DEC 07, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

Nifty Bank

Outlook (

43

1

3

9

)

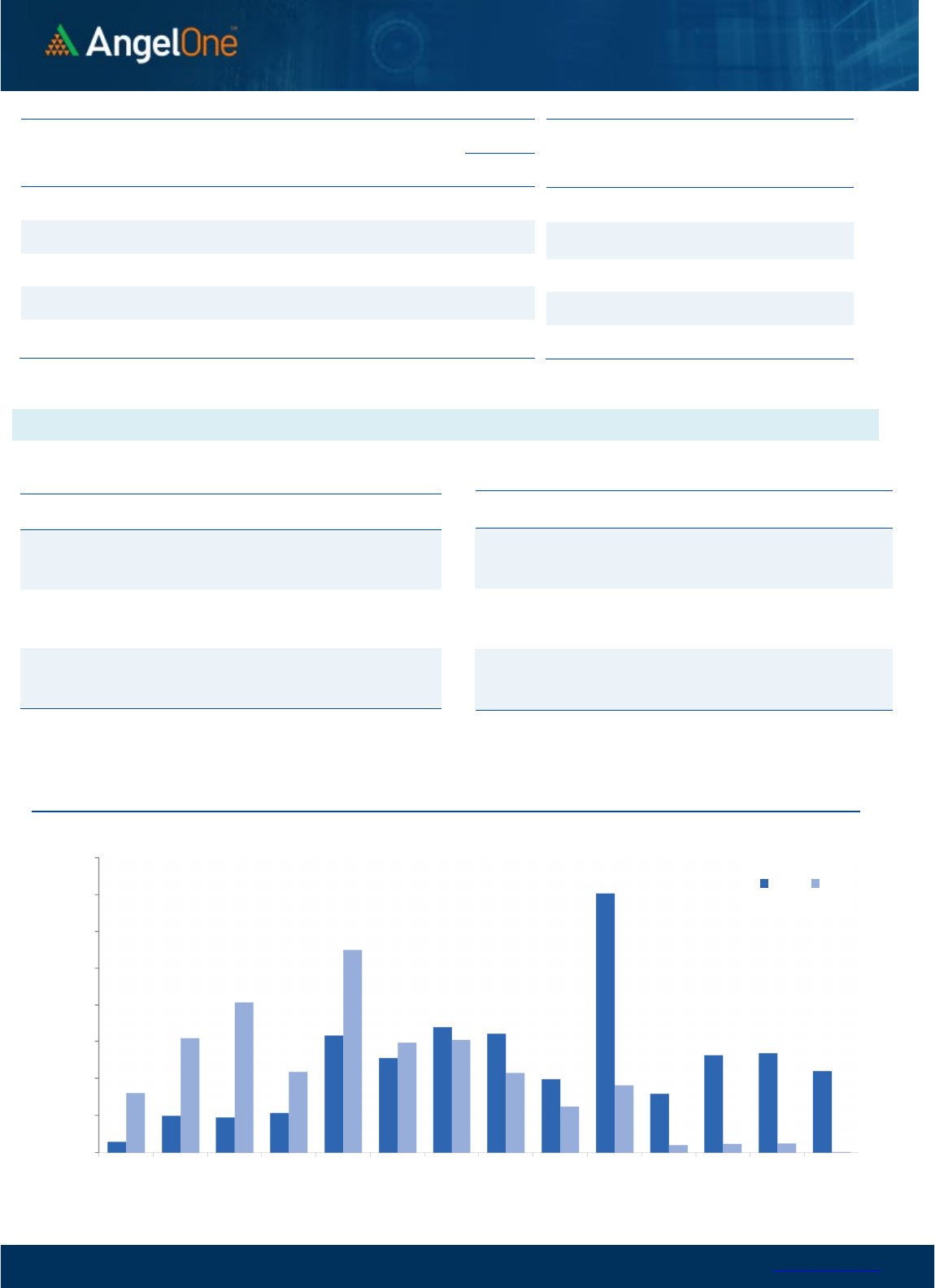

The BANKNIFTY too had a muted start for the session in line with

benchmark index. As the day progressed, we witnessed a gradual

decline in banking counters. In absence of any recovery, the

banking index ended the session with more than four tenths of a

percent cut.

