February 08, 2022

www.angelone.in

Technical & Derivatives Report

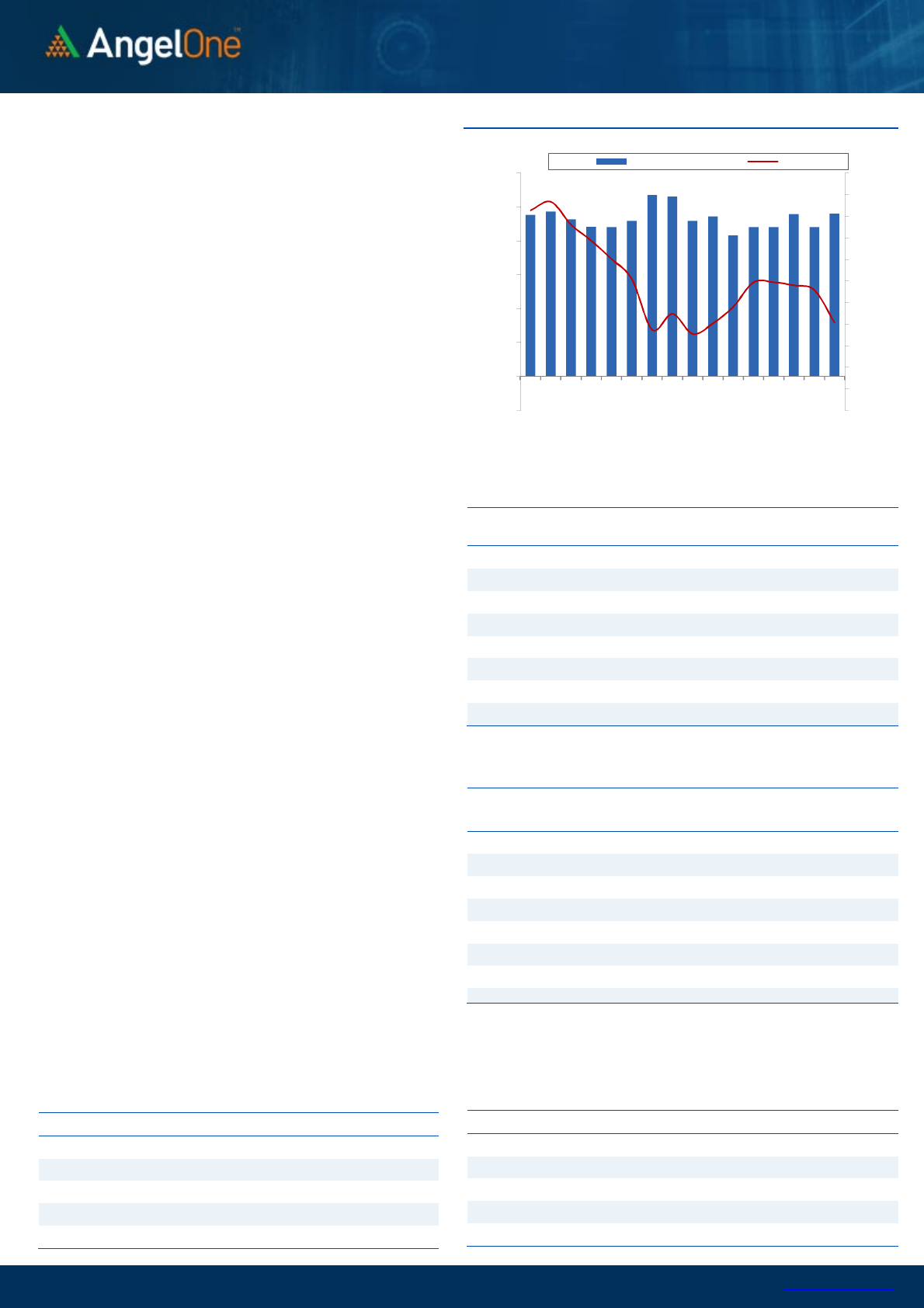

Nifty

Bank Outlook

-

(37995)

The Bank Nifty index has corrected over 2.05 percent and has

underperformed the benchmark index in the last trading

session. The turmoil in the index has dampened the overall

sentiments as the three days consecutive sell-off led by

financials and private sector banks have raised the concerning

factor in the market.

