www.angelbroking.com

Technical & Derivatives Report

January 08, 2020

Sensex (40869) / Nifty (12053)

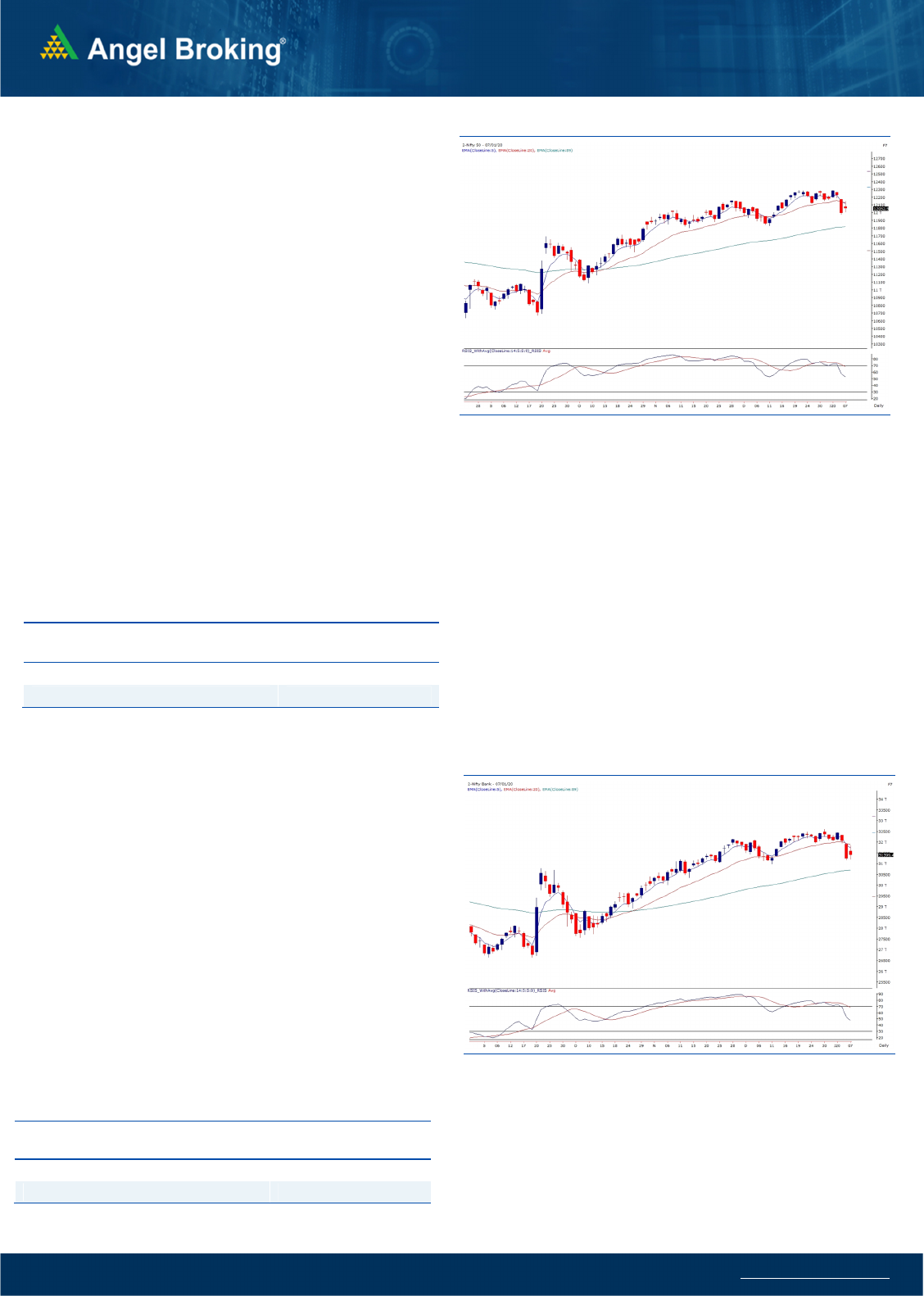

Post the sharp sell-off in Monday's session, our markets opened

on a positive note yesterday as the US and other global markets

were trading in the green. The index rallied higher but resisted

around 12150 mark and then corrected towards the 12000

mark. A mild recovery in the end led to the index closing the

session with gains of about half a percent.

