SEP 02, 2022

www.angelone.in

Technical & Derivatives Report

xOOOOOOOO

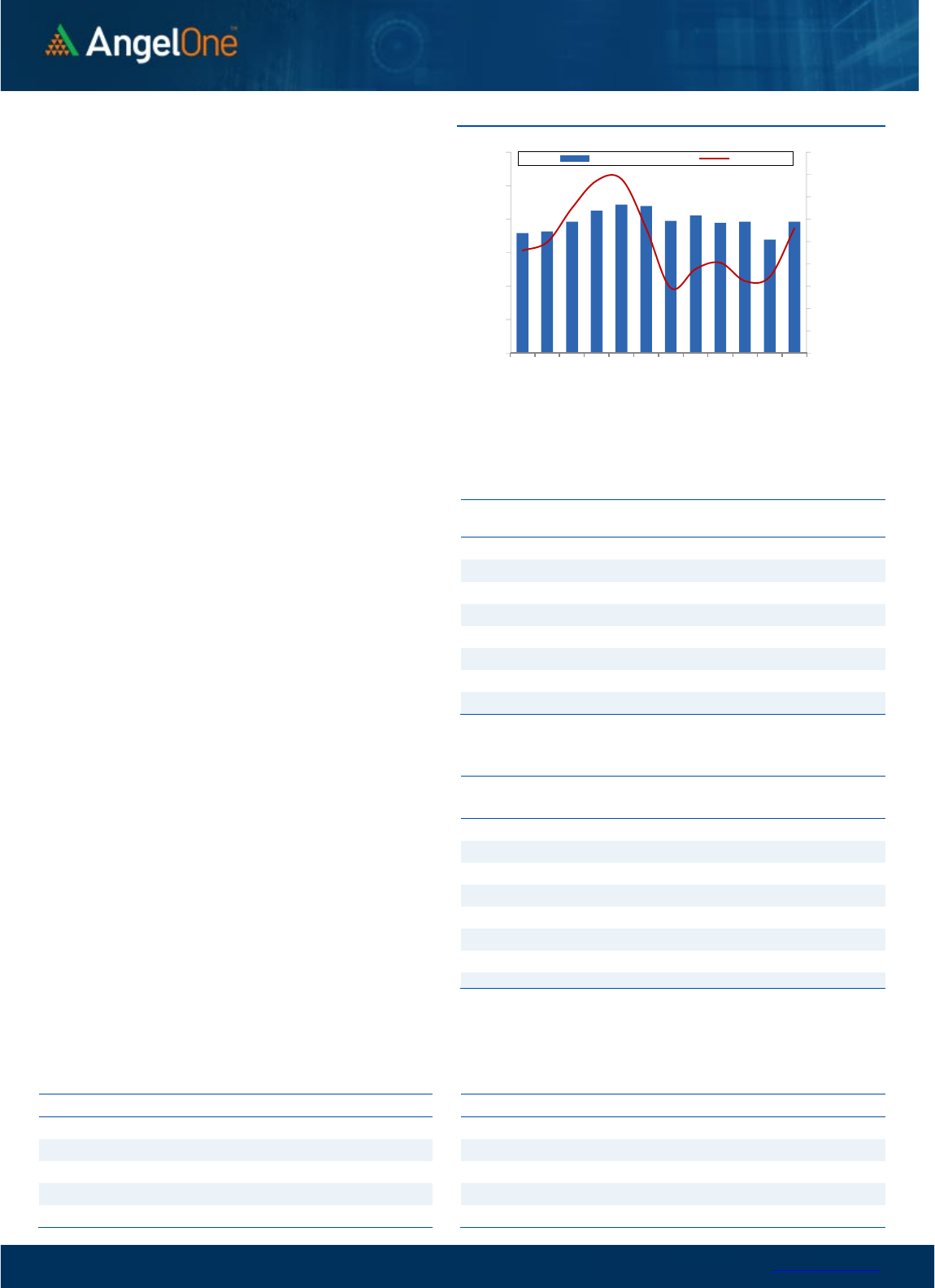

Nifty Bank Outlook (39301)

After a mid-week break, the BANKNIFTY started with a massive gap

down in tandem with benchmark. However, we saw almost complete

recovery in the initial hour, catching most of the complacent bears in

the wrong foot. Since it was an expiry session, market was not done

with it’s swings as we witnessed yet another bout of selling to

eventually conclude the session with more than half a percent cut.

