March 01, 2023

www.angelone.in

Technical & Derivatives Report

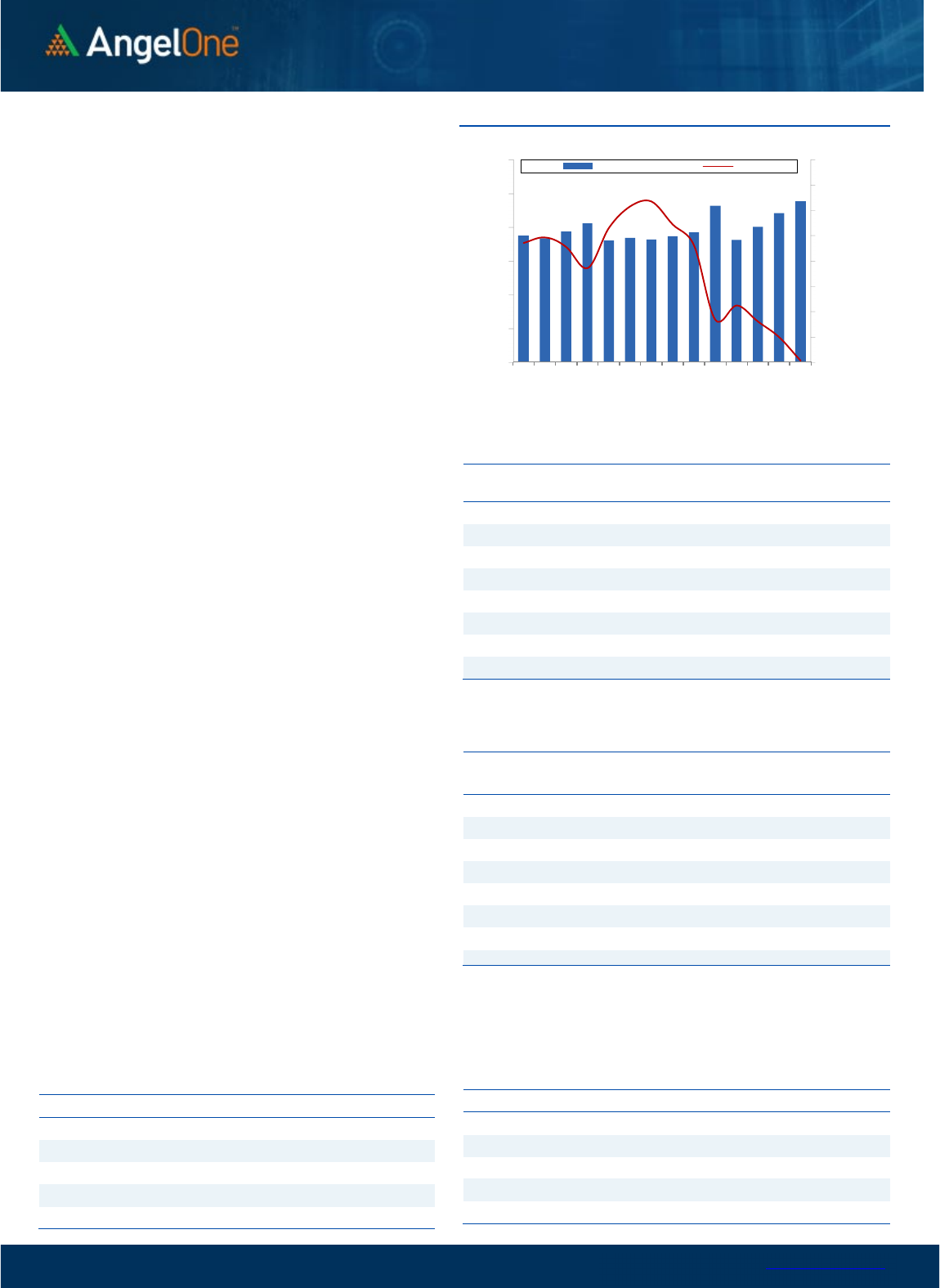

Nifty Bank

Outlook (

40

269

)

