www.angelbroking.com

Technical & Derivatives Report

June 17, 2020

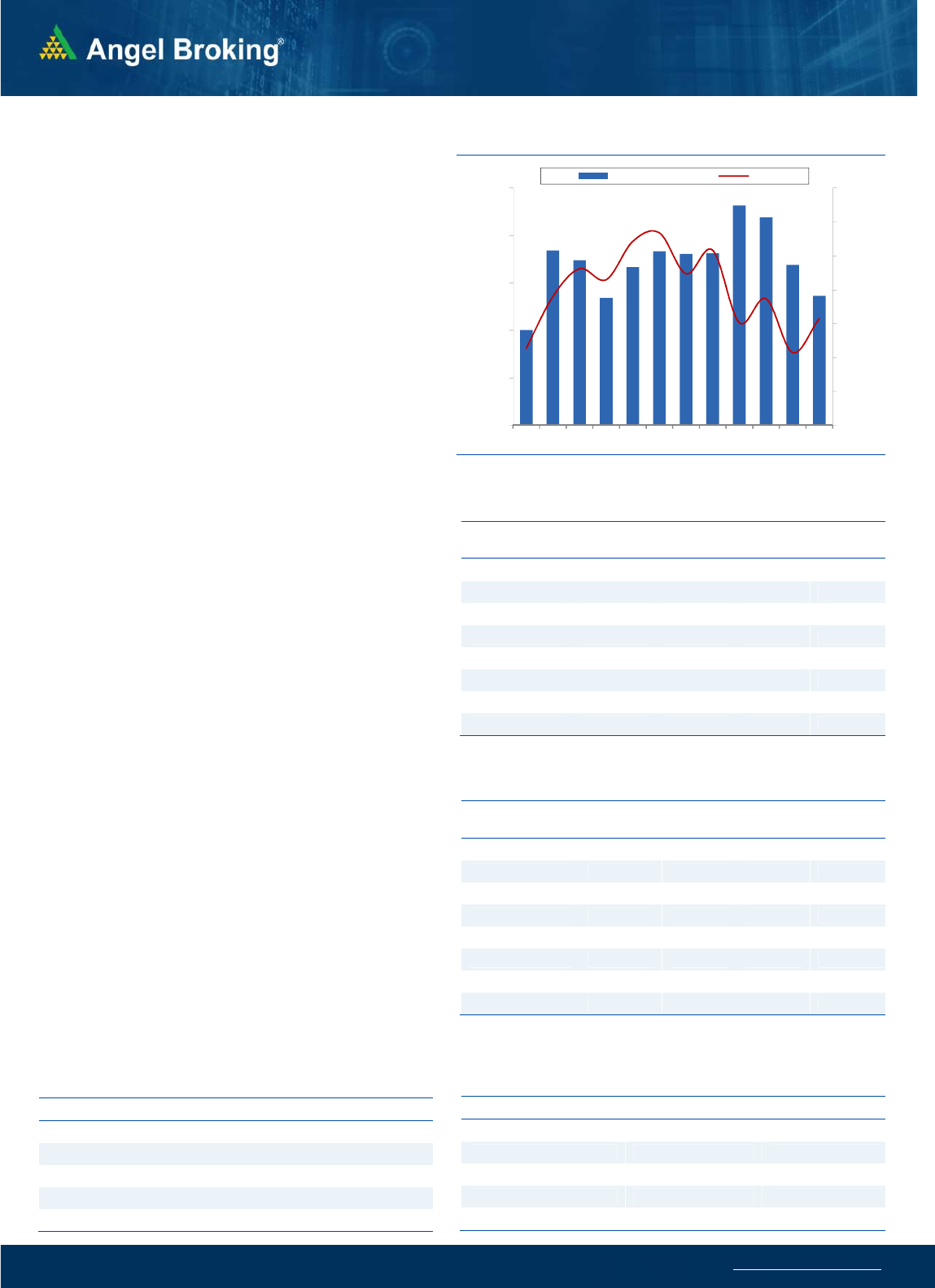

Nifty

Bank Out

look

-

(

20297

)

The Bank Nifty index too opened positive at 20500, but it

gradually crept lower and then it dipped sharply post the news of

violent face-off of Indian soldiers with Chinese troops. However,

post that initial sharp reaction, the index recovered from the low

of about 19500 and ended the day with gains of around 2 percent

at 20300.

