September 06, 2021

www.angelone.in

Technical & Derivatives Report

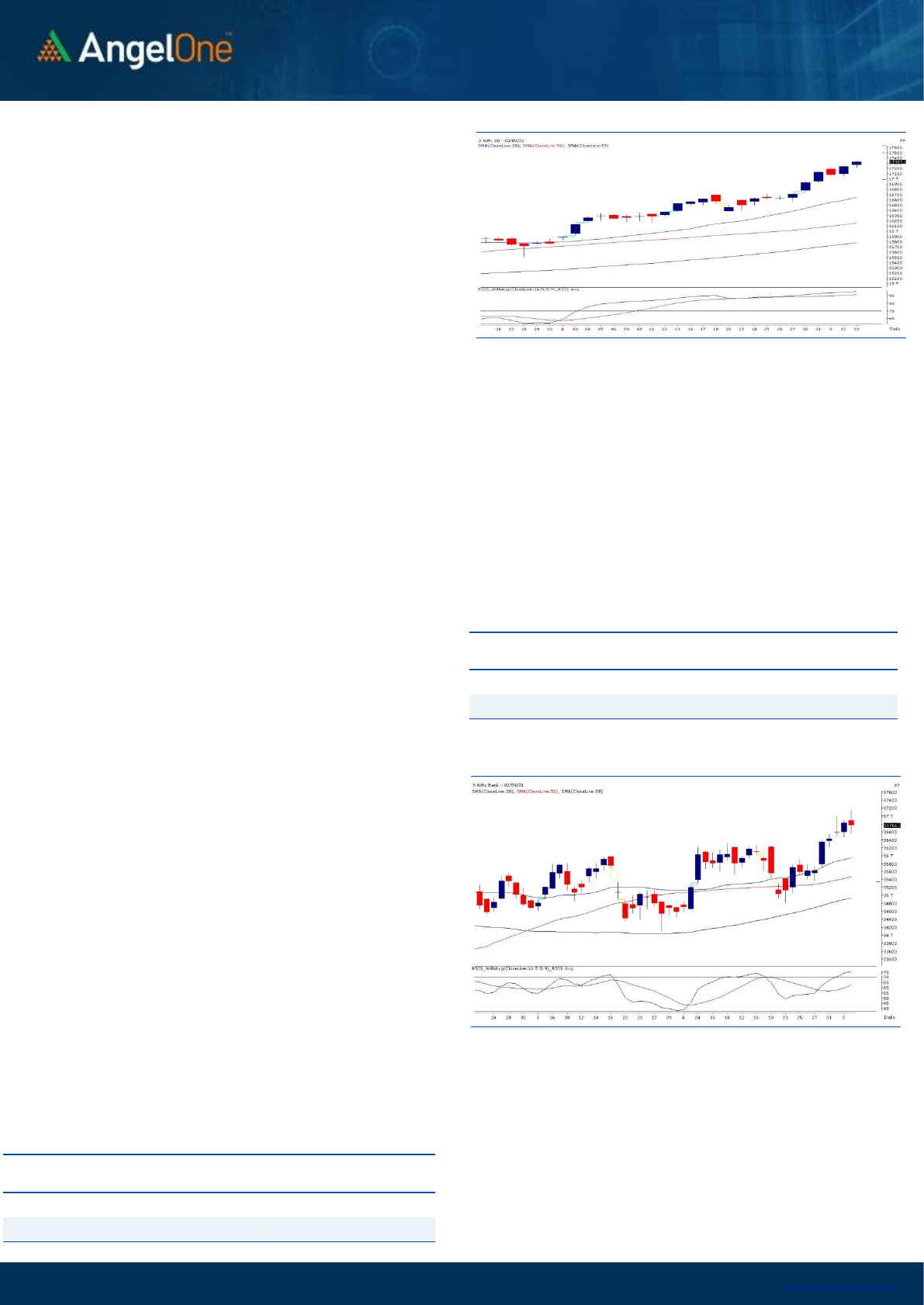

Exhibit 1: Nifty Daily Chart

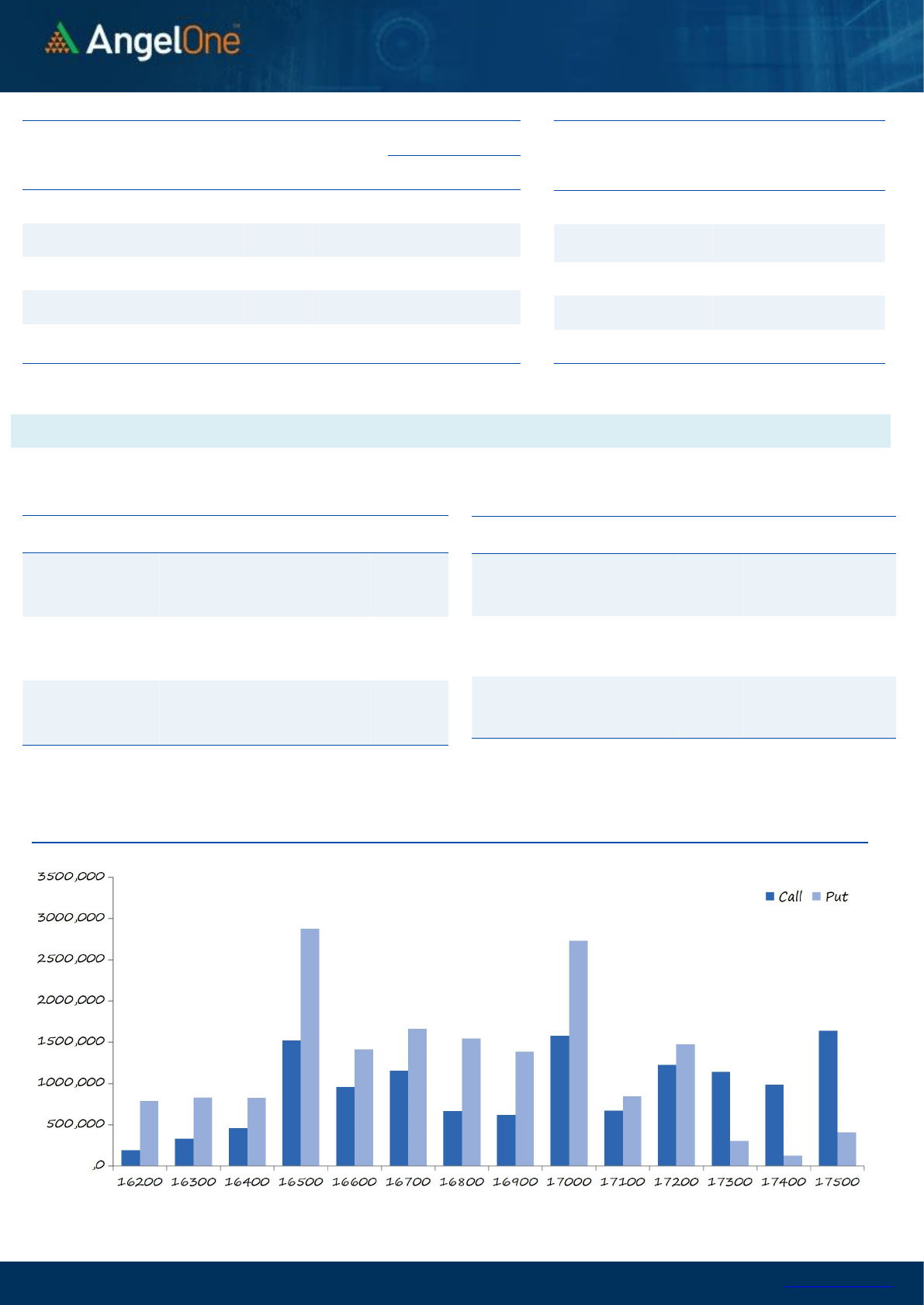

Nifty Bank Outlook - (36761)

On Friday, Bank Nifty started on a flat to positive note and made an

attempt to sustain above the 37000 levels. However, this attempt

once again got failed and the bank index eventually ended the

session with minor loss at 36761. Even though the bank index ended

with handsome gains during the week and managed to close above

the recent hurdle of 36200 - 36300 the follow up move post

breakout is missing. Now in the last few sessions, we have seen

37000 - 37300 acting as a resistance. Going ahead, we sense the

previous resistance around 36000 - 36300 will now act as support

whereas 37000 - 37300 may continue to act as resistance. As long

the bank nifty holds in this range one should continue with stock

specific approach and a momentum move can only be expected on a

breakout from this range.