In Monday's trading session, the index had breached the

immediate support of 12150 which now acted as a resistance in

the pullback move yesterday. The index again witnessed some

downmove from the resistance during the day. However, the

overall market breadth was in favor of advances and hence, there

were some stock specific momentum seen during the day. For

near term, 12150-12200 is now seen as a resistance and the

index need to surpass the same for a resumption of its uptrend.

Until we see a breakout above the same, traders are advised to

prefer a stock specific approach and trade with proper risk

management. Monday's low of 11974 is seen as the immediate

support which if breached, then we could see the correction

extending towards 11850-11800 range.

Key Levels

Support 1 – 11974 Resistance 1 – 12120

Support 2 – 11850 Resistance 2 – 12150

Exhibit 1: Nifty

Daily

Chart

Nifty Bank Outlook - (31399)

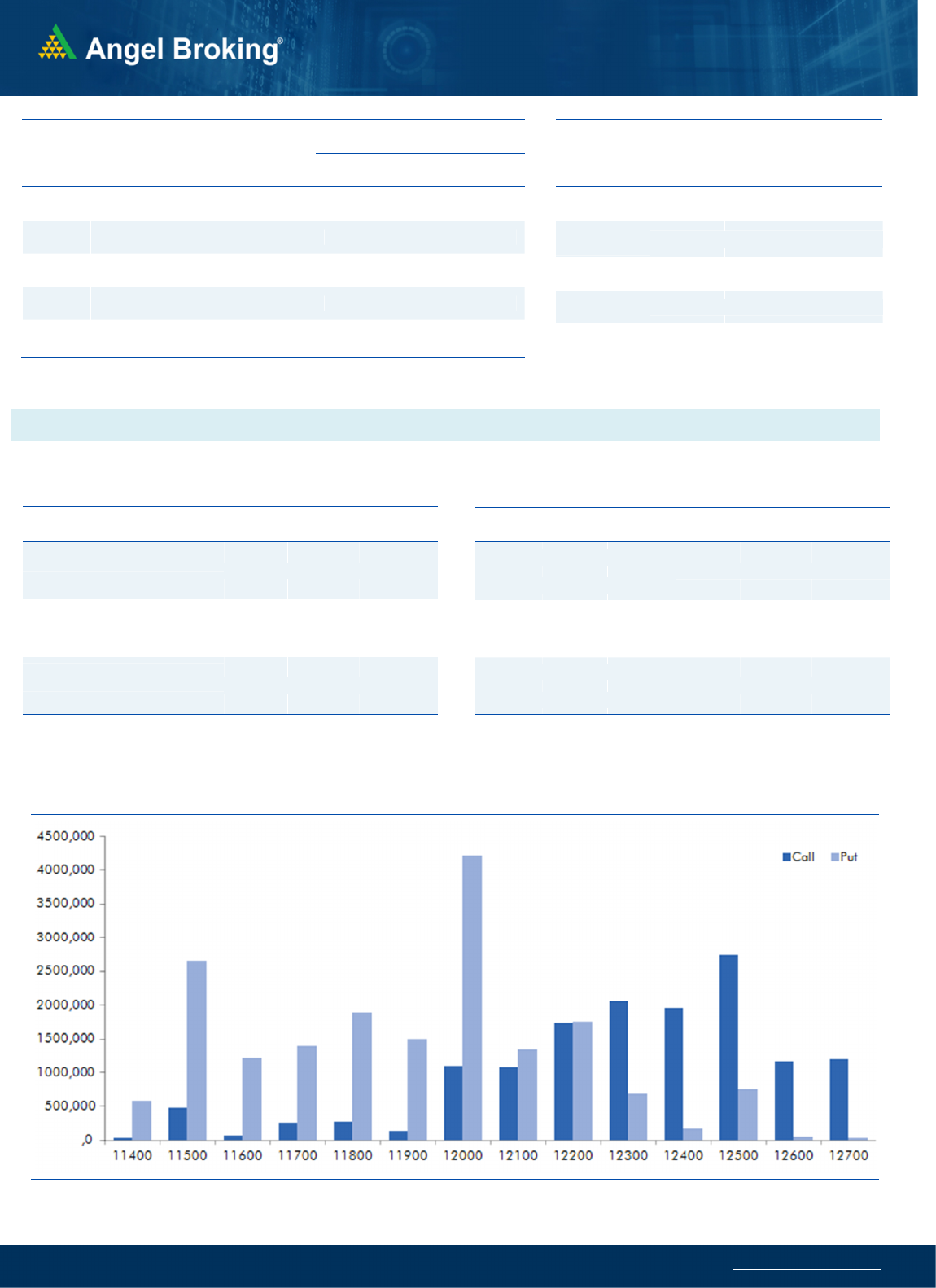

BankNifty too opened on a positive note yesterday and rallied

sharply in the first hour of the trade. At one point, the index was

trading with gains of over 600 points, but this pullback move

witnessed selling pressure from the highs and it gave up all the

gains before ending the session around 31400.