On the technical aspect, the index has plunged below the mean

of the Bollinger band and is a tad above the 21 DEMA on the daily

time frame, suggesting a cautious sign. The immediate and

crucial support is placed at the 37500 mark, sustenance above

which could trigger some traction in the index else, a dent could

be seen in the coming days. In contrast, a closure above 38700-

38800 zone in a decisive manner could only trigger the bulls to

take control of the index.

Going forward, the PSU banks index has added some traction in

the last couple of trading sessions and a watch over the counter

would be suggested ahead of the MPC meet outcome, due this

week. Also, looking at the volatility outburst, it is advisable to

stay selective and look out for stock-specific actions rather than

any thematic movement.

.Key Levels

Support 1 – 37500 Resistance 1 – 38700

Support 2 – 37000 Resistance 2 – 38800

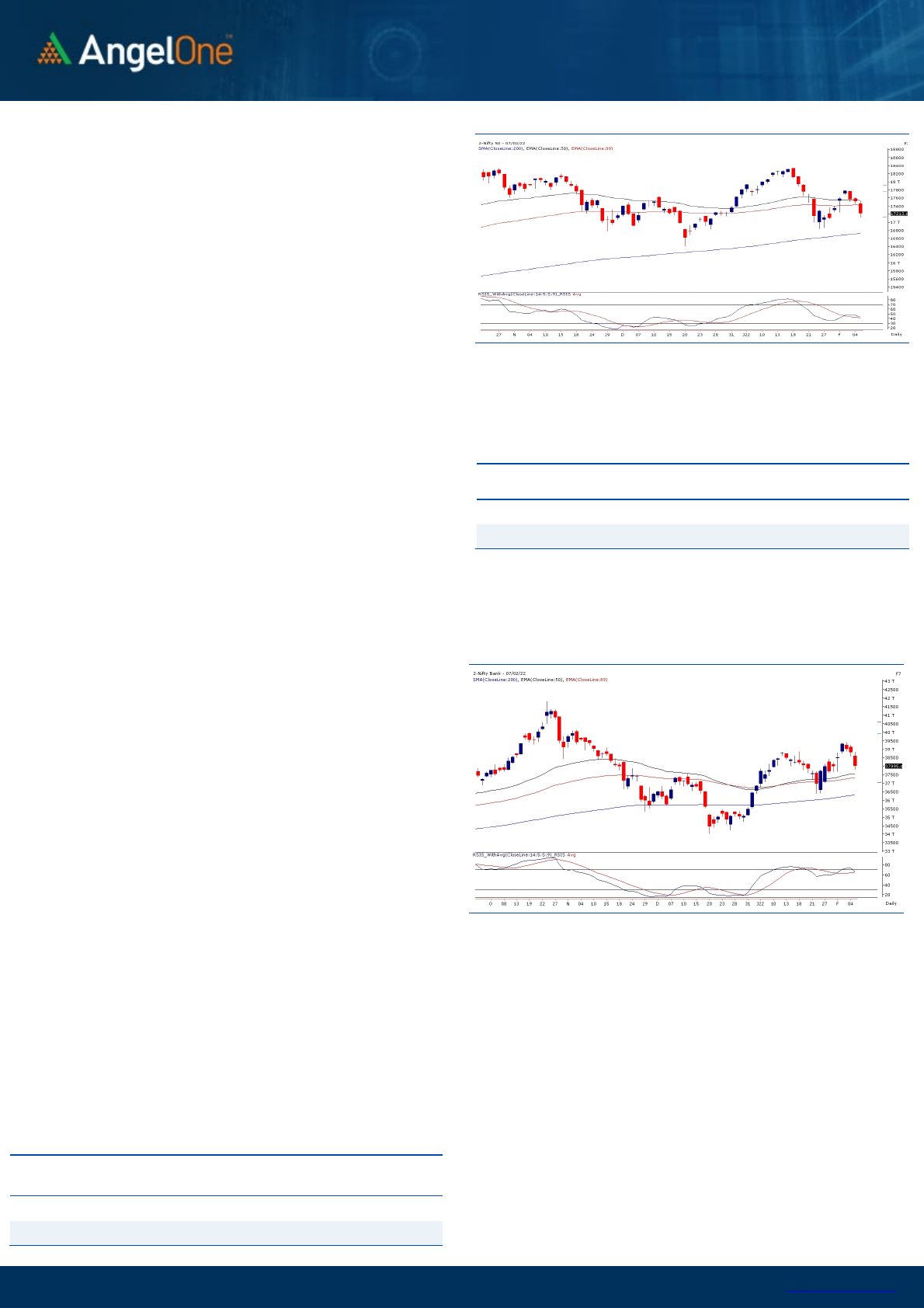

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank D

aily Chart

Sensex (57621) / Nifty (17214)

