DEC 06, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

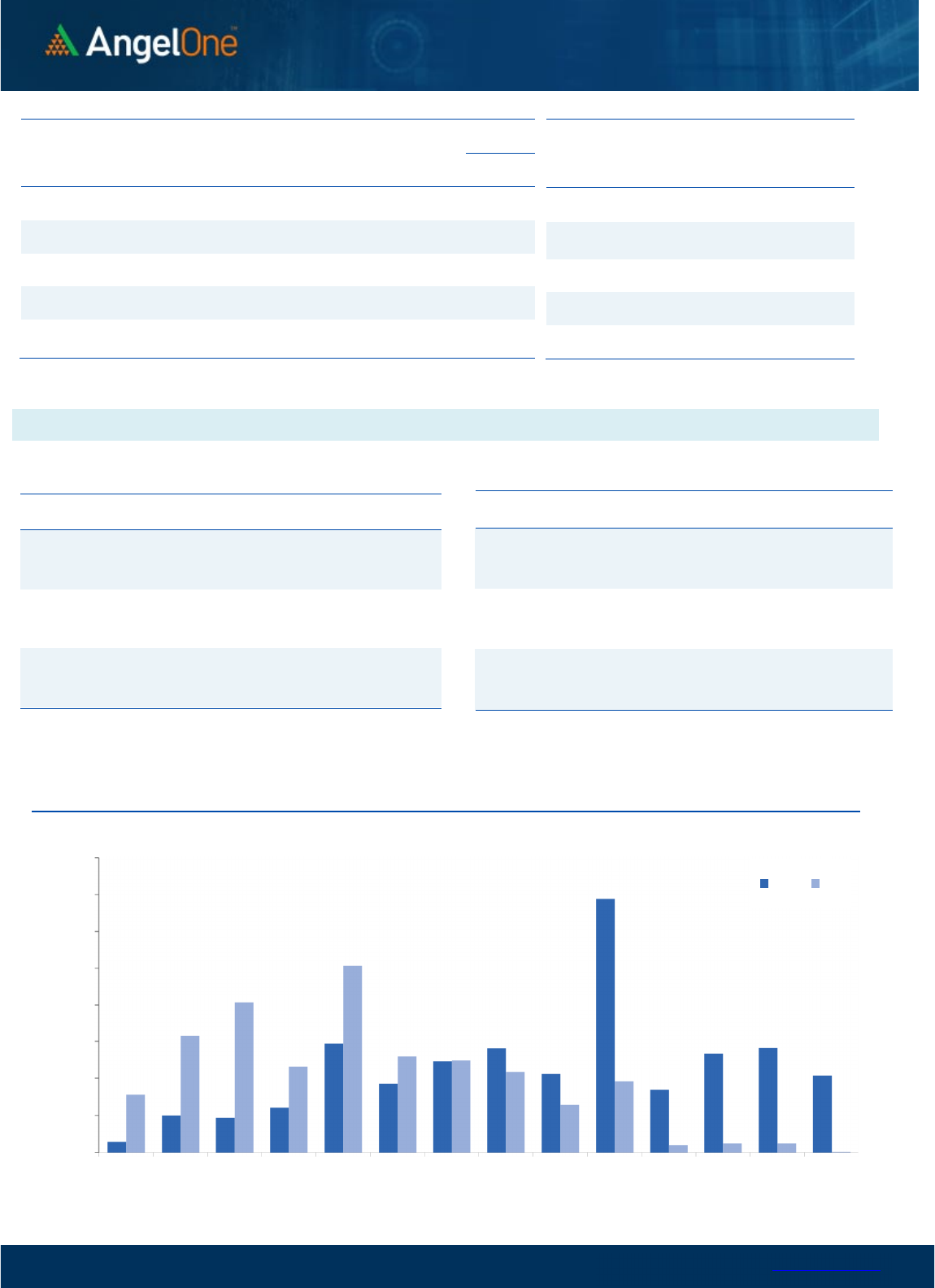

Nifty Bank Outlook (43333)

The banking index had a quiet start in tandem with benchmark. In

the initial hour, we observed some sluggish moves to enter sub-

43000 terrain. However, it was merely a formality as we witnessed

a good buying interest at lower levels to push the BANKNIFTY back

inside the green zone. In fact, as the day progressed, the banking

index took the charge as it single-handedly kept the benchmark

index in the hunt. It managed to pull the Nifty above the 18700

mark when other heavyweight pockets were sulking to some

extent. Eventually, the BANKNIFTY ended the session with nearly

half a percent gains.

