September 08, 2021

www.angelone.in

Technical & Derivatives Report

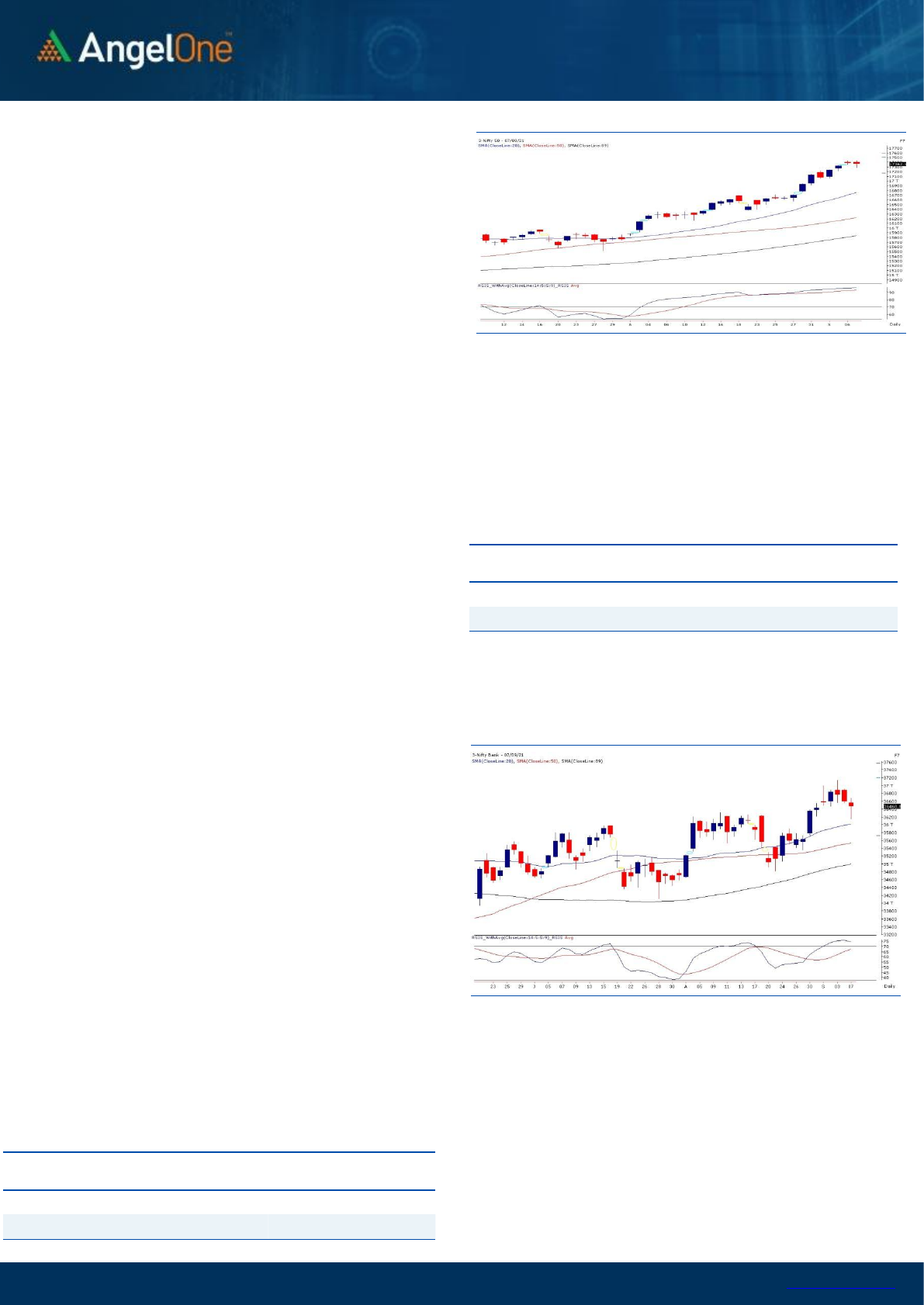

Exhibit 1: Nifty Daily Chart

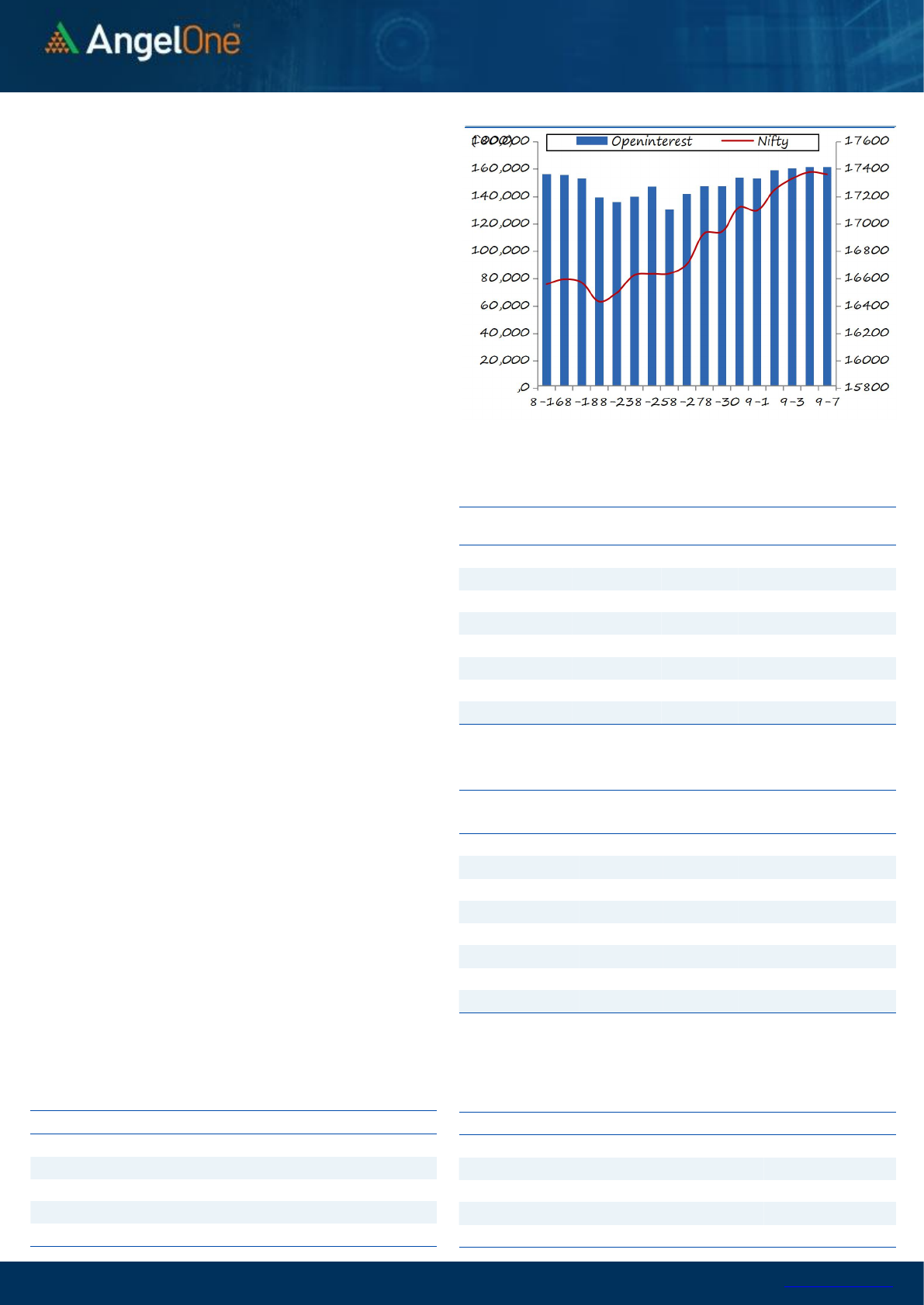

Nifty Bank Outlook - (36469)

We started-off the session slightly lower and then similar to previous

trading session saw selling pressure from the word go to tank below

36200. However, smart recovery from the subsequent hour followed

by one more round of profit resulted the bank index to conclude the

volatile day tad below 36500 with the loss of 0.34%.Throughout the

August series, the banking index struggle to surpass the sturdy wall

placed around 36200-36300 and yesterday this same levels acted as

a support zone. If we look at the hourly chart, the 89 EMA also

coincides with the above mentioned levels and considering the

recovery seen it has certainly gained more importance. Going ahead,

until we manage to sustain above 36000-36200 on the closing basis

there isn’t anything to be worried above but any fall below this shall

be a sign of caution. On the higher side, 37000-37200 shall be

looked as strong resistance zone.