Our domestic market started the day on a weak note amid the

mixed Asian bourses, and the sell-off further aggravated with no

sign of respite in the benchmark index. A strong sell-off among

the market participants further dampened the sentiments.

Eventually, Nifty ended the session on a negative note with a loss

of around 1.73 percent for the third consecutive session to settle

at 17214 levels.

The benchmark index slipped below the low of the Budget day

ahead of the outcome of the RBI monetary policy due in the week,

suggesting a sign of cautiousness in the market. A significant

correction was seen among the selective blue chips wherein the

bears easily shrugged off all the technical supports. As far as

levels are concerned, the 17000 mark is the crucial support for

the benchmark index followed by the swing low of 16836, while

any breach below this could trigger a major concern for the

investors. On the higher end, the 50 percent Fibonacci is

expected to act as the immediate resistance zone placed around

17380 levels, followed by 17500 in the near future.

.

Looking at the eventful week of MPC outcome, the global

bourses, the FIIs activities, and the burst in the volatility index,

it is advisable to stay light and selective while taking positions

in the market.

Key Levels

Support 1 – 17000 Resistance 1 – 17380

Support 2 – 16836 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

February 08, 2022

View

The week started on a negative note and as the day

progressed the sell-off got extended throughout the

session. Eventually, post some modest recovery in the

fag end Nifty ended with a loss of 1.73% at 17213.60.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1157 crores. In index futures, they sold

worth Rs. 1067 crores with rise in open interest

indicating short formations in yesterday’s session.

As our markets slipped lower fresh short formation was

seen in both the key indices. Strong hands were sellers

in cash as well as in the Index futures segment. As far

as option chain analysis is concerned, PUT writers ran

to cover their positions, and now the highest build up is

seen at the 17000 PUT and this is also a key

psychological level. On the flip side, 17500 CALL has the

highest build up indicating resistance level. The PCR-OI

has now slipped to 0.70 and even though the bears have

the upper hand we sense the market is approaching

oversold zone hence one should avoid aggressive short

bets and rather should focus on stock specific approach

that may show signs of a strong bounce back.

Comments

The Nifty futures open interest has increased by 7.21%.

and BANK Nifty futures open interest has increased by

0.64% as market closed at 17213.60 levels.

The Nifty February future closed with a premium of 4.7

point against a premium of 13.31 point in last trading

session. The March series closed at a premium of 66.05

point.

The INDIA VIX increased from 18.89 to 20.44. At the

same time, the PCR-OI of Nifty has decreased from 0.90

to 0.70.

Few of the liquid counters where we have seen high

cost of carry are PNB, VEDL, IDFC, IDEA, AND

CANFINHOME.