The banking index started the session on a flat note marginally in

the green. However, during the first half, previous day’s strong

performing space lacked follow up buying and hence, we saw some

tentativeness at higher levels. Although, it corrected slightly, there

was no damage to the bullishness it displayed on Monday. In fact,

towards the latter part of the day, we once again saw a good buying

emerging in some of the banking counters. Eventually, the

BANKNIFTY managed to recover fair bit of ground to conclude with

negligible loss. The BANKNIFTY maintains its firmness and unlike

Nifty, it has convincingly managed to defend its recent swing low

(on multiple occasions) of 39700 on a closing basis. Now, if overall

sentiments are to be improved in the market, the banking plays a

vital role here. A small aid from global peers can certainly provide

the much-needed impetus to this space and then we may see it

lifting Nifty higher from its multi-month lows. As far as levels are

concerned, 40000 – 39700 is likely to be seen as sacrosanct zone;

whereas on the flipside, a move beyond 40400 may result in

breaking the shackles to then march towards 40800 – 41000 levels.

Key Levels

Support 1 – 40000 Resistance 1 – 40400

Support 2 – 39700 Resistance 2 – 40800

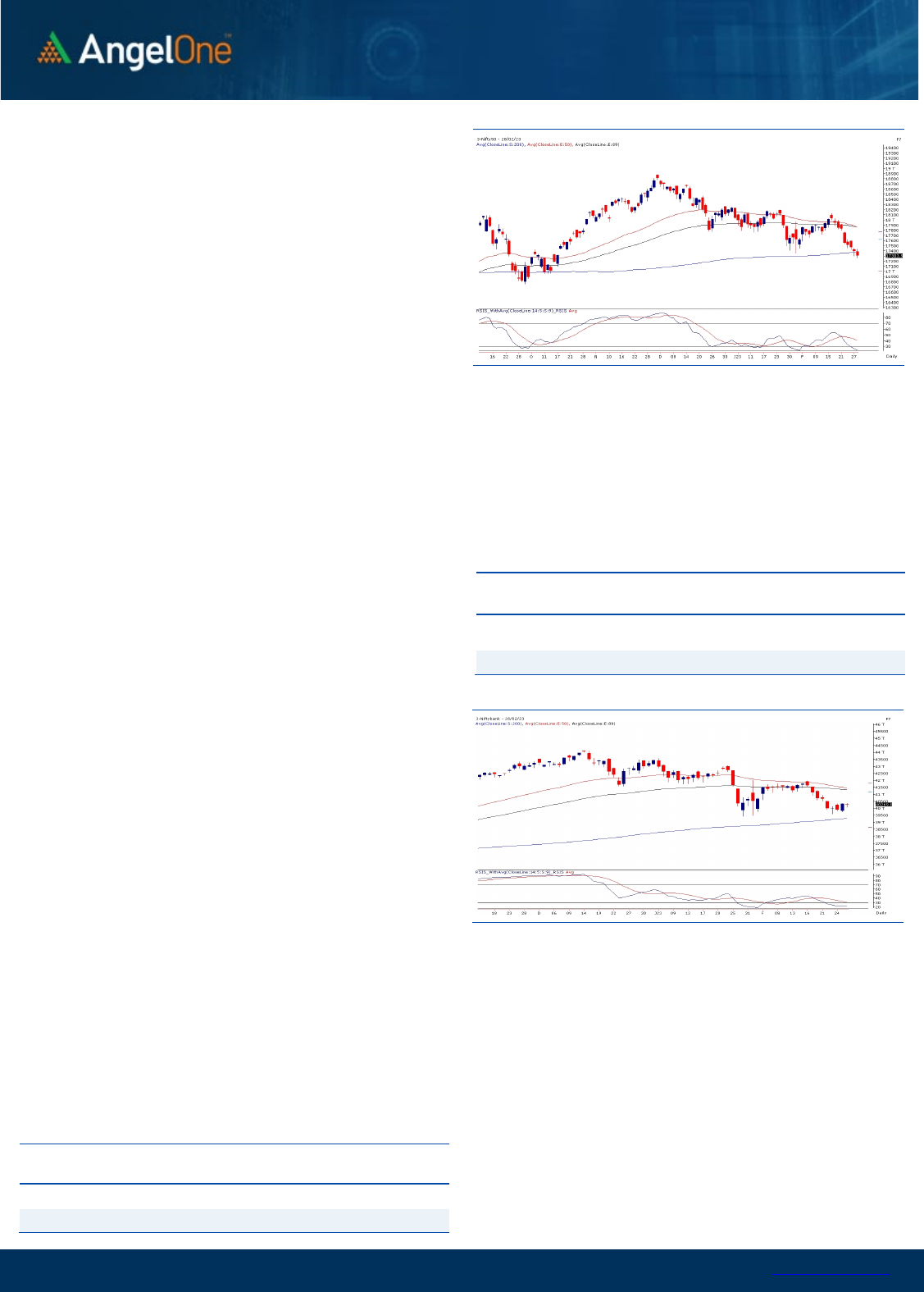

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (

5

8962

) / Nifty (

1

7

3

04

)

Our market started on a flat note tracking the positive global cues

and inched higher at the opening bell. But soon after, a sell-off got

triggered that gradually dragged the index below Monday’s low,

signifying the strength of the bears at higher grounds. With the

intense day of sell-off, Nifty continued the selling streak for the

eighth day in a row and settled a tad above the 17300 level with

another cut of 0.51 percent.

Technically speaking, the benchmark index kept flirting around the

200 SMA throughout the session but eventually settled tad below

the same. Price-wise it does not augur well for the bulls; but we are

still a bit skeptical and do not want to get carried away by the close.

The main reason behind this is a ‘Positive Divergence’ in the daily

‘RSI-Smoothened’ oscillator. When such condition takes place, we

may see deception in price breakdown. Also, the banking space is

showing some resilience and till the time, banking does not give up,

