September 03, 2021

www.angelone.in

Technical & Derivatives Report

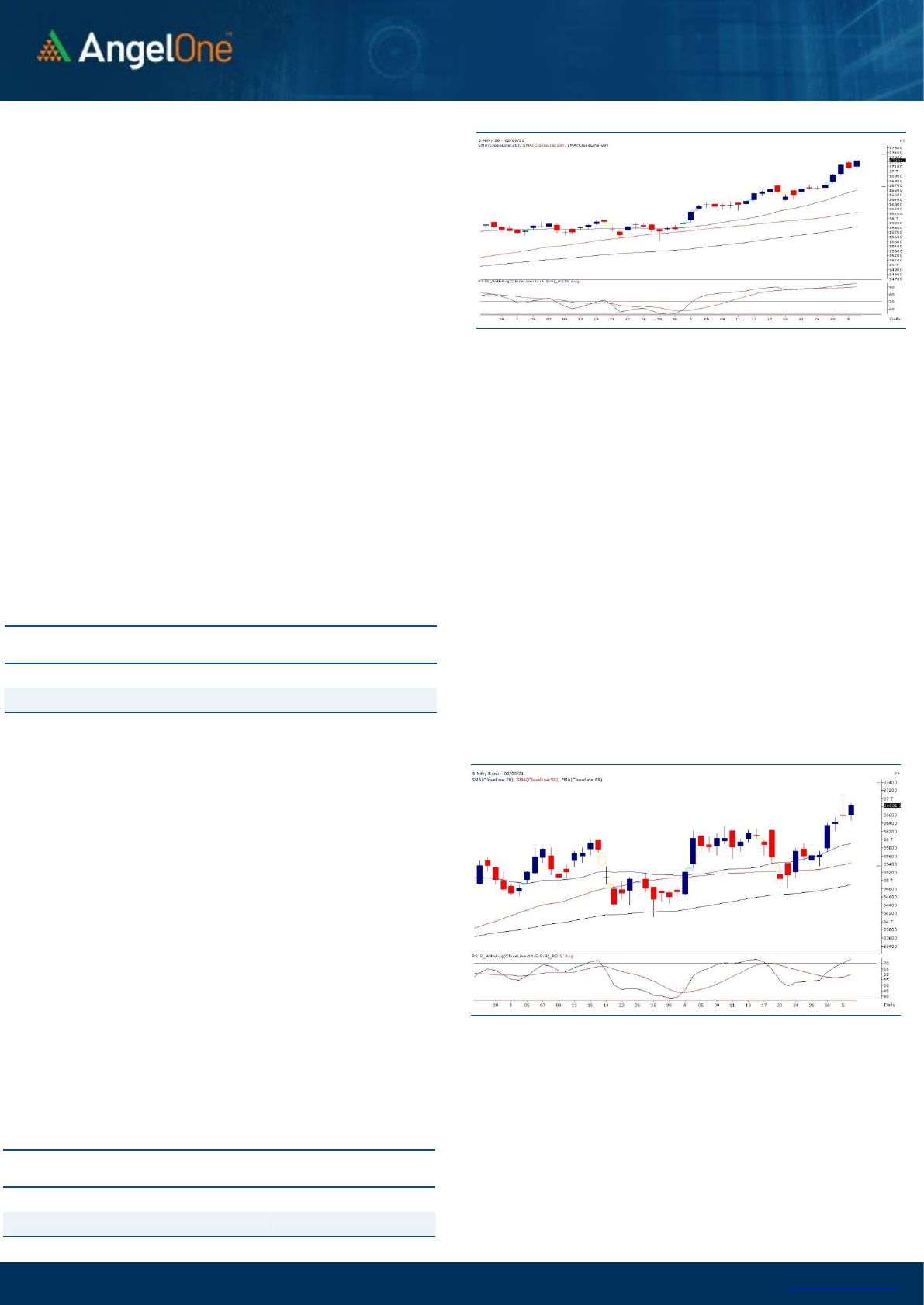

Exhibit 1: Nifty Daily Chart

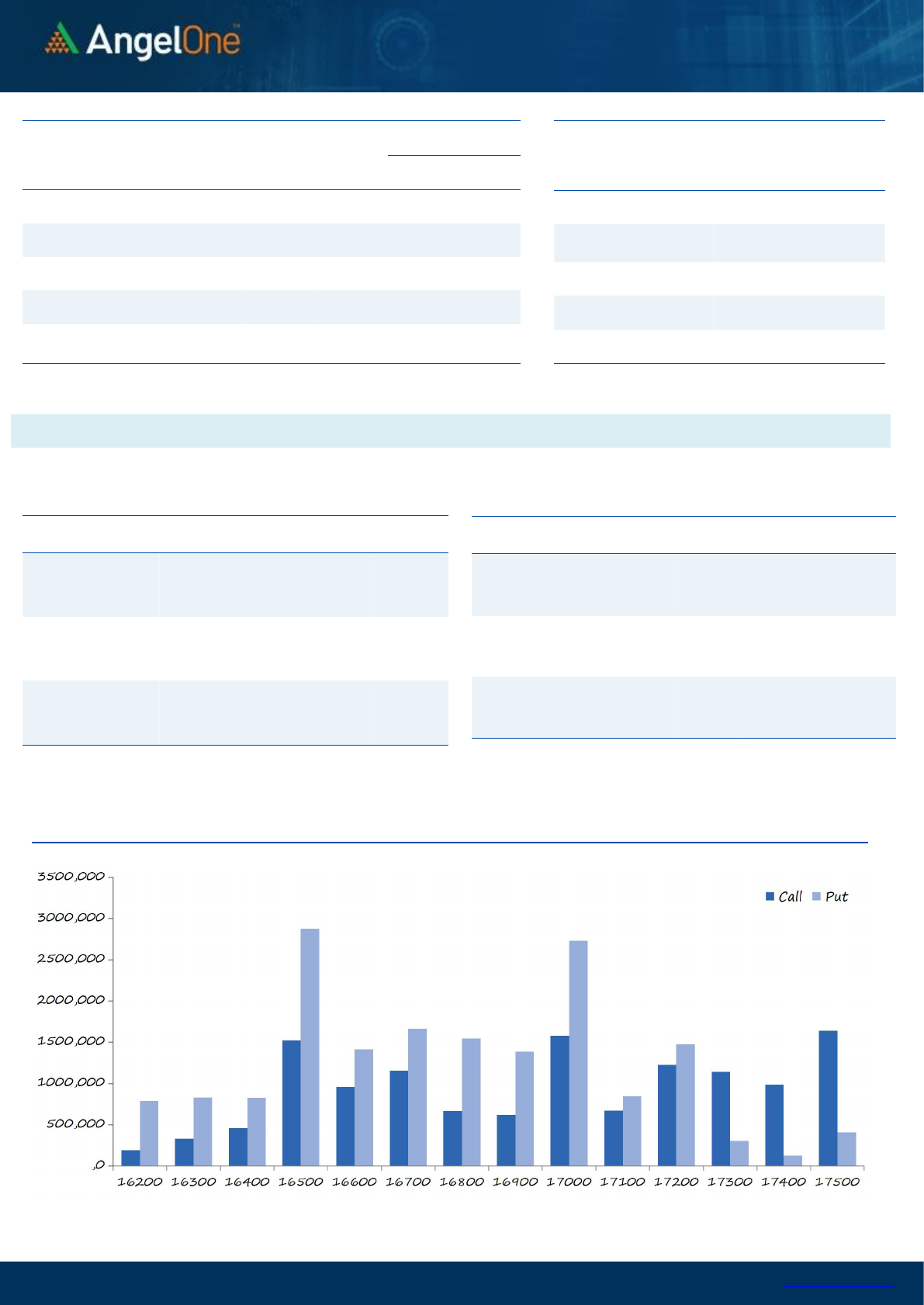

Nifty Bank Outlook - (36831)

The banking index had a quite start yesterday after Wednesday’s zig

zag move. After some initial trades, the banking index resumed its

northward trajectory and thereafter had a steady up move to

conclude the weekly expiry with seven tenths of a percent gains.

The move in banking space was not at all overpowering but it wasn’t

unnoticeable either. So we can say with its average performance, it

did manage to contribute a little in pushing the benchmark index at

new highs. Going ahead, 37000 – 37100 are the levels to watch out

for and any move beyond this zone would trigger some buying

interest in banking conglomerates. Until then expect some range

bound movement where 36400 – 36200 would be considered a key

support zone.

