Aug 08, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

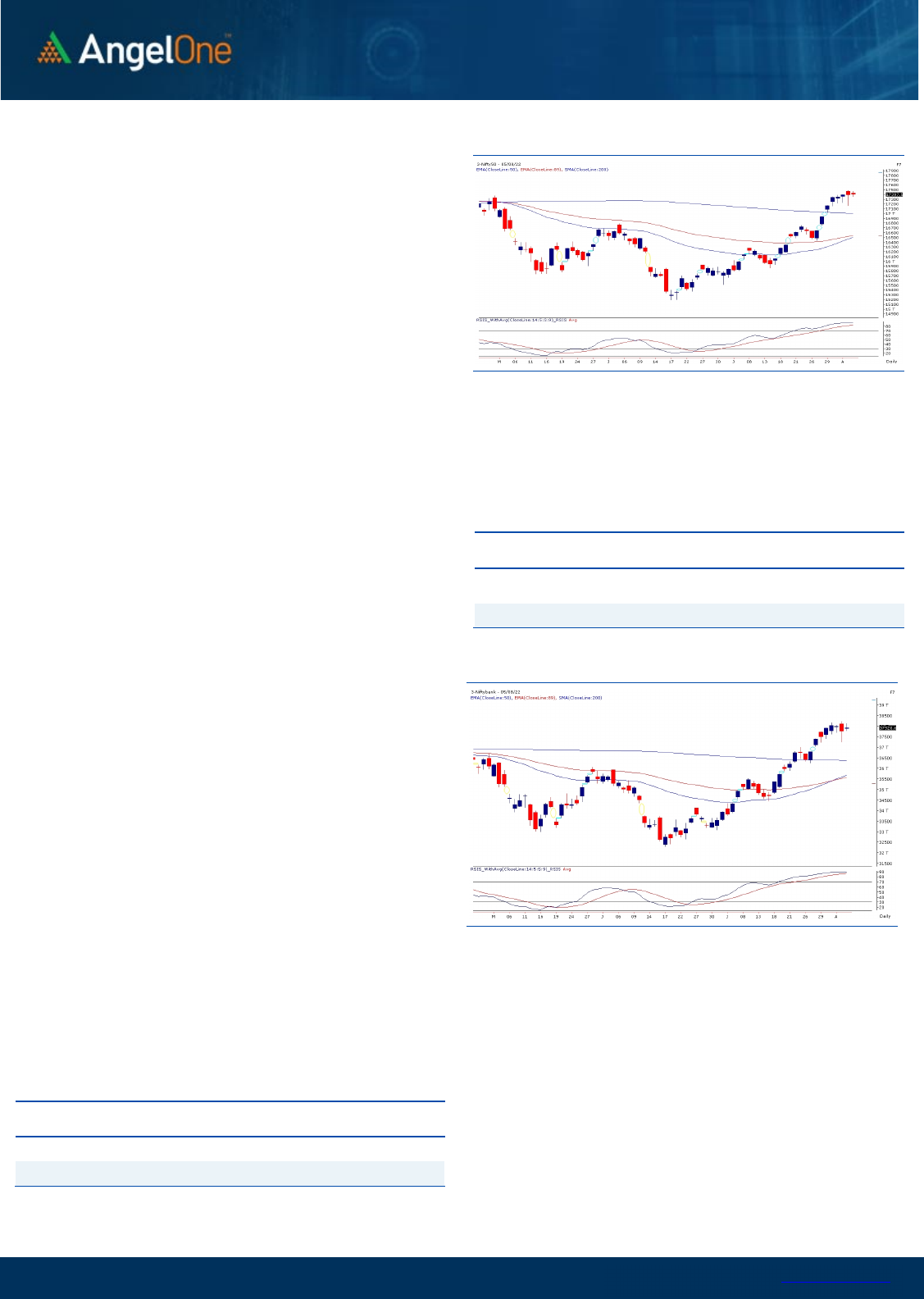

Nifty Bank Outlook (37921)

The BankNifty index has witnessed a lackluster move throughout the

week but managed to continue its positive closure consecutively for

the third week. The index moved in tandem with the benchmark index

and has helped to boost the overall market sentiments. The index

gained nearly 1.14 percent in the entire week and settled a tad above

37900 level.

