March 09, 2023

www.angelone.in

Technical & Derivatives Report

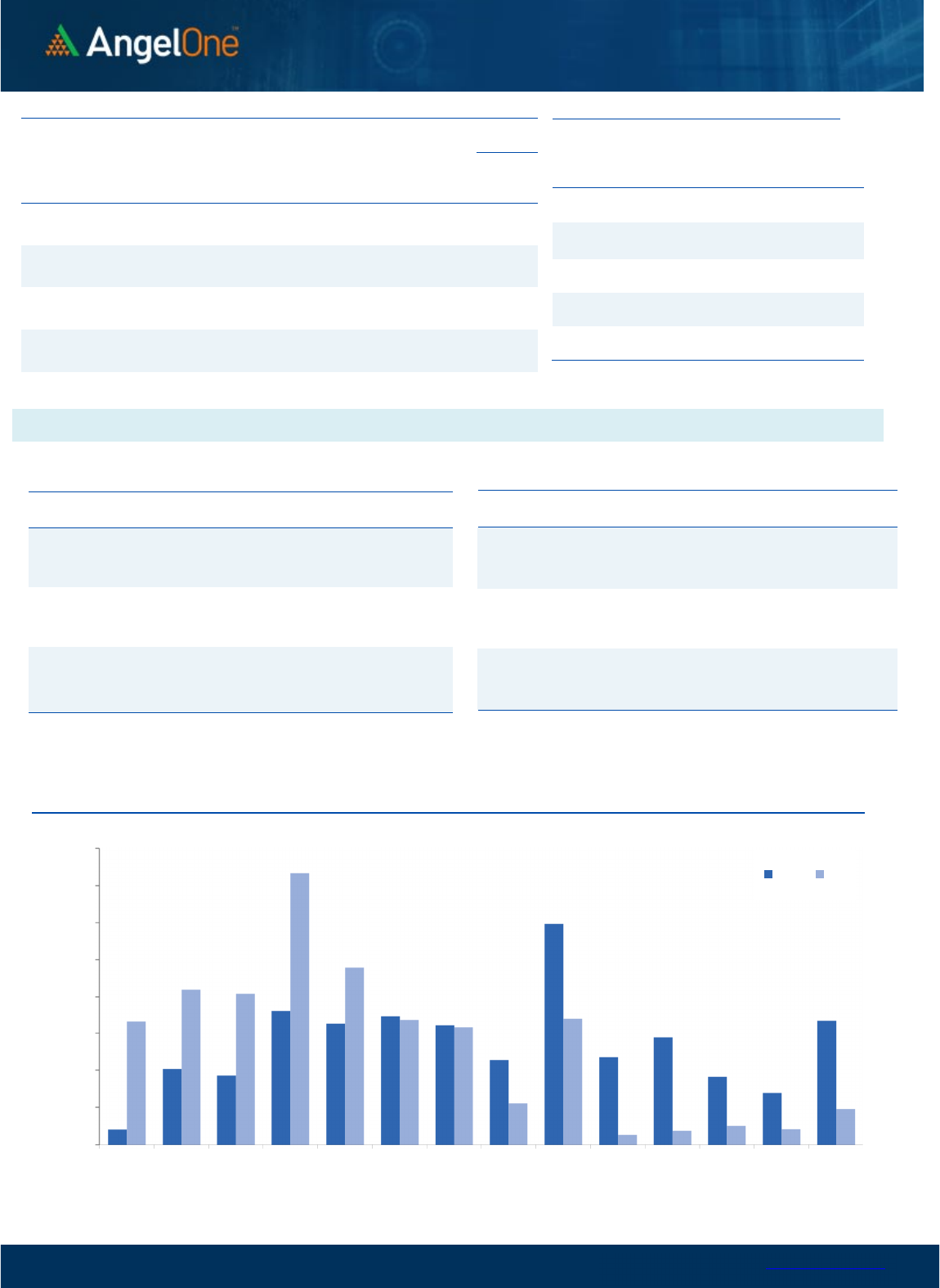

Nifty Bank

Outlook (

41

577

)

Post initial hiccups, the banking index stabilised and traded in a

range in the vicinity of 41200 for initial couple of hours. As we

progressed, fresh buying emerged around the mid-session to inch

higher towards 41600. The BankNifty outperformed the

benchmark index and concluded the day tad above 41500 with

gains of over half a percent.

