Aug 05, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

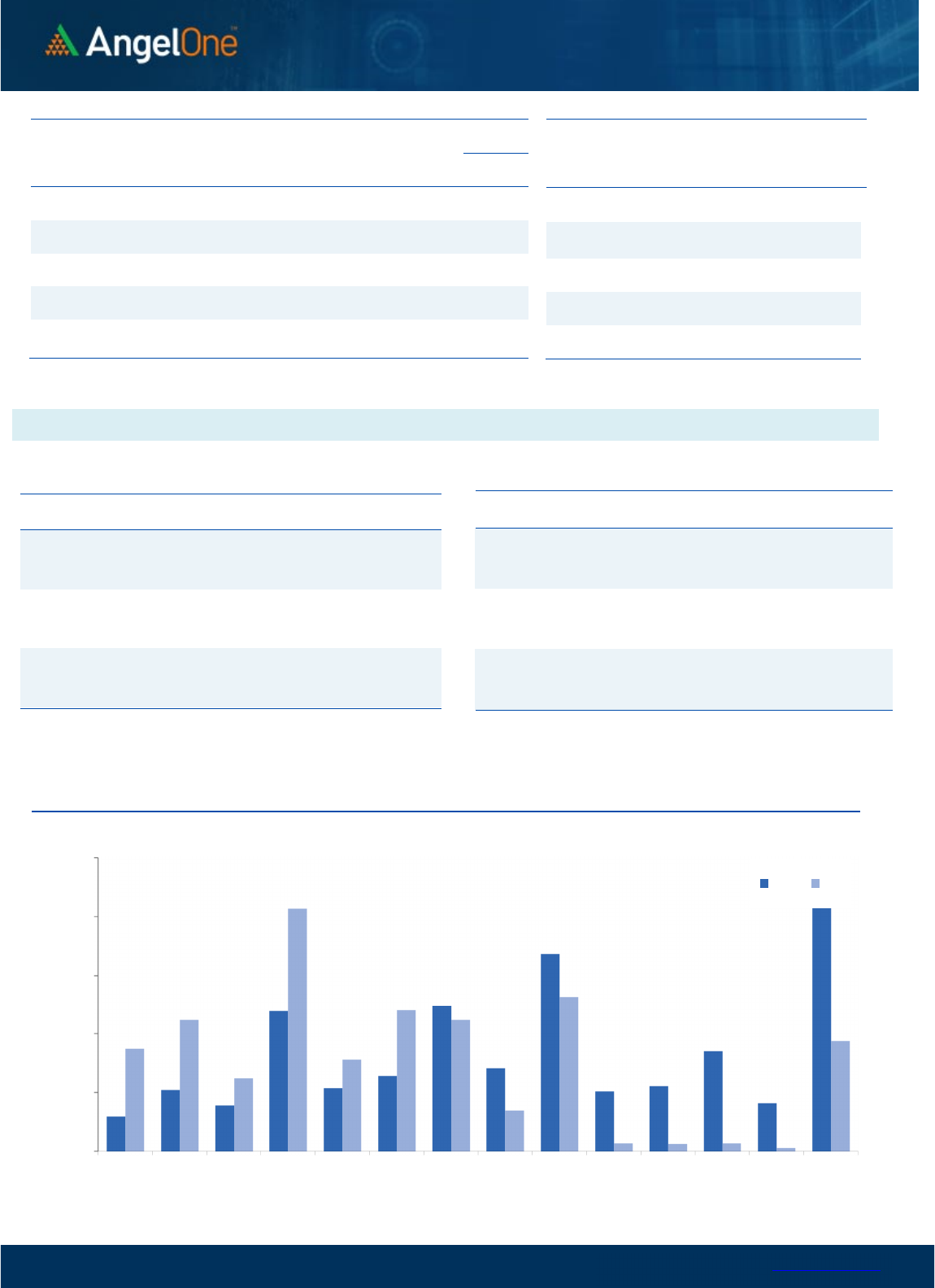

Nifty Bank Outlook (37756)