We have been witnessing a range bound action in BANKNIFTY since

last eight trading sessions and yesterday too, the recovery took

place precisely after nearing the lower band. Now, since yesterday

it has managed to close around day’s high, it would be interesting

to see whether it continue to move northwards or not. Beyond

43500, once again banking index resumes its journey in the

uncharted territory. It we have to make any immediate projection,

43800 – 44000 would be the next levels to watch out for. On the

flipside, the support base remains in the vicinity of 43200 – 43000.

Key Levels

Support 1 – 43200 Resistance 1 – 43800

Support 2 – 43000 Resistance 2 – 44000

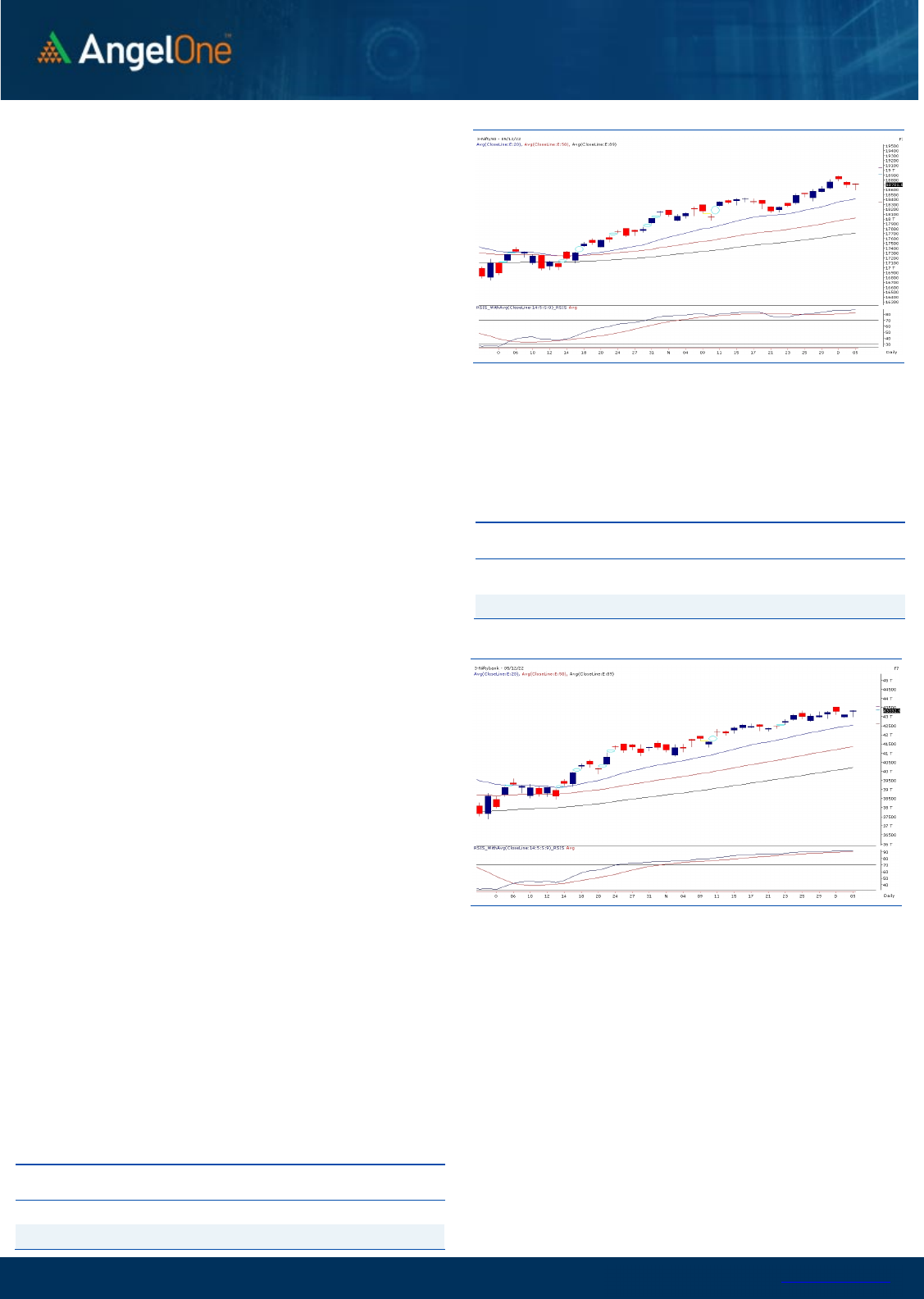

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (62835) / Nifty (18701)

