Technical & Derivatives Report

February 15, 2018

Sensex (34156) / Nifty (10501)

Exhibit 1: Nifty Hourly Chart

Some cooling off in the US markets resulted into a gap up

opening in our benchmarks by a small margin. However, this

early morning lead was very short lived as we witnessed a hint of

profit booking in the early trades. This was followed by a long

consolidation in a narrow range; however, a strong bout of

selling towards the fag end resulted into a nosedive below

the 10500 mark.

In our previous article, we had mentioned a formation of

‘Symmetrical Triangle’ which was visible on hourly chart.

Yesterday’s high precisely coincided with the higher boundary

(10590) of this pattern and a failure to surpass this hurdle

resulted into a sell off. In fact, the index went on to violate the

lower boundary of 10490 in the final trades. Hence, going

ahead, a sustainable move below 10455 would reinforce the

selling pressure in the market. In this scenario, we may see

extension of this corrective move towards 10400 - 10347 levels.

On the flipside, 10527 followed by 10590 would be seen as

immediate resistance levels. The PSU banking space was the

party spoiler yesterday as we saw massive cut in individual names

within this basket. Going ahead, one needs to keep a close eye

on this basket as a follow-through selling may result into further

dampness in the market.

Key Levels

Support 1 - 10455

Resistance 1 - 10527

Support 2 - 10400

Resistance 2 - 10590

Nifty Bank Outlook - (25341)

Exhibit 2: Nifty Bank Daily Chart

Although the Nifty Bank index opened marginally positive

yesterday along with the benchmark indices, the stocks from the

banking sector were in the bear grip right from the word go. The

sell-off accelerated towards the end of the session and the Nifty

Bank index eventually ended the session with a loss of

1.40

percent.

The underperformer PSU Banking space continued to witness

negative news first in form of disappointing quarterly results by

the heavyweight SBI in the weekend gone by, followed by the

news of PNB detecting

$1.77 billion worth of fraudulent

transactions. Also RBI came out with new framework for NPA

resolutions which market participants perceived as a possible

short-term pain for the banks. All this turned up the heat which

led to the sell-off and technically speaking, this indicates a

continuation of the corrective phase which the index has

been undergoing since the start of this month. Going ahead, the

near term support is placed at the recent low of 25024, breach of

which could extend the correction upto its '200 DMA' placed

around 24600. Hence, we advise traders to avoid any bottom

fishing and stay light in this sector. On the flipside, 25800 has

now become a short-term resistance.

