www.angelbroking.com

July 0

7

, 2021

Technical & Derivatives Report

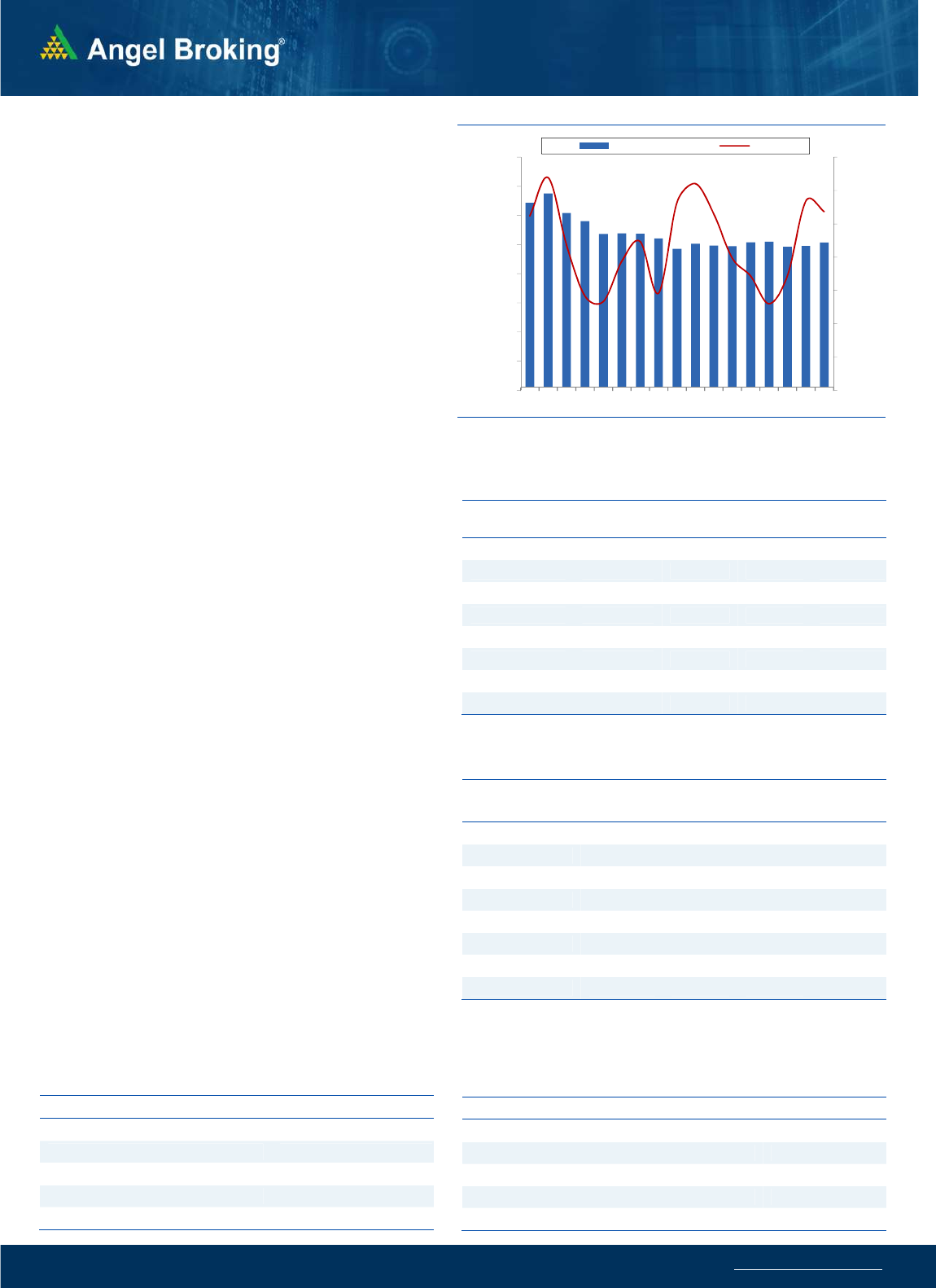

Nifty Bank Outlook

-

(3

5579

)

Yesterday, Bank Nifty started on a flat note however the positive

momentum from the previous session pushed the bank index towards

the 35800 levels. Subsequently, in the last hour, some profit booking

was seen to eventually end with gains of a percent at 35579.