the hope of recovery remains intact. Hence, we advise traders avoid

shorting and let us see whether follow through selling happens or

not. As far as levels are concerned, 17200 is to be seen as immediate

support; whereas on the flipside, 17400 followed by 17500 is the

crucial hurdle for the benchmark index.

As we advance, one needs to keep close track of the

heavyweight’s performance as they have contributed to the sell-

off. Besides this, global development should also be tracked

closely, and in the meantime, we would advocate traders to

avoid aggressive bets and focus on stock-specific actions.

Simultaneously, Investors can start picking good-quality

propositions in a staggered manner from a short to medium-

term perspective.

Key Levels

Support 1 – 17200 Resistance 1 – 17400

Support 2 – 17100 Resistance 2 – 17500

www.angelone.in

Technical & Derivatives Report

March 01, 2023

View

On Tuesday, market had a flat start but as we

progressed market attracted selling to gradually drag

index lower towards 17250. In the final hour, some

recovery was seen to end the day tad above 17300.

FIIs were net sellers in the cash market segment to

the tune of Rs. 4559 crores. Simultaneously, in Index

futures, they sold worth Rs. 1358 crores with some

rise in open interest, indicating short formation.

Yesterday, we witnessed follow-up selling with was

supported by shorts in both the key indices. Stronger

hands continue selling streak not only in equities but

also in index futures segment. Their index futures

Long Short Ratio stands at 15% which clearly hints

they are oversold. In options front, we saw fresh

build-up in 17300-17600 call options and considering

the high implied volatility than the puts it clearly

suggest these are long positions. On the other side,

17300 put witnessed fresh writing. For coming

session, any sustainable recovery is the key

especially above 17400 odd zone. On the downside,

support has been shifted lower to 17000-17100.

Comments

The Nifty futures open interest has increased by 5.46%

and Bank Nifty futures open interest has increased by

6.60% as the market closed at 17303.95.

The Nifty March future closed with a premium of 99.45

point against a premium of 105.25 point in the last

trading session. The April series closed at a premium of

200.35 point.

The INDIA VIX increased from 13.87 to 14.02. At the

same time, the PCR-OI of Nifty has decreased from 0.72

to 0.67.

