Aug 03, 2022

www.angelone.in

Technical & Derivatives Report

OOOOOOOO

Nifty Bank Outlook (38024)

The global markets were a bit nervous yesterday especially some of

the Asian bourses, which resulted in a soft opening in our market.

After the initial dip, market stabilised at lower levels which was then

followed by a series of higher highs and higher lows throughout the

remaining part of the session. Unfortunately due to some tail end

profit booking, the BANKNIFTY concluded the session slightly above

the psychological mark of 38000.

Our markets had a peculiar price movement yesterday where we

witnessed sharp profit booking on couple of occasions after a good

rally. First one around the midsession and then towards the fag end,

we had a sharp downtick to pare down major chunk of gains.

BANKNIFTY being the high beta index, saw bigger swings as compared

to the Nifty. Traders should now get accustomed to such kind of price

movement, because the easy trade in market has certainly gone. From

hereon, we may either see time wise consolidation or a price wise

profit booking, like yesterday. It’s advisable not to trade aggressively

in indices for a time being. The ideal strategy would be to buy as close

as possible to the supports and vice versa. As far as levels are

concerned, 38200 – 38500 seems to be a congestion zone; whereas on

the flipside, 37800 – 37600 are to be seen as immediate supports.

Key Levels

Support 1 – 37800 Resistance 1 – 38200

Support 2 – 37600 Resistance 2 – 38500

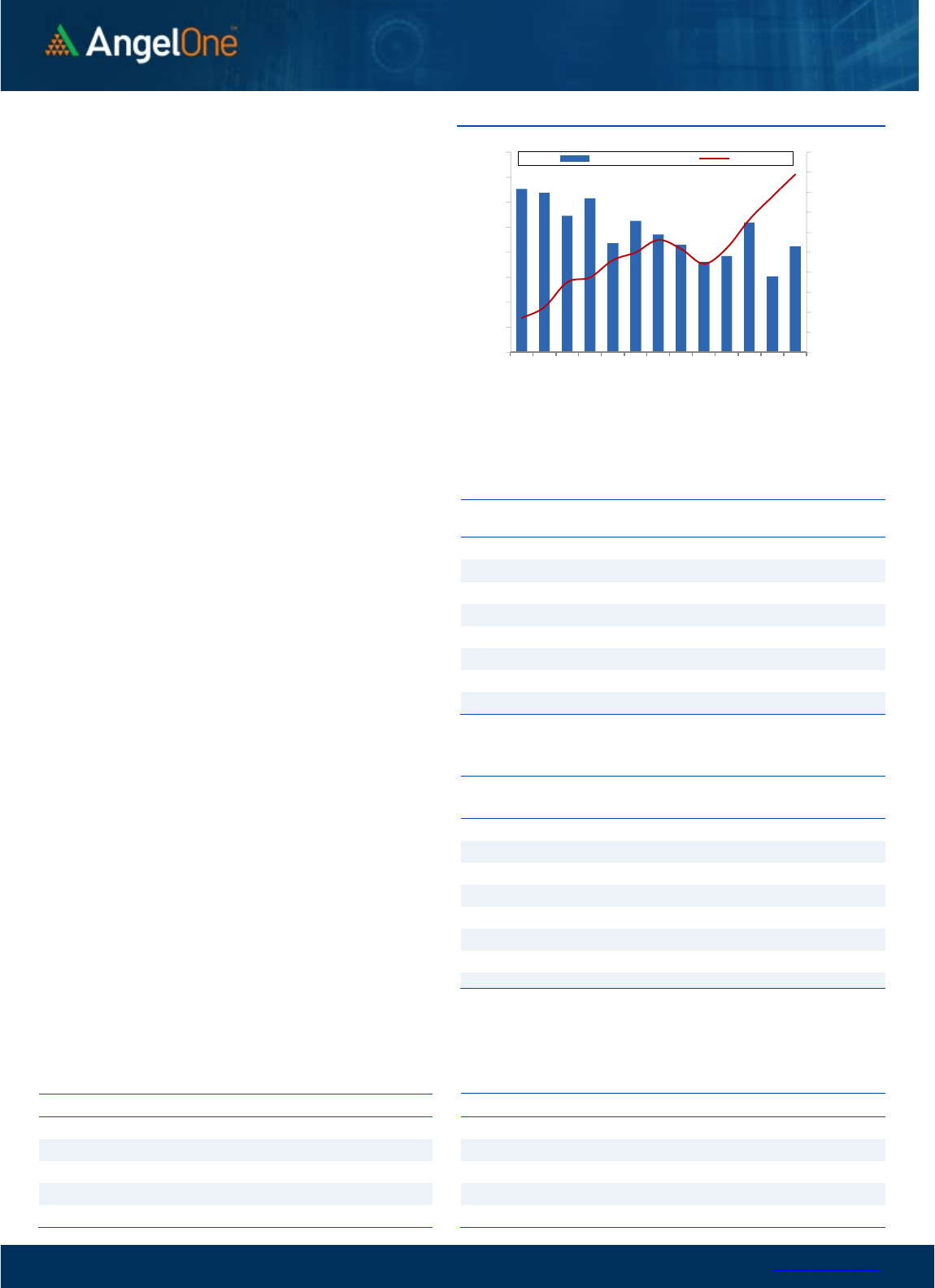

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (58136) / Nifty (17345)

The Indian equity market has witnessed a slender range-bound

movement in yesterday’s session until the fag end buying interest

levitated the benchmark index. The index went to the day’s high during

the last trading hour but was soon followed up by some profit booking.

With All the actions throughout, the benchmark index continued its

positive stature and maintained its bullish move for the fifth straight

day. The Nifty witnessed a mere gain of 0.03 percent to settle a tad

below the 17350 level.

Technically, the bullish momentum remains unchanged with the daily

gains in the broader market. We allude to our previous commentary of

not being complacent and staying watchful as the index showcased

some lackluster moves in yesterday’s session that might attract a round

of profit booking. However, the undertone is set in favor of the bulls,

and any minor correction could be seen as an opportunity to go long in