The global screen was cheerful yesterday morning and as a result, the

banking index too opened higher in tandem with benchmark. In the

initial trade, the BANKNIFTY hastened slightly beyond the 38200 mark

and then consolidated with a small hint of profit booking. Around the

mid session, the profit booking mode turned into a sell off and in the

process, the BANKNIFTY plunged towards the 37200 mark (i.e. 1000

points from morning high) in a flash. Fortunately the selling got

arrested as we stepped into the latter half and in fact, with the help of

modest recovery, the BANKNIFTY ended the session with over six

tenths of a percent loss. In our previous commentary, we had clearly

mentioned how 38200 - 38500 is a sturdy wall for banking index and

traders should certainly take some money off the table after reaching

this zone. Yesterday's brutal sell off triggered after making a high of

38231.85. Although the magnitude at which it came, was really

surprising and even intimidating as well. For the coming session,

38000 followed by 38200 remains a strong hurdle; whereas on the

flipside, 37500 - 37200 are to be seen as key supports for the banking

index. The banking space is going to be in focus today on the back of

RBI monetary policy. Let's see how things pan out post the event.

Key Levels

Support 1 – 37500 Resistance 1 – 38000

Support 2 – 37200 Resistance 2 – 38200

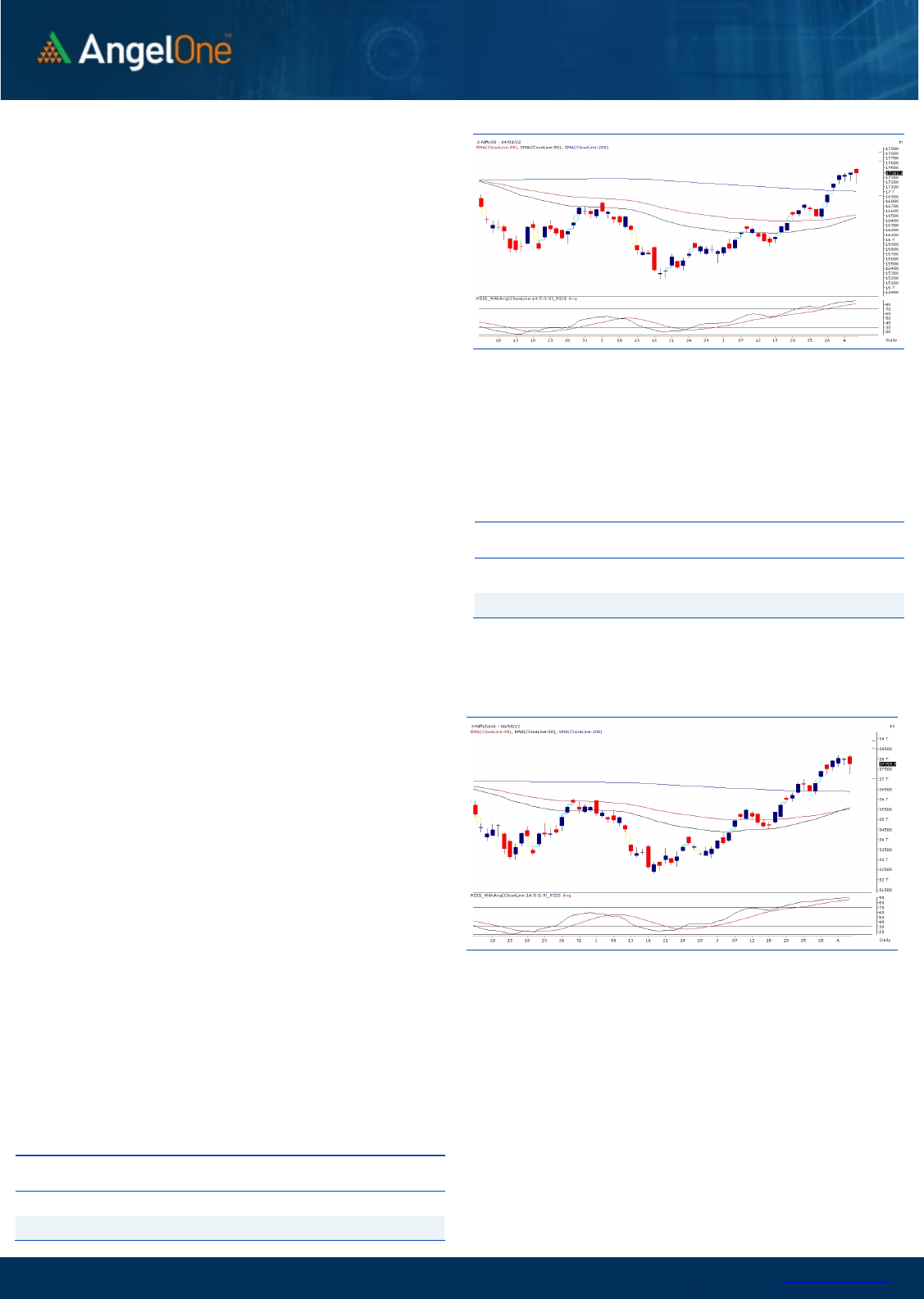

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (58299) / Nifty (17382)