After a very long time, we have seen a clear outperformance by the

banking space and even though the benchmark ended with minor loss

the bank index ended with handsome gains. Now with yesterday's

move, we are witnessing a trendline breakout however with the fag

end profit-booking it just missed to cross above the June swing high

of 35810. Next few sessions will be crucial as if the trend line break out

holds, and if we manage to break above the mentioned swing high,

the banking space can single-handedly push the benchmark index

above the 16000 levels. In such a scenario, traders are advised to focus

on a stock-specific approach within the basket. As far as levels are

concerned, immediate resistance is at 35810 - 36000 whereas support

is at 35160 and 35000 levels.

Key Levels

Support 1 – 35160 Resistance 1 – 35810

Support 2 – 35000 Resistance 2 – 36000

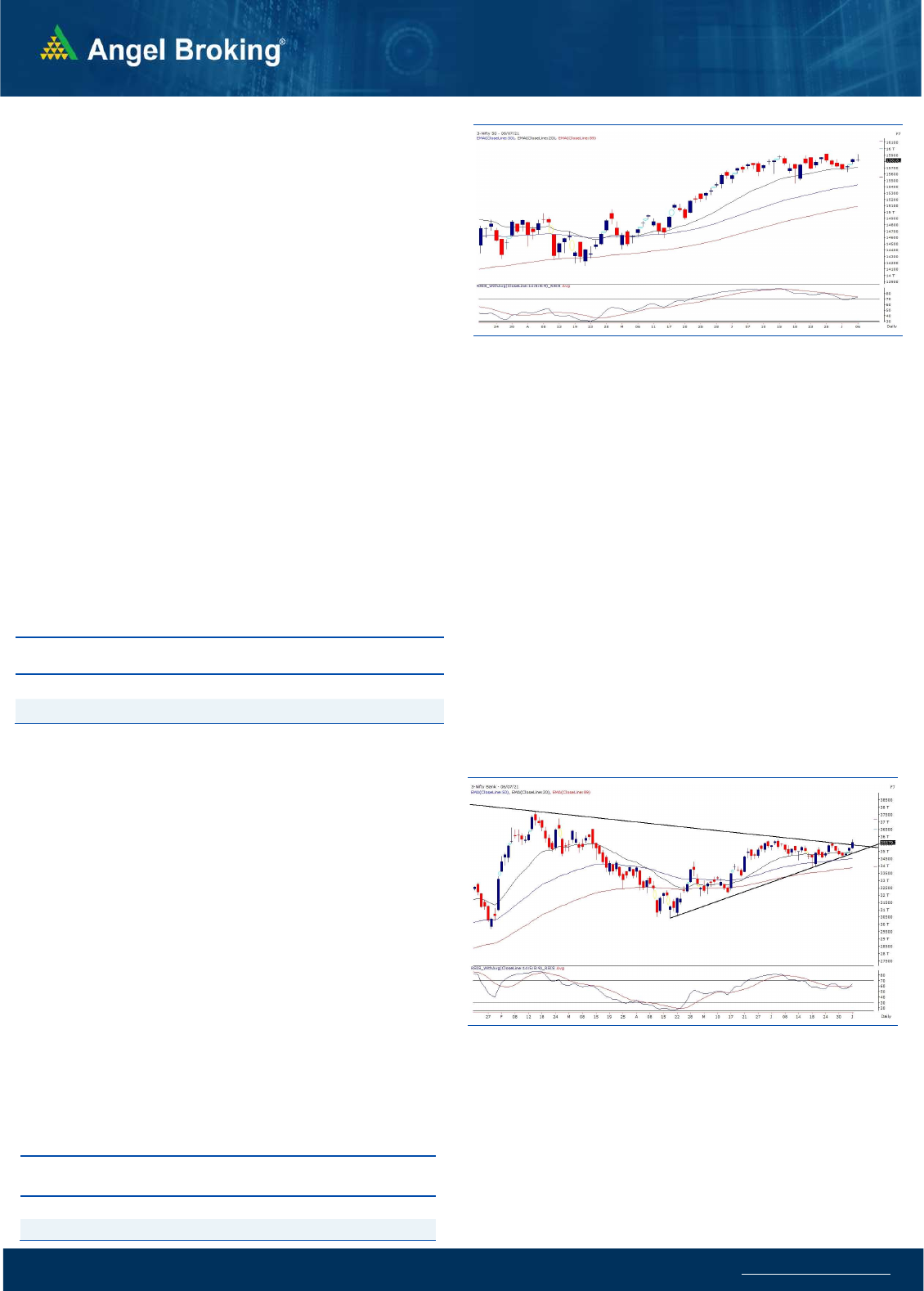

Exhibit 1: Nifty Daily Chart

Exhibit 2: Nifty Bank Daily Chart

Sensex (52861) / Nifty (15818)

Our markets started the day on a flat note as there was no major trigger

from the global peers. Subsequently, the buying momentum accelerated

in some of the financial stocks, which pushed the index higher towards

the record high. There were couple of attempts made post the mid-

session to register a new high; but this again failed as we saw a complete

nosedive at the stroke of the penultimate hour. This sudden profit

booking pared down all gains to conclude the session with nominal loss.

Yesterday, the kind of lead our markets took in the first half (courtesy to

heavyweight financial stocks), the set up was ideal to post a new high.

Nobody knows why market suddenly becomes so nervous when it enters

the 15900 zone. In the process, the daily candle of Nifty forms a small

body which is a sign of uncertainty. But fortunately the heavyweight

banking space still holds its positive posture and this certainly bodes well

for the bulls. Going ahead, this basket remains to be a decider and we

reiterate if Nifty has to reach the millstone of 16000, we need to have

follow up buying in banking constituents.

As far as levels are concerned for Nifty, 15750 – 15700 is to be seen as a

key support zone and on the higher side, 15900 remains a sturdy wall.

Since last few days, individual themes have again started to perform well

and hence, traders are advised to stick to stock centric approach; but at

the same time, avoid being complacent.