Few of the liquid counters where we have seen high

cost of carry are COALINDIA, AARTIIND, CUB,

RAMCOCEM and CANBK.

Historical Volatility

SCRIP HV

CIPLA 28.92

ADANIENT 91.14

VEDL 51.36

BERGEPAINT 30.03

ZEEL 54.12

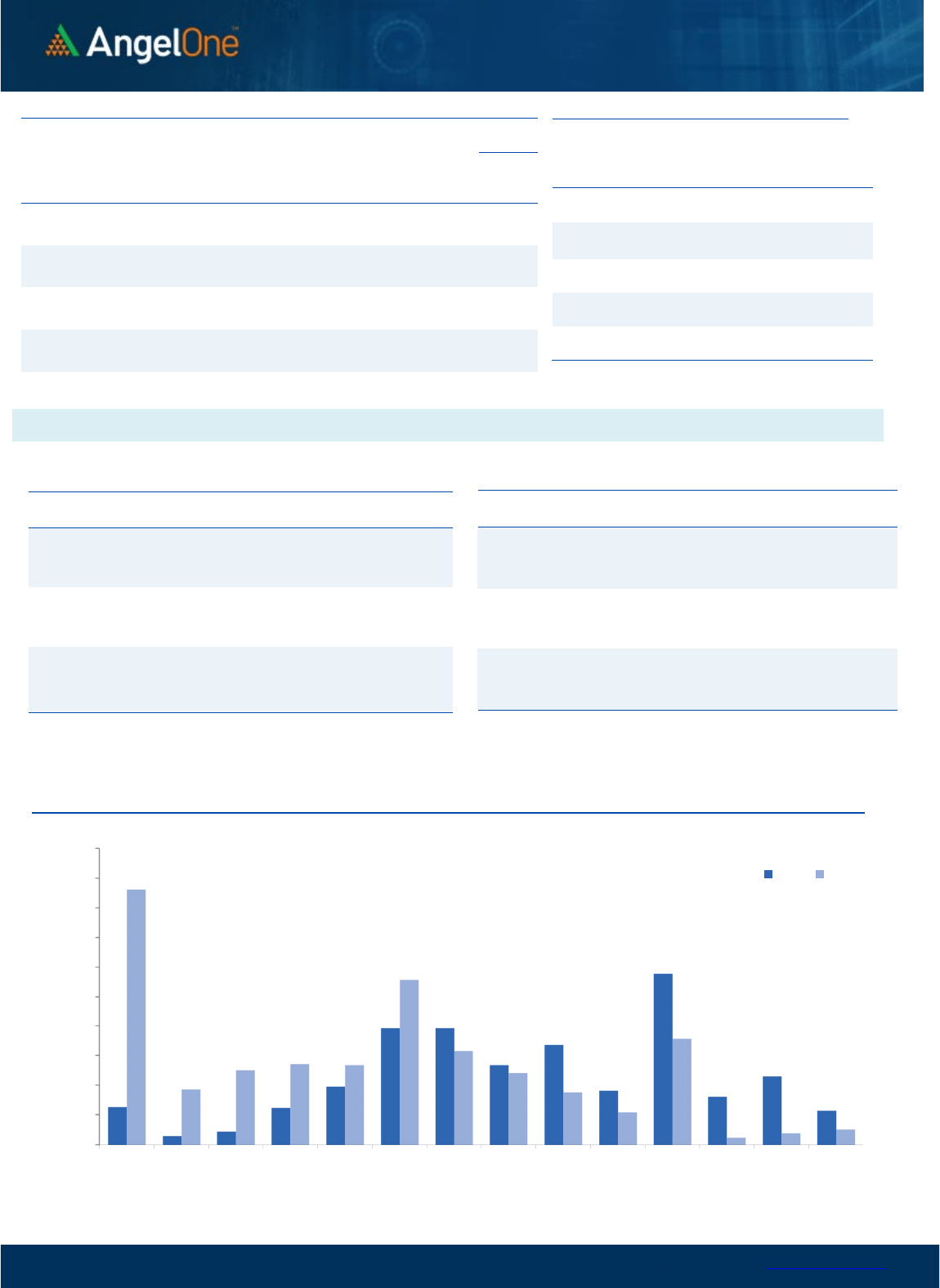

Nifty Vs OI

17400

17500

17600

17700

17800

17900

18000

18100

18200

4,000

6,000

8,000

10,000

12,000

14,000

16,000

2/8 2/10 2/14 2/16 2/20 2/23 2/27

Openinterest Nifty

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

CIPLA 11406850 22.07 906.40 -4.51

VEDL 39446000 20.29 268.35 -6.57

ESCORTS 1386550 12.54 2075.25 2.19

HCLTECH 14574000 10.03 1077.60 -0.41

POLYCAB 879300 9.45 3081.30 1.36

COALINDIA 42067200 9.23 215.40 -1.49

GUJGASLTD 3835000 8.91 504.90 0.29

LTIM 1268850 8.42 4722.10 -1.02

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

ADANIENT 12897000 -12.45 1363.85 14.47

POWERGRID 27704700 -11.79 222.25 1.39

