July 08, 2022

www.angelone.in

Technical & Derivatives

Report

Nifty Bank Outlook

-

(34920)

The stage was set on Wednesday the way market closed around

crucial levels and global market didn’t pour water on this. We

had a gap up opening in banking index too and then continued

its northward move in the initial hours. Around the midsession,

it came off a bit but some of the banking counters just picked

the momentum from there. Eventually, the BANKNIFTY ended

the weekly expiry session at day’s high and is now about the

knock the door at 35000.

Our market participants finally had something to cheer for. Last

month and a half has been a slumber phase, which prima facie

appears to have ended for a while. For the coming session, we

expect the momentum to continue towards 35400 - 35600 once

we see banking index surpassing the crucial zone of 35000-

35100. On the flipside, 34700 followed by 34500 are to be

considered as immediate supports. We advise momentum

traders not to get complacent and look to take some money off

the table around the higher trading range.

Key Levels

Support 1 – 34700 Resistance 1 – 35100

Support 2 – 34500 Resistance 2 – 35400

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (54178) / Nifty (16133)

The positive global cues had led to a promising start to our

market on the weekly expiry session. The initial gap up in the

benchmark index was sustained throughout the day, suggesting

an encouraging sign for the market participants. The rub-off

effect of the positivity was visible across the board as the index

decisively leaped over the psychological mark. By the end of the

session, the Nifty maintained its gain and concluded the day on a

positive note at the 16133 level, procuring near a percent.

Technically, the short-term structure seems bullish as the index

authoritatively reclaimed the psychological mark. Also, the

buying interest towards the fag end augurs well for the market

participants, with the Nifty closing near the day’s high. From here

on, the unfilled gap on the downside of the 16000-16045 odd level

should act as the demand zone and cushion any minor blips.

While on the flip side, the 16200 sub-level is likely to be seen as

the immediate resistance, breaching which the next potential

hurdle could be seen around the 16325-16400 zone.

Key Levels

Support 1 – 16045 Resistance 1 – 16200

Support 2 – 16000 Resistance 2 – 16325

Going forward, our

market is likely to remain upbeat in the

near term, wherein any minor dip could be seen as an

opportunity for the bulls to add long positions. From here on,

we may expect gradual moves in key indices, but individual

pockets are now likely to outshine. Hence, it’s advisable to

keep focusing on such potential movers, which are likely to

provide better trading opportunities. Also, we would like to

reiterate not being complacent with the gains and to stay

abreast with daily developments across the globe.

www.angelone.in

Technical & Derivatives Report

July 08, 2022

View

We began the weekly expiry session with an upside

gap tad above 16100. However, we observed some

consolidation thereafter; in the latter half the Nifty

slide below 16050 but sharp recovery was seen in the

final hour of trade to reclaim 16150 to close with a

handsome gains of almost a percent.

FIIs were net sellers in the cash market segment to

the tune of Rs. 925 crores. Simultaneously, in Index

futures, they bought worth Rs. 1263 crores with

decrease in open interest, indicating short covering.

Looking at the F&O data, we have observed short

covering in both the indices. Since last three session

stronger hands had been covering their bearish bets

in index futures and stock futures segment. On the

options front, we have observed piling up of positions

in 15900-16100 put strikes, which clearly hints the

immediate support has now shifted higher to 15900-

16000 zone. On the flip side, a considerable OI

concentration is visible at 16200 call strike. Global

set-up suggests positive opening and any sustainable

close beyond 16200 shall boost the overall sentiment

of market participants.

Comments

The Nifty futures open interest has decreased by 6.47%.

and BANK Nifty futures open interest has decreased by

5.11% as the market closed at 16132.90.

The Nifty July future closed with a premium of 15.25

point against a premium of 0.65 point in the last trading

session. The Aug series closed at a premium of 35.50

point.

The INDIA VIX decreased from 20.26 to 19.20. At the

same time, the PCR-OI of Nifty has decreased from 1.27

to 1.26.

Few of the liquid counters where we have seen high

cost of carry are IDEA, INDIACEM, RAIN, NATIONALUM

and RBLBANK.