Key Levels

Support 1 – 36500

Resistance 1 – 37000

Support 2 – 36400

Resistance 2 – 37200

Exhibit 2: Nifty Bank Daily Chart

Going ahead, 17450 is to be seen as immediate hurdle and the

moment we close below 17300, we would see some immediate profit

booking in the market. Hence, traders are advised to stay light and

avoid taking aggressive bets for a while. Apart from the benchmark

index, the banking space continues to sulk; but yesterday surprisingly,

the IT basket was also applying some pressure, which could be the

space to watch going ahead.

Key Levels

Support 1 – 17300

Resistance 1 – 17450

Support 2 – 17200

Resistance 2 – 17500

Sensex (58279) / Nifty (17362)

The benchmark index started the session with marginal upside gap

precisely at 17400. However due to some profit booking in the initial

hours, Nifty came off sharply to slide tad below the 17300 mark.

Fortunately no further damage done as bulls once again defended the

key support and thereafter lifted the Nifty back above the 17400

terrain. Towards the end, sceptical traders used this bounce back to

lighten up longs, which resulted in a small decline to conclude the

session with a negligible loss.

We witnessed a see-saw like price movement during the session, but

the overall range was not very wide as index kept vacillating within the

boundaries of not even a percent. At the end, Nifty managed to close

slightly below 17400 with some hint of profit booking at higher levels.

Price-wise, there is no damage visible yet but we continue with our

cautious stance on the index. Also, in our previous commentary, we had

mentioned about Nifty confirming first sign of weakness if starts trading

below previous week’s high of 17340. Yesterday it did trade below this

point but rebounded sharply from the key support of 17300. In

practical terms, we reckon this development as good enough evidence

for early sign of weakness/ profit booking.

