March 02, 2023

www.angelone.in

Technical & Derivatives Report

Nifty Bank

Outlook (

40

698

)

Bank Nifty started on a positive note and post an initial dip the

positive momentum continued throughout the session. The bank

index added another percent of gains to eventually end a tad

below 40700.

The bank index continues to outperform and yesterday it was the

charioteer to pull broader markets higher. Even though the Index

specific move post the gap up opening was not that significant but

the stock-specific move within the basket was very encouraging for

the traders. Going ahead, considering the chart structure of major

heavyweight counters we expect this up move to continue where

the next key level to watch out for would be in the zone of 41000 -

41300 that coincides with a descending trend line and 89EMA

resistance. Once these levels are taken out comfortably then one

can technically say that the recent tide of bearishness turns in favor

of bulls. On the flip side, on the weekly expiry day, traders are

advised to use dips as a buying opportunity where 40500 should be

considered as immediate support followed by 40300.

Key Levels

Support 1 – 40500 Resistance 1 – 41000

Support 2 – 40300 Resistance 2 – 41300

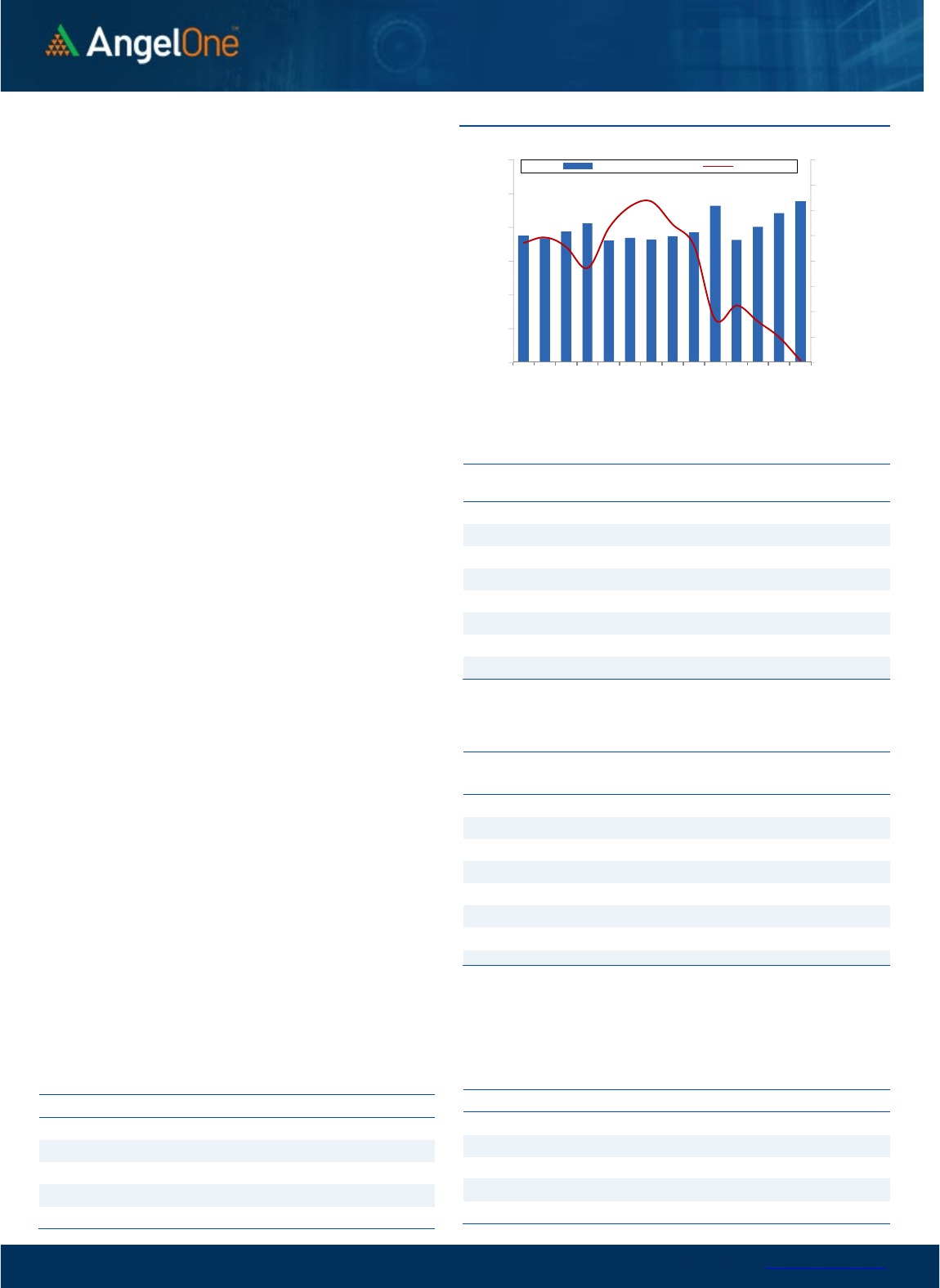

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

5

9411

) / Nifty (

1

7

451

)

The Indian equity market snapped its selling spree and made a

modest recovery in yesterday’s session. The benchmark index

kickstarted the session on a positive note and stayed on the upward

trajectory throughout the day. The bulls showed their presence post

the strong correction of eight consecutive sessions and levitated

market sentiments. The Nifty concluded near the day’s high,

procuring nearly nine-tenth of a percent, and settled around the

17450 level.

As we allude to our previous commentary of not being carried away

with the sell-off, it aligns precisely with the market move. Also, the

buying emergence in the beaten-down counter could be seen as a

constructive development in the market. On the technical front, the

200 SMA has shown its significance as Nifty kept hovering near the

same. As far as levels are concerned, 17350-17300 is likely to

cushion any short-term blip, while the swing low of the 17250 odd

zone is expected to act as a sheet anchor for Nifty. While on the

higher end, an authoritative breach beyond 17600 could trigger the

next leg of rally in the comparable period.

Going forward, many stock-specific adjustments are likely to

continue and provide substantial trading opportunities.

And even though the indices may not be doing much, the

individual stocks are not at all short of action. Hence one should

continue to identify such potential movers and trade accordingly

and stay abreast with global and domestic developments on a

regular basis.

Key Levels

Support 1 – 17350 Resistance 1 – 17500

Support 2 – 17300 Resistance 2 – 17640

www.angelone.in

Technical & Derivatives Report

March 02, 2023

View

On Wednesday, market had a positive start and

buying interest accelerated right from the word go.

Index maintained its posture for the entire day and

concluded the day in green at 17450.

FIIs were net sellers in the cash market segment to

the tune of Rs. 425 crores. Simultaneously, in Index

futures, they buyers worth Rs. 638 crores with some

rise in open interest, indicating long formation.

Yesterday, we witnessed blend of short covering and

long formation in both the key indices. Stronger

hands continue selling streak in equities but added

longs in index futures segment. Their index futures

Long Short Ratio stands at 18% from 15%. Put writers

shifted to 17400, which is an encouraging sign for

Bulls. On the other side, call writers of 17300 and

17400 strikes ran for shelter seeing smart recovery.

For now, base formation is seen around 17200 –

17300 odd zone and on the upside 17600 will be the

important level to watch out.

Comments

The Nifty futures open interest has decreased by 1.71%

and Bank Nifty futures open interest has increased by

0.97% as the market closed at 17450.90.

The Nifty March future closed with a premium of 81.8

point against a premium of 99.45 point in the last

trading session. The April series closed at a premium of

183.15 point.

The INDIA VIX decreased from 14.02 to 12.99. At the

same time, the PCR-OI of Nifty has decreased from 0.67

to 0.92.

Few of the liquid counters where we have seen high

cost of carry are COALINDIA, AARTIIND, CUB,

RAMCOCEM and CANBK.