On the technical aspect, the banking index has maintained its positive

stature as it hovers well above all its major exponential moving

averages on the daily chart. Though post the slender range bound

consolidation, one should not rule out the scope of profit booking

from the higher levels. However, the undertone is likely to favor the

bulls, wherein any minor correction could be seen as healthy and also

as an opportunity to add fresh longs. As far as levels are concerned,

37200-37000 is likely to provide a cushion for the index. While on the

flip side, 38200-38250 is expected to act as the immediate hurdle,

followed by the previous swing high of 38750 odd level in the near

period.

Key Levels

Support 1 – 37200 Resistance 1 – 38250

Support 2 – 37000 Resistance 2 – 38750

Exhibit 1: Nifty Daily Chart

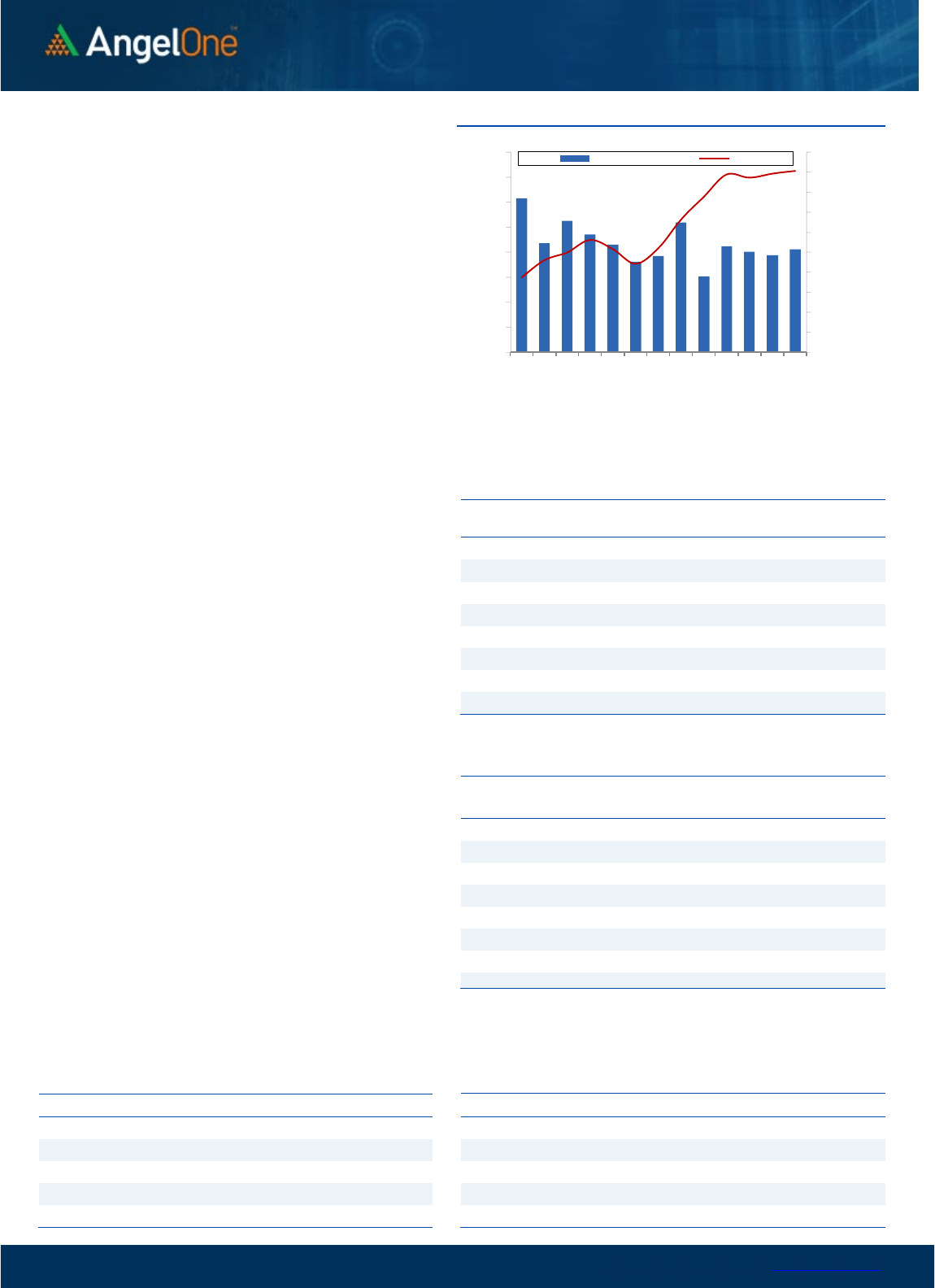

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (58388) / Nifty (17397)

On Friday, Nifty started on a flat note and throughout the session, there

was no major traction. The key RBI policy turned out to be a non-event

as markets ended flat tad below 17400.