The kind of recovery we witnessed was indeed remarkable

especially considering Monday’s profit booking and yesterday’s

weak start. Technically speaking, the banking index rebounded

precisely from the falling trendline support on the daily chart and

has also managed to close above the 89 EMA with authority. Going

ahead, 42000 remains the next important level to watch out for

and any sustainable move beyond same will certainly improve the

short to medium term chart structure. On the flip side, 41000-

41200 should now act as a strong demand zone for BankNifty.

Considering the above data points, we remain upbeat in this space

and would advocate ‘buy on dips’ strategy for same.

Key Levels

Support 1 – 41200 Resistance 1 – 41900

Support 2 – 41000 Resistance 2 – 42000

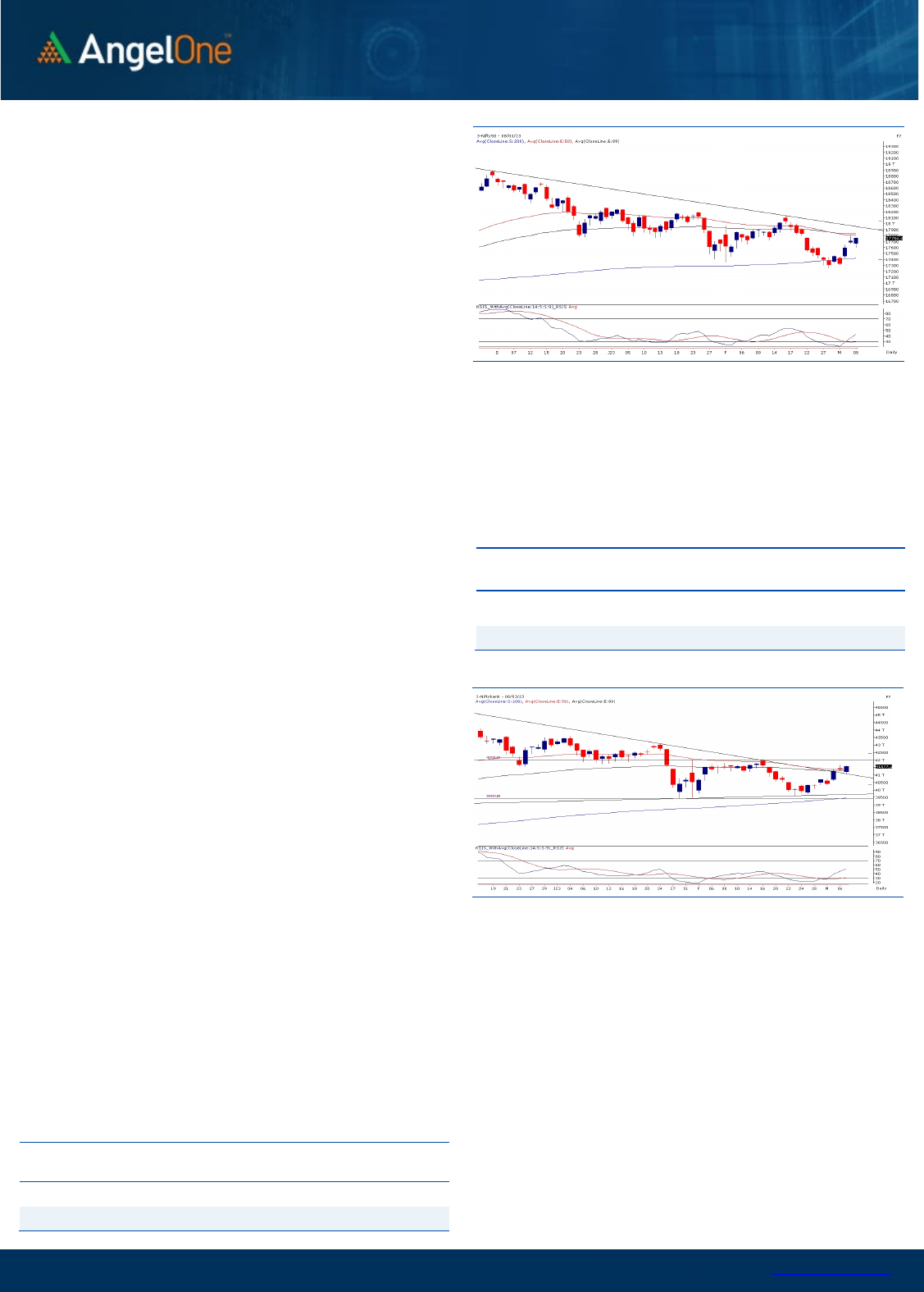

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

60

348

) / Nifty (

1

7

7

54

)