The Indian equity market started the week on a mild note despite

positive global developments over the weekend. The benchmark

index slipped instantly post the opening bell, but the dip augured

well for the bulls as they retaliated from the lows and made a

modest recovery in the index. We have witnessed some

tentativeness in the index as the follow-up buying was missing in

major heavyweights, and the index made a subdued move

throughout the day. Post the hustles, Nifty concluded the day on a

flat note with a mere gain of 0.03 percent and settled a tad above

18700 levels.

On the technical perspective, the crucial support of the 18600 was

firmly safeguarded, implying the resilience of the technical support.

However, some tentativeness was evident on the higher

grounds, but there has been no significant change in the chart

structure as such. The strategy of buy on the decline and sell on rise

fits perfectly in the current market scenario. As far as levels are

concerned, the 18600-18500 is likely to act as the sacrosanct

support zone, and on the higher end, the immediate hurdle could

be seen around 18800-18850, followed by the psychological mark

of 19000.

Going forward, our market is likely to remain upbeat in the near

term, wherein any minor dip could be seen as an opportunity for

the bulls to add long bets. We may expect gradual moves in key

indices, but individual pockets are performing well. Hence, it’s

advisable to keep focusing on such potential movers, which are

likely to provide better trading opportunities.

Key Levels

Support 1 – 18600 Resistance 1 – 18800

Support 2 – 18500 Resistance 2 – 18850

www.angelone.in

Technical & Derivatives Report

DEC 06, 2022

View

Trading for the week started mildly positive which was

followed by profit booking in the initial hour of trade to

test 18600. Fortunately, not much damage was

observed thereafter as index recouped almost entire

losses to end the day marginally higher to Friday’s

close.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1139 crores. Simultaneously, in Index

futures, they bought worth Rs. 240 crores with a

decrease in open interest, indicating covering of

shorts.

Yesterday, the banking index outperformed the

benchmark and also added fresh longs, whereas open

interest activity for Nifty remained muted. Stronger

hands covered few shorts in index futures segment. In

options front, some build-up was seen in 18700 call

which looks to be on the long side. On the flip side,

writing was seen in 18600 and 18700 PUT but the

quantum remained insignificant. The way market

rebounded from the vicinity of 18600, it seems going

ahead 18550-18600 zone may act as strong support

zone. On the higher side, 18900 followed buy 19000

shall be seen as immediate hurdles. We would

maintain our bullish stance on market and would

advocate utilizing dips to add fresh longs.

Comments

The Nifty futures open interest has decreased by

0.72% and Bank Nifty futures open interest has

increased by 6.61% as the market closed at 18701.05.

The Nifty December future closed with a premium of

116.7 point against a premium of 116.45 point in the

last trading session. The January series closed at a

premium of 217.80 point.

The INDIA VIX increased from 13.45 to 13.73. At the

same time, the PCR-OI of Nifty has decreased to 0.90

from 0.94.

Few of the liquid counters where we have seen high

cost of carry are BHEL, ASTRAL, OFSS, EICHERMOT

and ABCAPITAL.

