March 03, 2023

www.angelone.in

Technical & Derivatives Report

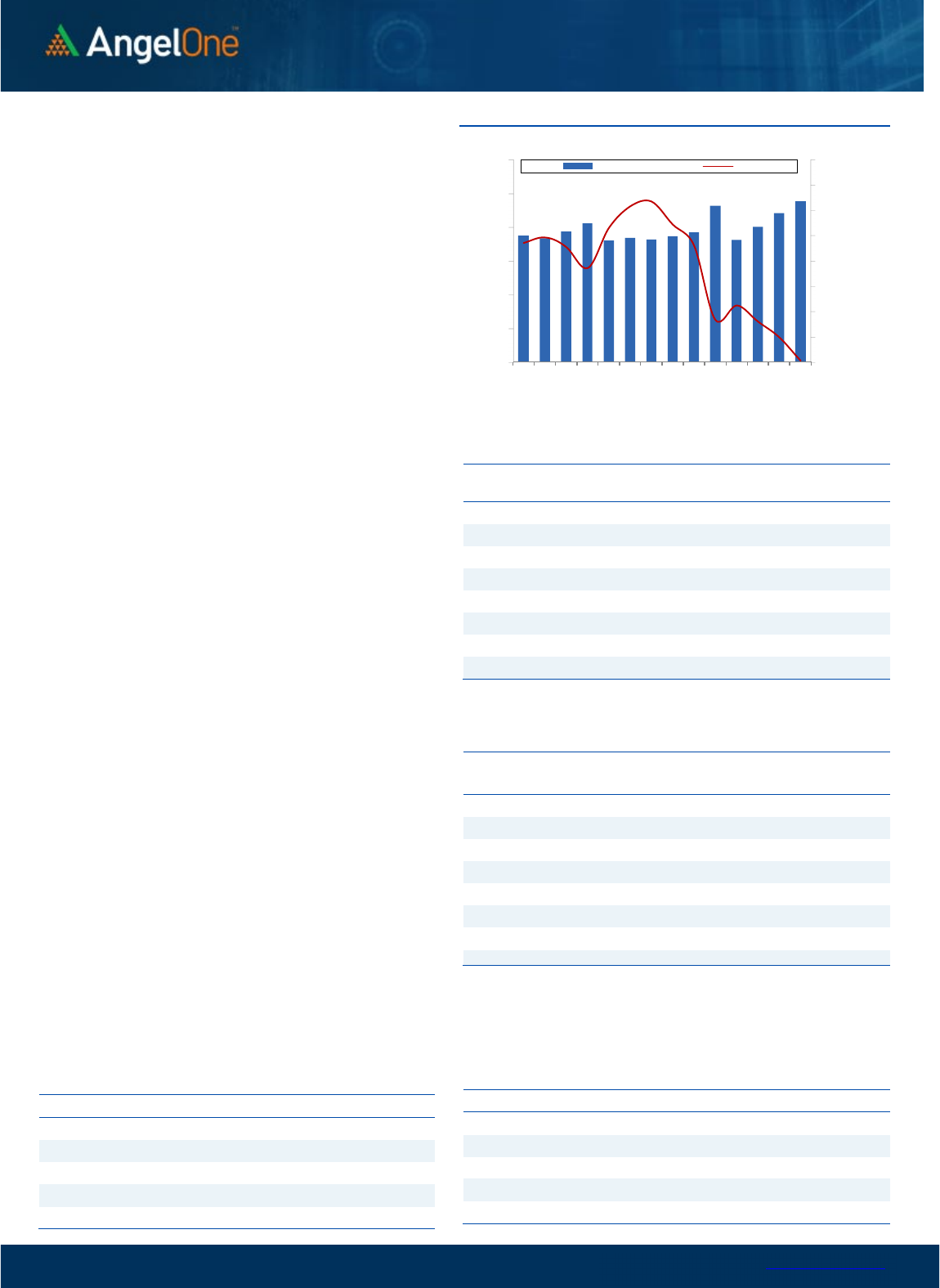

Nifty Bank

Outlook (

40

390

)

The BANKNIFTY started the session slightly in the red in tandem

with benchmark index. After some initial swings, the prices started

declining, which kept happening throughout the session in a

gradual manner. Eventually, the BANKNIFTY ended the session tad

below 40400 by shedding nearly eight tenths of percent from

previous close.