On Monday, banking space was the lone saviour and yesterday it

became the major culprit. However structurally we do not see any

major damage in the index. As far as levels are concerned, 43000 -

42800 remains to be a key support zone; whereas on the flipside,

43300 - 43500 has now become a strong cluster of hurdles. Traders

are advised to remain positive as long as the important support

base remains defended. Even though there was lack of traction in

Bank Nifty, real action was seen in individual stocks and the PSU

banking stocks continued with their recent outperformance. Going

ahead as well, traders should focus on stock specific trades on the

key RBI policy day.

Key Levels

Support 1 – 43000 Resistance 1 – 43300

Support 2 – 42800 Resistance 2 – 43500

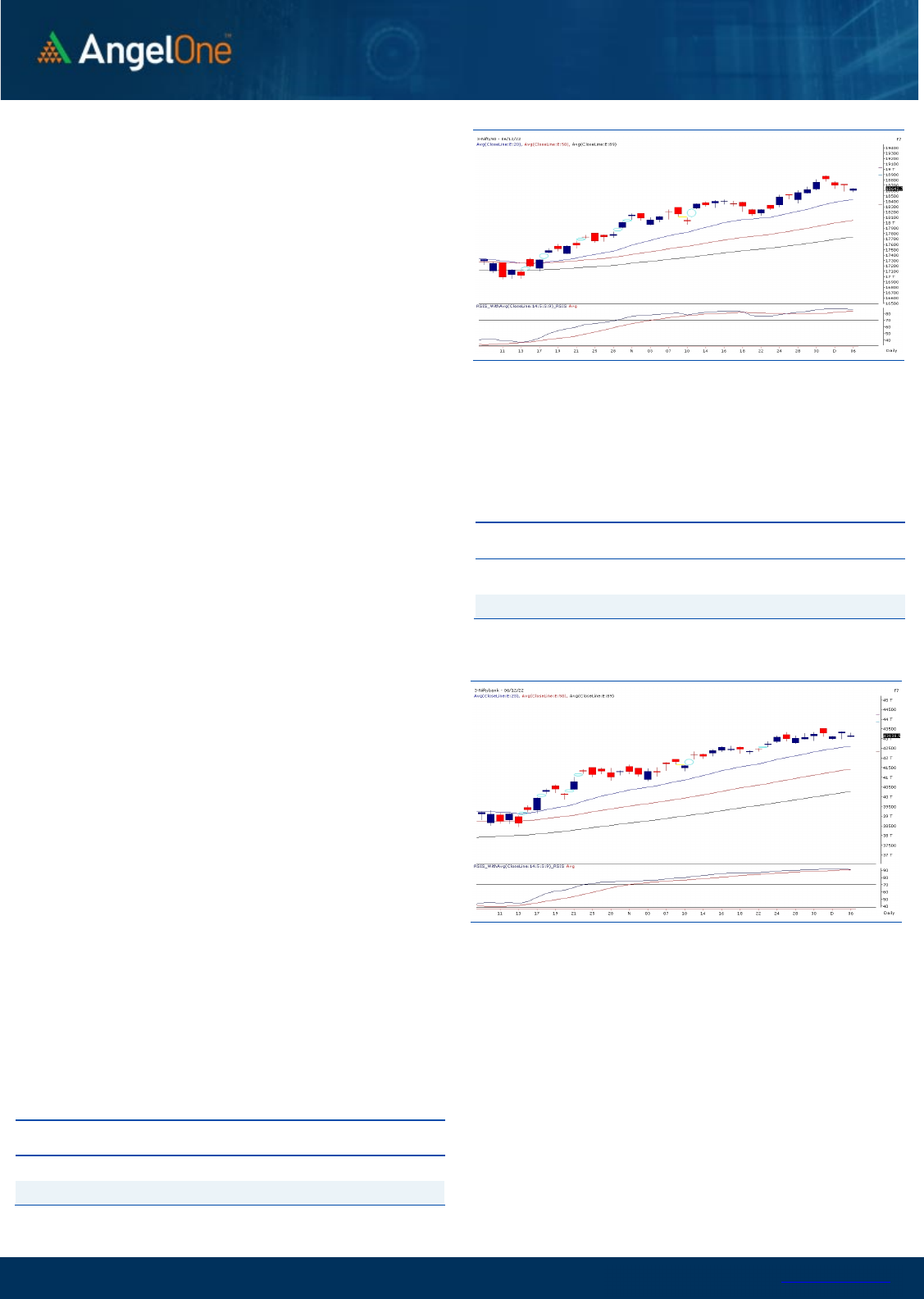

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (62626) / Nifty (18643)

