Technical & Derivatives Report

May 26, 2017

Sensex (30750) / Nifty (9510)

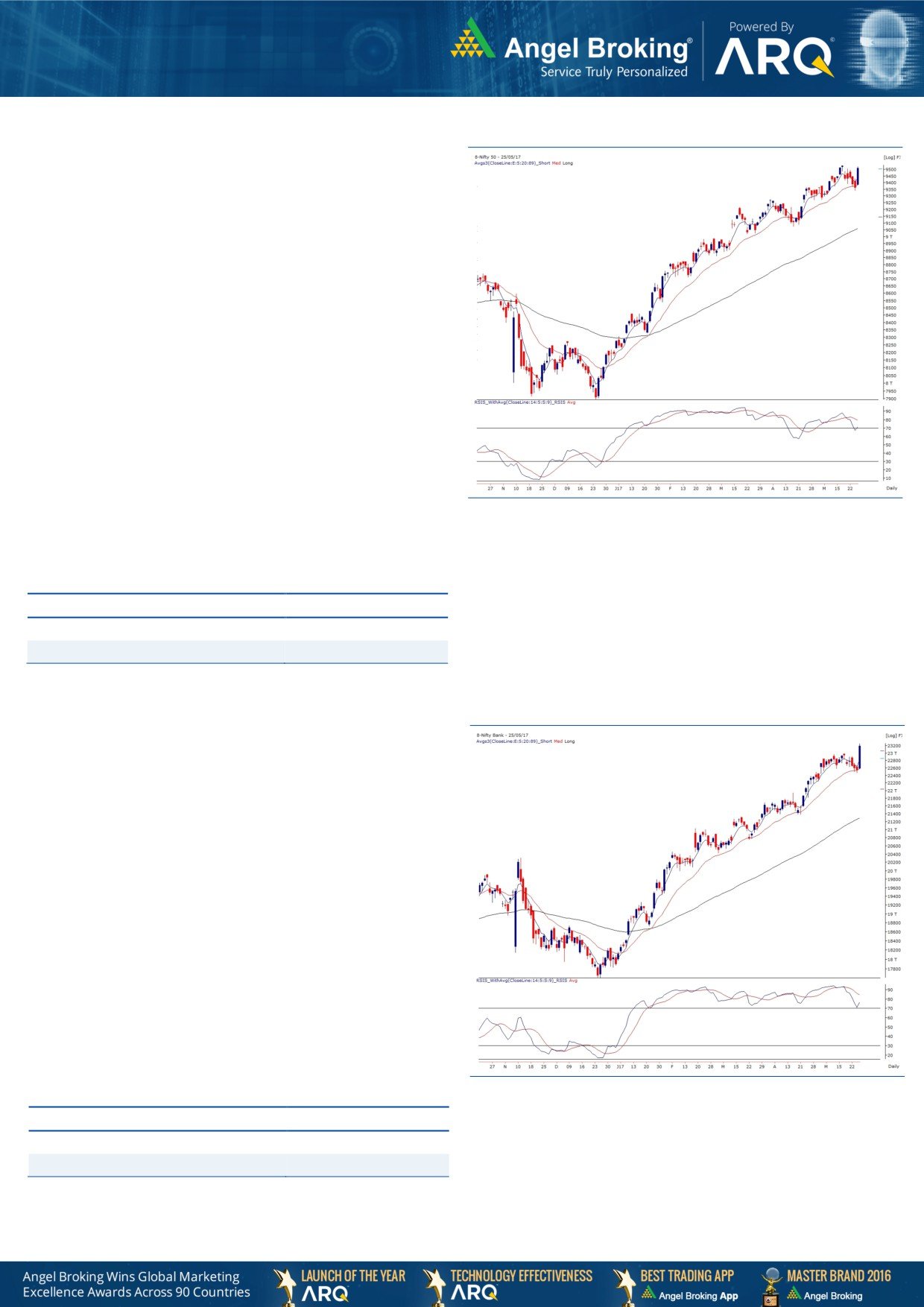

Exhibit 1: Nifty Daily Chart

It was a kind of day that we were looking for since last 2-3 days.