Key Levels

Support 1 – 15750 Resistance 1 – 15915

Support 2 – 15700 Resistance 2 – 16000

www.angelbroking.com

Technical & Derivatives Report

July 0

7

, 2021

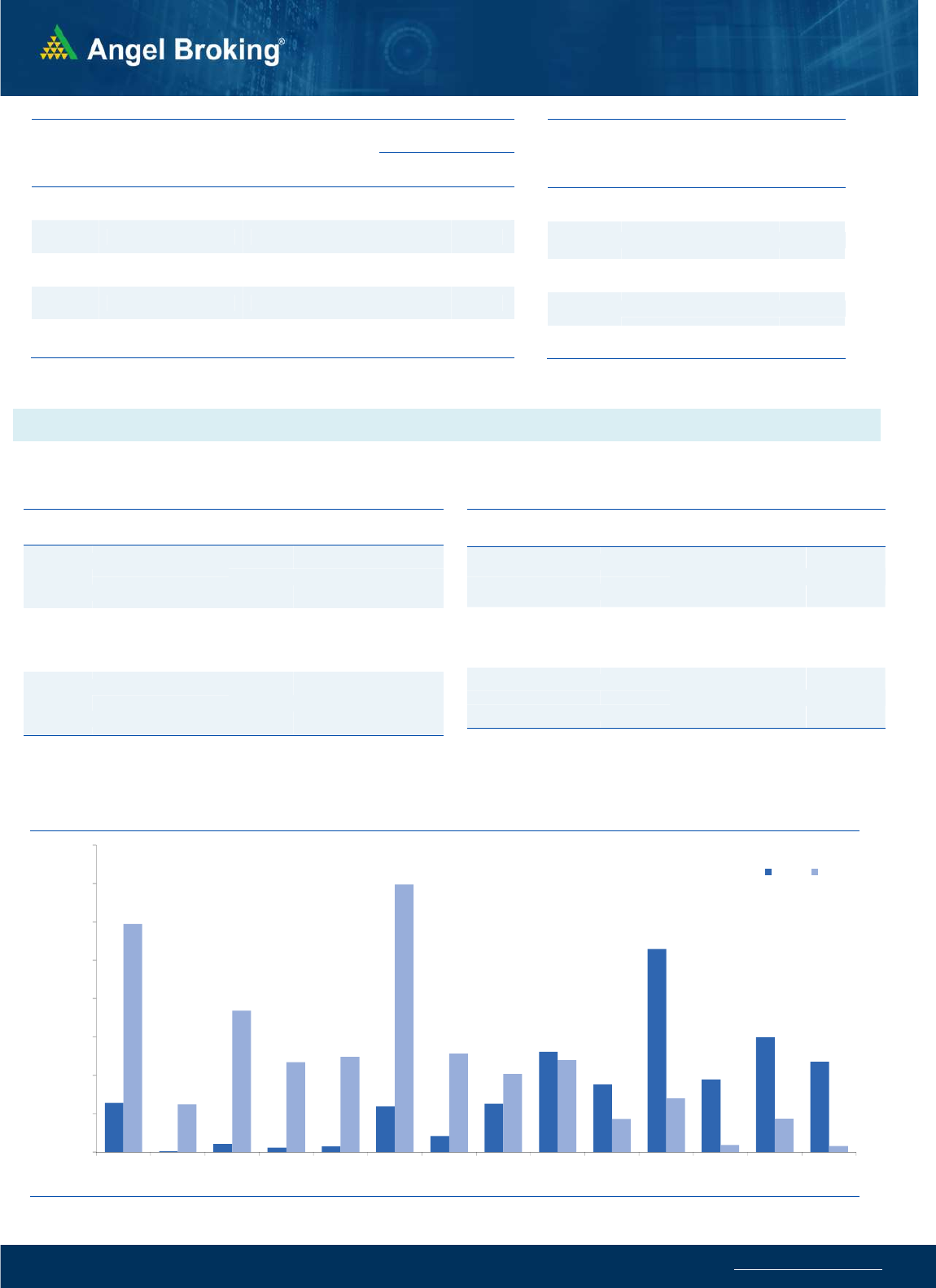

Nifty Vs OI

15550

15600

15650

15700

15750

15800

15850

15900

,0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

160,000

6/14 6/16 6/18 6/22 6/24 6/28 6/30 7/2 7/6

(`000)

Openinterest Nifty

View

Nifty started the day with a positive bias and rallied

towards 15900 mark. However, the index corrected in last

hour of the day and gave up all the gains to end with a

negligible loss.

FIIs were net sellers in the cash segment to the tune of

Rs. 543 crores. In index futures front, they bought worth

Rs 224 crores with rise in open interest indicating long

formations in yesterday’s session.

Nifty rallied towards the 15900 mark but again it failed to

continue the momentum. However, the banking index

showed strength and outperformed which was mainly

due to short covering. FII's added some longs to their

index futures positions but were sellers in cash segment.

In options segment, 15900-16000 calls added open

interest which is the resistance zone while marginal

unwinding was seen in out of money put options. The

index could continue to consolidate in 15700-16000

range and hence, traders can look to trade with a stock

specific approach.

Comments

The Nifty futures open interest has increased by 2.41%.

Bank Nifty futures open interest has decreased by 4.74%

as market closed at 15818.25 levels.

The Nifty July future closed with a premium of 19.2 point

against a premium of 33.65 point in last trading session.