The pullback move in yesterday's session witnessed selling

pressure during the day as the index heavyweights failed to hold

on to the morning gains. The immediate resistance for BankNifty

is seen around 31200 and it needs to be surpassed soon for a

resumption of the uptrend. Untill then, traders are advised to

stay light on positions in stocks within this sector. On the flipside,

the immediate supports for BankNifty are placed around 31000

and 30680.

Key Levels

Support 1 – 31000 Resistance 1 – 31850

Support 2 – 30680 Resistance 2 – 32000

Exhibit 2: Nifty Bank

Daily

Chart

www.angelbroking.com

Technical & Derivatives Report

January 08, 2020

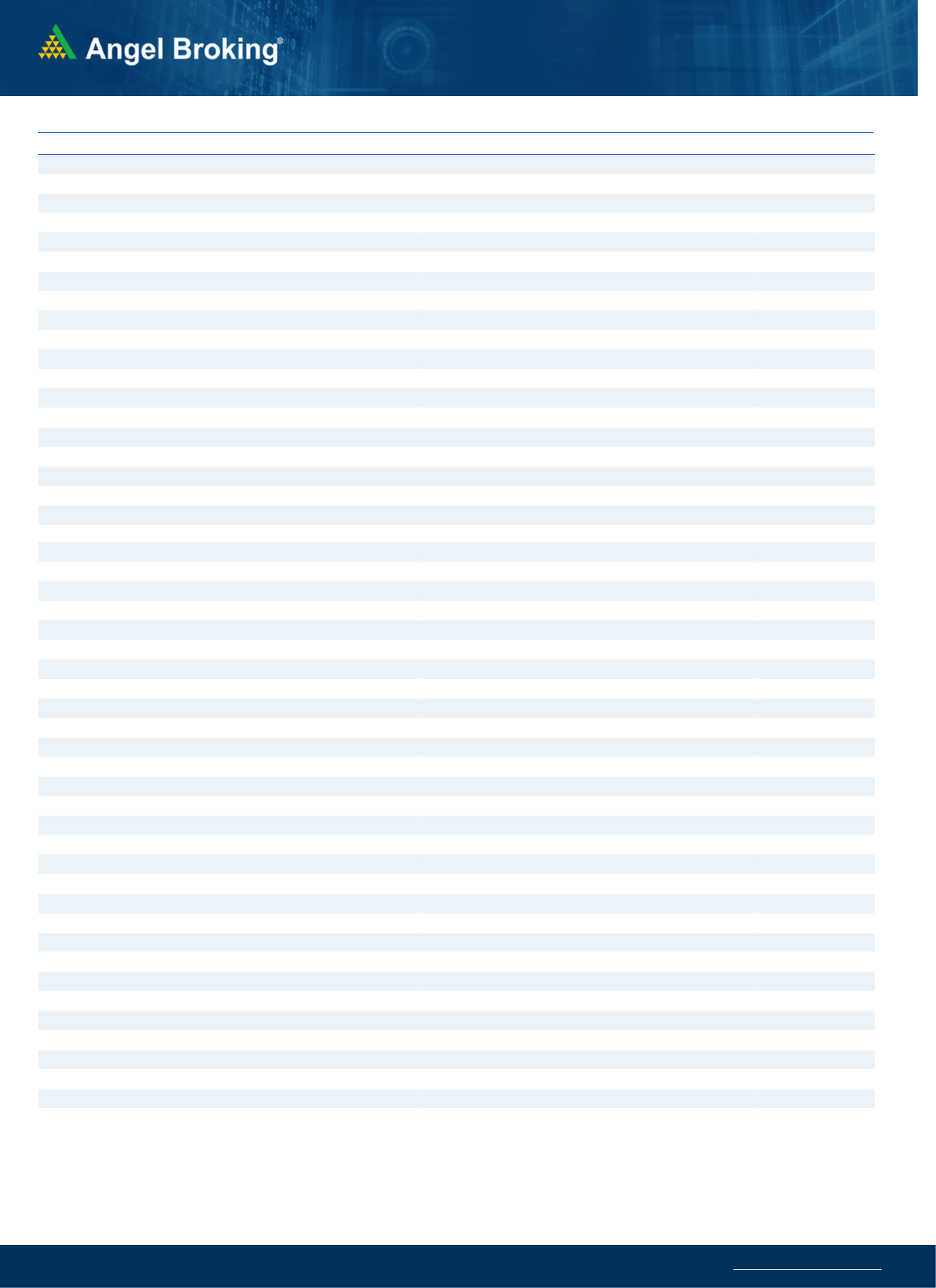

Nifty Vs OI

Views

Yesterday Nifty started on a strong positive note and

in the first hour itself was up by more than 150 points.

However the rub-off effect from the previous session

pulled Index lower to eventually end with half a

percent gains tad above 12050 levels.

FIIs were net sellers in the cash market segment to the

tune of Rs. 682 crores. In index futures, they were net

buyers worth Rs. 1392 crores fall in open interest by

2.31%.

The index rallied higher in the morning yesterday but

we did not witness a continuation of the momentum.

The index resisted around 12200 where there was

good amount of writing seen in the call option in last

two days. The options data indicates a stiff resistance

around 12200 whereas support is seen around 12000

where there is highest open interest in put options. A

move beyond this range of 12000-12200 along with

unwinding in positions will lead to the next directional

move in the index and hence, traders are advised to be

vigilant on the same.

Comments

The Nifty futures open interest has increased by 0.06%