Although we saw a sharp reaction to the above news, the index

again witnessed some buying interest at lower levels led by the

index heavyweights such as HDFC Bank, ICICI Bank and Kotak

Bank. The index has formed a support in the range of 19500-

19700 in last three sessions which is around the '200 SMA' on the

hourly chart. One should avoid forming any short positions till this

support is intact. Infact, we have witnessed some buying interest

in this range and hence, traders should look for stock specific

buying opportunities and trade with a positive bias. The

immediate resistance for Bank Nifty is seen in the range of 20650-

20750.

Key Levels

Support 1 – 19700 Resistance 1 – 20650

Support 2 – 19500 Resistance 2 – 20750

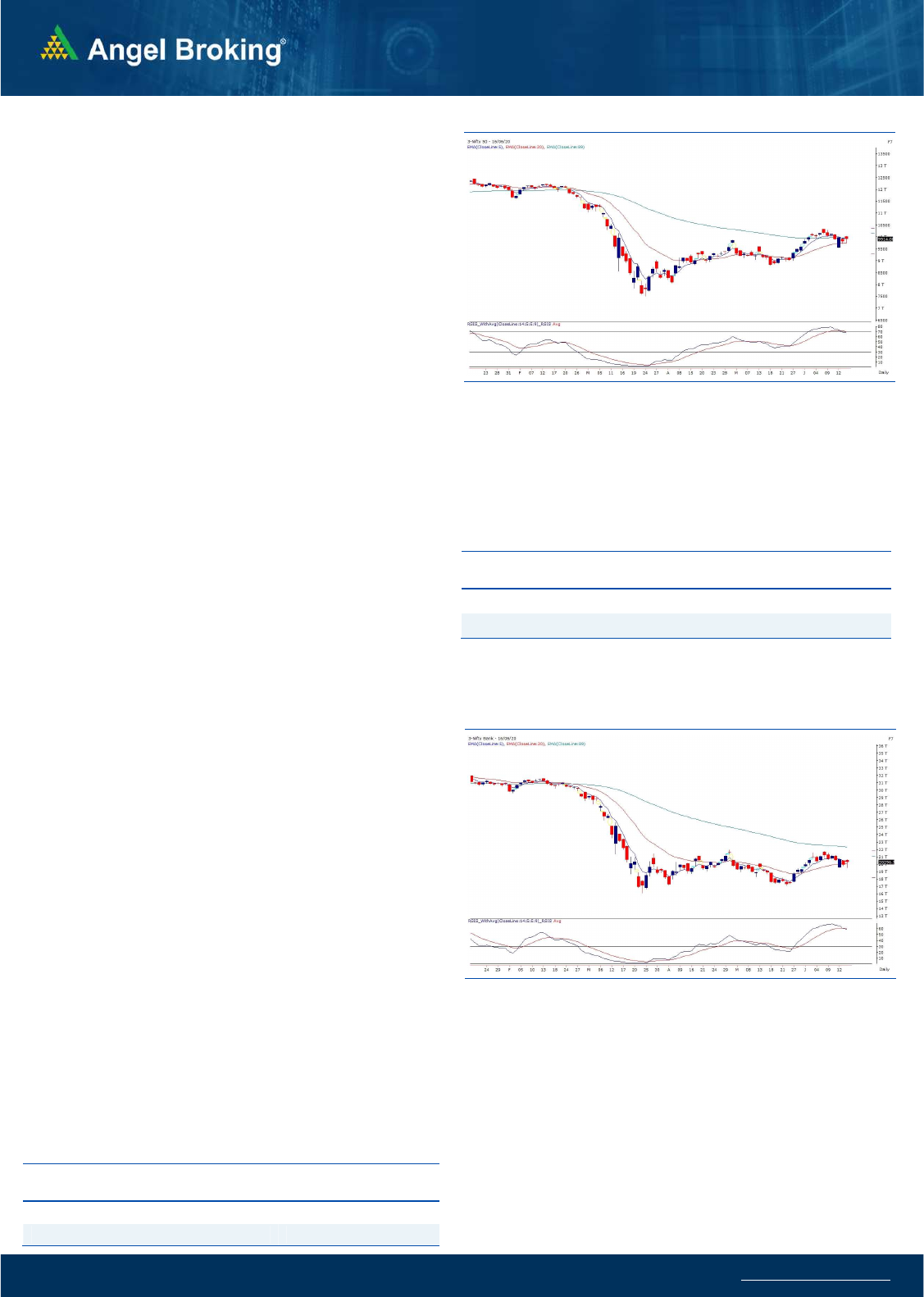

Exhibit 1: Nifty Daily Chart

Sensex (33605) / Nifty (9914)

When we closed on Monday, DOW future was trading deeply in

red and there was complete turnaround seen overnight. US

markets saw v-shaped recovery to close well inside the positive

territory and yesterday morning too the DOW future started with

a bang. Undoubtedly we had to follow these cues and as a result,

we started with a good bump up at the opening beyond the

10000 mark. Post this, market consolidated and looked a bit

uncomfortable at higher levels.