www.angelone.in

Technical & Derivatives Report

September 08, 2021

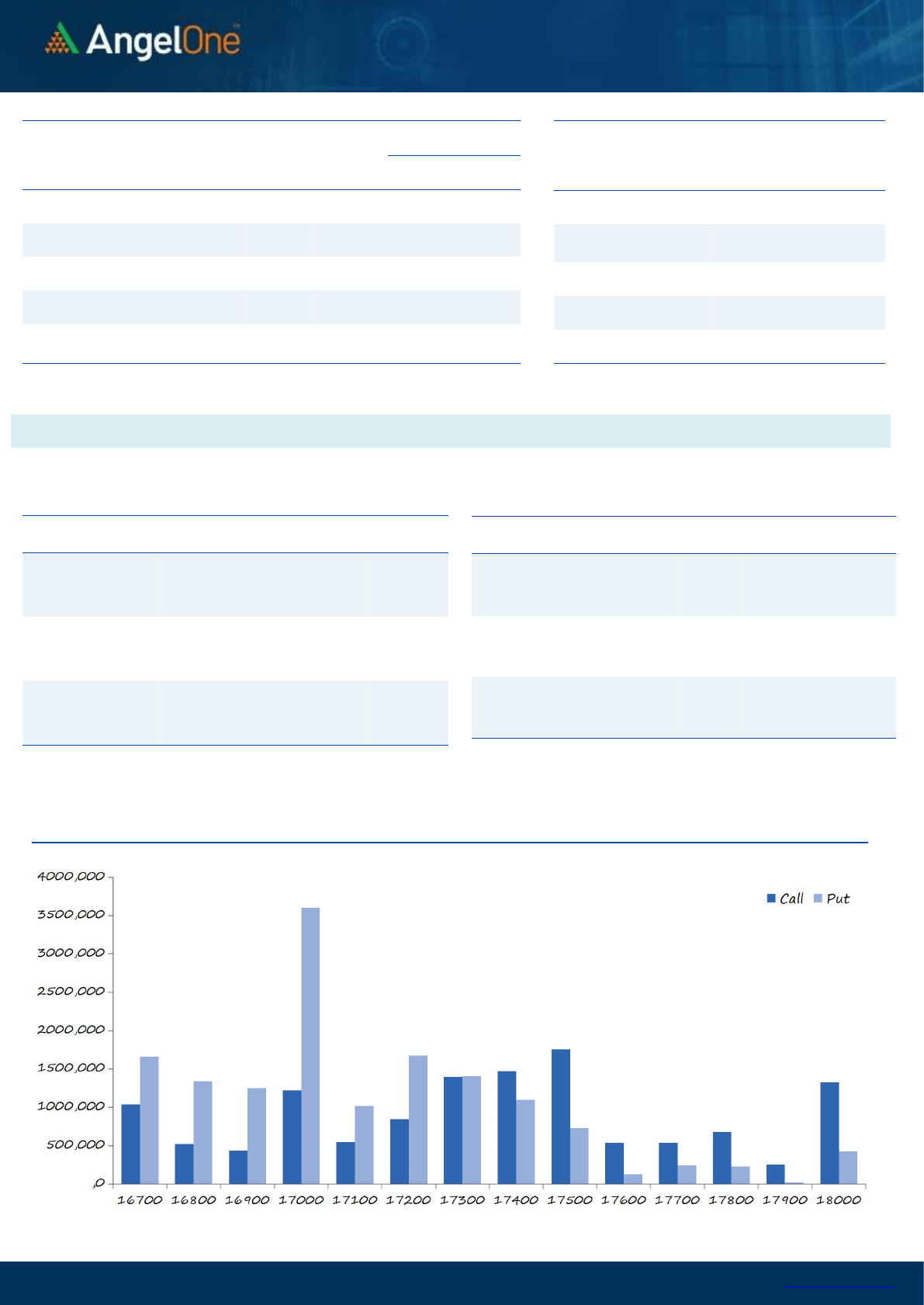

Nifty Vs OI

View

Nifty witnessed some volatile moves in yesterday's

session wherein the index corrected post opening and

entered sub 17300 zone. However, it immediately

witnessed buying interest around this support and

rallied to surpass 17400. It gave up the gains at the end

and closed with marginal loss around 17360.

FIIs were net sellers in cash market segment to the tune

of Rs. 145 crores. In index futures, they bought to the

tune of Rs. 433 crores with decrease in open interest

indicating short covering in yesterday’s session.