The US markets reacted negatively to the remark of the FED

Chairperson on the rate hikes and taking cues from there the SGX

Nifty indicated a weak opening. In line with this, our markets had a

gap-down opening however post the initial hiccup there was a

gradual bounce back to recover the lost ground. During the fag end

there was a strong positive traction that eventually resulted in Nifty

ending with gains of 0.24 tad above 17750.

Our markets outperformed as compared to the peers and the initial

dip getting bought into augurs well for the bulls. As highlighted in

our previous outlook, 17800 – 17850 is a key zone to watch out for

as it coincides with a 61.8% retracement level and 89EMA. However,

considering the broad-based buying and fag end surge we expect

the benchmark to surpass this level and head towards 18000 in the

coming sessions. On the flip side, even though the bullish gap left

on Monday got filled, it did its job of acting as a support, and going

ahead as well we continue to see 17600 – 17570 as strong support.

On the weekly expiry day, any dip toward this key level can be

considered a buying opportunity.

Even though there was no major change on the Index front, there

was a lot of action in the midcap counters. If we observe the Nifty

Midcap 100 index, it has broken above its recent swing high and

can be considered a technical bullish breakout. Going ahead, we

expect the midcap space to continue to outperform, and hence

traders are advised to focus on identifying apt themes that can

give mesmerizing moves in the near term.

Key Levels

Support 1 – 17600 Resistance 1 – 17850

Support 2 – 17570 Resistance 2 – 17930

www.angelone.in

Technical & Derivatives Report

March 09, 2023

View

Our market started the day on a bleak note which

augured well for the bulls and the benchmark index

made a modest recovery to not only trim down the

losses but eventually settled in green. Nifty

reclaimed the 17750 level, procuring 0.24 percent.

FIIs were net buyers in the cash market segment to

the tune of Rs. 3672 crores. Simultaneously, in Index

futures, they sold worth Rs. 577 crores with an

increase in open interest, indicating short addition.

Looking at the F&O data, there is no significant

change in the key indices ahead of the weekly expiry

session. On the options front, a considerable piling

up of position is seen at the 17600 put strike,

indicating strong support for Nifty. On the higher

end, the 17800-17900 call strikes have the maximum

OI concentration, indicating the immediate hurdles.

Meanwhile, the ‘Long Short Ratio’ has contracted a

bit to 25% from 26%. Considering the recent price

action, the undertone remains upbeat, wherein any

intraday dip could be utilized to add long in the index.

Comments

The Nifty futures open interest has increased by 4.21%

and Bank Nifty futures open interest has increased by

1.88% as the market closed at 17754.40.

The Nifty March future closed with a premium of 40.15

point against a premium of 63.50 point in the last

trading session. The April series closed at a premium of

139.85 point.

The INDIA VIX increased from 12.26 to 12.45. At the

same time, the PCR-OI of Nifty has increased from 1.12

to 1.26.

Few of the liquid counters where we have seen high

cost of carry are BALRAMCHIN, HAL, INDUSINDBK, PFC,

AND BOSCHLTD.