Key Levels

Support 1 - 25212

Resistance 1 - 25480

Support 2 - 25024

Resistance 2 - 25620

Technical & Derivatives Report

February 15, 2018

Comments

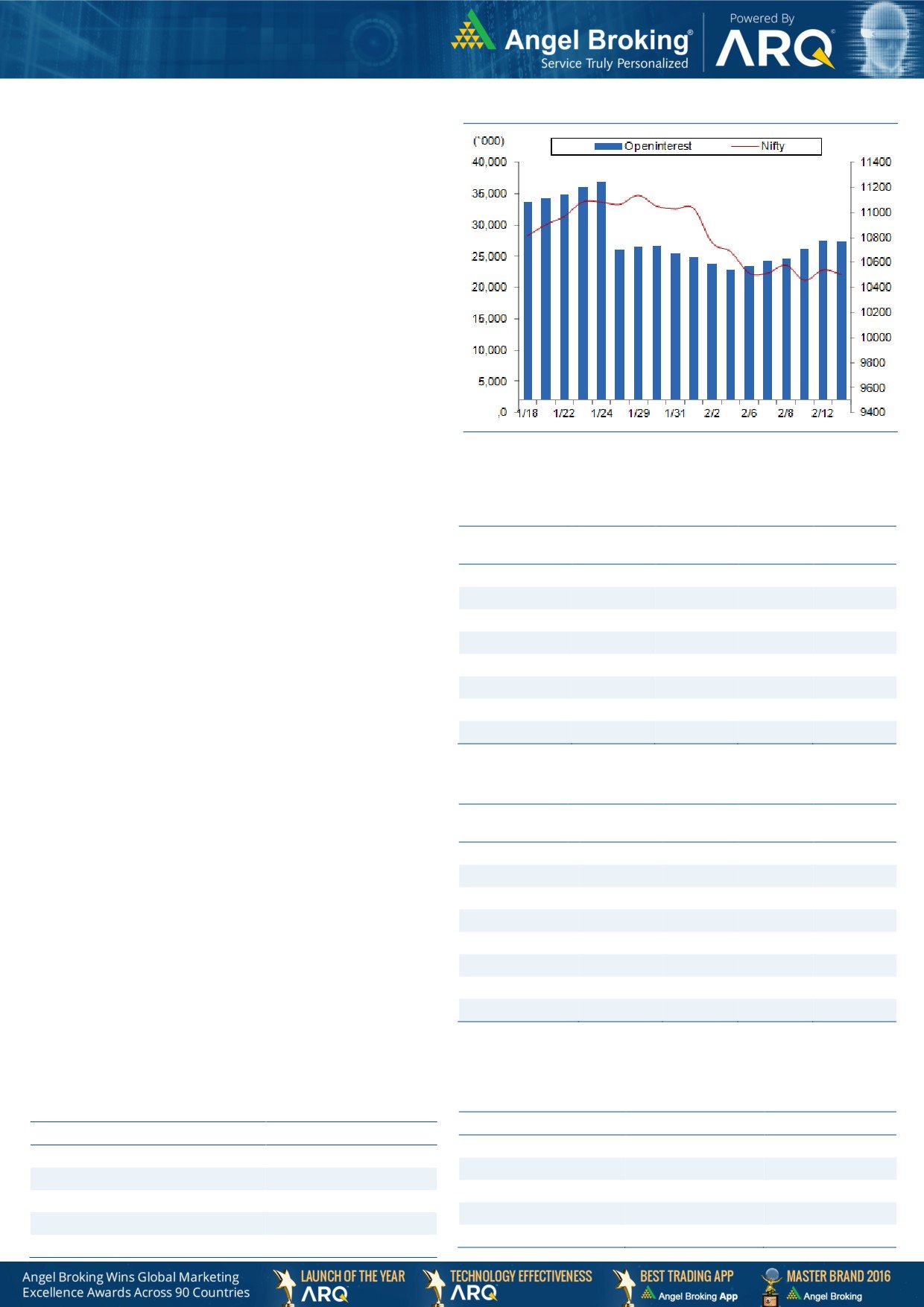

Nifty Vs OI

The Nifty futures open interest has decreased by 0.30%

BankNifty futures open interest has increased by 13.62%

as market closed at 10500.90 levels.

The Nifty February future closed with a discount of 5.70

points against a premium of 3.35 points in last trading

session. The March series closed at a premium of 18.95

points.

The INDIA VIX has decreased from 17.88 to 17.18. At

the same time, the PCR-OI of Nifty has decreased from

1.11 to 1.09 level.

Few of the liquid counters where we have seen high cost

of carry are DISHTV, SAIL, PTC, REPCOHOME and

BEML.

Views

FIIs continued selling in cash market segment to the tune

OI Gainers

of Rs. 729 crores. While, they were net buyers in index

OI

PRICE

futures of Rs. 1039 crores with negligible fall in open

SCRIP

OI

PRICE

CHG. (%)

CHG. (%)

interest, indicating formation of some long positions

PNB

55732000

34.57

146.20

-9.67

along with short covering in last trading session.