The Indian equity market has started the day with a decent gap up

tracking the positive global cues, wherein the benchmark index inched

towards the 17500 mark. But soon after the opening, markets lost their

sheen and slid inside the negative terrain. Generally, we term it as a

profit booking, but this time it wasn’t the normal move as we saw a

complete nosedive around the midsession, which was intimidating at

one point. Within a blink of an eye, we not only broke 17400 and 17300

but also went on to thrash the key support of 17200. Fortunately, it did

not turn out to be a nightmare, as the mighty bulls came to rescue and

defended the territory throughout the remaining part of the session.

With the intense tug of war between the bulls and the bears, the Nifty

managed to conclude the action-packed weekly expiry almost at

Wednesday’s close.

The market took a breather post six consecutive days of its up move,

but it was a bit scary at one point. Technically, the bullish structure

remains unchanged as the bulls showed their resilience and

reciprocated from lower grounds decisively. As far as levels are

concerned, 17500 is likely to be seen as a sturdy wall for the bulls, and

any persistent breakthrough could only open the gates for further

upside for the index. On the flip side, 17200 has proved its mettle in

providing vital support. Still, yesterday’s price activity was a reality

check for market participants, which is why we have been reiterating

not to get complacent at any point. The immediate support can be seen

around 17300.

The RBI monetary policy is slated in the coming session, and hence,

traders should keep a close eye on the event. Whether it turns out

to be a non-event or not, it would really be interesting to watch.

Apart from this, global development should also not be overlooked,

and hence, we may see some interesting actions going ahead.

Key Levels

Support 1 – 17200 Resistance 1 – 17450

Support 2 – 17150 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

Aug 05, 2022

View

The tug of war continued as we saw strong opening to

touch 17500 but all of the sudden sharp selling was

seen to drag the index below 17200. This wasn’t done

yet, luckily market recovered to conclude almost flat.

FIIs were net buyers in the cash market segment to

the tune of Rs. 1474 crores. Simultaneously, in Index

futures, they sold worth Rs. 830 crores with an

increase in open interest, indicating short formation.

As far as derivatives segment is concerned, we saw

mixed activity in Nifty and some unwinding was

observed in banking index. Stronger hands continued

to pump in liquidity in equities but preferred addition

some shorts in index futures segment. On index

options front, we saw some fresh build-up in 17300 put

and 17500 call strike in coming weekly series. Highest

open interest concentration is now placed at 17000 put

and 17500 call strike. Considering the recent price

action, we believe index has been stuck in the range of

17100-17500 for the time being and until we remain in

this range traders can focus on individual space.

Comments

The Nifty futures open interest has increased by

2.90%. and BANK Nifty futures open interest has

decreased by 4.05% as the market closed at 17382.

The Nifty Aug future closed with a premium of 7.85

point against a premium of 19.00 point in the last

trading session. The Sep series closed at a premium

of 75.10 point.

The INDIA VIX increased from 18.48 to 19.25. At the

same time, the PCR-OI of Nifty has decreased from

1.28 to 1.03.

Few of the liquid counters where we have seen high

cost of carry are L&TFH, ABFRL, IDEA, PIIND and

METROPOLIS.