Looking at Wednesday’s move, we expected some decent moves

in the upward direction. But due to lack up follow up buying, it

poured water on this promising attempt. Now although, the

correction was a bit depressing, we continue to remain hopeful as

long as 40000 - 39700 is being held convincingly. Hence, traders are

advised not to lose hope and wait for a sustenance above 40800-

41000. Meanwhile, 40500-40700 are to be seen immediate

hurdles.

Key Levels

Support 1 – 40200 Resistance 1 – 40700

Support 2 – 40000 Resistance 2 – 41000

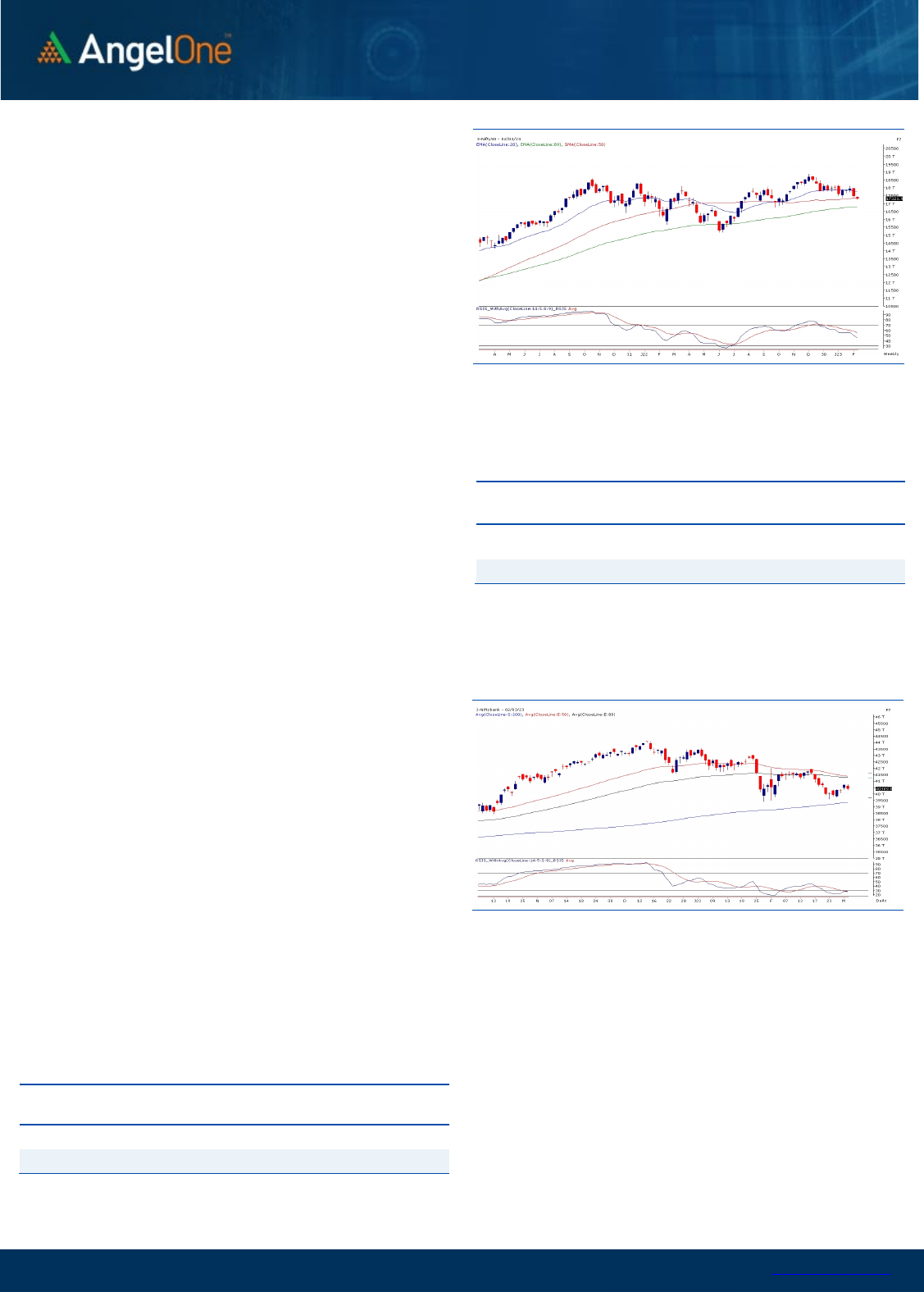

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

5

8909

) / Nifty (

1

7

322

)

