DEC 02, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

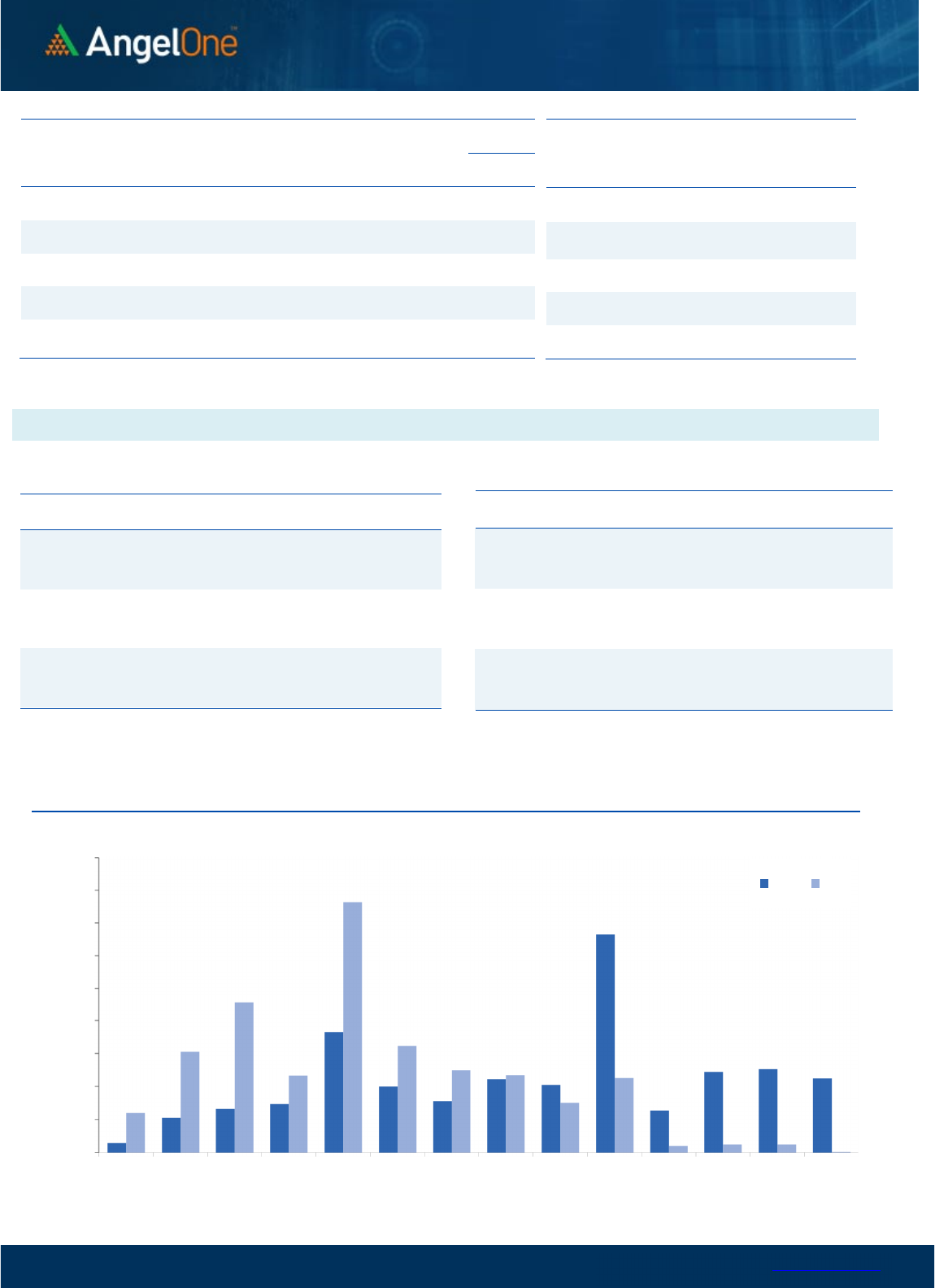

Nifty Bank Outlook (43261)

Bank Nifty as well started on a strong note however we witnessed

an open high kind of scenario where prices right from the word go

started to slide lower to mark an intraday low of 43101.

Subsequently, during the penultimate hour, we witnessed some

volatility amidst the weekly expiry to eventually end flat at 43261.

