www.angelbroking.com

January 18, 2021

Technical & Derivatives Report

Nifty

Bank Out

look

-

(

32247)

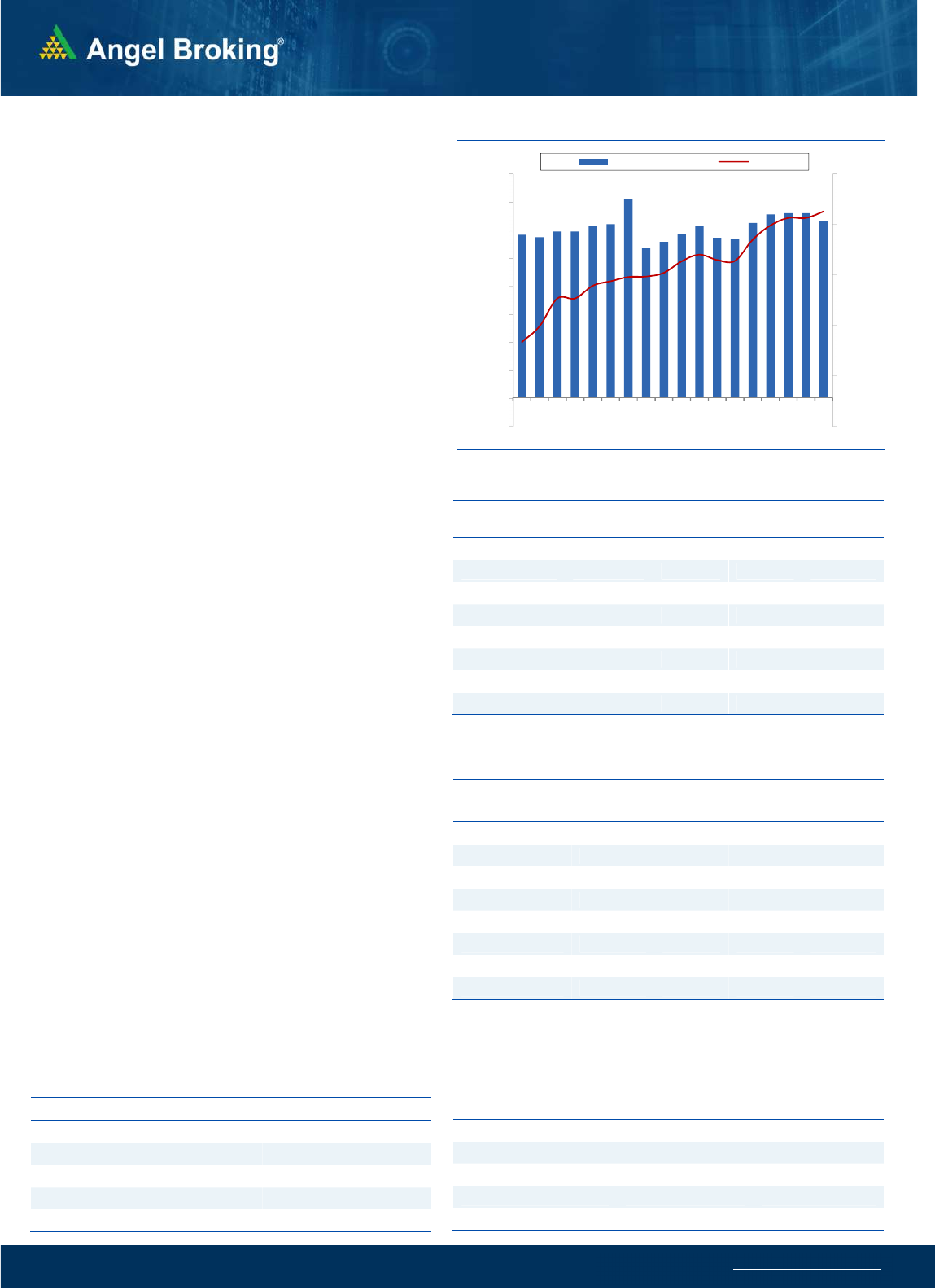

On Friday, Bank Nifty started on a negative note and from the

word go it started to moved lower. During the day it tested levels

around 32000 however some bounce in the last hour resulted

prices to erase some loss and eventually end with loss of 0.84%

at 32247.