Historical Volatility

SCRIP HV

NBCC 55.96

TITAN 39.68

CANBK 54.53

SYNGENE 38.62

HINDALCO 53.67

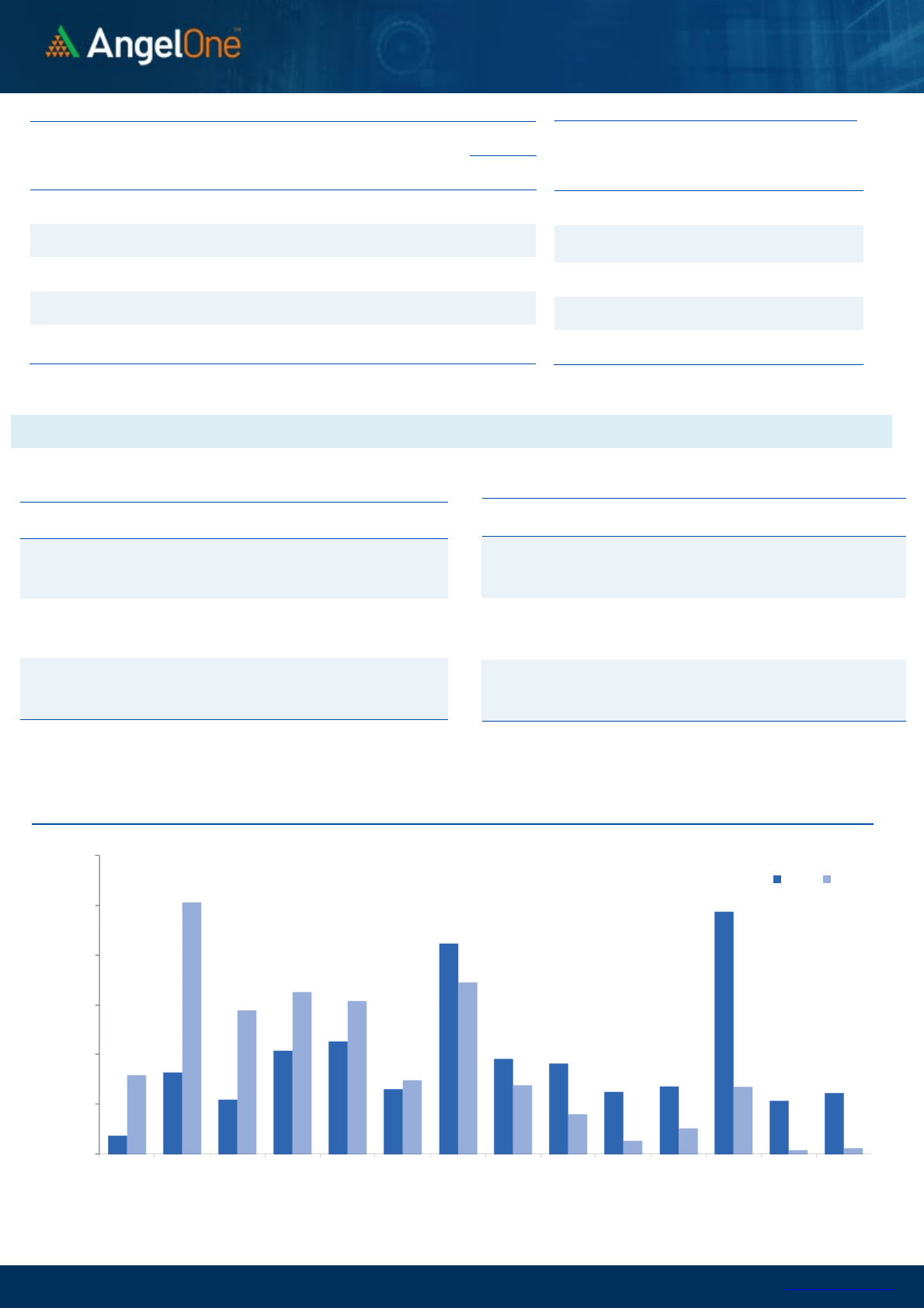

Nifty Vs OI

15000

15200

15400

15600

15800

16000

16200

16400

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

6-20 6-22 6-24 6-28 6-30 7-4 7-7

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABB 778250 25.42 2562.50 0.63

GUJGASLTD 4625000 19.09 456.35 1.69

BSOFT 4020900 13.38 340.50 0.24

HAL 1704300 12.58 1735.75 -0.79

BALRAMCHIN 7356800 11.76 345.70 -0.52

INDIAMART 349050 9.20 3911.80 4.59

APOLLOTYRE 15445500 8.75 202.05 3.10

INDIACEM 11022900 7.25 165.20 1.68

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DALBHARAT 1037000 -13.15 1453.10 5.20

