Technical & Derivatives Report

February 10, 2017

Sensex (28330) / Nifty (8778)

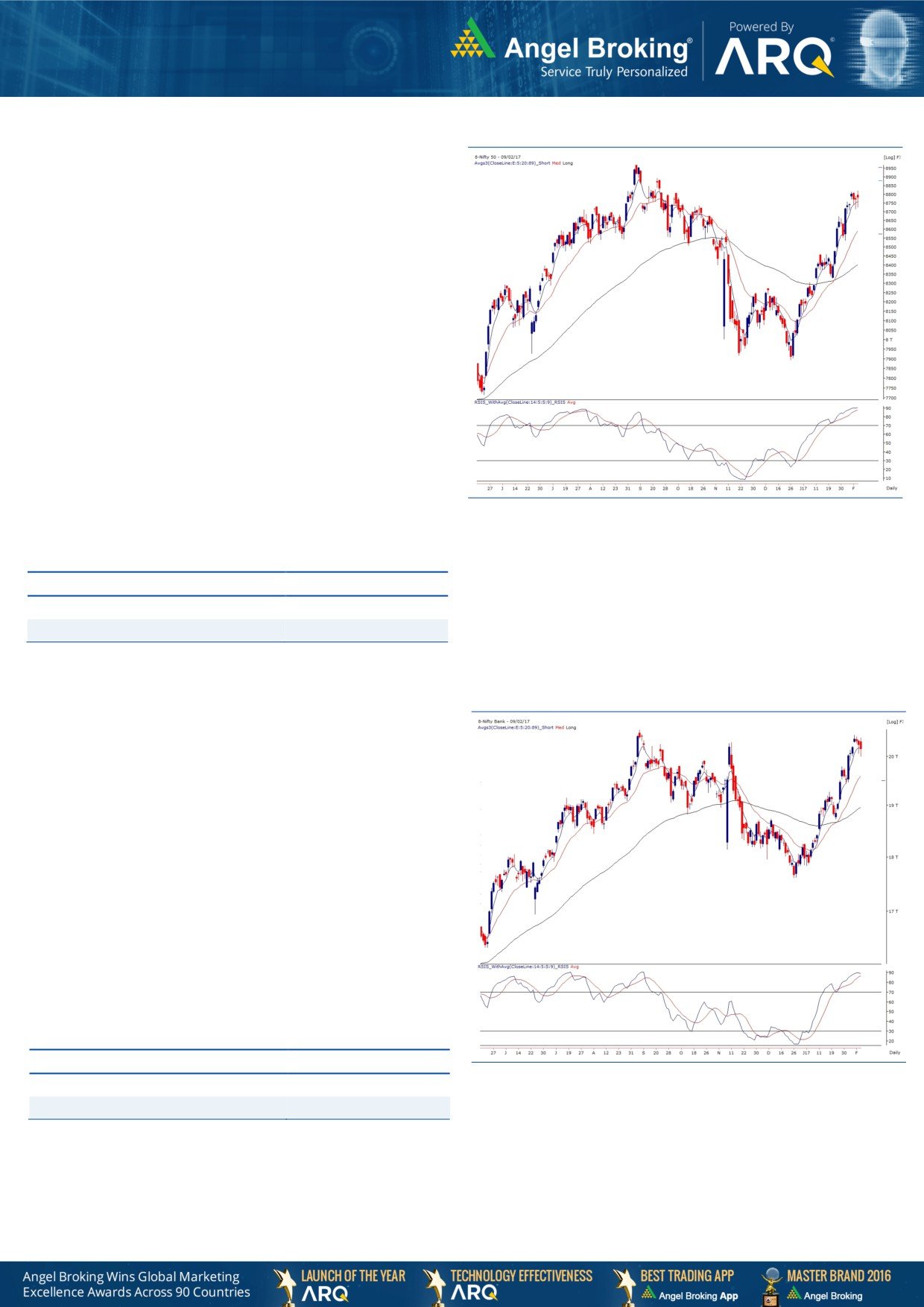

Exhibit 1: Nifty Daily Chart

The consolidation continues in our market as we almost witnessed

a replica of Wednesday’s session. The benchmark index opened

tad higher and then corrected sharply to test the previous day’s

low. However, once again a modest recovery in the latter half

pulled the index higher to close on a flat note with very nominal

gains.