We saw complete roller coaster move in key indices and in the midst

of all this, the BANKNIFTY appeared slightly stronger. Going ahead, we

continue to see a decent demand zone around 39000-38800; whereas

on the flipside, a cluster of resistances are visible at 39600-39800-

40000. Traders are advised to take a directional call only outside this

range; until then exiting as close as resistance levels and vice versa

should the apt strategy.

Key Levels

Support 1 – 39000 Resistance 1 – 39600

Support 2 – 38800 Resistance 2 – 39800

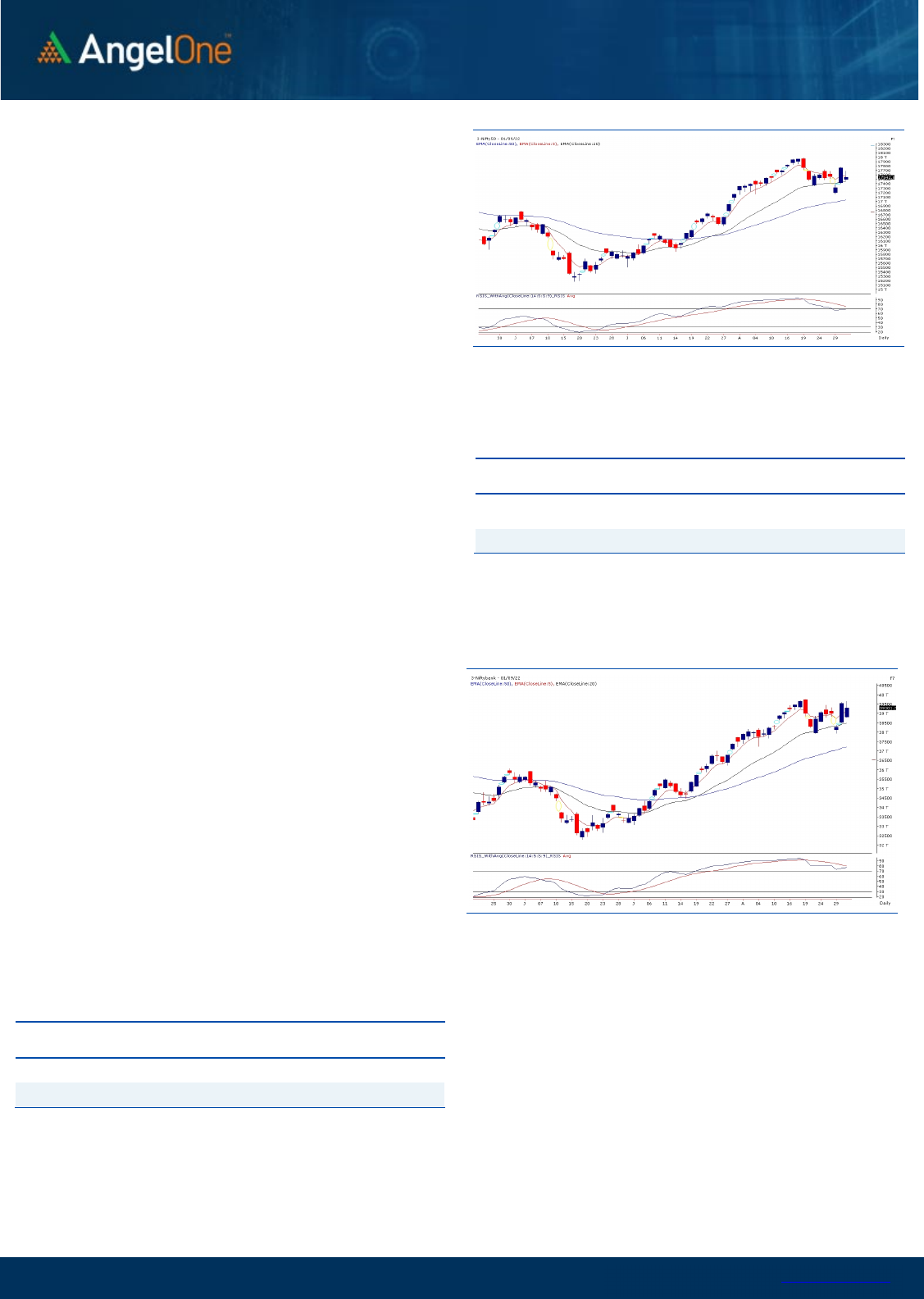

Exhibit 1: Nifty

Daily

Chart

Exhibit 2: Nifty Bank

Daily

Chart

Sensex (58767) / Nifty (17543)

The weakness in the global bourses led to a weak start of our equity

market, wherein the benchmark index initiated the day with a gap

down. However, our market retaliated soon after the opening bell and

gradually gauged momentum to march upwards. Though a

tentativeness at the higher level was sensed among participants, that

triggered a sell-off in the second half. And with the whipsaw

movements in the market, the benchmark index Nifty50 concluded the

day in red with a cut of 1.22 percent, a tad above the 17500 zone.