The August series closed at a premium of 57.7 point.

The INDIA VIX increased from 12.06 to 12.27. At the same

time, the PCR-OI of Nifty decreased from 1.25 to 1.08.

Few of the liquid counters where we have seen high cost

of carry are IDEA, GRASIM, JSWSTEEL, ADANIPORTS, AND

JUBLFOOD.

OI Gainers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

NMDC 107220100 32.82 169.45 -2.77

BAJFINANCE 3991750 15.66 6202.40 2.14

BIOCON 16856700 14.68 388.85 -3.90

TATAMOTORS 105355950 14.58 316.90 -8.68

AMBUJACEM 18858000 13.86 351.85 3.66

LALPATHLAB 536500 13.73 3472.75 2.80

BAJAJ-AUTO 1723500 11.72 4195.30 -0.11

ALKEM 557600 10.11 3315.25 1.99

OI Losers

SCRIP OI

OI

CHG. (%)

PRICE

PRICE

CHG. (%)

MUTHOOTFIN 3309000 -19.30 1535.20 -1.67

GODREJCP 4507000 -10.89 964.25 3.94

TRENT 892475 -10.86 901.85 0.07

AUBANK 3210000 -10.30 1114.35 7.99

KOTAKBANK 20276400 -9.03 1755.35 1.31

CHOLAFIN 9545000 -7.89 521.20 0.12

PAGEIND 62970 -7.66 30263.15 0.09

IBULHSGFIN 32624400 -7.41 262.25 -4.00

Put-Call Ratio

SCRIP PCR-OI PCR-VOL

NIFTY 1.08 0.94

BANKNIFTY 1.21 0.85

RELIANCE 0.42 0.41

ICICIBANK 0.63 0.43

INFY 0.57 0.49

Historical Volatility

SCRIP HV

TATAMOTORS 64.00

AUBANK 59.55

RAMCOCEM 38.90

GODREJCP 43.00

AMBUJACEM 39.49

www.angelbroking.com

Technical & Derivatives Report

July 0

7

, 2021

Note: Above mentioned Bullish or Bearish Spreads in Nifty (July Series) are given as an information and not as a recommendation.

Nifty Spot = 15818.25

FII Statistics for July 06, 2021

Detail Buy

Net Contracts

Open Interest

Sell

Value

(in Cr.)

Change

INDEX

FUTURES

3003.23

2779.50

223.73

130122

10615.04

3.96

INDEX

OPTIONS

394854.97

392488.31

2366.66

949692

84470.80

9.35

STOCK

FUTURES

14399.17

13340.49

1058.68

1402643

111358.70

0.94

STOCK

OPTIONS

13772.62

14146.87

(374.25) 229965

18448.40

9.49

Total 426029.99

422755.17

3274.82

2712422

224892.94

4.59

Turnover on July 06, 2021

Instru

ment

No. of

Contracts

Turnover

( in Cr. )

Change

(%)