Historical Volatility

SCRIP HV

RAIN 53.13

ADANIENT 92.72

NATIONALUM 50.47

ABCAPITAL 43.42

FEDERALBNK 39.66

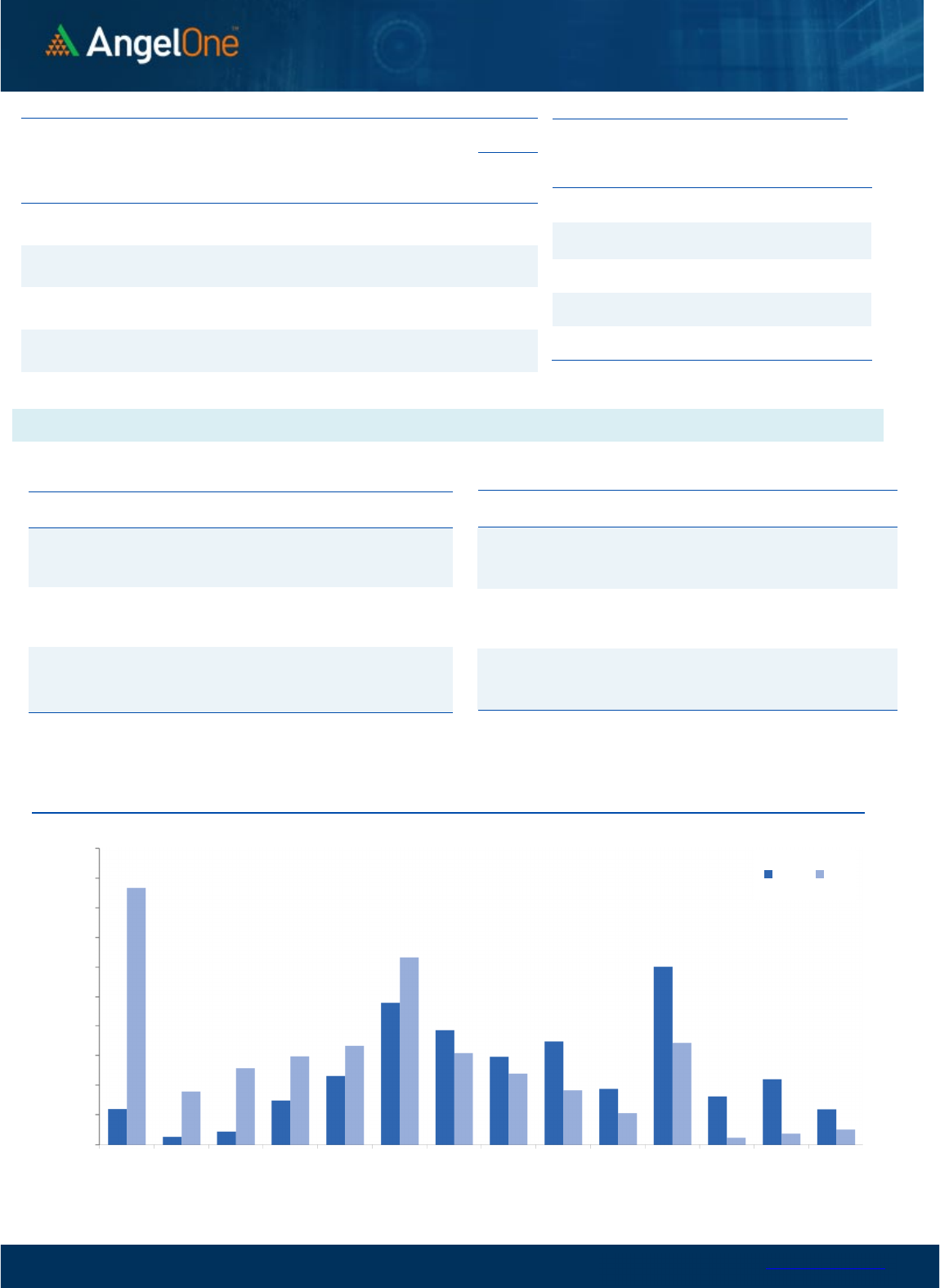

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/8 2/10 2/14 2/16 2/20 2/23 2/27

