December 06, 2021

www.angelone.in

Technical & Derivatives Report

Nifty Bank Outlook - (36197)

On Friday, the banking index began the session on a muted note but

witnessed sharp uptick to reclaim 36800 in the initial fifteen minute of

trade. However, this just turned out to be a formality as index

attracted fresh selling at higher levels. The sell-off aggravated in the

midst to slowly drag the BankNifty below 36100 and post some

consolidation in the final hour concluded the day tad below 36200

with the cut of 0.85%.

We observed strong selling as the Banking index as it entered the

vicinity of 36800 and we had been mentioning lately that it’s very

important to show upmove beyond 36800-37000 to gain further

strength. Considering Friday’s price action, we maintain our cautious

stance on market and hence would advocate exiting longs and adding

shorts in any pullback moves. On the flip side, immediate support is

seen in the range 35900 – 35800 levels.

Key Levels

Support 1 – 35900 Resistance 1 – 36500

Support 2 – 35800 Resistance 2 – 36800

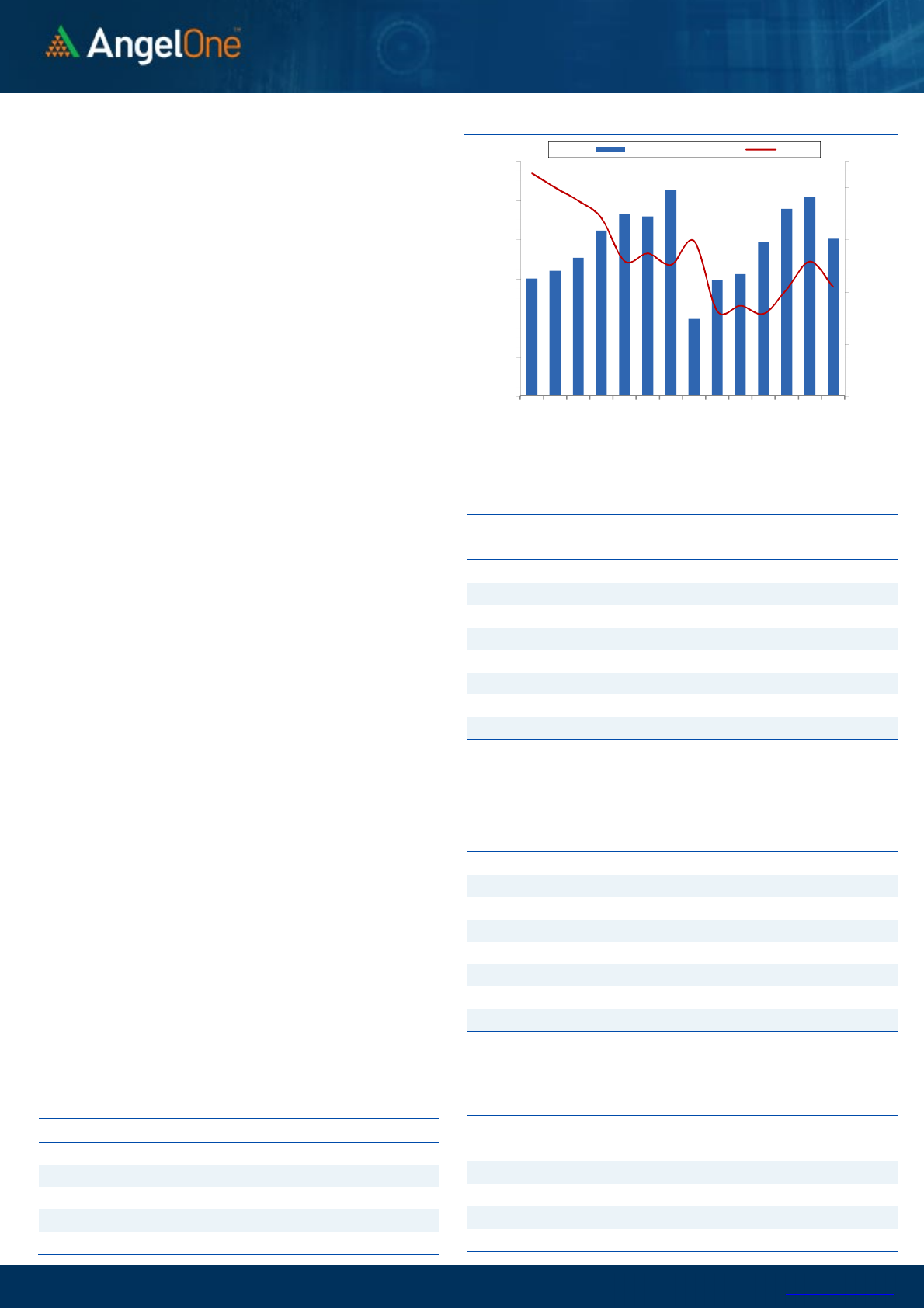

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (57696) / Nifty (17197)