Market is repeatedly proving its strength as we have seen a

complete reluctance of getting corrected on a sustainable basis.

All intraday dips are getting bought into, which is a sign of a

strong trend and we have been consistently advising the same.

Going forward, 8820 remains to be an immediate hurdle and

surpassing this point would extend the rally towards the next

milestone of 8900. On the downside, 8707 - 8685 has now

earned tremendous respect from the bears. Despite a small dip,

we would interpret this as a part of a consolidation phase and

hence, traders should keep following stock centric approach with

a positive bias in order to fetch good returns.

Key Levels

Support 1 - 8707

Resistance 1 - 8820

Support 2 - 8685

Resistance 2 - 8900

Nifty Bank Outlook - (20151)

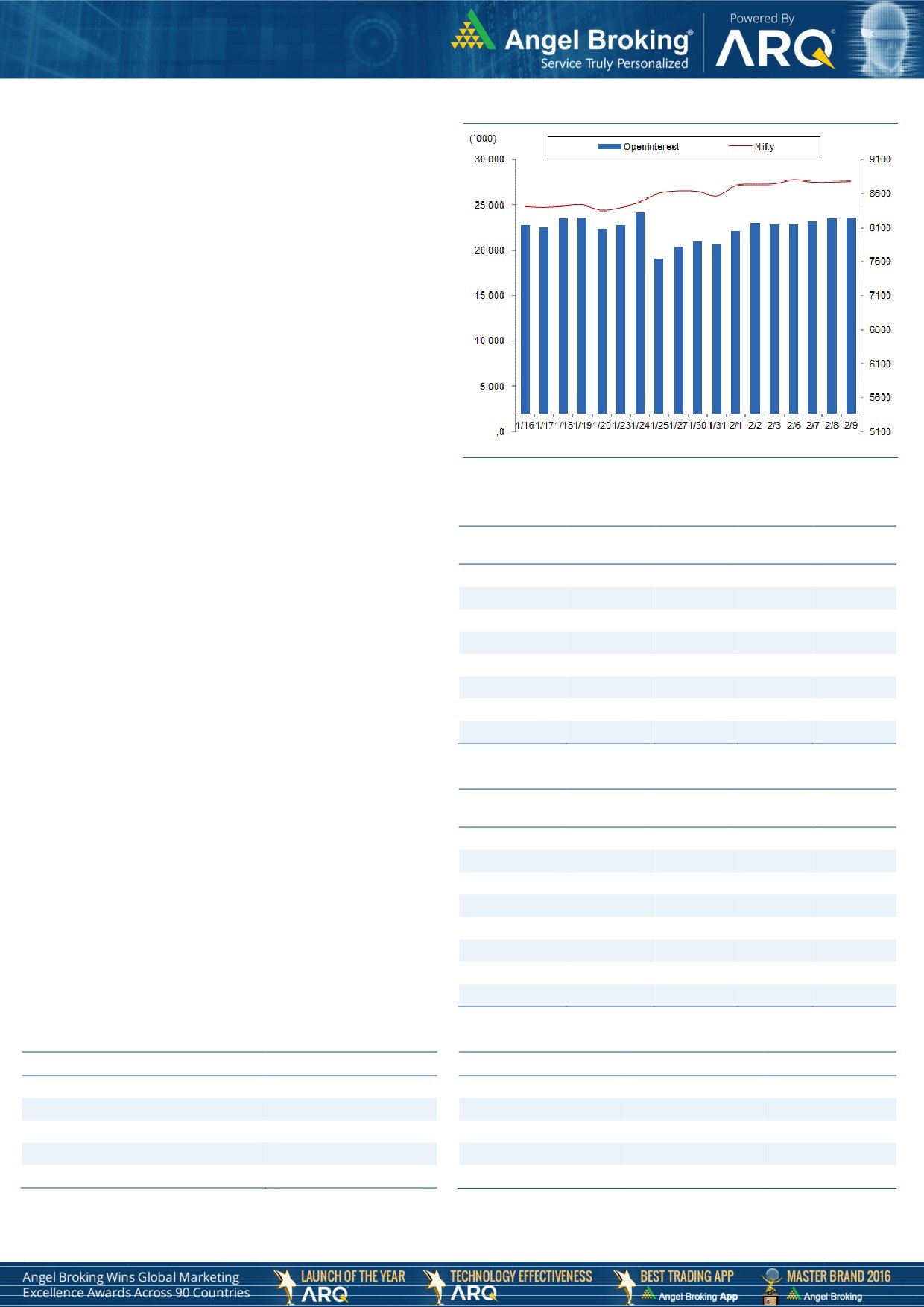

Exhibit 2: Nifty Bank Daily Chart

Although the Nifty Bank index opened marginally positive, the

index and its constituents witnessed some profit booking which led

to a marginal correction of 0.47 percent yesterday.

In last four trading sessions, the index has consolidated in a

range. Since there are no signs of trend reversal, we would

interpret this move to be a breather within an uptrend, Hence, the

broader trend for the index continues to be up and such corrective

declines should be used as buying opportunities. Traders should

hence focus on buying specific stocks which have shown

outperformance during the recent up move and are now showing

corrective move. The intraday supports for the Nifty Bank index is

placed in the range of 19915-19848 whereas resistances are

seen around 20330 and 20410.