Finally at the midst of the day, we got to know why markets were

struggling. They probably had some hints about what happened

at INDIA-CHINA border Monday night. The moment the news was

out of ‘Face-off’, our markets took a nosedive and within no time,

we were considerably off highs. As we all know, market never

accept such geopolitical uncertainty. Fortunately, after the initial

knee jerk reaction, market stabilised and then gave a steady

recovery to conclude the day tad above 9900. At the opening,

things were very much in line with our expectations, as we had

mentioned about the cluster of supports for DOW JONES and

DAX, while they were falling on Monday. But due to some tension

at the domestic front, we failed to sustain at higher levels. Despite

all this, we managed to reclaim a key level and if there is no further

escalation with respect to our geopolitical concerns, we would

again start moving in tandem with global peers.

Exhibit 2: Nifty Bank Daily Chart

Hence, we still remain hopeful and now with yesterday’s see-saw,

the sacrosanct support can be seen in the zone of 9700-9500. On

the flipside, the next leg of the rally will get unfolded once Nifty

confirms a breakout beyond 10020-10050 levels.

Key Levels

Support 1 – 9700 Resistance 1 – 10020

Support 2 – 9500 Resistance 2 – 10050

www.angelbroking.com

Technical & Derivatives Report

June 17, 2020

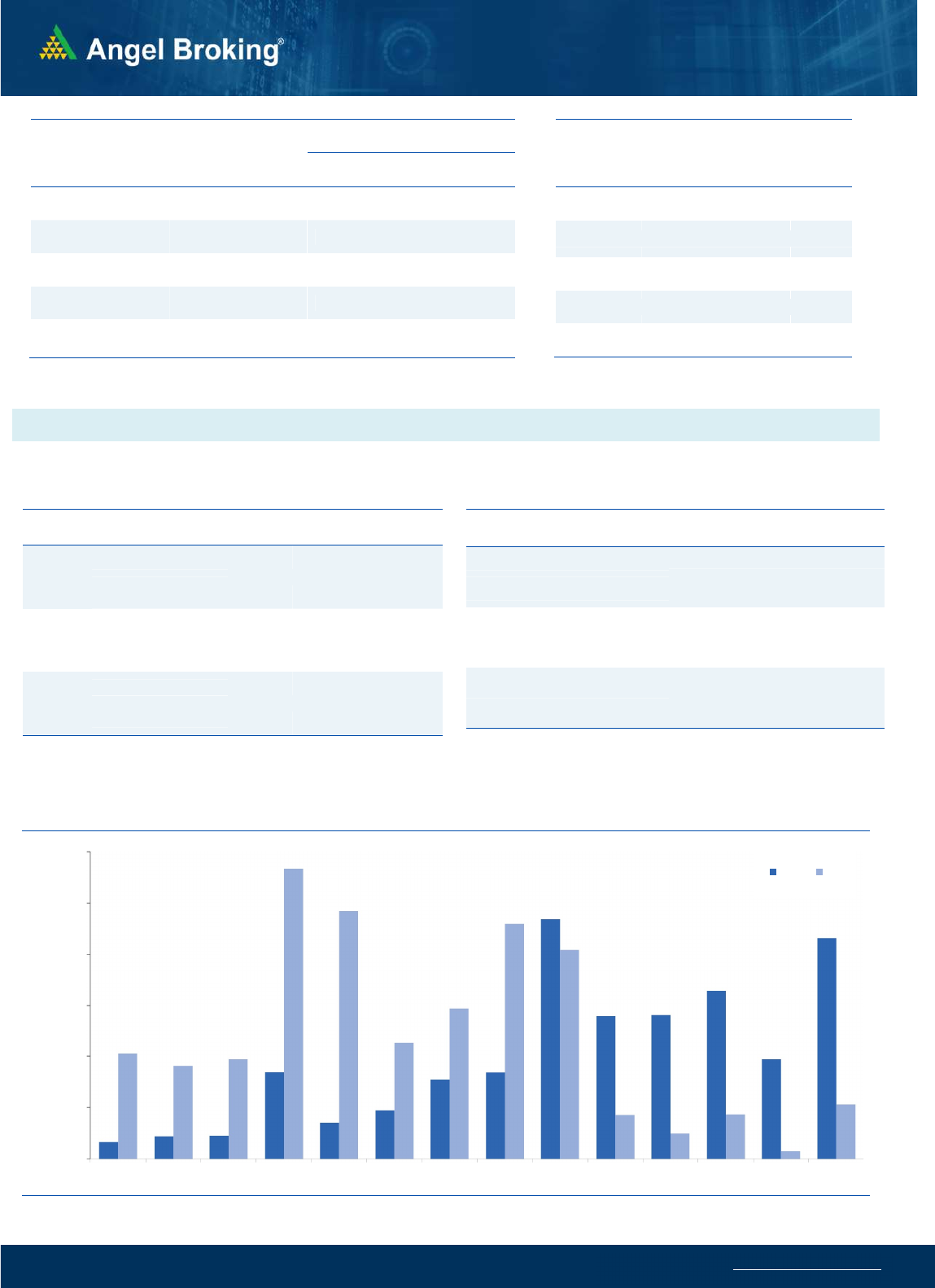

Nifty Vs OI

9600

9700

9800

9900

10000

10100

10200

10300

10,000

10,500

11,000

11,500

12,000

12,500

6/1 6/2 6/3 6/4 6/5 6/8 6/9 6/10 6/11 6/12 6/15 6/16

(`000)

Openinterest Nifty

V

iew

s

Nifty witnessed a big gap up opening however it was

followed by a volatile session as we witnessed swings

on both the side of trend. Nifty eventually ended with

gains of a percent at 9914.

FIIs were net sellers in the cash market segment to the

tune of Rs. 1479 crores. In index futures, they bought

worth 114 crores with no relevant change in open

interest.

Post a gap up opening, the indices traded with higher

volatility yesterday due to the news of India-China

border face-off. This led to some uncertainty due to

which we saw unwinding of positions in Nifty as well as

Bank Nifty. FII’s were net sellers in the cash segment