Historical Volatility

SCRIP HV

TORNTPOWER

40.87

GNFC

57.26

LUPIN

39.39

INDIGO

48.75

HDFCBANK

30.41

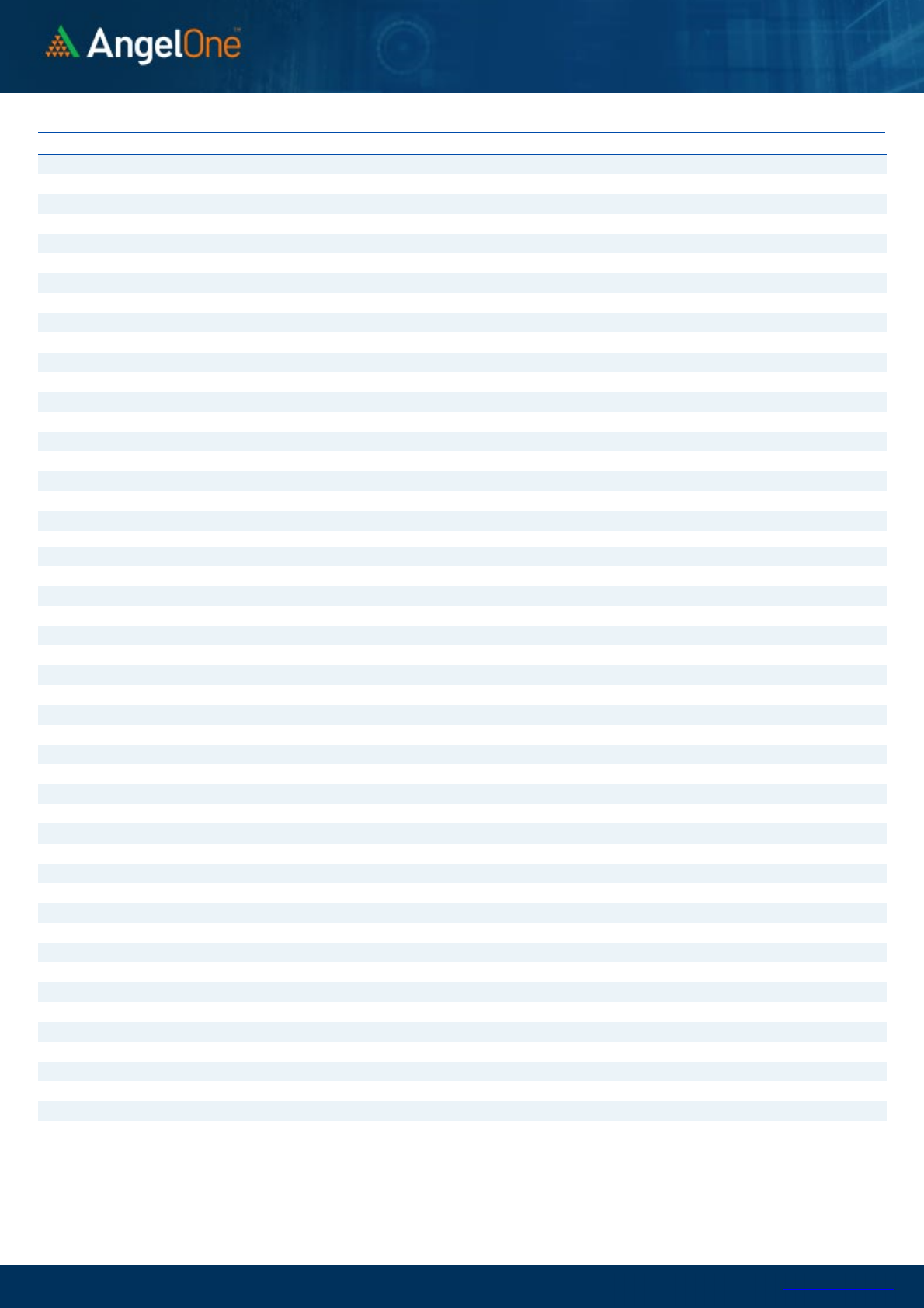

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

18000

18200

18400

18600

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

1-14 1-18 1-20 1-24 1-27 1-31 2-2 2-4

(`000)

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND

3181550 29.88 999.85 -1.86

LUPIN

10140500 25.00 804.70 -7.67

TORNTPOWER

4501500 18.57 524.15 -10.21

GNFC

3057600 18.01 515.50 12.81

HONAUT

9690 15.56 44991.60 1.05

HINDCOPPER

16972100 15.24 141.45 2.79

MFSL

1756950 15.07 869.30 -1.89

ESCORTS

7054300 8.66 1823.85 -0.66

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

FEDERALBNK

86340000 -11.52 99.50 0.50

MARICO

8263000 -7.46 511.40 0.09

GUJGASLTD

2093750 -6.58 690.35 1.14

ABFRL

15412800 -6.14 290.75 -1.69

JKCEMENT

288225 -5.62 3329.75 -0.37

SIEMENS

1586475 -5.53 2415.75 -0.63

PERSISTENT

395850 -5.04 4232.75 -1.87

RECLTD

32046000 -4.85 137.20 -2.80

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY

0.70 0.80

BANKNIFTY

0.58 1.01

RELIANCE

0.42 0.35

ICICIBANK

0.44 0.56

INFY

0.42 0.41

www.angelone.in

Technical & Derivatives Report

February 08, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (February Series) are given as an information and not as a recommendation.