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

POLYCAB 1081800 23.03 3116.00 1.06

MFSL 3303300 18.10 699.60 0.98

INDIAMART 331950 18.09 4951.25 3.45

GUJGASLTD 4398750 14.70 511.20 1.30

ADANIENT 14522250 12.60 1564.30 14.34

RAIN 11840500 11.95 166.30 8.45

TATASTEEL 205903500 9.17 105.50 1.53

PEL 6842550 6.58 778.50 1.22

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

DIXON 746875 -16.63 2929.85 1.00

DELTACORP 16492000 -9.16 196.10 4.46

GNFC 8087300 -8.93 541.60 3.19

BAJAJ-AUTO 1169500 -7.62 3731.40 1.71

SHRIRAMFIN 4155000 -5.49 1221.65 1.09

BANKBARODA 103065300 -5.20 164.40 3.96

NESTLEIND 254080 -4.65 18779.00 0.55

AXISBANK 47521200 -4.10 865.15 2.23

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.92 0.91

BANKNIFTY 1.14 0.90

RELIANCE 0.61 0.43

ICICIBANK 0.72 0.58

INFY 0.54 0.42

www.angelone.in

Technical & Derivatives Report

March 02, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

450.9

0900

Lot Size = 75

FII Statistics for

March 01

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3129.60

2491.17

638.43

197164

17899.01

4.23

INDEX

OPTIONS

1089344.21

1086990.69

2353.52

2739518

251879.64

4.39

STOCK

FUTURES

9547.20

8571.43

975.77

2173518

143046.71

(0.02)

