December 03, 2021

www.angelone.in

Technical & Derivatives Report

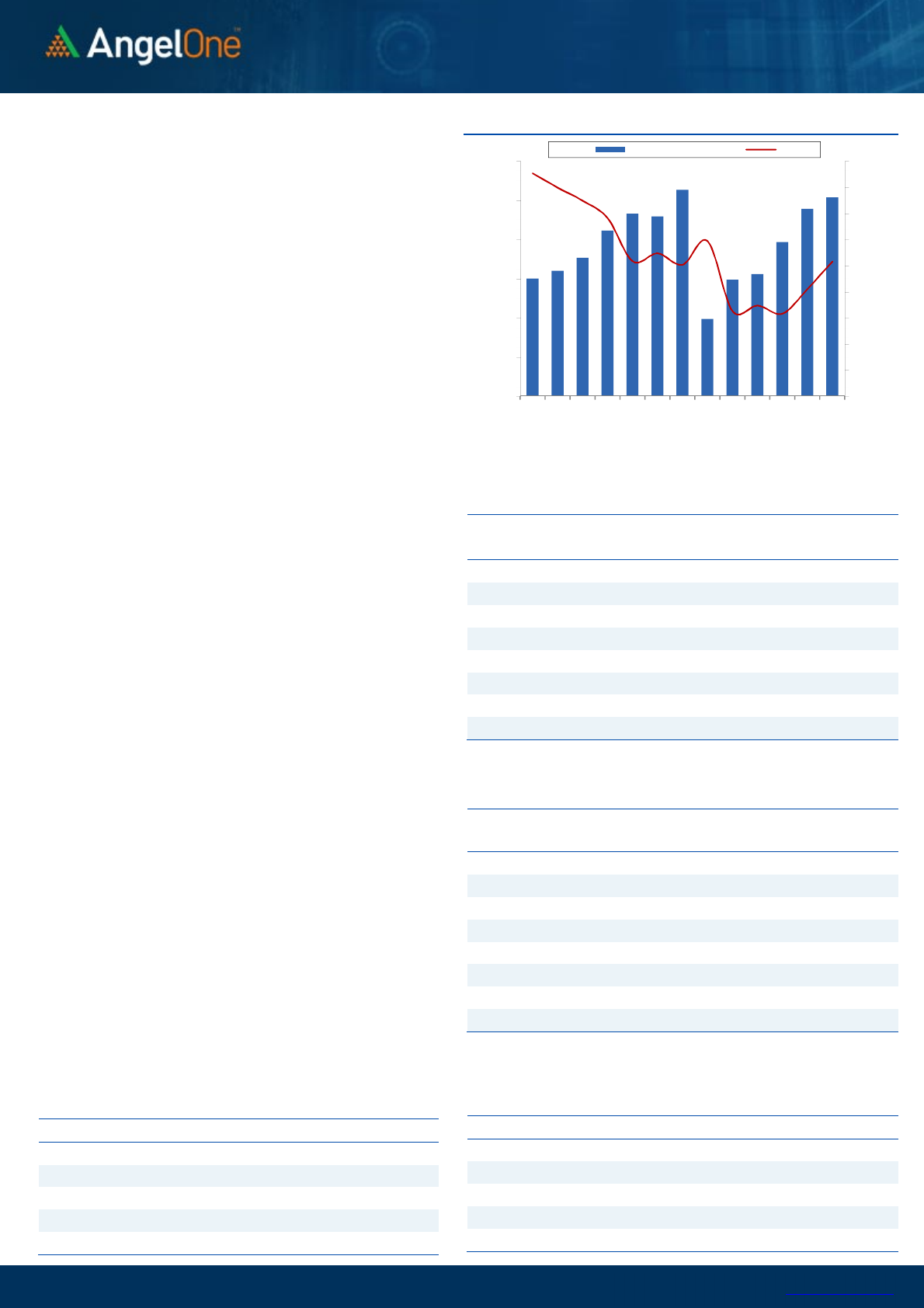

Nifty Bank Outlook - (36508)

We had a slightly negative start for the weekly expiry day. Index

witnessed some hiccups to hit day’s lows below 35200 but recovered

to soon enter positive terrain. However, with no major action in the

remaining part of the day we concluded tad above 36500.