Our market started the weekly expiry session on a bleak note, taking

cues from the SGX Nifty and soon after the opening bell the

benchmark index descended to the lower grounds. The bears once

again tightened their grip, showing strong resilience in letting the

Nifty surge. By the latter half, another round of sell-off dragged the

index below previous day’s swing low dampening sentiments. Post

all hustles, Nifty concluded the day in red with a cut of 0.74 percent

and settled a tad above the 17300 level.

Technically speaking, a sign of timidness is evident as there is no cue

of follow-up buying in the index to levitate the sentiments. The

recent developments construe a motion of tentativeness among the

market participants as Nifty struggles around the 200 SMA. The

absence of buying is only worrisome; however, most of the

indicators are in the oversold terrain and traders need to avoid fresh

short bets for the time being. As far as levels are concerned, the

immediate swing low of 17255 could act as the initial support zone,

breaching which 17200-17100 could be tested in the comparable

period. While on the higher end, 17450-17500 is the sturdy hurdle

and an authoritative breach could only turn around the sentiments

in the market.

As we advance, we advocate traders to keep a close tab on the

mentioned levels and should focus on a stock-centric approach

for better trading opportunities. Also, one should stay abreast

with global developments.

Key Levels

Support 1 – 17255 Resistance 1 – 17450

Support 2 – 17100 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

March 03, 2023

View

On the weekly expiry session, we witnessed some

tentativeness right from the word go to drag index

towards 17300.

FIIs were net buyers in the cash market segment to

the tune of Rs. 12771 crores. Simultaneously, in

Index futures, they sold worth Rs. 532 crores with

decrease in open interest, indicating long unwinding.

On the weekly expiry day, we witnessed a mixed bag

of pictures, as there was short formations in Nifty

whereas long unwinding in Bank Nifty. FIIs were

buyers in the cash segment considering the block

deal in the Adani group whereas in index futures

unwinding of longs were seen. On the option chain

front, 17400 CALL strike has decent build up whereas

on the PUT side 17000 strike is acting as support.

LONG SHORT Ratio has plunged back below 15% and

indicates markets in oversold zone. Considering this

factor we continue to advise traders to avoid fresh

short positions at current levels and look for buying

opportunities.

Comments

The Nifty futures open interest has increased by 2.59%

and Bank Nifty futures open interest has decreased by

2.27% as the market closed at 17321.90.

The Nifty March future closed with a premium of 77.5

point against a premium of 81.8 point in the last trading

session. The April series closed at a premium of 178.45

point.

The INDIA VIX decreased from 12.99 to 12.97. At the

same time, the PCR-OI of Nifty has decreased from 0.92

to 0.76.

Few of the liquid counters where we have seen high

cost of carry are ADANIENT, RAIN, CHOLAFIN,

HINDPETRO, AND ZYDUSLIFE.