while they formed marginal longs in index futures

segment. Their ‘Long Short Ratio’ is around 48 percent

now. In options segment, 10000-10200 call options

witnessed addition of open interest indicating

resistance in this range. On the flipside, 9500 is the

immediate support for the index. Considering the open

interest build-up in the weekly as well as the monthly

expiry, it seems the index would oscillate within the

broad range of 9500-10200. Within this broad range,

traders are advised to trade with a stock specific

approach as there could be opportunities to trade on

both sides of trade.

C

o

mm

e

n

t

s

The Nifty futures open interest has decreased by 2.79%

Bank Nifty futures open interest has decreased by 8.44%

as market closed at 9914 levels.

The Nifty June future closed with a discount of 16.15

point against a premium of 0.05 point in last trading

session. The July series closed at a discount of 36.4 point.

The INDIA VIX has increased from 32.57 to 32.96

At the same time, the PCR-OI of Nifty decreased from

1.34 to 1.28.

Few of the liquid counters where we have seen high cost

of carry are IDEA, ADANIENT, L&TFH, EQUITAS and

JINDALSTEL.

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

JINDALSTEL 20040000 27.85 143.50 5.69

TATAMOTORS 91166400 15.12 94.75 -5.82

AXISBANK 69598800 12.21 381.55 -1.94

BALKRISIND 1480000 11.92 1199.20 4.98

GODREJPROP 436800 10.89 818.15 0.05

BATAINDIA 1191300 5.97 1330.35 -0.70

L&TFH 25234800 5.95 61.20 -1.13

PVR 1671600 5.58 989.75 -3.59

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

UBL 1061200 -11.76 1004.45 0.01

TORNTPOWER 1608000 -7.75 324.75 -0.32

IDEA 264096000 -7.13 9.75 -3.45

NIITTECH 411000 -6.16 1347.15 0.85

VOLTAS 3605000 -5.31 549.60 0.27

LICHSGFIN 7106500 -5.18 283.90 5.51

BHEL 46668200 -5.16 28.35 -2.74

TATASTEEL 23225900 -4.90 308.95 1.24

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 1.28 1.06

BANKNIFTY 0.86 0.96

RELIANCE 0.71 0.52

ICICIBANK 0.64 0.70

INFY 0.52 0.51

Historical Volatility

SCRIP HV

HDFCBANK 44.85

GODREJCP 48.35

BALKRISIND 61.88

LICHSGFIN 67.70

TATAMOTORS 77.32

www.angelbroking.com

Technical & Derivatives Report

June 17, 2020

Note: Above mentioned Bullish or Bearish Spreads in Nifty (June Series) are given as an information and not as a recommendation.