The intraday volatility did not lead to any change in

open interest in Nifty, but the Banking index shed open

interest by 9 percent which indicates long unwinding,

Recently, some hopes were built for an upmove in the

BankNifty as the short positions were not rolled over

over and fresh longs were seen post expiry. But as there

was no follow up move in prices, traders seem to be

unwinding their longs, leading to uncertainty over the

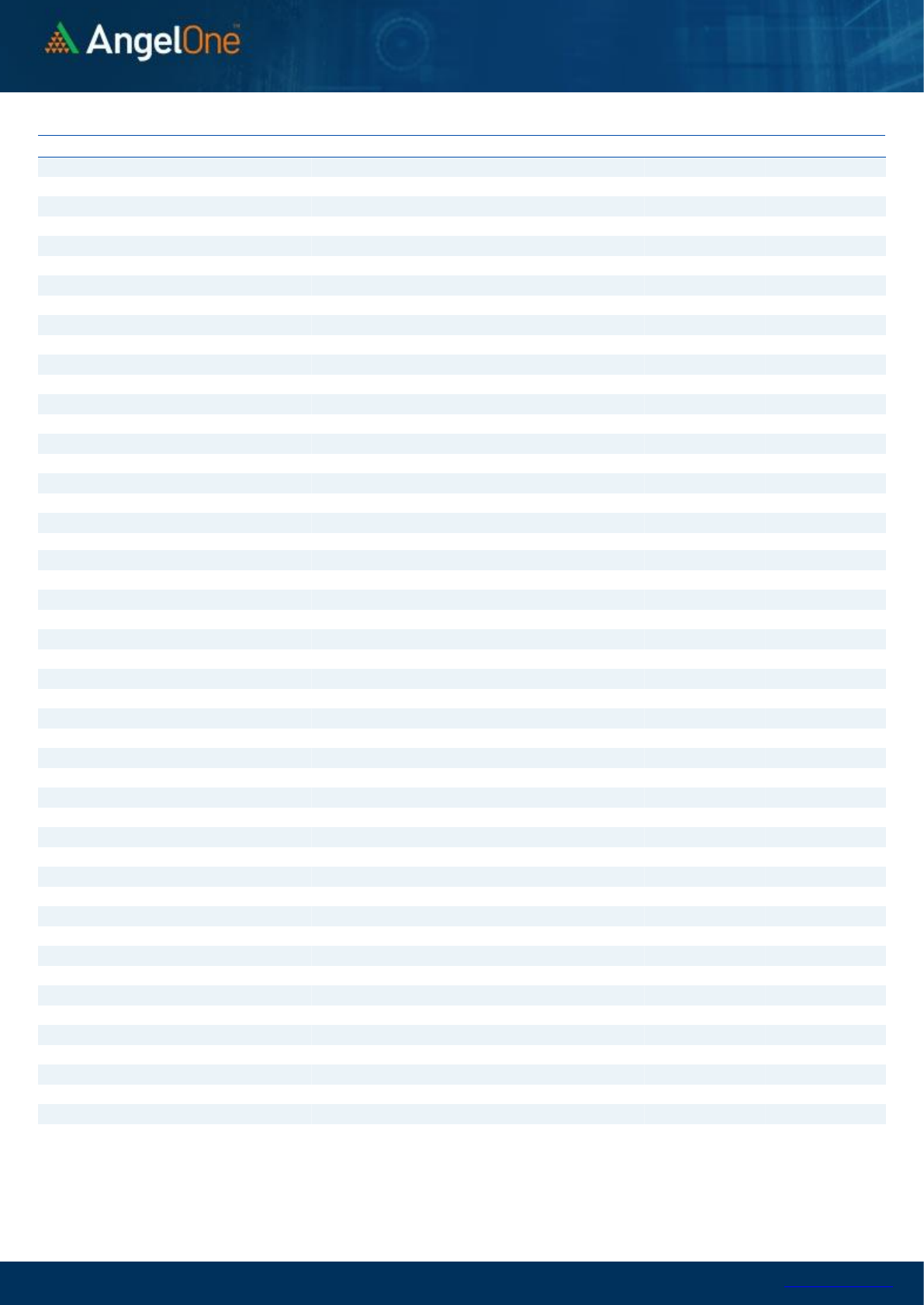

short term. In options segment, 17400 and 17500 calls

have decent positions indicating resistance zone. On the

flipside, 17300 is the immediate support and a breach

below the same could lead to profit booking in next

couple of sessions..

Comments

The Nifty futures open interest has decreased by 0.04%.

Bank Nifty futures open interest has decreased by 9.51%

as market closed at 17362.10 levels.

The Nifty September future closed with a premium of

13.7 point against a premium of 26.85 point in last

trading session. The October series closed at a premium

of 44.25 point.

The INDIA VIX increased from 14.05 to 14.90. At the

same time, the PCR-OI of Nifty has decreased from 1.29

to 1.20.

Few of the liquid counters where we have seen high cost

of carry are IDEA, INDIAMART, PEL, SIEMENS, AND

CANFINHOME

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CANFINHOME

2848950

44.15

615.70

3.91

POLYCAB

611700

33.79

2405.35

3.74

IDEA

732270000

24.23

8.25

14.38

IRCTC

2120625

14.15

3287.00

8.82

INDIAMART

240150

9.92

8752.45

-2.06

TATACONSUM

8715600

8.91

868.25

-0.25

MANAPPURAM

27240000

7.81

163.90

-2.40

GUJGASLTD

3387500

7.63

695.85

1.27

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

VOLTAS

3104000

-11.86

1187.25

5.64

NATIONALUM

119238000

-8.12

96.30

-2.95

NAM-INDIA

3470400

-7.27

420.05

-0.53

SUNPHARMA

31612000

-6.74

769.90

-1.84

DLF

38936700

-5.66

336.05

-3.08

HINDALCO

35907150

-4.96

462.30

-1.49

COFORGE

834200

-4.60

5179.45

-2.26

LTI

755850

-4.58

5404.70

-0.92

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.20

0.93

BANKNIFTY

0.69

0.89

RELIANCE

0.58

0.36

ICICIBANK

0.49

0.52

INFY

0.53

0.41

Historical Volatility

SCRIP

HV

IRCTC

47.81

VOLTAS

39.03

INDUSTOWER

56.27

IDEA

106.94

LICHSGFIN

50.10

www.angelone.in

Technical & Derivatives Report

September 08, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17362.10

FII Statistics for September 07, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