Our markets opened higher and immediately added some gains

in the initial hours. Subsequently, we witnessed some

consolidation in the market; but, the moment Nifty surpassed the

intraday hurdle of 9420, we witnessed a sort of gush in the

market. As a result, the index eventually went on to close this May

(F&O) series on a happy note.

Now, with reference to our recent reports, we remained firm on

our bullish stance on the market despite seeing some correction

below the 9400 mark. In fact, we were quite vocal about the

probable bounce back towards 9500 first and then to achieve the

next milestone of 9600. Due to today’s spectacular move, our first

level has been reached and now a move towards 9600 is just a

matter of time. Traders are advised to stay on the positive side

and use any intraday decline towards 9480 - 9450 to create long

positions in the market. At this juncture, a prudent strategy would

be to concentrate on individual stocks that are likely to fetch

higher returns.

Key Levels

Support 1 - 9480

Resistance 1 - 9550

Support 2 - 9450

Resistance 2 - 9600

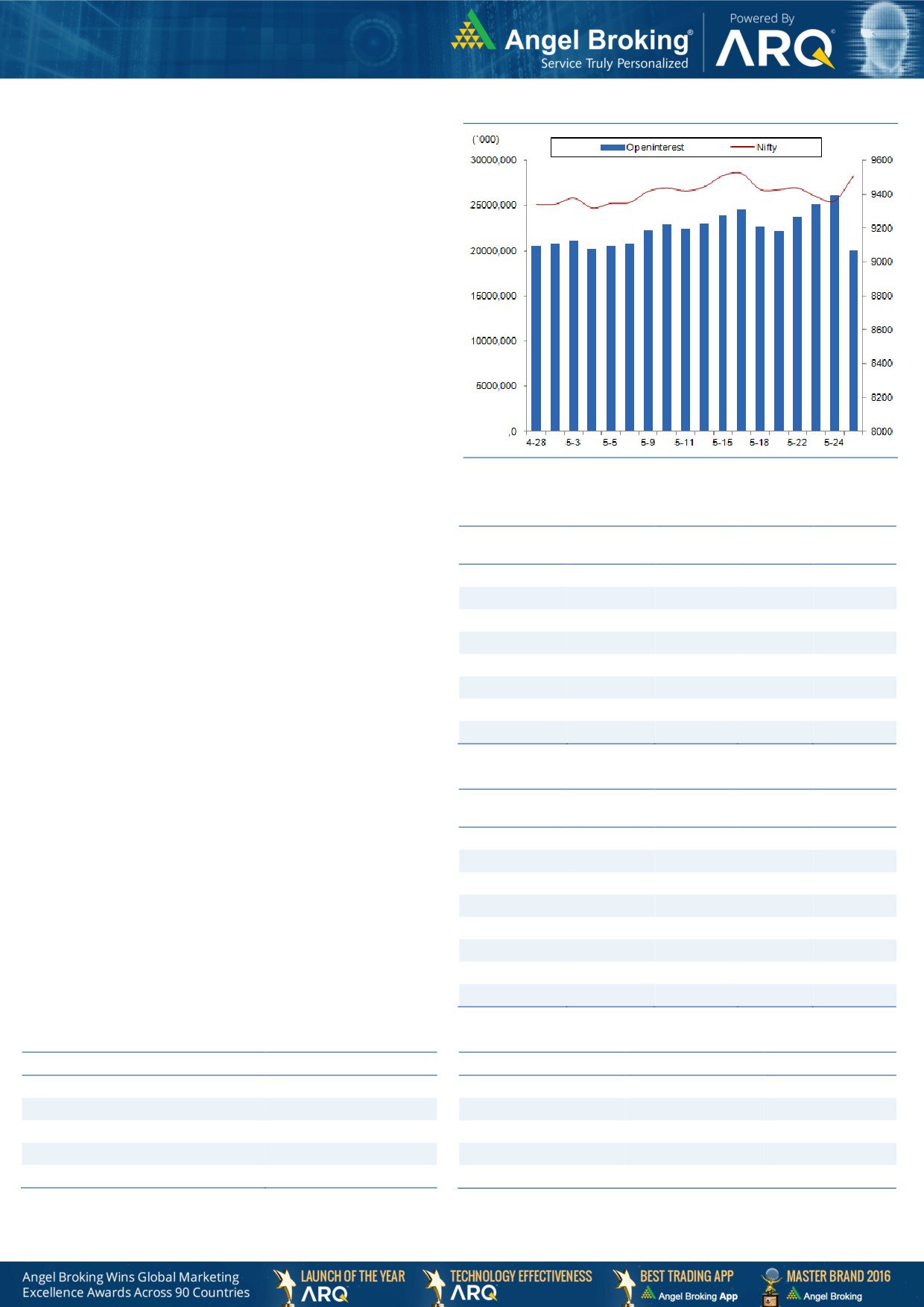

Nifty Bank Outlook - (23191)

