September 07, 2021

www.angelone.in

Technical & Derivatives Report

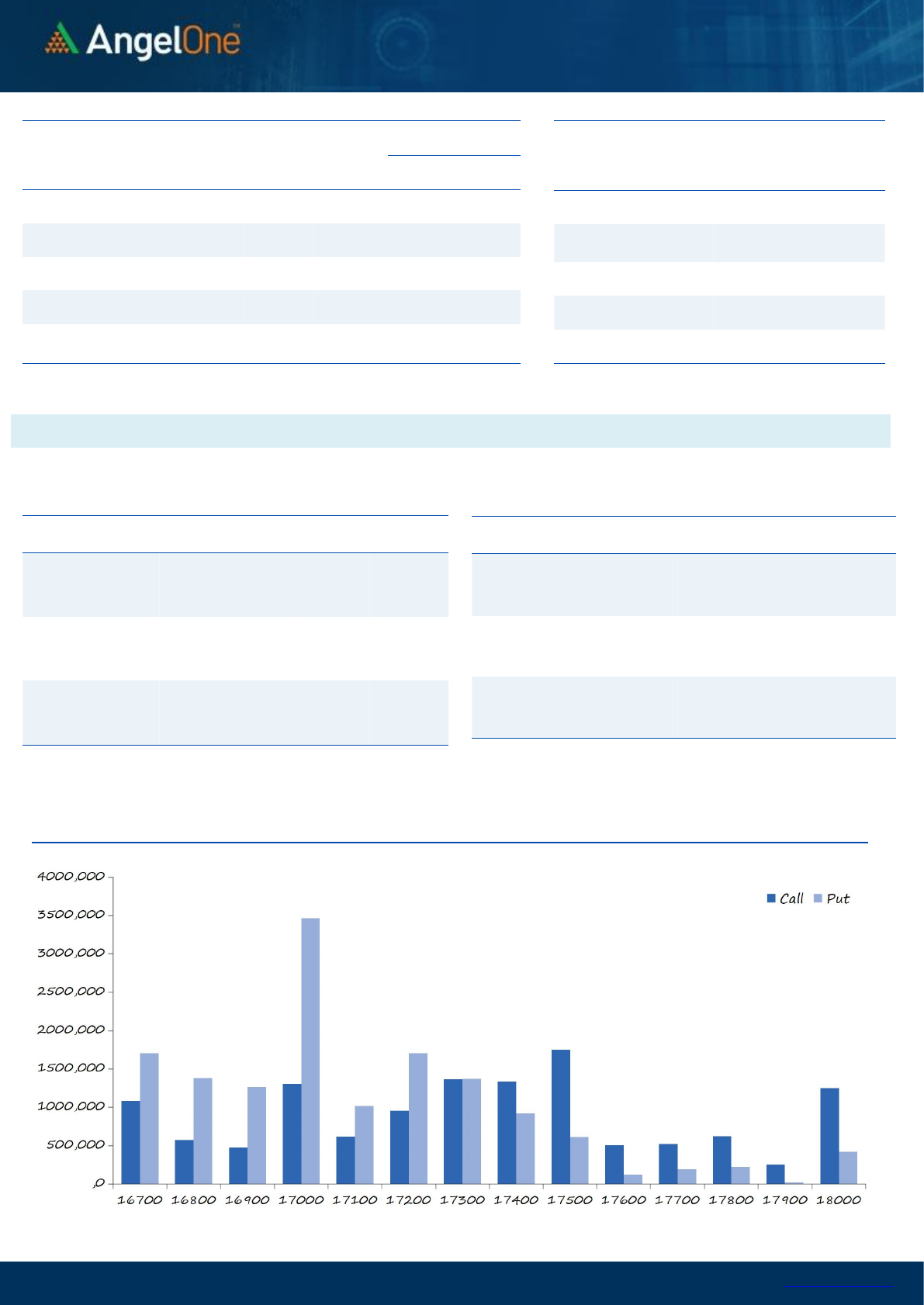

Exhibit 1: Nifty Daily Chart

Nifty Bank Outlook - (36592)

We had a cheerful start for the week; but in absence of follow-up

buying the banking index witnessed some profit taking in the initial

two hours of trade. As we progressed, index made an attempt to

recovery in the midst but once again failed to hit fresh intraday low

of 36554.45 and then concluded the day with a cut of almost half a

percent. It’s the fourth consecutive session wherein the BankNifty has

been witnessing strong selling pressure as it approaches 36900-

37200 zone. But, this is certainly nothing new as we have been

observing such underperformance by this space since quite some

time despite the benchmark has been clocking fresh record highs

every day since last six trading sessions. As far as levels are

concerned, the immediate support zone is placed around 36400-

36500; whereas, 37000-37200 is the sturdy wall now. Until we don’t

see a strong move beyond this range, trades are advised focusing on

individual counters that has been showing strength.