BANKINDIA

25548000

28.91

133.00

-8.31

In index options front, they were net buyers of Rs. 1733

ORIENTBANK

21282000

27.50

103.75

-7.94

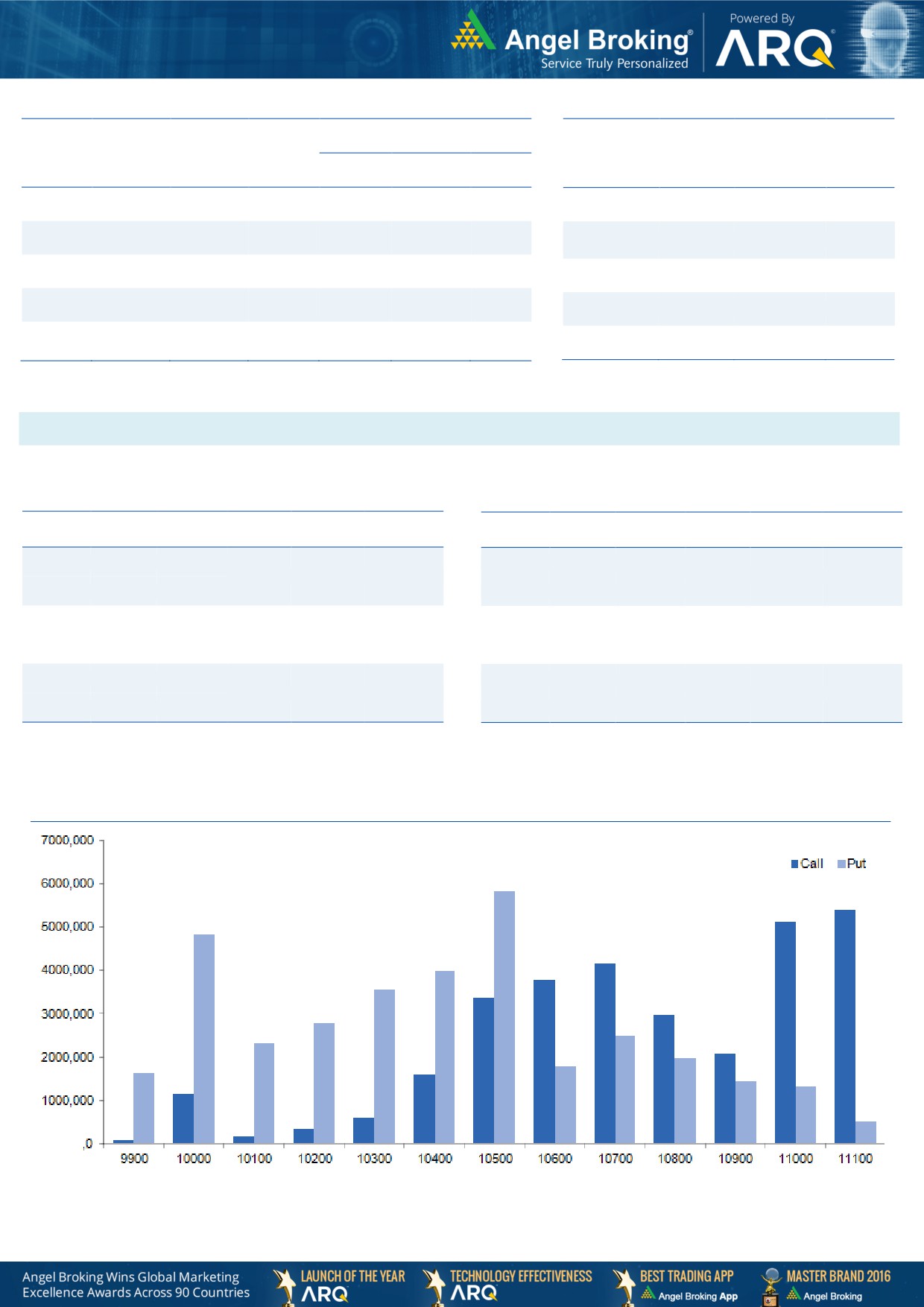

crores with rise in open interest. In Nifty call options, OI

SBIN

79407000

16.16

276.85

-4.32

build up was seen in 10500-10700 strikes; whereas in

ALBK

22360000

15.44

56.15

-8.10

put options OI build up was seen in 10500 strike along

SYNDIBANK

30195000

13.15

63.05

-4.32

with unwinding seen in 10000-10400 strikes. Now,

NCC

32856000

12.46

126.60

6.79

maximum open interest concentration stood at 11100

KAJARIACER

1506400

11.82

603.75

-1.09

call and 10500 put options.

In yesterday’s session, FII’s squared off some of their

short positions in index fut. and also formed some fresh

OI Losers

longs. However, they have also bought put options in

OI

PRICE

SCRIP

OI

PRICE

yesterday’s session. Overall, they continue to be net short

CHG. (%)

CHG. (%)

in the index fut. segment and considering their recent

IGL

6014250

-10.48

307.20

1.55

activity, we continue with our cautious stance on the

BATAINDIA

2808300

-6.93

717.75

0.24

market. As expected, the index witnessed selling pressure

MGL

1225200

-6.42

1035.75

1.01

from higher levels in yesterday’s session and hence,

JUSTDIAL

3952200

-6.06

465.85

-1.92

unless we see any meaningful change in data, indices

CEATLTD

1269100

-4.95

1620.00

0.51

are expected to trade with a negative bias.