On Friday, Nifty started on a strong positive note and almost retested

17500 during the early trades. But bears were not willing to give up as

they once again showed their dominance at higher levels to erase major

portion of weekly gains by ending tad below 17200.

Overall during the last week our market managed to close in the

positive terrain; but it was certainly a challenging week for both

counterparties. Market was clearly unsure of its direction for the most

part of the week. If we look at it from a technical point of view, market

is respecting the levels precisely. At the beginning, the Nifty started

rebounding after reaching the price target of ‘Head and Shoulder’

pattern of 16800 and on Friday, it became nervous after nearing a stiff

resistance zone of 17500 – 17600. Direction wise, we continue to

remain cautious and there is no doubt we are still in a ‘Sell on rise’ kind

of market. This view will remain intact as long as Nifty does not surpass

17900 which is the confluence point of two key trend lines. Also sooner

or later we expect the recent low around 16800 is to be breached soon;

but it will happen immediately or after some more consolidation in the

range of 16800 – 17500; we need to assess the situation in the coming

week.

Meanwhile, traders can continue with a st

ock specific approach and

we may see trades on both sides if Nifty remains in a consolidation

mode. But it would be a prudent strategy to keep booking timely

profits and considering the volatile nature of global markets,

carrying aggressive bets overnight should be strictly avoided. As far

as levels are concerned, 17350 – 17500 – 17600 are to be

considered as immediate hurdles; whereas on the flipside, 17000 –

16800 should be treated as a cluster of support.

Key Levels

Support 1 – 17000 Resistance 1 – 17350

Support 2 – 16800 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

December 06, 2021

View

Post a strong positive momentu on Thursday, index

almost reclaimed 17500 in Friday’s early morning trade

but couldn’t sustain and attracted decent profit booking

to drag Nifty below 17200.

FIIs were net sellers in the cash market segment to

the tune of Rs. 3356 crores. In index futures, they sold

worth Rs. 2364 crores with increase in open interest

indicating short formations on Friday.

In F&O space, we saw addition of few longs in Nifty

and short covering was seen in banking index. But, on

Friday’s fall the BankNifty attracted fresh shorts

again. The call writer added decent positions in

17200-17700 strikes and meanwhile, put writers of

17000-17300 strikes ran to cover their positions.

Considering the Friday’s development, we believe

17400-17500 will now act as strong hurdle and on the

downside, the psychological mark of 17000 may act

as a demand zone.

Comments

The Nifty futures open interest has decreased by 4.23%.

and BANK Nifty futures open interest has increased by

4.73% as market closed at 17196.70 levels.

The Nifty December future closed with a premium of

42.3 point against a premium of 31 point in last trading

session. The January series closed at a premium of

100.45 point.

The INDIA VIX increased from 18.09 to 18.45. At the

same time, the PCR-OI of Nifty has decreased from 1.31

to 0.91.