Historical Volatility

SCRIP HV

SIEMENS 32.33

ESCORTS 41.06

AMBUJACEM 55.98

MARUTI 30.81

BATAINDIA 30.94

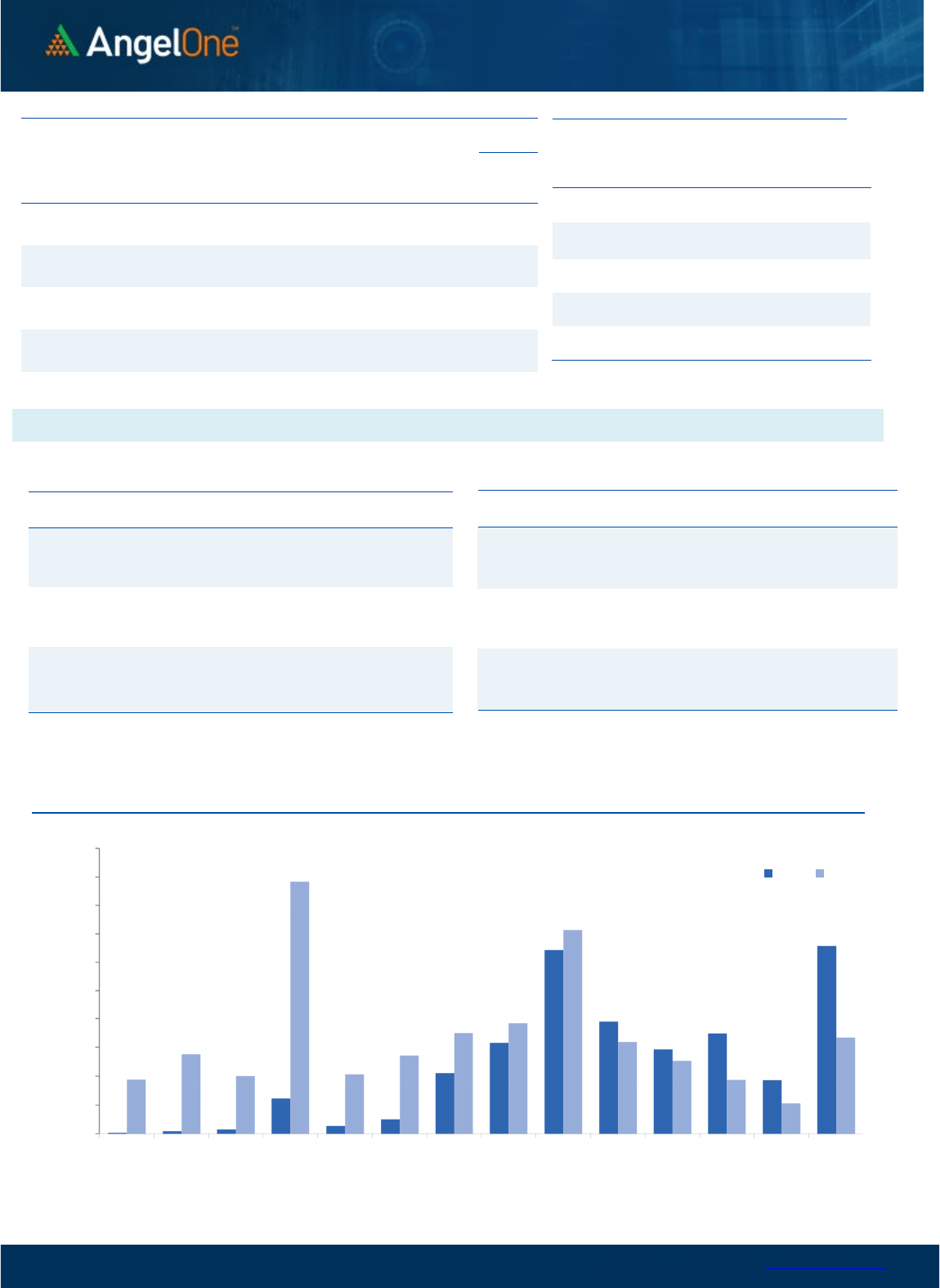

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/8 2/10 2/14 2/16 2/20 2/23 2/27

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

POWERGRID 32073300 13.64 220.35 1.00

ADANIENT 16306500 12.29 1607.20 3.13

VOLTAS 5251800 11.75 918.80 1.23

TORNTPOWER 3646500 11.46 515.60 1.59

MCX 983600 8.57 1424.30 -1.88

LTTS 1176000 8.23 3698.55 -1.62

PETRONET 13095000 7.12 221.90 0.47

MFSL 3532100 6.93 686.55 -1.78

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CROMPTON 5482500 -7.02 308.75 -0.51

MRF 55570 -5.54 86802.70 0.67

COALINDIA 38375400 -5.20 222.85 2.54

ABBOTINDIA 45920 -4.73 20094.70 -1.50

HONAUT 24105 -4.23 35397.15 0.03

APOLLOHOSP 1372375 -3.88 4402.20 -0.12

BHEL 71137500 -3.86 74.80 2.26

TECHM 10600800 -3.69 1109.80 -1.34

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.76 0.96

BANKNIFTY 0.79 1.04

RELIANCE 0.59 0.43

ICICIBANK 0.68 0.64

INFY 0.51 0.54

www.angelone.in

Technical & Derivatives Report

March 03, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7321.90

0900

Lot Size = 75

FII Statistics for

March 0

2

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

5908.07 6440.43 (532.36) 186446 16789.18 (5.44)