SIEMENS

838500

-4.77

1275.45

1.33

TORNTPOWER

3924000

-4.53

271.55

0.50

SUNTV

3791000

-4.10

997.85

1.64

Put-Call Ratio

Historical Volatility

SCRIP

PCR-OI

PCR-VOL

SCRIP

HV

NIFTY

1.09

0.88

BANKINDIA

59.28

BANKNIFTY

0.79

0.73

ORIENTBANK

58.00

SBIN

0.42

0.58

ALBK

59.21

RELIANCE

0.47

0.38

PNB

74.22

ITC

0.31

0.23

YESBANK

39.31

Technical & Derivatives Report

February 15, 2018

FII Statistics for February 14, 2018

Turnover on February 14, 2018

Open Interest

No. of

Turnover

Change

Detail

Buy

Sell

Net

Instrument

Value

Change

Contracts

( in Cr. )

(%)

Contracts

(in Cr.)

(%)

INDEX

INDEX

2810.09

1770.68

1039.41

265544

21641.97

(0.13)

234570

20718.25

16.87

FUTURES

FUTURES

INDEX

INDEX

74563.81

72830.69

1733.12

1063988

86198.89

3.11

6204280

581863.98

79.78

OPTIONS

OPTIONS

STOCK

9258.02

9159.95

98.06

1112525

79525.98

1.05

STOCK

FUTURES

792006

58496.55

6.31

FUTURES

STOCK

STOCK

8978.33

8920.75

57.58

116263

8603.46

2.69

638516

49699.87

9.84

OPTIONS

OPTIONS

Total

95610.25

92682.07

2928.17

2558320

195970.30

1.85

TOTAL

7869372

710778.64

60.93

Nifty Spot = 10500.90

Lot Size = 75

Bull-Call Spreads

Bear-Put Spreads

Action

Strike

Price

Risk

Reward

BEP

Action

Strike

Price

Risk

Reward

BEP

Buy

10500

106.80

Buy

10500

110.65

45.35

54.65

10545.35

32.75

67.25

10467.25

Sell

10600

61.45

Sell

10400

77.90

Buy

10500

106.80

Buy

10500

110.65

77.10

122.90

10577.10

59.00

141.00

10441.00

Sell

10700

29.70

Sell

10300

51.65

Buy

10600

61.45

Buy

10400

77.90

31.75

68.25

10631.75

26.25

73.75

10373.75

Sell

10700

29.70

Sell

10300

51.65

Note: Above mentioned Bullish or Bearish Spreads in Nifty (February Series) are given as an information and not as a recommendation.