Historical Volatility

SCRIP HV

ZYDUSLIFE 35.16

IPCALAB 34.52

GUJGASLTD 46.56

LUPIN 37.92

CIPLA 31.77

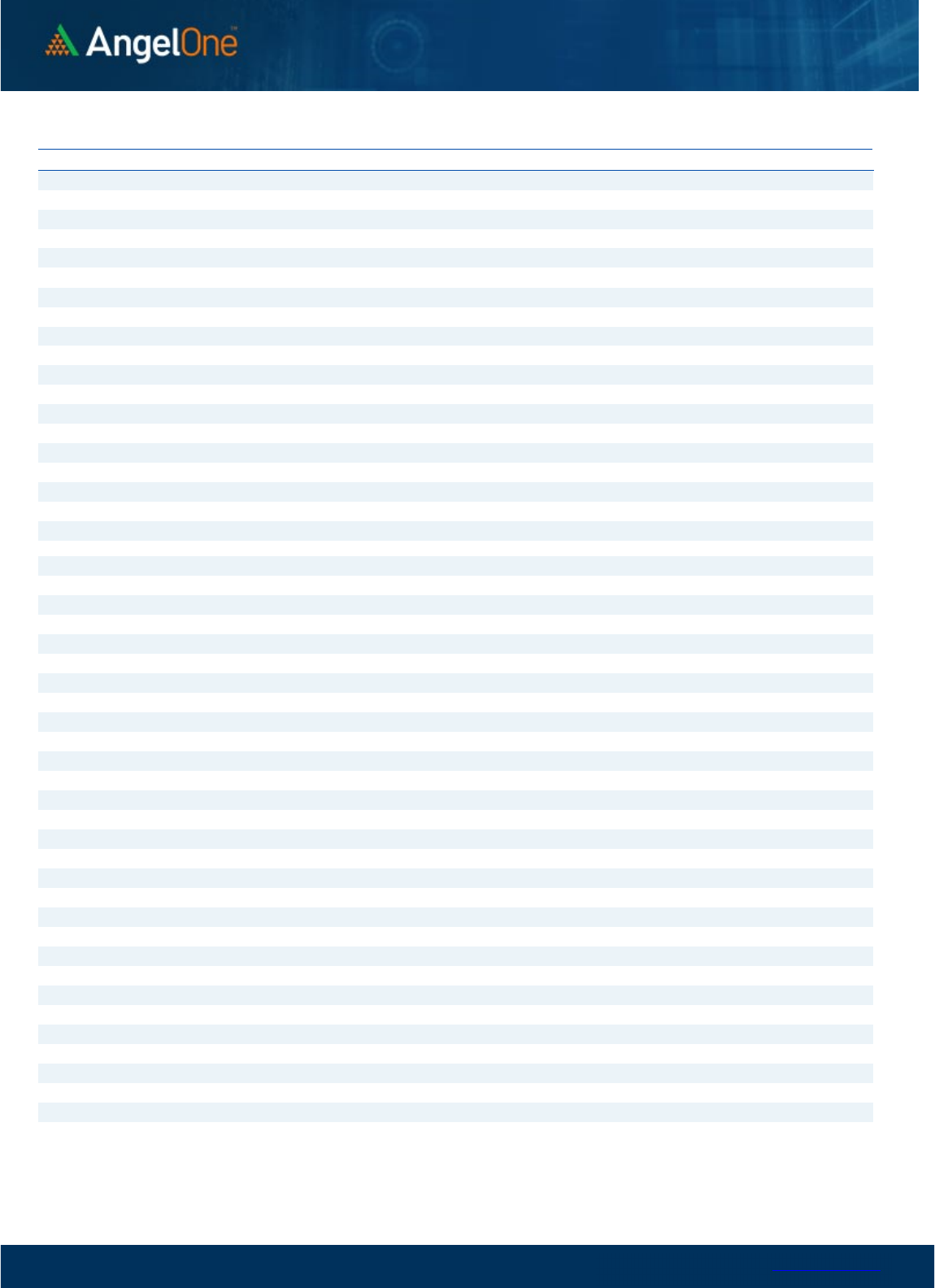

Nifty Vs OI

15600

15800

16000

16200

16400

16600

16800

17000

17200

17400

17600

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

7/18 7/20 7/22 7/26 7/28 7/1 7/4

Openinterest Nifty

OI

Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GUJGASLTD 5805000 70.55 444.45 -6.08

ALKEM 451200 31.16 3151.75 0.97

TATACONSUM 8849700 16.53 789.25 -2.92

LUPIN 10717650 13.35 659.95 5.13

IPCALAB 867100 12.76 1024.95 4.78

APOLLOTYRE 12992000 12.72 232.20 1.72

INDUSTOWER 19908000 12.29 203.30 -1.89

NAM-INDIA 2731200 11.28 299.55 -0.12

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

INDIGO 2462100 -12.73 1986.05 0.63

BOSCHLTD 173150 -12.53 17561.70 1.32

AUBANK 6460000 -12.42 636.60 4.66

BATAINDIA 2105125 -8.78 1913.85 -0.72

FSL 20051200 -7.46 105.35 2.03

PERSISTENT 562050 -7.23 3769.30 1.34

NAVINFLUOR 566550 -6.39 4320.95 1.36

GSPL 3162500 -6.37 238.40 -0.75

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.03 1.01

BANKNIFTY 0.84 1.03

RELIANCE 0.54 0.48

ICICIBANK 0.68 0.61

INFY 0.74 0.48

www.angelone.in

Technical & Derivatives Report

Aug 05, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

38

2

FII Statistics for

August

0

4

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3421.67 4251.52 (829.85) 137414 12306.52 1.09