Key Levels

Support 1 – 36300

Resistance 1 – 37000

Support 2 – 36000

Resistance 2 – 37300

Exhibit 2: Nifty Bank Daily Chart

To be on the safer side, we advise traders to keep booking profits in

the rally and avoid taking aggressive longs for a while. Yes, momentum

traders can still continue with their stock specific trades; but needs to

follow strict stop losses and booking timely profit is advocated. As far

as levels are concerned, 17400 – 17500 are to be considered

immediate hurdles; where we would certainly avoid being complacent.

On the flipside, 17200 – 17050 are to be seen as key supports for this

week. The first sign of weakness would start below 17000 after which

the crucial make or break support zone of 16700 – 16600 would be

tested.

Key Levels

Support 1 – 17200

Resistance 1 – 17400

Support 2 – 17050

Resistance 2 – 17500

Sensex (58130) / Nifty (17324)

During the last week, we had a bumper opening on Monday at new

record highs citing to cheerful mood across the globe. This head start

certainly set up the tone for the entire week as markets didn’t look back

from thereon. Everyday our benchmark index was making new high and

in the process even reached the millstone of 17000. In fact it didn’t stop

there as we witnessed a continuation of the upward trajectory in last

couple of sessions; courtesy to stellar comeback from heavyweight

RELIANCE who single-handedly propelled Nifty beyond 17300.

Eventually, it happened to be yet another spectacular week for our

markets as the bulls added another 3.70% to their kitty.

Nifty has been enjoying a strong Bull Run since last 16 – 17 months and

in last few weeks also, it gave some mesmerizing moves. Although the

recent momentum has been exceptionally strong, we can see some

extreme levels in benchmark index now. If we take a broader view, we

can see Nifty reaching the 200% ‘Fibonacci Retracement’ of the last

year’s massive decline from Jan’20 high to March’20 low. Also time-

wise, Nifty has entered 7th zone as per ‘Fibonacci Time Series’ on the

monthly time frame chart. We do not want to sound pessimistic but

since couple of important key ratios are coinciding at current juncture; it

will be unfair to overlook them.

www.angelone.in

Technical & Derivatives Report

September 06, 2021

Nifty Vs OI

View

The opening on the weekly expiry was slightly positive.

As we progressed, post some consolidation index

regained strength to surpass 17200 and then hits fresh

record highs of 17245.50.

FIIs were net buyers in cash market segment to the tune

of Rs. 349 crores. In index futures, they bought to the

tune of Rs. 1228 crores with fall in open interest

suggesting short covering in yesterday’s session.

In F&O space, Nifty added fresh longs whereas, short

covering was observed in banking index. In index

options segment, we saw good amount of writing in

17150-17200 puts. On the other side, good amount of

unwinding was seen in 17100-17500 calls except for

17250 strike which added fresh positions. FIIs too

continued adding longs in equites and stock futures;

while, short coverering was seen index futures.

Considering the above data point, we maintain our

optimistic stance on market.

Comments

The Nifty futures open interest has increased by 4.01%.

Bank Nifty futures open interest has decreased by 3.55%

as market closed at 17234.15 levels.

The Nifty September future closed with a premium of

22.75 point against a premium of 20.70 point in last

trading session. The October series closed at a premium

of 36.90 point.

The INDIA VIX increased from 14.18 to 14.24. At the

same time, the PCR-OI of Nifty has increased from 1.17

to 1.32.

Few of the liquid counters where we have seen high cost

of carry are IDEA, BATAINDIA, AMBUJACEM,

KOTAKBANK and BHARATFORG.

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND

3359200

22.92

920.70

0.40

IDEA

528920000

20.01

7.15

17.89

COFORGE

853600

13.87

5157.95

0.03

EXIDEIND

32540400

12.65

178.20

4.89

ICICIPRULI

7231500

12.17

676.10

2.82

CONCOR

7868142

11.69

735.70

7.02

UBL

1820000

11.06

1563.35

1.00

ESCORTS

7195100

11.01

1311.35

-2.91

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DLF

40580100

-6.23

338.90

1.82

BHARTIARTL

74935884

-6.07

666.50

-0.03

VOLTAS

3211500

-5.68

1085.35

3.54

SHREECEM

185225

-3.49

30321.90

6.41

APOLLOHOSP

2125500

-3.02

5043.50

0.24

HINDALCO

34920300

-2.84

456.95

0.00

CIPLA

11417900

-2.64

955.20

3.50

AUROPHARMA

15863250

-2.63

746.85

1.94

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.32

0.91

BANKNIFTY

1.16

0.95

RELIANCE

0.48

0.32

ICICIBANK

0.55

0.43

INFY

0.53

0.29

Historical Volatility

SCRIP

HV

SHREECEM

39.07

IDEA

106.18

HDFCLIFE

38.51

CONCOR

47.30

EXIDEIND

34.08

www.angelone.in

Technical & Derivatives Report

September 06, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17234.15

FII Statistics for September 02, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3825.56