During the last week, we mentioned resistance for Bank Index

around the all time high levels around 32600 levels and in spite

prices slightly breaking above it we did not witnessed follow up

buying. Infact we witnessed profit booking on Friday, going

ahead we sense the lackluster move may continue or we may

even see price wise correction as long we don't see prices

breaking above 32600 - 32700 on a sustained basis. On the flip

side, immediate support is now placed around 32000 - 31750

levels. Traders are advised to stay light and avoid aggressive

bets.

Key Levels

Support 1 – 32000 Resistance 1 – 32600

Support 2 – 31750 Resistance 2 – 32700

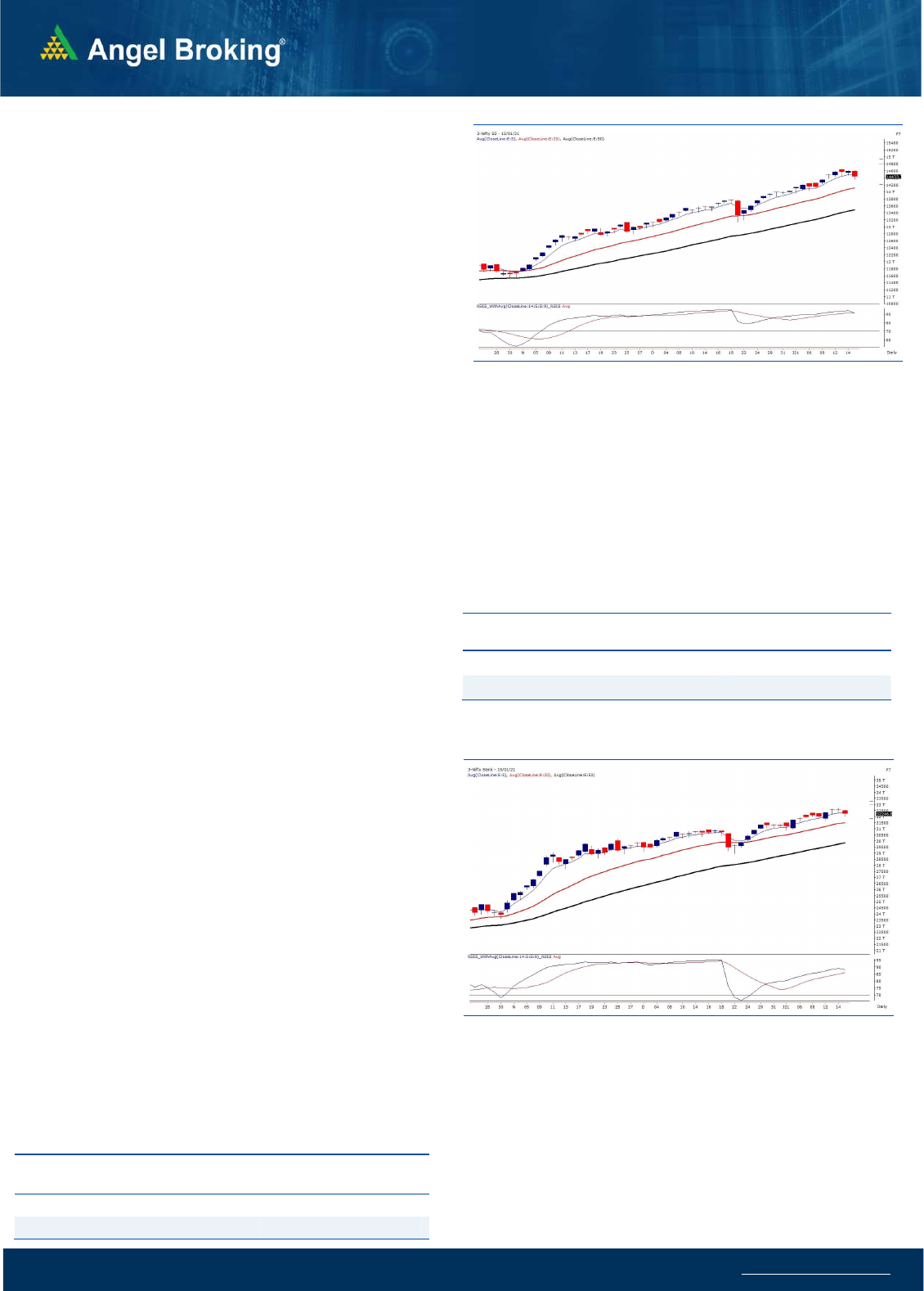

Exhibit 1: Nifty Daily Chart

Se

nsex

(

49035)

/ Nifty

(

14434

)

Second week of the new calendar year started with a good bump

up at fresh record high tad below the 14500 mark on Monday. In

the initial hour, we witnessed a small bout of correction; but similar

to recent trend, the intraday decline was bought into and the index

thereafter once again resumed its upward trajectory. The similar

price movement was continued for following three sessions.