Key Levels

Support 1 – 36500

Resistance 1 – 37000

Support 2 – 36400

Resistance 2 – 37200

Exhibit 2: Nifty Bank Daily Chart

Sensex (58297) / Nifty (17378)

Our markets had a pleasant start to the new week owing to favourable

global cues. In the course of action, Nifty reached yet another milestone

of 17400. However due to lack of follow up buying, the up move got

restricted for the day. Market didn’t correct either, in fact it remained in

a slender range of nearly 60 – 70 points throughout the remaining part

of the session.

There has been no stopping for benchmark index and every day we are

seeing new milestones being achieved. Before anyone could realise, we

have conquered 17400 as well. The rally has been steady in nature but

the kind of elevated levels we have reached now, it’s too fast too

furious. Hence, although the trend is extremely strong, we remain a bit

sceptical and continue to advise booking profits in the rally at least with

a short term view. As far as levels are concerned, 17450 – 17500 would

be seen as immediate hurdles and the moment we slide below 17340,

we may see some decent profit booking towards 17250 – 17200.

Key Levels

Support 1 – 17340

Resistance 1 – 17450

Support 2 – 17200

Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

September 07, 2021

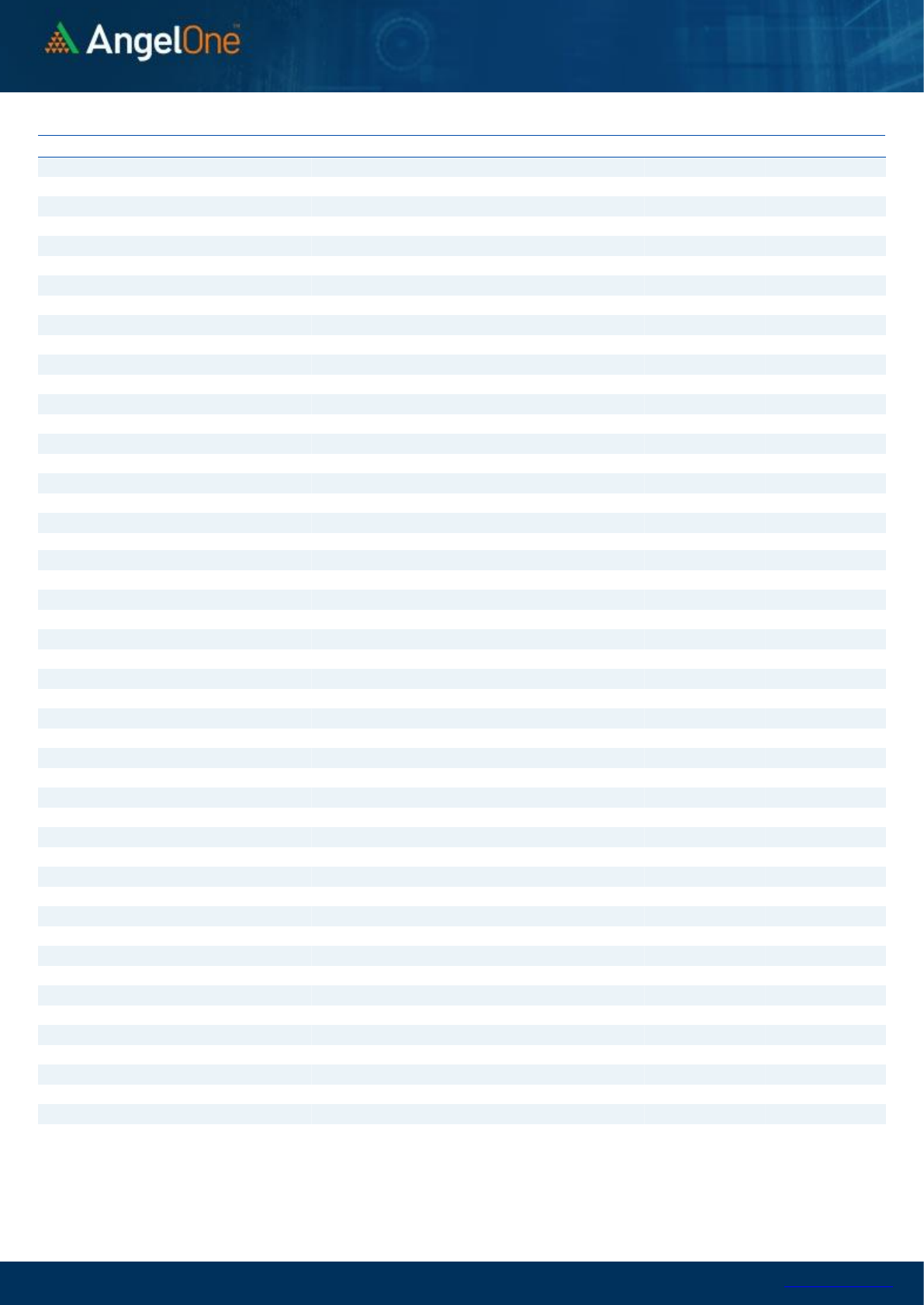

Nifty Vs OI

View

Nifty started the day on a positive note and surpassed

the 17400 mark. It then consolidated within a range for

most part of the day and ended with gains of three-

tenths of a percent.

FIIs were net sellers in cash market segment to the tune

of Rs. 589 crores. In index futures, they bought to the

tune of Rs. 347 crores with rise in open interest

indicating long formations in yesterday’s session.

The benchmark hit another milestone of 17400

yesterday, but it then consolidated in a range and we

did not see any addition of fresh positions. However,

the existing longs are still intact. FII's added some fresh

longs in the index futures and their 'Long Short Ratio' is

