March 08, 2023

www.angelone.in

Technical & Derivatives Report

Nifty Bank

Outlook (

41

350

)

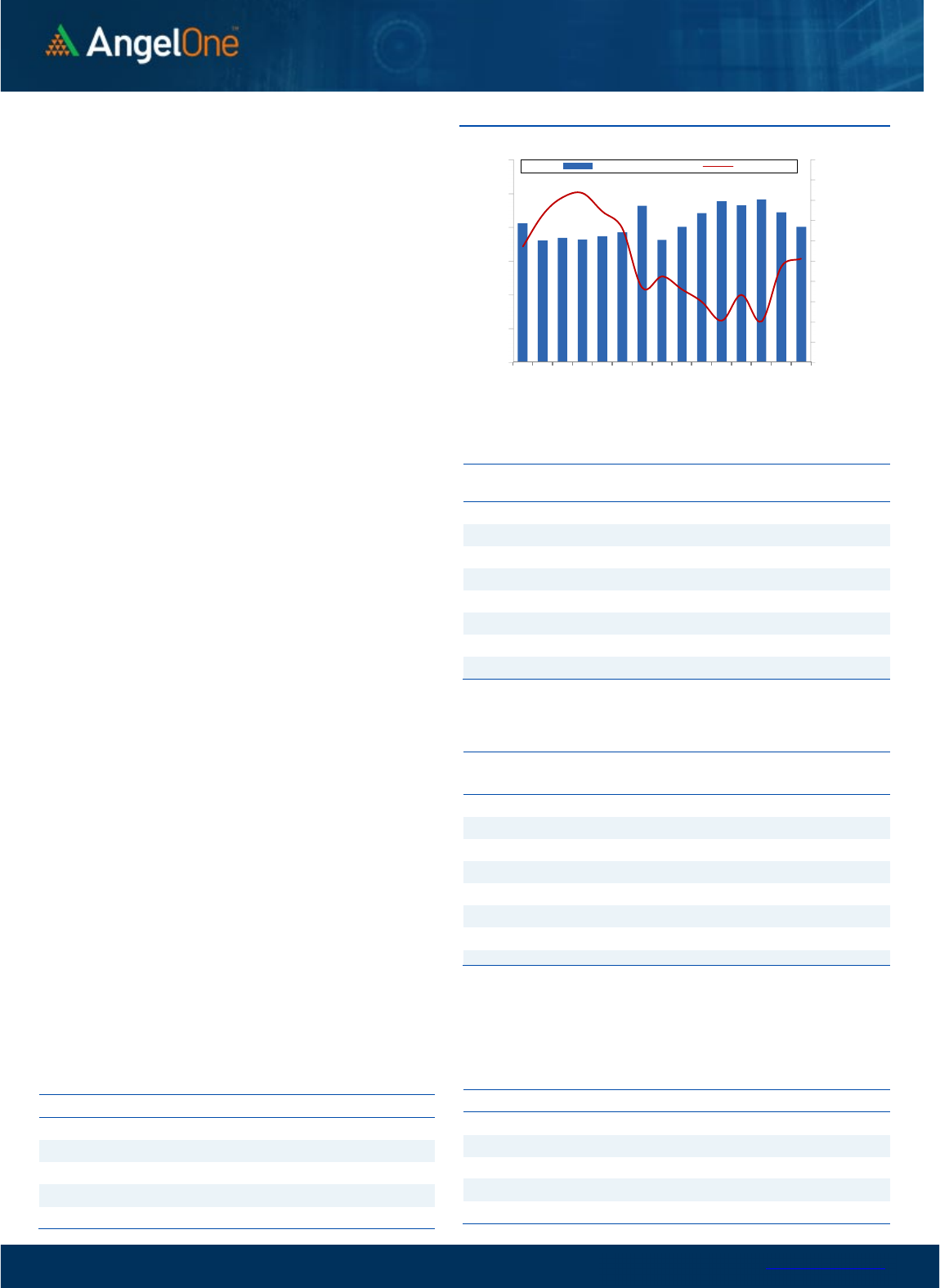

Following the strong closing on Friday, the week started on a

positive note and the momentum continued during the morning

session. As the day progressed, there was a lack of buying at higher

levels and profit booking in key heavyweights pulled the bank index

lower to erase a major part of morning gains. The Bank Index ended

the session with marginal gains of 0.24% tad above 41350.