Index Futures

2,59,252 22040.20 20.78

Index

Options

4,52,94,036 44,24,628.58

75.97

Stock Futures

7,84,398 65022.67 32.33

Stock

Options

22,19,568 1,88,754.66 39.66

Total 4,85,57,254 47,00,446.11

73.01

Bull-Call Spreads

Action Strike Price Risk Reward BEP

Buy 15800 194.90

52.05 47.95 15852.05

Sell 15900 142.85

Buy 15800 194.90

95.90 104.10 15895.90

Sell 16000 99.00

Buy 15900 142.85

43.85 56.15 15943.85

Sell 16000 99.00

Bear-Put Spreads

Action Strike Price Risk Reward BEP

Buy 15800 157.45

37.85 62.15 15762.15

Sell 15700 119.60

Buy 15800 157.45

65.65 134.35 15734.35

Sell 15600 91.80

Buy 15700 119.60

27.80 72.20 15672.20

Sell 15600 91.80

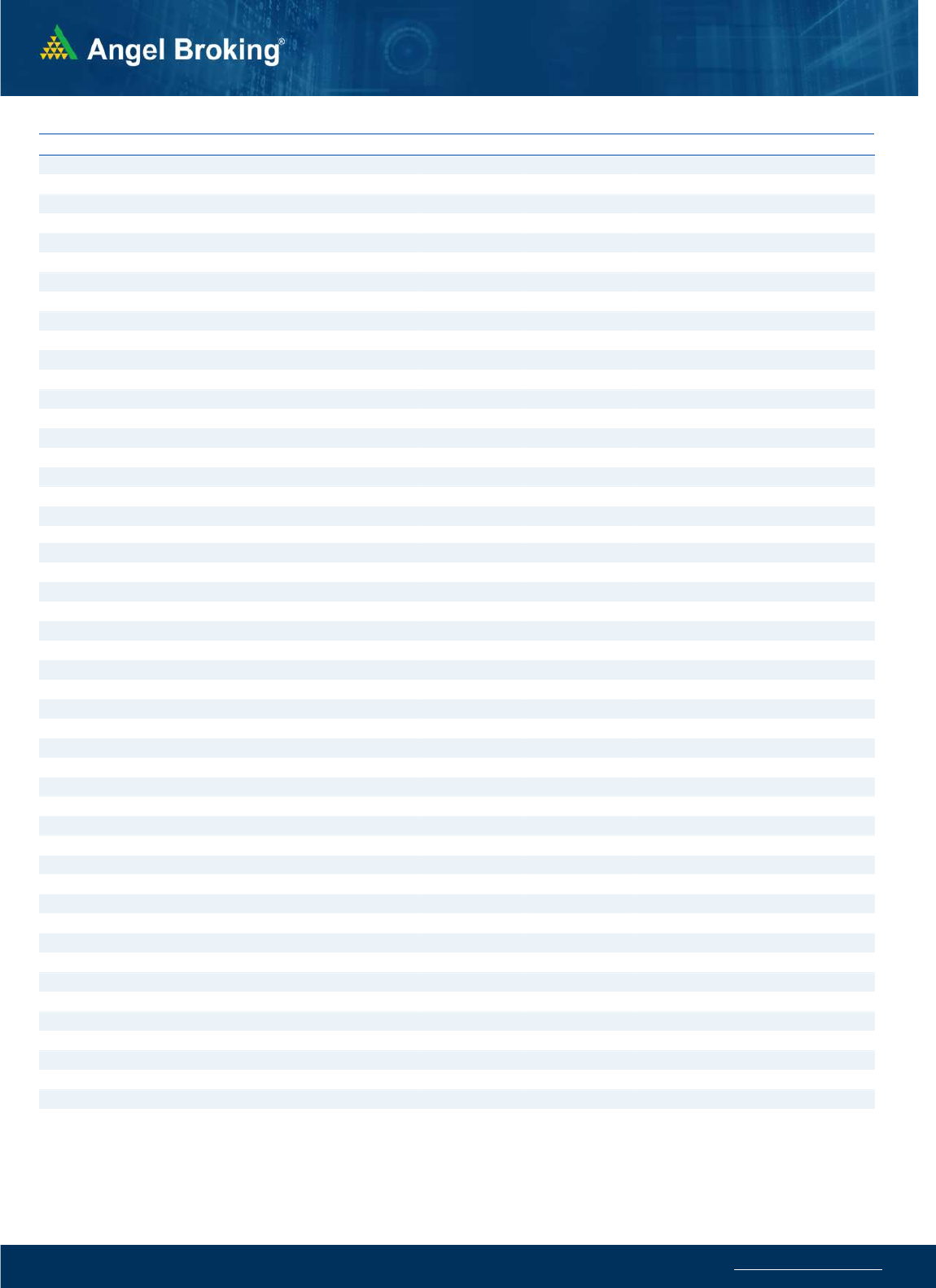

Nifty Put-Call Analysis

,0

500,000

1000,000

1500,000

2000,000

2500,000

3000,000

3500,000

4000,000

15000 15100 15200 15300 15400 15500 15600 15700 15800 15900 16000 16100 16200 16300