Technically, not much changed on the index front as the prices

continue to inch higher in the northward direction. In our last

couple of outlooks, we have been mentioning the high overbought

conditions and to prefer buying on dips and selling on the rise. This

has worked well, and we remain with this stance as we expect

some consolidation in the near term. There is however no shortage

of action in individual stocks as they continue to buzz for example

yesterday it was the PSU basket that again resumed positive

traction after a couple of days of pause; traders should continue to

identify such potential outperformers in the near term. As far as

levels for the bank index are concerned, 43040 - 42880 remains an

immediate support whereas 43500 - 43640 is immediate

resistance.

Key Levels

Support 1 – 43040 Resistance 1 – 43500

Support 2 – 42880 Resistance 2 – 43650

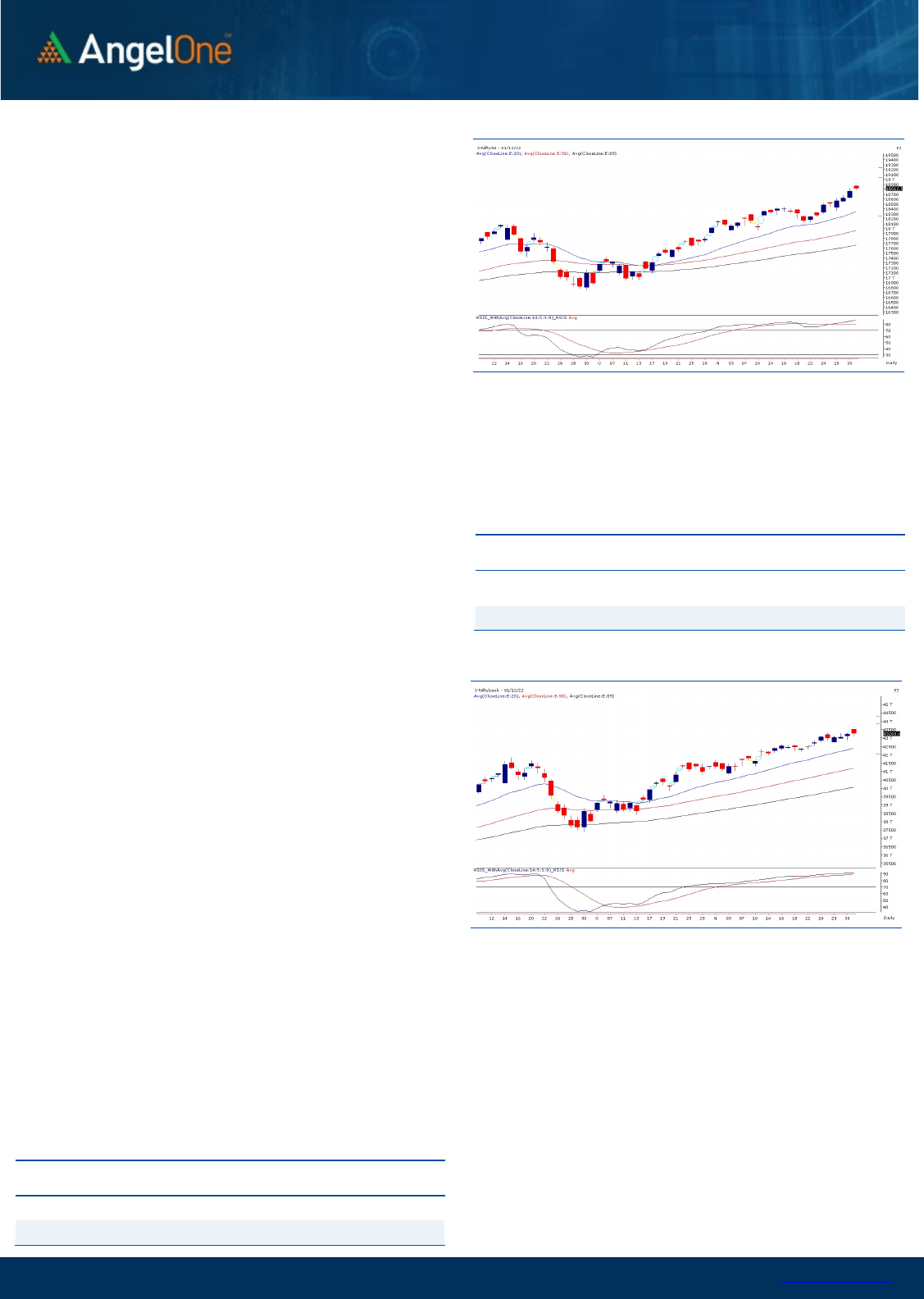

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (63284) / Nifty (18812)

The positive global cues led to a decent gap-up opening to our

domestic market, wherein the benchmark index Nifty50 continued

its northwards journey consecutively for the eighth trading session.