On Monday, the bank index tested the key 50SMA levels however

since it had already rallied in the last few days there was a lack of

follow-up buying as the indicators were overbought. Also, the

traders preferred to book some profits ahead of the mid-week

holiday to avoid undue risk from global cues. Going ahead, since

we have already seen a trend line breakout, traders should

continue to use any dips as a buying opportunity. On the higher

side, we see a sturdy wall of resistance in the range of 41700 -

42000 that coincides with the 50SMA and Budget Day high, hence

we may see some consolidation before the next leg of up move.

Key Levels

Support 1 – 41100 Resistance 1 – 41700

Support 2 – 41000 Resistance 2 – 42000

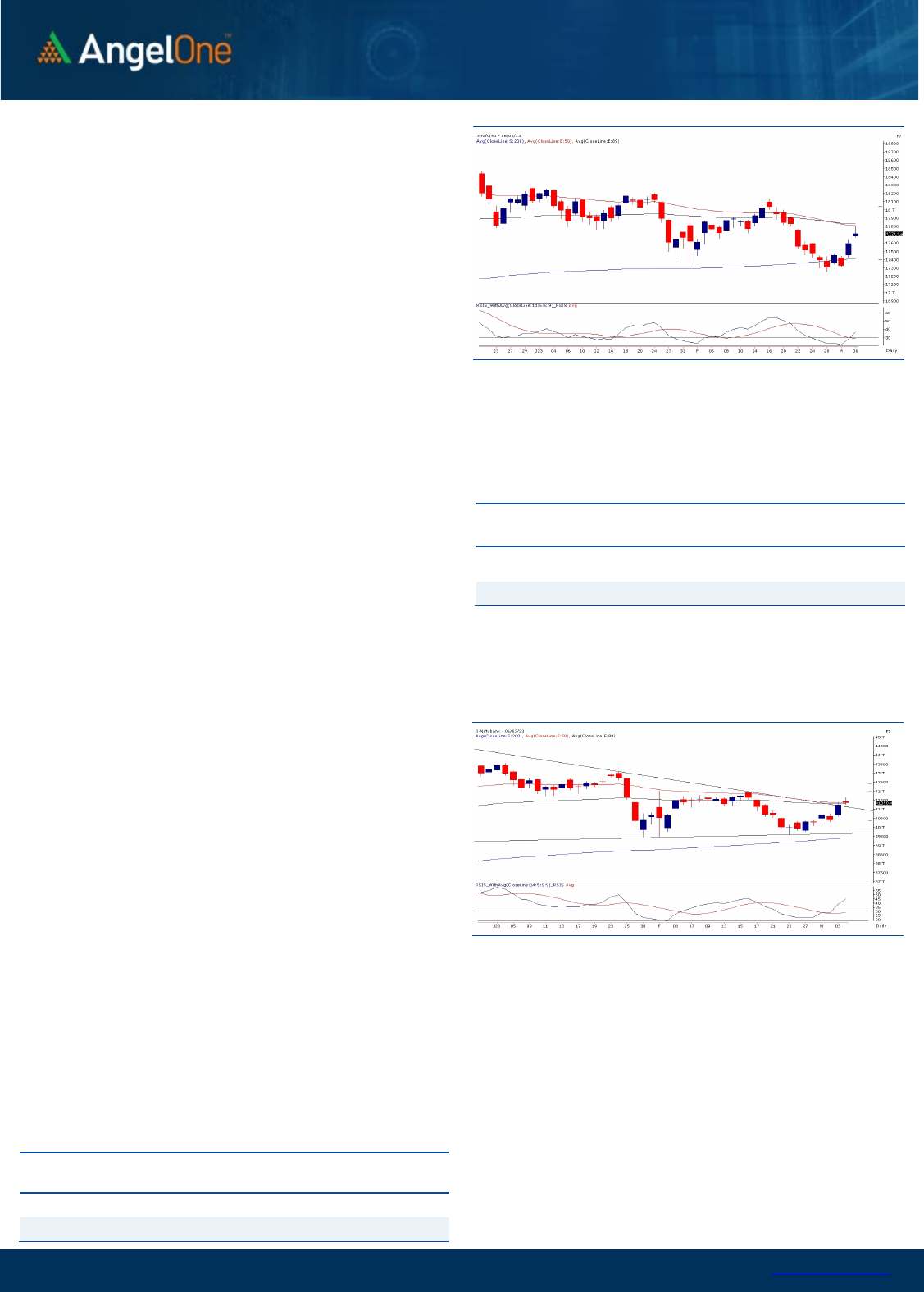

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

60224

) / Nifty (

1

7

711

)