Key Levels

Support 1 - 19915

Resistance 1 - 20330

Support 2 - 19848

Resistance 2 - 20410

Technical & Derivatives Report

February 10, 2017

Comments

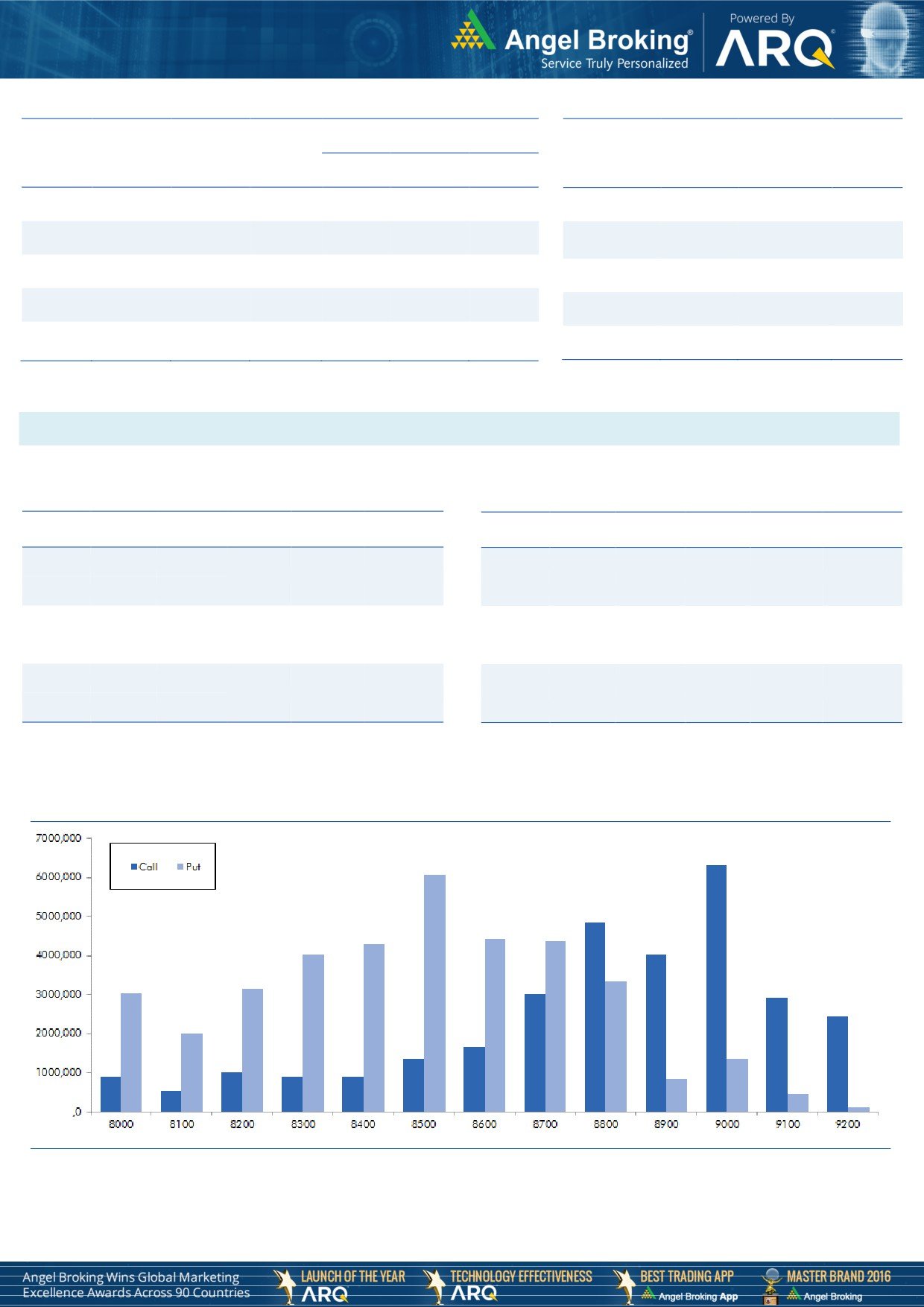

Nifty Vs OI

The Nifty futures open interest has increased by 0.67%

BankNifty futures open interest has decreased by 6.65%

as market closed at 8778.40 levels.

The Nifty February future closed with a premium of

18.45 points against the premium of 27.30 points in last

trading session. The March series closed at a premium of

50.00 points.

The Implied Volatility of at the money options has

decreased from 11.37% to 10.92%. At the same time,

the PCR-OI of Nifty has increased from 1.11 to 1.12

levels.

The total OI of the market is Rs. 3,26,616/- cr. and the

stock futures OI is Rs. 88,591/- cr.

Few of the liquid counters where we have seen high

cost of carry are JPASSOCIAT, IBREALEST, RCOM,

VOLTAS and ADANIPOWER.

OI Gainers

Views

OI

PRICE

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

Yesterday, FIIs were net buyer in both cash market and

UNIONBANK

33584000

44.48

147.95

-10.01

index future segment. They bought equities worth Rs. 357

PAGEIND

51500

25.92

14233.85

-2.17

crores. While, they were buyer in index futures to the tune

BEML

2316600

19.98

1336.75

4.39

of Rs. 600 crores with rise in open interest, indicating

TORNTPHARM

565200

19.04

1252.05

-0.79

long build-up in previous trading session.