It was certainly not an easy-going week for market participants. Barring

the strong up move on Monday, we witnessed nervousness at higher

levels throughout the remaining part of the week. In fact, on the weekly

expiry session, we witnessed a massive profit booking from the

morning highs of 17490. Within a blink of any eye, we not only slid

below 17400 and 17300 but also went on to test the sub-17200 terrain.

This intimidating sell off was as good as a reality check for bulls and

hence, we have been reiterating not to become complacent at any

point this week. Fortunately, the undertone is extremely bullish and

hence, all these intraday declines were successfully getting absorbed in

the market. For this week, 17500 – 17650 remains a sturdy wall and till

the time, we do not surpass it convincingly, we would continue to see

some tentativeness at higher levels. On the flipside, 17300 followed by

17150 has now become a sacrosanct support. Considering the overall

development, we expect some consolidation to continue in this week

as well.

Traders are advised not to carry aggressive bets overnight for a while

and ideally, the strategy would be to follow one step at a time and

respect levels on either side. At the start of the last week, the stock

specific movements were a bit vibrant, but it seems to have cooled

off a bit towards the end. Hence, we need to see what all themes

emerge as we step into the new week.

Key Levels

Support 1 – 17300 Resistance 1 – 17500

Support 2 – 17150 Resistance 2 – 17650

www.angelone.in

Technical & Derivatives Report

Aug 08, 2022

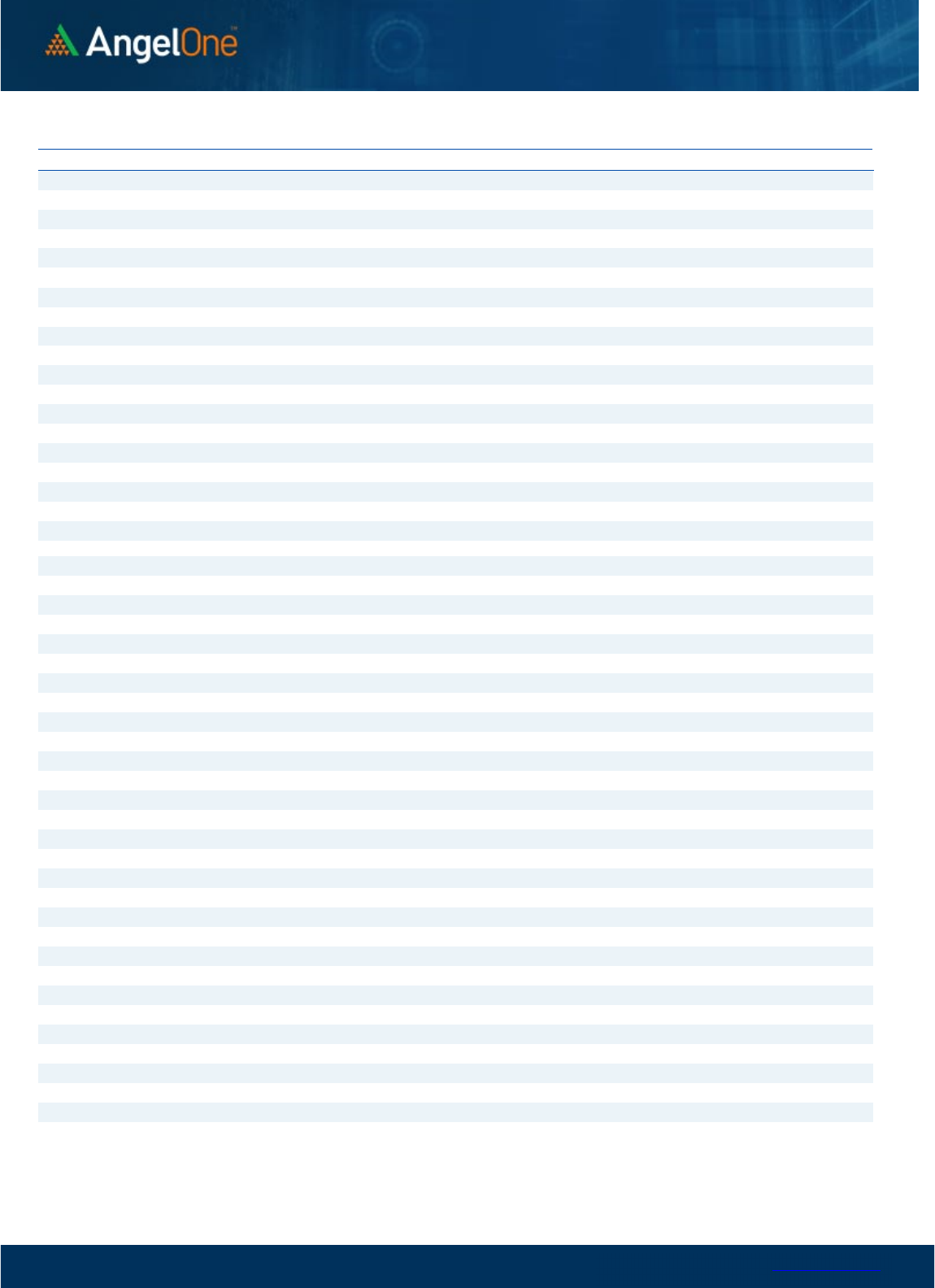

View

We had a positive start for the week and the

optimism extended throughout the week to reclaim

17500. However, we did observed some profit

booking at higher levels.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1606 crores. Simultaneously, in Index

futures, they bought worth Rs. 902 crores with an

increase in open interest, indicating long formation.

As far as derivatives segment is concerned, we

observed good amount of open interest addition in both

the indices; we believe majority of them were on long

side. Stronger hands continued to pour liquidity in

index equity market but added few shorts in index

futures segment. Their ‘Long Short Ratio’ declined to

55% from 60% WOW. In options front, we observed

massive writing in 17500-17600 call options.

Considering the above data points, we believe 17500-