the index. As far as levels are concerned, the 17450-17500 odd zone is

expected to act as an immediate hurdle for the index. On the

contrary, 17200 is expected to cushion any minor correction, while the

unfilled gap around the 17000 mark holds the sacrosanct support zone

for the index.

Going forward, we might expect significant traction outside the

indices in the broader market space. Hence, it’s advisable to keep

focusing on such potential movers, which are likely to provide better

trading opportunities. Meanwhile, keeping a close tab on global and

domestic macro developments is advisable.

Key Levels

Support 1 – 17200 Resistance 1 – 17450

Support 2 – 17000 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

Aug 03, 2022

View

Our market opened slightly negative and witnessed

follow-up selling in the initial hour of trade to touch

17200. However, as we progressed index recoped all

the losses and inched higher towards 17400 in the final

hour but some profit booking in last few minutes led

closing with minor gains.

FIIs were net buyers in the cash market segment to

the tune of Rs. 825 crores. Simultaneously, in Index

futures, they sold worth Rs. 2727 crores with a

decrease in open interest, indicating long unwinding.

In derivatives segmet, we saw some unwinding in

Nifty; whereas, mixed bets were formed in index

futures segment. Stronger hands continued pouring

liquidity in Indian equity market but opted to book profit

in index futures. This resulted their index futures ‘Long

Short Ratio’ declining to 57% from 67%. Surprisingly,

we could hardly trace any relevant build-up in both call

and put options. Now, highest open interest

concentration stands at 17500 call and 17200 put.

Looking at the above development, we see strong

resistance around 17400-17500 zone for now;

whereas, 17100-17200 shall act as demand zone now.

Traders are advocated to focus stock specific trade for

now and keep a close watch on above mention Nifty

levels.

Comments

The Nifty futures open interest has decreased by

1.87%. and BANK Nifty futures open interest has

increased by 4.72% as the market closed at 17345.45.

The Nifty Aug future closed with a premium of 0.85

point against a premium of 38.25 point in the last

trading session. The Sep series closed at a premium

of 70.20 point.

The INDIA VIX increased from 17.48 to 18.53. At the

same time, the PCR-OI of Nifty has decreased from

1.49 to 1.38.

Few of the liquid counters where we have seen high

cost of carry are IDEA, UPL, PNB, ABB and

INDHOTEL.