CUB 12025000 -6.42 138.45 2.17

MCX 937200 -5.45 1402.65 1.67

ALKEM 456200 -4.64 3175.00 -2.98

RECLTD 42832000 -4.48 114.30 1.77

DELTACORP 18155200 -4.18 187.80 2.98

TATACOMM 2182500 -3.81 1208.55 1.80

Put-Call Ratio

SCRIP PCR (OI) PCR (VOL)

NIFTY 0.67 0.89

BANKNIFTY 0.86 1.01

RELIANCE 0.61 0.47

ICICIBANK 0.74 0.48

INFY 0.54 0.44

www.angelone.in

Technical & Derivatives Report

March 01, 2023

Note: Above mentioned Bullish or Bearish Spreads in Nifty (March Series) are given as an information and not as a recommendation.

Nifty Spot =

1

7

3

04

0900

Lot Size = 75

FII Statistics for

February

2

8

, 202

3

Detail Buy

Contracts

Open

Interest

Value

(in Cr.)

Sell

Net

CHANGE

INDEX

FUTURES

3401.83

4759.80

(1357.97) 189163

17025.40

5.95

INDEX

OPTIONS

1578263.91

1573817.98

4445.93

2624364

237561.44

4.91

STOCK

FUTURES

13185.65

12116.92

1068.73

2174044

141350.08

(0.34)