BANKINDIA

28572000

15.25

136.90

3.17

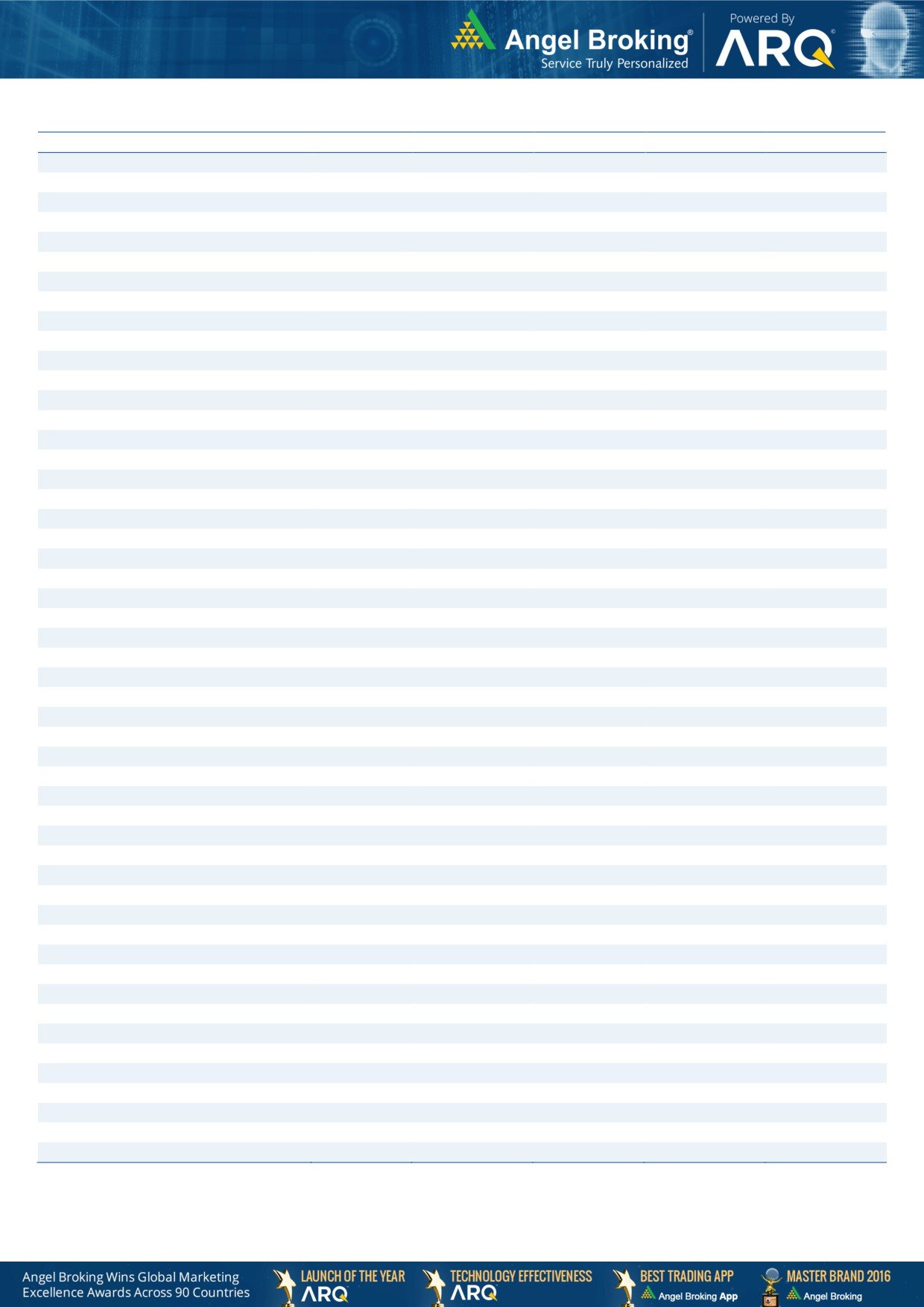

In index options segment, FIIs were buyer worth Rs. 1373

LUPIN

7196000

11.48

1497.25

0.27

crores with marginal rise in open interest. In call options,

IGL

2063600

11.27

1031.25

1.38

8800 strike added fresh positions; followed by unwinding

in 8900 strike. On the other hand, in put options, OI

PIDILITIND

1307000

9.56

666.15

-1.09

addition was visible in 8800 and 8700 strikes. Highest

open interest in current series is placed at 9000 call and

OI Losers

8500 put option.

OI

PRICE

SCRIP

OI

PRICE

After subdued activity for few sessions, FIIs has started

CHG. (%)

CHG. (%)

DCBBANK

2871000

-22.67

138.30

2.33

buying in index future segment from last couple of

INFRATEL

7947200

-11.26

319.35

2.90

sessions. We also witnessed their buying in cash segment

SOUTHBANK

43080000

-10.81

23.00

-0.65

in yesterday’s session. Considering current derivative

data, market seems to be poised for further up move.

SUNTV

7890000

-9.14

735.65

3.85

Thus, we continue to maintain our bullish stance on the

HDIL

29320000

-6.98

69.85

1.38

index. Hence, we advise traders to trade with positive

MCLEODRUSS

3717000

-5.78

171.45

0.56

bias and use declines as a buying opportunity.