INDEX

OPTIONS

2274632.26 2256380.06 18252.20

1899927 169098.26 (30.65)

STOCK

FUTURES

10143.97 12725.10 (2581.13) 2142859 140694.94 (1.41)

STOCK

OPTIONS

6606.05 6730.05 (124.00) 118369 7754.01 11.99

Total 2297290.35

2282275.64

15014.71

4347601

334336.39

(16.65)

Turnover

on

March

0

2

, 202

3

Instrumen

t

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

327351

30483.48 17.04

Index Options

3559695

85

51617.94 17.00

Stock Futures

755562

47025.65 1.11

Stock Options

2422927

3599.73 0.09

Total

2,422,92

7

3599.73 10.36

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17400 213.50

51.20 48.80 17451.20

Sell

17500 162.30

Buy

17400 213.50

93.75 106.25 17493.75

Sell

17600 119.75

Buy

17500 162.30

42.55 57.45 17542.55

Sell

17600 119.75

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17300 175.70

33.45 66.55 17266.55

Sell 17200 142.25

Buy 17300 175.70

61.55 138.45 17238.45

Sell

17100 114.15

Buy

17200 142.25

28.10 71.90 17171.90

Sell 17100 114.15

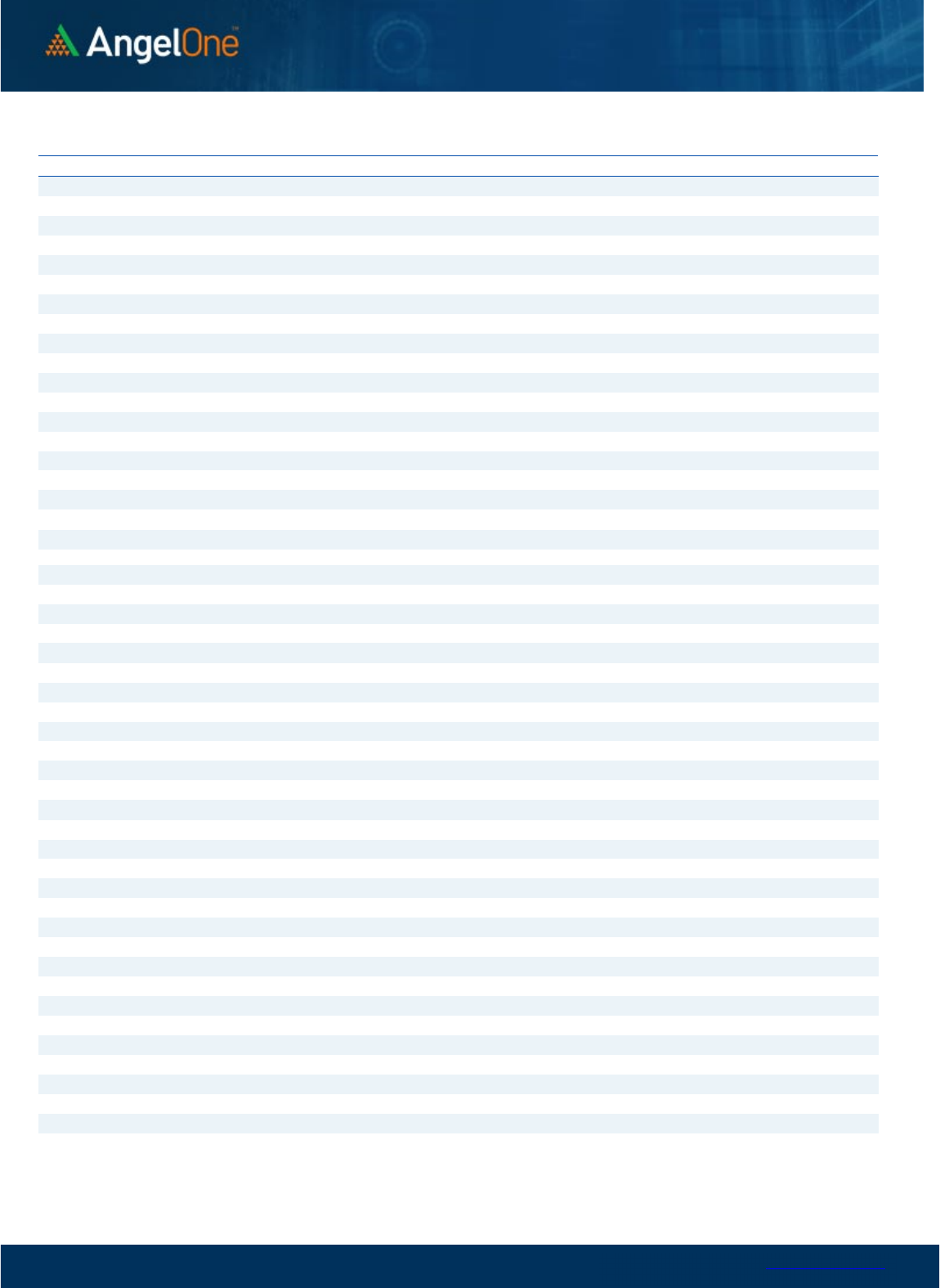

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

16700 16800 16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000

Call Put

www.angelone.in

Technical & Derivatives Report

March 03, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,316

1,461

1,554

1,700

1,792

ADANIPORTS 572 597

611

637

651

APOLLOHOSP

4,342

4,372

4,411

4,441

4,480

ASIANPAINT

2,793

2,814

2,831

2,852

2,869

AXISBANK 829 837

852

860

875

BAJAJ-AUTO

3,640

3,678

3,718

3,755

3,795

BAJFINANCE

5,981

6,032

6,121

6,172

6,260

BAJAJFINSV

1,307

1,325

1,356

1,374

1,404

BPCL 312 316

319

324

326

BHARTIARTL 727 733