Bank Nifty futures open interest has increased 4.71% as

market closed at 12052.95 levels.

The Nifty January future closed with a premium of 53.75

points against a premium of 50.65 points in last trading

session. The February series closed at a premium of

96.25 points.

The INDIA VIX has increased from 14.47 to 14.61.

At the same time, the PCR-OI of Nifty has increased

from 1.12 to 1.19.

Few of the liquid counters where we have seen high cost

of carry are ICICIBANK, SAIL, CENTURYTEX, LUPIN and

MGL.

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

BIOCON 12645400 12.48 284.15 -1.51

RBLBANK 15730500 8.07 344.00 1.86

GLENMARK 6731200 7.11 343.20 0.89

MINDTREE 1455200 6.94 846.30 1.94

MGL 1981200 6.62 1040.75 -0.76

HINDALCO 41513500 6.34 208.85 -0.05

NMDC 25944000 5.46 128.05 -0.70

INDUSINDBK 11036800 5.33 1461.65 -0.60

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

RAMCOCEM 1012800 -6.64 788.70 4.85

CANBK 14378000 -5.53 208.05 0.70

CADILAHC 6681400 -5.51 257.05 1.00

ASHOKLEY 54240000 -5.08 82.10 2.05

AMARAJABAT 1373600 -5.03 726.25 1.50

ADANIPORTS 32985000 -4.34 384.80 1.10

BALKRISIND 1767200 -3.66 967.50 0.45

INDIGO 3308700 -3.41 1364.05 2.80

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 1.19 0.94

BANKNIFTY 0.77 1.04

RELIANCE 0.70 0.55

ICICIBANK 0.52 0.65

INFY 0.61 0.81

Historical Volatility

SCRIP HV

RAMCOCEM 29.27

SHREECEM 32.04

PFC 42.21

HDFCBANK 20.40

ULTRACEMCO 30.60

www.angelbroking.com

Technical & Derivatives Report

January 08, 2020

Note: Above mentioned Bullish or Bearish Spreads in Nifty (January Series) are given as an information and not as a recommendation.

Nifty Spot

=

1

2052

.

9

5

Lot Size = 75

FII Statistics for

January

0

7

, 2020

Detail Buy Sell Net

Open Interest

Contracts

Value

(in Cr.)