The weakness among the global peers led to a timid opening in our

equity market. The benchmark index Nifty50 started the day with a

small gap down and hustled in a narrow range at the lower end

throughout the session. Amidst the lackluster session, the bulls

showed their comeback in the penultimate hour and made a

modest recovery to pare down some of the initial losses. The Nifty

concluded near the day’s high, shedding nearly 0.30 percent, and

settled a tad below the 18650 level.

On the technical front, the support of 18600 once again proved its

mettle as bulls firmly retaliated to safeguard the same. We allude to

our previous commentary to have the buy on dip and sell on rise

approach, which seems perfectly aligned with the current market

conditions. As far as levels are concerned, till the time the

sacrosanct support of 18600-18500 is firmly withheld, there is no

sign of worry for the participants. While on the higher end, a series

of resistances could be seen starting from 18700-18750 to 18800-

18850 in the comparable period.

Going forward, the index is likely to hover within the mentioned

range and meanwhile, one should keep focusing on the stock-

specific front for trading opportunities. Simultaneously, all eyes

would be on the upcoming RBI policy outcome that might dictate

the near-term trend for the market. Hence, we advocate to stay

abreast with domestic as well as global developments.

Key Levels

Support 1 – 18600 Resistance 1 – 18750

Support 2 – 18500 Resistance 2 – 18850

www.angelone.in

Technical & Derivatives Report

DEC 07, 2022

View

We had a gap down start on Tuesday, which was

followed by consolidation around the vicinity of 18600

for major part of the day. Final hour, some recovery

was seen to trim initial losses and conclude the day

with a cut of 0.31%.

FIIs were net sellers in the cash market segment to

the tune of Rs. 635 crores. Simultaneously, in Index

futures, they sold worth Rs. 1533 crores with a rise in

open interest, indicating formation of bearish bets.

Yesterday, we could hardly see any fresh build-up in

key indices. Stronger hands added fresh shorts in

index and stock futures segment. In options front, we

witnessed huge pile up of positions in 18600 and 18550

put strikes, which is an encouraging sign. Meanwhile,

18600 and 18800 call strikes also added some

positions. It was a second straight session wherein

market rebounded from the vicinity of 18600, which is

certainly making 18550-18600 zone a strong demand

zone. On the higher side, 18900 followed buy 19000

shall be seen as immediate hurdles. We would

maintain our bullish stance on market and would

advocate utilizing dips to add fresh longs.

Comments

The Nifty futures open interest has decreased by

2.21% and Bank Nifty futures open interest has

decreased by 7.06% as the market closed at 18642.75.

The Nifty December future closed with a premium of

128.60 point against a premium of 116.45 point in the

last trading session. The January series closed at a

premium of 235.10 point.

The INDIA VIX increased from 13.73 to 14.04. At the

same time, the PCR-OI of Nifty has increased to 0.91

from 0.90.

Few of the liquid counters where we have seen high

cost of carry are BHEL, ASTRAL, OFSS, EICHERMOT

and ABCAPITAL.