Nifty Spot = 17213.60

FII Statistics for

February

07

, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

4461.91 5529.39 (1067.48) 155476 13719.97 7.52

INDEX

OPTIONS

655347.95 653969.61 1378.34

1505693 133986.19 12.58

STOCK

FUTURES

15825.89 15660.87 165.02

1876515 129708.42 1.34

STOCK

OPTIONS

15767.72 16123.41 (355.69) 275824 20340.39 7.22

Total

691403.47

691283.28

120.19

3813508

297754.97

6.19

Turnover

on

February

07

, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

415866 37700.84 1.58

Index Options

74471496 6868959.43

29.34

Stock Futures

866317 63199.71 4.66

Stock Options

2957409 226570.64 13.27

Total

7,87,11,088

7196430.62

28.32

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy

17200 294.00

51.10 48.90 17251.10

Sell

17300 242.90

Buy

17200 294.00

94.80 105.20 17294.80

Sell

17400 199.20

Buy

17300 242.90

43.70 56.30 17343.70

Sell

17400 199.20

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy

17200 276.40

43.45 56.55 17156.55

Sell

17100 232.95

Buy

17200 276.40

80.80 119.20 17119.20

Sell

17000 195.60

Buy

17100 232.95

37.35 62.65 17062.65

Sell

17000 195.60

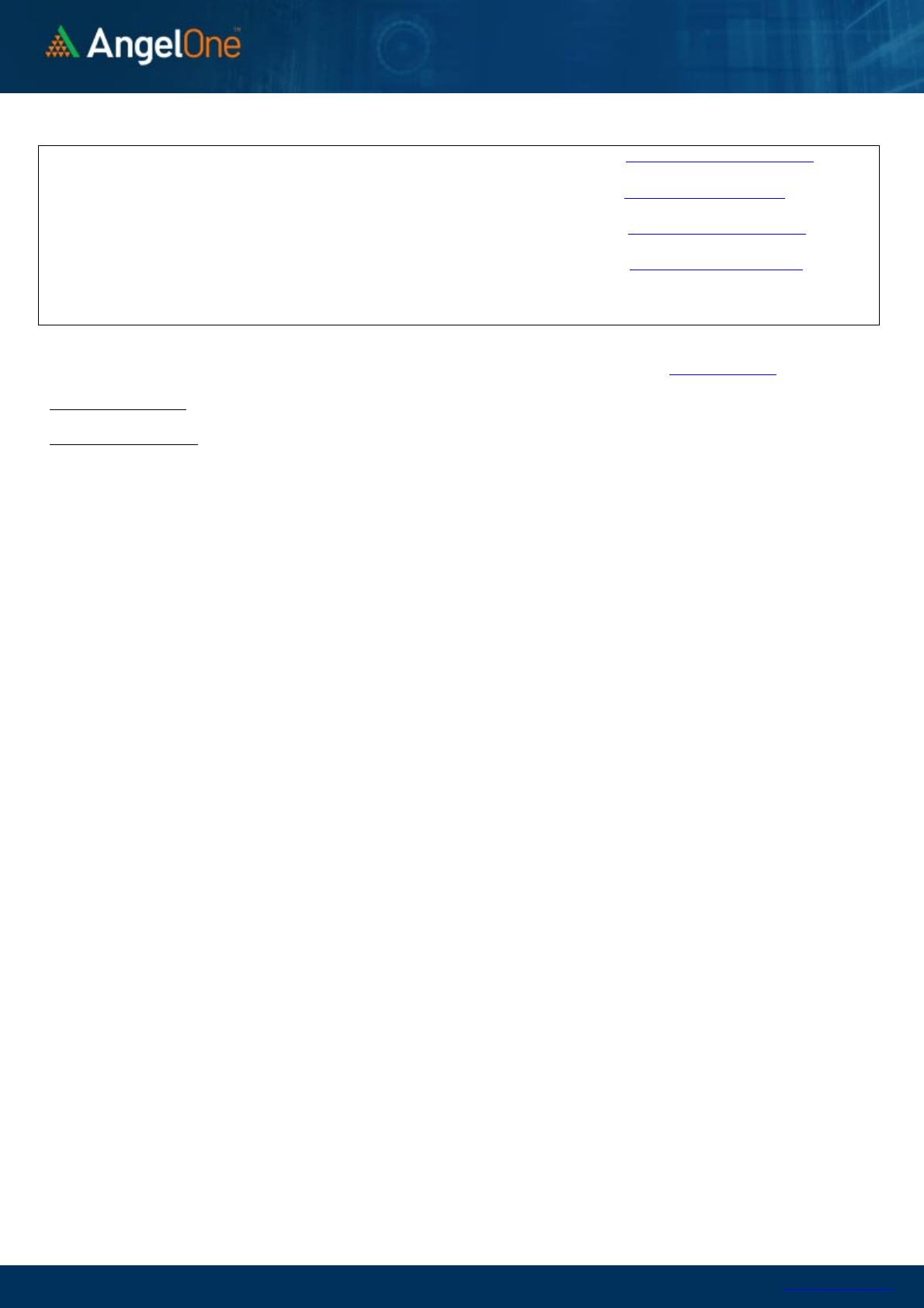

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

February 08, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS 703 709

719 726 736

ASIANPAINT 3,082 3,128

3,190 3,236 3,298

AXISBANK 773 781

792 801 812

BAJAJ-AUTO 3,403 3,439

3,505 3,541 3,607

BAJFINANCE 6,708 6,819

6,992 7,103 7,276

BAJAJFINSV 15,194 15,453

15,908 16,167 16,623

BPCL 365 369

374 377 382

BHARTIARTL 688 697

709 718 729

BRITANNIA 3,350 3,399

3,489 3,539 3,629

CIPLA 916 925

