Traders are

advised to keep a tab on these levels and trade accordingly.

Key Levels

Support 1 – 36400

Resistance 1 – 37000

Support 2 – 36300

Resistance 2 – 37200

Exhibit 2: Nifty Bank Daily Chart

Sensex (58250) / Nifty (17353)

We had a flat opening yesterday in line with quiet global cues. However

the intraday movement was exactly a replica of Tuesday’s session. After

consolidating above 17350 throughout the first half, the index suddenly

started correcting post the mid session and within no time, it tested the

17250 mark. Once again the mighty bears came for a rescue and lifted

the benchmark to a comfortable position.

The benchmark index Nifty looks a bit uncomfortable around 17400 but

the moment it falls by nearly a percent, the buying tends to happen

immediately. So ideally both counterparties are trying to show their

presence. As of now, clearly bulls are having a firm grip on the market

but as we have been mentioning since a week or so, they would find a

bit difficult now going ahead. With a short term view, we remain

cautious and advise traders booking profits in the rally. As far as levels

are concerned, 17400 - 17450 remains to a sturdy wall; whereas on the

flipside, 17300 - 17250 are the levels to watch on a closing basis.

Key Levels

Support 1 – 17300

Resistance 1 – 17450

Support 2 – 17250

Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

September 09, 2021

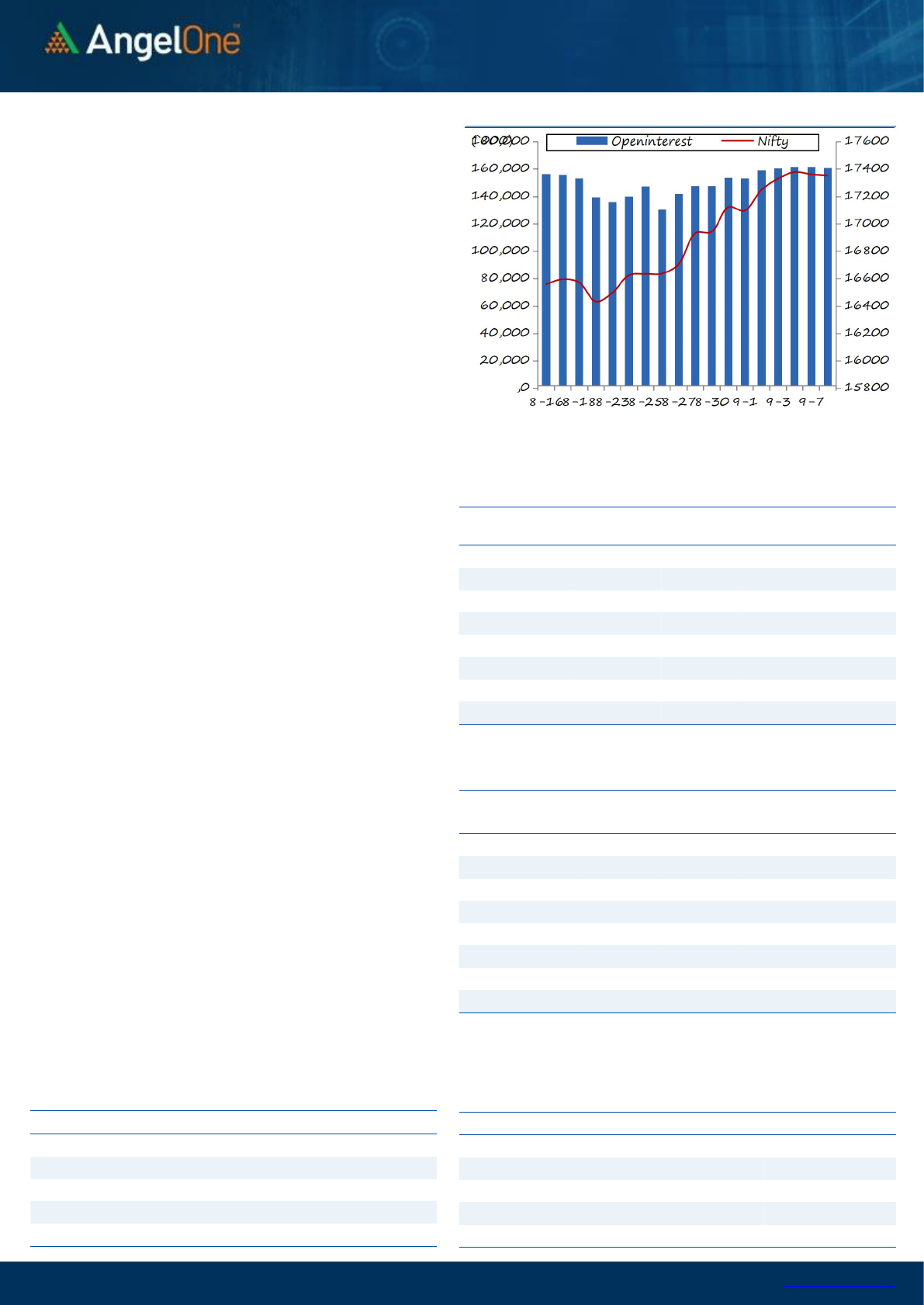

Nifty Vs OI

View

Nifty started this week on a positive note and has

consolidated within a slender range with some hint of

profit booking being witnessed whenever it approached

the zone of 17400 - 17450. However on the flipside, the

buying interest was clearly visible on all intraday

declines towards 17300.

FIIs were net sellers in cash market segment to the tune

of Rs. 803 crores. In index futures, they bought

marginally to the tune of Rs. 44 crores with increase in

open interest.

There is not much change in open interest in Nifty but

long unwinding was observed in the Bank Nifty on

Tuesday. However, the banking index showed some

encouraging signs on Wednesday. It is very close to its

resistance of 37000 where highest open interest in call