Historical Volatility

SCRIP HV

BPCL 34.32

DRREDDY 28.99

HONAUT 36.97

HINDPETRO 41.12

PERSISTENT 46.75

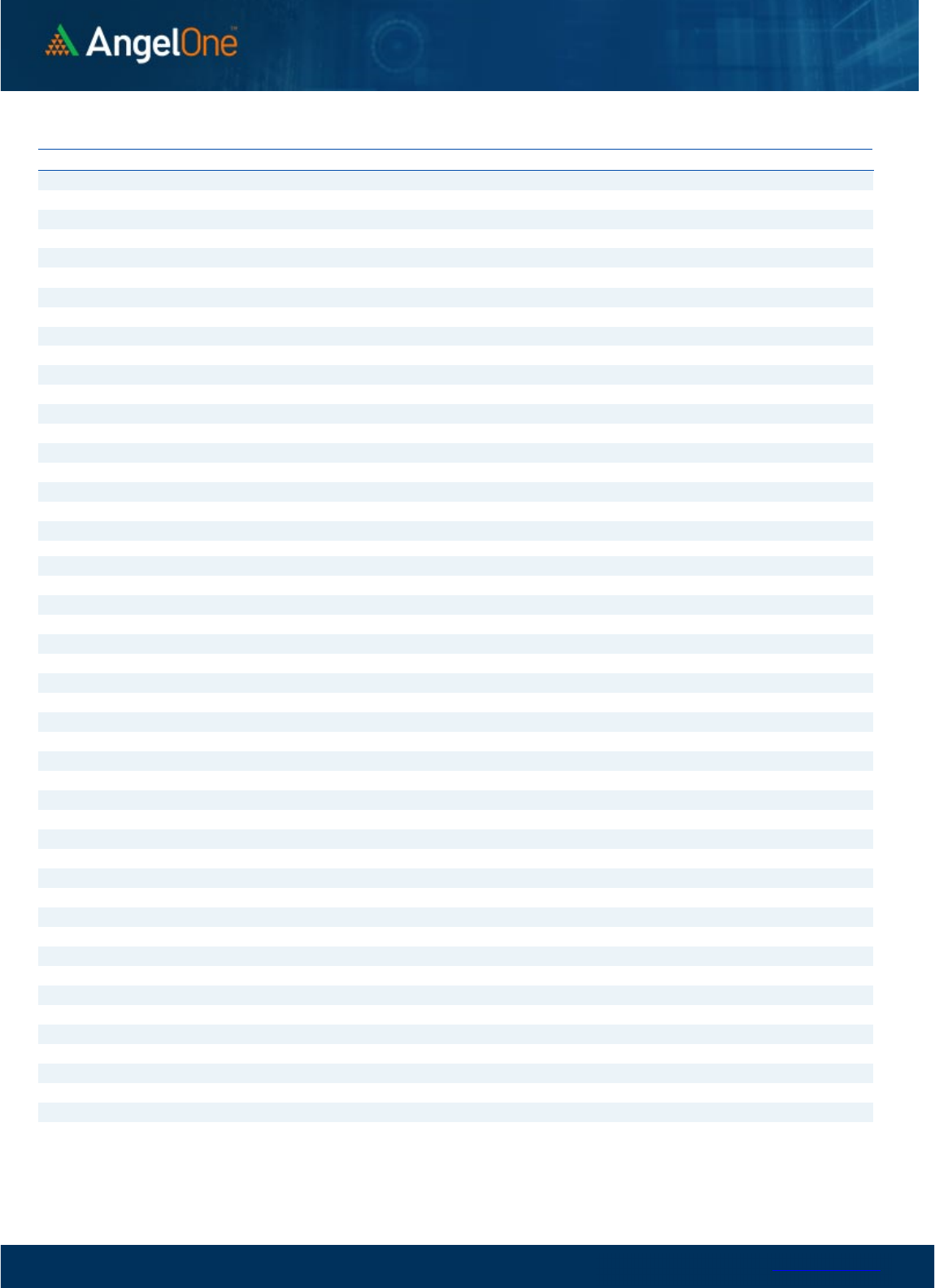

Nifty Vs OI

17800

18000

18200

18400

18600

18800

19000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

11/17 11/22 11/24 11/28 11/30 12/2 12/6

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PNB 260336000 20.62 55.45 0.90

IRCTC 18151875 20.53 716.45 -2.68

COLPAL 2478000 15.07 1586.50 -0.72

SBILIFE 5705250 8.66 1285.10 0.24

DRREDDY 1927500 7.10 4374.20 -2.07

PEL 6471300 6.10 901.05 0.15

TATACHEM 8093000 6.03 1043.20 -1.23

CROMPTON 3921000 5.83 362.15 -1.88

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BOSCHLTD 126000 -7.49 17286.10 0.68