Exhibit 2: Nifty Bank Daily Chart

The Nifty Bank index rallied sharply higher in yesterday's session

and registered it's all time high to end the day with gains of 2.90

percent.

The bulls came back roaring post the consolidation phase seen in

last few trading sessions. The '20 DEMA', which we have been

referring to as a strong support in this uptrend once again acted

as a savior and the index registered all-time high to mark the

continuation of the uptrend. Analyzing the reciprocal retracements

of the previous corrective move, we expect the index to continue

this upmove till 23500-23550 in next few trading sessions.

Traders are hence advised to trade with positive bias as the stocks

from this sector could outperform the broader markets in near

term. The intraday supports for the Nifty Bank index are placed in

the range of 22978 - 22900 whereas resistances are seen

around 23480 and 23550.

Key Levels

Support 1 - 22978

Resistance 1 - 23480

Support 2 - 22900

Resistance 2 - 23550

Technical & Derivatives Report

May 26, 2017

Comments

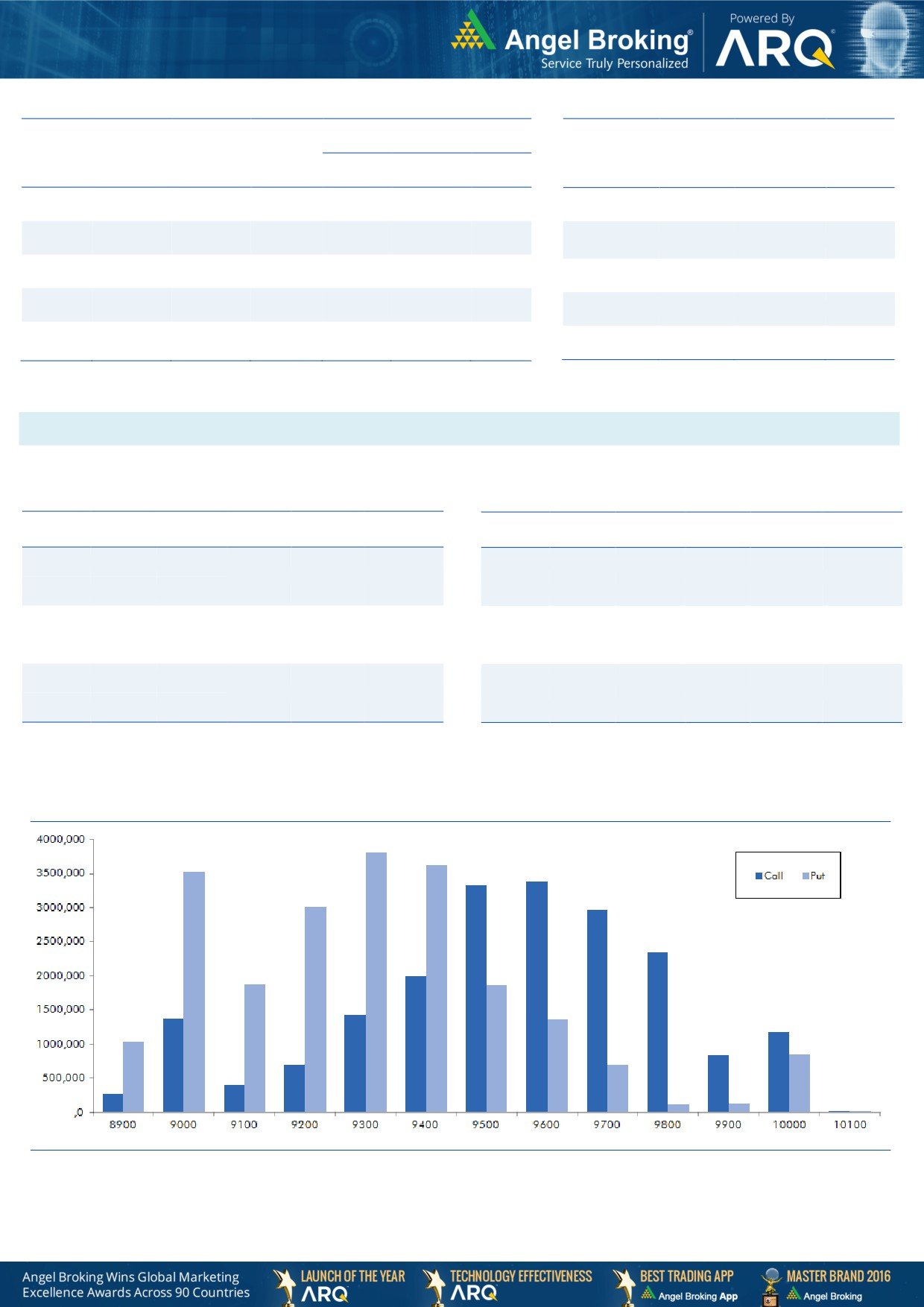

Nifty Vs OI

The Nifty futures open interest has decreased by 23.53%

BankNifty futures open interest has decreased by 20.09%

as market closed at 9509.75 levels.

The Nifty June future closed with a discount of 13.85

points against the premium of 12.60 points in last

trading session. The July series closed at a discount of

0.15 point.

The Implied Volatility of at the money options has

decreased from 12.49% to 8.01%. At the same time, the

PCR-OI of Nifty has decreased from 1.07 to 1.06 levels.

The total OI of the market is Rs. 2,38,057/- cr. and the

stock futures OI is Rs. 90,358/- cr.

Few of the liquid counters where we have seen high cost

of carry are UJJIVAN, BALKRISIND, GMRINFRA,

TV18BRDCST and SOUTHBANK.