Historical Volatility

SCRIP HV

IDFCFIRSTB 52.11

M&M 39.36

PNB 50.71

RAIN 62.99

MCX 47.37

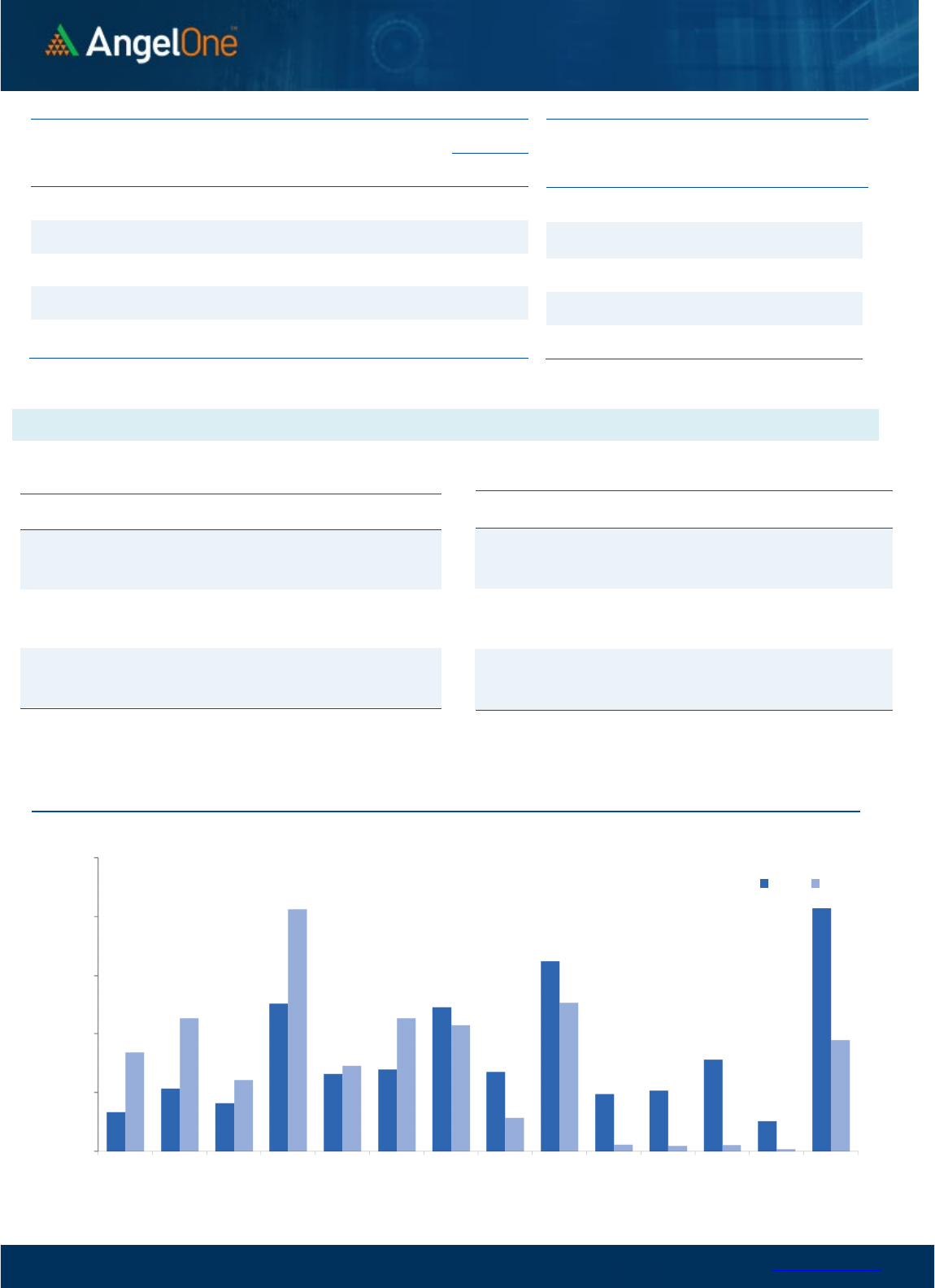

Nifty Vs OI

15600

15800

16000

16200

16400

16600

16800

17000

17200

17400

17600

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

7/14 7/18 7/20 7/22 7/26 7/28 7/1

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG.

(%)

PRICE

PRICE

CHG. (%)

FSL 22968400 32.32 105.85 -4.75

SYNGENE 2279000 30.60 563.85 -2.41

CONCOR 4304000 18.86 726.30 2.31

EICHERMOT 3494400 14.64 3120.90 1.03

BOSCHLTD 173100 14.30 17802.50 0.84

AUBANK 7304000 13.43 617.80 3.00

AMBUJACEM 46900800 11.77 378.65 0.83

ESCORTS 3089350 11.69 1633.45 -6.50

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ABBOTINDIA 39960 -7.93 20509.60 0.73