The banking index clearly looked reluctant showcase any excitement

despite the benchmark index showed a fabulous recovery to rally near

1.40%. If we consider the recent price action, this would look as a

normal practice. Hence, until we don’t see a sustainable move beyond

37000-37200 we would just avoid any aggressive bullish bets in this

space. Going ahead, 36000-37000 shall we the range and violation of

this in either direction shall dictate for future move; till then trader’s’

are advised to stay light specifically in BankNifty.

Key Levels

Support 1 – 36000 Resistance 1 – 37000

Support 2 – 35700 Resistance 2 – 37200

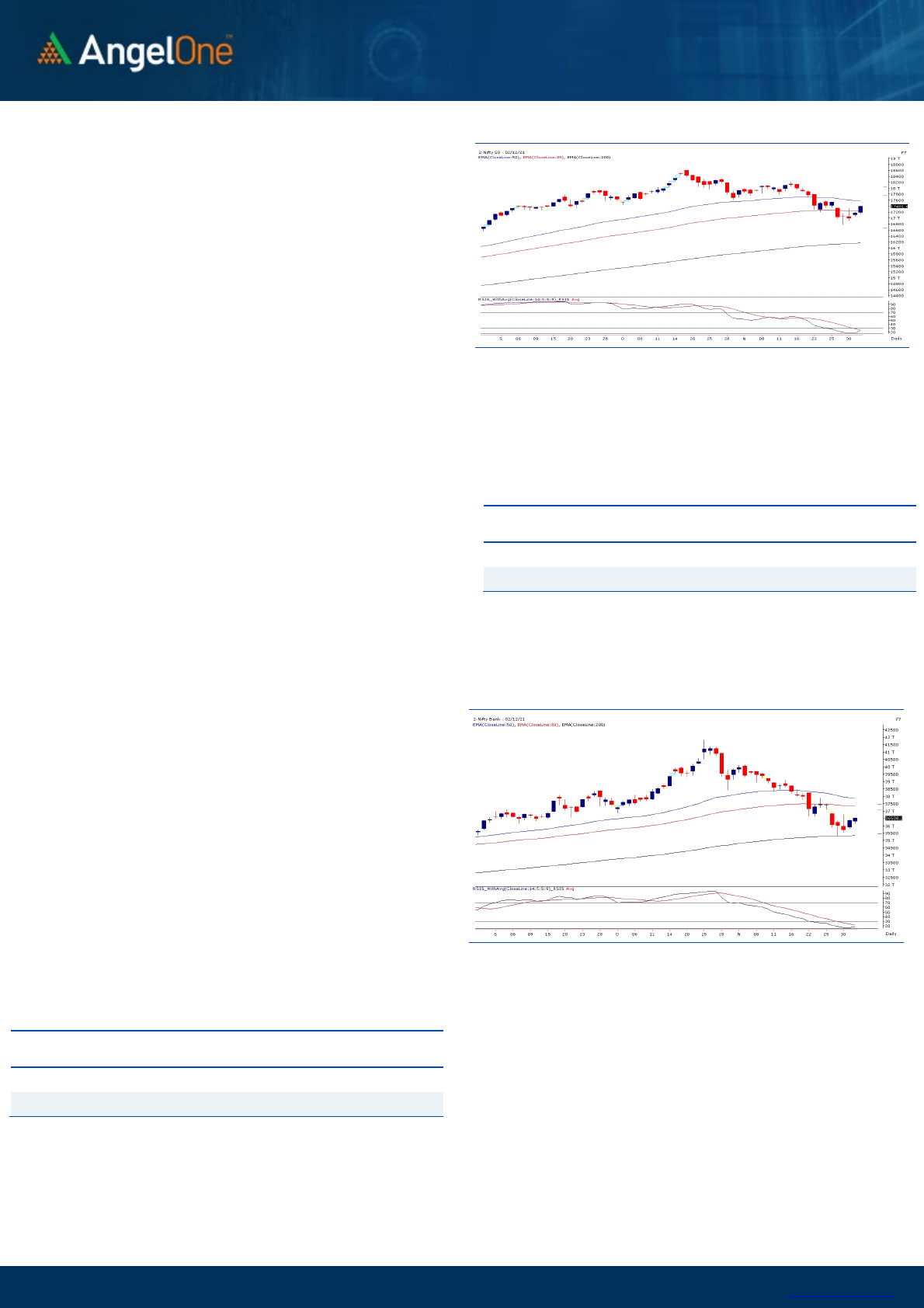

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (58461) / Nifty (17402)