HINDALCO 19919025 -6.69 470.00 -2.31

HCLTECH 10073000 -6.30 1120.95 -0.92

IGL 8496125 -6.27 439.75 0.86

FEDERALBNK 73975000 -5.76 134.80 -1.53

TORNTPOWER 2830500 -5.46 543.35 -0.84

TATASTEEL 202778000 -5.12 112.95 -2.45

COALINDIA 28648200 -4.55 231.65 0.15

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.91 0.90

BANKNIFTY 0.84 0.99

RELIANCE 0.56 0.43

ICICIBANK 0.48 0.51

INFY 0.44 0.60

www.angelone.in

Technical & Derivatives Report

DEC 07, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

642.75

FII Statistics for

December

0

6

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

1864.89 3398.31 (1533.42) 177757 17478.05 2.45

INDEX

OPTIONS

783512.91 781576.10 1936.81

1955817 191934.13 3.50

STOCK

FUTURES

7417.48 9233.71 (1816.23) 1932627 135862.36 0.46

STOCK

OPTIONS

6829.39 6955.69 (126.30) 135643 9780.82 4.19

Total 799624.67

801163.81

(1539.14) 4201844

355055.36

2.06

Turnover on

December

0

6

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

229443 22771.81 -7.53

Index

Options

146117964 32178.05 -8.02

Stock

Futures

658090 47830.45 -1.84

Stock

Options

2530006 3498.56 -4.80

Total

2,530,006 3498.56 -5.12

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18700 269.70

57.80

42.20

18757.80

Sell

18800 211.90

Buy

18700 269.70

106.20

93.80

18806.20

Sell

18900 163.50

Buy

18800 211.90

48.40 51.60 18848.40

Sell 18900 163.50

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18600 158.65

31.60

68.40

18568.40

Sell

18500 127.05

Buy 18600 158.65

56.05

143.95

18543.95

Sell 18400 102.60

Buy

18500 127.05

24.45 75.55 18475.55

Sell 18400 102.60

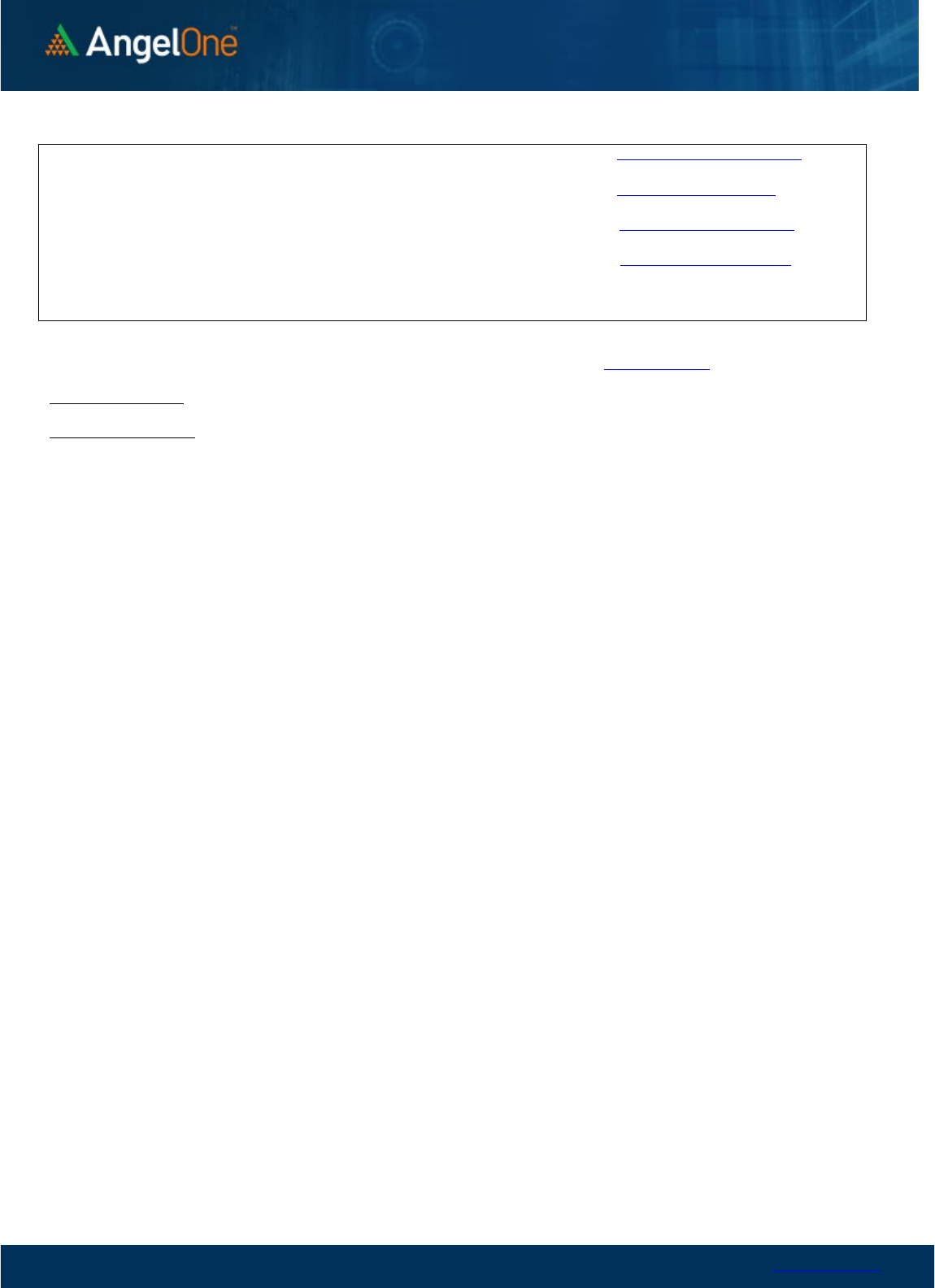

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100 19200 19300 19400

Call Put

www.angelone.in

Technical & Derivatives Report

DEC 07, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT

3,851

3,942

3,999

4,090

4,147

ADANIPORTS

879

888

895

904

911

APOLLOHOSP 4,683 4,735