Historical Volatility

SCRIP HV

M&MFIN 54.62

ABCAPITAL 45.62

PEL 51.63

HINDALCO 50.72

TVSMOTOR 38.10

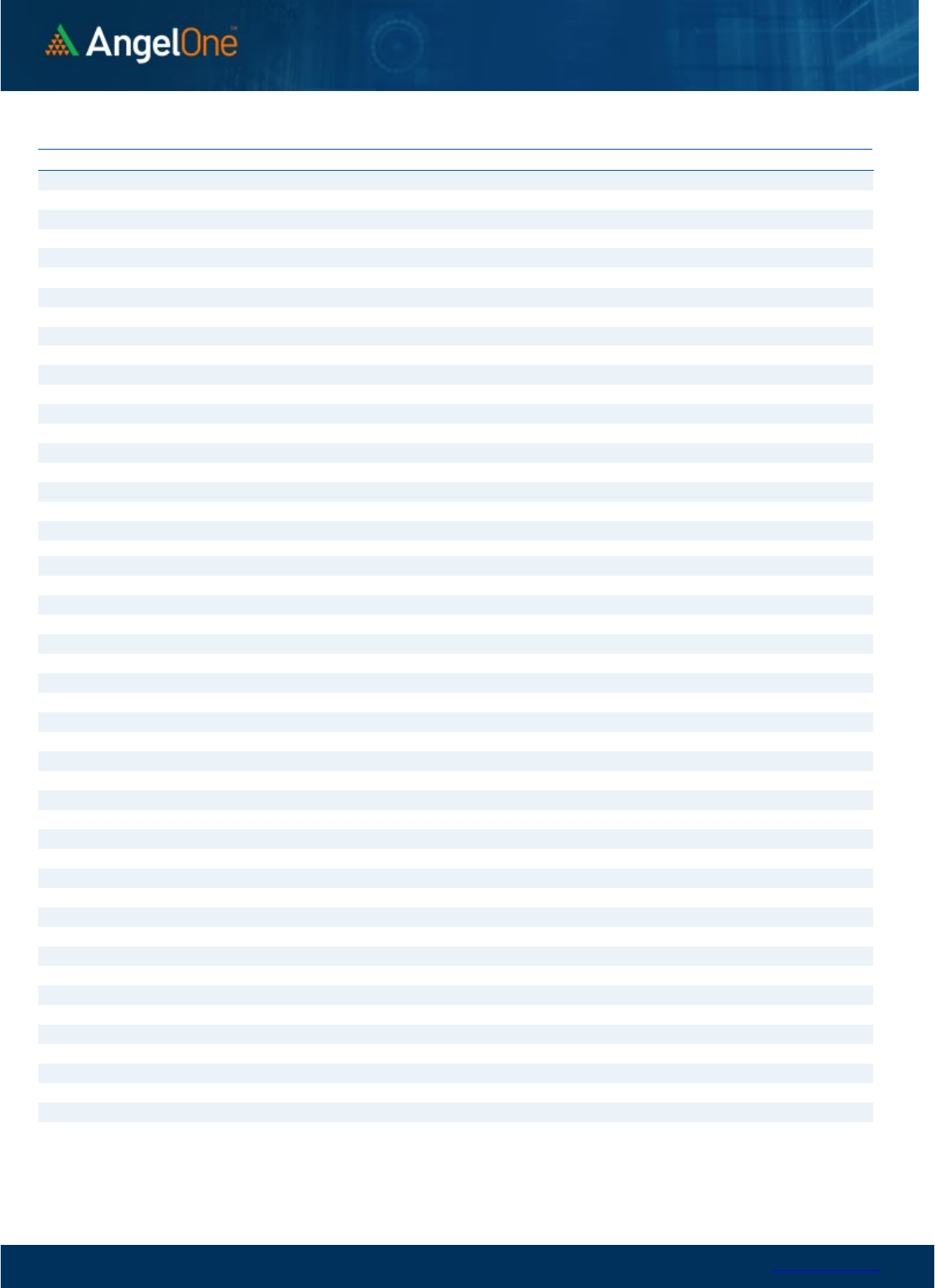

Nifty Vs OI

17800

18000

18200

18400

18600

18800

19000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

11/16 11/18 11/23 11/25 11/29 12/1 12/5

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

NAVINFLUOR 453000 29.95 4397.65 -0.38

GNFC 8255000 16.45 599.15 0.41

M&MFIN 20820000 12.59 241.15 5.66

PEL 6099225 12.04 896.30 4.60

HINDALCO 21347525 10.01 481.20 4.09

CUB 8515000 9.59 195.65 2.15

ASTRAL 1487475 7.39 2040.70 0.95

BERGEPAINT 6597800 6.82 622.20 0.90

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

PERSISTENT 505875 -11.96 4263.70 -2.14

NAUKRI 1482500 -6.33 4056.40 0.21

COALINDIA 30013200 -6.27 231.25 1.88

BRITANNIA 1337600 -5.58 4403.35 -0.65

NESTLEIND 275640 -5.41 19752.30 -0.19

GUJGASLTD 5012500 -5.16 508.50 -1.83

HDFC 15477300 -4.73 2675.80 0.26

UBL 1147600 -4.62 1748.35 0.55

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.90 0.83

BANKNIFTY 1.09 0.91

RELIANCE 0.58 0.58

ICICIBANK 0.51 0.46

INFY 0.52 0.45

www.angelone.in

Technical & Derivatives Report

DEC 06, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

70

1

FII Statistics for

December

0

5

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2697.64 2457.98 239.66

173508 17055.85 (2.21)