US markets had a massive volatility during the previous night and

towards the end they took a nosedive from the day high. As a result of

this, yesterday early morning the SGX Nifty was first indicating a

massive gap down. But as we came closer to our opening point, the

global picture changed. Our markets started the day on a positive note;

courtesy to some relief in the global peers. In fact as the day

progressed, the buying momentum kept accelerating to conclude the

weekly expiry precisely at 17400 by adding nearly 1.40% to the previous

close.

The kind of price development we had in the previous session, the

possibility of some recovery was on cards. But honestly speaking, Nifty

has clearly over surpassed our expectations after extending the relief

move beyond 17350. Now looking at the individual stocks, we may see

Nifty heading towards 17500 – 17600; but we reiterate, markets are

not completely out of the woods yet and hence, it’s advisable to stay

light after nearing this zone. On the flipside, 17300 – 17200 are to be

seen as intraday supports.

For

today’s

session, if Nifty continues with the bounce back mode,

one can look to identify potential candidates that are trading at key

supports and are likely to provide good buying opportunity. But we

reiterate, our positional view remains bearish and hence, it’s

advisable to book intraday profits if Nifty enters the above

mentioned resistance zone.

Key Levels

Support 1 – 17300 Resistance 1 – 17500

Support 2 – 17200 Resistance 2 – 17600

www.angelone.in

Technical & Derivatives Report

December 03, 2021

View

On the weekly expiry day, Nifty started on a positive

note and post an immediate dip in the initial hour

started moving higher gradually throughout the

session. Eventually, the benchmark ended tad at

17400 with gains of 1.37%

FIIs were net sellers in the cash market segment to

the tune of Rs. 907 crores. In index futures, they

bought worth Rs. 153 crores with a marginal increase

in open interest.

Nifty witnessed some long formations in yesterday’s

upmove whereas there was marginal upmove in the

bank nifty due to short covering. Strong hands

continue to be sellers in the cash market whereas in

Index futures they were marginal buyers. With

yesterday’s upmove the call writers ran to cover

whereas now for the coming weekly series highest

build up is seen at 18000 call. Before that 17500 and

17700 call strikes aswell has a decent build up. On the

flip side, 17300 put have a good build up and highest

build up is at 17000 put. With the above data it seems,

this bounce may extend further however we are still

not out of woods and hence traders should avoid

aggressive bets.

Comments

The Nifty futures open interest has increased by 1.18%.

and BANK Nifty futures open interest has decreased by

3.78% as market closed at 17401.65 levels.

The Nifty December future closed with a premium of 31

point against a premium of 55 point in last trading

session. The January series closed at a premium of 83.4

point.

The INDIA VIX decreased from 19.44 to 18.09. At the

same time, the PCR-OI of Nifty has increased from 1.01

to 1.31.