2597.10

1228.46

171395

14975.32

(1.12)

INDEX

OPTIONS

667319.47

670700.51

(3381.04)

1079032

93951.43

(34.36)

STOCK

FUTURES

12857.23

12395.30

461.93

1448054

123027.23

0.32

STOCK

OPTIONS

15191.82

15178.44

13.38

197766

17121.35

6.84

Total

699194.08

700871.35

(1677.27)

2896247

249075.33

(15.95)

Turnover on September 03, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

2,90,486

25969.46

29.39

Index Options

4,01,21,163

36,12,327.60

-64.44

Stock Futures

8,03,484

66017.59

11.34

Stock Options

30,10,984

2,48,569.74

17.34

Total

4,42,26,117

39,52,884.39

-62.17

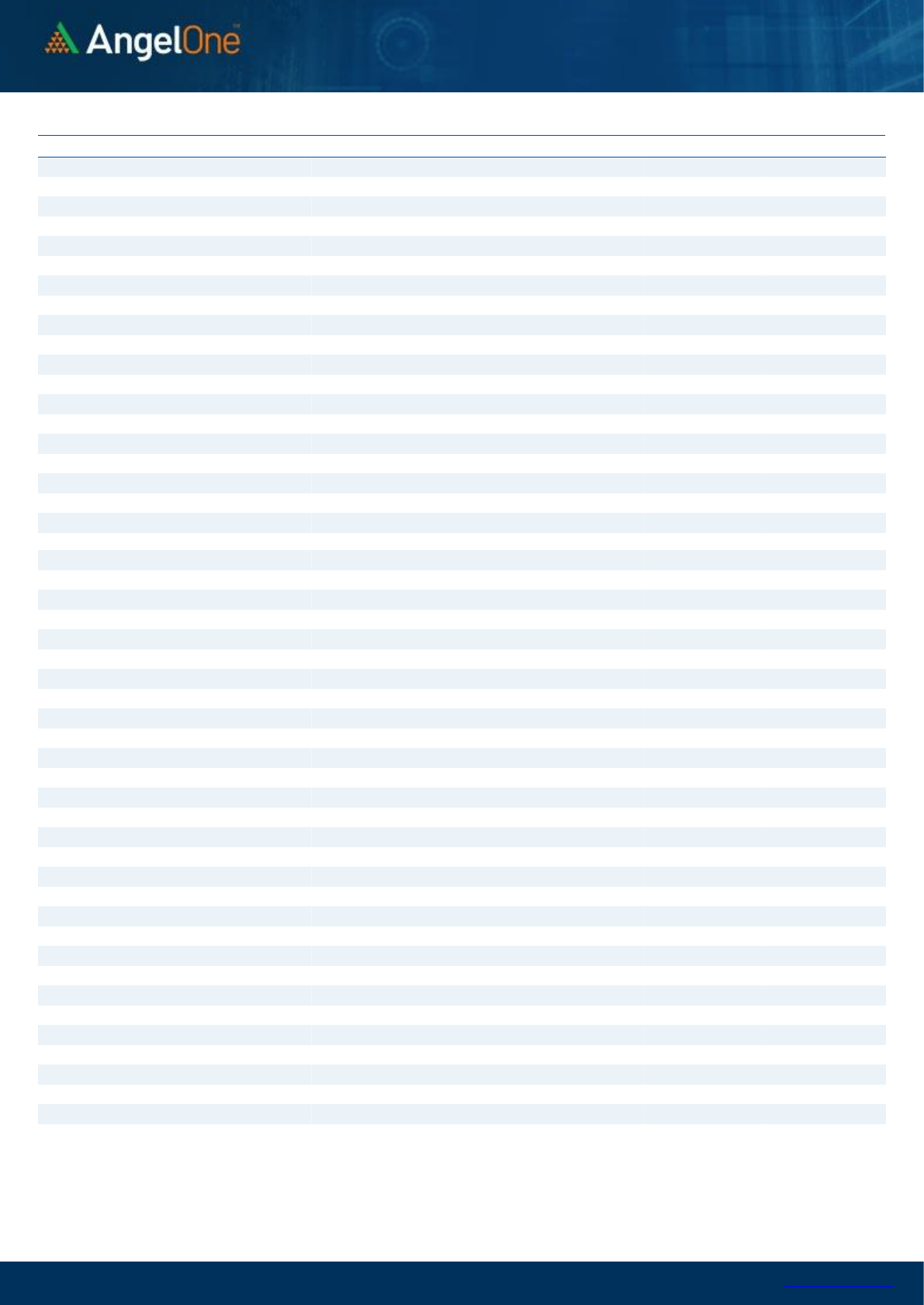

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17200

244.30

54.15

45.85

17254.15

Sell

17300

190.15

Buy

17200

244.30

98.75

101.25

17298.75

Sell

17400

145.55

Buy

17300

190.15

44.60

55.40

17344.60

Sell

17400

145.55

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17200

199.95

41.35

58.65

17158.65

Sell

17100

158.60

Buy

17200

199.95

73.80

126.20

17126.20

Sell

17000

126.15

Buy

17100

158.60

32.45

67.55

17067.55

Sell

17000

126.15

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 06, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

737

746

754

763

771

ASIANPAINT

3,265

3,302

3,323

3,360

3,382

AXISBANK

776

787

799

809

821

BAJAJ-AUTO

3,680

3,719

3,764

3,803

3,849

BAJFINANCE

7,420

7,472

7,513

7,565

7,607

BAJAJFINSV

16,418

16,576

16,718

16,876

17,018

BPCL

475

483

489

497

502

BHARTIARTL

645

652

661

667

676

BRITANNIA

4,049

4,087

4,111

4,148

4,172

CIPLA

913

927

945

959

977

COALINDIA

140

143

145