On the technical perspective, the crucial support of the 17500 was

firmly safeguarded, implying the resilience of the technical support.

Though some tentativeness was seen in our domestic market during

the weekly expiry session, but any sign of respite from the global

bourses could trigger strong momentum from hereon. In terms of

technical levels, any breach below the mentioned support could drag

the market towards the 17350 zone, which is likely to be seen as the

sheet anchor. At the same time, on the higher end, the 17700-17750

could be seen as immediate resistance, followed by the 17850-17900

zone.

We would advocate avoiding aggressive overnight bets for the time

being and keeping a close tab on global developments. Meanwhile,

identifying the thematic movers should be the key to better trading

opportunities in the current market condition.

Key Levels

Support 1 – 17500 Resistance 1 – 17700

Support 2 – 17350 Resistance 2 – 17750

www.angelone.in

Technical & Derivatives Report

SEP 02, 2022

View

We started the proceeding with a downside gap

amidst selling seen in the global market. During the

day, index recovered a bit but bears were not ready

to give up hence we concluded the day with the cut

of more than a percent.

FIIs were net sellers in the cash market segment to

the tune of Rs. 2290 crores. Simultaneously, in Index

futures, they sold worth Rs. 4189 crores with a

increase in open interest, indicating short formation.

Yesterday, we observed fresh short formation in Nifty,

whereas long unwinding took place in banking index.

Stronger hands too turned net seller not only in

equities but also in index and stock futures segment.

We observed huge pile up of positions in 17550-17650

call strikes, which we believe are shorts. On the

contrary, put writer covered their shorts in ATM as

well as OTM strikes, which is certainly not an

encouraging sign for market. At present, we could

advocate trader’s too stay light and prefer trading

outside index.

Comments

The Nifty futures open interest has increased by

8.49%. and Bank Nifty futures open interest has

decreased by 11.16% as the market closed at 17542.80.

The Nifty Sep future closed with a premium of 49.60

point against a premium of 68.2 point in the last

trading session. The Oct series closed at a premium

of 95.85 point.

The INDIA VIX increased from 18.70 to 19.87. At the

same time, the PCR-OI of Nifty has decreased from

1.37 to 1.03.