Few of the liquid counters where we have seen high

cost of carry are IDEA, CONCOR, NAM-INDIA,

WHIRLPOOL, AND GAIL

Historical Volatility

SCRIP HV

GMRINFRA

52.46

HDFC

37.42

PERSISTENT

45.35

POWERGRID

35.05

ADANIPORTS

48.79

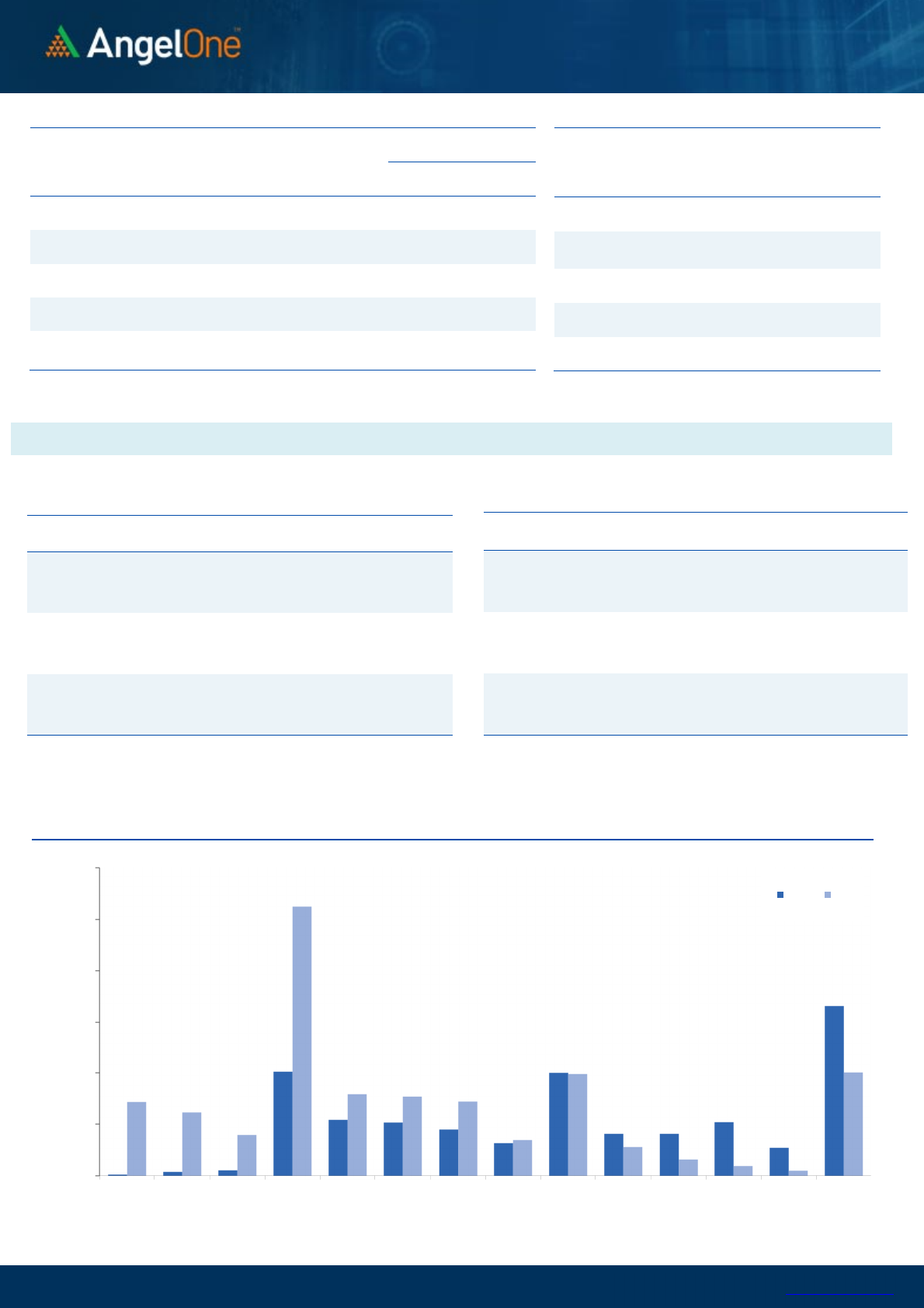

Nifty Vs OI

16400

16600

16800

17000

17200

17400

17600

17800

18000

18200

10,000

10,500

11,000

11,500

12,000

12,500

13,000

11-15 11-17 11-22 11-24 11-26 11-30 12-2

(`000)

Openinterest

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CROMPTON

1831500 35.92 433.70 -0.99

GUJGASLTD

2618750 26.20 686.65 3.66

MCX

1752450 17.42 1643.00 3.52

GMRINFRA

137655000 14.04 41.30 7.12

PERSISTENT

262200 11.05 4392.50 4.62

COFORGE

1052600 10.75 5413.95 1.87

POWERGRID

22510593 9.41 214.50 3.48

TORNTPOWER

3162000 9.11 562.05 2.27

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MPHASIS

1968700 -9.49 3107.00 3.07

IBULHSGFIN

45442900 -6.25 256.40 2.57

COALINDIA

53600400 -6.04 159.30 2.24

GODREJPROP

3247725 -5.65 2020.75 2.32

CHAMBLFERT

2143500 -4.61 397.25 0.05

SBILIFE

7422750 -4.56 1188.05 1.98

TCS

11988450 -4.49 3642.80 1.75

APLLTD

1820850 -3.78 803.60 -1.36

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY

1.31 1.07

BANKNIFTY

0.95 0.89

RELIANCE

0.58 0.40

ICICIBANK

0.48 0.43

INFY

0.63 0.60

www.angelone.in

Technical & Derivatives Report

December 03, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (December Series) are given as an information and not as a recommendation.