17600 may act as a hurdle for the forthcoming week,

whereas 17100-17200 remains the strong demand

zone. Hence, until we are trading in above mentioned

range, traders are advised to prefer stock specific

approach.

Comments

The Nifty futures open interest has increased by

2.00%. and BANK Nifty futures open interest has

decreased by 3.84% as the market closed at 17397.5.

The Nifty Aug future closed with a premium of 18.65

point against a premium of 7.85 point in the last

trading session. The Sep series closed at a premium

of 87.95 point.

The INDIA VIX decreased from 19.25 to 18.91. At the

same time, the PCR-OI of Nifty has increased from

1.03 to 1.05.

Few of the liquid counters where we have seen high

cost of carry are L&TFH, ABFRL, IDEA, PIIND and

METROPOLIS.

Historical Volatility

SCRIP HV

ZYDUSLIFE 35.16

IPCALAB 34.52

GUJGASLTD 46.56

LUPIN 37.92

CIPLA 31.77

Nifty Vs OI

15600

15800

16000

16200

16400

16600

16800

17000

17200

17400

17600

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

7/19 7/21 7/25 7/27 8/29 7/2 7/5

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GAIL 45865900 43.99 140.10 -5.38

BALRAMCHIN 10673600 31.14 364.50 -3.92

CROMPTON 3784500 28.99 388.85 -2.82

BALKRISIND 1855500 25.69 2319.95 -6.88

ICICIPRULI 8062500 20.71 560.15 2.76

DELTACORP 20219300 16.47 194.90 -0.46

JKCEMENT 463000 13.76 2536.65 3.27

PEL 4791600 8.18 1731.85 0.07

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BEL 26421400 -10.34 284.15 -3.00

NAM-INDIA 2505600 -8.26 299.55 0.27

ASTRAL 658900 -7.13 1963.30 1.31

MUTHOOTFIN 4564125 -7.02 1101.30 3.69

ALKEM 424000 -6.03 3151.75 0.32

IOC 77814750 -4.86 71.20 2.61

LAURUSLABS 5882400 -4.79 543.85 0.53

JUBLFOOD 10321250 -4.77 569.30 1.27

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.05 0.88

BANKNIFTY 0.91 0.91

RELIANCE 0.51 0.41

ICICIBANK 0.89 0.45

INFY 0.83 0.58

www.angelone.in

Technical & Derivatives Report

Aug 08, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

3

97.50

FII Statistics for

August

0

5

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3643.03 2741.09 901.94

145724 13091.28 6.05

INDEX

OPTIONS

583811.67 586113.29 (2301.62) 1054583 93739.41 24.76

STOCK

FUTURES

12299.14 11448.46 850.68

2145589 146525.96 (0.11)

STOCK

OPTIONS

7186.46 7253.78 (67.32) 114743 7966.45 8.86

Total 606940.30

607556.62

(616.32) 3460639

261323.10

6.94

Turnover on

August

0

5

, 2022

Instrument

No. of

Contracts

Turnov

er

( in Cr.