Historical Volatility

SCRIP HV

ADANIENT 94.60

IDEA 70.87

IBULHSGFIN 67.23

RBLBANK 63.63

ADANIPORTS 60.14

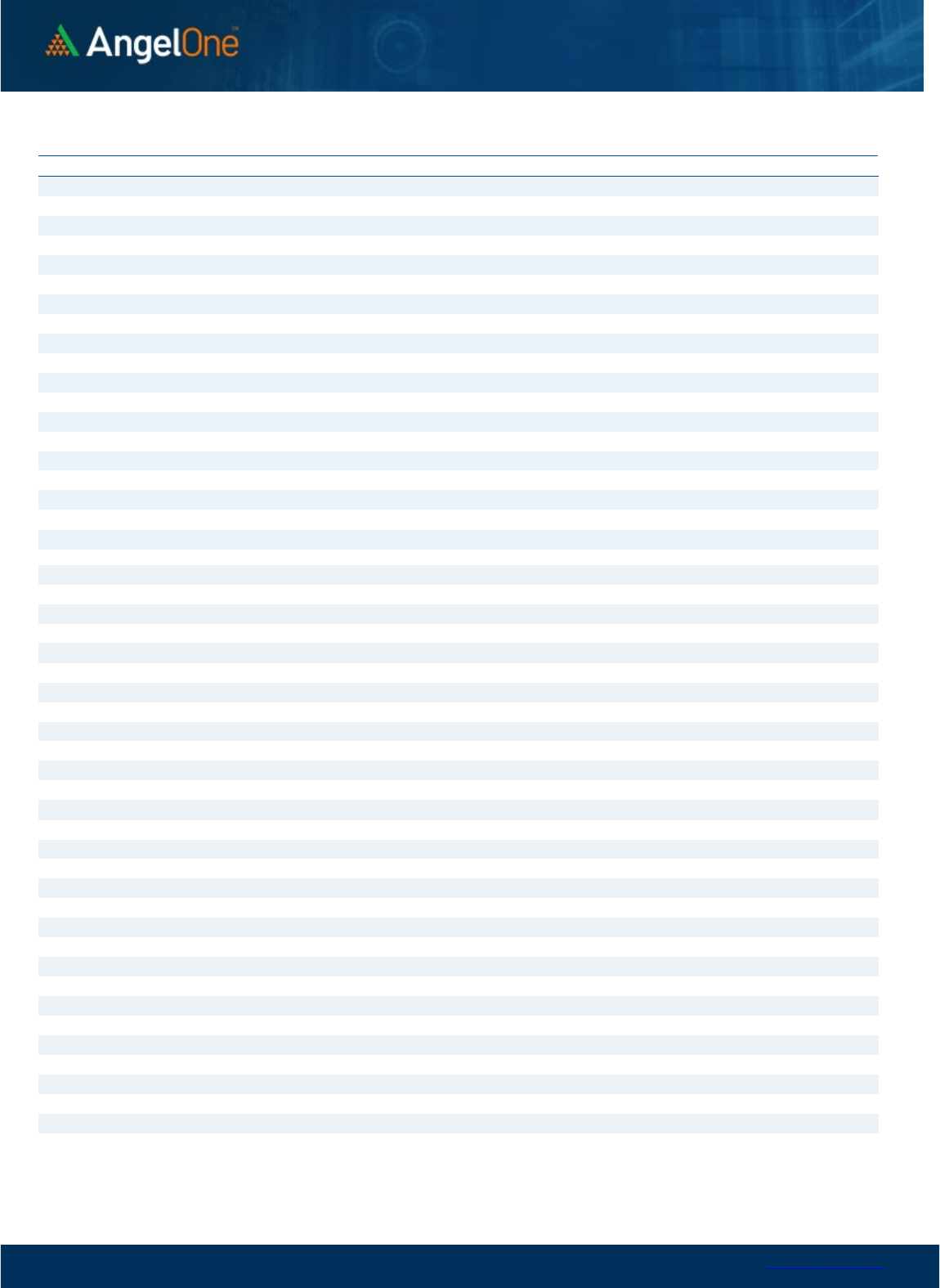

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/14 2/16 2/20 2/23 2/27 3/1 3/3 3/8

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BALRAMCHIN 9339200 64.10 400.35 6.85

HAL 3383100 11.64 2863.25 5.41

LT 8654100 8.89 2170.80 1.28

SUNPHARMA 17498600 8.85 957.50 -0.97

RECLTD 52104000 7.78 124.65 2.37

ICICIGI 3696225 7.65 1093.40 0.12

BOSCHLTD 157450 7.44 18724.40 3.24

RAMCOCEM 2869600 7.21 742.35 1.90

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

OFSS 299800 -4.70 3235.95 -0.02

ULTRACEMCO 1904800 -4.51 7267.25 0.66

FSL 14986400 -4.28 114.65 -0.95

HONAUT 23685 -4.07 35783.60 0.76

VOLTAS 5450400 -3.94 909.70 -0.17

NAVINFLUOR 414450 -3.90 4230.05 0.23

MGL 3043200 -3.53 987.25 -0.04

COFORGE 882000 -3.50 4279.65 -1.30

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.26 0.99

BANKNIFTY 1.27 0.88

RELIANCE 0.65 0.56

ICICIBANK 0.72 0.52

INFY 0.48 0.43

www.angelone.in

Technical & Derivatives Report

March 09, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

7

54

.