Views

FIIs were net buyers in both cash market segment and

OI Gainers

index futures. They bought equities worth Rs. 589 crores;

OI

PRICE

SCRIP

OI

PRICE

while they were net buyer to the tune of Rs. 371 crores in

CHG. (%)

CHG. (%)

JINDALSTEL

38650500

0.69

119.40

7.04

index futures with fall in open interest, due to expiry.

TV18BRDCST

90542000

0.11

35.95

7.47

In index options front, they bought of Rs. 2043 crores

with fall in open interest. In Nifty options, 9800 call

-

-

-

-

-

option added huge positions; followed by decent

-

-

-

-

-

build-up in 9500 - 9700 strikes. On the other hand, in

-

-

-

-

-

put options,

9300

-

9500 are attracting trader’s

-

-

-

-

-

attraction and added fresh positions. At current juncture,

-

-

-

-

-

highest open interest in June series is placed at 9600 call

-

-

-

-

-

and 9300 put options.

Rollover in Nifty (74.09%) is higher than its quarterly

OI Losers

average of 69.36%, thus indicating that traders have

OI

PRICE

SCRIP

OI

PRICE

rolled their long positions to the next series. However, the

CHG. (%)

CHG. (%)

rollover in banking index (60.60%) is on lower side as

ITC

34315200

-38.21

298.00

-0.18

compared to its average (68.40). Yesterday, FIIs have

INFIBEAM

1204800

-34.93

973.25

6.69

exited around 55% of their short positions in index future

NHPC

20844000

-34.47

29.50

1.37

and added some fresh longs. As a result, their

LT

7286500

-34.17

1773.35

4.72

‘Long/Short Ratio’ has increased from 65.50% to 81%.

TORNTPHARM

194000

-33.56

1225.30

-1.15

Considering overall rollover activity, we continue to

MRPL

2817000

-32.98

131.00

5.73

maintain our bullish stance on the market and thus,

M&M

2901500

-32.85

1336.25

1.50

would advice traders to trade with a positive bias.