STOCK

OPTIONS

8185.01

8340.15

(155.14) 100725

6520.49

18.35

Total 1603036.40

1599034.85

4001.55

5088296

402457.41

2.86

Turnover

on

February

2

8

, 202

3

Instrumen

t

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

319992

29627.05 -15.96

Index Options

2667799

26

52727.61 -2.77

Stock Futures

885216

53125.89 20.70

Stock Options

2681953

3899.96 37.11

Total

2,681,95

3

3899.96 2.23

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy

17300 295.40

59.20

40.80

17359.20

Sell

17400 236.20

Buy

17300 295.40

111.90

88.10

17411.90

Sell

17500 183.50

Buy

17400 236.20

52.70 47.30 17452.70

Sell

17500 183.50

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy

17300 193.70

34.35

65.65

17265.65

Sell 17200 159.35

Buy 17300 193.70

65.10

134.90

17234.90

Sell

17100 128.60

Buy

17200 159.35

30.75 69.25 17169.25

Sell 17100 128.60

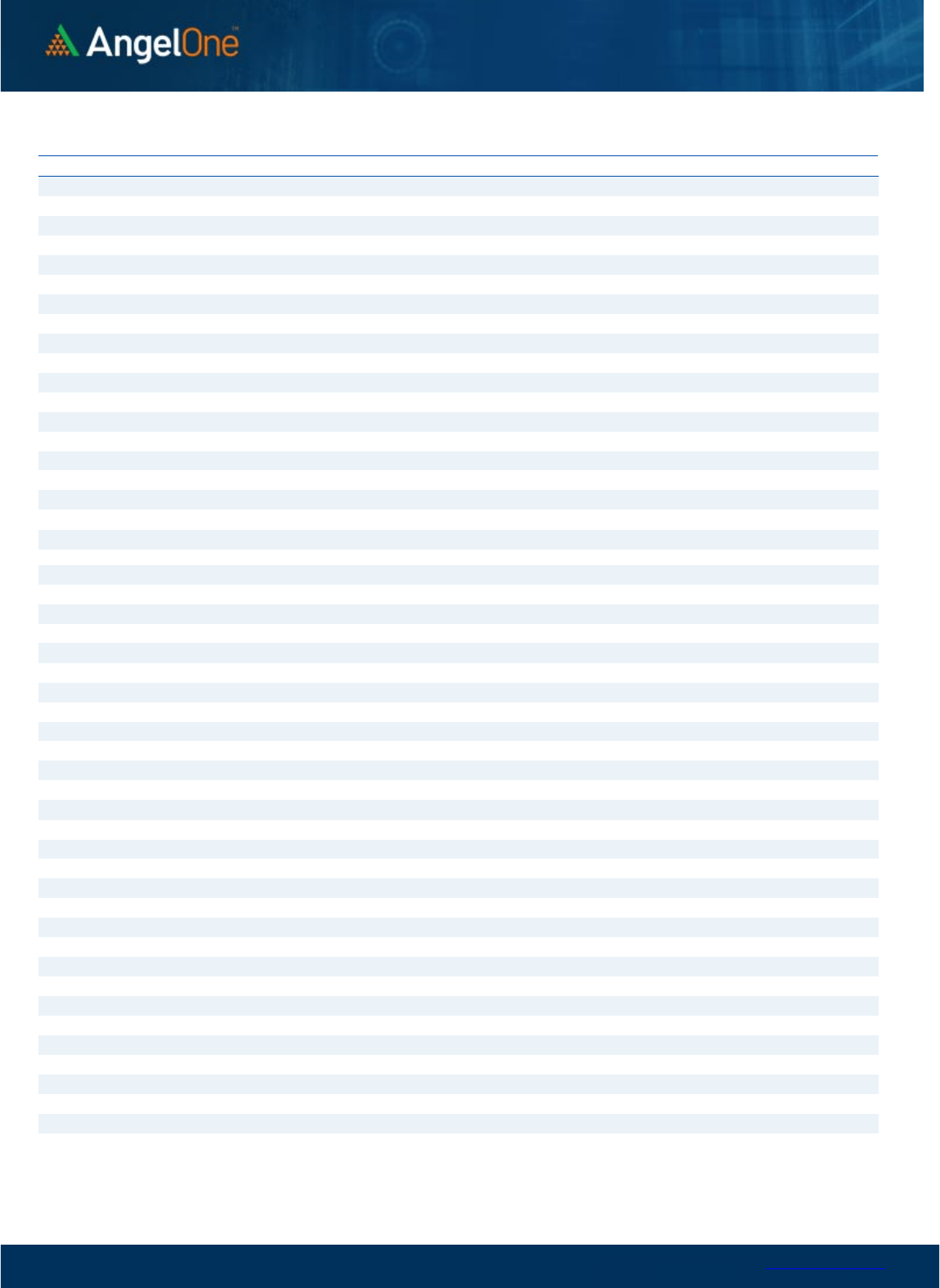

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

4500,000

5000,000

17000 17100 17200 17300 17400 17500 17600 17700 17800 17900 18000 18100 18200 18300