SIEMENS

1090500

-5.05

1226.90

0.25

ZEEL

7855900

-4.98

522.70

1.90

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

UNIONBANK

73.09

NIFTY

1.12

1.08

BHARATFORG

42.77

BANKNIFTY

0.72

0.86

CIPLA

30.08

INFY

0.55

0.44

JUSTDIAL

58.67

SBIN

0.68

0.58

OFSS

37.21

ICICIBANK

0.56

0.54

Technical & Derivatives Report

February 10, 2017

FII Statistics for February 09, 2017

Turnover on February 09, 2017

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2810.59

2210.48

600.11

307933

20949.87

2.75

300358

21814.17

26.36

FUTURES

FUTURES

INDEX

INDEX

72555.04

71181.78

1373.26

1126880

76329.09

0.82

10175835

788948.66

125.70

OPTIONS

OPTIONS

STOCK

7987.50

8152.74

(165.25)

1043168

69632.08

1.26

STOCK

FUTURES

642826

46001.48

11.18

FUTURES

STOCK

STOCK

5276.35

5126.66

149.69

98896

6966.50

7.06

407949

30235.84

16.29

OPTIONS

OPTIONS

TOTAL

88629.48

86671.66

1957.82

2576877

173877.54

1.45

TOTAL

11526968

887000.14

104.29

Nifty Spot = 8778.40

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

8800

72.05

Buy

8800

77.55

39.80

60.20

8839.80

35.00

65.00

8765.00

Sell

8900

32.25

Sell

8700

42.55

Buy

8800

72.05

Buy

8800

77.55

59.70

140.30

8859.70

54.70

145.30

8745.30

Sell

9000

12.35

Sell

8600

22.85

Buy

8900

32.25

Buy

8700

42.55

19.90

80.10

8919.90

19.70

80.30

8680.30

Sell

9000

12.35

Sell

8600

22.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (February Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

Technical & Derivatives Report

February 10, 2017

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,457

1,471

1,492

1,506

1,526

ADANIPORTS

297

301

305

308

312

AMBUJACEM

232

235

240

243

248

ASIANPAINT

986

994

1,000

1,008

1,014

AUROPHARMA

695

701

707

713

720

AXISBANK

476

481

488

492

499

BAJAJ-AUTO

2,723

2,754

2,782

2,813

2,841

BANKBARODA

177

181

184

188

191

BHEL

150

154

156

160

162

BPCL

718

722

726

730

734

BHARTIARTL

348

352

354

358

361

INFRATEL

303

311

317

325

330

BOSCH

22,215

22,591

22,935

23,311

23,656

CIPLA

567

578

595

605

622

COALINDIA

315

319

322

325

329

DRREDDY

2,992

3,008

3,019

3,034

3,045

EICHERMOT

23,231

23,562

23,831

24,162

24,431

GAIL

481

486

490

495

499

GRASIM

943

959

971

987

999

HCLTECH

794

807

815

827

835

HDFCBANK

1,276

1,287

1,303

1,314

1,331

HDFC

1,366

1,381

1,401

1,417

1,437

HEROMOTOCO

3,177

3,221

3,270

3,314

3,363

HINDALCO

177

180

185

189

194

HINDUNILVR

838

844

850

857

863

ICICIBANK

274

279

284

290

294

IDEA

108

109

110

112

112

INDUSINDBK

1,282

1,293

1,308

1,319

1,334

INFY

931

938

944

952

958

ITC

270

274

276

280

282

KOTAKBANK

757

763

771

778

786

LT

1,458

1,474

1,493

1,509

1,527

LUPIN

1,451

1,471

1,496

1,516

1,540

M&M

1,253

1,273

1,284

1,303

1,314

MARUTI

6,065

6,111

6,158

6,204

6,250

NTPC

163

166

170

172

176

ONGC

190

192

194

195

198

POWERGRID

198

200

203

205

208

RELIANCE

1,024

1,028

1,031

1,036

1,038

SBIN

266

271

276

280

285

SUNPHARMA

644

650

659

665

675

TCS

2,247

2,282

2,305

2,340

2,363

TATAMTRDVR

312

316

320

324

329

TATAMOTORS

500

506

512

519

524

TATAPOWER

80

81

82

83

84

TATASTEEL

446

453

463

470

480

TECHM

470

477

482

490

494

ULTRACEMCO

3,697

3,725

3,743

3,771

3,789

WIPRO

454

460

463

469

473

YESBANK

1,383

1,396

1,408

1,420

1,432

ZEEL

502

512

518

529

535

Technical & Derivatives Report

February 10, 2017

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.