Few of the liquid counters where we have seen high

cost of carry are IDEA, PEL, METROPOLIS, L&TFH,

AND FSL

Historical Volatility

SCRIP HV

GMRINFRA 50.23

ASHOKLEY 48.32

SRF 44.83

ABB 41.57

TATACOMM 46.05

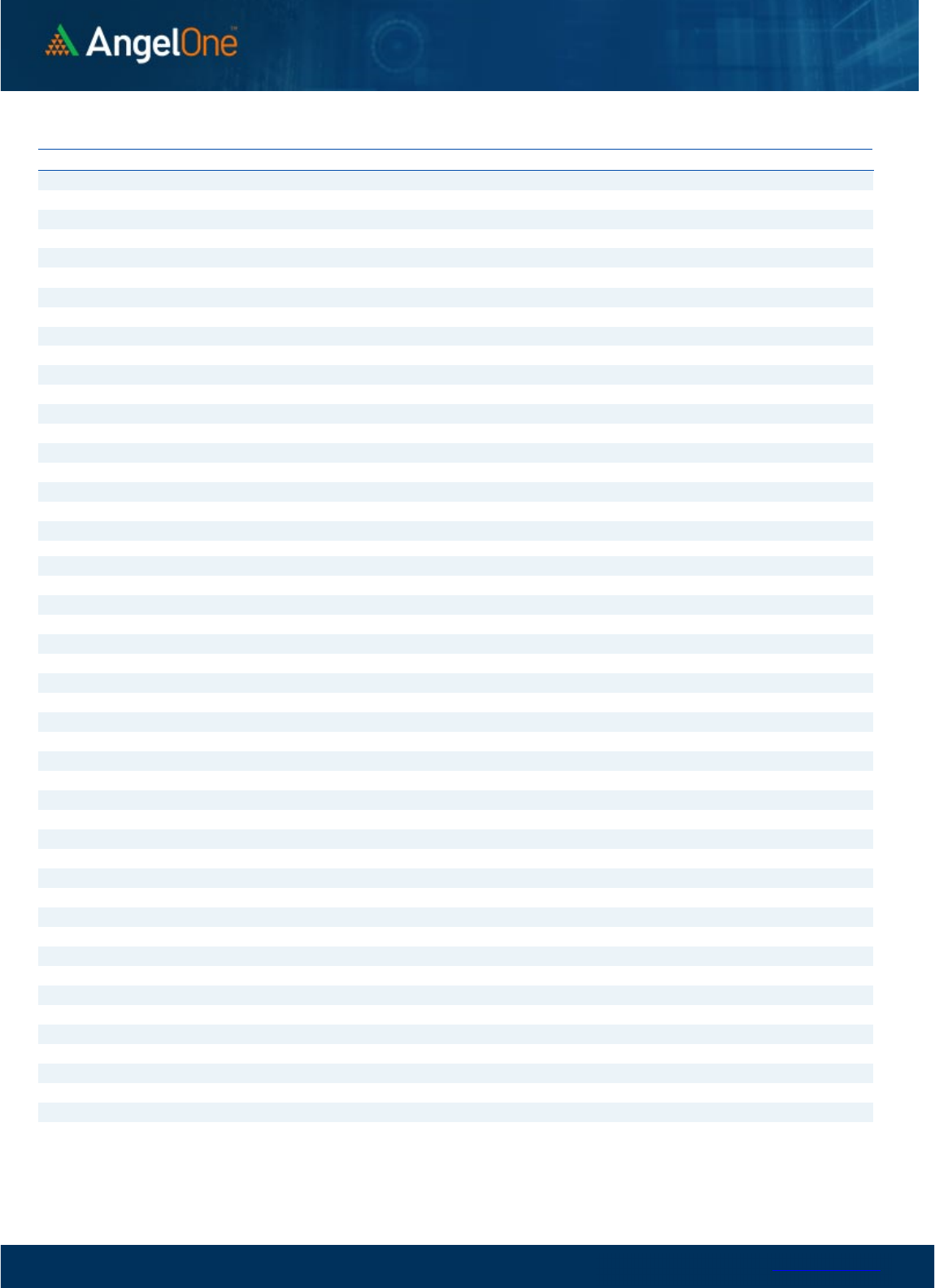

Nifty Vs OI

17200

17300

17400

17500

17600

17700

17800

17900

18000

18100

6,000

8,000

10,000

12,000

14,000

16,000

18,000

8/11 8/16 8/18 8/22 8/24 8/30

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BAJAJFINSV 838550 14.92 17406.25 2.31

RELIANCE 36406000 13.49 2560.40 -2.83

ASHOKLEY 53845000 12.80 162.75 5.45

HINDALCO 25389350 10.83 421.95 -3.82

VOLTAS 3805500 10.14 979.95 -1.91

PERSISTENT 518850 9.53 3400.00 -3.40

NATIONALUM 59840000 8.90 77.70 -3.52

SBILIFE 6177000 8.54 1296.55 -2.09

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GUJGASLTD 4421250 -14.87 478.05 1.94

ESCORTS 1595550 -10.55 2020.75 1.89

COROMANDEL 1157100 -9.97 1081.65 2.59

GSPL 3397500 -6.60 240.00 -0.31

RBLBANK 52535000 -5.78 122.15 -0.32

BEL 22986200 -4.98 319.80 3.87

POLYCAB 841200 -4.46 2483.45 0.26

SUNTV 10398000 -4.45 501.55 -0.01

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 1.03 0.97

BANKNIFTY 1.04 0.96

RELIANCE 0.51 0.53

ICICIBANK 0.67 0.55

INFY 0.40 0.40

www.angelone.in

Technical & Derivatives Report

SEP 02, 2022

Note: Above mentioned Bullish or Bearish Spreads in Nifty (Sep Series) are given as an information and not as a recommendation.