We kickstarted the week on a strong note taking favorable global

cues into a consideration. In the initial hour, the move extended to

reach the 17800 mark. However, the traders chose to take some

money off the table at higher levels, which resulted in a gradual

decline throughout the remaining part of the session. Eventually,

the Nifty managed to hold nearly seven tenths of percent gains to

conclude tad above 17700.

Our markets started the session from where it left on Friday and this

time, we had support from our global peers. But it seems we had

already anticipated it in advance as we witnessed a stellar move

during previous session. On Monday, due to some overbought

condition mainly in the financial space, we didn’t have enough legs

to maintain the similar tempo. Technically speaking, we are not

surprised with this profit booking, because Monday’s high precisely

coincides with the 61.8% retracement of the recent down move.

However, by no means, we expect resumption of recent corrective

phase. This is merely a profit booking after a sharp recovery in last

two days and after reaching important levels. As a trader, such

declines would provide excellent opportunities to create fresh longs

as we expect Nifty to surpass 17800 sooner or later and head

towards the psychological mark of 18000. As far as supports are

concerned, 17600 – 17500 are to be seen as immediate levels.

Traders are advised to continue with an optimistic approach and

now should start focusing more on thematic movers. Apart from

this, the broader end of the spectrum has been sulking for a long

time now, has started showing early signs of revival. It’s better

to keep a close eye on this segment as well.

Key Levels

Support 1 – 17670 Resistance 1 – 17800

Support 2 – 17600 Resistance 2 – 17880

The apt strategy would be to buy on dips and book profits at

higher levels as long the market consolidates within a range. As

far as support levels are concerned, 41100 - 41000 is seen as

immediate support.

www.angelone.in

Technical & Derivatives Report

March 08, 2023

View

Our market has started the truncated week on a

promising note, wherein the benchmark index re-

tested the 17800 but amid profit booking settled a

tad above the 17700 level, procuring 0.67 percent.

FIIs were net buyers in the cash market segment to

the tune of Rs. 721 crores. Simultaneously, in Index

futures, they bought worth Rs. 1447 crores with a

decrease in open interest, indicating short covering.