4316.03

3883.08

432.95

169964

14906.52

(7.10)

INDEX

OPTIONS

362079.02

360114.38

1964.64

1603879

141410.27

2.83

STOCK

FUTURES

12476.54

13567.58

(1091.04)

1447600

123793.90

(0.46)

STOCK

OPTIONS

18279.95

18309.58

(29.63)

248096

21108.63

5.50

Total

397151.54

395874.62

1276.92

3469539

301219.32

1.09

Turnover on September 07, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

3,26,765

29164.06

71.22

Index Options

5,71,27,063

51,34,177.72

61.00

Stock Futures

7,02,868

59529.20

3.24

Stock Options

27,52,542

2,41,919.47

1.33

Total

6,09,09,238

54,64,790.45

56.03

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

200.35

47.95

52.05

17447.95

Sell

17500

152.40

Buy

17400

200.35

86.05

113.95

17486.05

Sell

17600

114.30

Buy

17500

152.40

38.10

61.90

17538.10

Sell

17600

114.30

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

225.75

46.60

53.40

17353.40

Sell

17300

179.15

Buy

17400

225.75

82.50

117.50

17317.50

Sell

17200

143.25

Buy

17300

179.15

35.90

64.10

17264.10

Sell

17200

143.25

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 08, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

734

740

747

753

761

ASIANPAINT

3,281

3,309

3,352

3,379

3,422

AXISBANK

772

780

790

797

807

BAJAJ-AUTO

3,739

3,755

3,778

3,794

3,816

BAJFINANCE

7,318

7,388

7,477

7,547

7,636

BAJAJFINSV

16,472

16,627

16,786

16,940

17,099

BPCL

473

477

485

490

498

BHARTIARTL

634

652

666

685

699

BRITANNIA

4,052

4,074

4,102

4,123

4,151

CIPLA

937

944

951

957

964

COALINDIA

144

146

147

148

150

DIVISLAB

5,153

5,182

5,208

5,237

5,263

DRREDDY

4,823

4,860

4,893

4,930

4,963

EICHERMOT

2,762

2,793

2,836

2,867

2,910

GRASIM

1,499

1,527

1,542

1,570

1,586

HCLTECH

1,158

1,170

1,192

1,205

1,227

HDFCBANK

1,542

1,556

1,569

1,582

1,596

HDFCLIFE

723

729

736

742

749

HDFC

2,710

2,773

2,814

2,877

2,917

HEROMOTOCO

2,771

2,784

2,805

2,818

2,839

HINDALCO

454

458

465

470

477

HINDUNILVR

2,747

2,762

2,785

2,801

2,824

ICICIBANK

706

712

717

722

728

IOC

110

111

112

113

113

INDUSINDBK

971

986

999

1,014

1,027

INFY

1,684

1,695

1,715

1,726

1,746

ITC

208

210

212

214

216

JSW STEEL

673

678

688

694

703

KOTAKBANK

1,730

1,747

1,763

1,781

1,797

LT

1,663

1,672

1,689

1,698

1,714

M&M

743

748

753

759

764

MARUTI

6,811

6,844

6,887

6,920

6,963

NESTLEIND

20,083

20,226

20,309

20,452

20,536

NTPC

114

115

116

117

118

ONGC

118

119

121

122

124

POWERGRID

172

172

173

174

175

RELIANCE

2,391

2,416

2,437

2,462

2,483

SBILIFE

1,215

1,227

1,240

1,252

1,265

SHREECEM

29,983

30,318

30,596

30,931

31,208

SBIN

422

426

429

432

435

SUNPHARMA

757

763

773

780

790

TCS

3,770

3,793

3,831

3,854

3,893

TATACONSUM

850

859

874

883

898

TATAMOTORS

288

291

294

298

301

TATASTEEL

1,398

1,413

1,436

1,452

1,474

TECHM

1,406

1,421

1,447

1,461

1,487

TITAN

2,002

2,018

2,029

2,045

2,056

ULTRACEMCO

7,851

7,939

7,999

8,087

8,148

UPL

739

745

753

759

767

WIPRO

662

668

679

685

696

www.angelone.in

Technical & Derivatives Report

September 08, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.