Nifty Spot =

17,

542.80

FII Statistics for

September

01

, 2022

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

4420.13 8609.39 (4189.26) 133037 12117.26 34.07

INDEX

OPTIONS

2290909.15 2280718.06 10191.09

862975 77398.75

(43.94)

STOCK

FUTURES

13370.13 16832.81 (3462.68) 2087852 145898.62 1.07

STOCK

OPTIONS

8002.46 8114.17 (111.71) 92801 6553.24 10.84

Total 2316701.87

2314274.43

2427.44

3176665

241967.87

(16.14)

Turnover on

September

01

, 2022

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index

Futures

580916 53703.80 26.01

Index Options

329041952

31079021.33 116.25

Stock

Futures

903792 66121.71 6.62

Stock

Options

2555988 198486.07 -9.04

Total

2,555,988

198486.07 113.67

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17600 329.20

50.55

49.45

17650.55

Sell

17700 278.65

Buy

17600 329.20

96.50

103.50

17696.50

Sell

17800 232.70

Buy

17700 278.65

45.95 54.05 17745.95

Sell 17800 232.70

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 7500 306.55

38.40

61.60

7461.60

Sell

7400 268.15

Buy 7500 306.55

73.40

126.60

7426.60

Sell 7300 233.15

Buy

7400 268.15

35.00 65.00 7365.00

Sell 7300 233.15

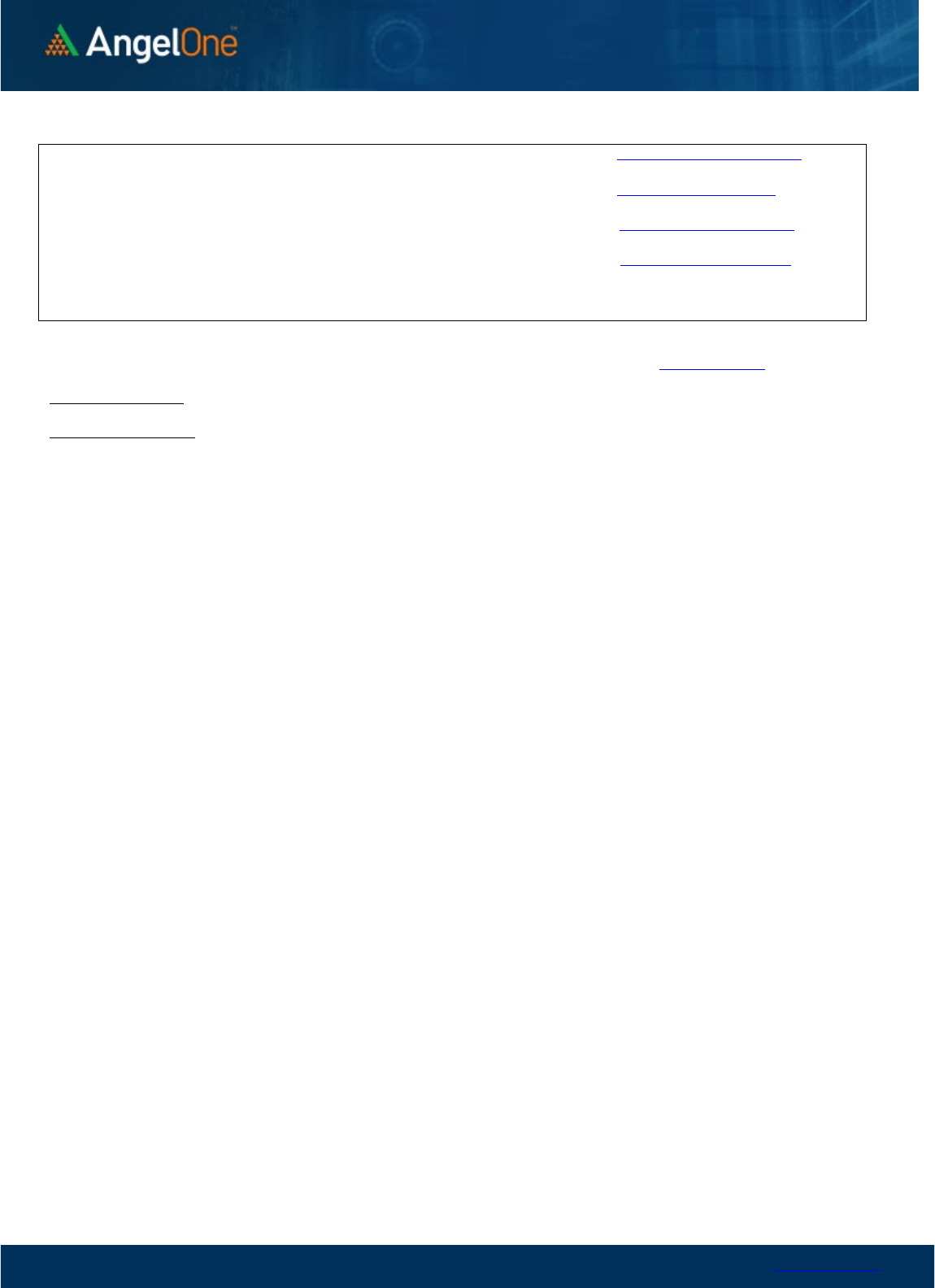

Nifty Put

-

Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

16900 17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200

Call Put

www.angelone.in

Technical & Derivatives Report

SEP 02, 2022

`

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1 R2

ADANIPORTS

823

831

839

846

854

APOLLOHOSP

4,198

4,238

4,283 4,323

4,368

ASIANPAINT 3,253 3,350

3,412

3,509

3,571

AXISBANK 723 733

744

755

766

BAJAJ-AUTO

3,951

4,014

4,073

4,135

4,194

BAJFINANCE

7,027

7,104

7,219

7,296

7,411

BAJAJFINSV 16,417 16,912

17,299

17,794

18,182

BPCL

321

326

330

335

338

BHARTIARTL

716

726

736

745

755

BRITANNIA

3,639

3,678

3,712

3,752

3,785

CIPLA

1,004

1,014

1,029

1,038

1,054

COALINDIA

225

228

232

235

239

DIVISLAB 3,554 3,576

3,600

3,623

3,647

DRREDDY

4,175

4,189

4,211

4,224

4,246

EICHERMOT

3,169

3,290

3,363

3,484 3,556

GRASIM

1,638

1,661

1,684

1,708

1,730

HCLTECH

910

918

924

933

939

HDFCBANK

1,443

1,458

1,474

1,488

1,504

HDFCLIFE

563

569

575

581

587

HDFC

2,369

2,386

2,412

2,429

2,455

HEROMOTOCO

2,761