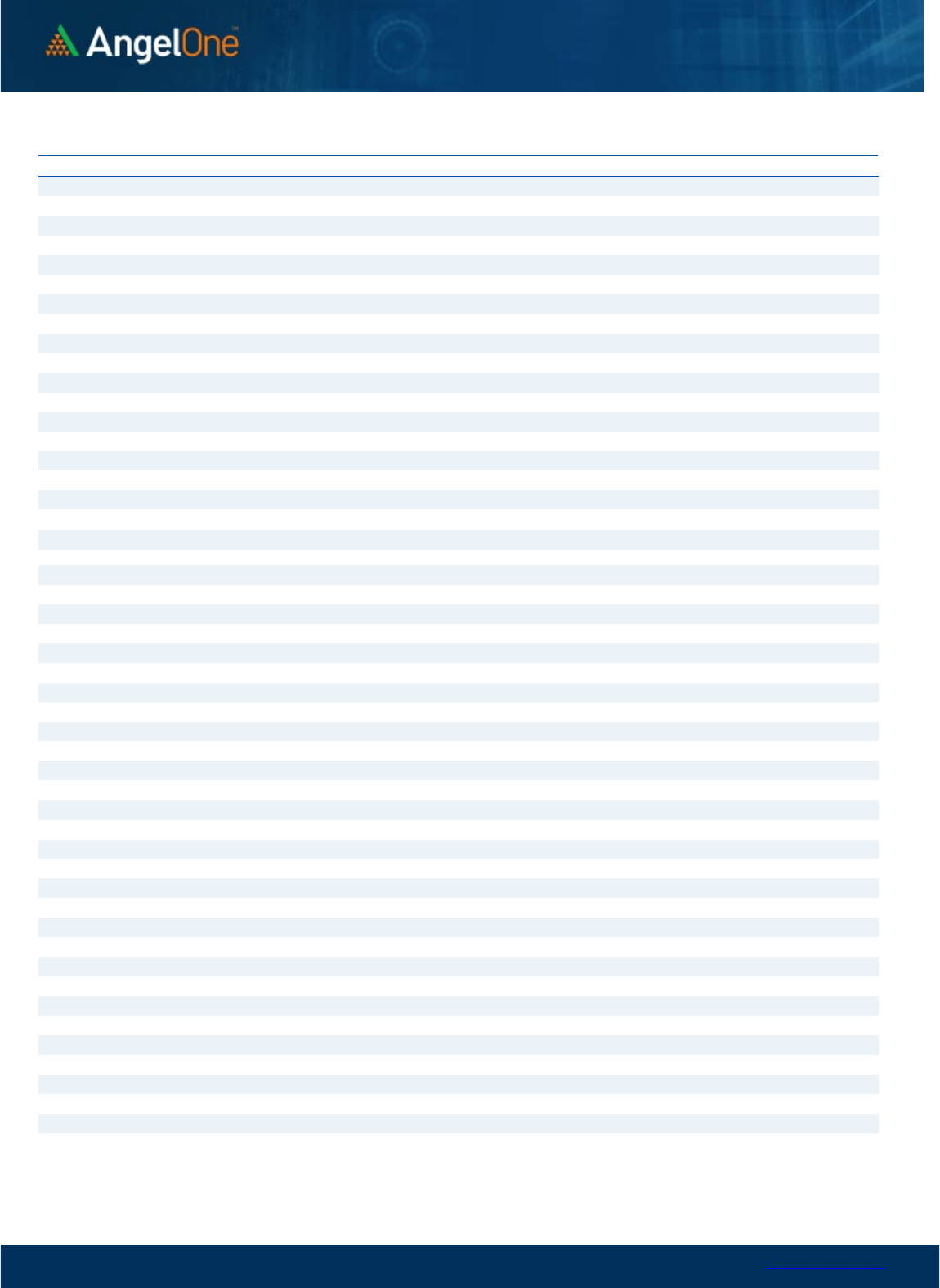

Looking at the F&O data, we observed short covering in

both the key indices at the start of the week. On the

options front, piling up of positions is seen at 17700-

17600 put strikes indicating nearby support for Nifty. On

the higher end, the 17800-call strike has the maximum OI

concentration, followed by 18000 CE, indicating the

immediate hurdles. Meanwhile, the stronger hands have

covered their shorts in the system, resulting in a surge to

‘Long Short Ratio’ to 26% from 23%. Considering the

recent price action, the undertone remains upbeat,

wherein any intraday dip could be utilized to add long in

the index.

Comments

The Nifty futures open interest has decreased by 6.77%

and Bank Nifty futures open interest has decreased by

1.55% as the market closed at 17711.45.

The Nifty March future closed with a premium of 63.50

point against a premium of 77.20 point in the last

trading session. The April series closed at a premium of

162.35 point.

The INDIA VIX increased from 12.18 to 12.26. At the

same time, the PCR-OI of Nifty has decreased from 1.17

to 1.12.

Few of the liquid counters where we have seen high

cost of carry are MGL, FSL, PFC, GAIL, AND

MANAPPURAM.