However, on Friday, there was some sustained profit booking seen

to conclude the week tad below the Monday’s opening point.

The bulls are continuing with their strong hold on the market and

barring single day of sharp correction last month, the relentless

rally resumed to clock fresh record highs day by day. In our intra-

week commentary, we had mentioned how 2.30 factor played out

well since last few days. There was a typical pattern when we see

some price decline in the first half and buying emerges in the latter

half to hit new record highs. But this winning streak finally got

snapped on Friday when market corrected further after 2-2.30.

Although it’s just a one day activity and still no major damage

done, we expect 14650 to act as an immediate resistance now. On

the daily chart, Nifty closed below 5-day EMA for the first time in

the recent past, which is a first sign of weakness. Hence, in this

week, the extension of profit booking cannot be ruled out. The

moment we see Nifty sliding below 14380, we expect the Nifty to

slide towards 14250-14100 levels.

In fact, stock specific the fatigue was seen in so many counters

from Wednesday itself. The major banking index is at its previous

record highs and the Nifty Midcap 50 index, which is at crucial

Fibonacci ratios, may provide this much awaited corrective move.

Let see how things pan out in the early part of this week. Since the

overall trend has been strongly bullish, even if the correction

comes, one needs to go one at a time rather than projecting bigger

downside targets. Traders are advised to stay light and avoid

aggressive leveraged positions.