)

Change

(%)

Index Futures

370336 33586.23 -33.32

Index Options

77870713 7119982.61 -76.95

Stock Futures

877204 60415.78 -7.18

Stock Options

3136521 229009.97 -1.22

Total

3,136,521 229009.97 -76.17

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17400 272.70

55.55

44.45

17455.55

Sell

17500 217.15

Buy

17400 272.70

102.70

97.30

17502.70

Sell

17600 170.00

Buy

17500 217.15

47.15 52.85 17547.15

Sell

17600 170.00

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17400 256.85

39.90

60.10

17360.10

Sell

17300 216.95

Buy 17400 256.85

74.05

125.95

17325.95

Sell 17200 182.80

Buy

17300 216.95

34.15 65.85 17265.85

Sell

17200 182.80

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 08, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

798

804

811

817

825

APOLLOHOSP 4,290 4,332

4,377

4,419

4,464

ASIANPAINT 3,432 3,453

3,472 3,493

3,513

AXISBANK

717

723

727

733

737

BAJAJ-AUTO

3,970

3,991

4,015

4,037

4,060

BAJFINANCE 7,224 7,265

7,316

7,356

7,408

BAJAJFINSV

14,892

14,989

15,120

15,217

15,348

BPCL

330

333

335

338

340

BHARTIARTL

690

697

703

710

717

BRITANNIA

3,577

3,633

3,734

3,790

3,891

CIPLA

1,023

1,029

1,037

1,043

1,051

COALINDIA

204

206

208

211

213

DIVISLAB

3,871

3,892

3,921

3,941

3,970

DRREDDY 4,115 4,136

4,165

4,186

4,215

EICHERMOT 2,998 3,044

3,112

3,158

3,226

GRASIM

1,565

1,582

1,599

1,615

1,633

HCLTECH

949

954

959

963

969

HDFCBANK 1,413 1,420

1,428

1,436

1,444

HDFCLIFE 531 535

540

544

549

HDFC 2,324 2,340

2,352

2,367

2,380

HEROMOTOCO

2,732

2,751

2,781

2,800 2,829

HINDALCO

398

404

415 422

433

HINDUNILVR

2,613

2,629

2,644

2,660

2,674

ICICIBANK 816 827

834

845

852

INDUSINDBK 1,018 1,027

1,043

1,052

1,067

INFY 1,591 1,604

1,615 1,627

1,638

ITC

308

309

311

312

313

JSW STEEL

660

663

669

672

678

KOTAKBANK

1,808

1,821

1,836

1,848

1,863

LT

1,758

1,773

1,790

1,805

1,822

M&M 1,201 1,219

1,249

1,266

1,296

MARUTI 8,704 8,772

8,879 8,948

9,054

NESTLEIND

19,599

19,760

19,890

20,051

20,181

NTPC

151

153

155 158

159

ONGC

131

134

136

139

141

POWERGRID

217

220

222

226

228

RELIANCE 2,495 2,514

2,547

2,566

2,598

SBILIFE

1,245

1,256

1,272

1,283

1,299

SHREECEM 20,495 20,866

21,072

21,443

21,648

SBIN

520

526

534

540

548

SUNPHARMA

902

909

919

926

936

TCS 3,344 3,354

3,366

3,376

3,388

TATACONSUM

775 780

787

791

798

TATAMOTORS

458

462

467

471

476

TATASTEEL

106

107

108

109

110

TECHM 1,041 1,050

1,059

1,067

1,076

TITAN 2,386 2,409

2,441

2,464 2,496

ULTRACEMCO

6,510

6,643

6,721

6,853

6,932

UPL 722 733

741 752

760

WIPRO

434

437

439

443

445

www.angelone.in

Technical & Derivatives Report

Aug 08, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.