STOCK

OPTIONS

7235.01

7481.02

(246.01) 105693

6924.14

4.93

Total 1109256.02

1105534.31

3721.71

5215893

419749.50

2.51

Turnover

on

March

01

, 202

3

Instrumen

t

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

275107

26044.88 -12.09

Index Options

1719926

73

44116.02 -16.33

Stock Futures

742676

46510.70 -12.45

Stock Options

2524288

3596.65 -7.78

Total

2,524,28

8

3596.65 -13.71

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17500 231.15

52.80

47.20

17552.80

Sell

17600 178.35

Buy

17500 231.15

97.95

102.05

17597.95

Sell

17700 133.20

Buy

17600 178.35

45.15 54.85 17645.15

Sell

17700 133.20

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17400 163.00

32.55

67.45

17367.45

Sell 17300 130.45

Buy 17400 163.00

58.45

141.55

17341.55

Sell

17200 104.55

Buy

17300 130.45

25.90 74.10 17274.10

Sell 17200 104.55

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

March 02, 2023

`

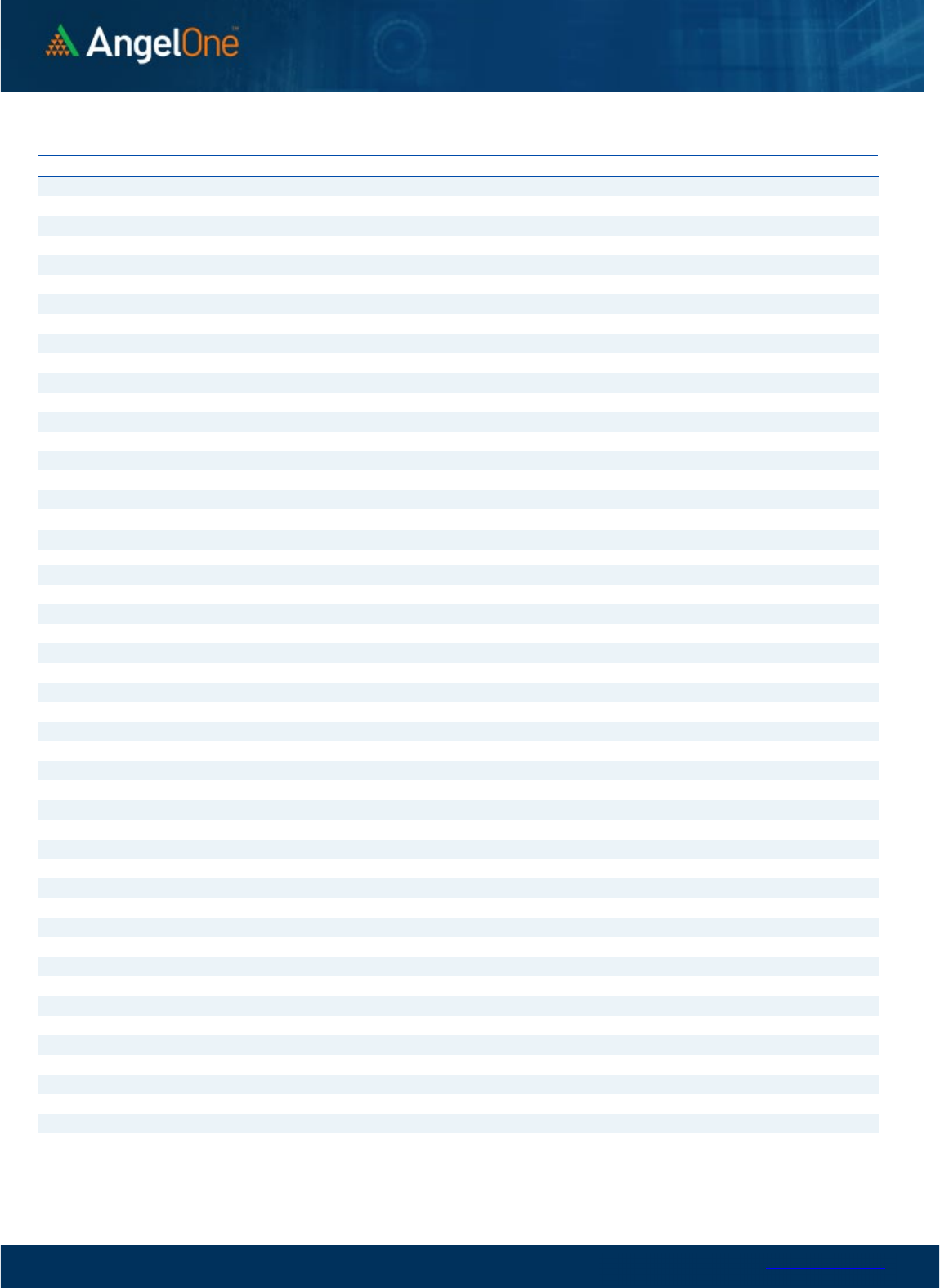

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT

1,349

1,457

1,518

1,626

1,687

ADANIPORTS 583 592

604

614

626

APOLLOHOSP

4,290

4,352

4,399

4,461

4,508

ASIANPAINT

2,800

2,820

2,837

2,857

2,874

AXISBANK 836 851

860

874

883

BAJAJ-AUTO

3,594

3,663

3,706

3,774

3,817

BAJFINANCE

6,049

6,102

6,153

6,206

6,257

BAJAJFINSV

1,321

1,333

1,346

1,358

1,371

BPCL 312 314

317

319

323

BHARTIARTL 736 743

748

755

761

BRITANNIA

4,297

4,338

4,397

4,438

4,496

CIPLA 888 894

902

908

916

COALINDIA 213 216

217

220