Key Levels

Support 1 – 14380 Resistance 1 – 14600

Support 2 – 14250 Resistance2 – 14650

Exhibit 2: Nifty Bank Daily Chart

www.angelbroking.com

Technical & Derivatives Report

January 18, 2021

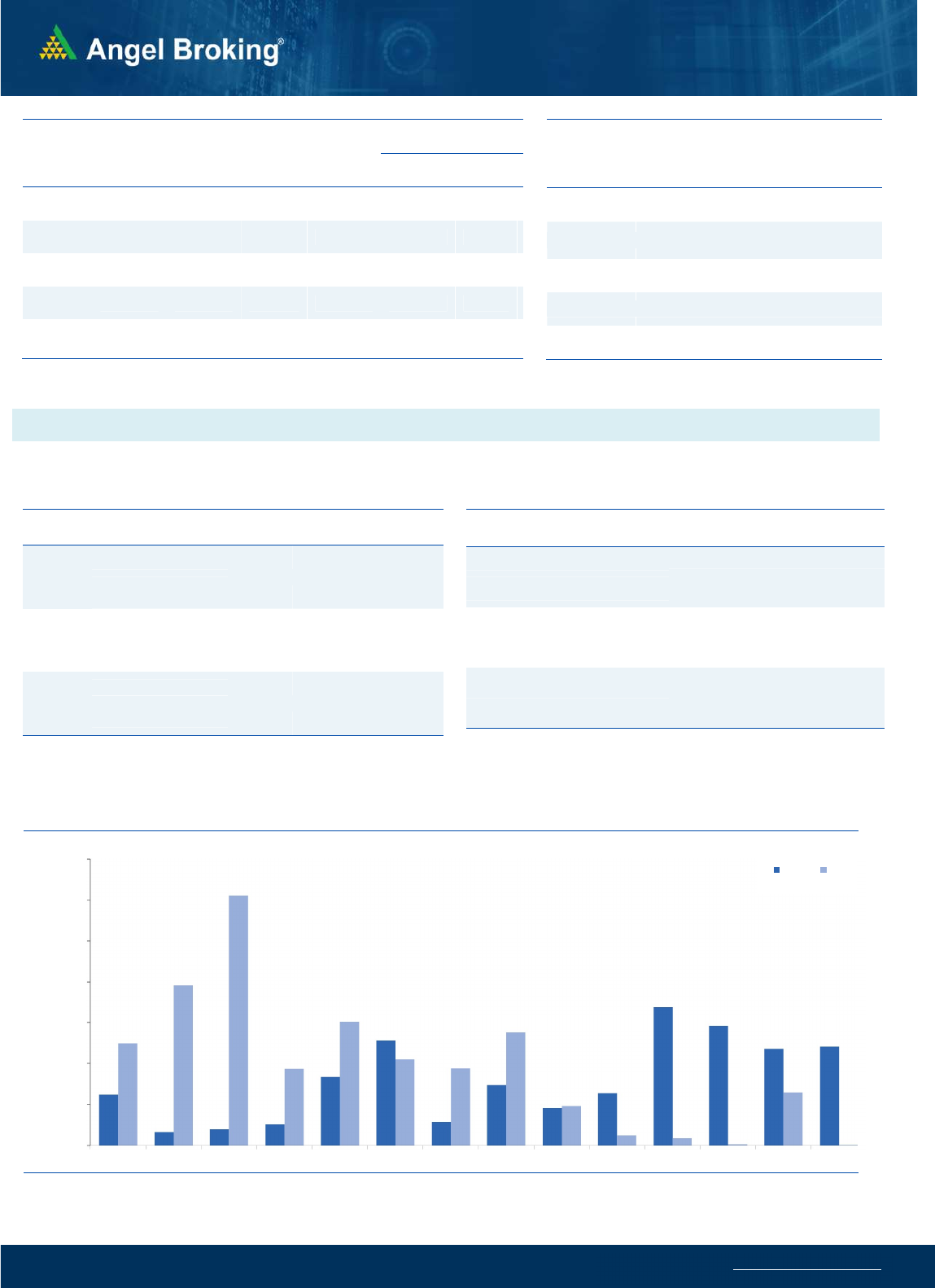

Nifty Vs OI

12500

13000

13500

14000

14500

15000

,0

2,000

4,000

6,000

8,000

10,000

12,000

14,000

16,000

18,000

12/21 12/24 12/28 12/30 1/1 1/5 1/7 1/11 1/13

(`000)

Openinterest Nifty

View

We began the week on a cheerful note and saw follow-up

buying to extend the up move beyond 14650 mark.

Around this levels, we found some parameters like PCR-OI

and FIIs ‘Long short Ratio’ hinting market in the

overbought zone. As anticipated, we witnessed decent

profit booking at the higher level which led weekly closing

below 14450 mark.

FIIs were net buyers in the cash segment to the tune of

Rs. 971 crore. In index future segment, they sold worth Rs.

1063 crores with decent rise in open interest indicating

short formation in Friday’s session.

Last week, we saw mixed activity in terms of open

interest in index futures segment. The PCR-OI surged to

1.80 on Tuesday, which clearly suggested market was

overbought. From the next trading sessions, strong

writing was observed in 14600-14700 call options. On

Friday, we also saw good amount of writing in 14500

strikes. In case of puts, hardly any meaningful build-up

was seen during the week. The Volatility index surged

more than 16% last week, which is certainly not good

for Bull’s. Considering the overall development seen in

F&O space, we expect some follow-up selling in the

coming week as well. Hence, traders are advised

lightening up their longs and prefer buying slightly

OTM puts in case of any pullback around 14500-14550

.

C

o

mme

n

t

s

The Nifty futures open interest has decreased by 2.59%

Bank Nifty futures open interest has increased by 4.35%

as market closed at 14433.70 levels.

The Nifty January future closed with a premium of 24.80

point against a premium of 32.50 point in last trading

session. The February series closed at a premium of

59.60 point.

The INDIA VIX increased from 23.02 to 24.10.

At the same time, the PCR-OI of Nifty decreased from

1.47 to 1.19.

Few of the liquid counters where we have seen high cost

of carry are IDEA, MRF, APOLLOTYRE, HINDPETRO,

NMDC and LALPATHLAB.

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

SAIL 179322000 121.34 70.15 4.37

HDFCAMC 366000 24.15 3244.30 -2.29

CADILAHC 11708400 11.57 487.80 -3.45

L&TFH 33465600 11.38 105.25 -2.08

ICICIPRULI 4726500 9.41 499.70 -1.89

VOLTAS 2263000 9.27 887.55 -2.48

APOLLOTYRE 13175000 9.15 183.30 -3.58

HINDALCO 24944300 9.12 253.35 -2.79

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

GAIL 31073400 -13.89 138.50 -3.98

UPL 16896100 -9.07 522.55 2.42

RECLTD 13962000 -7.62 145.40 1.04

AARTIIND 399075 -7.31 1256.50 -0.94

RAMCOCEM 1394000 -7.08 822.45 -2.07

BHEL 117747000 -6.38 39.40 -2.24

BANKBARODA 63121500 -5.67 75.15 -1.25

GODREJCP 4141000 -5.61 780.10 -0.17

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 1.19 1.02

BANKNIFTY 0.88 1.12

RELIANCE 0.49 0.47

ICICIBANK 0.55 0.47

INFY 0.36 0.37

Historical Volatility

SCRIP HV

TECHM 44.48

TATAMOTORS 68.40

IDEA 121.80

HCLTECH 44.14

WIPRO 43.03

www.angelbroking.com

Technical & Derivatives Report

January 18, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (January Series) are given as an information and not as a recommendation.