Call Put

www.angelbroking.com

Technical & Derivatives Report

July 0

7

, 2021

Daily Pivot Levels for Nifty Constituents

Scrips

S2

S1

PIVOT

R1

R2

ADANIPORTS

692

703

717

727

742

ASIANPAINT 2,976 2,989

3,009

3,023

3,043

AXISBANK

748

753

760

765

772

BAJAJ-AUTO 4,128 4,162

4,205

4,239

4,282

BAJFINANCE 5,910 6,056

6,199

6,346

6,489

BAJAJFINSV 11,670

11,881

12,081

12,292

12,493

BPCL

454

456

460

462

465

BHARTIARTL

518

522

525

529

532

BRITANNIA 3,495 3,507

3,521

3,532

3,546

CIPLA

959

964

970

974

980

COALINDIA

145

146

148

150

152

DIVISLAB 4,470 4,497

4,539

4,567

4,609

DRREDDY 5,491 5,515

5,538

5,562

5,585

EICHERMOT 2,674 2,693

2,712

2,730

2,750

GRASIM 1,471 1,484

1,505

1,518

1,538

HCLTECH

963

967

975

979

987

HDFCBANK 1,480 1,507

1,524

1,551

1,568

HDFCLIFE

669

674

681

686

693

HDFC 2,473 2,485

2,502

2,513

2,531

HEROMOTOCO 2,887 2,903

2,929

2,945

2,970

HINDALCO

380

383

387

390

394

HINDUNILVR 2,451 2,462

2,480

2,491

2,509

ICICIBANK 640

645

650

655

660

IOC

107

108

109

109

110

INDUSINDBK 1,007 1,019

1,027

1,039

1,047

INFY 1,539 1,551

1,569

1,580

1,598

ITC

201

202

203

203

204

JSW STEEL

663

668

675

680

687

KOTAKBANK 1,714 1,735

1,747

1,768

1,780

LT 1,489 1,497 1,

508

1,516

1,527

M&M

769

775

785

792

802

MARUTI 7,383 7,449

7,553

7,619

7,724

NESTLEIND 17,287

17,379

17,508

17,600

17,729

NTPC

116

117

118

119

120

ONGC

119

120

123

124

126

POWERGRID

227

228

229

230

231

RELIANCE 2,103 2,114

2,131

2

,142

2,160

SBILIFE

994

1,009

1,021

1,035

1,048

SHREECEM 26,640

27,204

27,565

28,129

28,490

SBIN

423

426

431

435

440

SUNPHARMA

666

669

676

680

687

TCS 3,210 3,236

3,282

3,308

3,354

TATACONSUM

752

757

763

768

774

TATAMOTORS

282

300

329

346

376

TATASTEEL 1,137 1,152

1,165

1,180

1,193

TECHM 1,030 1,040

1,057

1,067

1,084

TITAN 1,733 1,748

1,761

1,776

1,789

ULTRACEMCO 6,615 6,774

6,887

7,046

7,158

UPL

792

798

807

812

822

WIPRO

528

530

534

537

541

www.angelbroking.com

Technical & Derivatives Report

July 0

7

, 2021

*

Research Team Tel: 022 – 39357600 (Extn. 6844) Website: www.angelbroking.com

For Technical Queries E-mail: technicalresearch-cso@angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager and Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed

public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits

and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Technical and Derivatives Team:

Sameet Chavan Chief Analyst - Technical & Derivatives sameet.chavan@angelbroking.com

Ruchit Jain Senior Analyst - Technical & Derivatives ruchit.jain@angelbroking.com

Rajesh Bhosale Technical Analyst rajesh.bhosle@angelbroking.com

Sneha Seth Derivatives Analyst sneha.seth@angelbroking.com