The bulls are being dominant as they persuade on the intraday dip

to showcase their resilience; however, some profit booking was

seen later in the session. The technical structure remains buoyant

as Nifty is in a roll of making higher highs, and with yet another

positive closure Nifty settled at fresh highs of 18812 levels,

procuring 0.29 percent.

The broad-based buying interest has levitated overall market

sentiments, followed by positive developments overseas, which

strengthened the momentum. All these phenomena are auguring

well for the bulls of D-Street. Technically, the structure construes

optimism and any short-term blip to be considered healthy. As far

as levels are concerned, 18600-18500 is likely to be the sacrosanct

support zone. While on the higher end, 18900-19000 is expected to

act as an immediate hurdle for the index in the comparable period.

Looking at the recent developments, the undertone is likely to

remain in favor of the bulls, with significant traction seen outside

the indices. Hence it is advisable to keep Identifying apt themes

and potential movers within the same, which are likely to provide

better trading opportunities. Meanwhile, it is also advisable to

keep a close tab on global developments.

Key Levels

Support 1 – 18675 Resistance 1 – 18900

Support 2 – 18600 Resistance 2 – 19000

www.angelone.in

Technical & Derivatives Report

DEC 02, 2022

View

Our market maintained its winning streak for the

eighth consecutive session, wherein the benchmark

index Nifty50 logs a fresh high to settle above the

18800 zone with gains of 0.29 percent.

FIIs were net sellers in the cash market segment to

the tune of Rs. 1566 crores. Simultaneously, in Index

futures, they sold worth Rs. 526 crores with a

decrease in open interest, indicating long unwinding.

Looking at the overall F&O data, we have witnessed a

mixed trade on the weekly expiry. On the options front,

the piling up of OI is visible in the 18800 put strike,

followed by 18600 PE, indicating nearby support. On the

higher end, the piling up of positions could be seen at

the 19000-call strike, suggesting the immediate

resistance for the index. Meanwhile, the stronger

hands have remained steady with their bullish bets as

the ‘Long Short Ratio’ remained unchanged at 75%.

Considering the recent price action, the undertone is

likely to remain upbeat, and any intra-day dip towards

the mentioned support zone could augur well for the

bulls to add long bets in the index.

Comments

The Nifty futures open interest has increased by

0.55% and Bank Nifty futures open interest has

decreased by 0.27% as the market closed at 18812.50.

The Nifty December future closed with a premium of

135.80 point against a premium of 116.15 point in the

last trading session. The January series closed at a

premium of 228.15 point.

The INDIA VIX decreased from 13.80 to 13.36. At the

same time, the PCR-OI of Nifty has decreased to 1.15

from 1.55.

Few of the liquid counters where we have seen high

cost of carry are LTTS, MPHASIS, BSOFT,

PERSISTENT and ATUL.