Key Levels

Support 1 – 36400

Resistance 1 – 37000

Support 2 – 36200

Resistance 2 – 37100

Exhibit 2: Nifty Bank Daily Chart

Sensex (57853) / Nifty (17234)

Nifty started the session marginally positive and it then crept higher

throughout the day to post its highest close at 17234 with gains of

almost a percent.

The bulls continue with their relentless run and with a broad market

participation, Nifty has ended comfortably above 17200. The index

heavyweights have seen a good buying interest this week which has led

to the acceleration of the momentum. Yesterday, we highlighted that

the RSI oscillator on lower time frame charts is overbought and next

couple of sessions could be crucial to determine whether there’s any

pause in the ongoing trend. As of now, there’s no sign of weakness and

hence, we may see the index moving towards its next resistances of

17270 and 17330. The near term support zone is now placed around

17100-17050 for Nifty. Traders are advised to look for sectors/stocks

which are in momentum on a given day and trade with the trend in such

counters. Also, at higher levels one should look to book timely profits

on their trading positions.

Key Levels

Support 1 – 17100

Resistance 1 – 17270

Support 2 – 17050

Resistance 2 – 17330

www.angelone.in

Technical & Derivatives Report

September 03, 2021

Nifty Vs OI

View

The opening on the weekly expiry was slightly positive.

As we progressed, post some consolidation index

regained strength to surpass 17200 and then hits fresh

record highs of 17245.50.

FIIs were net buyers in cash market segment to the tune

of Rs. 349 crores. In index futures, they bought to the

tune of Rs. 1228 crores with fall in open interest

suggesting short covering in yesterday’s session.

In F&O space, Nifty added fresh longs whereas, short

covering was observed in banking index. In index

options segment, we saw good amount of writing in

17150-17200 puts. On the other side, good amount of

unwinding was seen in 17100-17500 calls except for

17250 strike which added fresh positions. FIIs too

continued adding longs in equites and stock futures;

while, short coverering was seen index futures.

Considering the above data point, we maintain our

optimistic stance on market.

Comments

The Nifty futures open interest has increased by 4.01%.

Bank Nifty futures open interest has decreased by 3.55%

as market closed at 17234.15 levels.

The Nifty September future closed with a premium of

22.75 point against a premium of 20.70 point in last

trading session. The October series closed at a premium

of 36.90 point.

The INDIA VIX increased from 14.18 to 14.24. At the

same time, the PCR-OI of Nifty has increased from 1.17

to 1.32.

Few of the liquid counters where we have seen high cost

of carry are IDEA, BATAINDIA, AMBUJACEM,

KOTAKBANK and BHARATFORG.

OI Gainers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

AARTIIND

3359200

22.92

920.70

0.40

IDEA

528920000

20.01

7.15

17.89

COFORGE

853600

13.87

5157.95

0.03

EXIDEIND

32540400

12.65

178.20

4.89

ICICIPRULI

7231500

12.17

676.10

2.82

CONCOR

7868142

11.69

735.70

7.02

UBL

1820000

11.06

1563.35

1.00

ESCORTS

7195100

11.01

1311.35

-2.91

OI Losers

SCRIP

OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DLF

40580100

-6.23

338.90

1.82

BHARTIARTL

74935884

-6.07

666.50

-0.03

VOLTAS

3211500

-5.68

1085.35

3.54

SHREECEM

185225

-3.49

30321.90

6.41

APOLLOHOSP

2125500

-3.02

5043.50

0.24

HINDALCO

34920300

-2.84

456.95

0.00

CIPLA

11417900

-2.64

955.20

3.50

AUROPHARMA

15863250

-2.63

746.85

1.94

Put-Call Ratio

SCRIP

PCR-OI

PCR-VOL

NIFTY

1.32

0.91

BANKNIFTY

1.16

0.95

RELIANCE

0.48

0.32

ICICIBANK

0.55

0.43

INFY

0.53

0.29

Historical Volatility

SCRIP

HV

SHREECEM

39.07

IDEA

106.18

HDFCLIFE

38.51

CONCOR

47.30

EXIDEIND

34.08

www.angelone.in

Technical & Derivatives Report

September 03, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (September Series) are given as an information and not as a recommendation.