2,819

2,851

2,908 2,940

HINDALCO 414 418

425

429

436

HINDUNILVR 2,557 2,582

2,618

2,643

2,679

ICICIBANK

852

863

874

886

897

INDUSINDBK

1,083

1,097

1,109 1,123

1,135

INFY

1,444

1,454

1,461

1,471

1,478

ITC

313

315

319

321

324

JSW STEEL

645

653

662

670

678

KOTAKBANK 1,851 1,877

1,901 1,927

1,952

LT

1,873

1,893

1,912 1,932

1,950

M&M

1,260

1,286

1,306

1,332

1,352

MARUTI 8,774 8,899

9,066

9,192

9,359

NESTLEIND 19,310 19,522

19,786

19,997

20,261

NTPC 158 159

162

163

166

ONGC

133

134

135

136

137

POWERGRID 222 224

227

229

232

RELIANCE

2,518

2,539

2,572

2,593

2,626

SBILIFE

1,278

1,287

1,300

1,309

1,322

SHREECEM 21,221 21,404

21,727

21,910 22,233

SBIN 514 523

532

542 551

SUNPHARMA

850

861

881 892

913

TCS

3,079

3,105

3,148

3,174

3,217

TATACONSUM

793 816

829

852

865

TATAMOTORS

456

461

468

473

480

TATASTEEL 105 106

107

107

109

TECHM

1,032

1,042

1,054

1,064

1,076

TITAN 2,530 2,576

2,612

2,658

2,693

ULTRACEMCO 6,511 6,572

6,666

6,727

6,821

UPL

743

750

758

765

773

WIPRO

402

406

409

413 416

www.angelone.in

Technical & Derivatives Report

SEP 02, 2022

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of

the subject company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or

its associates nor Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period

preceding twelve months from the date of this report for services in respect of managing or co-managing public offerings, corporate

finance, investment banking or merchant banking, brokerage services or other advisory service in a merger or specific transaction

in the normal course of business. Angel or its associates did not receive any compensation or other benefits from the companies

mentioned in the report or third party in connection with the research report. Neither Angel nor its research analyst entity has been

engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible

for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel One

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make

any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel

One Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest

in the subject company. Research analyst has not served as an officer, director or employee of the subject company.