Historical Volatility

SCRIP HV

IDEA 73.36

IBULHSGFIN 70.19

RBLBANK 68.78

GNFC 59.73

HINDCOPPER 59.09

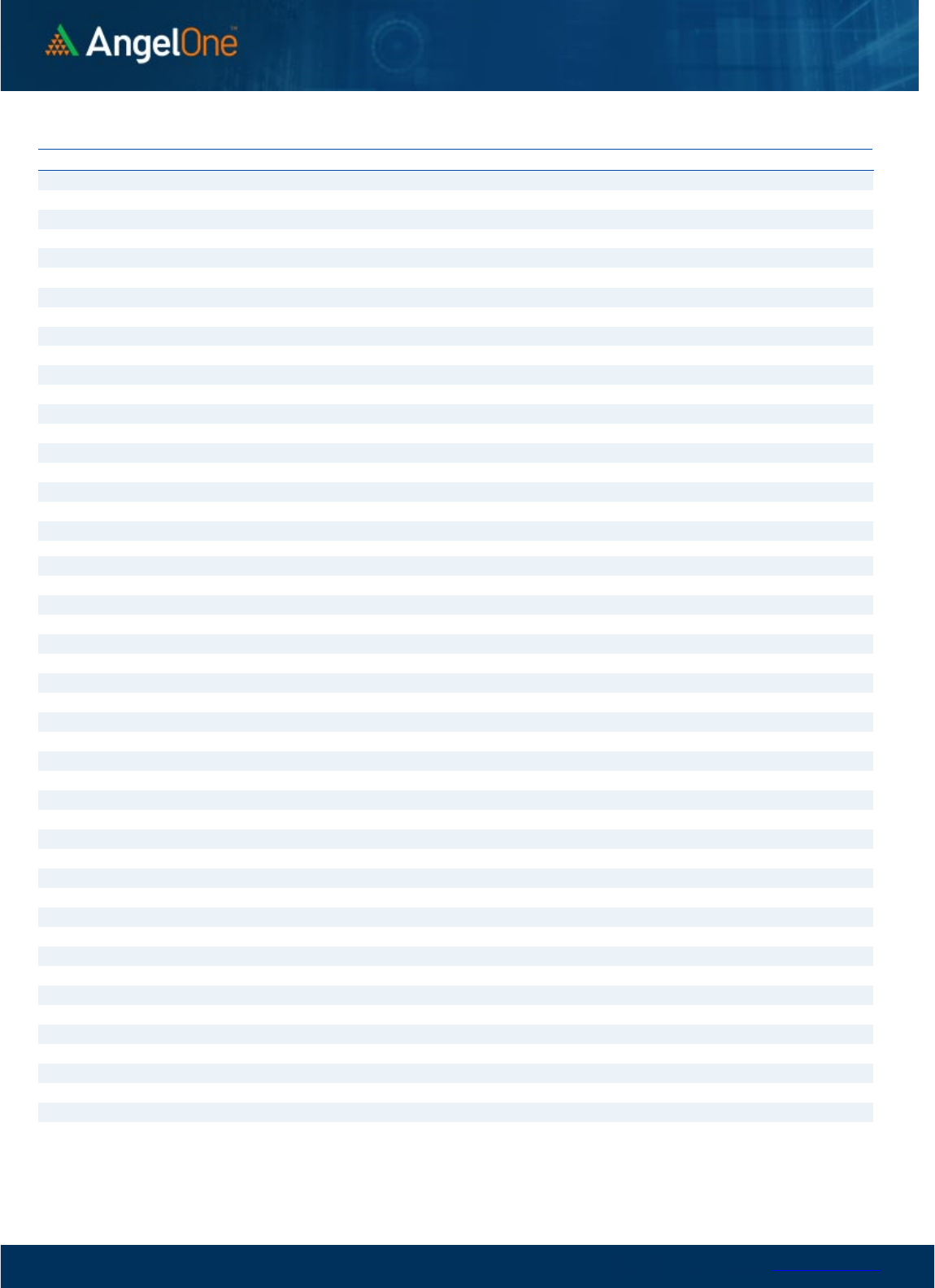

Nifty Vs OI

17800

18000

18200

18400

18600

18800

19000

8,000

9,000

10,000

11,000

12,000

13,000

14,000

15,000

16,000

11/14 11/16 11/18 11/23 11/25 11/29 12/1

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

OFSS 563600 17.22 3121.20 0.81

ASTRAL 1458600 15.83 1924.20 2.27

GUJGASLTD 5156250 12.67 508.30 1.54

RAIN 10192000 10.81 186.30 2.99

PERSISTENT 547400 10.02 4323.95 4.91

CUB 7685000 7.03 189.45 0.61

BAJAJFINSV 8614000 6.83 1638.80 0.78

HONAUT 33120 6.62 42019.60 1.12

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CUMMINSIND 1590000 -13.96 1437.85 1.31

BANDHANBNK 54068400 -12.51 235.50 -1.15

LICHSGFIN 9814000 -7.22 394.00 1.74

ULTRACEMCO 1857200 -6.57 7274.15 2.47

ICICIGI 4014125 -6.02 1224.65 1.04

APOLLOTYRE 16912000 -5.79 315.50 -0.19

RBLBANK 45070000 -5.38 153.30 0.00

TVSMOTOR 7578200 -5.18 1050.00 0.57

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.15 1.06

BANKNIFTY 0.81 0.95

RELIANCE 0.71 0.54

ICICIBANK 0.62 0.60

INFY 0.64 0.39

www.angelone.in

Technical & Derivatives Report

DEC 02, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Dec Series) are given as an information and not as a recommendation.