BAJFINANCE 5586375 -6.52 5860.65 -0.89

FEDERALBNK 66630000 -6.34 97.00 1.65

CROMPTON 3949500 -5.90 367.35 1.80

RECLTD 34974000 -5.02 129.95 0.16

PETRONET 13749000 -4.96 220.65 0.20

COALINDIA 35338800 -4.66 186.00 2.90

WHIRLPOOL 552650 -4.53 1664.40 2.29

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.26 1.04

BANKNIFTY 1.36 1.01

RELIANCE 0.50 0.56

ICICIBANK 0.82 0.62

INFY 0.62 0.45

www.angelone.in

Technical & Derivatives Report

July 08, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Spot =

16132.90

FII Statistics for

July 0

7

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3280.71 2017.47 1263.24

146412 12170.92 (8.10)

INDEX

OPTIONS

1631697.13 1626179.57 5517.56

1035476 84985.22 (32.15)

STOCK

FUTURES

9793.97 9660.99 132.98

2282012 144966.62 (0.53)

STOCK

OPTIONS

6140.96 6138.76 2.20

109041 7035.84 6.69

Total

1650912.77

1643996.79

6915.98

3572941

249158.60

(12.47)

Turnover

on

July

07

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

423085 35296.05 -20.51

Index

Options

252794234 21231700.09 69.30

Stock

Futures

828396 51021.65 -2.09

Stock

Options

2522491 162469.84 0.15

Total

25,22,491 162469.84 67.82

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

16100 310.00

58.80

41.20

16158.80

Sell

16200 251.20

Buy

16100 310.00

108.10

91.90

16208.10

Sell

16300 201.90

Buy

16200 251.20

49.30 50.70 16249.30

Sell 16300 201.90

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

16100 256.60

37.65

62.35

16062.35

Sell

16000 218.95

Buy

16100 256.60

71.35

128.65

16028.65

Sell

15900 185.25

Buy

16000 218.95

33.70 66.30 15966.30

Sell

15900 185.25

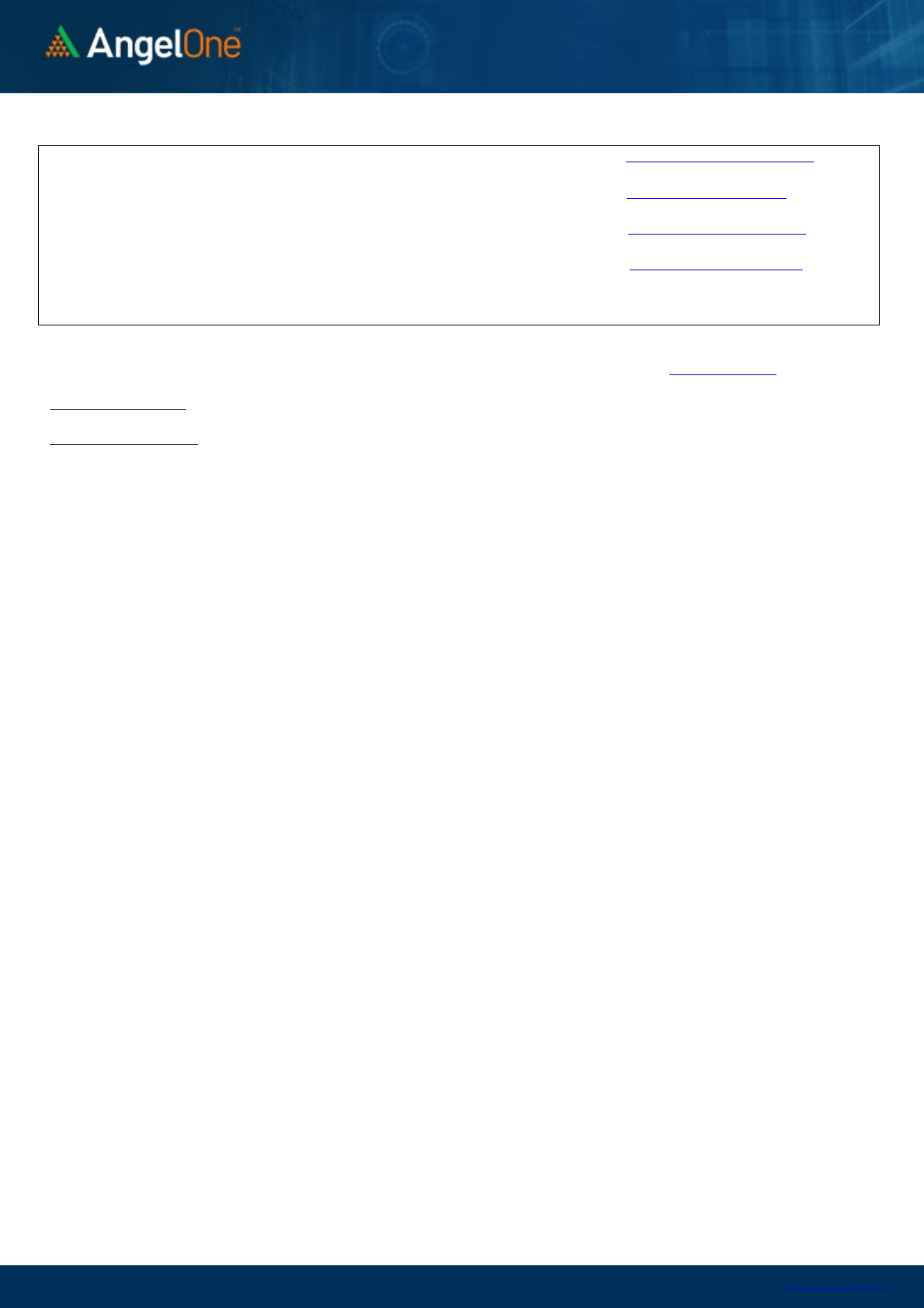

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

15400 15500 15600 15700 15800 15900 16000 16100 16200 16300 16400 16500 16600 16700

Call Put

www.angelone.in

Technical & Derivatives Report

July 08, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 687 691