4

0

0900

Lot Size = 75

FII Statistics for

March 0

8

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

5207.90 5784.48 (576.58) 156800 14598.16 3.72

INDEX

OPTIONS

1332485.34 1327936.91 4548.43

2814683 263661.45 24.84

STOCK

FUTURES

8452.31 8334.20 118.11

2151475 144422.77 0.76

STOCK

OPTIONS

9310.45 9220.28 90.17

139591 9448.87 8.29

Total 1355456.00

1351275.87

4180.13

5262549

432131.25

12.69

Turnover

on

March

0

8

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

332940 32195.29

11.51

Index Options

189352781 46309.98

-7.43

Stock Futures

682752 45333.99

-10.93

Stock Options

2781216 3686.96 -30.98

Total

27,81,216 3686.96 -5.63

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17800 181.05

49.30

50.70

17849.30

Sell

17900 131.75

Buy

17800 181.05

88.90

111.10

17888.90

Sell

18000 92.15

Buy

17900 131.75

39.60 60.40 17939.60

Sell

18000 92.15

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17800 188.80

40.70

59.30

17759.30

Sell 17700 148.10

Buy 17800 188.80

72.10

127.90

17727.90

Sell

17600 116.70

Buy

17700 148.10

31.40 68.60 17668.60

Sell 17600 116.70

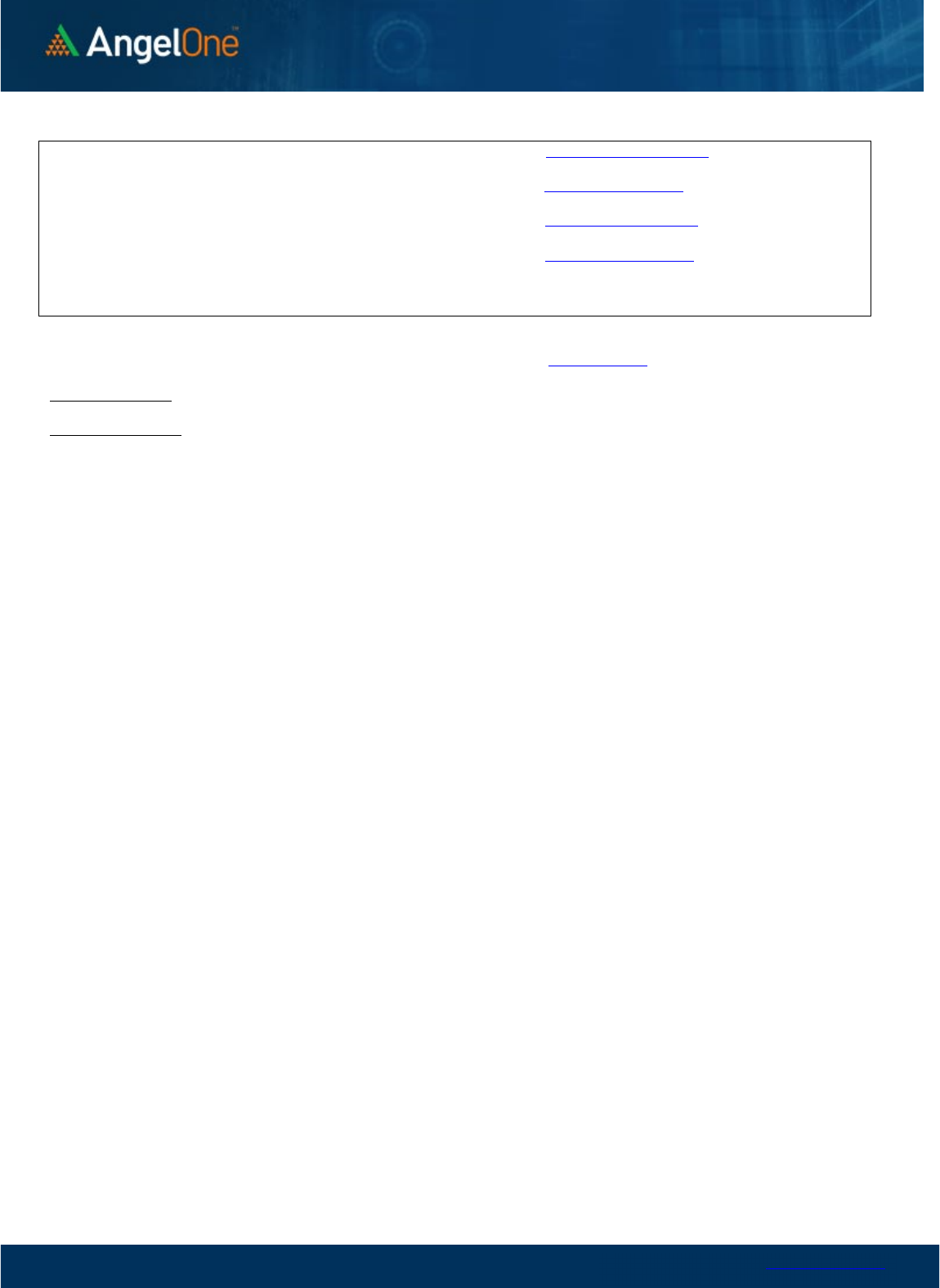

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400 18500

Call Put

www.angelone.in

Technical & Derivatives Report

March 09, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,876

1,958

2,023

2,105

2,170

ADANIPORTS 670 691

703

724

736

APOLLOHOSP

4,311

4,344

4,392

4,425

4,474

ASIANPAINT

2,809

2,834

2,852

2,877

2,895

AXISBANK 849 855

859

865

868

BAJAJ-AUTO

3,673

3,742

3,780

3,849

3,887

BAJFINANCE

5,893

5,945

6,037

6,089

6,181

BAJAJFINSV

1,348

1,365

1,374

1,390

1,400

BPCL 321 323