Nifty Put-Call Analysis

Technical & Derivatives Report

February 15, 2018

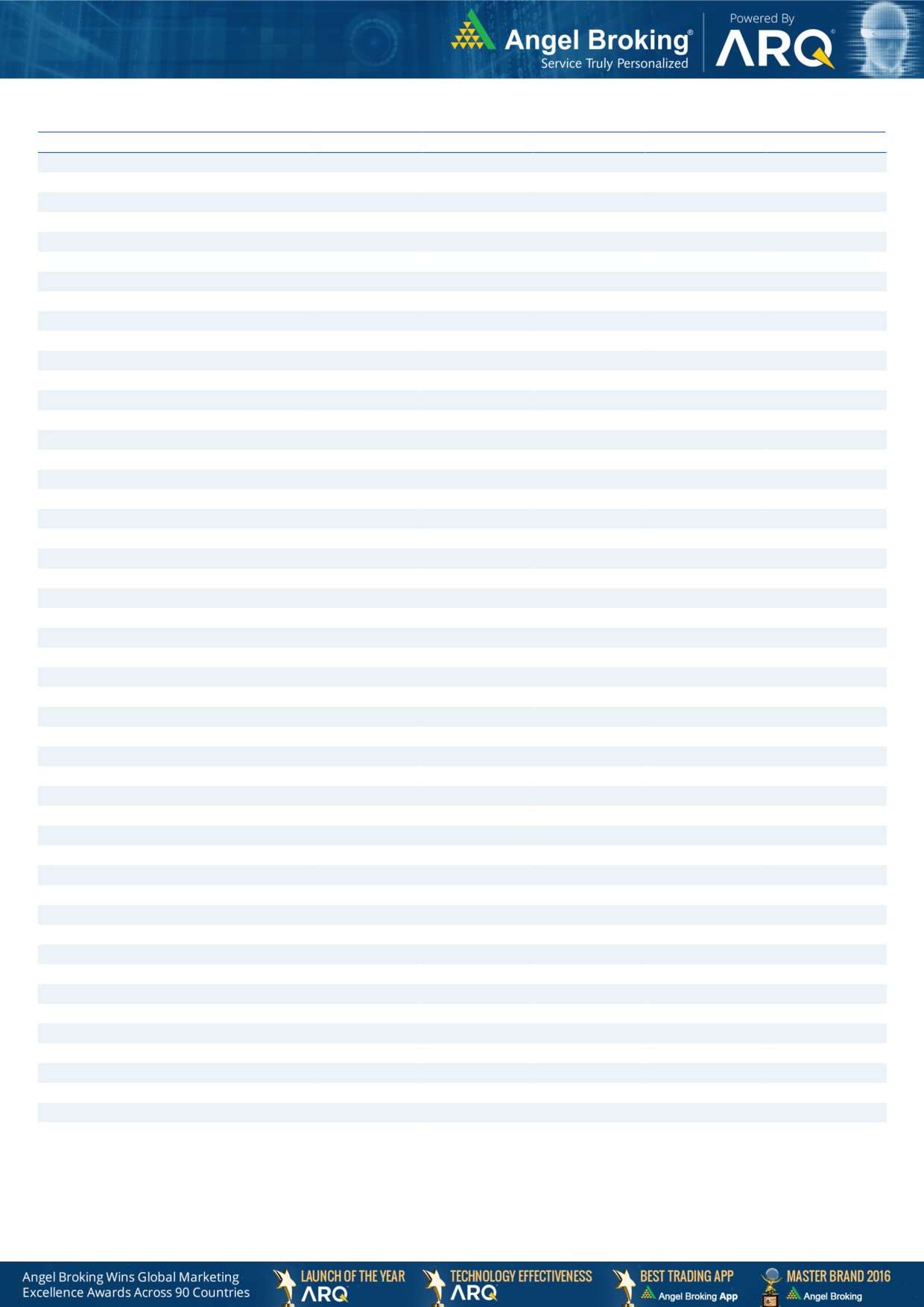

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

400

406

412

418

423

AMBUJACEM

250

252

255

257

261

ASIANPAINT

1,120

1,129

1,137

1,146

1,154

AUROPHARMA

590

596

605

612

621

AXISBANK

524

534

550

560

576

BAJAJ-AUTO

3,063

3,087

3,123

3,146

3,183

BAJFINANCE

1,627

1,649

1,673

1,694

1,718

BPCL

452

456

463

467

474

BHARTIARTL

421

428

433

440

445

INFRATEL

316

322

331

337

346

BOSCHLTD

19,372

19,443

19,542

19,613

19,712

CIPLA

601

608

619

627

638

COALINDIA

296

301

305

311

315

DRREDDY

2,145

2,164

2,195

2,214

2,245

EICHERMOT

27,534

27,781

27,999

28,246

28,464

GAIL

457

462

468

473

479

HCLTECH

913

925

943

955

972

HDFCBANK

1,862

1,873

1,885

1,896

1,908

HDFC

1,789

1,802

1,817

1,830

1,845

HEROMOTOCO

3,533

3,564

3,594

3,626

3,656

HINDALCO

239

241

244

246

249

HINDPETRO

371

377

386

392

401

HINDUNILVR

1,324

1,337

1,345

1,358

1,366

IBULHSGFIN

1,301

1,324

1,347

1,370

1,393

ICICIBANK

310

315

321

325

331

IOC

372

375

378

381

384

INDUSINDBK

1,664

1,679

1,694

1,710

1,725

INFY

1,075

1,086

1,102

1,113

1,129

ITC

262

264

268

270

273

KOTAKBANK

1,028

1,035

1,044

1,051

1,059

LT

1,333

1,347

1,360

1,374

1,387

LUPIN

811

819

833

842

856

M&M

736

741

748

753

760

MARUTI

8,877

8,939

9,048

9,111

9,220

NTPC

160

162

164

165

167

ONGC

180

183

187

190

195

POWERGRID

191

193

196

198

201

RELIANCE

911

922

932

944

954

SBIN

266

271

280

285

294

SUNPHARMA

559

567

579

587

600

TCS

2,844

2,878

2,926

2,960

3,008

TATAMOTORS

365

371

377

383

388

TATASTEEL

695

702

711

717

727

TECHM

579

595

605

621

631

ULTRACEMCO

4,127

4,151

4,179

4,203

4,231

UPL

709

716

724

731

740

VEDANTA

306

311

317

322

329

WIPRO

286

290

293

297

300

YESBANK

307

314

326

332

345

ZEEL

564

570

578

585

593

Technical & Derivatives Report

February 15, 2018

Research Team Tel: 022 - 39357800

For Technical Queries

For Derivatives Queries

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the c*ompany covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.