Historical Volatility

SCRIP HV

ADANIENT 94.76

IDEA 71.05

IBULHSGFIN 67.38

RBLBANK 63.79

ADANIPORTS 60.16

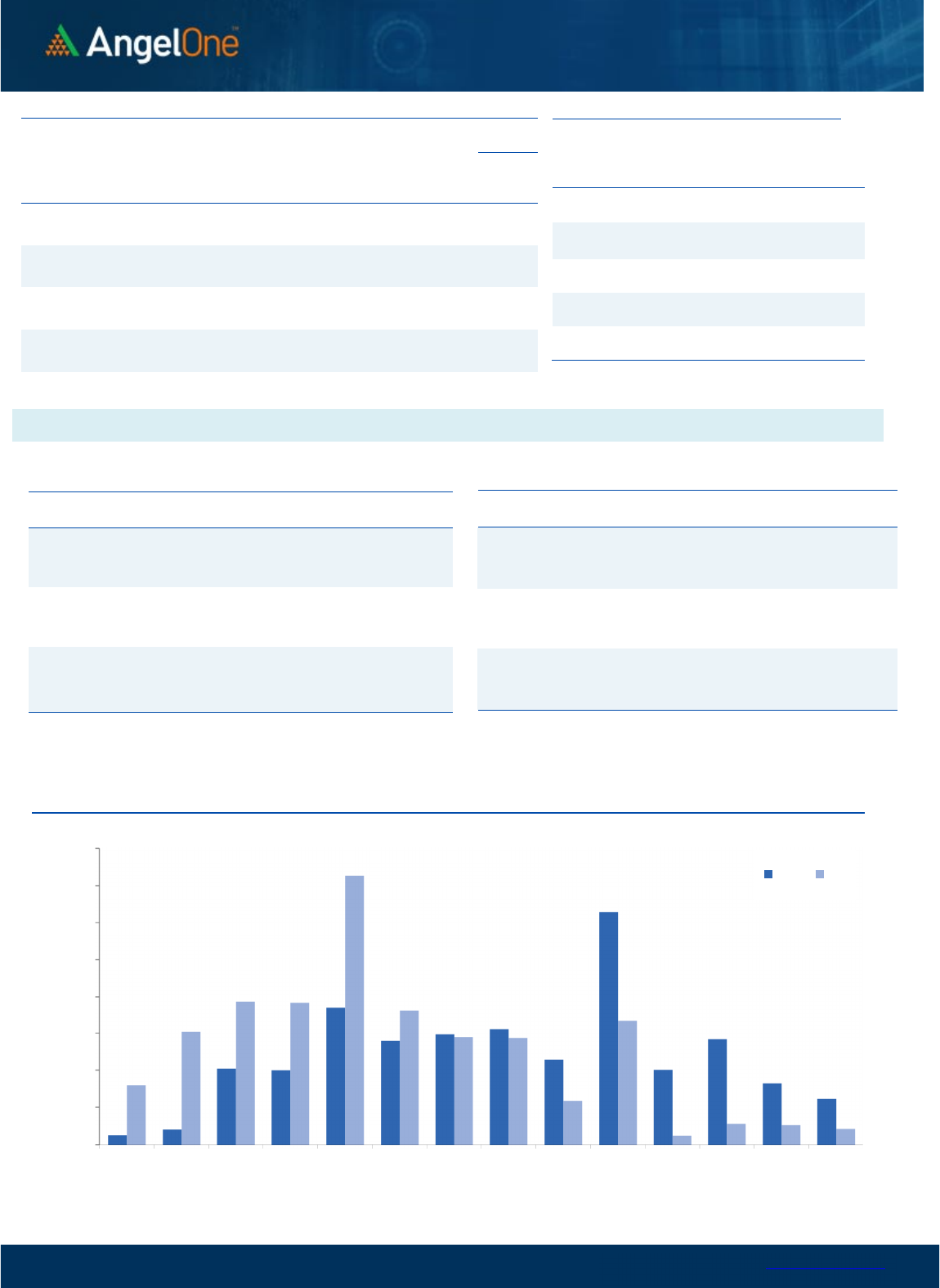

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/13 2/15 2/17 2/22 2/24 2/28 3/2 3/6

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MGL 3154400 51.36 985.95 8.75

GUJGASLTD 5390000 19.12 512.65 0.63

IGL 9981125 16.97 445.05 3.29

PFC 58608600 11.94 161.75 3.90

ONGC 42488600 9.98 158.20 2.41

CIPLA 14725100 9.61 880.90 0.19

NTPC 85653900 7.24 176.80 2.10

RECLTD 48344000 6.86 121.45 2.73

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CROMPTON 5182500 -7.05 316.05 1.02

WHIRLPOOL 856100 -6.82 1339.65 1.32

PVR 2303620 -6.35 1579.30 1.08

RBLBANK 24860000 -6.05 165.90 -0.66

BAJAJFINSV 9787000 -5.63 1380.80 1.68

BRITANNIA 1272600 -5.51 4319.85 -2.29

TORNTPOWER 3499500 -5.09 520.75 1.80

SBIN 75504000 -5.02 561.70 0.01

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.12 0.95

BANKNIFTY 1.00 0.92

RELIANCE 0.65 0.52

ICICIBANK 0.72 0.62

INFY 0.51 0.46

www.angelone.in

Technical & Derivatives Report

March 08, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

711

.