Nifty Spot =

1

8

812

.

50

FII Statistics for

December

01

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

2816.52 3342.61 (526.09) 193074 19037.54 (4.19)

INDEX

OPTIONS

2367750.73 2359661.90 8088.83

1382533 134344.36 (30.85)

STOCK

FUTURES

10649.38 9708.27 941.11

1962566 138823.96 (0.80)

STOCK

OPTIONS

8293.97 8547.30 (253.33) 111129 8091.38 6.94

Total 2389510.60

2381260.08

8250.52

3649302

300297.24

(14.80)

Turnover on

December

01

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

274805 2776888.46

3.03

Index

Options

309575145 4401875.09

16.94

Stock

Futures

800991 5515407.80

-3.45

Stock

Options

3027838 416913.86 13.82

Total

30,27,838 416913.86 4.57

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

18700 345.60

67.75

32.35

18767.75

Sell

18800 285.65

Buy

18700 345.60

132.80

67.20

18832.80

Sell

18900 227.05

Buy

18800 285.65

65.05 34.95 18865.05

Sell 18900 227.05

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 18700 175.70

25.50

74.50

18674.50

Sell

18600 145.55

Buy 18700 175.70

47.65

152.35

18652.35

Sell 18500 121.90

Buy

18600 145.55

22.15 77.85 18577.85

Sell 18500 121.90

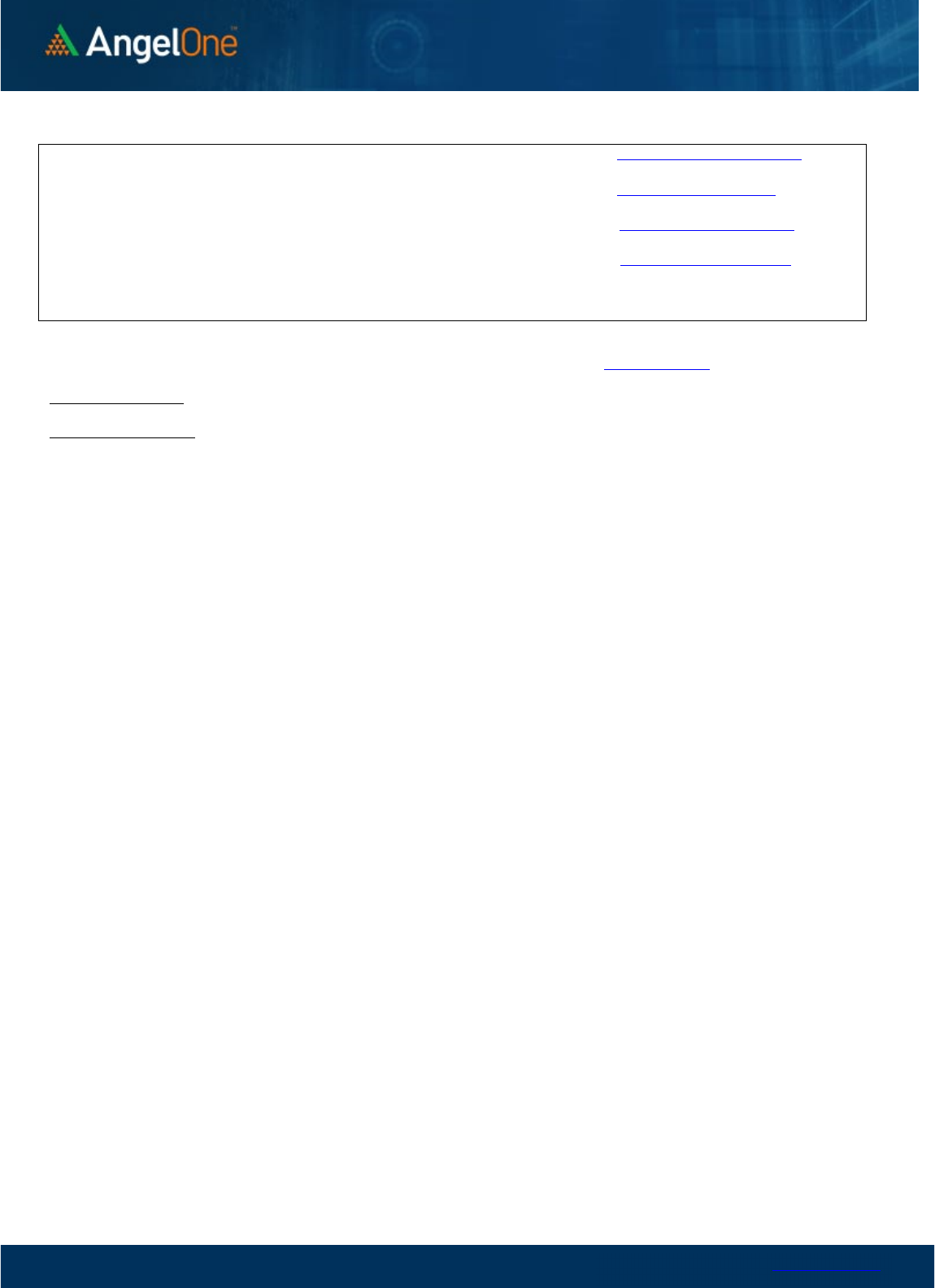

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

18100 18200 18300 18400 18500 18600 18700 18800 18900 19000 19100 19200 19300 19400

Call Put

www.angelone.in

Technical & Derivatives Report

DEC 02, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIENT 3,878 3,897

3,921

3,939

3,963

ADANIPORTS

875

883

890

897

904

APOLLOHOSP 4,664 4,720

4,757

4,813

4,850

ASIANPAINT

3,143

3,161

3,179

3,197

3,215

AXISBANK

894

899

904

909 914

BAJAJ-AUTO 3,532 3,620

3,682

3,770

3,832

BAJFINANCE

6,679

6,713

6,742

6,776

6,805