GAIL

9662000

-32.67

402.75

2.72

Historical Volatility

Put-Call Ratio

SCRIP

HV

SCRIP

PCR-OI

PCR-VOL

MINDTREE

39.96

NIFTY

1.06

1.09

DISHTV

66.34

BANKNIFTY

1.00

0.75

LUPIN

46.92

SBIN

0.66

0.38

JPASSOCIAT

134.89

RELIANCE

0.53

0.48

HDFCBANK

20.25

ICICIBANK

0.77

0.61

Technical & Derivatives Report

May 26, 2017

FII Statistics for May 25, 2017

Turnover on May 25, 2017

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

8505.83

8134.88

370.95

246257

18202.68

(18.48)

604418

47412.23

41.00

FUTURES

FUTURES

INDEX

INDEX

74677.90

72634.90

2043.00

644484

46631.81

(39.96)

12558724

1018815.21

50.72

OPTIONS

OPTIONS

STOCK

31100.42

30972.60

127.81

1014215

65739.95

(19.71)

STOCK

FUTURES

2143889

143234.32

19.03

FUTURES

STOCK

STOCK

4299.69

4072.57

227.11

1656

97.81

(98.57)

722546

51652.59

-8.05

OPTIONS

OPTIONS

TOTAL

118583.83

115814.96

2768.88

1906612

130672.25

(30.78)