option is seen. So if this index surpasses the 37000 mark

and the call writers unwind their positions, then the

outperformance could continue in this space. In Nifty

options, 17400 and 17500 calls have a good amount of

open interest, whille 17300 and 17200 puts also have

seen decent build up. Looking at the data, we advise

traders to lighten up their longs in Nifty on pullback and

trade with a stock specific approach.

Comments

The Nifty futures open interest has decreased by 0.61%.

Bank Nifty futures open interest has decreased by 1.26%

as market closed at 17353.50 levels.

The Nifty September future closed with a premium of

17.4 point against a premium of 13.7 point in last

trading session. The October series closed at a premium

of 43.45 point.

The INDIA VIX decreased from 14.90 to 14.41. At the

same time, the PCR-OI of Nifty has decreased from 1.20

to 1.17.

Few of the liquid counters where we have seen high cost

of carry are IDEA, INDHOTEL, HDFCAMC, NESTLEIND,

AND ICICIGI

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

TRENT

2022750

36.16

1034.00

3.59

NAUKRI

1183625

17.38

6715.45

8.49

NAM-INDIA

4067200

17.20

435.80

4.08

HDFCAMC

1394200

17.06

3267.60

5.00

INDIAMART

274800

14.43

8999.35

2.78

IRCTC

2393300

12.86

3296.10

0.24

CANFINHOME

3193125

12.08

639.90

3.82

OFSS

365250

11.02

4711.20

-0.43

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

VOLTAS

2943500

-5.17

1206.60

1.59

FEDERALBNK

79660000

-4.56

83.10

1.95

ICICIPRULI

6859500

-4.03

717.15

2.32

UBL

1489600

-3.71

1592.60

#N/A

TCS

9604800

-3.70

3774.15

-1.05

METROPOLIS

325600

-3.55

2929.20

1.83

NATIONALUM

115090000

-3.48

96.40

0.00

BHARTIARTL

73042311

-3.45

667.85

-0.33

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.17

0.95

BANKNIFTY

0.94

0.89

RELIANCE

0.55

0.51

ICICIBANK

0.50

0.43

INFY

0.53

0.48

Historical Volatility

SCRIP

HV

NAUKRI

51.05

HDFCAMC

38.25

RECLTD

43.84

NESTLEIND

29.86

PFC

44.39

www.angelone.in

Technical & Derivatives Report

September 09, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17353.50

FII Statistics for September 08, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2979.84