Few of the liquid counters where we have seen high

cost of carry are RBLBANK, ZEEL, ABBOTINDIA,

INDUSTOWER, AND ADANIENT

Historical Volatility

SCRIP HV

POWERGRID

35.37

IDEA

105.41

IEX

53.65

GUJGASLTD

43.45

RELIANCE

36.95

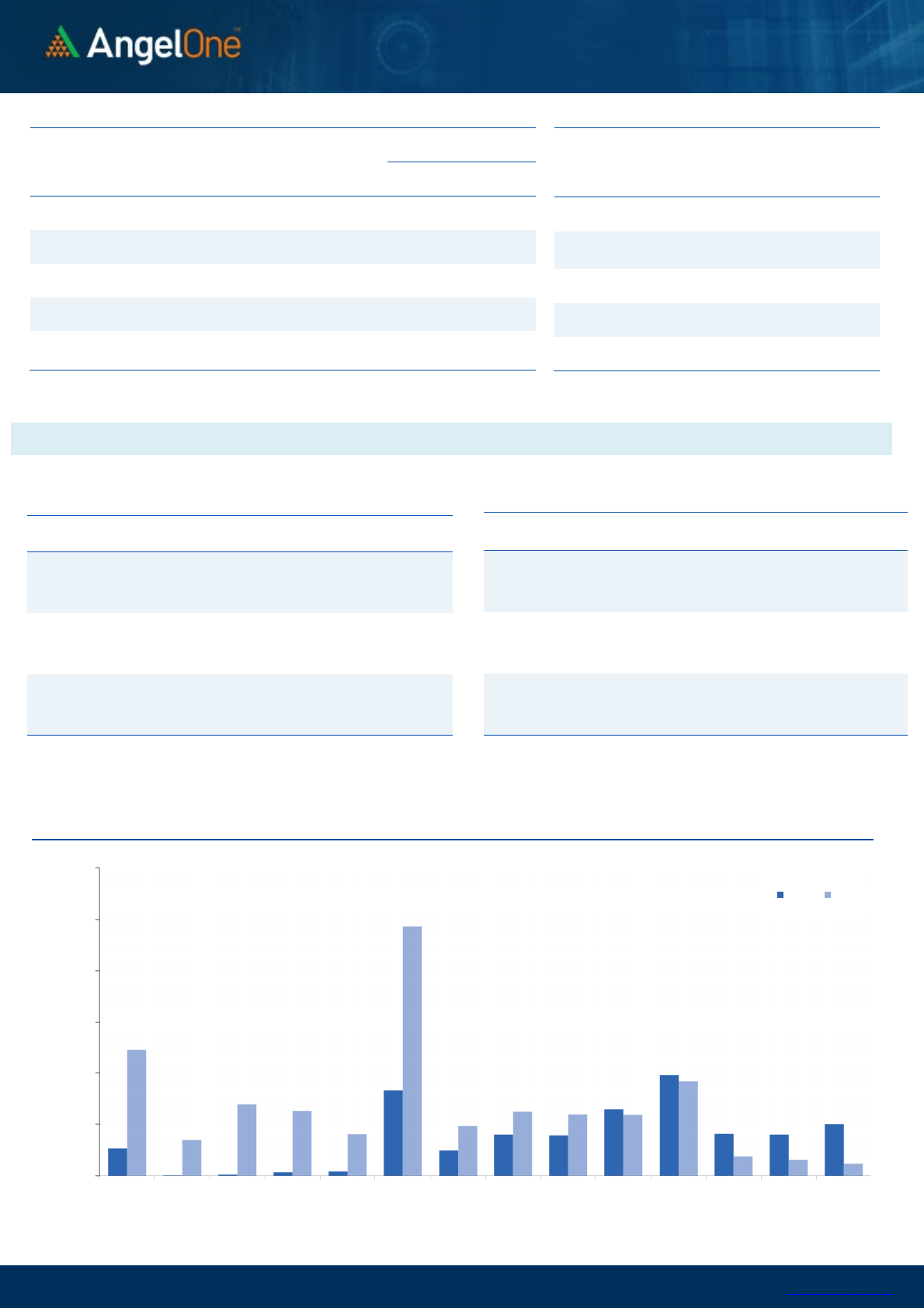

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

18000

18200

10,000

10,500

11,000

11,500

12,000

12,500

13,000

11-15 11-17 11-22 11-24 11-26 11-30 12-2

(`000)

Openinterest

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

IEX

37526250 206.15 255.75 3.51

GSPL

1536800 30.82 309.85 1.47

CROMPTON

2380400 29.97 427.75 -1.45

MCX

1962800 12.00 1620.30 -1.66

INDIAMART

189750 10.92 7164.75 -3.05

CHAMBLFERT

2374500 10.78 405.40 1.86

PFIZER

216000 10.27 4917.70 -0.41

NAM-INDIA

3139200 9.67 366.25 -1.60

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

POWERGRID

19316126 -14.19 206.10 -2.27

IDEA

860580000 -13.43 14.45 12.02

ULTRACEMCO

1698300 -8.88 7332.55 0.36

GUJGASLTD

2410000 -7.97 662.40 -3.92

RAMCOCEM

1840250 -6.84 950.80 0.01

IBULHSGFIN

42488600 -6.50 256.45 -0.56

IGL

10250625 -6.12 505.80 1.54

WHIRLPOOL

384500 -5.88 2027.10 -0.94

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

0.91 0.92

BANKNIFTY

0.71 0.97

RELIANCE

0.52 0.61

ICICIBANK

0.48 0.44

INFY

0.56 0.60

www.angelone.in

Technical & Derivatives Report

December 06, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Spot = 17196.70

FII Statistics for December 03, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3542.36 5905.95 (2363.59) 169519 14811.20 (7.97)