INDEX

OPTIONS

828806.35 826540.08 2266.27

1889685 183848.50 8.86

STOCK

FUTURES

9112.19 9978.26 (866.07) 1923775 135754.53 (1.17)

STOCK

OPTIONS

6964.77 6971.06 (6.29) 130186 9396.63 8.21

Total 847580.95

845947.38

1633.57

4117154

346055.51

3.44

Turnover on

December

0

5

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

246984 24627.43 -8.08

Index

Options

108761108 34984.41 12.69

Stock

Futures

691175 48726.92 -4.84

Stock

Options

2694578 3675.05 -7.30

Total

2,694,578 3675.05 -0.88

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18700 297.85

61.35

38.65

18761.35

Sell

18800 236.50

Buy

18700 297.85

113.45

86.55

18813.45

Sell

18900 184.40

Buy

18800 236.50

52.10 47.90 18852.10

Sell 18900 184.40

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18700 179.15

33.90

66.10

18666.10

Sell

18600 145.25

Buy 18700 179.15

60.95

139.05

18639.05

Sell 18500 118.20

Buy

18600 145.25

27.05 72.95 18572.95

Sell 18500 118.20

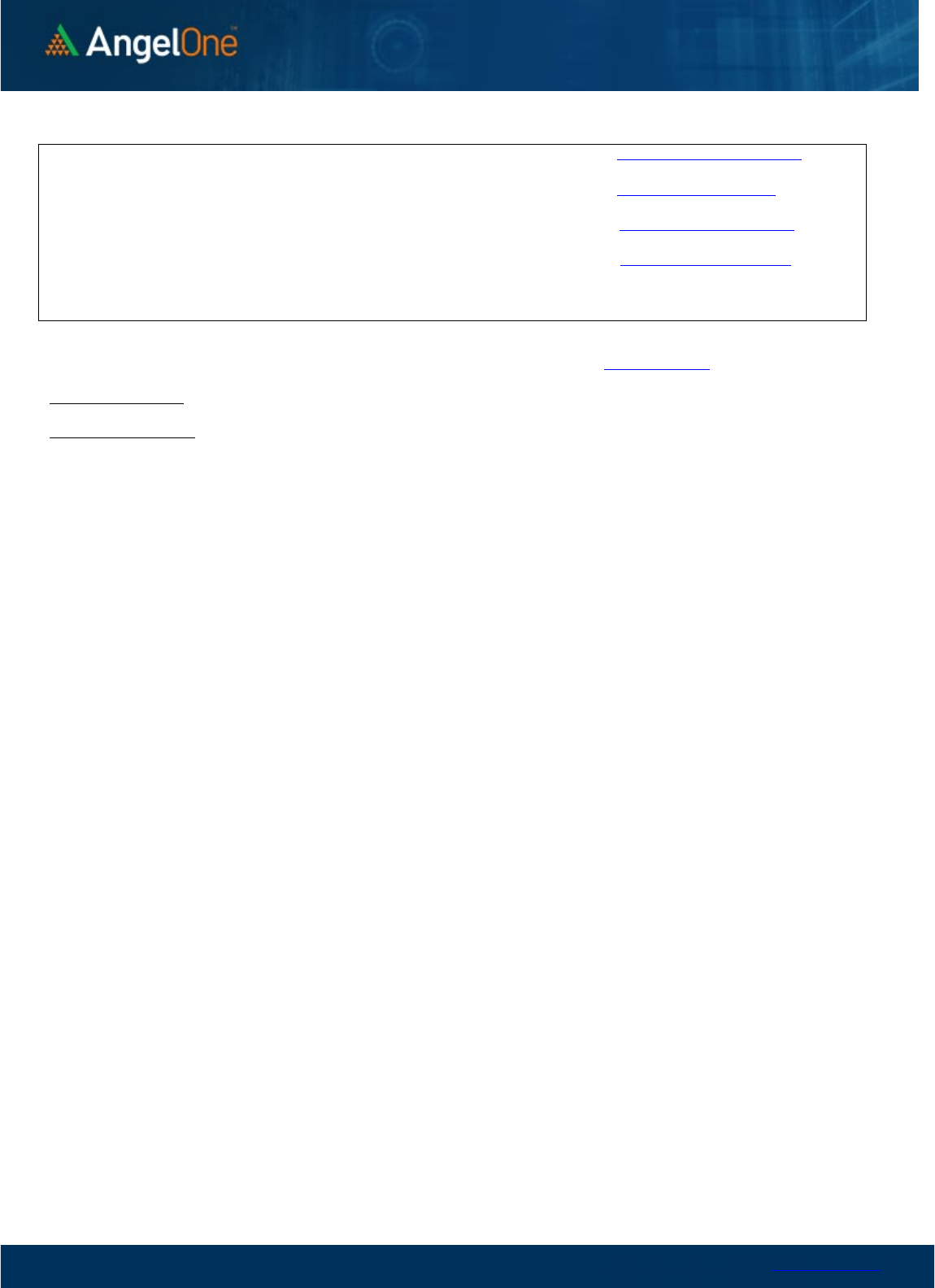

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100 19200 19300 19400

Call Put

www.angelone.in

Technical & Derivatives Report

DEC 06, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,764 3,847

3,893

3,976

4,022

ADANIPORTS 871 882

889

900

907

APOLLOHOSP

4,681

4,730

4,816

4,865

4,951

ASIANPAINT 3,090 3,123

3,146

3,180

3,202

AXISBANK

892

895

901

905

911

BAJAJ-AUTO

3,623

3,641

3,657

3,675

3,691

BAJFINANCE

6,597

6,629

6,664

6,696

6,731

BAJAJFINSV 1,617 1,625

1,640

1,649

1,664

BPCL

335

337

339

341

344

BHARTIARTL

835

839

846

850

856

BRITANNIA 4,343 4,373

4,400