Change

(%)

INDEX

FUTURES

5490.03 4098.38 1391.65

140829 11882.70 (2.31)

INDEX

OPTIONS

372765.96 371890.31 875.65

721941 59571.03 12.62

STOCK

FUTURES

11635.93 11088.59 547.34

1467128 97110.26 0.09

STOCK

OPTIONS

4327.28 4247.98 79.30

52160 3511.28 4.93

Total 394219.20

391325.26

2893.94

2382058

172075.27

3.54

Turnover on

January

0

7

, 20

20

Instrument

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

INDEX

FUTURES

411495 30722.10 11.58

INDEX

OPTIONS

23795432 1708214.05 45.38

STOCK

FUTURES

673263 45968.05 1.32

STOCK

OPTIONS

592956 43424.45 -10.84

TOTAL 2,54,73,146 1828328.65 41.01

Bull

-

Call Spreads

Action Strike Price Risk Reward BEP

Buy 12000 218.85

64.75 35.25 12064.75

Sell 12100 154.10

Buy 12000 218.85

116.15 83.85 12116.15

Sell 12200 102.70

Buy 12100 154.10

51.40 48.60 12151.40

Sell 12200 102.70

Bear

-

Put Spreads

Action Strike Price Risk Reward BEP

Buy 12000 116.95

27.80 72.20 11972.20

Sell 11900 89.15

Buy 12000 116.95

50.05 149.95 11949.95

Sell 11800 66.90

Buy 11900 89.15

22.25 77.75 11877.75

Sell 11800 66.90

Nifty Put

-

Call Analysis

www.angelbroking.com

Technical & Derivatives Report

January 08, 2020

Daily Pivot Levels for Nifty Constituents

Scrips S2 S1

PIVOT

R1

R2

ADANIPORTS 378 382

386 389

393

ASIANPAINT 1,696 1,710

1,725 1,740 1,755

AXISBANK 711 719

728 735

745

BAJAJ-AUTO 3,005 3,021

3,047 3,063 3,089

BAJFINANCE 3,936 3,972

4,032 4,068 4,128

BAJAJFINSV 8,942 9,019

9,142 9,219 9,342

BPCL 450 456

465 471

480

BHARTIARTL 436 440

448 453

460

INFRATEL 231 235

241 244

251

BRITANNIA 3,014 3,025

3,040 3,051 3,066

CIPLA 461 465

467 471

474

COALINDIA 202 204

206 208

210

DRREDDY 2,849 2,867

2,888 2,906 2,927

EICHERMOT 20,320 20,562

20,956 21,198 21,592

GAIL 123 124

125 126

127

GRASIM 724 733

745 754

765

HCLTECH 575 580

584 588

592

HDFCBANK 1,242 1,251

1,261 1,271 1,281

HDFC 2,359 2,387

2,408 2,436 2,457

HEROMOTOCO

2,299

2,323

2,362

2,386

2,425

HINDALCO 204 207

210 212

215

HINDUNILVR 1,910 1,915

1,923 1,928 1,936

ICICIBANK 513 518

527 532

541

IOC 122 123

125 127

129

INDUSINDBK 1,405 1,433

1,471 1,499 1,536

INFY 714 721

732 739

749

ITC 233 234

236 237

239

JSW STEEL 259 262

266 269

273

KOTAKBANK 1,641 1,656

1,665 1,680 1,690

LT 1,299 1,310

1,325 1,335 1,350

M&M 518 522

527 531

536

MARUTI 6,949 7,011

7,089 7,151 7,228

NESTLEIND 14,080 14,185

14,366 14,471 14,652

NTPC 118 119

120 122

123

ONGC 124 125

126 127

129

POWERGRID 189 190

192 194

196

RELIANCE 1,503 1,514

1,524 1,535 1,545

SBIN 309 314

320 325

332

SUNPHARMA 434 440

444 450

454

TCS 2,171 2,188

2,201 2,219 2,232

TATAMOTORS 178 182

185 189

193

TATASTEEL 467 472

478 483

489

TECHM 754 766

772 784

790

TITAN 1,140 1,150

1,162 1,172 1,184

ULTRACEMCO 4,130 4,186

4,220 4,276 4,310

UPL 573 584

594 605

615

VEDANTA 151 153

155 158

159

WIPRO 248 251

254 258

260

YESBANK 43 44

45 46 48

ZEEL 259 264

267 272

275

www.angelbroking.com

Technical & Derivatives Report

January 08, 2020

*

Research Team Tel: 022

-

39357800

Website:

www.angelbroking.com

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

For Derivatives Queries E-mail: derivatives.desk@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel

Broking Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed

or co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate

the contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we

cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this

document. While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there

may be regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or

in connection with the use of this information.