BALKRISIND 1446000 -6.26 2439.00 2.06

HINDALCO 26829850 -5.47 418.40 -1.38

PERSISTENT 660000 -4.97 3623.55 -1.10

MANAPPURAM 28080000 -4.45 103.40 -0.68

MRF 75410 -4.42 88181.25 1.28

CHOLAFIN 7816250 -4.42 746.75 1.45

ASTRAL 681175 -4.40 1890.65 -0.06

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.49 0.91

BANKNIFTY 1.26 0.92

RELIANCE 0.64 0.34

ICICIBANK 0.80 0.50

INFY 0.76 0.50

www.angelone.in

Technical & Derivatives Report

Aug 03, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Aug Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

340.05

FII Statistics for

August

0

2

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2596.82 5323.97 (2727.15) 140183 12528.75 (9.47)

INDEX

OPTIONS

898823.73 893479.59 5344.14

1293401 115504.67 2.23

STOCK

FUTURES

11969.32 11895.03 74.29

2128151 145190.45 0.09

STOCK

OPTIONS

7485.50 7661.39 (175.89) 90454 6339.25 15.80

Total 920875.37

918359.98

2515.39

3652189

279563.12

0.77

Turnover on

August

0

2

, 2022

Instrument

No. of

Contracts

Turnov

er

( in Cr.

)

Change

(%)