743

749

759

BRITANNIA

4,319

4,357

4,381

4,418

4,443

CIPLA 873 880

891

898

910

COALINDIA 214 219

222

226

229

DIVISLAB

2,809

2,835

2,853

2,879

2,897

DRREDDY

4,289

4,340

4,371

4,421

4,452

EICHERMOT

3,066

3,096

3,127

3,157

3,189

GRASIM

1,582

1,590

1,596

1,604

1,610

HCLTECH

1,078

1,092

1,104

1,119

1,131

HDFCBANK

1,567

1,576

1,591

1,600

1,615

HDFCLIFE

476

479

485

489

495

HDFC

2,577

2,590

2,608

2,622

2,640

HEROMOTOCO

2,420

2,442

2,463

2,484

2,505

HINDALCO 403 407

412

416

421

HINDUNILVR

2,430

2,443

2,456

2,469

2,482

ICICIBANK 845 849

856

860

866

INDUSINDBK

1,085

1,093

1,102

1,111

1,119

INFY

1,455

1,463

1,476

1,485

1,497

ITC 372 374

377

379

382

JSW STEEL 667 671

677

681

688

KOTAKBANK

1,700

1,711

1,729

1,739

1,757

LT

2,085

2,103

2,126

2,145

2,168

M&M

1,231

1,242

1,260

1,270

1,289

MARUTI

8,348

8,448

8,610

8,710

8,872

NESTLEIND

18,236

18,359

18,580

18,702

18,923

NTPC 169 170

171

172

173

ONGC 152 153

154

155

156

POWERGRID 214 217

219

222

224

RELIANCE

2,303

2,315

2,333

2,345

2,363

SBILIFE

1,082

1,091

1,107

1,116

1,132

SBIN 528 531

535

538

543

SUNPHARMA 945 955

961

971

977

TCS

3,285

3,303

3,336

3,355

3,388

TATACONSUM

698 703

711

715

723

TATAMOTORS 415 418

422

425

429

TATASTEEL 103 104

105

106

108

TECHM

1,094

1,102

1,113

1,121

1,132

TITAN

2,326

2,342

2,368

2,385

2,411

ULTRACEMCO

7,214

7,251

7,291

7,329

7,368

UPL 697 701

709

713

721

WIPRO 386 387

389

390

392

www.angelone.in

Technical & Derivatives Report

March 03, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.