Nifty Spot = 17401.65

FII Statistics for December 02, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3862.21 3708.76 153.45

184191 16229.93 0.76

INDEX

OPTIONS

979402.71 976896.27 2506.44

1265342 110930.05 (31.37)

STOCK

FUTURES

12627.15 12578.17 48.98

1861824 133969.23 0.62

STOCK

OPTIONS

9545.18 9391.18 154.00

196948 14544.92 4.15

Total

1005437.25

1002574.38

2862.87

3508305

275674.13

(13.71)

Turnover on December 02, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

315530 27903.39 -16.99

Index Options

144230638 12842719.36

74.04

Stock Futures

672552 50919.42 -8.38

Stock Options

1768237 138383.97 -8.18

Total

14,69,86,957 13059926.14

71.41

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17400 196.85

-33.15 133.15 17366.85

Sell

17500 230.00

Buy

17400 196.85

-69.50 269.50 17330.50

Sell

17600 266.35

Buy

17500 230.00

-36.35 136.35 17463.65

Sell

17600 266.35

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17400 266.35

36.35 63.65 17363.65

Sell

17300 230.00

Buy

17400 266.35

69.50 130.50 17330.50

Sell

17200 196.85

Buy

17300 230.00

33.15 66.85 17266.85

Sell

17200 196.85

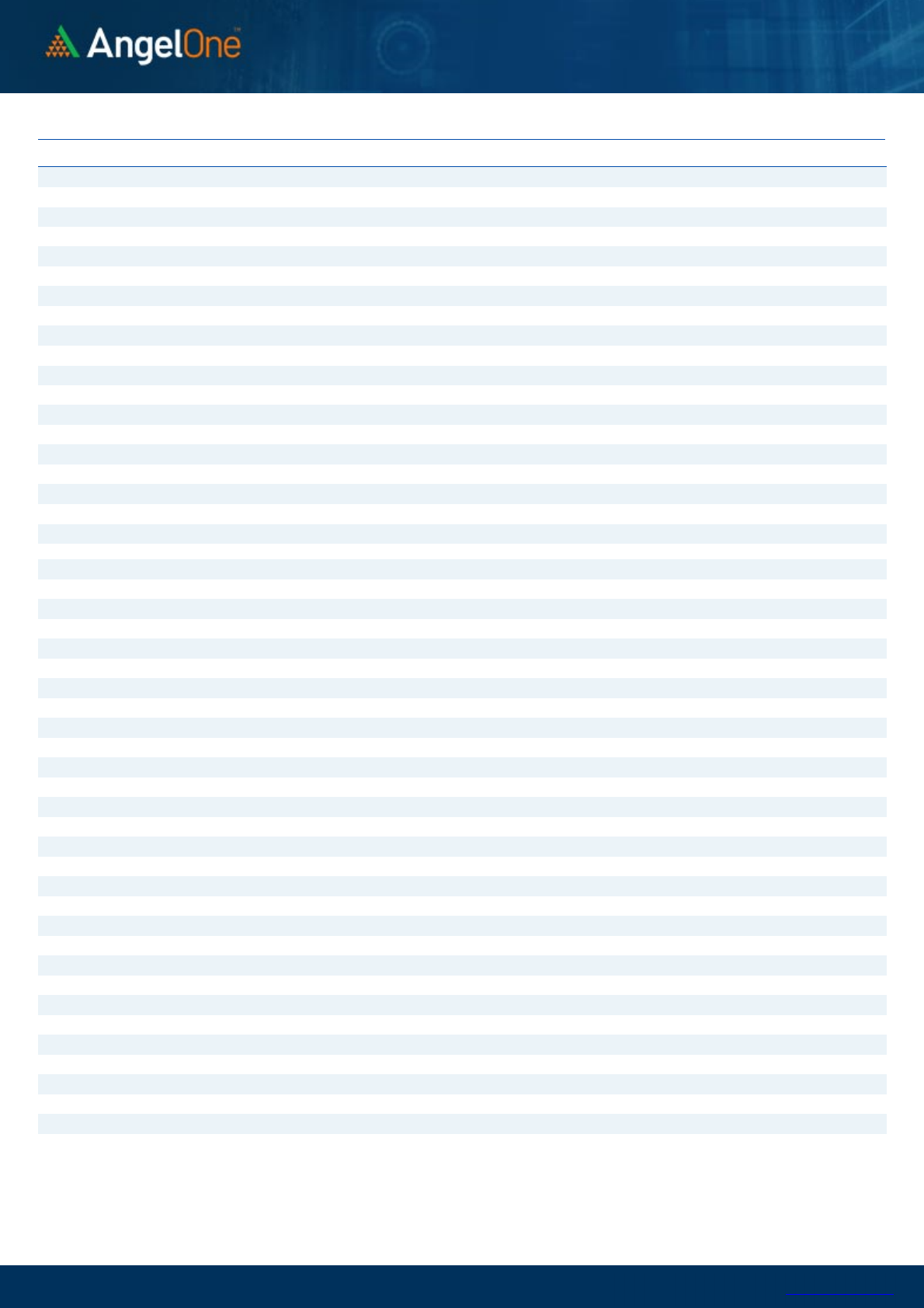

Nifty Put-Call Analysis

,0

1000,000

2000,000

3000,000

4000,000

5000,000

6000,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

December 03, 2021

`

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1 PIVOT R1 R2

ADANIPORTS 688 714

728 754 768

ASIANPAINT 3,134 3,157

3,176 3,199 3,217

AXISBANK 664 670

674 681 685

BAJAJ-AUTO 3,200 3,264

3,301 3,365 3,402

BAJFINANCE 6,950 7,065

7,138 7,253 7,325

BAJAJFINSV 17,024 17,391

17,641 18,008 18,257

BPCL 365 372

376 383 387