Nifty Spot =

9914

FII Statistics for June 16, 2020

Detail Buy Sell Net

Open Interest

Contracts

Value

(in Cr.)

Change

(%)

INDEX

FUTURES

7999.56

7885.61

113.95

123819

8134.51

0.19

INDEX

OPTIONS

312916.39

312885.76

30.63

828599

55428.90

2.86

STOCK

FUTURES

17100.98

16732.31

368.67

1549379

82304.40

0.60

STOCK

OPTIONS

6180.76

6217.35

(36.59) 106551

5856.64

0.38

Total 344197.69

343721.03

476.66

2608348

151724.45

1.28

Turnover on June 16, 2020

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures 9,01,556 48443.74 22.73

Index Options 2,66,32,072

15,10,220.83 45.31

Stock Futures 10,81,590 55981.35 5.29

Stock Options 13,75,680 77597.72 9.38

Total 2,99,90,898

16,92,243.64 40.68

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy 9900 205.80

50.65 49.35 9950.65

Sell 10000 155.15

Buy 9900 205.80

92.05 107.95 9992.05

Sell 10100 113.75

Buy 10000 155.15

41.40 58.60 10041.40

Sell 10100 113.75

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy 9900 209.95

40.25 59.75 9859.75

Sell 9800 169.70

Buy 9900 209.95

72.70 127.30 9827.30

Sell 9700 137.25

Buy 9800 169.70

32.45 67.55 9767.55

Sell 9700 137.25

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

9200 9300 9400 9500 9600 9700 9800 9900 10000 10100 10200 10300 10400 10500

Call Put

www.angelbroking.com

Technical & Derivatives Report

June 17, 2020

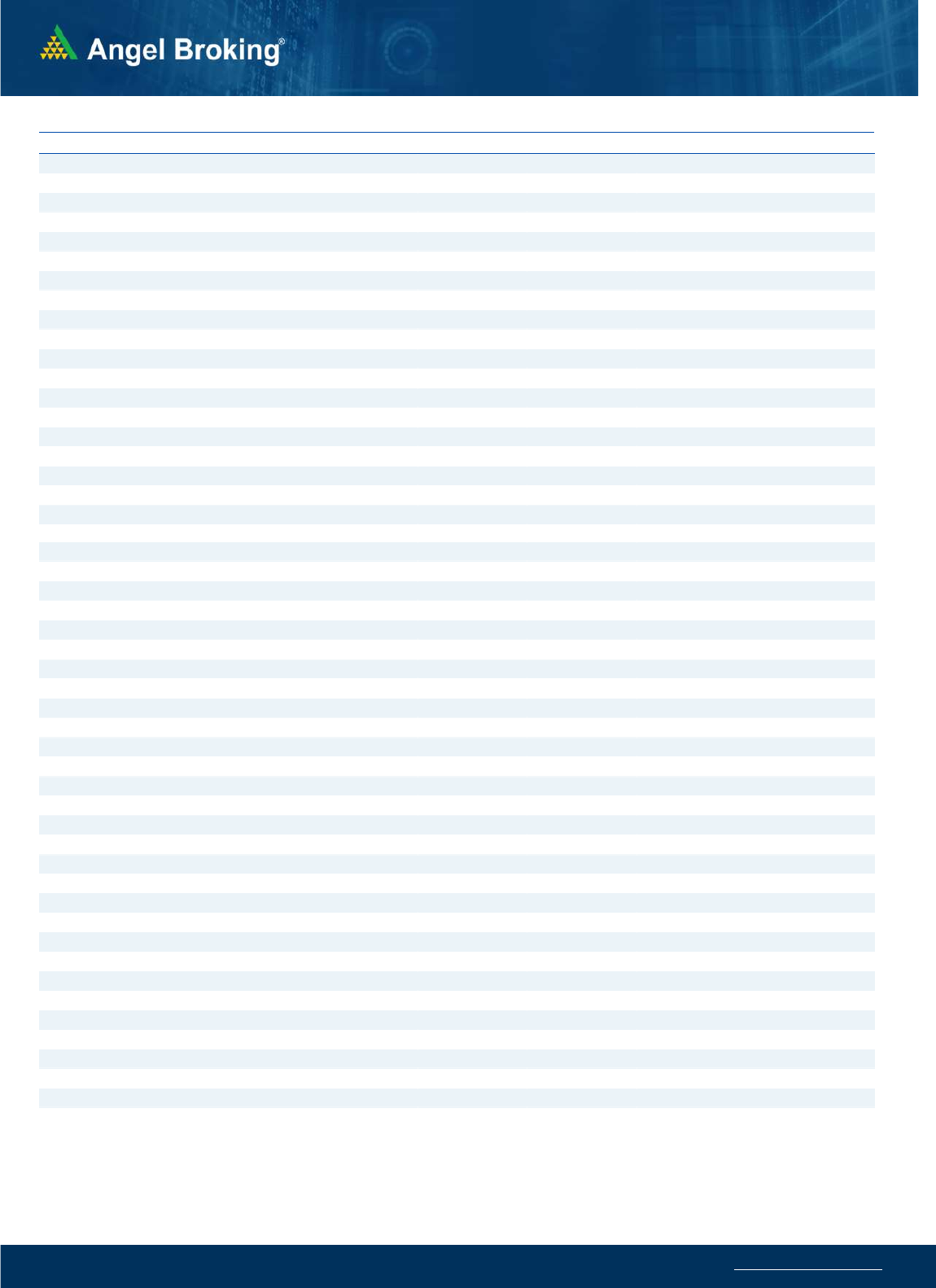

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

330

335

341

347

352

ASIANPAINT 1,591 1,606

1,623

1,639

1,656

AXISBANK

338

360

382

404

427

BAJAJ-AUTO 2,652 2,685

2,736

2,769

2,820

BAJFINANCE 2,198 2,282

2,368

2,452

2,539

BAJAJFINSV 4,837 4,983

5,126

5,272

5,416

BPCL

347

354

363

369

378

BHARTIARTL

525

535

547

557