325

328

330

BHARTIARTL 757 762

766

771

775

BRITANNIA

4,274

4,307

4,338

4,371

4,403

CIPLA 865 871

877

884

890

COALINDIA 222 223

224

226

227

DIVISLAB

2,800

2,817

2,839

2,856

2,877

DRREDDY

4,381

4,404

4,424

4,446

4,467

EICHERMOT

3,127

3,166

3,189

3,227

3,250

GRASIM

1,587

1,594

1,602

1,608

1,616

HCLTECH

1,101

1,111

1,117

1,127

1,134

HDFCBANK

1,611

1,621

1,630

1,640

1,650

HDFCLIFE

485

490

493

498

502

HDFC

2,646

2,663

2,680

2,697

2,714

HEROMOTOCO

2,426

2,452

2,467

2,493

2,507

HINDALCO 391 399

405

413

418

HINDUNILVR

2,450

2,468

2,485

2,502

2,519

ICICIBANK 857 865

869

877

881

INDUSINDBK

1,079

1,127

1,153

1,200

1,226

INFY

1,475

1,484

1,490

1,499

1,505

ITC 382 387

390

395

398

JSW STEEL 659 667

672

680

685

KOTAKBANK

1,720

1,730

1,737

1,747

1,755

LT

2,118

2,144

2,167

2,193

2,216

M&M

1,246

1,268

1,280

1,302

1,314

MARUTI

8,570

8,632

8,672

8,734

8,774

NESTLEIND

18,320

18,419

18,497

18,596

18,673

NTPC 174 176

178

180

182

ONGC 155 157

158

159

160

POWERGRID 225 226

227

229

230

RELIANCE

2,373

2,395

2,407

2,429

2,441

SBILIFE

1,096

1,113

1,127

1,143

1,158

SBIN 553 559

562

568

571

SUNPHARMA 939 948

957

966

975

TCS

3,307

3,349

3,372

3,414

3,438

TATACONSUM

706 713

718

726

731

TATAMOTORS 434 437

439

442

444

TATASTEEL 103 105

106

108

109

TECHM

1,060

1,069

1,079

1,088

1,098

TITAN

2,361

2,379

2,390

2,408

2,419

ULTRACEMCO

7,150

7,209

7,246

7,305

7,342

UPL 697 707

712

722

728

WIPRO 387 390

391

394

396

www.angelone.in

Technical & Derivatives Report

March 09, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.