Call Put

www.angelone.in

Technical & Derivatives Report

March 01, 2023

`

Daily

Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIENT 994 1,179

1,289

1,473

1,583

ADANIPORTS 524 558

586

621

649

APOLLOHOSP

4,300

4,351

4,412

4,463

4,524

ASIANPAINT

2,687

2,758

2,798

2,869

2,910

AXISBANK 830 837

847

854

865

BAJAJ-AUTO

3,559

3,610

3,677

3,728

3,794

BAJFINANCE

5,993

6,053

6,150

6,209

6,306

BAJAJFINSV

1,304

1,319

1,346

1,361

1,388

BPCL 310 314

318

321

325

BHARTIARTL 729 736

746

753

764

BRITANNIA

4,344

4,403

4,439

4,498

4,534

CIPLA 876 891

918

934

961

COALINDIA 210 213

215

218

220

DIVISLAB

2,776

2,801

2,842

2,867

2,908

DRREDDY

4,213

4,265

4,352

4,404

4,491

EICHERMOT

3,036

3,071

3,126

3,161

3,216

GRASIM

1,547

1,563

1,574

1,589

1,600

HCLTECH

1,052

1,065

1,081

1,094

1,110

HDFCBANK

1,581

1,590

1,598

1,607

1,614

HDFCLIFE

481

485

488

492

496

HDFC

2,535

2,572

2,597

2,634

2,659

HEROMOTOCO

2,372

2,396

2,434

2,457

2,495

HINDALCO 388 394

404

409

420

HINDUNILVR

2,418

2,439

2,457

2,478

2,496

ICICIBANK 846 851

854

859

862

INDUSINDBK

1,057

1,067

1,079

1,089

1,100

INFY

1,455

1,471

1,498

1,514

1,540

ITC 369 373

379

382

388

JSW STEEL 653 660

672

679

691

KOTAKBANK

1,711

1,720

1,731

1,740

1,751

LT

2,058

2,083

2,111

2,137

2,164

M&M

1,241

1,255

1,274

1,289

1,308

MARUTI

8,543

8,583

8,646

8,687

8,750

NESTLEIND

18,354

18,512

18,618

18,777

18,883

NTPC 168 169

171

172

174

ONGC 149 150

153

155

157

POWERGRID 217 220

221

224

226

RELIANCE

2,281

2,302

2,334

2,355

2,388

SBILIFE

1,096

1,108

1,122

1,134

1,148

SBIN 517 520

524

527

532

SUNPHARMA 940 948

962

970

984

TCS

3,243

3,278

3,335

3,370

3,427

TATACONSUM

701 708

713

720

725

TATAMOTORS 416 418

422

424

427

TATASTEEL 101 103

105

106

108

TECHM

1,072

1,086

1,111

1,125

1,150

TITAN

2,326

2,349

2,387

2,411

2,449

ULTRACEMCO

7,114

7,188

7,236

7,309

7,358

UPL 682 688

699

705

717

WIPRO 381 384

389

392

396

www.angelone.in

Technical & Derivatives Report

March 01, 2023

*

Technical and Derivatives Team:

Sameet Chavan Chief Analyst – Technical & Derivatives sameet.chavan@angelone.in

Sneha Seth Senior Analyst – Technical & Derivatives sneha.seth@angelone.in

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelone.in

Osho Krishan Senior Analyst – Technical & Derivatives osho.krishan@angelone.in

Research Team Tel: 022 – 39357600 Website: www.angelone.in

For Technical Queries E-mail: technicalresearch-cso@angelone.in

For Derivatives Queries E-mail: derivatives.desk@angelone.in

DISCLAIMER

Angel One Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay Stock Exchange

Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and Portfolio Manager and investment

advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel One Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not been

debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision.

Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations

as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document

(including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment.

Angel or its associates or research analyst or his relative may have actual/beneficial ownership of 1% or more in the securities of the subject

company at the end of the month immediately preceding the date of publication of the research report. Neither Angel or its associates nor

Research Analysts or his relative has any material conflict of interest at the time of publication of research report.

Angel or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve

months from the date of this report for services in respect of managing or co-managing public offerings, corporate finance, investment banking or

merchant banking, brokerage services or other advisory service in a merger or specific transaction in the normal course of business. Angel or its

associates did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with the

research report. Neither Angel nor its research analyst entity has been engaged in market making activity for the subject company.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading

volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. Investors

are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed

to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance

only. Angel One Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. Angel One Limited has not independently verified all the information

contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy,

contents or data contained within this document. While Angel One Limited endeavors to update on a reasonable basis the information discussed

in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or

passed on, directly or indirectly.

Neither Angel One Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection

with the use of this information. Angel or its associates or Research Analyst or his relative might have financial interest in the subject company.

Research analyst has not served as an officer, director or employee of the subject company.