Nifty Spot = 17234.15

FII Statistics for September 02, 2021

Detail

Buy

Net

Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3825.56

2597.10

1228.46

171395

14975.32

(1.12)

INDEX

OPTIONS

667319.47

670700.51

(3381.04)

1079032

93951.43

(34.36)

STOCK

FUTURES

12857.23

12395.30

461.93

1448054

123027.23

0.32

STOCK

OPTIONS

15191.82

15178.44

13.38

197766

17121.35

6.84

Total

699194.08

700871.35

(1677.27)

2896247

249075.33

(15.95)

Turnover on September 02, 2021

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

2,25,944

20070.49

-30.27

Index Options

11,35,25,755

1,01,58,009.74

48.91

Stock Futures

7,07,863

59294.42

-10.95

Stock Options

24,38,431

2,11,838.03

-6.25

Total

11,68,97,993

1,04,49,212.68

46.28

Bull-Call Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17200

244.30

54.15

45.85

17254.15

Sell

17300

190.15

Buy

17200

244.30

98.75

101.25

17298.75

Sell

17400

145.55

Buy

17300

190.15

44.60

55.40

17344.60

Sell

17400

145.55

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Buy

17200

199.95

41.35

58.65

17158.65

Sell

17100

158.60

Buy

17200

199.95

73.80

126.20

17126.20

Sell

17000

126.15

Buy

17100

158.60

32.45

67.55

17067.55

Sell

17000

126.15

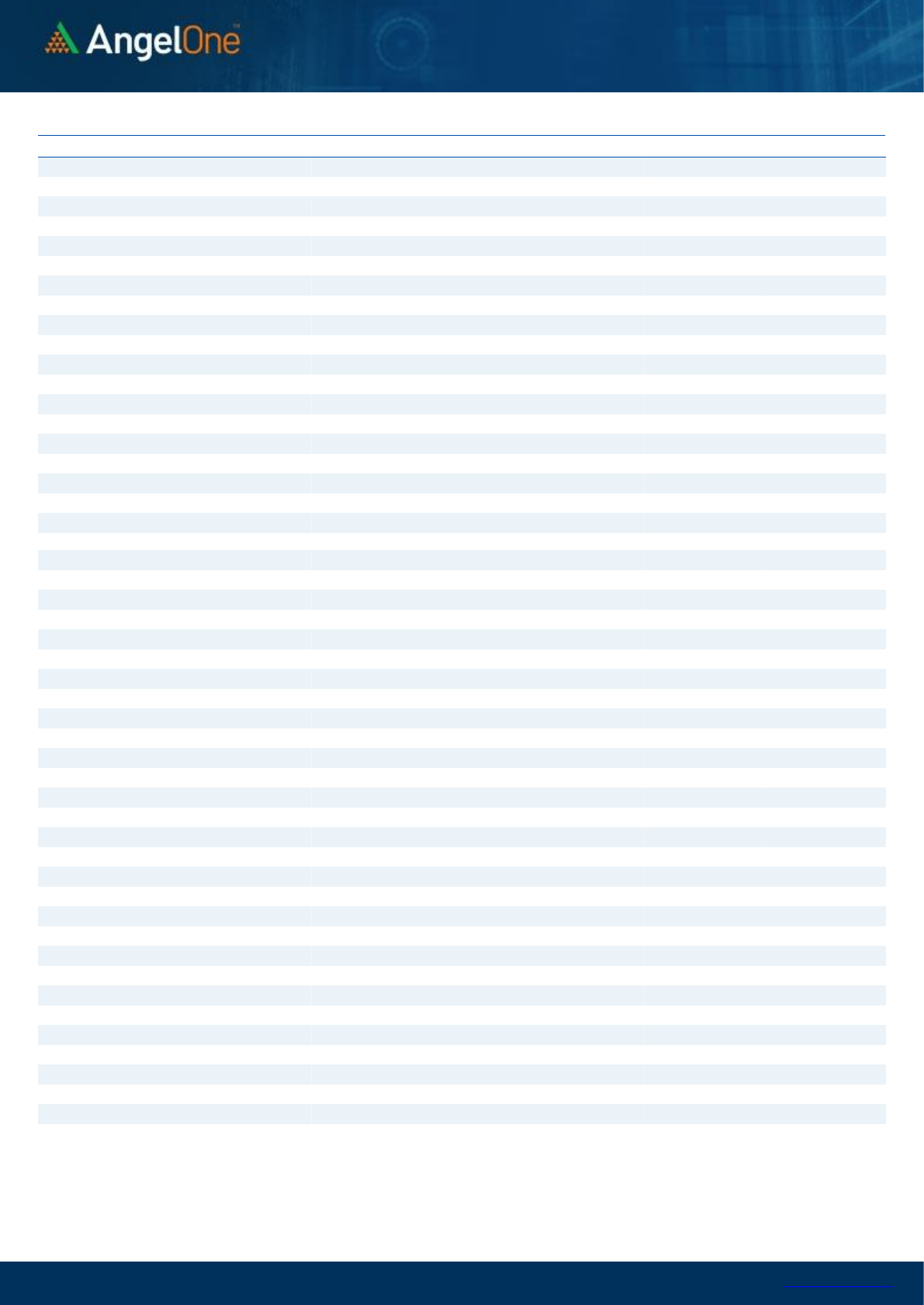

Nifty Put-Call Analysis

www.angelone.in

Technical & Derivatives Report

September 03, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

736

745

753

762

769

ASIANPAINT

3,243

3,273

3,296

3,325

3,348

AXISBANK

787

795

800

808

814

BAJAJ-AUTO

3,670

3,696

3,742

3,768

3,814

BAJFINANCE

7,369

7,434

7,510

7,575

7,651

BAJAJFINSV

16,448

16,576

16,738

16,866

17,028

BPCL

475

477

479

482

484

BHARTIARTL

658

662

668

672

678