699 703 711

APOLLOHOSP 3,832 3,858

3,894 3,920 3,956

ASIANPAINT 2,835 2,848

2,890 2,903 2,945

AXISBANK 645 651

658 664 671

BAJAJ-AUTO 3,747 3,760

3,798 3,811 3,849

BAJFINANCE 5,736 5,826

5,907 5,997 6,077

BAJAJFINSV 11,676 11,852

12,026 12,202 12,376

BPCL 318 320

325 327 332

BHARTIARTL 681 687

692 698 703

BRITANNIA 3,755 3,793

3,838 3,875 3,920

CIPLA 926 936

943 953 960

COALINDIA 178 180

183 185 188

DIVISLAB 3,542 3,593

3,652 3,703 3,762

DRREDDY 4,272 4,331

4,387 4,446 4,502

EICHERMOT 2,887 2,898

2,928 2,938 2,968

GRASIM 1,353 1,361

1,377 1,385 1,400

HCLTECH 975 981

991 997 1,007

HDFCBANK 1,358 1,364

1,381 1,388 1,405

HDFCLIFE 544 551

558 565 573

HDFC 2,215 2,222

2,236 2,243 2,257

HEROMOTOCO 2,798 2,815

2,842 2,859 2,886

HINDALCO 326 333

349 357 372

HINDUNILVR 2,433 2,466

2,498 2,531 2,564

ICICIBANK 723 725

734 736 745

INDUSINDBK 824 830

847 853 870

INFY 1,482 1,487

1,500 1,505 1,519

ITC 286 287

290 292 295

JSW STEEL 535 545

561 571 588

KOTAKBANK 1,694 1,699

1,722 1,727 1,749

LT 1,530 1,543

1,579 1,592 1,627

M&M 1,095 1,100

1,119 1,124 1,144

MARUTI 8,512 8,571

8,635 8,695 8,759

NESTLEIND 17,994 18,192

18,371 18,568 18,747

NTPC 137 138

140 141 144

ONGC 119 120

122 123 125

POWERGRID 209 210

213 213 216

RELIANCE 2,348 2,380

2,407 2,438 2,465

SBILIFE 1,100 1,108

1,119 1,127 1,138

SHREECEM 19,775 19,883

20,028 20,136 20,281

SBIN 477 478

483 485 490

SUNPHARMA 834 836

844 846 855

TCS 3,227 3,244

3,282 3,298 3,336

TATACONSUM

744 747

753 756 763

TATAMOTORS 409 413

423 426 437

TATASTEEL 826 842

874 890 922

TECHM 1,007 1,008

1,018 1,019 1,029

TITAN 2,027 2,020

2,096 2,089 2,165

ULTRACEMCO 5,723 5,776

5,824 5,876 5,924

UPL 650 656

671 677 691

WIPRO 412 414

419 421 426

www.angelone.in

Technical & Derivatives Report

July 08, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Derivatives

sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.