currently above 65 percent. The data hints at a

resistance around 17500 and support around 17300. We

expect the index to trade within this range in next two-

three sessions and hence, traders should look to buy if

index approaches support and lighten up longs if

market reaches around the mentioned resistance.

Comments

The Nifty futures open interest has increased by 0.68%.

Bank Nifty futures open interest has increased by 3.17%

as market closed at 17377.80 levels.

The Nifty September future closed with a premium of

26.85 point against a premium of 5.75 point in last

trading session. The October series closed at a premium

of 52.90 point.

The INDIA VIX decreased from 14.54 to 14.05. At the

same time, the PCR-OI of Nifty has decreased from 1.35

to 1.29.

Few of the liquid counters where we have seen high cost

of carry are IDEA, INDIAMART, PEL, SIEMENS, AND

CANFINHOME

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

INDIAMART

218475

42.44

8920.40

10.05

OFSS

324750

21.97

4818.05

1.57

NATIONALUM

129778000

21.72

99.20

5.53

PVR

2477002

19.15

1377.05

2.89

MCX

2033850

16.01

1643.65

3.03

HAL

1508125

15.62

1361.20

-2.48

CANFINHOME

1976325

15.11

591.95

1.16

SYNGENE

963900

14.43

628.80

0.17

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

UBL

1619100

-6.20

1581.10

0.36

ONGC

55247500

-5.05

121.65

-1.40

M&MFIN

28996000

-4.83

168.25

1.69

BALKRISIND

1378400

-4.73

2454.15

1.69

HDFCLIFE

20135500

-4.57

736.05

0.23

SUNPHARMA

33896800

-4.35

784.25

-0.71

LUPIN

9886350

-4.28

981.95

1.52

BPCL

40917600

-3.93

490.80

-0.46

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.29

0.99

BANKNIFTY

0.67

0.89

RELIANCE

0.55

0.33

ICICIBANK

0.50

0.48

INFY

0.56

0.34

Historical Volatility

SCRIP

HV

INDIAMART

57.43

WIPRO

38.30

IRCTC

46.54

ESCORTS

46.58

ICICIGI

40.62

www.angelone.in

Technical & Derivatives Report

September 07, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17377.80

FII Statistics for September 06, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