TOTAL

16029577

1261114.37

42.32

Nifty Spot = 9509.75

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

9500

102.95

Buy

9500

110.05

46.70

53.30

9546.70

34.95

65.05

9465.05

Sell

9600

56.25

Sell

9400

75.10

Buy

9500

102.95

Buy

9500

110.05

76.25

123.75

9576.25

59.20

140.80

9440.80

Sell

9700

26.70

Sell

9300

50.85

Buy

9600

56.25

Buy

9400

75.10

29.55

70.45

9629.55

24.25

75.75

9375.75

Sell

9700

26.70

Sell

9300

50.85

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

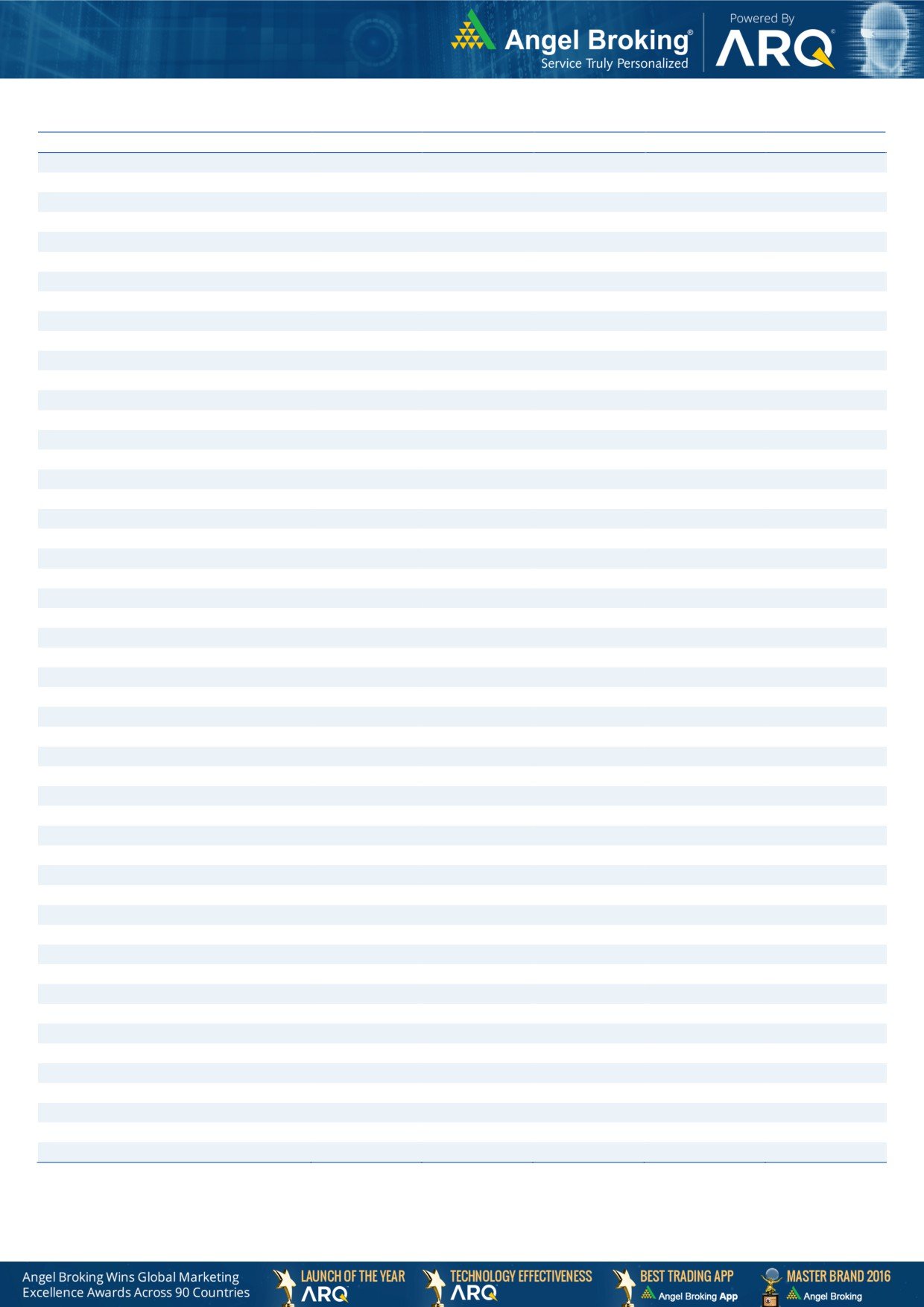

Nifty Put-Call Analysis

Technical & Derivatives Report

May 26, 2017

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ACC

1,546

1,583

1,608

1,645

1,670

ADANIPORTS

324

333

339

348

354

AMBUJACEM

230

235

238

244

247

ASIANPAINT

1,074

1,094

1,109

1,129

1,144

AUROPHARMA

509

517

524

533

540

AXISBANK

490

499

504

513

518

BAJAJ-AUTO

2,733

2,778

2,806

2,851

2,879

BANKBARODA

174

178

180

184

187

BPCL

696

712

722

738

748

BHARTIARTL

354

362

369

378

385

INFRATEL

361

367

372

378

382

BOSCHLTD

22,202

22,882

23,480

24,161

24,759

CIPLA

480

492

508

521

537

COALINDIA

261

263

265

267

268

DRREDDY

2,334

2,381

2,445

2,491

2,555

EICHERMOT

27,018

27,514

27,817

28,313

28,616

GAIL

387

394

399

406

411

GRASIM

1,068

1,083

1,098

1,113

1,128

HCLTECH

845

852

860

867

875

HDFCBANK

1,542

1,580

1,605

1,642

1,667

HDFC

1,523

1,532

1,539

1,547

1,554

HEROMOTOCO

3,481

3,554

3,599

3,672

3,718

HINDALCO

183

187

189

193

196

HINDUNILVR

1,022

1,033

1,041

1,052

1,061

IBULHSGFIN

1,010

1,028

1,050

1,068

1,089

ICICIBANK

301

309

315

323

328

IOC

415

427

435

447

455

INDUSINDBK

1,397

1,429

1,451

1,483

1,505

INFY

951

967

977

993

1,003

ITC

291

295

300

305

309

KOTAKBANK

925

941

952

967

978

LT

1,662

1,716

1,745

1,799

1,828

LUPIN

1,069

1,105

1,142

1,178

1,215

M&M

1,291

1,309

1,322

1,341

1,354

MARUTI

6,763

6,874

6,946

7,057

7,129

NTPC

154

155

156

157

158

ONGC

172

173

174

175

177

POWERGRID

193

196

199

201

204

RELIANCE

1,288

1,295

1,304

1,311

1,320

SBIN

281

285

288

293

296

SUNPHARMA

567

580

594

606

621

TCS

2,541

2,583

2,610

2,652

2,680

TATAMTRDVR

274

278

282

286

289

TATAMOTORS

459

467

473

482

488

TATAPOWER

79

80

81

81

82

TATASTEEL

472

479

483

489

493

TECHM

412

419

423

431

435

ULTRACEMCO

4,103

4,133

4,160

4,190

4,217

WIPRO

521

529

534

542

547

YESBANK

1,416

1,440

1,455

1,479

1,494

ZEEL

498

505

511

518

525

Technical & Derivatives Report

May 26, 2017

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by *Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.