BRITANNIA

3,962

4,024

4,064

4,126

4,166

CIPLA

910

932

946

969

983

COALINDIA

140

141

142

143

145

DIVISLAB

5,097

5,131

5,188

5,222

5,279

DRREDDY

4,764

4,812

4,858

4,906

4,952

EICHERMOT

2,661

2,697

2,723

2,758

2,784

GRASIM

1,475

1,487

1,497

1,509

1,519

HCLTECH

1,142

1,157

1,170

1,185

1,198

HDFCBANK

1,563

1,576

1,584

1,597

1,605

HDFCLIFE

696

727

752

783

807

HDFC

2,719

2,748

2,767

2,796

2,814

HEROMOTOCO

2,688

2,709

2,724

2,745

2,760

HINDALCO

450

453

459

463

469

HINDUNILVR

2,701

2,751

2,780

2,831

2,860

ICICIBANK

713

719

724

730

734

IOC

108

109

110

111

111

INDUSINDBK

989

999

1,006

1,017

1,023

INFY

1,650

1,670

1,682

1,701

1,714

ITC

208

209

210

211

213

JSW STEEL

673

679

684

690

695

KOTAKBANK

1,725

1,751

1,770

1,795

1,814

LT

1,665

1,675

1,693

1,703

1,721

M&M

735

744

759

768

783

MARUTI

6,636

6,714

6,787

6,865

6,937

NESTLEIND

19,568

19,904

20,097

20,433

20,626

NTPC

114

115

116

117

118

ONGC

117

118

119

120

121

POWERGRID

173

175

175

177

177

RELIANCE

2,233

2,264

2,286

2,316

2,339

SBILIFE

1,213

1,228

1,239

1,254

1,265

SHREECEM

27,738

29,031

29,773

31,065

31,808

SBIN

425

427

430

433

436

SUNPHARMA

784

787

791

794

799

TCS

3,669

3,753

3,806

3,890

3,943

TATACONSUM

857

864

870

877

882

TATAMOTORS

289

291

294

296

298

TATASTEEL

1,400

1,413

1,422

1,435

1,444

TECHM

1,406

1,422

1,437

1,453

1,469

TITAN

1,932

1,949

1,964

1,982

1,997

ULTRACEMCO

7,670

7,811

7,903

8,044

8,135

UPL

741

747

752

759

764

WIPRO

633

642

650

659

666

www.angelone.in

Technical & Derivatives Report

September 03, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.