148

150

DIVISLAB

5,075

5,142

5,203

5,270

5,331

DRREDDY

4,843

4,871

4,890

4,918

4,937

EICHERMOT

2,647

2,725

2,791

2,869

2,935

GRASIM

1,480

1,495

1,508

1,523

1,535

HCLTECH

1,149

1,162

1,171

1,184

1,194

HDFCBANK

1,551

1,564

1,581

1,593

1,610

HDFCLIFE

716

725

736

746

757

HDFC

2,720

2,739

2,762

2,781

2,804

HEROMOTOCO

2,700

2,750

2,782

2,832

2,864

HINDALCO

444

453

459

467

473

HINDUNILVR

2,724

2,746

2,777

2,798

2,830

ICICIBANK

715

720

726

730

736

IOC

109

111

112

114

116

INDUSINDBK

978

991

1,010

1,023

1,042

INFY

1,675

1,688

1,697

1,710

1,719

ITC

209

210

211

211

212

JSW STEEL

677

684

690

697

702

KOTAKBANK

1,760

1,776

1,794

1,810

1,828

LT

1,657

1,674

1,689

1,707

1,722

M&M

739

744

751

756

763

MARUTI

6,651

6,757

6,858

6,964

7,064

NESTLEIND

19,995

20,131

20,237

20,373

20,479

NTPC

116

116

117

118

119

ONGC

117

120

122

125

127

POWERGRID

173

174

176

177

178

RELIANCE

2,270

2,329

2,362

2,422

2,455

SBILIFE

1,214

1,229

1,241

1,257

1,269

SHREECEM

29,703

30,072

30,331

30,700

30,960

SBIN

425

428

431

434

437

SUNPHARMA

777

783

790

796

803

TCS

3,782

3,812

3,835

3,864

3,887

TATACONSUM

857

863

869

875

880

TATAMOTORS

290

293

295

297

299

TATASTEEL

1,401

1,422

1,438

1,459

1,474

TECHM

1,414

1,428

1,439

1,453

1,464

TITAN

1,950

1,985

2,005

2,039

2,059

ULTRACEMCO

7,786

7,858

7,944

8,016

8,101

UPL

740

747

753

760

766

WIPRO

647

651

654

658

661

www.angelone.in

Technical & Derivatives Report

September 06, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.