INDEX

OPTIONS

2495243.95 2494114.63 1129.32

845288 74847.75 (36.43)

STOCK

FUTURES

12647.40 11945.70 701.70

2147950 145976.03 0.76

STOCK

OPTIONS

9113.12 8949.30 163.82

105401 7283.08 9.62

Total 2520426.14

2519261.15

1164.99

3236053

240413.38

(12.38)

Turnover on

August

0

4

, 2022

Instrument

No. of

Contracts

Turnov

er

( in Cr.

)

Change

(%)

Index Futures

560204 50373.00 53.40

Index Options

338899646 30886857.28 150.59

Stock Futures

973262 65089.63 12.26

Stock Options

3349452 231827.70 7.59

Total

3,349,452 231827.70 147.26

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17400 346.05

57.35

42.65

17457.35

Sell

17500 288.70

Buy

17400 346.05

110.35

89.65

17510.35

Sell

17600 235.70

Buy

17500 288.70

53.00 47.00 17553.00

Sell

17600 235.70

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17400 239.75

36.25

63.75

17363.75

Sell

17300 203.50

Buy 17400 239.75

68.65

131.35

17331.35

Sell 17200 171.10

Buy

17300 203.50

32.40 67.60 17267.60

Sell

17200 171.10

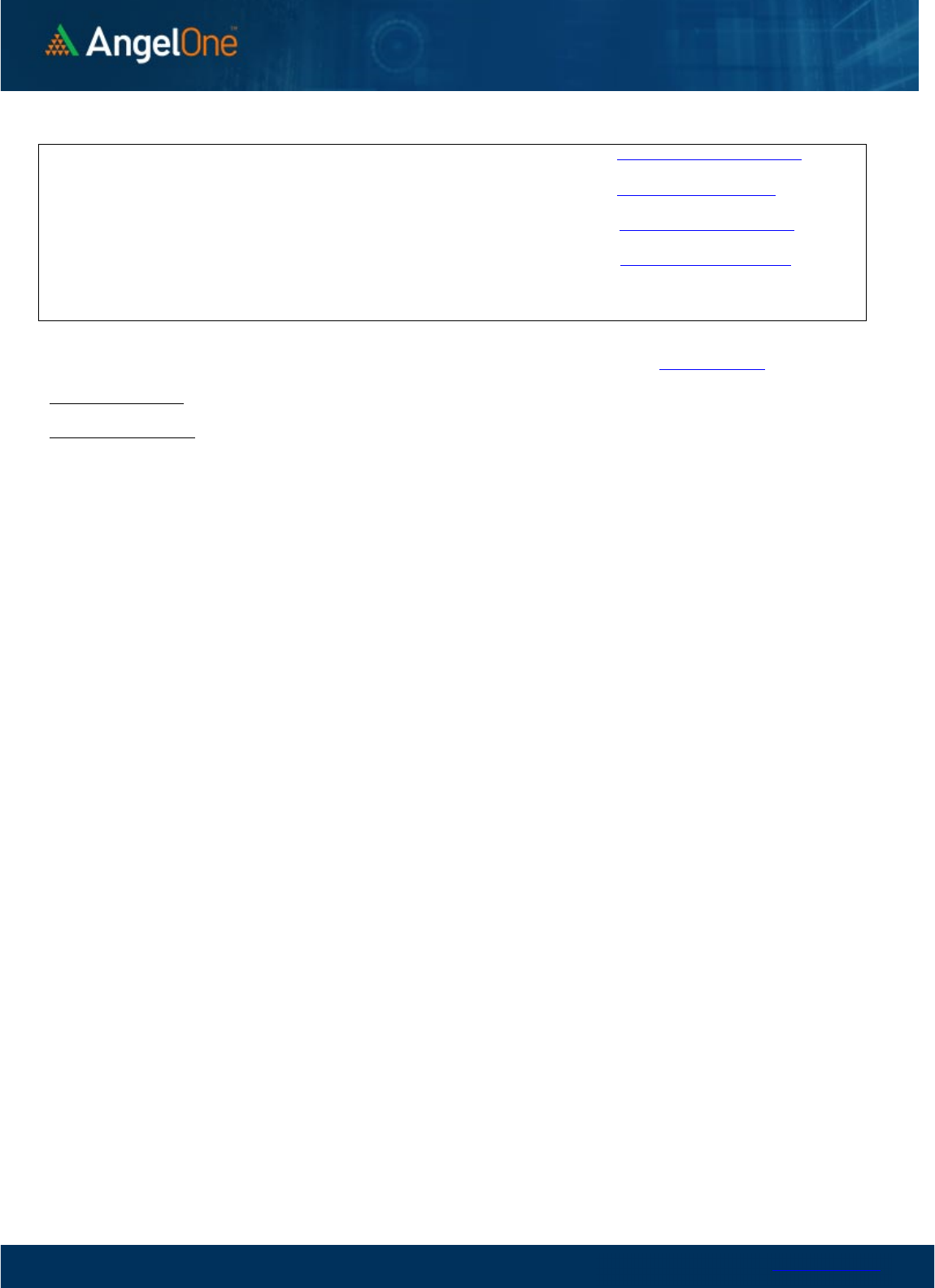

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 05, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

784

796

808

820

832

APOLLOHOSP 4,273 4,334

4,372 4,433

4,471

ASIANPAINT 3,383 3,422

3,449 3,488

3,516

AXISBANK 699 710

724

735

748

BAJAJ-AUTO 3,949 3,980

4,008

4,039 4,067

BAJFINANCE

7,122

7,219

7,302

7,399

7,482

BAJAJFINSV

14,864

15,025

15,216

15,377

15,568

BPCL 326 330

334

338

342

BHARTIARTL 673 684

691

702

709

BRITANNIA 3,698 3,737

3,764 3,803

3,830

CIPLA

1,004

1,024

1,035

1,056

1,067