Index Futures

426597 38401.30 39.00

Index Options

122203036 10954976.25 56.62

Stock Futures

905177 63396.19 -0.81

Stock Options

3251708 241858.15 -0.34

Total

3,251,708 241858.15 54.16

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17300 313.75

47.80

52.20

17347.80

Sell

17400 265.95

Buy

17300 313.75

101.40

98.60

17401.40

Sell

17500 212.35

Buy

17400 265.95

53.60 46.40 17453.60

Sell

17500 212.35

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 17300 275.75

37.65

62.35

17262.35

Sell

17200 238.10

Buy 17300 275.75

77.55

122.45

17222.45

Sell 17100 198.20

Buy

17200 238.10

39.90 60.10 17160.10

Sell

17100 198.20

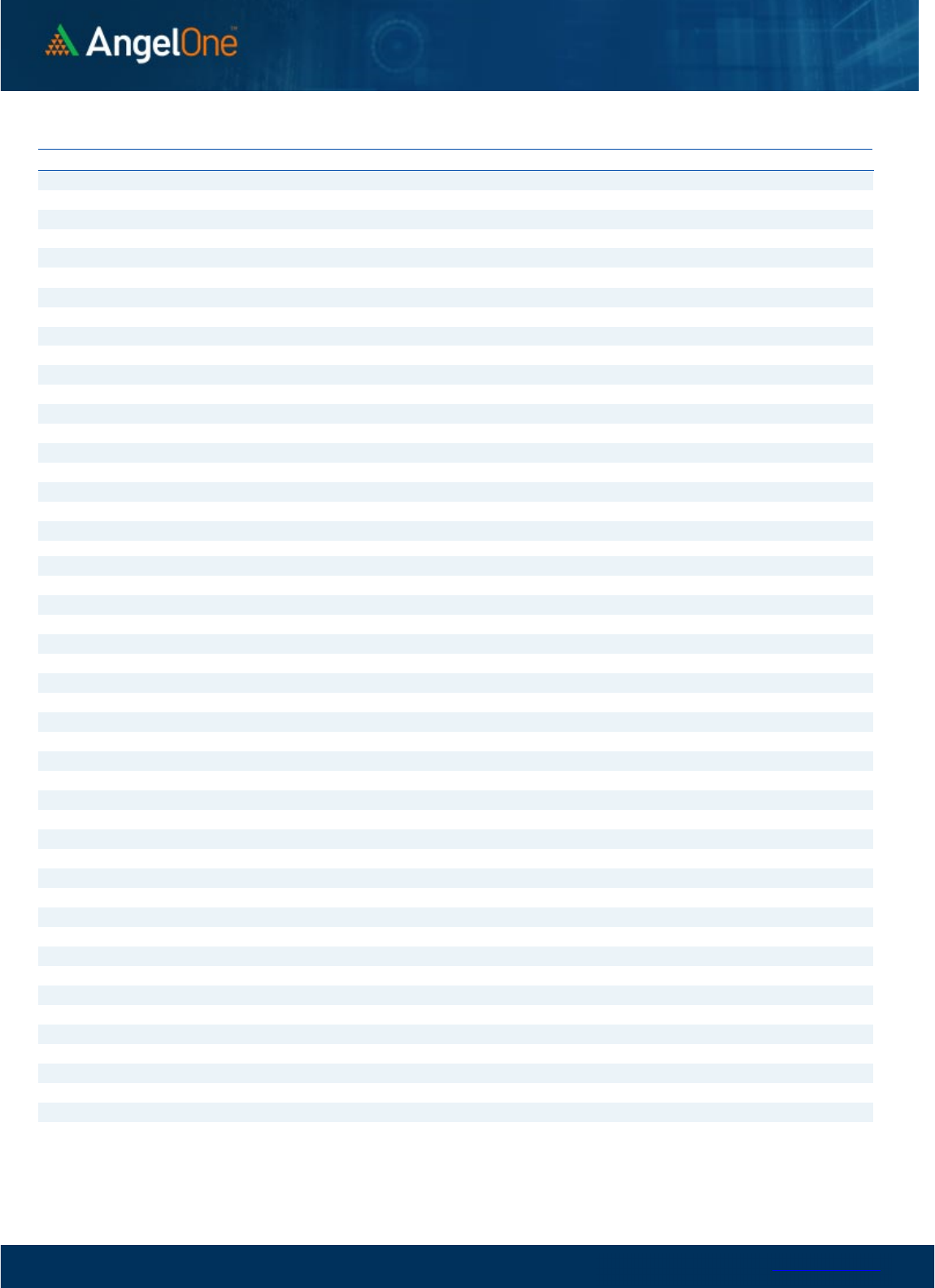

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

Aug 03, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

787

795

803

810

818

APOLLOHOSP 4,238 4,282

4,315

4,359 4,392

ASIANPAINT

3,296

3,346

3,376

3,425

3,455

AXISBANK

715

723

729

736

742

BAJAJ-AUTO

3,917

3,957

3,981

4,020

4,045

BAJFINANCE

7,120

7,231

7,293

7,405

7,467

BAJAJFINSV

14,697

14,960

15,125

15,389

15,554

BPCL 327 331

336

340

346

BHARTIARTL

670

679

689

698

709

BRITANNIA 3,668 3,728

3,818

3,879

3,969

CIPLA

987

995

1,001

1,010

1,015

COALINDIA

209

212

215

218

220

DIVISLAB 3,764 3,795

3,817

3,848 3,870

DRREDDY 4,038 4,062

4,095 4,119

4,152

EICHERMOT 2,826 2,973

3,061

3,208

3,296

GRASIM

1,536

1,563

1,579

1,606

1,621

HCLTECH 936 943

949

956

961

HDFCBANK

1,411

1,421

1,433

1,442

1,454

HDFCLIFE

529

534

539

544

550

HDFC 2,305 2,329

2,355

2,379

2,404

HEROMOTOCO 2,694 2,733

2,781

2,820 2,868

HINDALCO

403

411

416 423

428

HINDUNILVR 2,584 2,610

2,624 2,650

2,665

ICICIBANK

808

813

817 822

827

INDUSINDBK 1,017 1,042

1,057

1,082

1,097

INFY 1,521 1,532

1,540

1,551

1,558

ITC

303

307

312

315

320

JSW STEEL 618 633

642

657

665

KOTAKBANK 1,812 1,848

1,871 1,907

1,929

LT

1,758

1,775

1,793

1,811

1,829

M&M 1,213 1,234

1,247

1,267

1,280

MARUTI 8,865 9,019

9,108

9,262

9,351

NESTLEIND 19,219 19,339

19,420

19,540

19,621

NTPC 155 157

159

161

162

ONGC 134 135

136

138

139

POWERGRID

215

219

221

225

227

RELIANCE 2,538 2,562

2,585 2,608

2,631

SBILIFE

1,260

1,273

1,293

1,305

1,325

SHREECEM

20,591

20,851

21,070

21,330

21,549

SBIN

526

534

539

548

553

SUNPHARMA

904

911

919

925

933

TCS

3,251

3,271

3,292

3,313 3,333

TATACONSUM

795 803

815 823

834

TATAMOTORS

464

470

475

481

486

TATASTEEL 104 106

107

108

109

TECHM 1,018 1,025

1,037

1,045

1,057

TITAN

2,339

2,362

2,380 2,403

2,421

ULTRACEMCO 6,548 6,600

6,647

6,699

6,746

UPL

709

724

745

761

781

WIPRO

422

426

429

433

436

www.angelone.in

Technical & Derivatives Report

Aug 03, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.