BAJAJFINSV 1,617 1,628

1,635

1,646

1,653

BPCL

333

336

340

343

347

BHARTIARTL

836

842

848

854

859

BRITANNIA 4,307 4,354

4,382 4,429

4,458

CIPLA

1,101

1,113

1,129

1,141

1,157

COALINDIA 222 224

227

229

233

DIVISLAB

3,372

3,390

3,408

3,426

3,444

DRREDDY 4,399 4,437

4,484

4,522 4,569

EICHERMOT 3,386 3,412

3,456 3,482

3,526

GRASIM

1,742

1,771

1,789

1,818

1,837

HCLTECH

1,116

1,126

1,138

1,149

1,161

HDFCBANK

1,602

1,611

1,624

1,633

1,646

HDFCLIFE

584

590

595

602

607

HDFC

2,666

2,684

2,706

2,723

2,745

HEROMOTOCO 2,803 2,838

2,861

2,895

2,918

HINDALCO

449

456

461 469

474

HINDUNILVR 2,628 2,645

2,664 2,682 2,700

ICICIBANK

924

932

944

953

965

INDUSINDBK 1,153 1,164

1,172 1,183

1,191

INFY

1,640

1,649

1,661 1,669

1,681

ITC

334

337

339

342

344

JSW STEEL

738

742

747

752

757

KOTAKBANK

1,907

1,921

1,941

1,955

1,975

LT

2,067

2,086

2,098 2,116

2,128

M&M 1,271 1,282

1,299

1,311

1,328

MARUTI 8,876 8,917

8,971

9,012

9,066

NESTLEIND

19,697

19,873

20,111

20,288

20,526

NTPC

169

171

172

174

175

ONGC 138 139

141

141 143

POWERGRID 218 220

222

224

227

RELIANCE

2,692

2,708

2,731

2,747

2,770

SBILIFE

1,266

1,279

1,288

1,301

1,310

SBIN

598

603

606

611

615

SUNPHARMA

1,030

1,038

1,048

1,056

1,066

TCS

3,399

3,437

3,459 3,497

3,519

TATACONSUM

803

808

815 820

827

TATAMOTORS

433

436

440

442

446

TATASTEEL

107

109

110

112

113

TECHM

1,079

1,090

1,099

1,110

1,119

TITAN

2,610

2,624

2,645

2,659

2,680

ULTRACEMCO

6,939

7,106

7,203

7,370

7,467

UPL 769 774

781 786

794

WIPRO

409

411

414 416 419

www.angelone.in

Technical & Derivatives Report

DEC 02, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.