569

INFRATEL

206

211

220

225

234

BRITANNIA 3,288 3,317

3,358

3,387

3,428

CIPLA

623

630

640

648

658

COALINDIA

126

129

132

134

137

DRREDDY 3,885 3,945

4,013

4,073

4,140

EICHERMOT 16,079

16,394

16,697

17,012

17,315

GAIL

92

95

98

101

105

GRASIM

567

578

591

602

616

HCLTECH

569

575

584

590

599

HDFCBANK

937

964

979

1,006

1,021

HDFC 1,742 1,782

1,808

1,848

1,874

HEROMOTOCO

2,322

2,359

2,397

2,434

2,473

HINDALCO

143

146

151

154

158

HINDUNILVR 2,021 2,049

2,084

2,112

2,147

ICICIBANK

317

330

339

352

361

IOC

81

83

86

87

90

INDUSINDBK

426

454

484

512

543

INFY

691

696

704

709

717

ITC

177

181

186

190

195

JSW STEEL

180

185

191

195

201

KOTAKBANK 1,213 1,245

1,270

1,302

1,328

LT

870

883

904

916

937

M&M

491

499

509

517

527

MARUTI 5,292 5,397

5,505

5,610

5,717

NESTLEIND 16,075

16,209

16,403

16,537

16,731

NTPC

91

92

93

95

96

ONGC

81

82

84

86

87

POWERGRID

159

161

163

165

168

RELIANCE 1,554 1,586

1,617

1,649

1,680

SHREECEM 21,410

21,761

22,150

22,501

22,890

SBIN

164

169

174

178

183

SUNPHARMA

467

475

484

492

501

TCS 2,007 2,027

2,050

2,070

2,093

TATAMOTORS

85

90

97

102

108

TATASTEEL

290

299

311

321

332

TECHM

515

524

540

550

566

TITAN

918

938

954

974

990

ULTRACEMCO 3,686 3,733

3,782

3,829

3,877

UPL

398

406

418

426

437

VEDANTA

100

102

104

106

108

WIPRO

205

209

213

217

222

ZEEL

155

159

166

170

177

www.angelbroking.com

Technical & Derivatives Report

June 17, 2020

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelbroking.com

For Technical & Derivatives Queries E-mail: technic[email protected]

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com