4,768 4,820

4,853

ASIANPAINT

3,108

3,135

3,152

3,179

3,196

AXISBANK 891 898

902

909 914

BAJAJ-AUTO

3,621

3,658

3,679

3,716

3,737

BAJFINANCE 6,586 6,642

6,689

6,745

6,792

BAJAJFINSV 1,618 1,627

1,637

1,645

1,656

BPCL

320

324

333

337

346

BHARTIARTL 821 827

836

842 851

BRITANNIA 4,350 4,387

4,419

4,457

4,489

CIPLA

1,096

1,103

1,110

1,117

1,125

COALINDIA

228

230

231

233

234

DIVISLAB 3,338 3,347

3,358

3,367

3,378

DRREDDY 4,287 4,331

4,403

4,446

4,518

EICHERMOT 3,246 3,273

3,305

3,332

3,365

GRASIM

1,789

1,807

1,819

1,837

1,849

HCLTECH 1,100 1,110

1,118

1,128

1,136

HDFCBANK

1,595

1,603

1,608

1,617

1,622

HDFCLIFE 579 583

589

593

599

HDFC 2,634 2,659

2,676

2,701

2,718

HEROMOTOCO 2,754 2,776

2,801

2,823

2,848

HINDALCO 461 466

472

476

482

HINDUNILVR 2,583 2,619

2,639

2,675

2,696

ICICIBANK

915

919

924

928

934

INDUSINDBK

1,161

1,173

1,190 1,202

1,219

INFY

1,597

1,605

1,615 1,623

1,634

ITC

332

335

337

339 341

JSW STEEL 732 739

748

755

763

KOTAKBANK 1,910 1,923

1,933

1,945

1,956

LT 2,054 2,074

2,087 2,107

2,120

M&M

1,242

1,253

1,259

1,270

1,276

MARUTI 8,632 8,675

8,737

8,780

8,842

NESTLEIND 19,410 19,661

19,825

20,076

20,240

NTPC

173

174

175

176

177

ONGC 140 141

142 143

144

POWERGRID 218 221

222

225

227

RELIANCE

2,647

2,668

2,683 2,704

2,719

SBILIFE 1,261 1,273

1,293

1,305

1,325

SBIN

600

605

612

617

624

SUNPHARMA 1,016 1,025

1,032

1,041

1,049

TCS 3,347 3,366

3,387 3,406 3,427

TATACONSUM

791

794

797

801

804

TATAMOTORS

422

425

428

431

434

TATASTEEL

110

112

114

115

117

TECHM

1,072

1,081

1,088

1,097

1,104

TITAN 2,578 2,598

2,611 2,630 2,643

ULTRACEMCO 7,085 7,163

7,219

7,297

7,352

UPL

771

779

791

800 812

WIPRO

406

409

411

413 415

www.angelone.in

Technical & Derivatives Report

DEC 07, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.