4,431

4,458

CIPLA

1,101

1,108

1,115

1,123

1,130

COALINDIA

225

228

230

233

235

DIVISLAB

3,322

3,346

3,370 3,394

3,418

DRREDDY 4,405 4,442

4,487

4,524 4,569

EICHERMOT

3,310

3,327

3,344

3,361

3,377

GRASIM

1,798

1,807

1,822

1,831

1,846

HCLTECH

1,119

1,125

1,133 1,139

1,148

HDFCBANK

1,590

1,601

1,608

1,620

1,626

HDFCLIFE

580

585

589

594

598

HDFC

2,619

2,648

2,664

2,693

2,709

HEROMOTOCO

2,768

2,798

2,815

2,845 2,863

HINDALCO

459

470

477

488

495

HINDUNILVR 2,570 2,595

2,610

2,635

2,650

ICICIBANK

924

929

933

938

942

INDUSINDBK 1,173 1,184

1,191

1,202

1,209

INFY 1,614 1,627

1,636

1,649

1,658

ITC

332

334

337

339 341

JSW STEEL 741 749

754

762

767

KOTAKBANK 1,910 1,924

1,934

1,948

1,958

LT 2,056 2,071

2,084

2,099

2,112

M&M

1,244

1,252

1,261 1,269

1,277

MARUTI

8,715

8,754

8,803

8,842 8,892

NESTLEIND 19,421 19,587

19,718

19,884

20,016

NTPC

170

172

174

177

178

ONGC

139

142

143 145 146

POWERGRID

215

219

220

224

226

RELIANCE 2,654 2,668

2,692

2,707

2,731

SBILIFE 1,261 1,273

1,285

1,297

1,310

SBIN

604

611

614

621

625

SUNPHARMA

1,024

1,031

1,039

1,047

1,054

TCS

3,392

3,409

3,424

3,441

3,456

TATACONSUM

783

792

797

806 812

TATAMOTORS

422

425

431 435

441

TATASTEEL 111 114

115

117

118

TECHM

1,082

1,091

1,105

1,114

1,129

TITAN

2,571

2,593

2,612

2,634

2,652

ULTRACEMCO 7,086 7,142

7,214

7,270

7,341

UPL 776 789

798

812 821

WIPRO

408

410

413 415 417

www.angelone.in

Technical & Derivatives Report

DEC 06, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.