4

5

0900

Lot Size = 75

FII Statistics for

March 0

6

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4055.09 2608.45 1446.64

151174 14022.10 (9.17)

INDEX

OPTIONS

1429915.90 1430826.61 (910.71) 2254569 211291.50 (8.44)

STOCK

FUTURES

9054.94 9159.86 (104.92) 2135269 142952.90 (0.13)

STOCK

OPTIONS

9402.46 9190.92 211.54

128900 8677.11 5.36

Total 1452428.39

1451785.84

642.55

4669912

376943.61

(4.48)

Turnover

on

March

0

6

, 202

3

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

299503 28871.92

-33.49

Index Options

257570902 50029.28

8.57

Stock Futures

790755 50895.26

-31.00

Stock Options

3392758 5341.50 62.33

Total

33,92,758 5341.50 -18.86

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17700 225.95

55.95

44.05

17755.95

Sell

17800 170.00

Buy

17700 225.95

101.90

98.10

17801.90

Sell

17900 124.05

Buy

17800 170.00

45.95 54.05 17845.95

Sell

17900 124.05

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17700 154.75

34.60

65.40

17665.40

Sell 17600 120.15

Buy 17700 154.75

61.45

138.55

17638.55

Sell

17500 93.30

Buy

17600 120.15

26.85 73.15 17573.15

Sell 17500 93.30

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300 18400

Call Put

www.angelone.in

Technical & Derivatives Report

March 08, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,711

1,847

1,991

2,127

2,271

ADANIPORTS 657 674

698

715

740

APOLLOHOSP

4,364

4,392

4,441

4,469

4,518

ASIANPAINT

2,806

2,835

2,860

2,889

2,913

AXISBANK 851 855

860

864

868

BAJAJ-AUTO

3,683

3,703

3,738

3,759

3,794

BAJFINANCE

6,083

6,109

6,146

6,172

6,209

BAJAJFINSV

1,337

1,359

1,379

1,401

1,421

BPCL 319 322

324

327

329

BHARTIARTL 758 763

769

773

780

BRITANNIA

4,220

4,270

4,330

4,379

4,439

CIPLA 862 871

879

888

895

COALINDIA 220 223

224

226

228

DIVISLAB

2,818

2,832

2,857

2,871

2,896

DRREDDY

4,395

4,417

4,438

4,460

4,481

EICHERMOT

3,119

3,143

3,156

3,179

3,193

GRASIM

1,587

1,593

1,602

1,608

1,617

HCLTECH

1,108

1,117

1,133

1,142

1,157

HDFCBANK

1,607

1,617

1,628

1,638

1,650

HDFCLIFE

484

487

492

495

500

HDFC

2,635

2,655

2,674

2,694

2,713

HEROMOTOCO

2,447

2,463

2,478

2,494

2,508

HINDALCO 409 412

417

420

425

HINDUNILVR

2,463

2,474

2,486

2,497

2,510

ICICIBANK 858 863

870

875

881

INDUSINDBK

1,102

1,112

1,126

1,135

1,149

INFY

1,480

1,494

1,507

1,521

1,534

ITC 381 385

389

392

396

JSW STEEL 667 670

677

681

688

KOTAKBANK

1,729

1,740

1,752

1,763

1,776

LT

2,110

2,126

2,155

2,171

2,200

M&M

1,258

1,264

1,274

1,280

1,290

MARUTI

8,556

8,594

8,628

8,666

8,701

NESTLEIND

18,369

18,442

18,498

18,571

18,627

NTPC 171 174

176

179

180

ONGC 151 155

157

161

163

POWERGRID 221 224

226

230

232

RELIANCE

2,387

2,398

2,411

2,422

2,436

SBILIFE

1,112

1,120

1,133

1,141

1,154

SBIN 554 558

563

567

572

SUNPHARMA 954 960

970

975

985

TCS

3,333

3,352

3,379

3,398

3,425

TATACONSUM

705 709

714

718

723

TATAMOTORS 426 433

437

444

449

TATASTEEL 103 105

106

107

109

TECHM

1,079

1,085

1,090

1,096

1,101

TITAN

2,374

2,389

2,407

2,422

2,441

ULTRACEMCO

7,151

7,176

7,216

7,240

7,280

UPL 703 707

713

717

722

WIPRO 390 392

394

396

399

www.angelone.in

Technical & Derivatives Report

March 08, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.