COALINDIA

202

204

209

212

216

DIVISLAB

3,776

3,832

3,868 3,924 3,960

DRREDDY 4,062 4,105

4,132

4,175 4,202

EICHERMOT 3,052 3,099

3,148

3,195 3,243

GRASIM

1,540

1,560

1,581

1,600

1,621

HCLTECH

934

946

958

970

982

HDFCBANK

1,397

1,414

1,431

1,448

1,464

HDFCLIFE

525

530

535

540

545

HDFC 2,303 2,332

2,359

2,389

2,416

HEROMOTOCO

2,756

2,781

2,805 2,830

2,854

HINDALCO 410 416

424

430

439

HINDUNILVR 2,600 2,614

2,629

2,643

2,657

ICICIBANK

798

809

820

831

841

INDUSINDBK

1,027

1,038

1,056

1,067

1,085

INFY

1,564

1,582

1,593

1,611

1,622

ITC

306

308

309

311

312

JSW STEEL

643

654

664

674

684

KOTAKBANK

1,792

1,814

1,836

1,858

1,881

LT

1,750

1,765

1,790

1,805

1,830

M&M

1,229

1,246

1,255

1,272

1,281

MARUTI 8,730 8,848

8,948

9,066

9,166

NESTLEIND 19,196 19,523

19,723

20,051

20,251

NTPC 149 152

156

159

164

ONGC

133

134

136

138

139

POWERGRID

216

219

221

224

226

RELIANCE 2,492 2,532

2,575 2,615 2,658

SBILIFE

1,262

1,270

1,279

1,287

1,295

SHREECEM 20,116 20,402

20,826

21,112

21,536

SBIN 514 524

534

543

554

SUNPHARMA

887

903

911

927

936

TCS

3,270

3,312

3,350

3,393

3,431

TATACONSUM

773 781

789

798

806

TATAMOTORS

449

459

466

476

484

TATASTEEL 104 106

108

109

111

TECHM 1,018 1,037

1,055

1,074

1,091

TITAN 2,349 2,386

2,408

2,446

2,468

ULTRACEMCO

6,472

6,530

6,608

6,666

6,743

UPL

712

722

731

741

751

WIPRO 421 428

434

442

448

www.angelone.in

Technical & Derivatives Report

Aug 05, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.