Nifty Spot =

14433.70

FII Statistics for January 15, 2020

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3779.34 4842.66 (1063.32) 124590 12557.91 2.19

INDEX

OPTIONS

293136.97 292519.75 617.22

836448 82997.52 18.98

STOCK

FUTURES

14230.07 15162.14 (932.07) 1226596 101767.48 0.14

STOCK

OPTIONS

10901.01 11165.22 (264.21) 182548 15194.96 6.42

Total 322047.39

323689.77

(1642.38) 2370182

212517.87

6.70

Turnover on January 15, 2020

Instrume

nt

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures 4,11,549 38891.62 42.87

Index Options 2,09,97,097

19,72,045.30 29.52

Stock Futures 9,20,211 82647.95 13.03

Stock Options 19,55,065 1,82,212.06 21.47

Total 2,42,83,922

22,75,796.93 28.36

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy 14500 191.60

50.20 49.80 14550.20

Sell 14600 141.40

Buy 14500 191.60

89.65 110.35 14589.65

Sell 14700 101.95

Buy 14600 141.40

39.45 60.55 14639.45

Sell 14700 101.95

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy 14400 84.35

16.00 84.00 14384.00

Sell 14300 68.35

Buy 14400 84.35

29.10 170.90 14370.90

Sell 14200 55.25

Buy 14300 68.35

13.10 86.90 14286.90

Sell 14200 55.25

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

13500

13600

13700

13800

13900

14000

14100

14200

14300

14400

14500

14600

14700

14800

Call Put

www.angelbroking.com

Technical & Derivatives Report

January 18, 2021

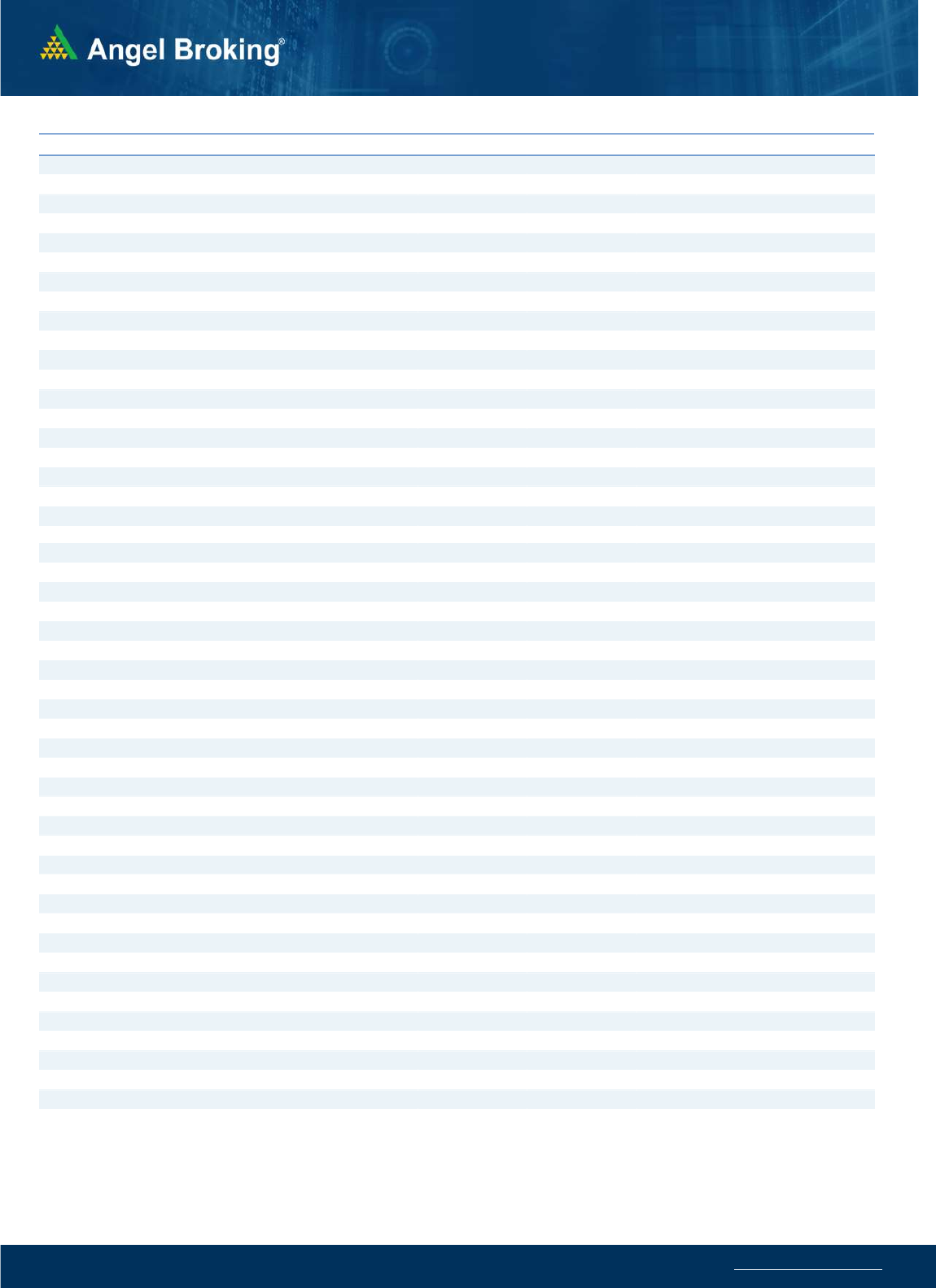

Da

ily

Pivot Level

s for

Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

514

521

531

538

548

ASIANPAINT 2,530 2,560

2,611

2,642

2,692

AXISBANK

662

669

676

682

689

BAJAJ-AUTO 3,499 3,540

3,581

3,622

3,663

BAJFINANCE 4,800 4,842

4,884

4,926

4,969

BAJAJFINSV 8,475 8,555

8,691

8,772

8,907

BPCL

400

407

418

426

437