2935.36

44.48

171188

15031.41

0.72

INDEX

OPTIONS

435752.11

445522.03

(9769.92)

1490356

131216.42

(7.08)

STOCK

FUTURES

11944.54

12897.99

(953.45)

1448361

123757.94

0.05

STOCK

OPTIONS

15819.37

16263.39

(444.02)

262638

22277.69

5.86

Total

466495.86

477618.77

(11122.91)

3372543

292283.46

(2.80)

Turnover on September 08, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

2,55,394

22848.59

-21.65

Index Options

6,69,25,521

60,07,775.91

17.02

Stock Futures

6,68,388

56061.34

-5.83

Stock Options

24,82,401

2,16,983.00

-10.31

Total

7,03,31,704

63,03,668.84

15.35

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

182.95

46.05

53.95

17446.05

Sell

17500

136.90

Buy

17400

182.95

82.65

117.35

17482.65

Sell

17600

100.30

Buy

17500

136.90

36.60

63.40

17536.60

Sell

17600

100.30

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

217.10

46.55

53.45

17353.45

Sell

17300

170.55

Buy

17400

217.10

82.30

117.70

17317.70

Sell

17200

134.80

Buy

17300

170.55

35.75

64.25

17264.25

Sell

17200

134.80

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 09, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

731

739

746

754

761

ASIANPAINT

3,267

3,302

3,332

3,366

3,396

AXISBANK

777

786

792

800

806

BAJAJ-AUTO

3,686

3,706

3,738

3,757

3,789

BAJFINANCE

7,360

7,412

7,463

7,514

7,566

BAJAJFINSV

16,300

16,430

16,660

16,790

17,020

BPCL

477

483

488

494

499

BHARTIARTL

653

661

672

679

691

BRITANNIA

3,983

4,022

4,055

4,094

4,127

CIPLA

935

943

948

957

961

COALINDIA

145

147

148

151

152

DIVISLAB

4,944

5,014

5,119

5,189

5,294

DRREDDY

4,826

4,868

4,904

4,947

4,983

EICHERMOT

2,734

2,767

2,795

2,828

2,856

GRASIM

1,523

1,550

1,579

1,606

1,636

HCLTECH

1,158

1,174

1,182

1,198

1,206

HDFCBANK

1,559

1,568

1,574

1,583

1,589

HDFCLIFE

728

736

742

749

755

HDFC

2,778

2,804

2,828

2,853

2,878

HEROMOTOCO

2,766

2,782

2,796

2,812

2,826

HINDALCO

448

452

459

463

470

HINDUNILVR

2,747

2,774

2,792

2,819

2,837

ICICIBANK

712

716

720

724

727

IOC

110

112

112

113

114

INDUSINDBK

975

987

1,005

1,017

1,034

INFY

1,674

1,684

1,692

1,702

1,710

ITC

208

210

211

213

215

JSW STEEL

677

682

687

692

697

KOTAKBANK

1,726

1,771

1,799

1,844

1,872

LT

1,636

1,651

1,673

1,688

1,710

M&M

745

750

754

759

763

MARUTI

6,696

6,739

6,799

6,841

6,901

NESTLEIND

19,307

19,573

20,052

20,318

20,797

NTPC

111

113

114

115

116

ONGC

117

118

119

120

121

POWERGRID

169

171

172

174

176

RELIANCE

2,383

2,407

2,431

2,455

2,478

SBILIFE

1,191

1,206

1,226

1,241

1,261

SHREECEM

30,045

30,420

30,675

31,050

31,305

SBIN

423

427

431

435

439

SUNPHARMA

758

768

773

783

789

TCS

3,723

3,748

3,782

3,807

3,841

TATACONSUM

846

863

872

889

898

TATAMOTORS

288

292

295

299

302

TATASTEEL

1,406

1,418

1,430

1,442

1,454

TECHM

1,408

1,418

1,430

1,440

1,453

TITAN

1,994

2,025

2,046

2,077

2,098

ULTRACEMCO

7,876

7,934

8,004

8,062

8,132

UPL

736

749

761

774

786

WIPRO

650

656

666

672

681

www.angelone.in

Technical & Derivatives Report

September 09, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.