INDEX

OPTIONS

342555.88 342038.44 517.44

1464956 127355.24 15.78

STOCK

FUTURES

14585.99 13437.38 1148.61

1824214 130426.45 (2.02)

STOCK

OPTIONS

10025.92 10105.73 (79.81) 204822 14987.25 4.00

Total

370710.15

371487.50

(777.35) 3663511

287580.14

4.42

Turnover on December 03, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

410988 36498.74 30.80

Index Options

48857190 4377590.38

-65.91

Stock Futures

766827 57165.24 12.27

Stock Options

2020368 156695.07 13.23

Total

5,20,55,373 4627949.43

-64.56

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17200 312.00

54.90 45.10 17254.90

Sell

17300 257.10

Buy

17200 312.00

104.45 95.55 17304.45

Sell

17400 207.55

Buy

17300 257.10

49.55 50.45 17349.55

Sell

17400 207.55

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17200 276.10

34.70 65.30 17165.30

Sell

17100 241.40

Buy

17200 276.10

71.60 128.40 17128.40

Sell

17000 204.50

Buy

17100 241.40

36.90 63.10 17063.10

Sell

17000 204.50

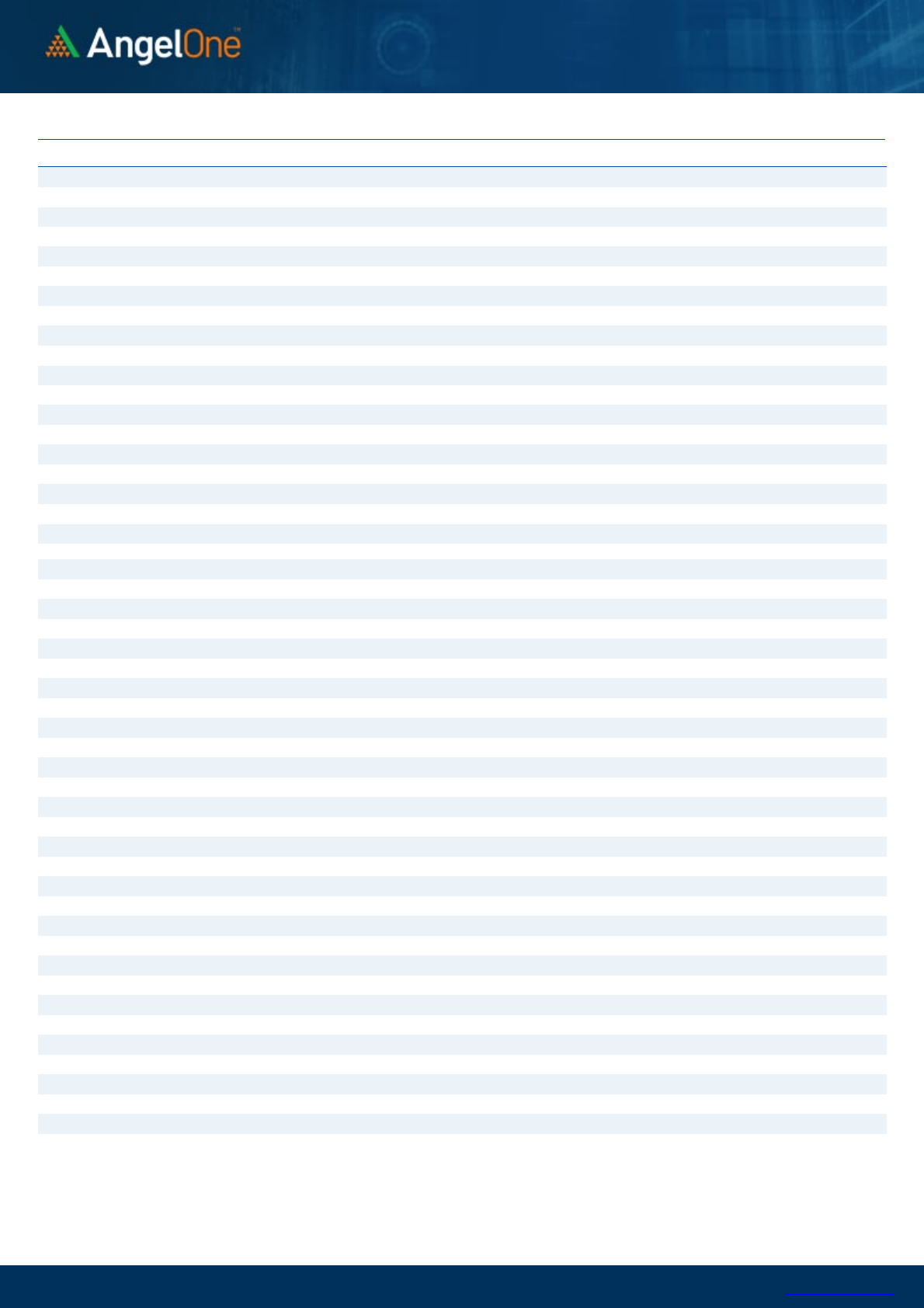

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

16500 16600 16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800

Call Put

www.angelone.in

Technical & Derivatives Report

December 06, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 727 732

739 745 752

ASIANPAINT 3,053 3,082

3,135 3,163 3,216

AXISBANK 661 667

677 683 693

BAJAJ-AUTO 3,241 3,265

3,304 3,327 3,366

BAJFINANCE 6,941 7,005

7,119 7,184 7,298

BAJAJFINSV 17,170 17,329

17,609 17,769 18,049

BPCL 378 382

385 389 392

BHARTIARTL 705 712

723 730 741

BRITANNIA 3,522 3,538