BHARTIARTL 706 719

727 741 749

BRITANNIA 3,495 3,537

3,572 3,614 3,649

CIPLA 905 913

926 934 946

COALINDIA 154 156

158 161 162

DIVISLAB 4,715 4,746

4,785 4,817 4,856

DRREDDY 4,587 4,625

4,647 4,685 4,707

EICHERMOT 2,411 2,431

2,447 2,468 2,484

GRASIM 1,639 1,682

1,716 1,758 1,792

HCLTECH 1,141 1,163

1,175 1,196 1,208

HDFCBANK 1,489 1,508

1,518 1,536 1,547

HDFCLIFE 689 697

702 710 715

HDFC 2,661 2,734

2,775 2,848 2,889

HEROMOTOCO 2,381 2,427

2,455 2,501 2,529

HINDALCO 416 424

429 437 442

HINDUNILVR 2,329 2,356

2,372 2,399 2,415

ICICIBANK 710 716

722 728 733

IOC 117 119

120 122 123

INDUSINDBK 916 931

940 955 965

INFY 1,698 1,723

1,737 1,762 1,776

ITC 219 222

224 227 229

JSW STEEL 624 635

642 653 660

KOTAKBANK 1,928 1,946

1,964 1,982 1,999

LT 1,751 1,770

1,782 1,801 1,813

M&M 823 836

848 861 873

MARUTI 7,199 7,262

7,309 7,372 7,418

NESTLEIND 19,037 19,270

19,460 19,693 19,883

NTPC 125 127

129 130 132

ONGC 139 141

143 146 147

POWERGRID 203 209

212 218 222

RELIANCE 2,446 2,464

2,480 2,499 2,515

SBILIFE 1,145 1,167

1,178 1,200 1,211

SHREECEM 25,624 25,957

26,353 26,686 27,082

SBIN 468 473

475 480 483

SUNPHARMA 736 751

761 776 786

TCS 3,548 3,595

3,622 3,669 3,696

TATACONSUM

755 764

773 782 790

TATAMOTORS 468 474

477 482 486

TATASTEEL 1,059 1,086

1,101 1,128 1,143

TECHM 1,562 1,596

1,614 1,648 1,667

TITAN 2,327 2,357

2,390 2,419 2,452

ULTRACEMCO 7,198 7,260

7,325 7,387 7,452

UPL 682 690

695 703 709

WIPRO 622 635

641 654 660

www.angelone.in

Technical & Derivatives Report

December 03, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Sneha Seth Derivatives Analyst sneha.seth@angelone.in