BHARTIARTL

586

594

602

611

619

BRITANNIA 3,508 3,558

3,622

3,672

3,736

CIPLA

806

815

830

839

854

COALINDIA

139

141

144

146

150

DIVISLAB 3,550 3,598

3,680

3,727

3,810

DRREDDY 5,122 5,167

5,241

5,287

5,361

EICHERMOT 2,804 2,831

2,866

2,893

2,928

GAIL

131

135

140

144

150

GRASIM

987

1,010

1,025

1,048

1,062

HCLTECH

940

965

1,009

1,034

1,078

HDFCBANK 1,434 1,451

1,461

1,477

1,488

HDFCLIFE

693

699

708

714

723

HDFC 2,573 2,603

2,646

2,676

2,718

HEROMOTOCO 3,119 3,161

3,216

3,258

3,313

HINDALCO

244

249

256

261

268

HINDUNILVR 2,303 2,327

2,367

2,391

2,431

ICICIBANK

536

539

545

549

555

IOC

99

100

102

103

105

INDUSINDBK

938

952

967

981

997

INFY 1,325 1,335

1,350

1,360

1,374

ITC

209

213

216

221

223

JSW STEEL

385

389

396

401

407

KOTAKBANK 1,824 1,844

1,874

1,894

1,924

LT 1,322 1,338

1,361

1,377

1,401

M&M

802

811

824

833

847

MARUTI 7,862 7,943

8,081

8,163

8,301

NESTLEIND 17,512

17,673

17,961

18,122

18,410

NTPC

98

99

101

103

105

ONGC

97

99

103

105

108

POWERGRID

201

202

204

205

207

RELIANCE 1,890 1,914

1,944

1,967

1,998

SBILIFE

888

899

914

926

941

SHREECEM 23,859

24,136

24,490

24,768

25,122

SBIN

296

300

305

309

315

SUNPHARMA

588

596

606

615

625

TCS 3,175 3,204

3,239

3,268

3,303

TATAMOTORS

234

247

256

269

278

TATASTEEL

685

695

708

719

732

TECHM

964

986

1,024

1,046

1,084

TITAN 1,448 1,463

1,486

1,500

1,524

ULTRACEMCO 5,281 5,366

5,512

5,597

5,743

UPL

504

513

521

530

537

WIPRO

422

430

445

453

468

www.angelbroking.com

Technical & Derivatives Report

January 18, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelbroking.com

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com