3,566 3,581 3,609

CIPLA 895 904

917 925 938

COALINDIA 148 149

151 152 153

DIVISLAB 4,672 4,715

4,756 4,798 4,840

DRREDDY 4,534 4,565

4,615 4,646 4,696

EICHERMOT 2,414 2,435

2,466 2,487 2,518

GRASIM 1,671 1,687

1,715 1,731 1,759

HCLTECH 1,157 1,164

1,177 1,184 1,197

HDFCBANK 1,490 1,502

1,519 1,531 1,548

HDFCLIFE 676 684

695 703 715

HDFC 2,728 2,750

2,787 2,809 2,846

HEROMOTOCO 2,424 2,443

2,470 2,490 2,517

HINDALCO 418 421

427 431 437

HINDUNILVR 2,305 2,324

2,357 2,376 2,409

ICICIBANK 706 711

720 726 735

IOC 120 121

122 123 124

INDUSINDBK 930 940

949 960 969

INFY 1,697 1,717

1,752 1,771 1,806

ITC 218 220

223 225 228

JSW STEEL 628 636

645 654 663

KOTAKBANK 1,852 1,883

1,936 1,968 2,021

LT 1,766 1,784

1,814 1,832 1,862

M&M 821 829

842 850 864

MARUTI 7,049 7,129

7,229 7,309 7,409

NESTLEIND 18,957 19,139

19,319 19,501 19,681

NTPC 124 126

128 129 132

ONGC 142 144

145 147 149

POWERGRID 198 202

209 213 220

RELIANCE 2,337 2,373

2,436 2,471 2,534

SBILIFE 1,148 1,157

1,173 1,181 1,197

SHREECEM 25,110 25,512

25,966 26,368 26,822

SBIN 463 468

475 480 486

SUNPHARMA 735 743

758 766 781

TCS 3,611 3,626

3,646 3,661 3,681

TATACONSUM

760 767

774 781 788

TATAMOTORS 473 477

481 484 488

TATASTEEL 1,086 1,102

1,118 1,134 1,150

TECHM 1,559 1,576

1,607 1,624 1,656

TITAN 2,326 2,348

2,377 2,398 2,427

ULTRACEMCO 7,202 7,267

7,361 7,426 7,520

UPL 692 702

710 720 728

WIPRO 631 636

645 650 659

www.angelone.in

Technical & Derivatives Report

December 06, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in