936 945 956

COALINDIA 158 159

161 163 165

DIVISLAB 4,074 4,138

4,242 4,305 4,409

DRREDDY 4,203 4,256

4,303 4,356 4,403

EICHERMOT 2,519 2,560

2,603 2,644 2,687

GRASIM 1,671 1,692

1,721 1,741 1,770

HCLTECH 1,133 1,145

1,158 1,170 1,184

HDFCBANK 1,423 1,446

1,482 1,505 1,541

HDFCLIFE 585 594

609 618 633

HDFC 2,361 2,395

2,453 2,487 2,546

HEROMOTOCO 2,560 2,604

2,669 2,713 2,778

HINDALCO 511 517

525 531 539

HINDUNILVR 2,191 2,224

2,270 2,304 2,350

ICICIBANK 767 777

791 800 815

IOC 121 122

123 124 125

INDUSINDBK 909 921

940 952 971

INFY 1,678 1,696

1,714 1,733 1,751

ITC 225 228

231 234 237

JSW STEEL 633 642

654 663 676

KOTAKBANK 1,776 1,802

1,846 1,872 1,916

LT 1,829 1,857

1,902 1,930 1,975

M&M 810 820

832 842 855

MARUTI 8,294 8,403

8,509 8,618 8,724

NESTLEIND 17,626 17,849

18,135 18,358 18,644

NTPC 133 134

135 136 137

ONGC 167 170

172 174 176

POWERGRID 208 211

213 215 217

RELIANCE 2,275 2,296

2,326 2,348 2,378

SBILIFE 1,109 1,127

1,149 1,167 1,189

SHREECEM 23,939 24,402

24,764 25,227 25,589

SBIN 512 523

536 546 560

SUNPHARMA 868 877

889 899 911

TCS 3,713 3,746

3,789 3,822 3,865

TATACONSUM

680 692

715 727 749

TATAMOTORS 485 490

497 502 509

TATASTEEL 1,133 1,158

1,186 1,211 1,240

TECHM 1,416 1,430

1,448 1,462 1,480

TITAN 2,322 2,365

2,432 2,476 2,542

ULTRACEMCO 7,294 7,382

7,450 7,538 7,607

UPL 736 746

761 771 785

WIPRO 544 550

562 569 580

www.angelone.in

Technical & Derivatives Report

February 08, 2022

*

Technical and Derivatives Team:

Sameet Chavan

Chief Analyst

–

Technical & Deriv

atives

sameet.chavan@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.