2862.88

2515.79

347.09

182954

16115.00

2.00

INDEX

OPTIONS

261073.15

256207.46

4865.69

1559789

137803.09

16.78

STOCK

FUTURES

12929.80

13133.03

(203.23)

1454297

124709.71

0.18

STOCK

OPTIONS

15918.99

16129.45

(210.46)

235156

20027.24

7.98

Total

292784.82

287985.73

4799.09

3432196

298655.04

7.78

Turnover on September 06, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

1,90,396

17033.09

-40.32

Index Options

3,53,87,845

31,88,904.61

-38.97

Stock Futures

6,76,256

57659.65

-21.76

Stock Options

27,60,028

2,38,752.17

1.43

Total

3,90,14,525

35,02,349.52

-37.04

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

223.50

49.00

51.00

17449.00

Sell

17500

174.50

Buy

17400

223.50

88.65

111.35

17488.65

Sell

17600

134.85

Buy

17500

174.50

39.65

60.35

17539.65

Sell

17600

134.85

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17400

222.00

44.30

55.70

17355.70

Sell

17300

177.70

Buy

17400

222.00

79.40

120.60

17320.60

Sell

17200

142.60

Buy

17300

177.70

35.10

64.90

17264.90

Sell

17200

142.60

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 07, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

737

744

754

762

772

ASIANPAINT

3,281

3,298

3,323

3,340

3,365

AXISBANK

790

795

801

806

811

BAJAJ-AUTO

3,734

3,758

3,793

3,817

3,852

BAJFINANCE

7,406

7,456

7,535

7,586

7,665

BAJAJFINSV

16,503

16,625

16,797

16,919

17,091

BPCL

486

488

492

495

499

BHARTIARTL

646

650

658

662

670

BRITANNIA

4,008

4,044

4,096

4,132

4,185

CIPLA

935

943

950

958

966

COALINDIA

143

144

146

148

150

DIVISLAB

5,148

5,176

5,212

5,241

5,276

DRREDDY

4,838

4,877

4,910

4,949

4,982

EICHERMOT

2,760

2,802

2,845

2,888

2,931

GRASIM

1,482

1,506

1,537

1,561

1,592

HCLTECH

1,159

1,179

1,195

1,216

1,231

HDFCBANK

1,551

1,558

1,570

1,577

1,589

HDFCLIFE

721

729

736

744

751

HDFC

2,725

2,745

2,761

2,782

2,798

HEROMOTOCO

2,787

2,802

2,816

2,831

2,845

HINDALCO

455

462

469

476

482

HINDUNILVR

2,744

2,762

2,794

2,812

2,843

ICICIBANK

715

718

723

726

731

IOC

110

111

112

113

115

INDUSINDBK

980

986

997

1,003

1,014

INFY

1,688

1,709

1,721

1,742

1,753

ITC

208

209

210

211

212

JSW STEEL

673

680

688

695

704

KOTAKBANK

1,746

1,760

1,784

1,798

1,822

LT

1,674

1,684

1,700

1,710

1,726

M&M

741

748

754

761

767

MARUTI

6,764

6,805

6,880

6,921

6,996

NESTLEIND

20,056

20,139

20,244

20,327

20,432

NTPC

115

116

117

117

118

ONGC

119

120

122

124

126

POWERGRID

171

173

174

176

178

RELIANCE

2,371

2,398

2,439

2,466

2,507

SBILIFE

1,228

1,236

1,242

1,251

1,257

SHREECEM

29,874

30,205

30,731

31,062

31,588

SBIN

428

429

432

433

435

SUNPHARMA

772

778

786

792

799

TCS

3,784

3,818

3,848

3,882

3,911

TATACONSUM

856

863

870

877

885

TATAMOTORS

295

296

297

299

300

TATASTEEL

1,409

1,423

1,437

1,452

1,466

TECHM

1,423

1,442

1,455

1,474

1,487

TITAN

1,993

2,007

2,020

2,034

2,047

ULTRACEMCO

7,860

7,906

7,976

8,022

8,092

UPL

745

750

755

760

764

WIPRO

645

666

677

698

709

www.angelone.in

Technical & Derivatives Report

September 07, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.