222

DIVISLAB

2,808

2,827

2,842

2,861

2,876

DRREDDY

4,273

4,308

4,333

4,369

4,393

EICHERMOT

3,066

3,102

3,123

3,160

3,180

GRASIM

1,557

1,575

1,587

1,605

1,617

HCLTECH

1,068

1,084

1,094

1,111

1,121

HDFCBANK

1,585

1,592

1,602

1,609

1,620

HDFCLIFE

482

486

488

492

495

HDFC

2,597

2,608

2,618

2,628

2,638

HEROMOTOCO

2,400

2,416

2,430

2,445

2,459

HINDALCO 397 405

410

418

423

HINDUNILVR

2,439

2,453

2,461

2,475

2,483

ICICIBANK 845 851

857

863

870

INDUSINDBK

1,056

1,078

1,092

1,115

1,129

INFY

1,473

1,485

1,493

1,504

1,512

ITC 371 375

378

382

384

JSW STEEL 664 670

675

681

685

KOTAKBANK

1,716

1,730

1,741

1,755

1,765

LT

2,085

2,100

2,115

2,130

2,145

M&M

1,246

1,259

1,282

1,295

1,319

MARUTI

8,564

8,664

8,720

8,820

8,876

NESTLEIND

18,480

18,629

18,725

18,874

18,970

NTPC 169 170

172

174

175

ONGC 151 153

154

156

157

POWERGRID 215 217

220

222

224

RELIANCE

2,315

2,330

2,338

2,352

2,360

SBILIFE

1,100

1,109

1,118

1,127

1,136

SBIN 518 527

532

542

547

SUNPHARMA 944 952

959

967

974

TCS

3,289

3,337

3,363

3,411

3,437

TATACONSUM

707 711

714

718

721

TATAMOTORS 419 422

425

429

432

TATASTEEL 103 104

106

107

108

TECHM

1,086

1,106

1,118

1,138

1,150

TITAN

2,352

2,367

2,382

2,397

2,411

ULTRACEMCO

7,155

7,215

7,279

7,339

7,403

UPL 688 700

707

720

727

WIPRO 386 388

390

393

394

www.angelone.in

Technical & Derivatives Report

March 02, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.